Conoco Phillips

Latest Conoco Phillips News and Updates

Will Oil Hit $100 a Barrel? A Forecast

With the cost of crude oil on the rise, will it reach the wild price of $100 a barrel?

Perfect Storm for Natural Gas—What Are the Top Stock Picks?

With nearly 100 percent gains YTD, natural gas has become one of the top-performing commodities in 2021. What are the best natural gas stocks to buy now?

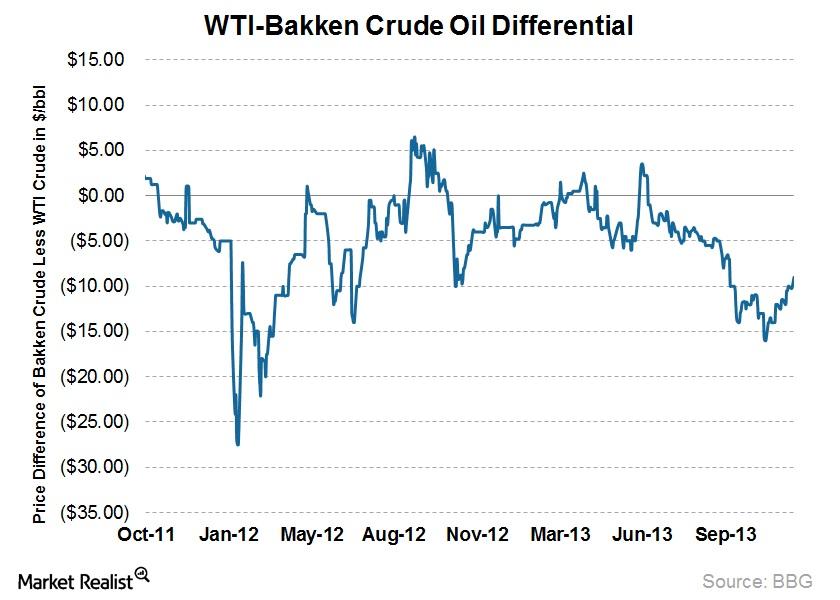

Why oil takeaway capacity in the Bakken can affect earnings

The availability of takeaway capacity from the Bakken can affect producers’ earnings.

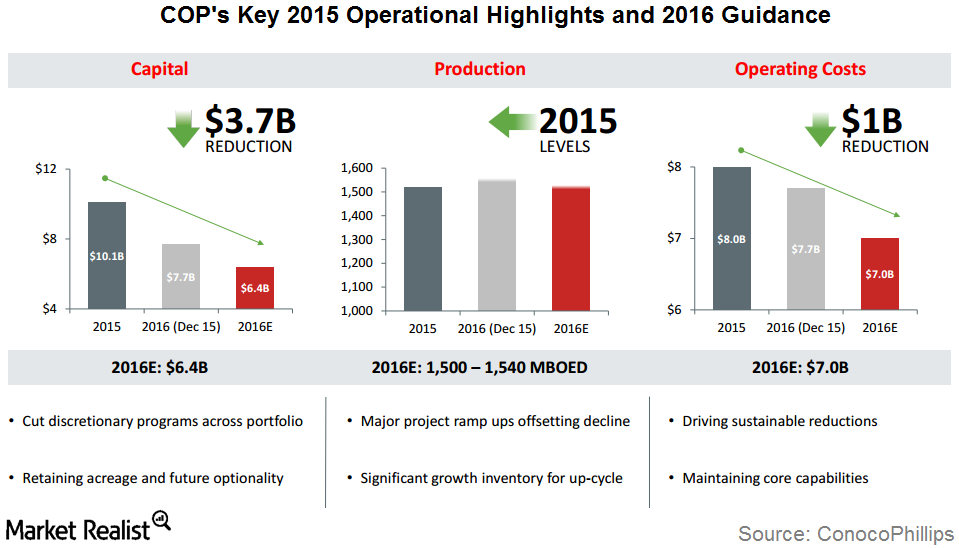

ConocoPhillips: 2015 Operational Highlights, 2016 Guidance

ConocoPhillips’s (COP) total production volume in 2015 was 1,589 Mboe/d excluding Libya. This represents a 5% year-over-year growth after adjusting for asset dispositions and downtime.

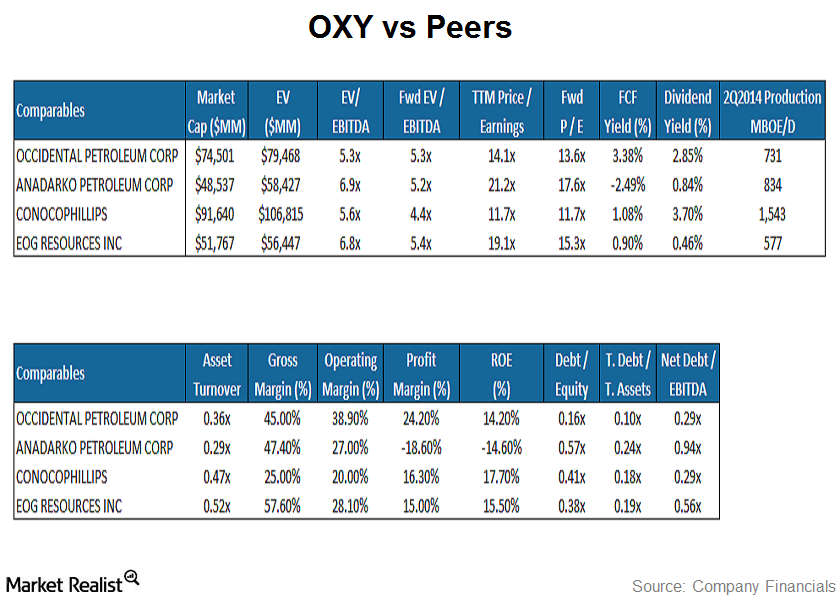

How does Occidental Petroleum compare to industry peers?

In terms of profitability, OXY has the highest profit margins amongst its peers at 24.2%. OXY also has one of the highest dividend yields at 2.85%.

ConocoPhillips: Investors’ Confidence Is Rising

Since ConocoPhillips (COP) reported its fourth-quarter earnings results on January 31, the stock has fallen 1.7%.

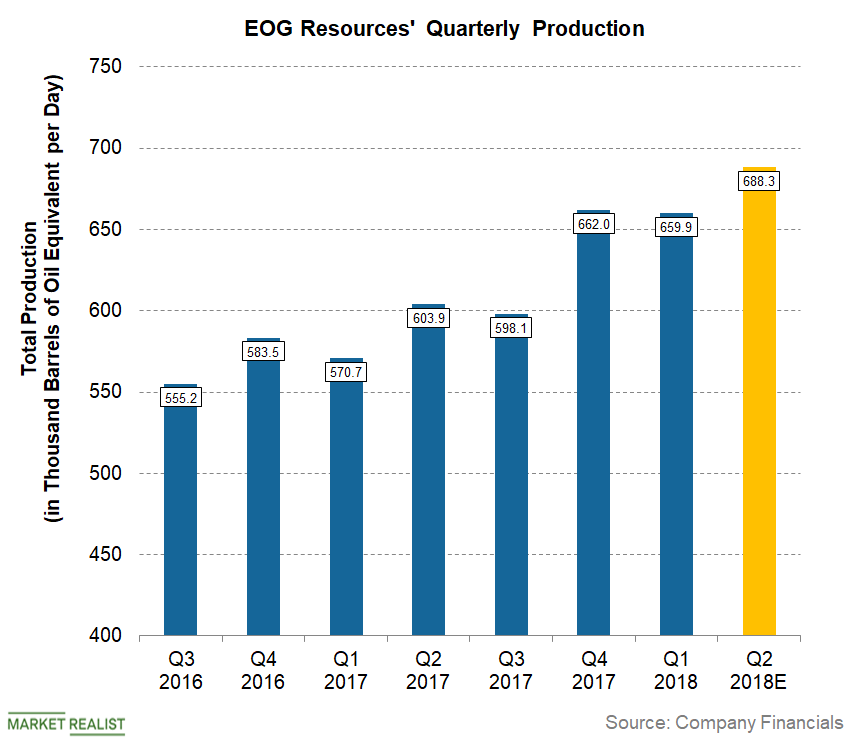

Understanding EOG Resources’ Q2 2018 Production Guidance

For the second quarter, EOG Resources expects total production in the range of 670.3–706.2 Mboepd (thousand barrels of oil equivalent per day).

