Invesco DB Oil Fund

Latest Invesco DB Oil Fund News and Updates

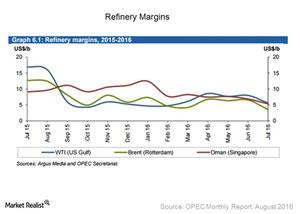

Oil Supply and Refinery Margins Concern Crude Tankers

Refinery margins have fallen throughout most of the world. US Gulf refinery margins for WTI crude lost more than $2 compared to last month’s level.

Why Did Oil Prices Move Higher?

On February 22, 2018, US crude oil’s April 2018 futures rose 1.8% and closed at $62.77 per barrel.

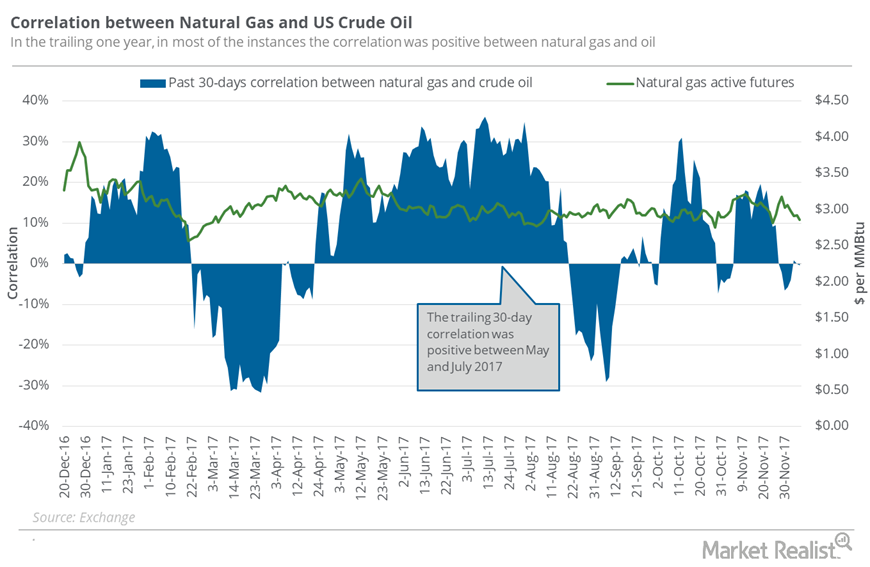

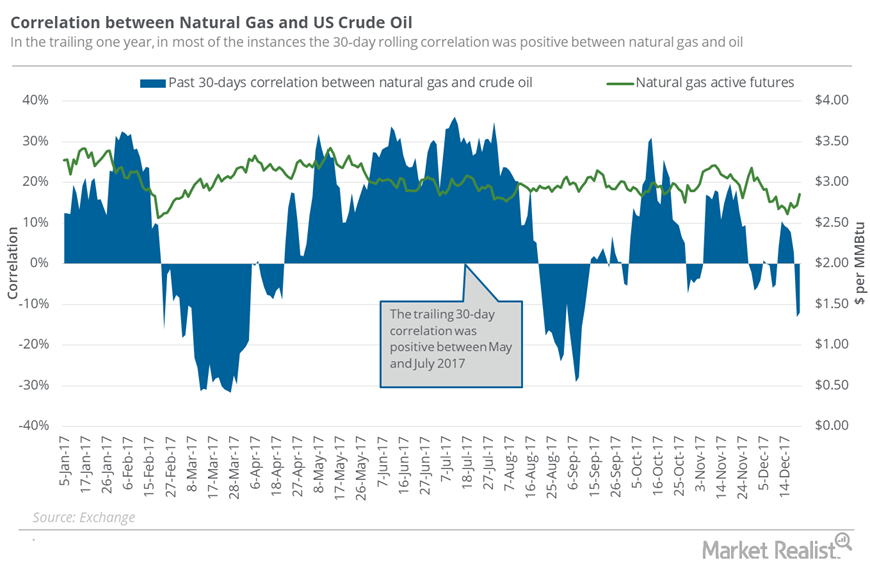

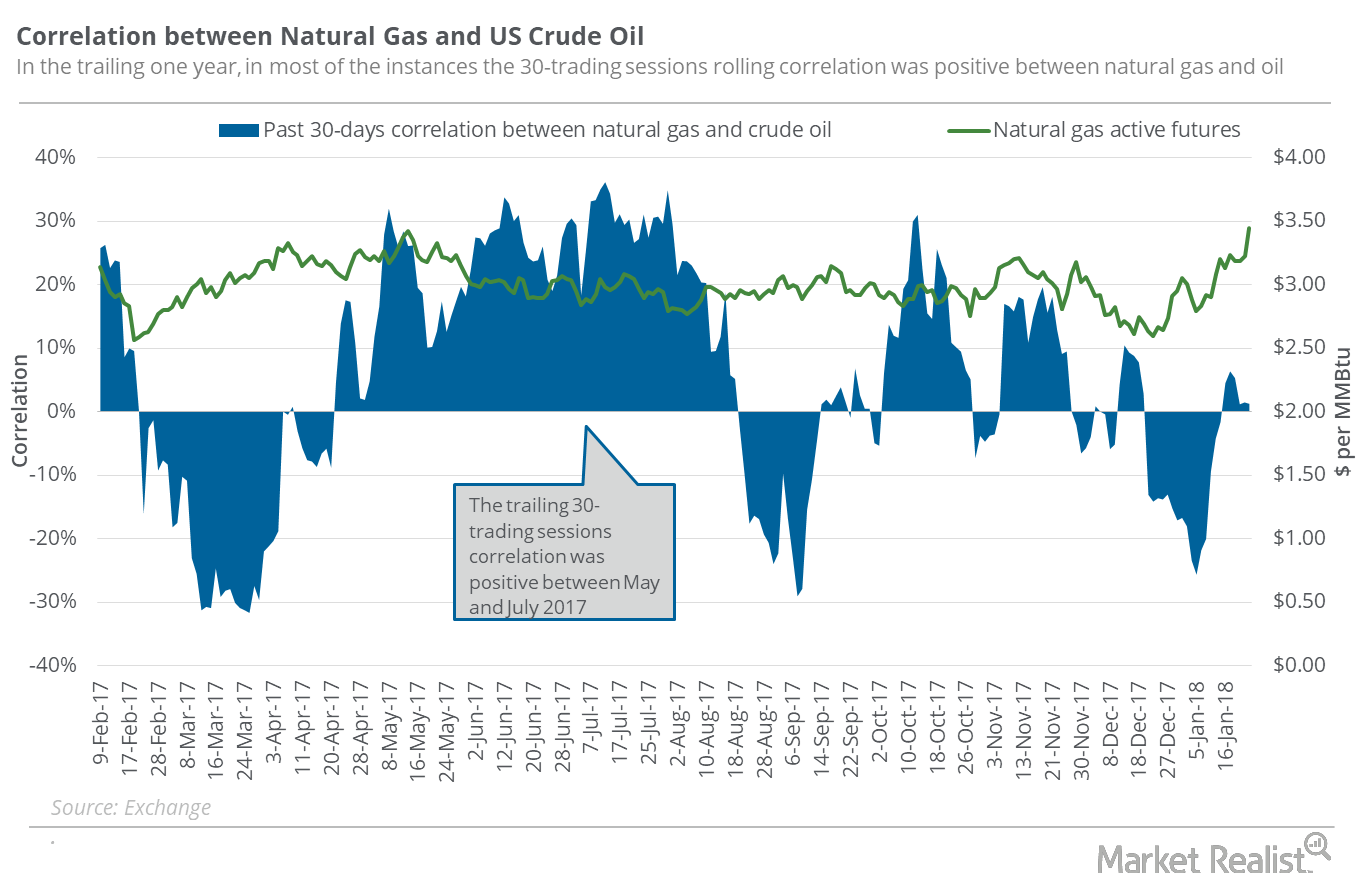

Does the Natural Gas Fall Relate to Oil’s Decline?

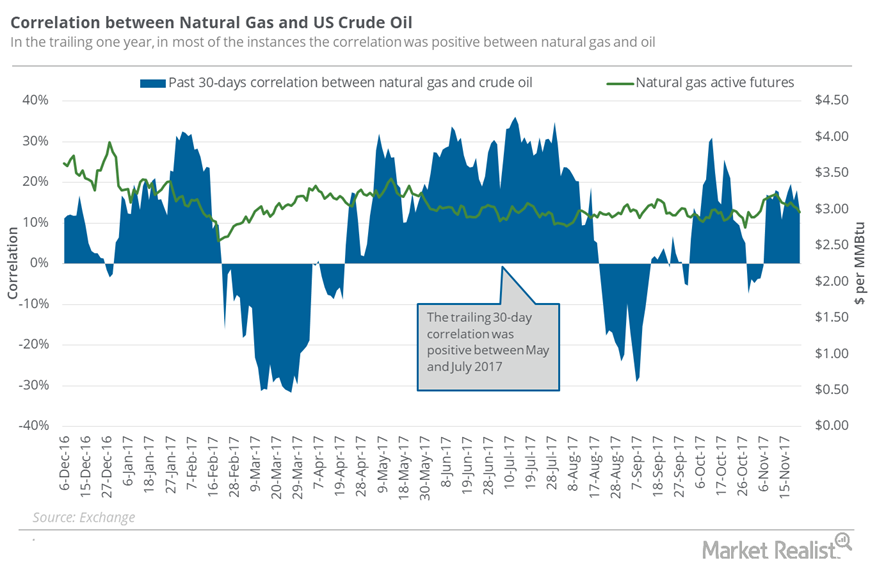

Between November 29 and December 6, natural gas (GASL)(GASX)(FCG) January 2018 futures had a correlation of -1.6% with US crude oil January futures.

Kurdistan Referendum: Time to Buy Crude Oil Futures?

On September 25, 2017, the people in Kurdistan voted in a referendum for independence. As a result, Turkey blocked 500,000 bpd of crude oil exports.

Why Did Oil Prices Fall?

On March 22, natural gas April 2018 futures declined 0.8% and settled at $2.62 per million British thermal units.

Geopolitical Tensions Impact Crude Oil Prices

On October 3, 2017, Iraq banned selling dollars to Kurdistan’s banks due to the vote in the referendum. Geopolitical tensions could impact crude oil prices.

