Invesco DB Oil Fund

Latest Invesco DB Oil Fund News and Updates

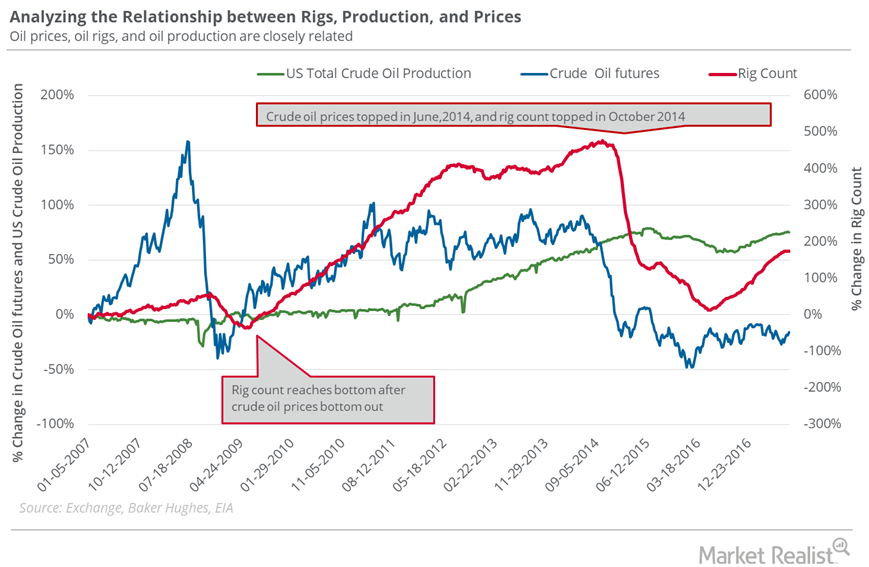

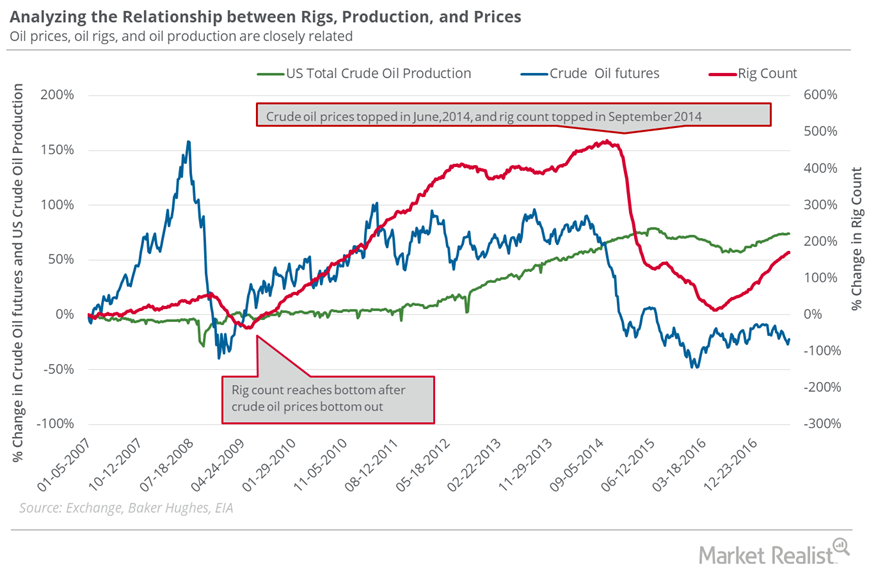

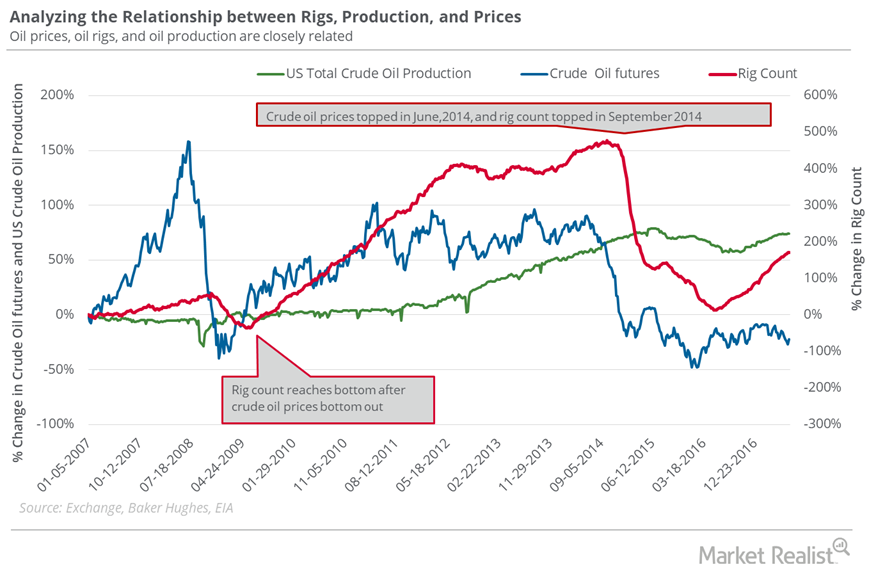

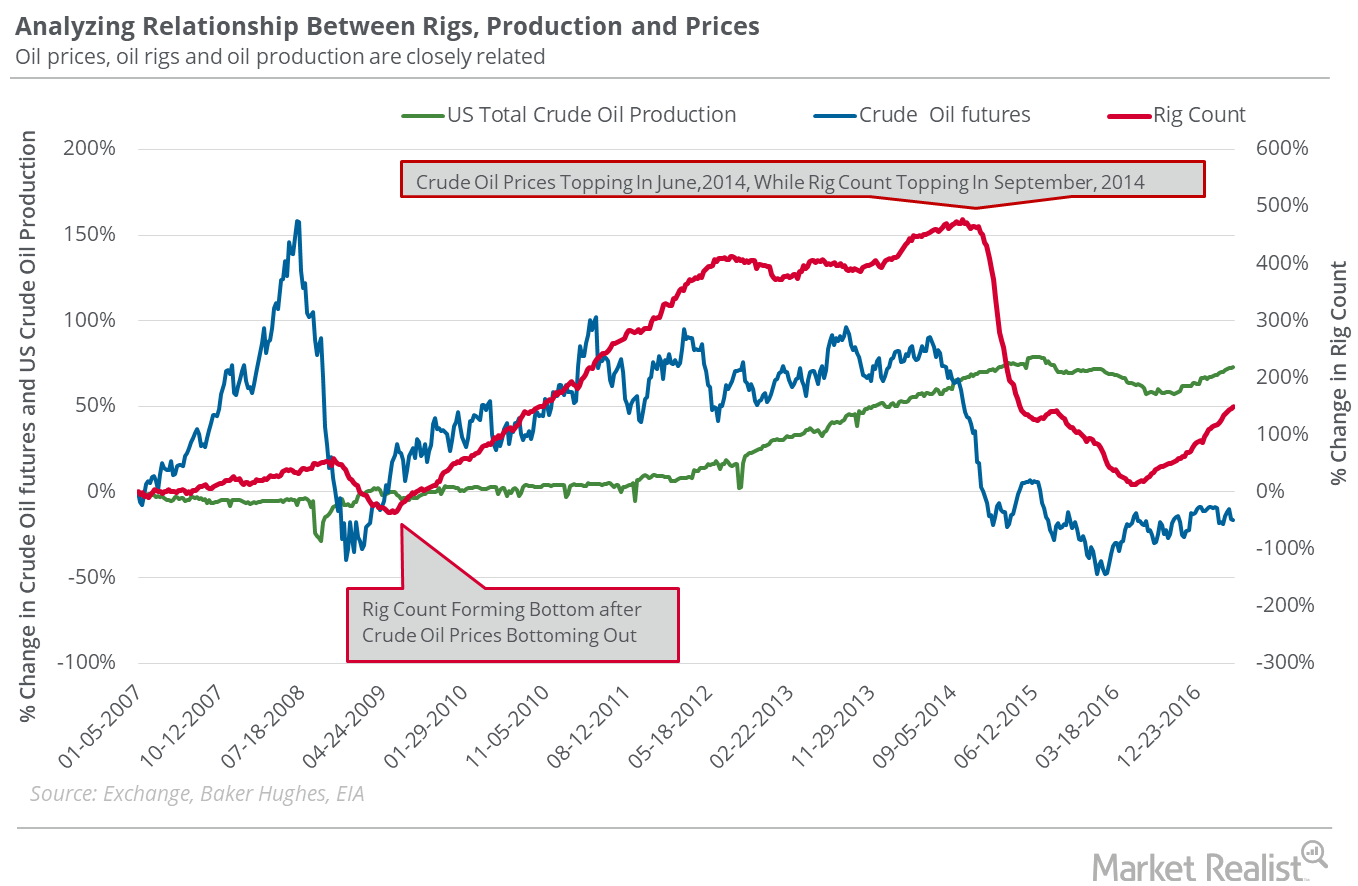

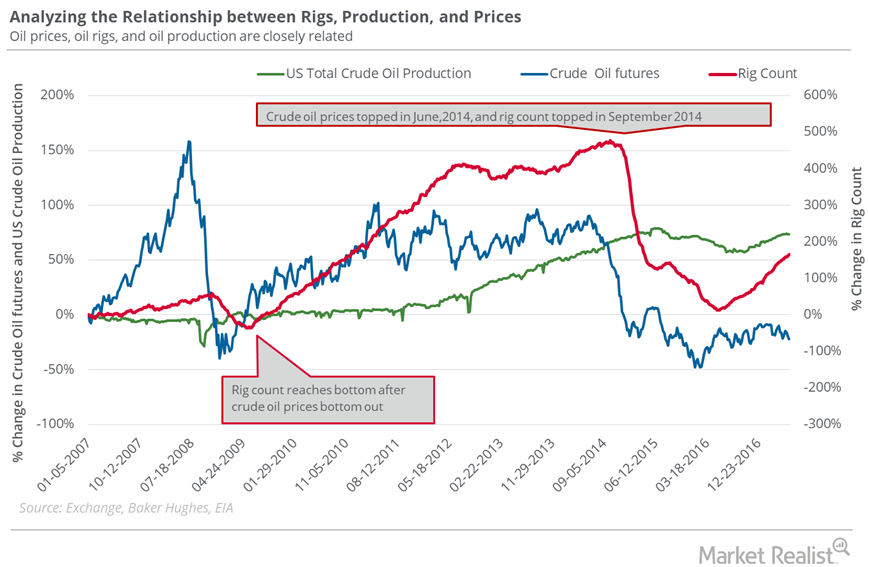

Could the Oil Rig Count Threaten Bullish Bets on Oil Prices?

The US oil rig count rose by three to 768 for the week ended August 11, 2017.