Analyzing Denbury Resources’ 1Q16 Earnings Call

For 1Q16, Denbury Resources (DNR) reported an adjusted EBITDA of ~$105 million with an EBITDA margin of ~40%. Its EBITDA margin is only ~20% lower.

Why Did ConocoPhillips’s Revenue Grow in 1Q18?

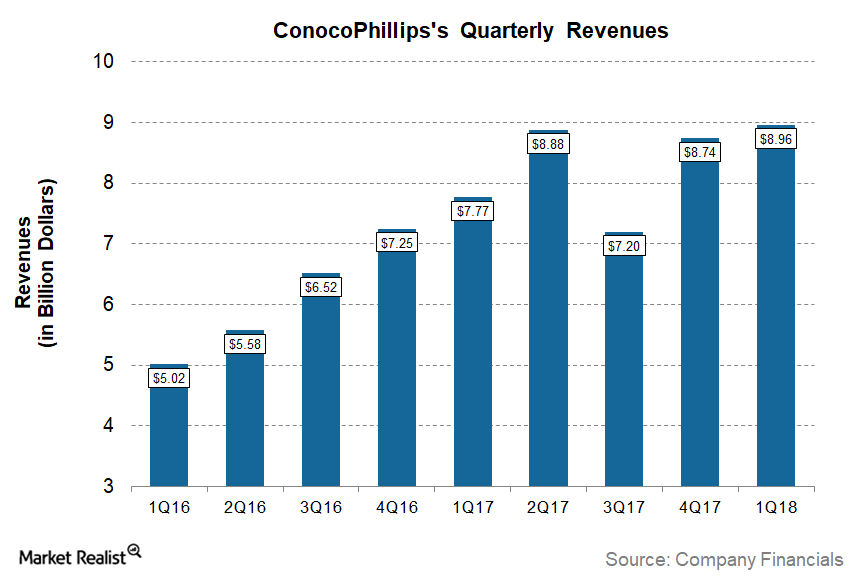

For 1Q18, ConocoPhillips (COP) reported revenues of ~$9.0 billion—higher than analysts’ consensus of ~$8.8 billion.

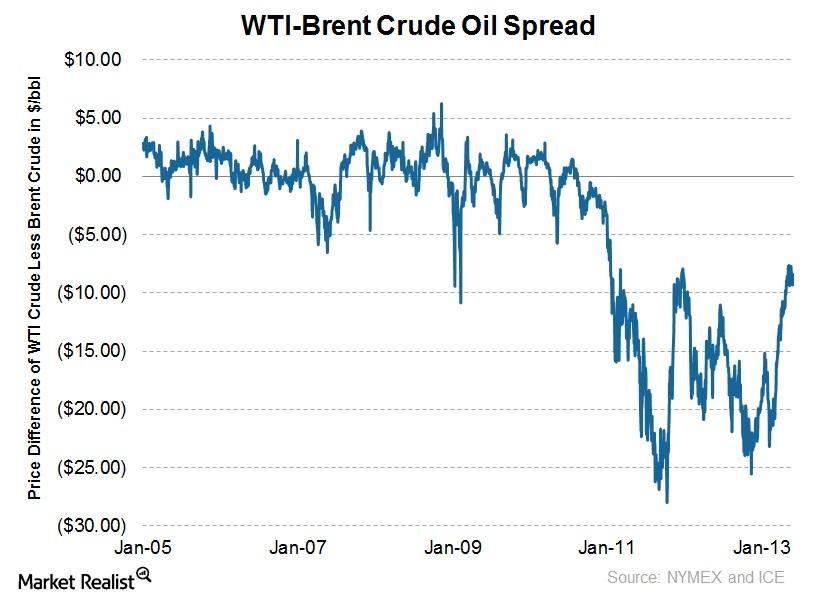

Spread between WTI crude oil and Brent oil has closed in significantly since YE2012

The WTI-Brent spread remained relatively unchanged last week, but has closed in significantly since year-end 2012.

An Overview of US LNG Production and Exports

Investors may be seeing a lot of reports about rising US LNG (liquefied natural gas) exports. Let’s review the basics of LNG.

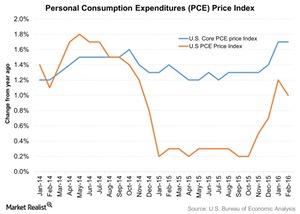

What Do the PCE Price Index and Break-Even Inflation Indicate?

The PCE price index is the Federal Reserve’s preferred measure of inflation because it covers the broadest set of goods and services.

Stock Comparison: How Have COP, DVN, OXY, APC, and EOG Fared?

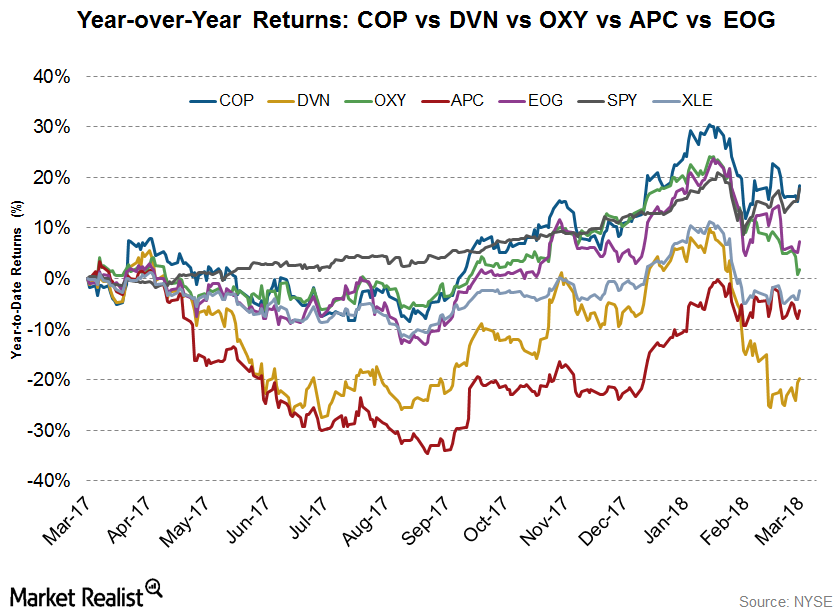

Stock performance In this article, we’ll discuss the year-to-date (YTD) stock performance of ConocoPhillips (COP), Devon Energy (DVN), Occidental Petroleum (OXY), Anadarko Petroleum (APC), and EOG Resources (EOG), which reported the highest revenue among upstream companies in fiscal 2017. Outliers and underperformers The above image shows that ConocoPhillips (COP) is the outlier among peers. YoY […]

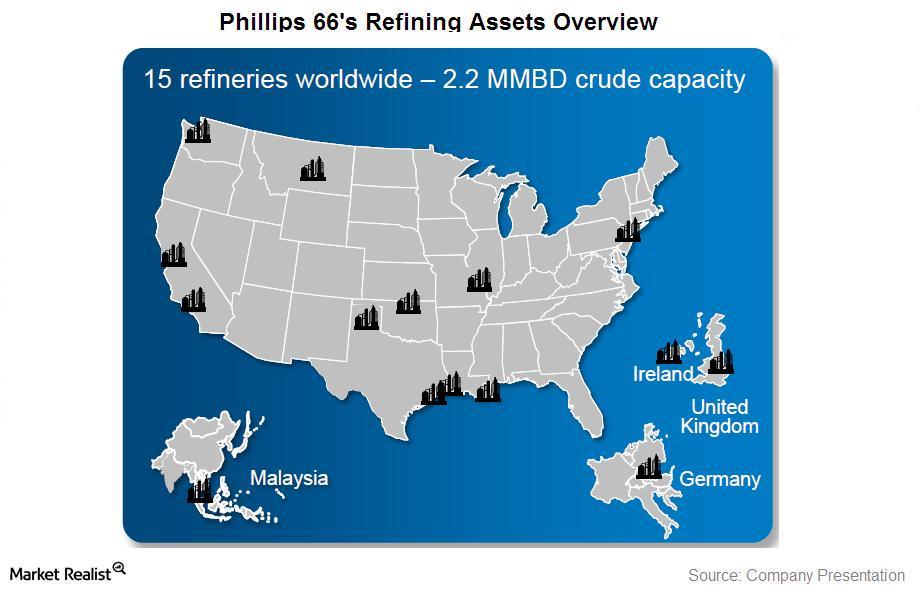

Phillips 66: An overview

In 2013, Phillips 66 generated 67%, 13%, and 6% of its revenues from the United States, the United Kingdom, and Germany, respectively. The company’s other foreign operations contributed ~16%.Financials Understanding the simple moving average in technical analysis

The simple moving average (or SMA) is an average of the closing price of a stock over a specified number of periods. The moving average smooths the short-term fluctuations in the stock prices.