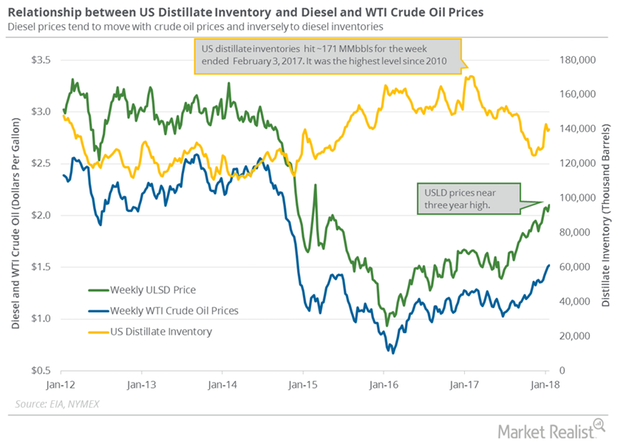

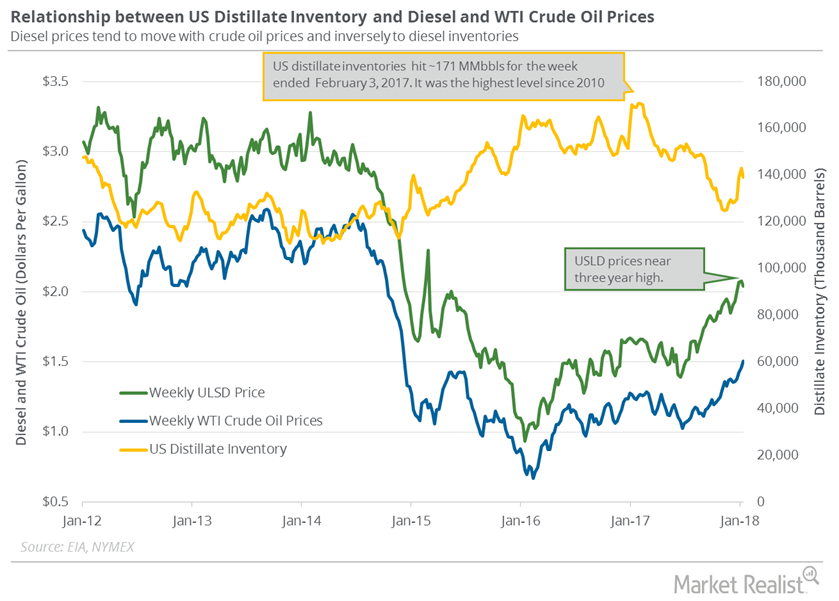

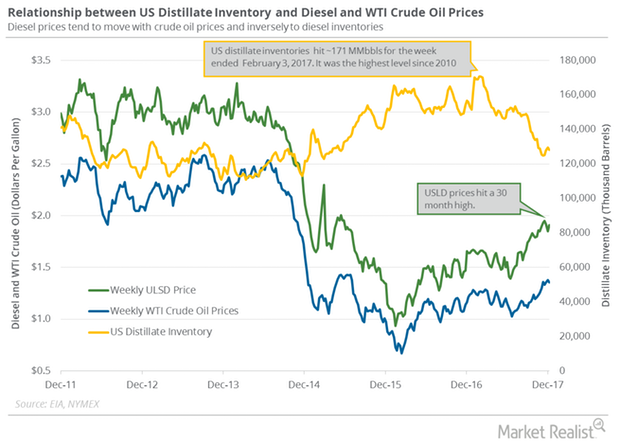

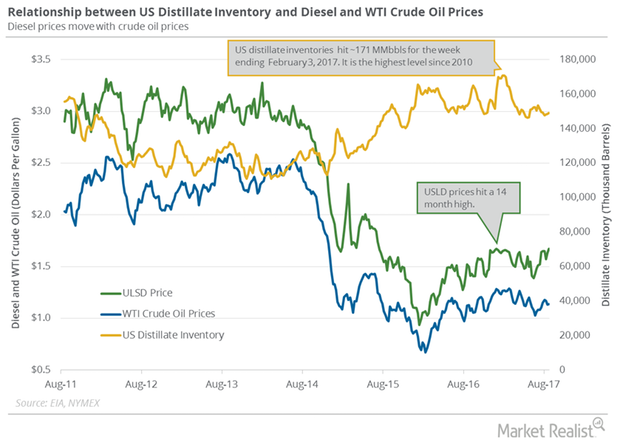

US Distillate Inventories Rose for the Eighth Time in 10 Weeks

US distillate inventories rose by 0.64 MMbbls (million barrels) to 139.8 MMbbls on January 12–19, 2018, according to the EIA.

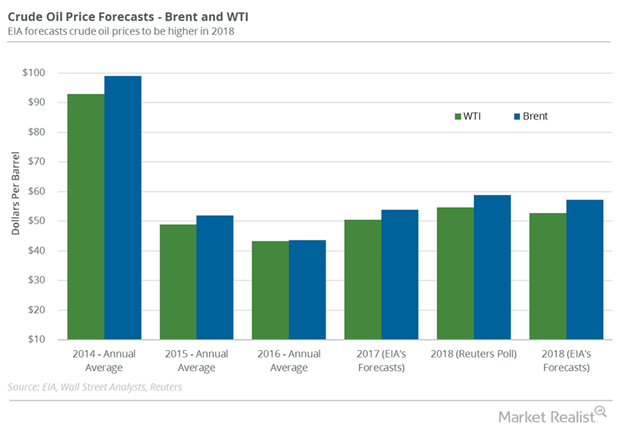

Will Crude Oil Prices Start 2018 on a Positive Note?

A Reuters survey estimated that Brent and US crude oil prices could average $58.84 per barrel and $54.78 per barrel in 2018.

Is Natural Gas Moving with Oil Prices?

The correlation between natural gas (GASL)(GASX)(FCG) active futures with US crude oil active futures was 99.8% between December 12 and December 19.

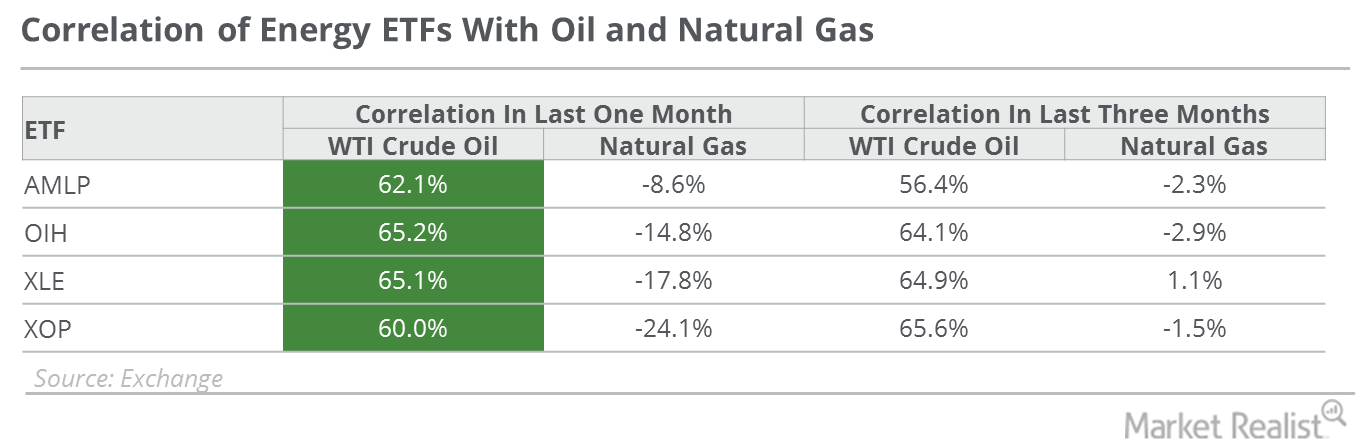

How Energy ETFs Are Correlated to Falling Oil Prices

At ~65.2%, the VanEck Vectors Oil Services ETF (OIH) showed the highest correlation with US crude oil between April 4–May 4, 2017.

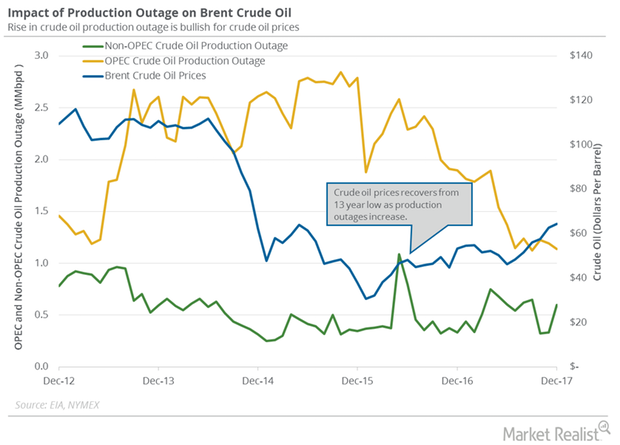

Global Crude Oil Supply Outages Are near a 4-Month High

Global crude oil supply outages increased by 208,000 bpd (barrels per day) to 1,738,000 bpd in December 2017—compared to the previous month.

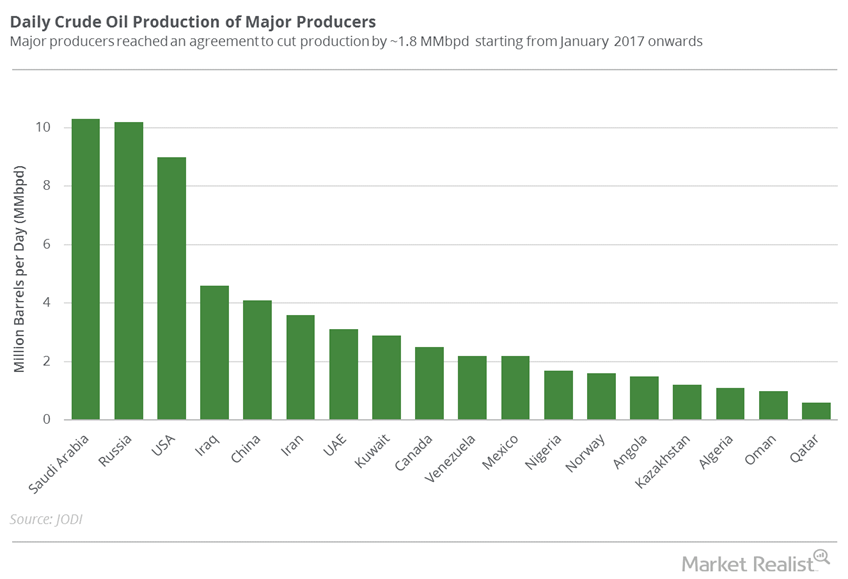

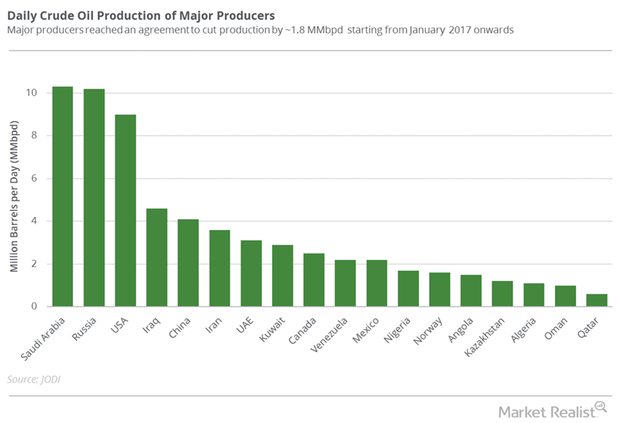

Chart of the Week: Crude Oil Production of Global Majors

Crude oil (OIIL) (DBO) (USL) prices fell on June 5, 2017, due to geopolitical tensions.