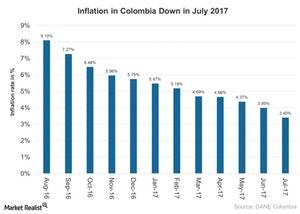

Inflation in Colombia Continues to Fall in July 2017

Consumer prices in Colombia (GXG) rose 3.4% on a year-over-year basis in July 2017, lower than the 4.0% rise in June 2017.

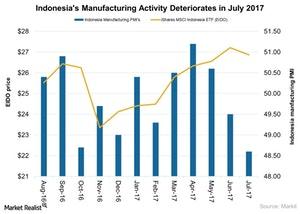

Why Indonesia’s Manufacturing Activity Fell

Manufacturing activity in Indonesia In July 2017, manufacturing activity in Indonesia (EIDO) fell at the fastest pace in 19 months, mainly due to sharp decline in its output. Indonesia’S (EEM) manufacturing PMI (purchasing managers’ index) fell to 48.6, compared with 49.5 in June 2017, according to an IHS Markit report. New orders also fell in July […]

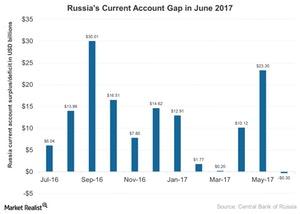

Is Russia’s Current Account Deficit in June Temporary?