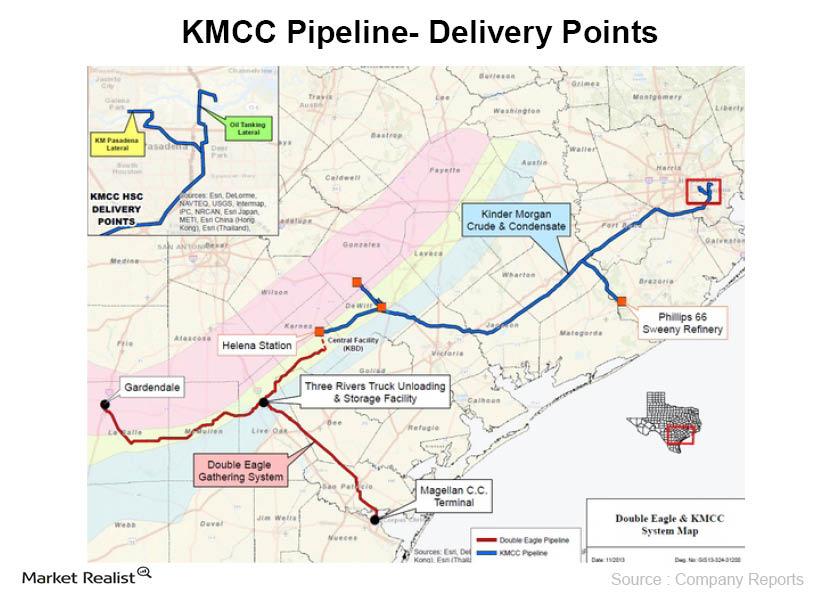

Must-know: Why the Kinder Morgan Eagle Ford expansion is positive

Kinder Morgan Energy Partners plans several major Eagle Ford joint ventures and projects that could reach almost $900 million in expenditures if company reports are to be believed.

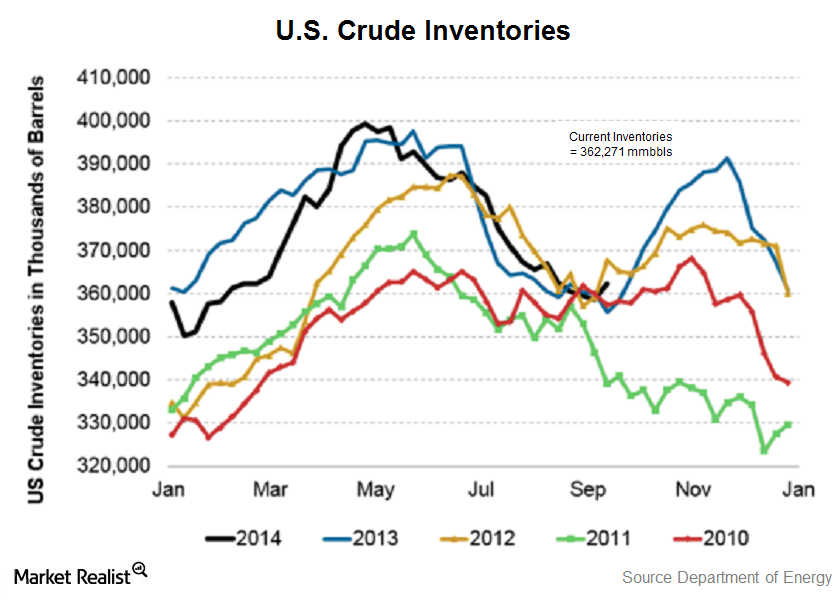

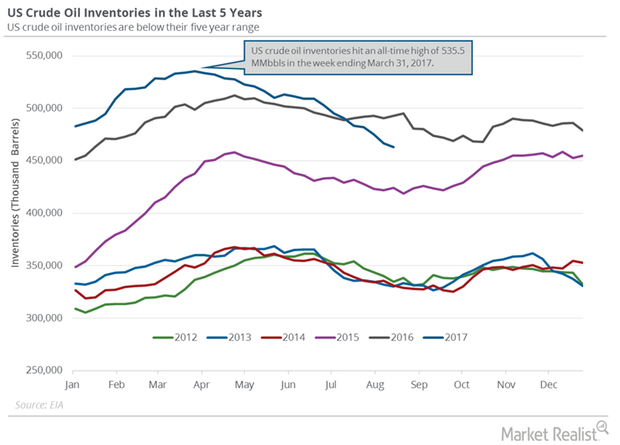

Must-know: Why energy investors monitor crude oil inventories

Analysts had expected a drop of 1.5 million barrels (mmbbls) in crude inventories last week. The following parts will cover actual changes in inventories.

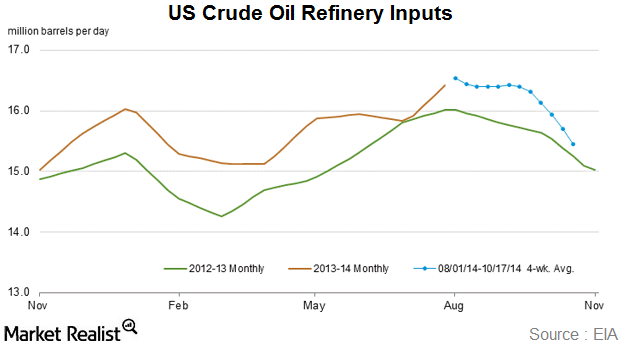

Why peak refinery maintenance season affects crude inventory

U.S. crude oil refinery inputs averaged 15.2 million barrels per day during the week ending October 17. Input levels were 113,000 bpd less than the previous week’s average.

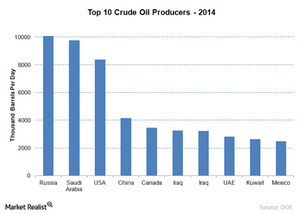

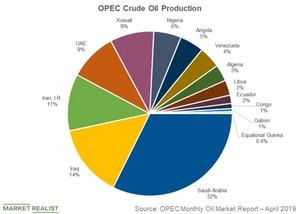

Why is OPEC important to the price of crude oil?

High market share gives OPEC bargaining power to price oil above a competitive market. It can sway crude oil prices by increasing or decreasing production.

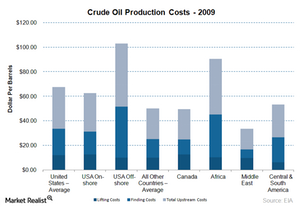

How does the production cost of crude oil affect oil prices?

Recent consensus says the production cost of crude oil could range from $20 to $25 per barrel.

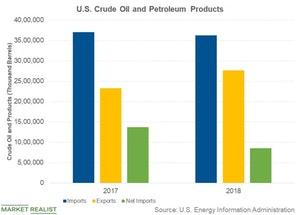

The US Energy Sector: An Overview

To understand the US energy sector, it’s essential first to understand the country’s energy needs. The US uses various energy sources to meet its energy needs.

Why the United States Imports Oil

Several factors contributed to the rising crude oil exports in 2018.

OPEC’s Role in World Oil Production

OPEC (the Organisation of the Petroleum Exporting Countries) aims to “coordinate and unify the petroleum policies of its Member Countries.”

Capital World Investors Sold a Major Position in NBL in Q2

So far in this series, we’ve looked at institutional investments in five major oil-weighted E&P (exploration and production) stocks: ConocoPhillips (COP), EOG Resources (EOG), Occidental Petroleum (OXY), Anadarko Petroleum (APC), and Pioneer Natural Resources (PXD).