Why the Service Sector’s Contribution to Brazil Is Important

The service sector is the main contributor to Brazil’s GDP and job creation, but it’s currently suffering from structural weakness and poor international performance.

US Distillate Inventories Fell for the Third Time in 10 Weeks

US distillate inventories fell by 3.8 MMbbls or 2.7% to 139.2 MMbbls on January 5–12, 2018. The inventories fell by 29.9 MMbbls or 18% from a year ago.

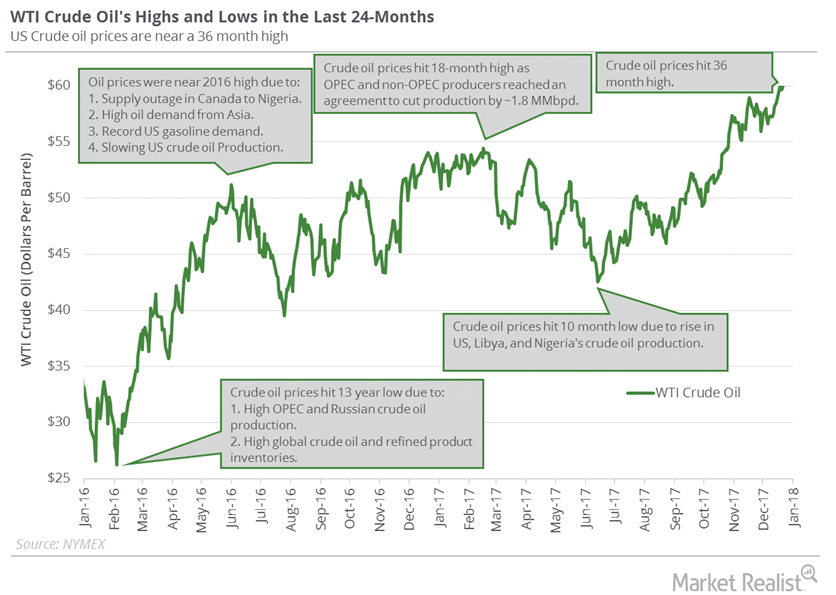

Crude Oil Futures: Next Important Resistance Level

WTI crude oil (UCO) futures closed at $62.01 per barrel on January 4, 2018—the highest level since December 2014. WTI prices rose ~12.4% in 2017.

How Closely Is Natural Gas Tracking Oil?

Between November 15 and 22, natural gas (UNG)(FCG) January futures had a correlation of 52.5% with US crude oil January futures.

How OPEC’s Spare Crude Oil Production Capacity Is Recovering

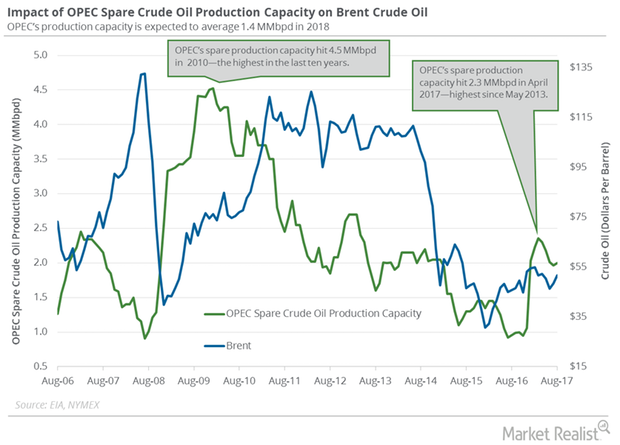

The EIA estimates that OPEC’s spare crude oil production capacity rose 35,000 bpd (barrels per day) to 2 MMbpd (million barrels per day) in August 2017.

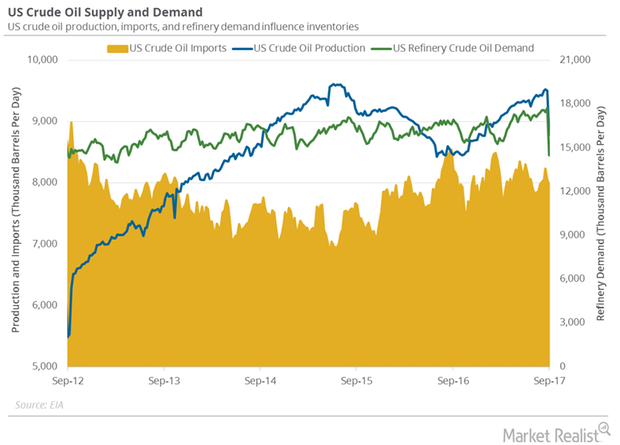

Will US Oil Production Pressure Crude Oil Futures?

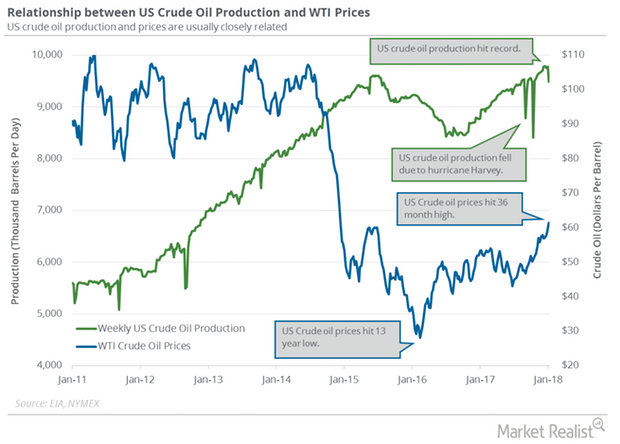

February WTI crude oil futures contracts fell 0.9% to $63.73 per barrel on January 16. Brent oil futures fell 1.6% to $69.15 per barrel on the same day.

US Crude Oil Production Fell and Boosted Oil Futures

US crude oil production fell by 290,000 bpd (barrels per day) or 3% to 9,492,000 bpd between December 29, 2017, and January 5, 2018.

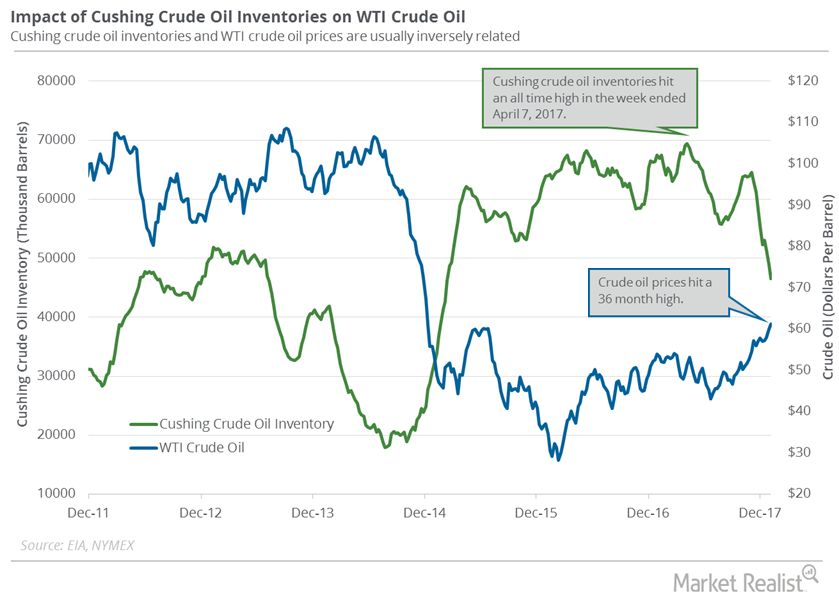

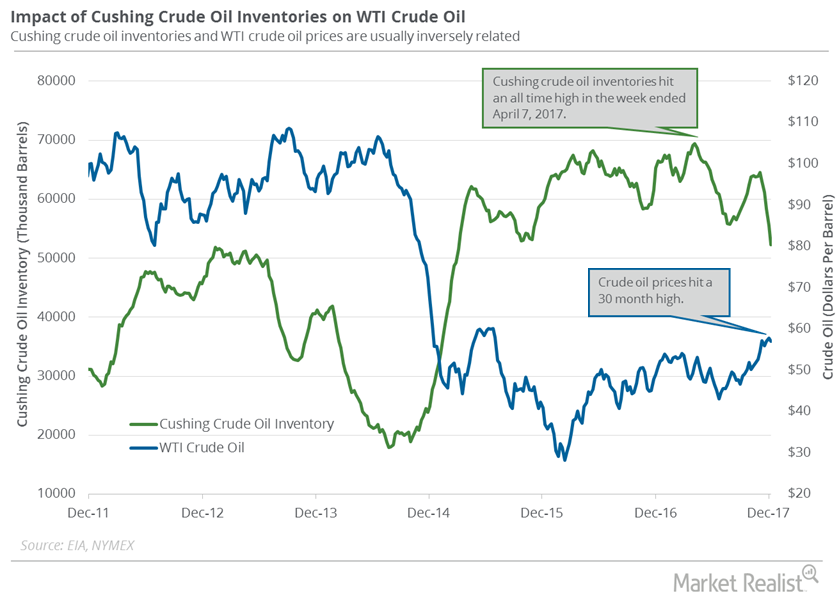

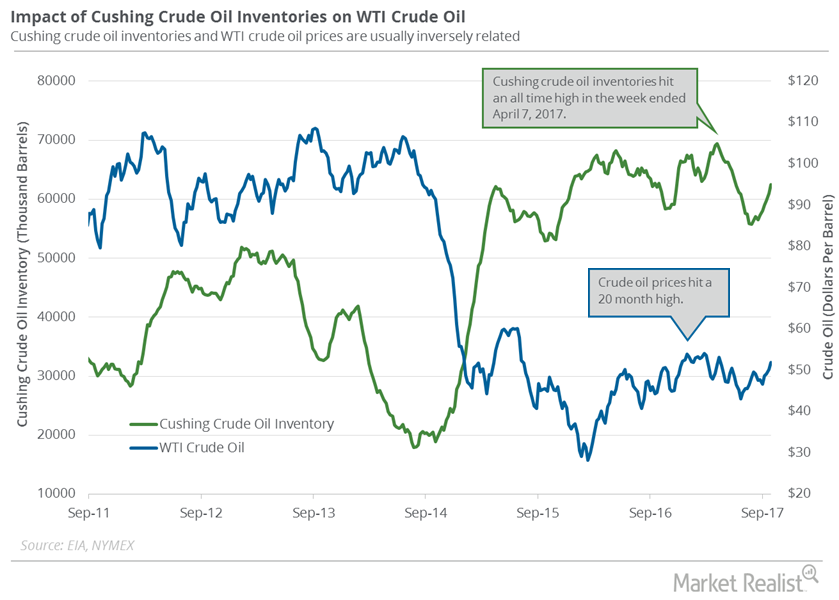

Cushing Inventories Fell 33% from the Peak

Analysts expect that Cushing crude oil inventories could have declined on January 5–12, 2018. A fall in Cushing inventories is bullish for oil prices.