Russia’s (ERUS) current account recorded a $0.3 billion gap in 2Q17 as compared to a $23.3 billion surplus in the previous quarter and a $2 billion surplus in the same period.

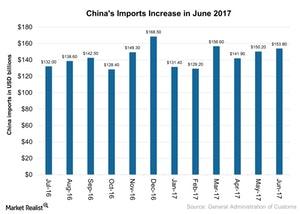

Did China’s Imports Rise on Its Structural Shift in June 2017?

China’s (FXI) imports rose to $153.8 billion in June 2017, a 17.2% rise year-over-year (or YoY) and a 2% rise month-over-month.

Oil Rigs: Oil Prices Could Make a U-Turn

The US oil rig count extended to 765 in the week ending July 14, 2017—a gain of two rigs compared to the previous week.

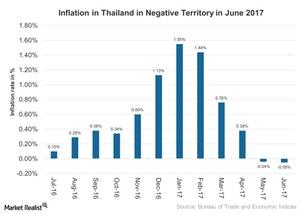

Is Negative Inflation Suggesting Contraction in Thailand in 2017?

Thailand’s (EEM) inflation in June 2017 exceeded the market estimate of a 0.1% drop.

Why Oil Prices Could Plunge

The US oil rig count rose by seven to 763 in the week ended July 7, 2017. This was the rig count’s highest level since April 10, 2015.

Oil Rigs: Will Oil Prices Rise More?

On June 23–June 30, the US oil rig count fell by two to 756. The fall was marginal, but it was the first fall after rising for 23 consecutive weeks.

Will US Crude Oil Hit $40 Next Week?