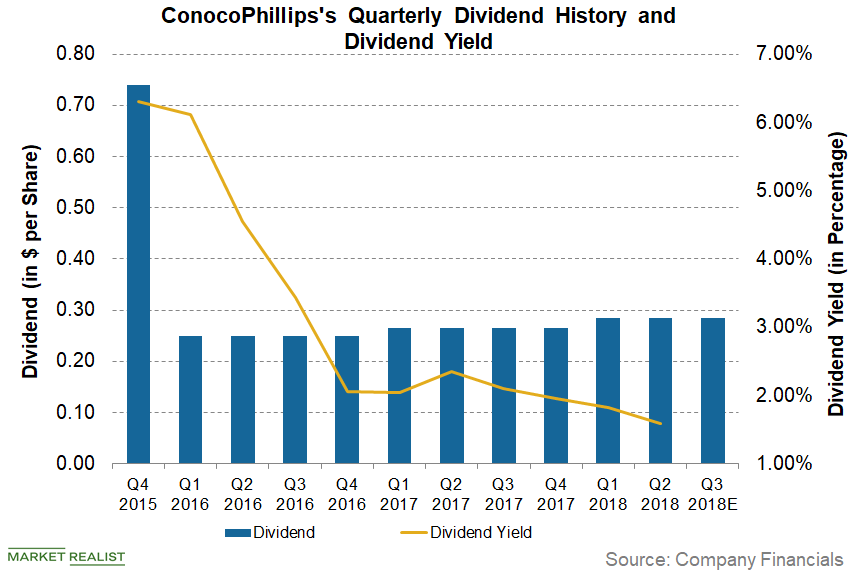

Analyzing ConocoPhillips’s Dividend and Dividend Yield

On July 11, ConocoPhillips (COP) announced a dividend of $0.285 per share on its common stock.

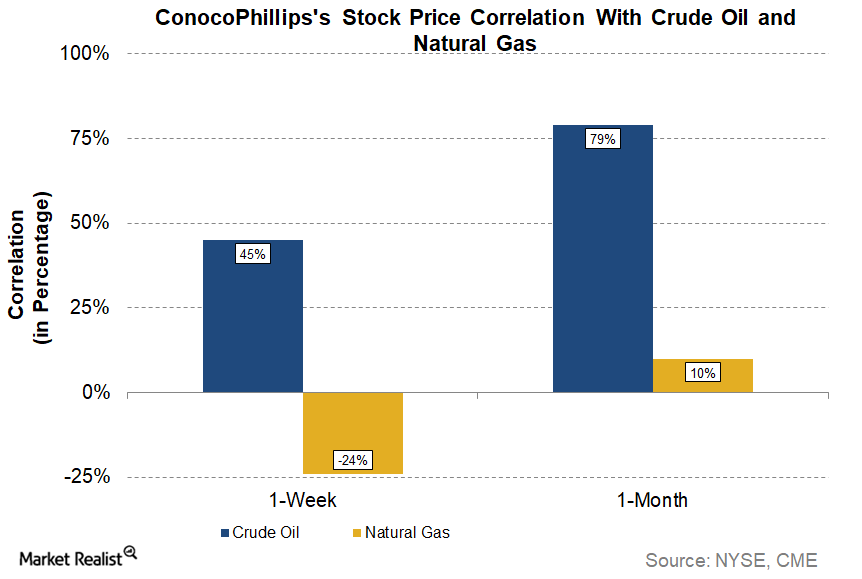

Understanding ConocoPhillips Stock’s Correlation with Crude Oil

ConocoPhillips’s stock performance As we saw in the previous part of this series, ConocoPhillips’s (COP) stock price rose ~2% in the week ended March 9, while crude oil (UWT) (SCO) (DWT) rose ~1%, suggesting that COP stock followed crude oil. In this part, we’ll try to quantify this correlation between COP stock and crude oil. ConocoPhillips’s stock […]

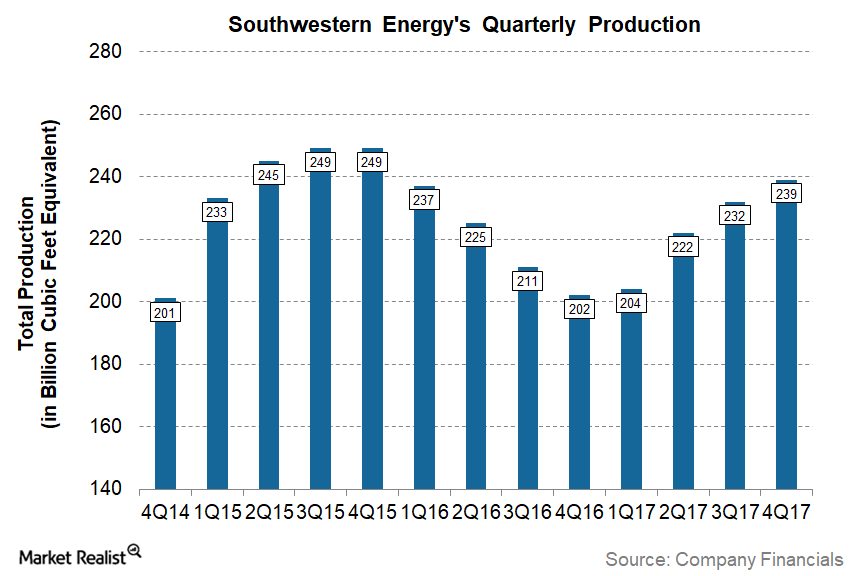

Southwestern Energy Reported Higher Production in 4Q17

Sequentially, Southwestern Energy’s 4Q17 production is ~3% higher compared to its production of 232 Bcfe in 3Q17.

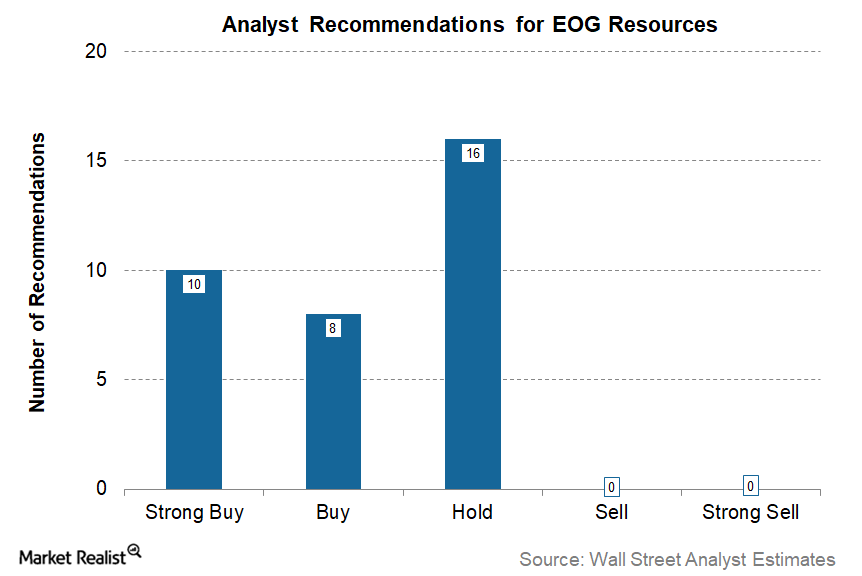

EOG Resources: Post-Earnings Wall Street Ratings

As of March 1, 2018, a total of 34 analysts have made recommendations on EOG Resources (EOG) stock, according to Reuters.