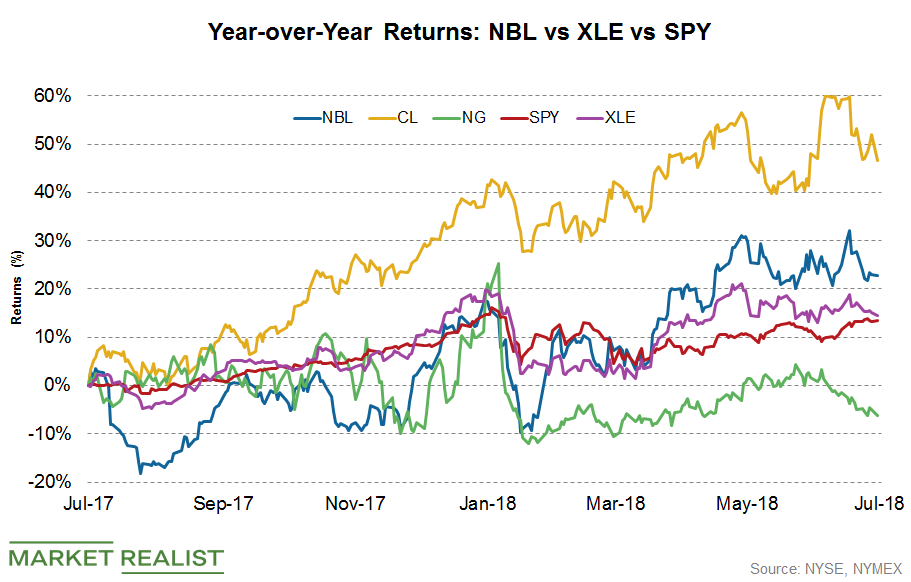

How Has Noble Energy Stock Been Performing Recently?

Year-over-year, NBL stock has risen ~22.7%, while crude oil prices have surged 46.5% in the same period.

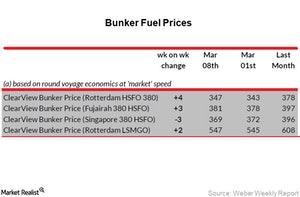

Analyzing Bunker Fuel Prices in Week 12

On March 22, 2018, the average bunker fuel price was $423 per ton—compared to $413 per ton on March 15.

Does Natural Gas’s Rise Depend on Crude Oil?

Between January 16 and January 23, 2018, natural gas (GASL) (UNG) (FCG) had a correlation of 84.6% with US crude oil (OIIL) (USL) (DBO) active futures.

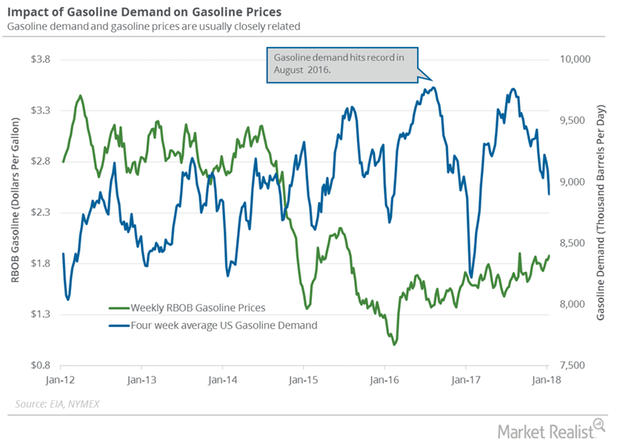

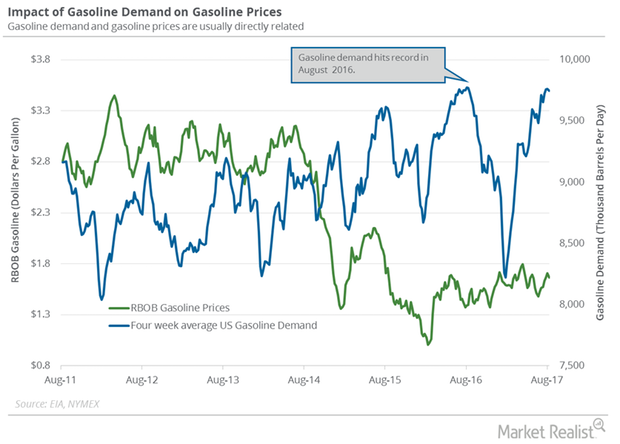

US Gasoline Demand Could Extend the Crude Oil Price Rally

The EIA estimated that four-week average US gasoline demand decreased by 190,000 bpd (barrels per day) to 8,904,000 bpd on January 5–12, 2018.

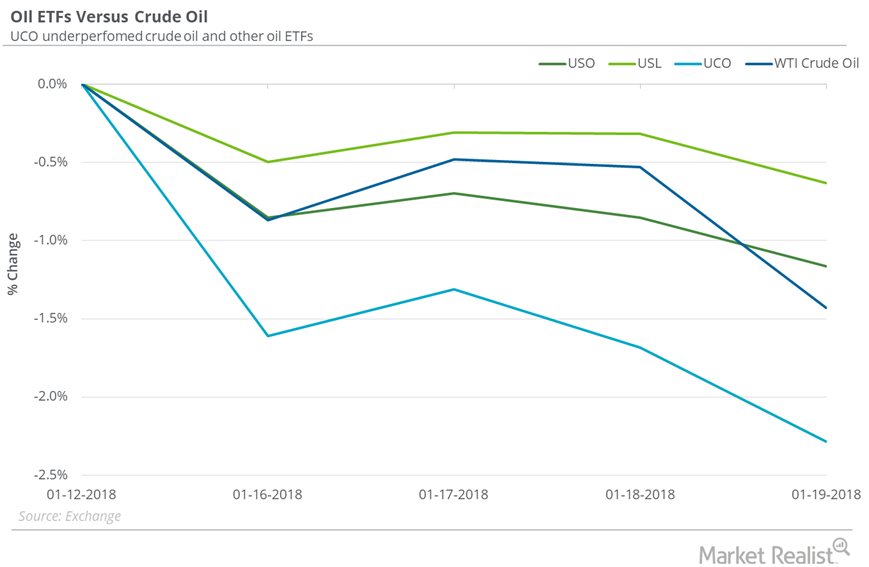

Are Oil ETFs Outperforming Oil?

Between January 12 and January 19, 2018, the United States Oil ETF (USO) fell 1.2%.