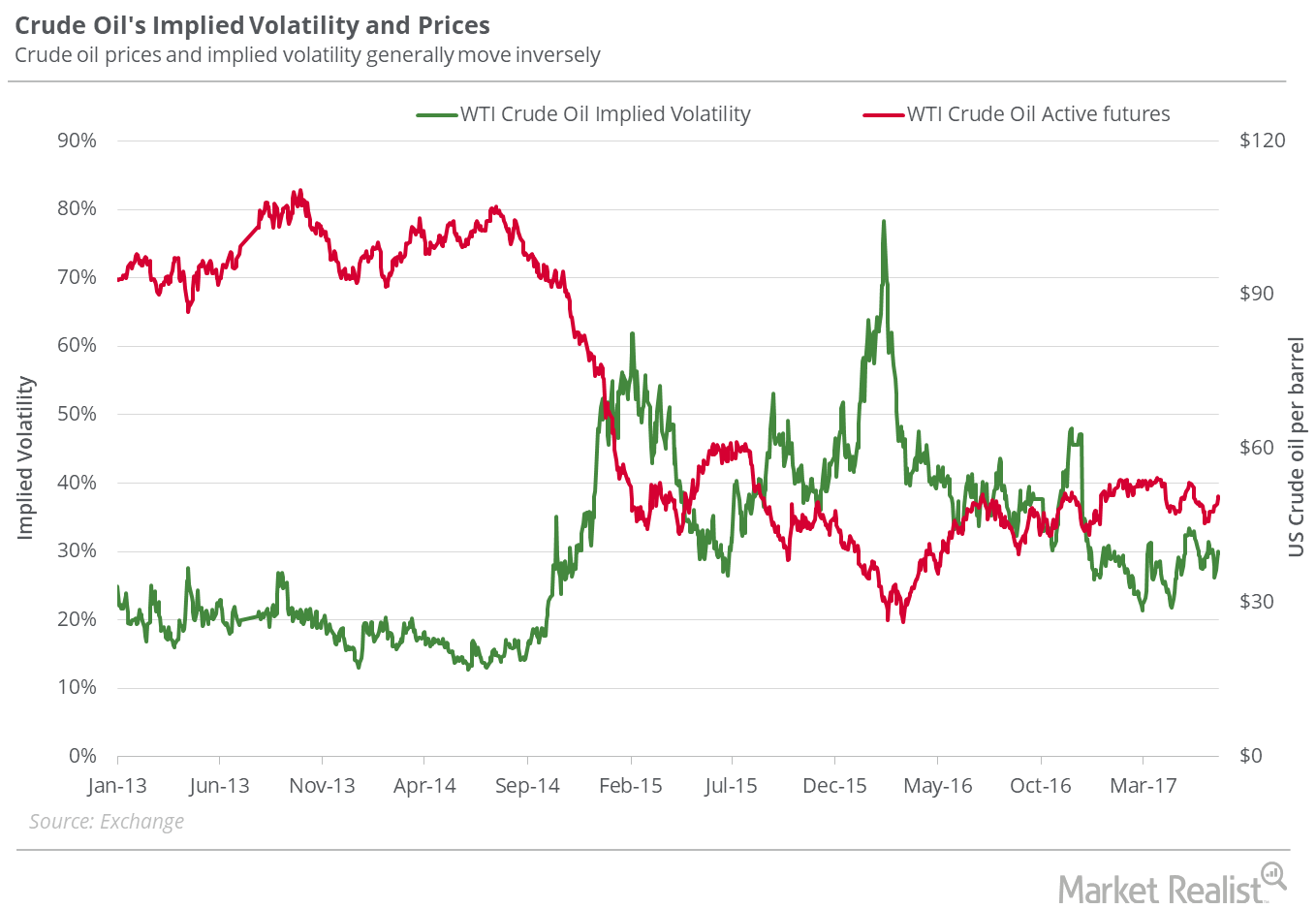

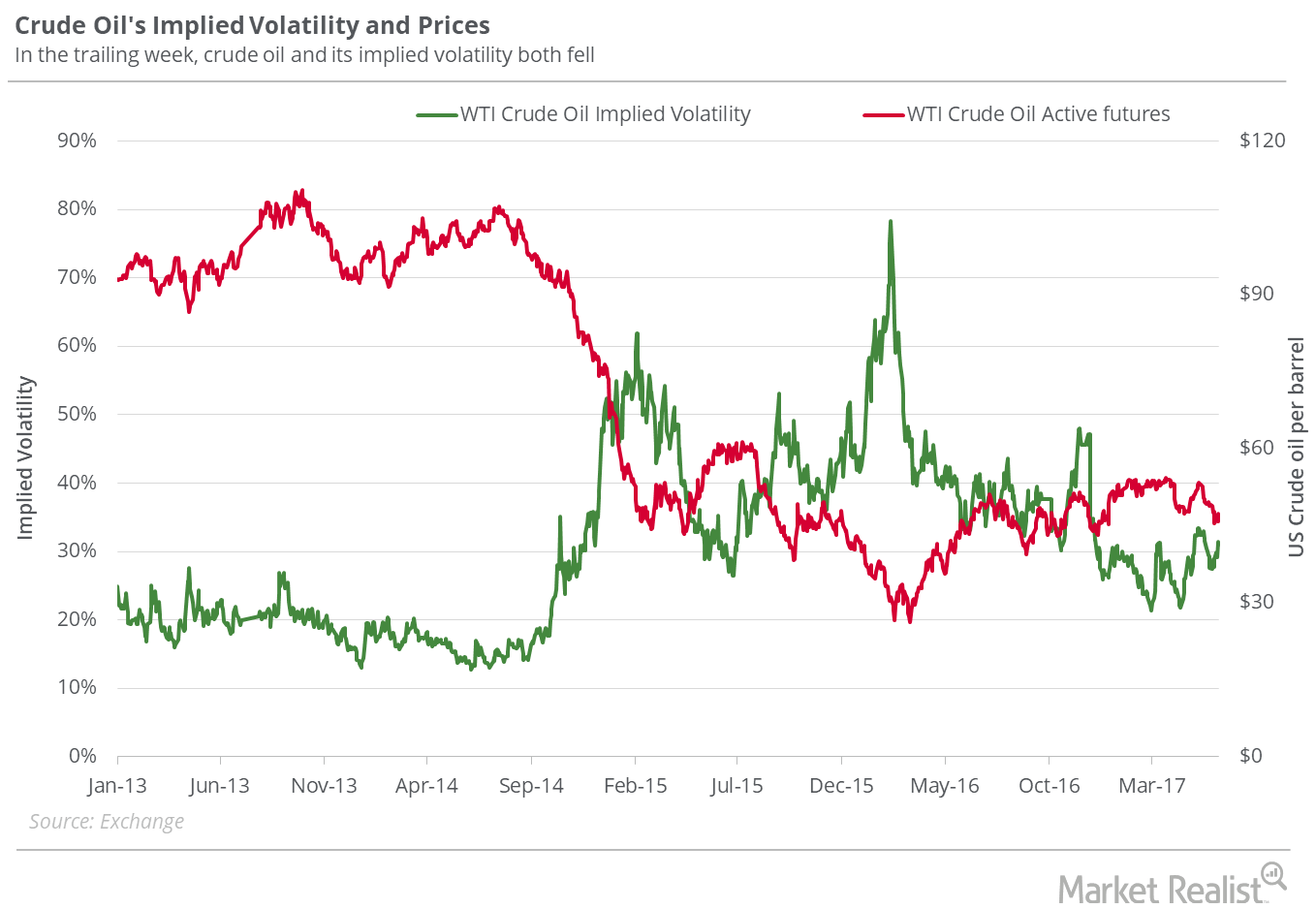

On June 22, 2017, WTI crude oil (USO) (OIIL) active futures’ implied volatility was 29.7%, up 1.7% compared to its 15-day average.

Rising Oil Rigs: Oil Bears’ Friend, Oil Bulls’ Foe

In the week ended June 16, 2017, the US oil rig count was 747, its highest level since the week ended April 17, 2015.

Where Will US Crude Prices Settle?

On June 15, 2017, US crude oil active futures’ implied volatility was 27.9%.

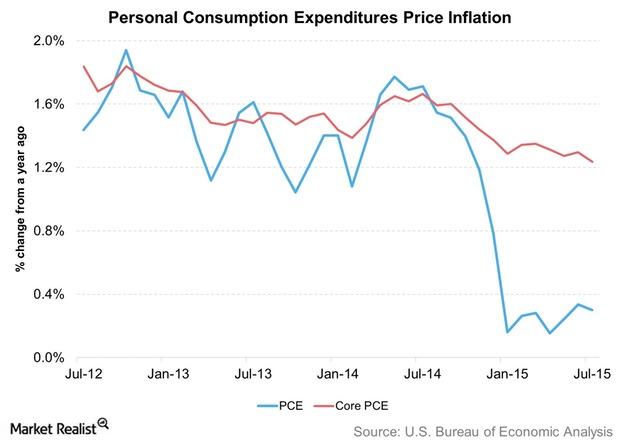

Import Prices and Crude Oil Keep US PCE Inflation Down

When the Fed refers to “inflation,” it’s talking about the rate of change in PCE (personal consumption expenditure) inflation. This is the price index for PCE.

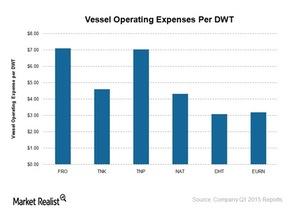

Comparing Tanker Companies’ Operating Expenses per DWT

Vessel operating expenses mainly include crewing, repair and maintenance, and insurance expense, but not fuel cost (DBO).

5- and 10-year VLCC Prices Higher in February

Five-year VLCC prices in February increased to $80.9 million from $80.7 million in January. Ten-year VLCC prices fell to $52.2 million from $52.8 million.

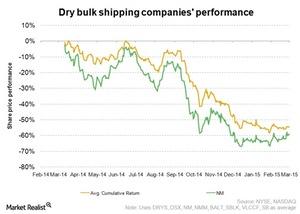

A snapshot of Navios Maritime Holdings’ fourth quarter earnings

Navios Maritime Holdings (NM) is a global seaborne shipping and logistics company. It’s focused on the transport and transshipment of dry bulk commodities.