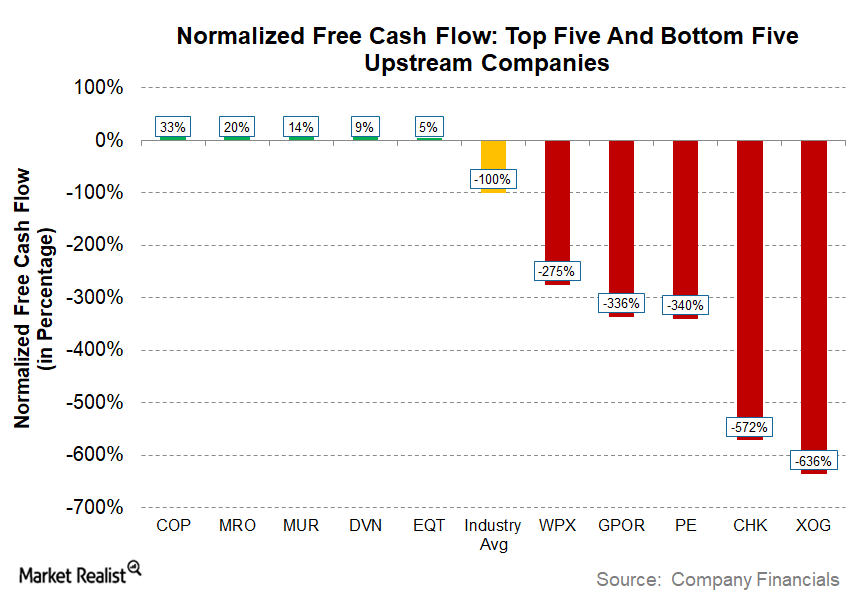

Upstream Energy’s Best and Worst Free Cash Flow Companies

Free cash flow (or FCF) is an important metric for the crude oil (USO) and natural gas (UNG) production (or upstream) sector.

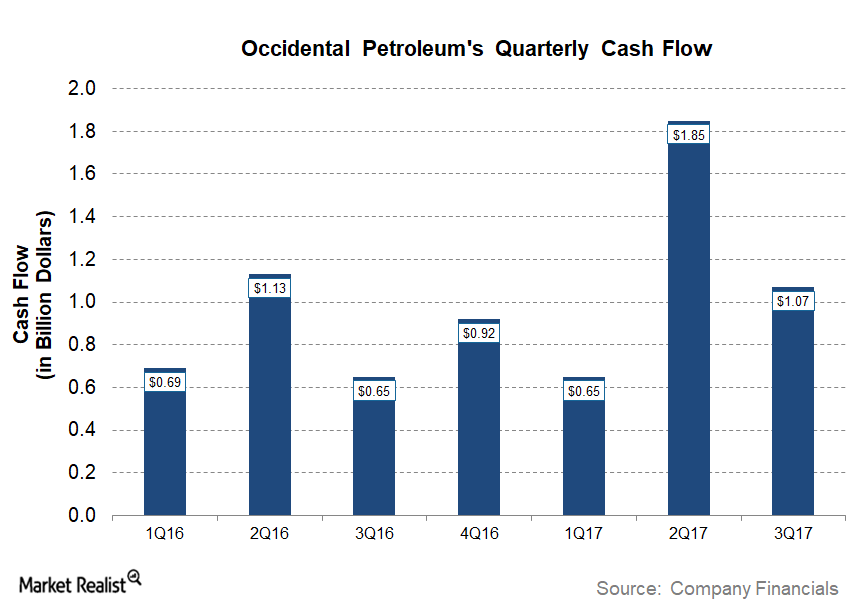

Did Occidental Petroleum Generate Positive Free Cash Flow in 3Q17?

On a year-over-year basis, OXY’s 3Q17 operating cash flow was ~65% higher than the ~$650 million it generated in 3Q16.