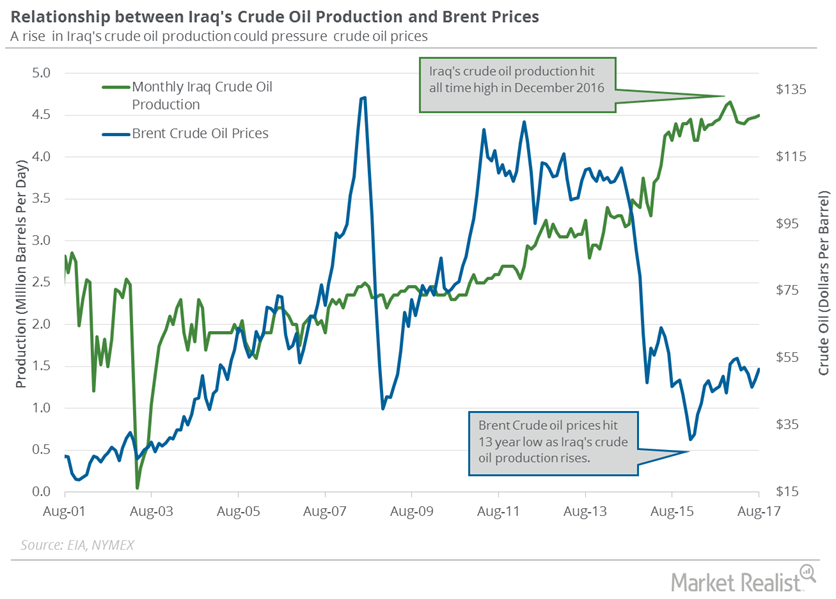

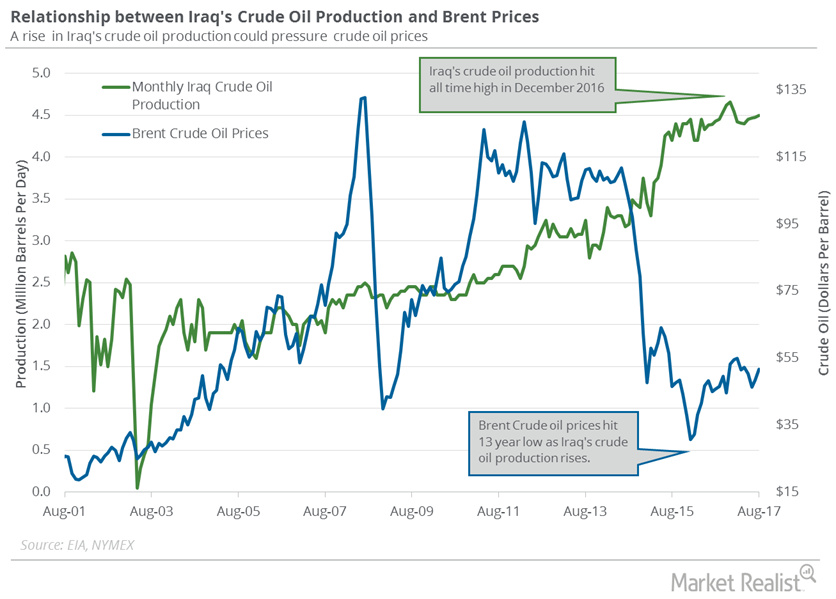

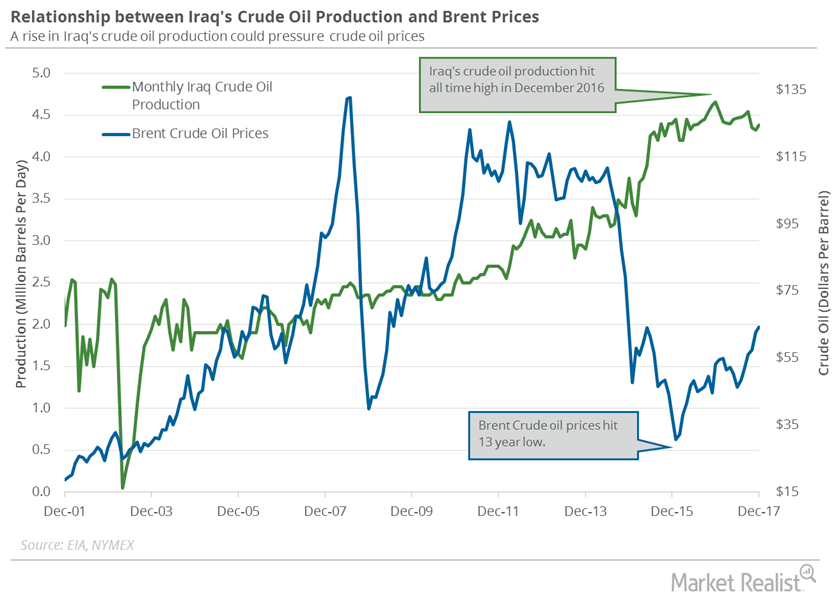

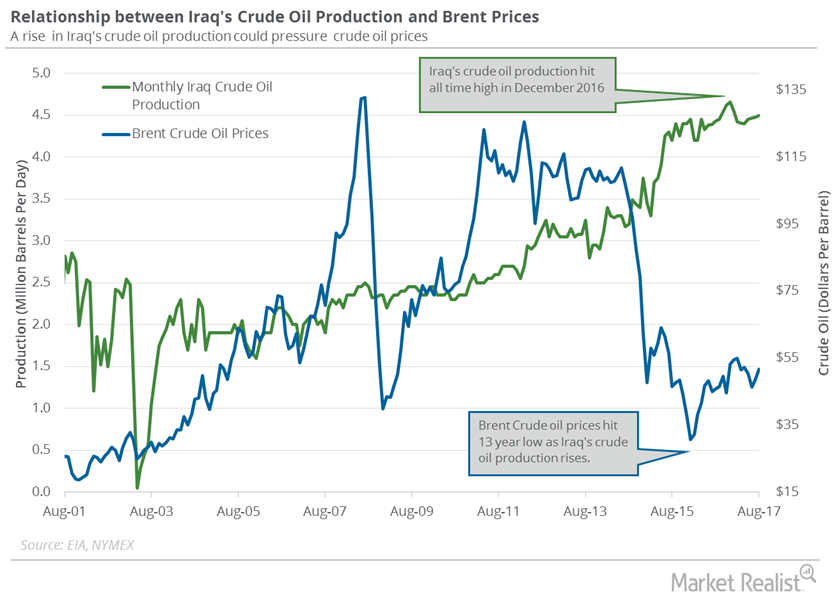

Iraq’s Crude Oil Production Capacity Could Hit 5 MMbpd

The EIA estimated that Iraq’s crude oil production increased by 60,000 bpd to 4,380,000 bpd in December 2017—compared to the previous month.

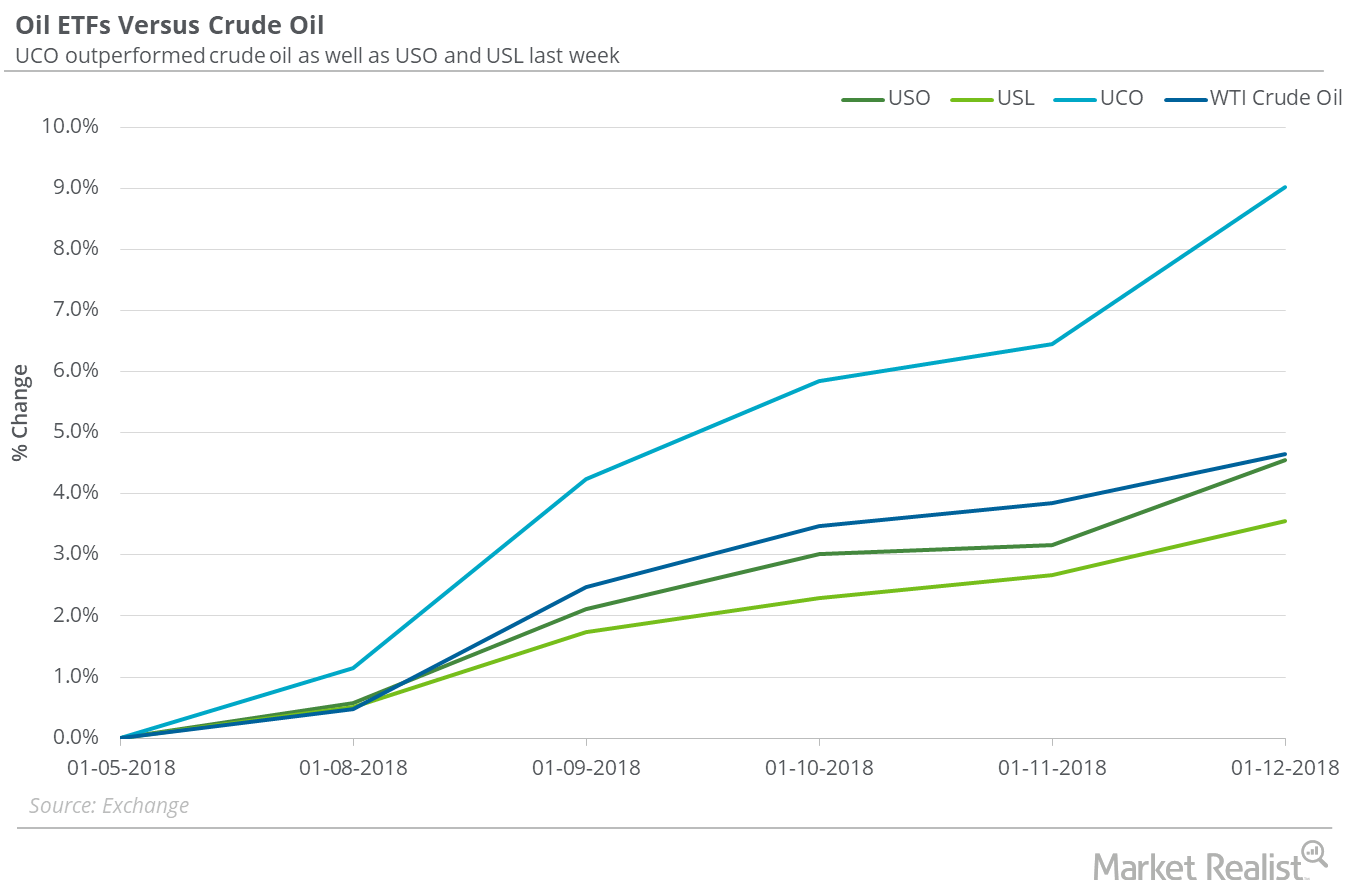

Oil ETFs: How They’re Performing at Oil’s 3-Year High

Between January 5 and January 12, 2018, the United States Oil ETF (USO), which holds positions in US crude oil active futures, gained 4.5%.

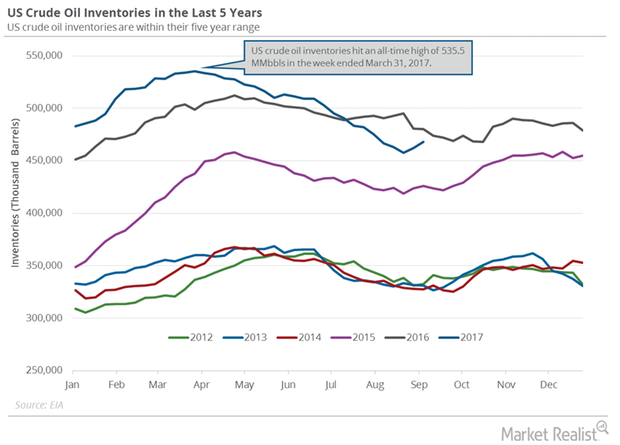

Oil Inventory Data Could Push Oil Higher

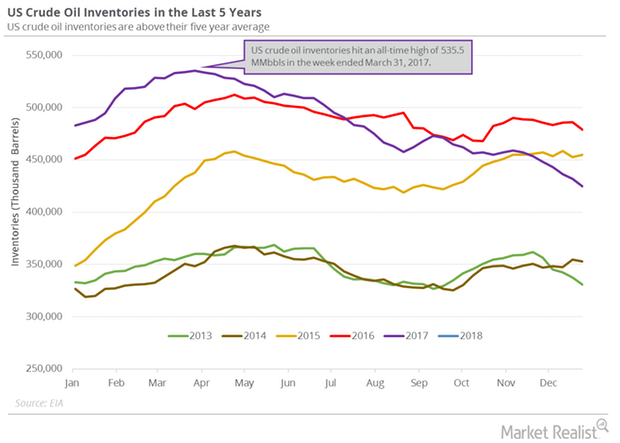

In the week ending January 5, 2018, US crude oil inventories fell by 4.9 MMbbls (million barrels)—1 MMbbls more than the market’s expected fall.

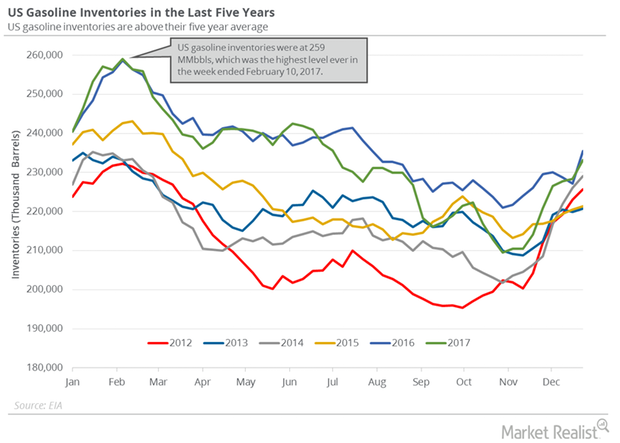

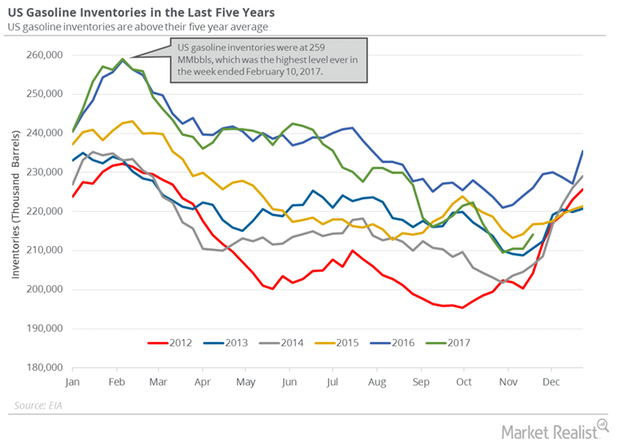

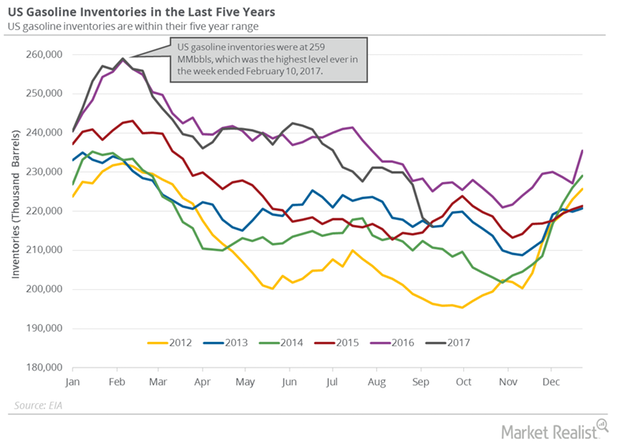

US Gasoline Inventories Could Pressure Crude Oil Prices

The EIA estimated that US gasoline inventories increased by 4.8 MMbbls (million barrels) or 2.1% to 233.1 MMbbls on December 22–29, 2017.