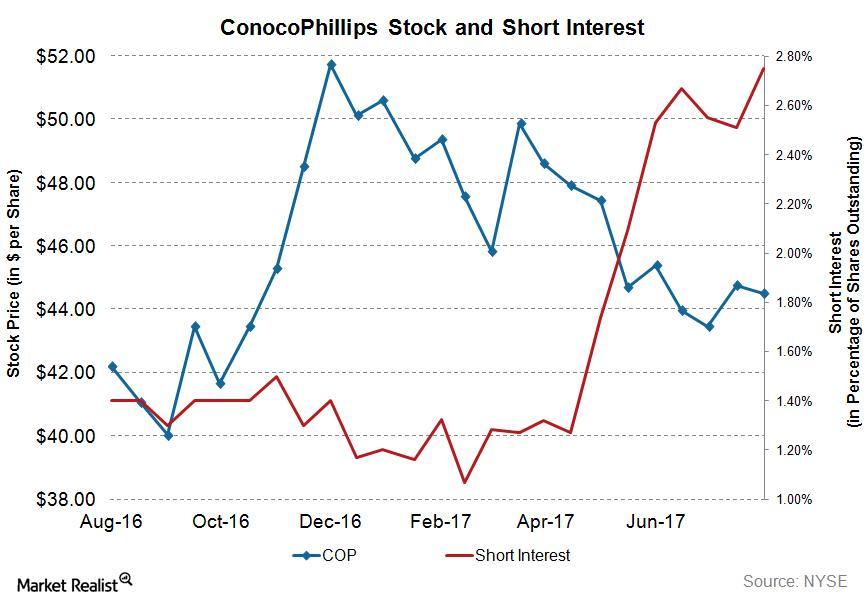

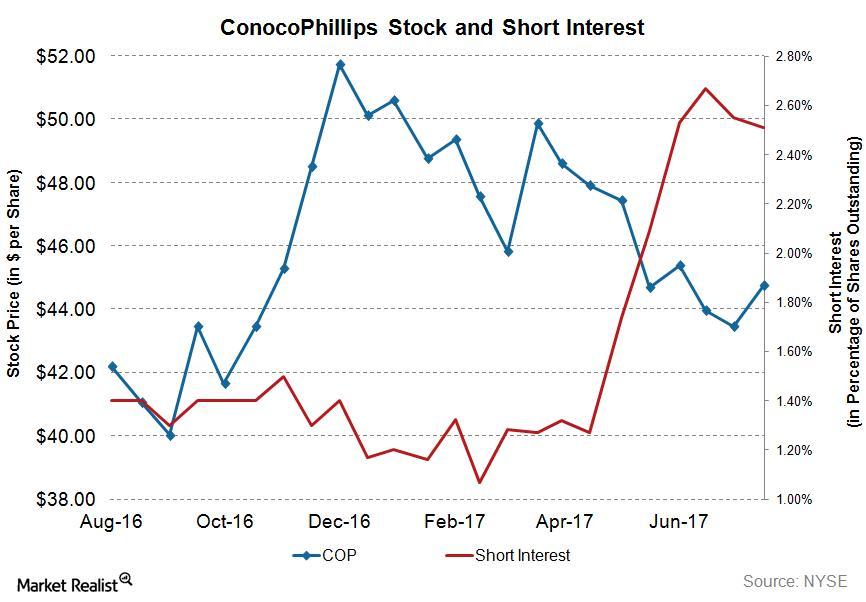

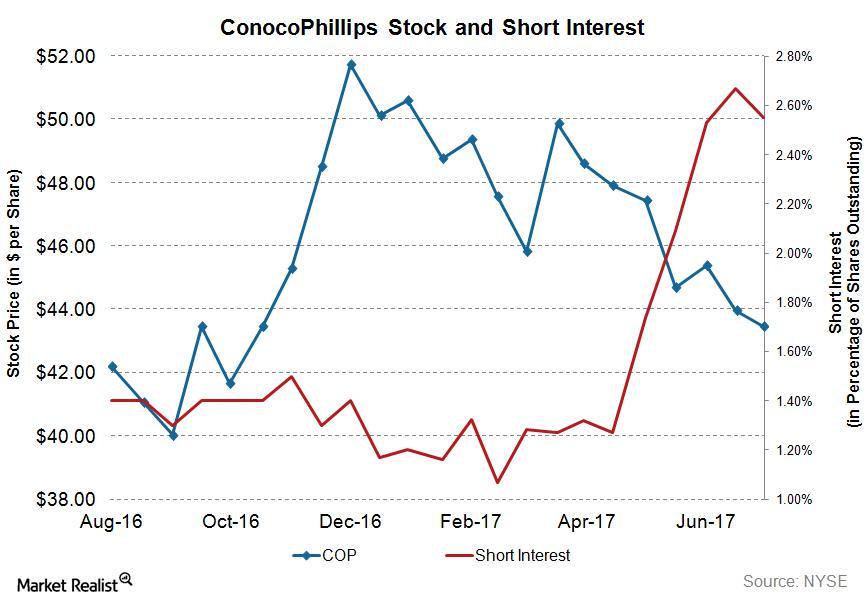

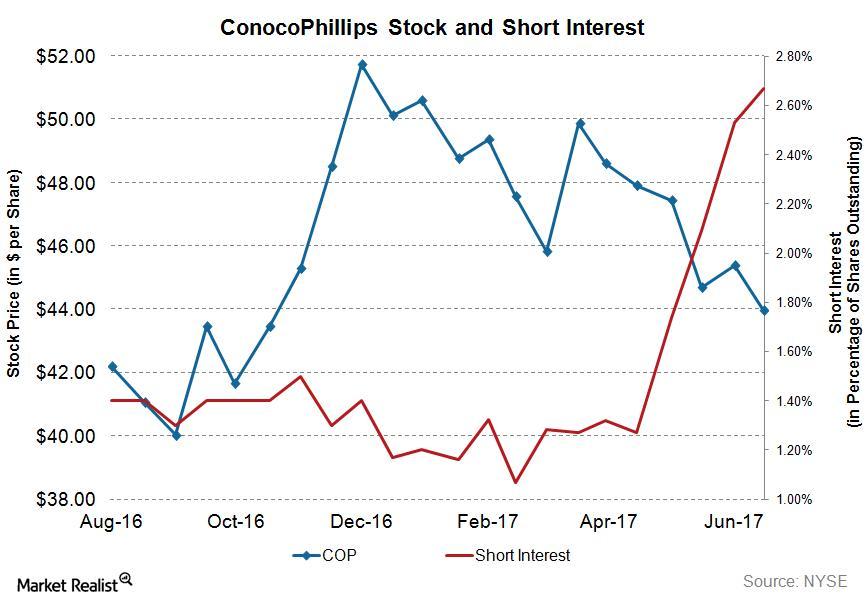

Who’s Shorting COP: Reading the Short Interest in ConocoPhillips’s Stock

Short interest in COP On August 14, 2017, ConocoPhillips’s (COP) total shares shorted (or short interest) stood at ~33.4 million, while its average daily volume was ~8.02 million. This means the short interest ratio for COP’s stock was ~4.6x. COP’s average daily volume is calculated for the short interest reporting period from August 1, 2017, […]

US Crude Oil Inventories Fall in Line with Market Expectations

A Reuters survey estimated that US crude oil inventories would fall 3.5 MMbbls between August 11, 2017, and August 18, 2017.

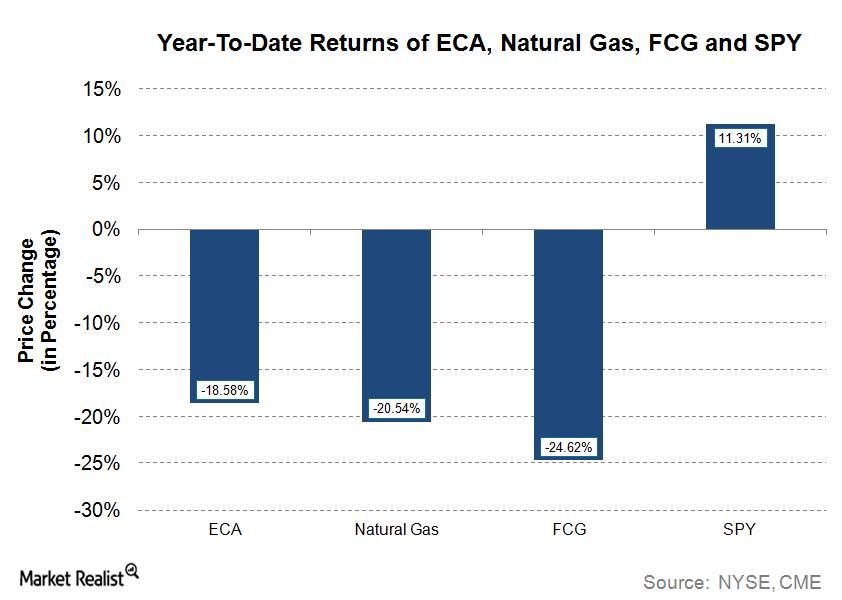

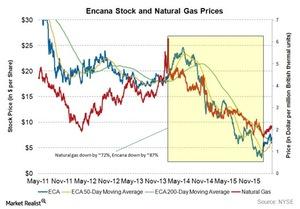

How Encana Stock Has Performed This Year

Year-to-date, Encana’s (ECA) stock has fallen ~19% to $9.53. The stock is trading below its 50-week and 200-week moving averages.

Analyzing the Short Interest in ConocoPhillips Stock

As of July 31, 2017, ConocoPhillips’s (COP) total shares shorted (or short interest) was ~31.6 million, and its average daily volume was ~8.0 million.

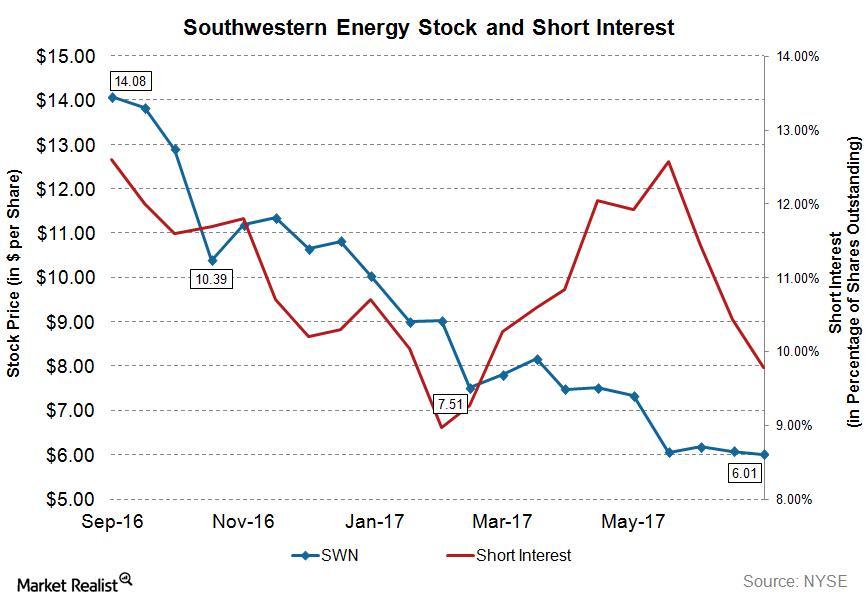

What’s the Short Interest in Southwestern Energy Stock?

As of July 14, 2017, Southwestern Energy’s (SWN) total shares shorted (or short interest) stood at ~49.5 million, whereas its average daily volume was ~18.4 million.

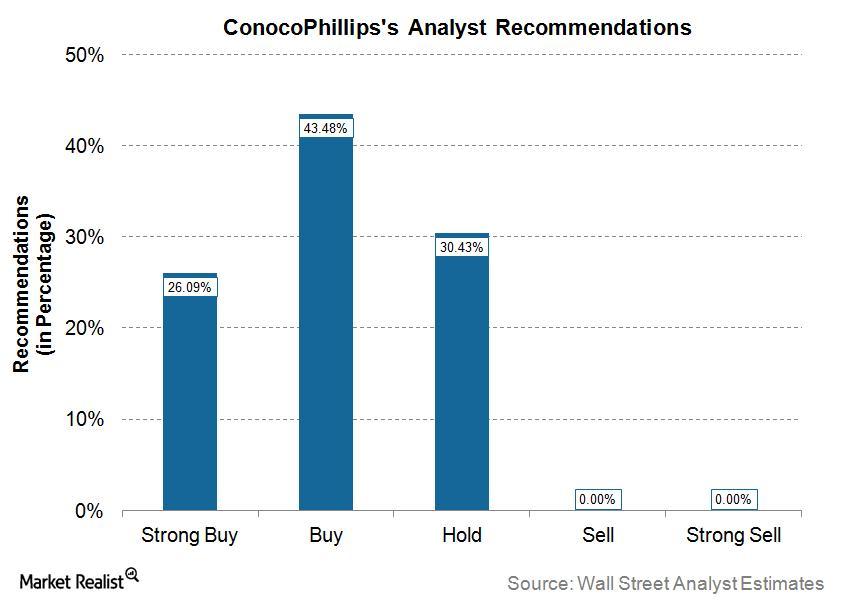

What Wall Street Analysts Are Saying about ConocoPhillips

As of July 28, 2017, 43.48% of the total Wall Street analysts covering ConocoPhillips (COP) have a “hold” recommendation on ConocoPhillips.

Analyzing Short Interest Trends in ConocoPhillips’s Stock

As of July 14, 2017, ConocoPhillips’s (COP) total shares shorted (or short interest) stood at ~31.48 million, whereas its average daily volume is ~5.91 million.

Analyzing Short Interest in ConocoPhillips Stock

On March 31, 2017, 1,282 13F filers held ConocoPhillips (COP) stock in their portfolios. However, only 19 filers featured COP in their top ten holdings.

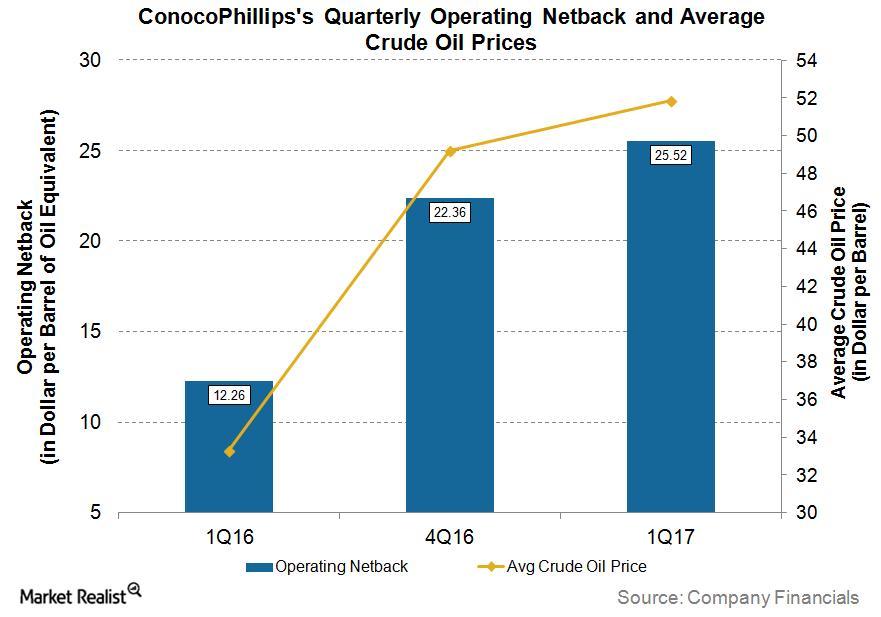

Chart in Focus: ConocoPhillips’s Operating Netback

What is the operating netback? The operating netback (also referred as production netback) is oil and gas revenue realized per boe (barrel of oil equivalent) after all costs to bring one boe to the market are subtracted from the realized price. The operating netback is derived by subtracting production expenses (or field operating expenses), production taxes, […]

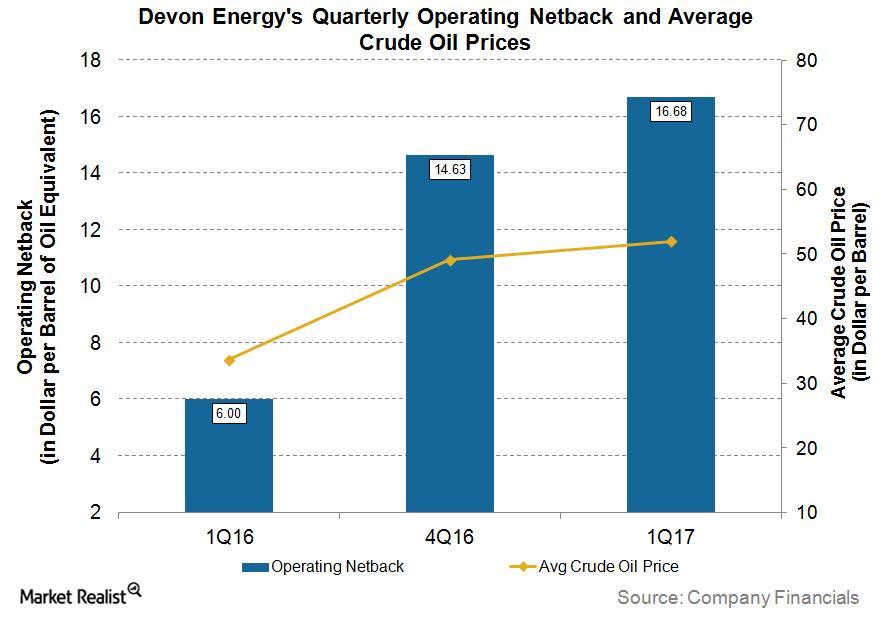

Devon Energy’s Operating Netbacks

In 1Q17, Devon Energy’s (DVN) reported operating netback was ~$16.68 per boe (barrel of oil equivalent), which is ~178% higher than in 1Q16.

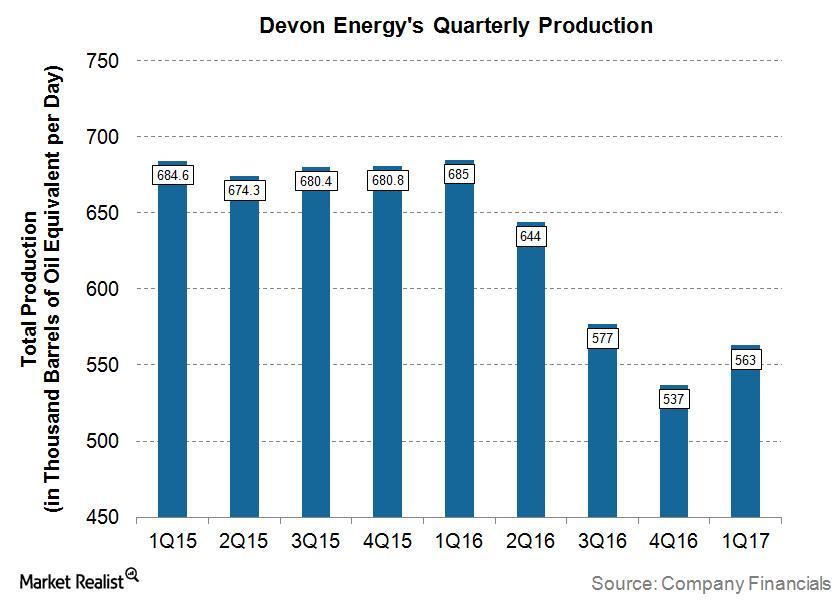

Understanding Devon Energy’s Production Volumes

For 1Q17, Devon Energy (DVN) reported total production of 563 MBoepd, which is ~18% lower when compared with 1Q16.

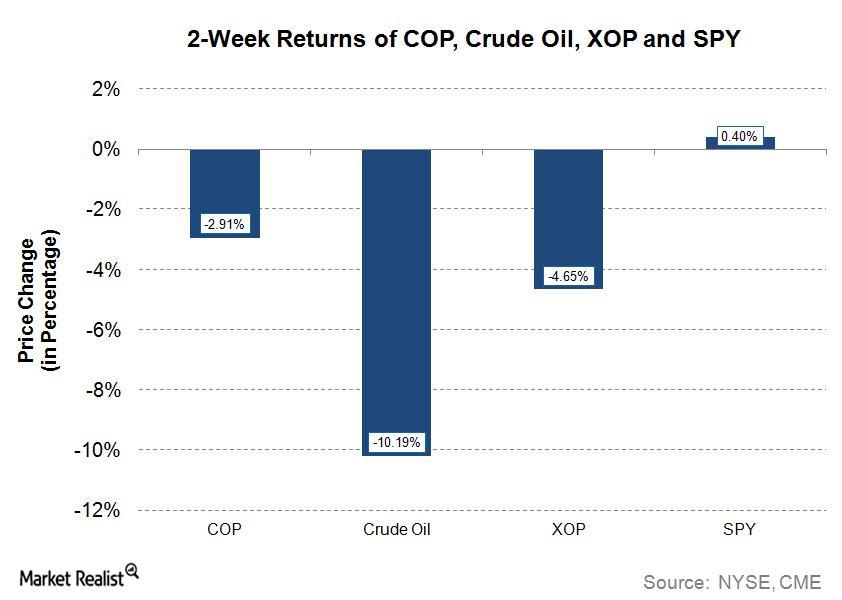

Why ConocoPhillips Stock Is Outperforming Crude Oil and Peers

In the last two weeks, the stock of ConocoPhillips (COP), a crude oil (USO) and natural gas (UNG) producer, has outperformed crude oil prices.