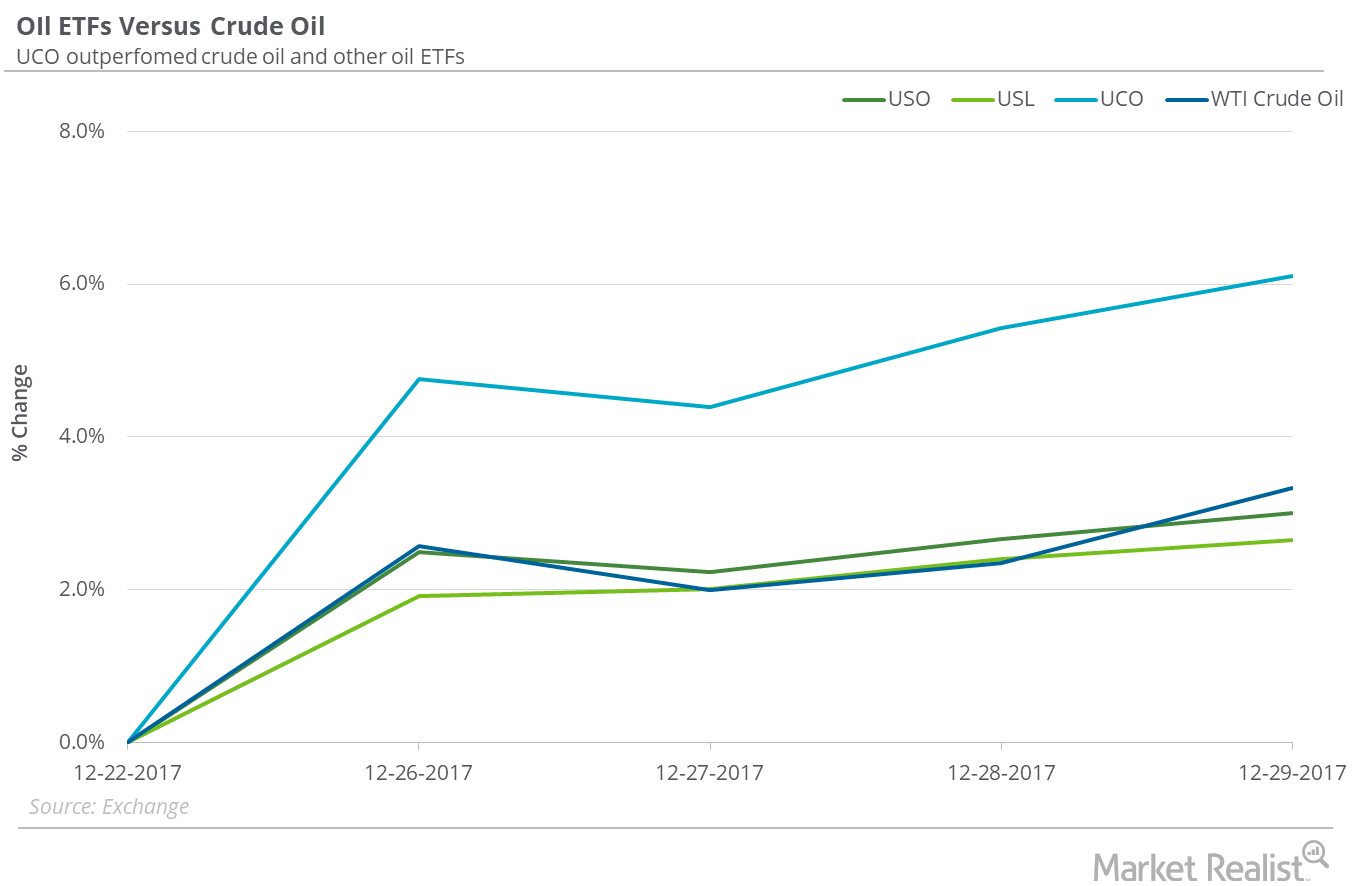

Which Oil ETFs Might Be a Better Bet in 2018?

On December 29, 2017, the closing prices of US crude oil futures contracts between March 2018 and January 2019 were progressively lower.

How Much Fall in Inventories Could Support Oil This Week?

In the week ended December 22, 2017, US crude oil inventories were 431.9 MMbbls (million barrels), a fall of 4.6 MMbbls compared to the previous week.

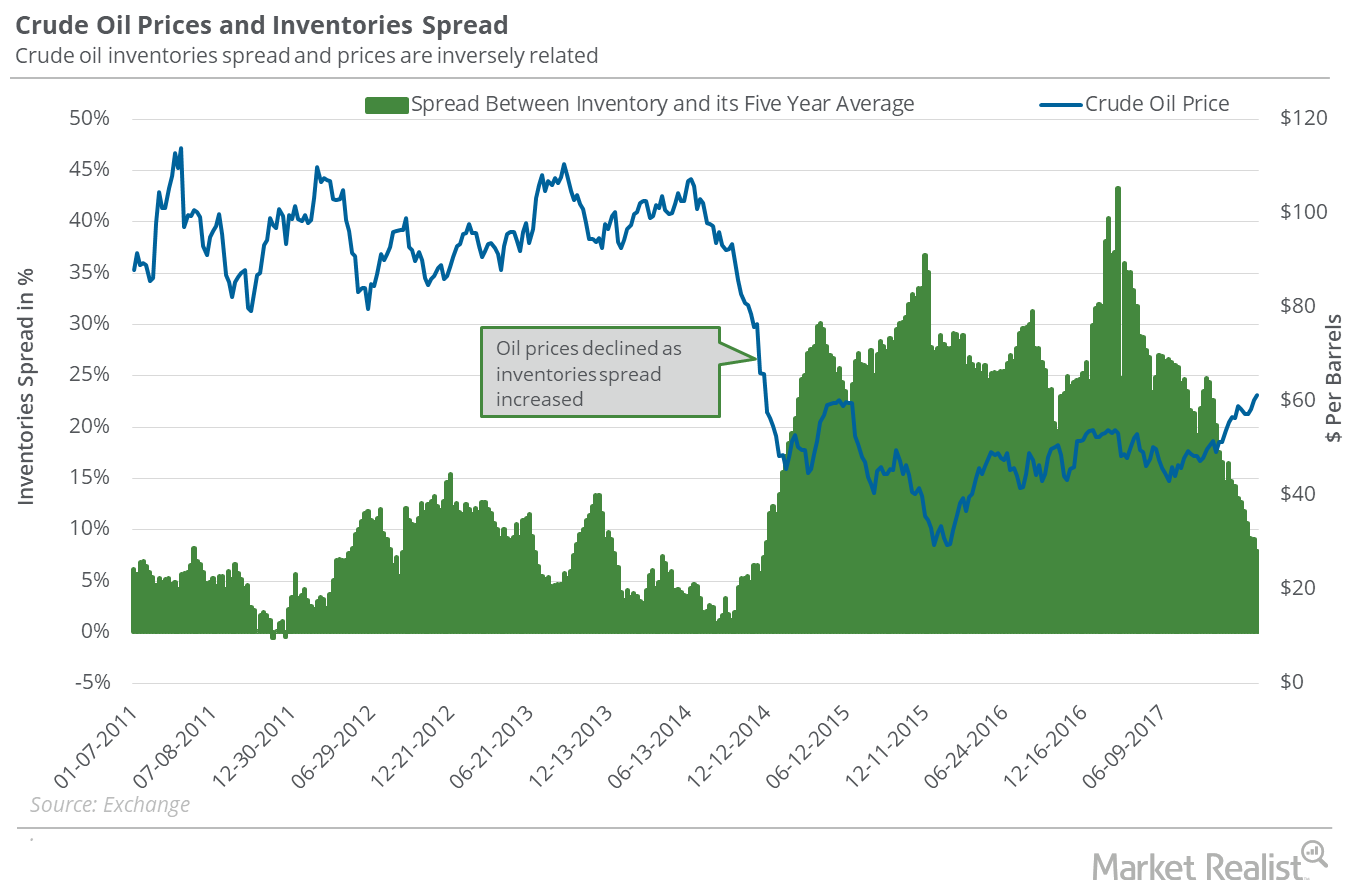

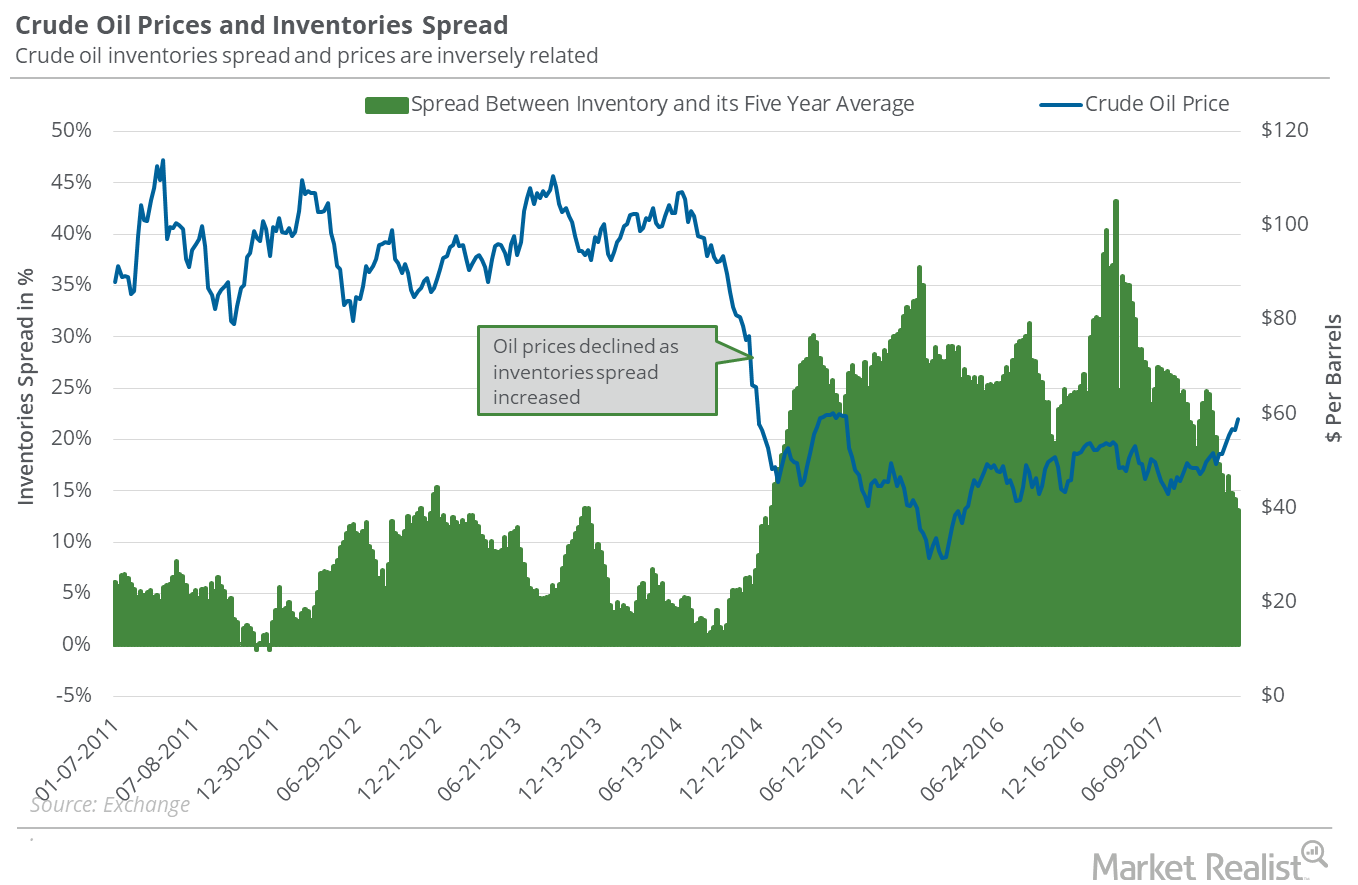

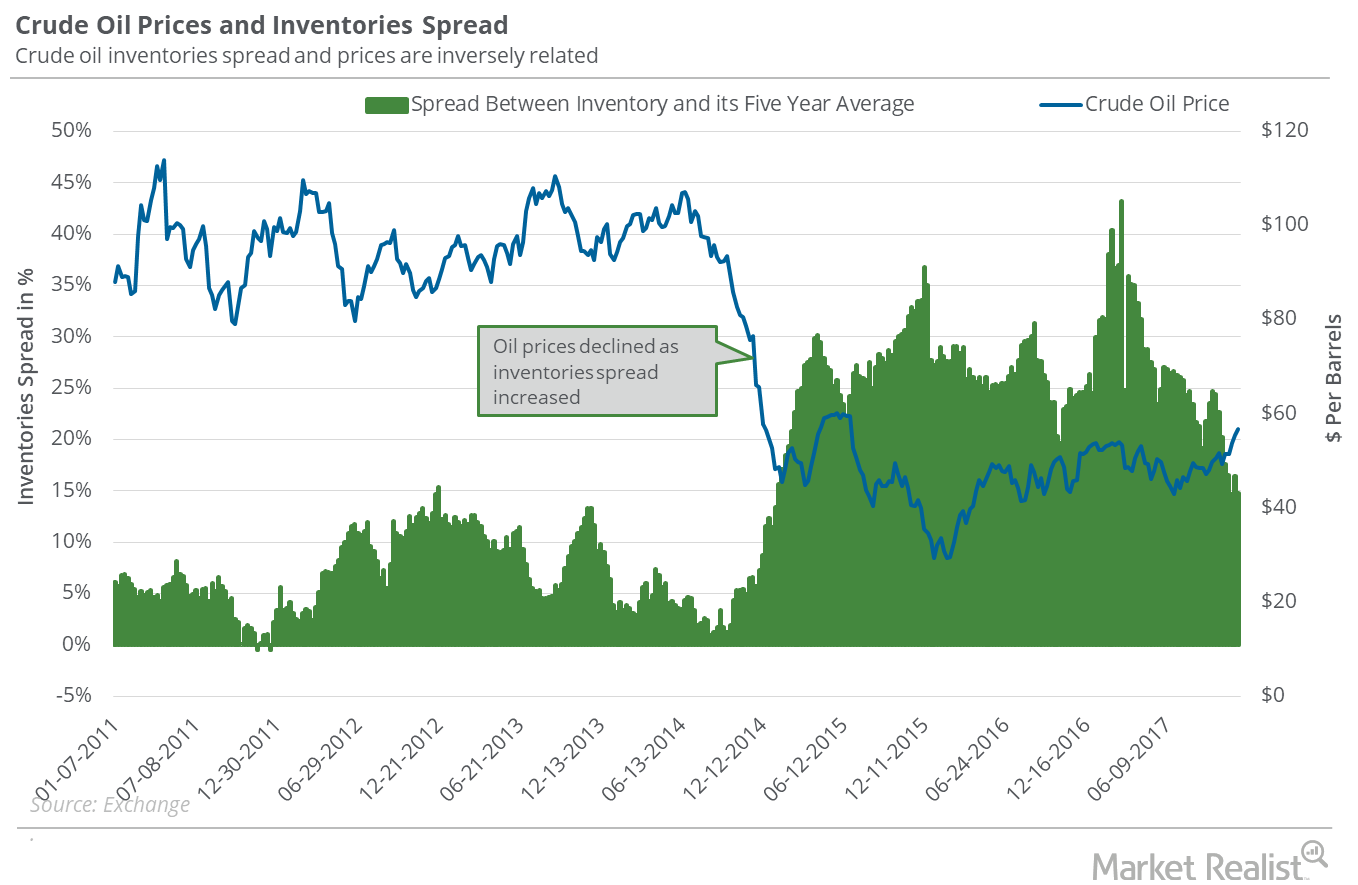

What Oil Bulls Could Expect for Oil Inventories

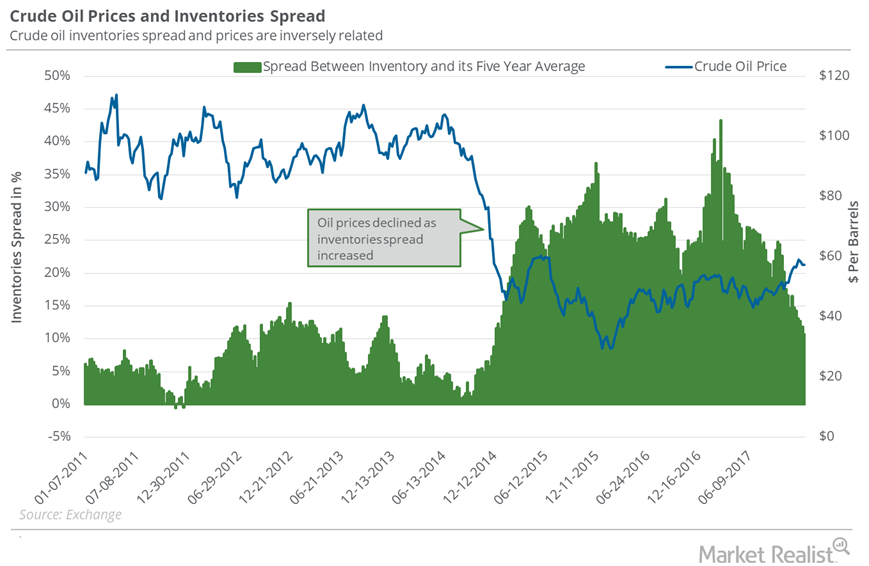

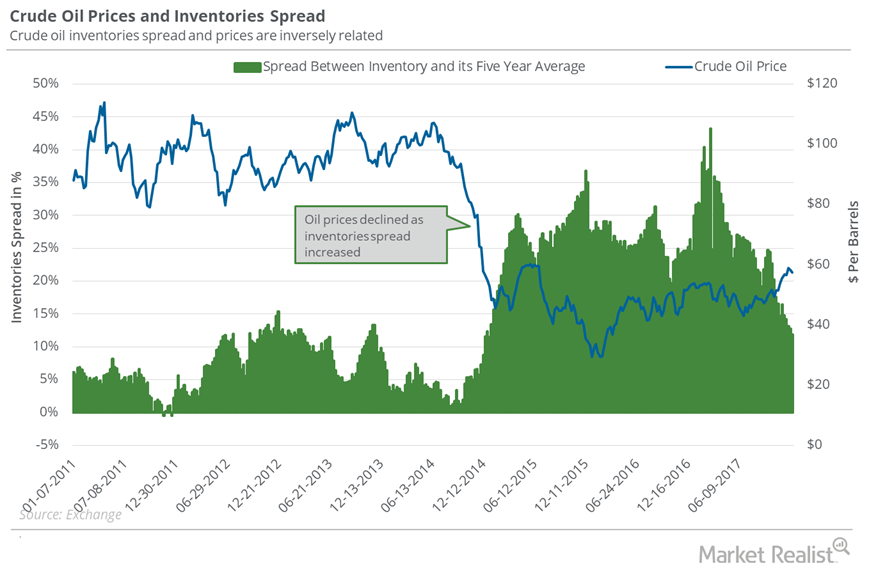

Oil stockpiles In the week ended December 8, 2017, US crude oil inventories fell by 5.1 MMbbls (million barrels) to 443 MMbbls. However, motor gasoline inventories rose 5.7 MMbbls. The data was released by the EIA (U.S. Energy Information Administration) on December 13. That day, US crude oil prices fell 0.9%. Inventory spread The gap between US oil inventories […]

Cushing Inventories: Largest Weekly Fall since 2009

Cushing inventories fell by 3,317,000 barrels to 52.2 MMbbls (million barrels) on December 1–8, 2017, according to the EIA.

Can US Crude Oil Break Below $57 Next Week?

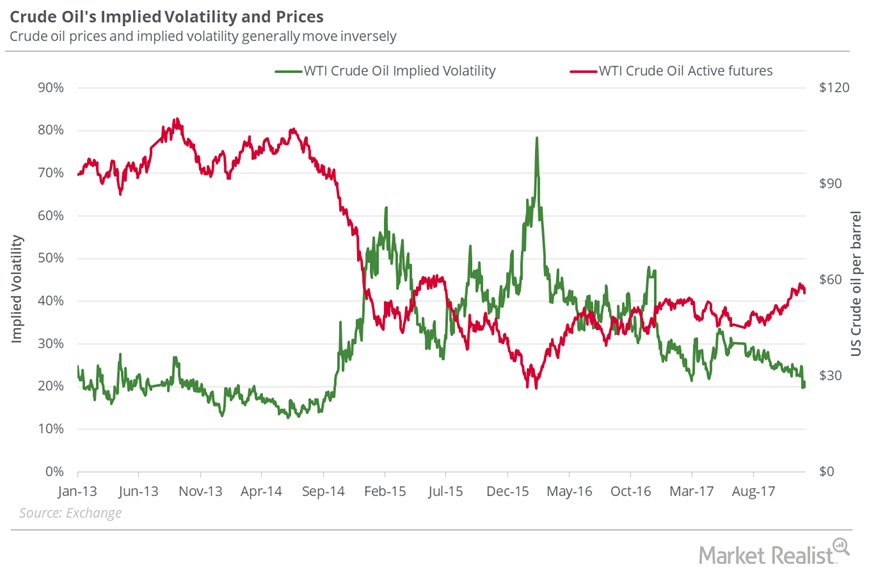

On December 14, 2017, the implied volatility of US crude oil futures was 18.1%. It was 14.8% below its 15-day average.