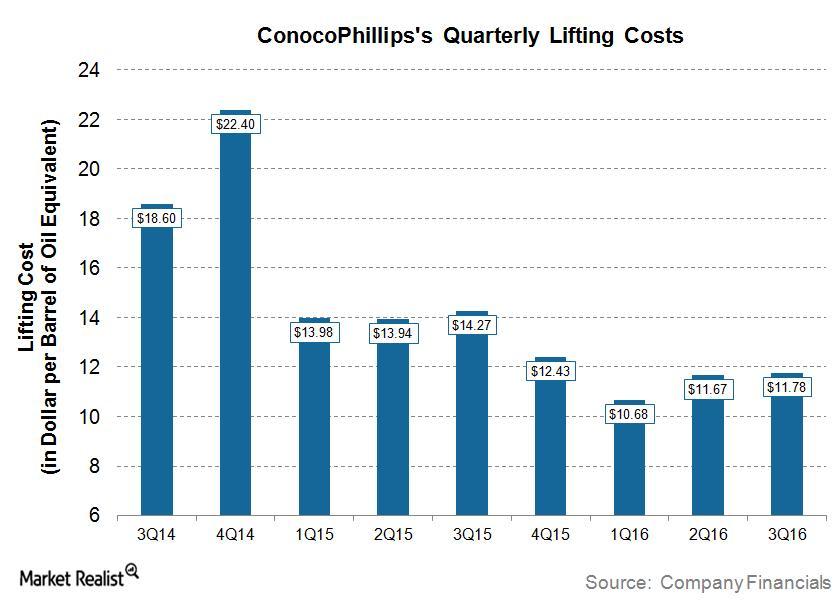

Analyzing ConocoPhillips’s Lifting Costs

In 3Q16, ConocoPhillips (COP) reported lifting costs of ~$11.78 per boe (barrel of oil equivalent), which is ~17.0% lower than 3Q15.

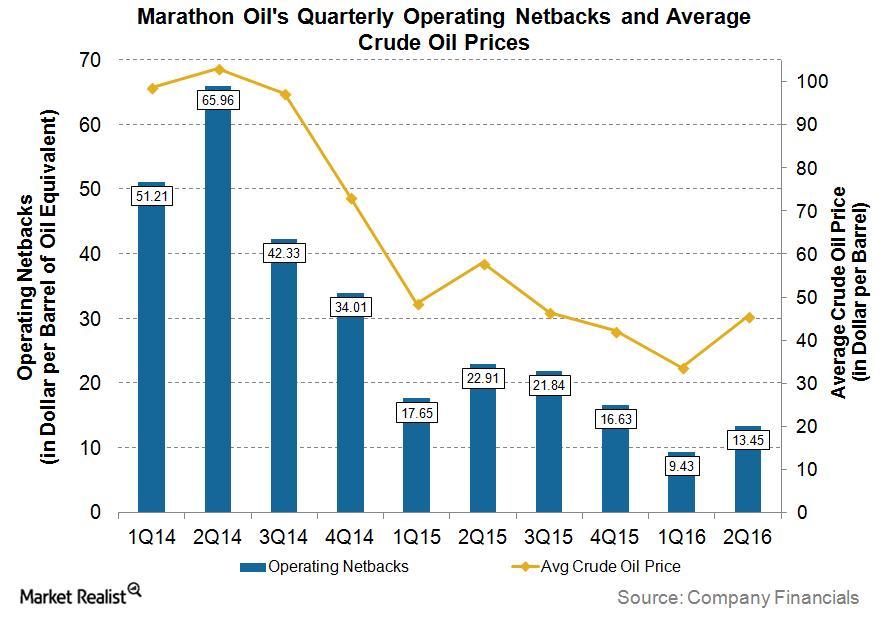

Marathon Oil’s 2Q16 Operating Netbacks Unveiled

In 2Q16, Marathon Oil (MRO) reported an operating netback of ~$13.45 per boe (barrel of oil equivalent), which is ~41% lower than in 2Q15.

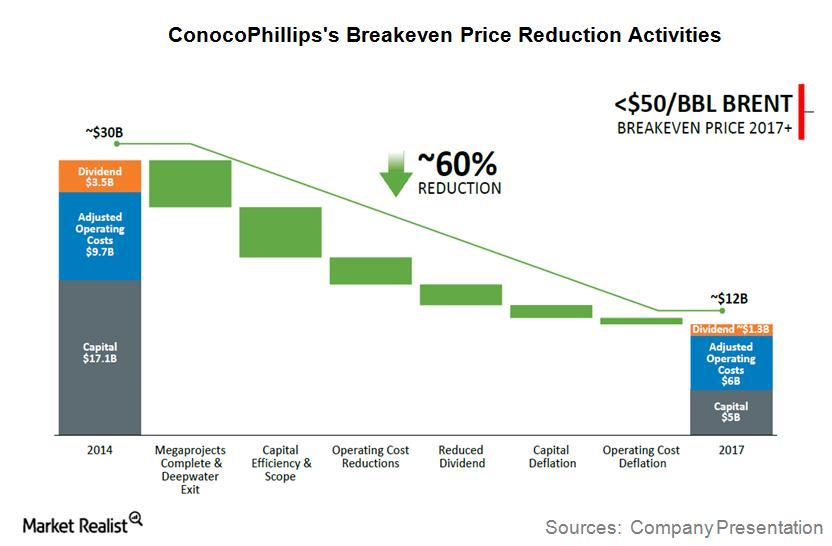

ConocoPhillips’s Steps to Reduce Its Break-Even Price

Since 2014, ConocoPhillips (COP) has been focusing on reducing its break-even price.

Encana: The Effect of Declining Natural Gas Prices

In this series, we’ll take a look at the effect of declining natural gas prices on Encana. We’ll also cover its May 17 Presentation for Investors on its Montney Resource Play.

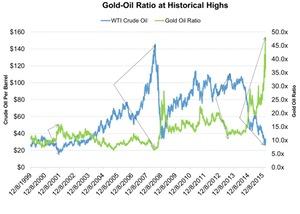

Gold-Oil Ratio Is at a Historic High: Why Isn’t the Bottom Near?

A rise in the ratio can be correlated the corresponding rise in gold prices. An increase in the ratio indicates that gold is more expensive than crude oil.

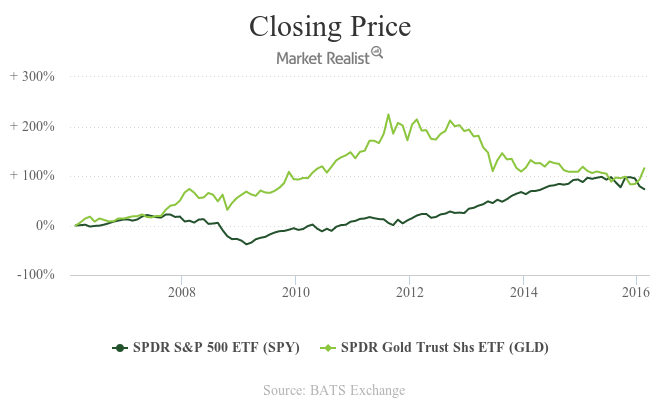

How Gold Correlates with the S&P 500 Index

Since July 2011, the S&P 500 Index has gained about 62% and touched its high of 2130 in July 2015. During the same period, gold (GLD) has lost about 92%.

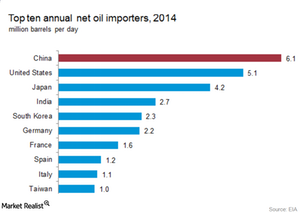

Top Crude Oil Importers’ Role in 2016

China and the United States are the largest crude oil importers in the world. In 2015, they consumed about 30.5 MMbpd (million barrels per day) of crude oil and liquid fuels, per the EIA.

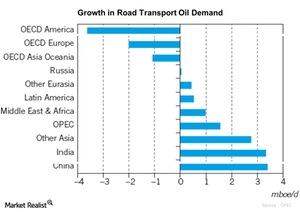

Crude Oil Demand Expected to Grow from Road Transportation

OPEC has estimated that the road transportation sector will account for one-third of the global crude oil demand growth between 2014 and 2040.