US Distillate Inventories Fell for the First Time in 4 Weeks

US distillate inventories fell by 1.3 MMbbls (million barrels) to 128.1 MMbbls on December 1–8, 2017, according to the EIA.

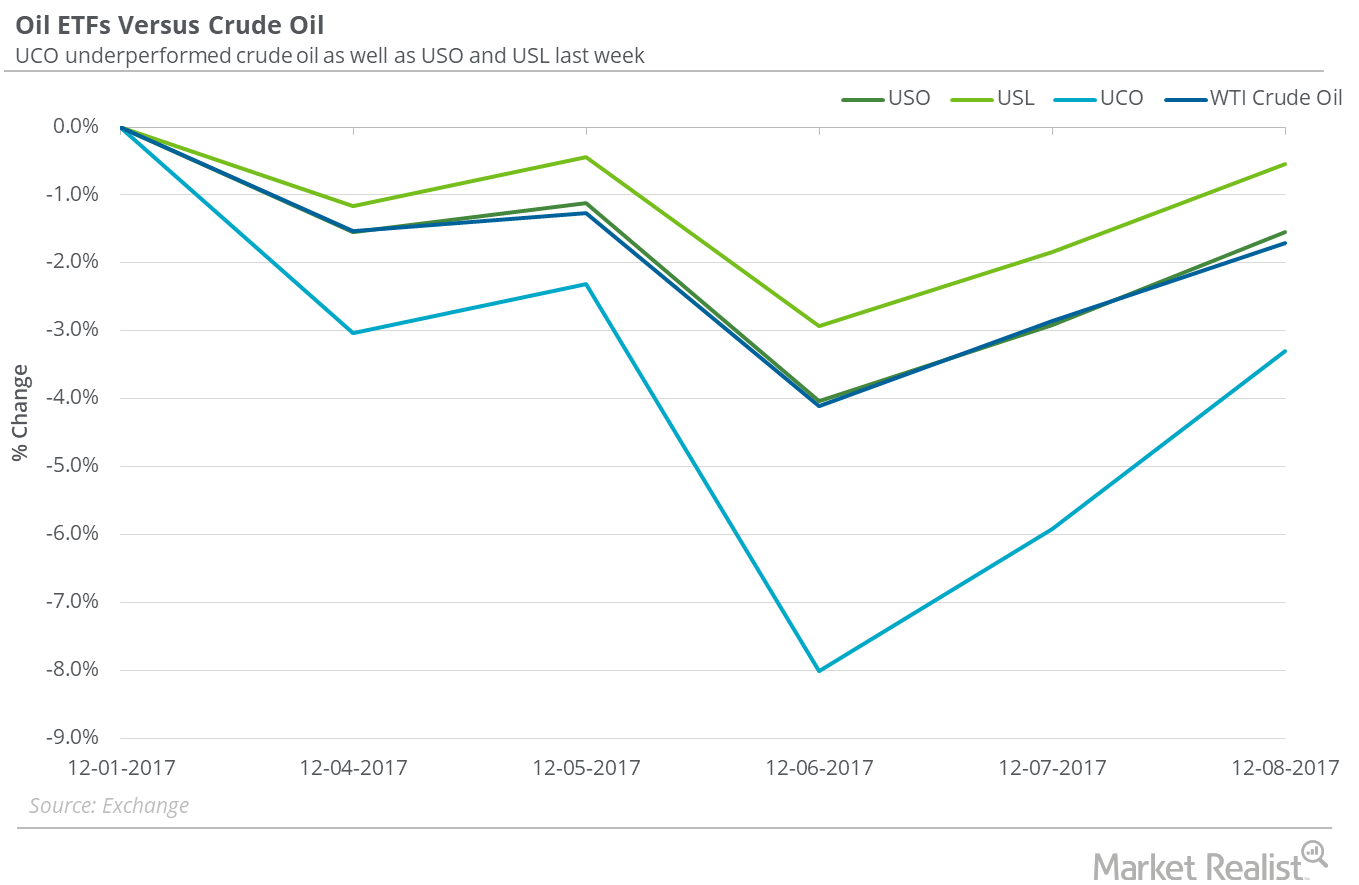

Oil ETFs That Outperformed US Crude Oil Last Week

On December 1–8, 2017, the United States Oil Fund (USO), which holds crude US oil futures contracts, fell 1.5%. US crude oil January 2018 futures fell 1.7%.

US Crude Oil Prices Could Remain below $58 Next Week

On December 7, 2017, US crude oil’s implied volatility was 20% or ~1.1% less than its 15-day average. On December 1, the implied volatility fell to 19.8%.

Analyzing Crude Oil Inventories and Oil Prices

In the week ending November 24, 2017, US crude oil inventories fell by 3.4 MMbbls (million barrels) to 453.7 MMbbls.

US Gasoline Inventories Weighed on Crude Oil Futures

US gasoline inventories rose by 3,627,000 barrels to 214 MMbbls (million barrels) on November 17–24, 2017, according to the EIA.

Crude Oil Prices Are Positive before OPEC’s Meeting

US crude oil futures for January delivery rose 0.3% to $57.47 per barrel at 1:10 AM EST on November 30, 2017. Prices rose ahead of OPEC’s meeting.

Will the Inventories Spread Impact US Crude Oil?

US commercial crude oil inventories fell by 1.9 MMbbls in the week ending November 17, 2017—0.5 MMbbls more than the market’s expected fall.

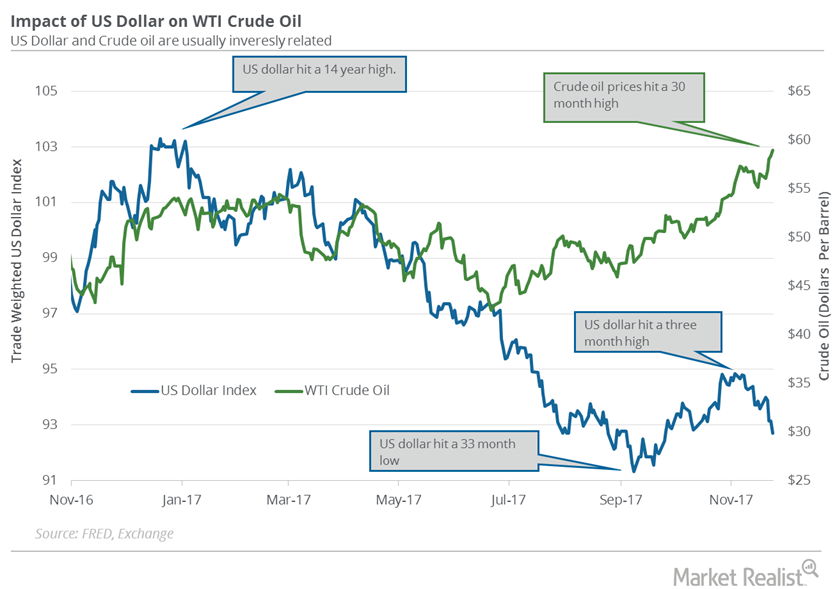

US Dollar Is near a 2-Month Low

The US Dollar Index fell 0.5% to 92.7 on November 24, 2017—the lowest level in almost two months. The US dollar (UUP) fell 1.27% last week.

How Iran and Iraq’s Crude Oil Exports Could impact crude Oil Prices

Iraq’s crude oil exports hit 3.98 MMbpd (million barrels per day) in September 2017, according to Bloomberg—its highest level since December 2016.

Cushing Inventories Are above Their 5-Year Average

Cushing crude oil inventories rose for the sixth consecutive week. Any rise in Cushing inventories is bearish for crude oil (USO) (USL) (SCO) prices.

US Gasoline Inventories Fell for 4th Time in 5 Weeks

The EIA (U.S. Energy Information Administration) estimates that US gasoline inventories fell 2.1 MMbbls (million barrels), or 1%, to 216.1 MMbbls between September 8, 2017, and September 15, 2017.

Why US Crude Oil Inventories Rose Again

On September 13, the EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report.

Hurricanes Could Impact Global and US Crude Oil Demand

West Texas Intermediate crude oil (DBO) (DIG) (XLE) futures contracts for October delivery rose 1.2% to $48.07 per barrel on September 11, 2017.

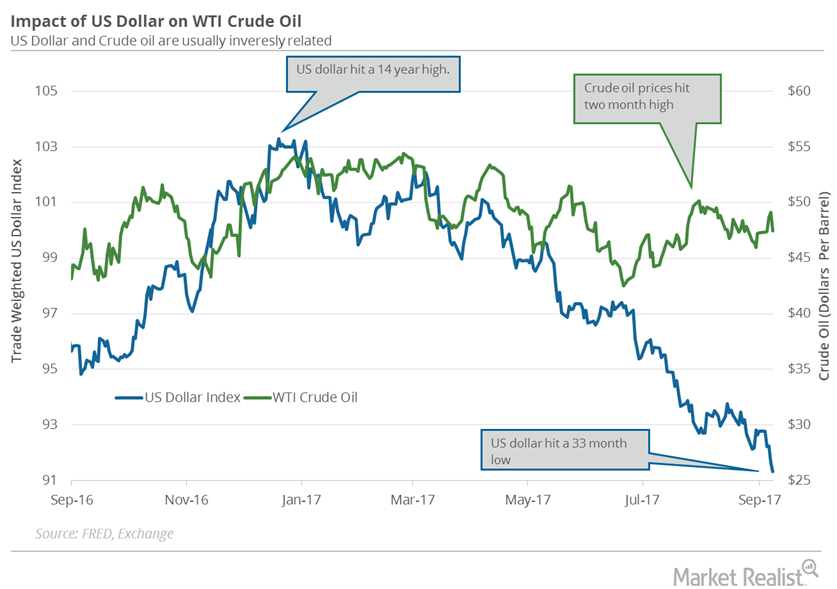

Why the US Dollar Hit a 33-Month Low

The US Dollar Index fell 0.34% to 91.33 on September 8—the lowest level in the last 33 months. Prices fell due to the following factors.…

US Distillate Inventories Rise for a Third Week

US distillate inventories On August 30, 2017, the EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report. The EIA estimates that US distillate inventories rose by 0.5% to 149.1 MMbbls (million barrels) between August 18 and 25, 2017. Inventories fell by 5.6 MMbbls, or 3.6%, from the same period in 2016. Inventories […]

Could US Gasoline Demand Fall in the Coming Months?

The EIA estimates that US gasoline demand will fall 275.0 Mbpd (thousand barrels per day) to 9.5 MMbpd (million barrels per day) August 4–11, 2017.