United States Brent Crude Oil Fund

Latest United States Brent Crude Oil Fund News and Updates

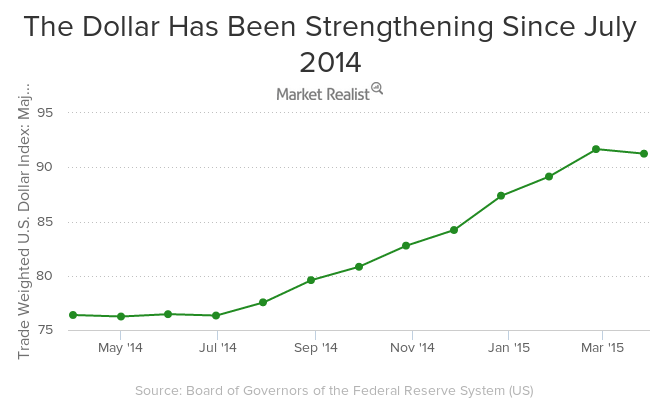

Why the US Economy Stalled in 1Q15

The US economy stalled in 2014 for several reasons, including seasonality, weather, strength of the dollar, the West Coast port strike, and the oil price slump.

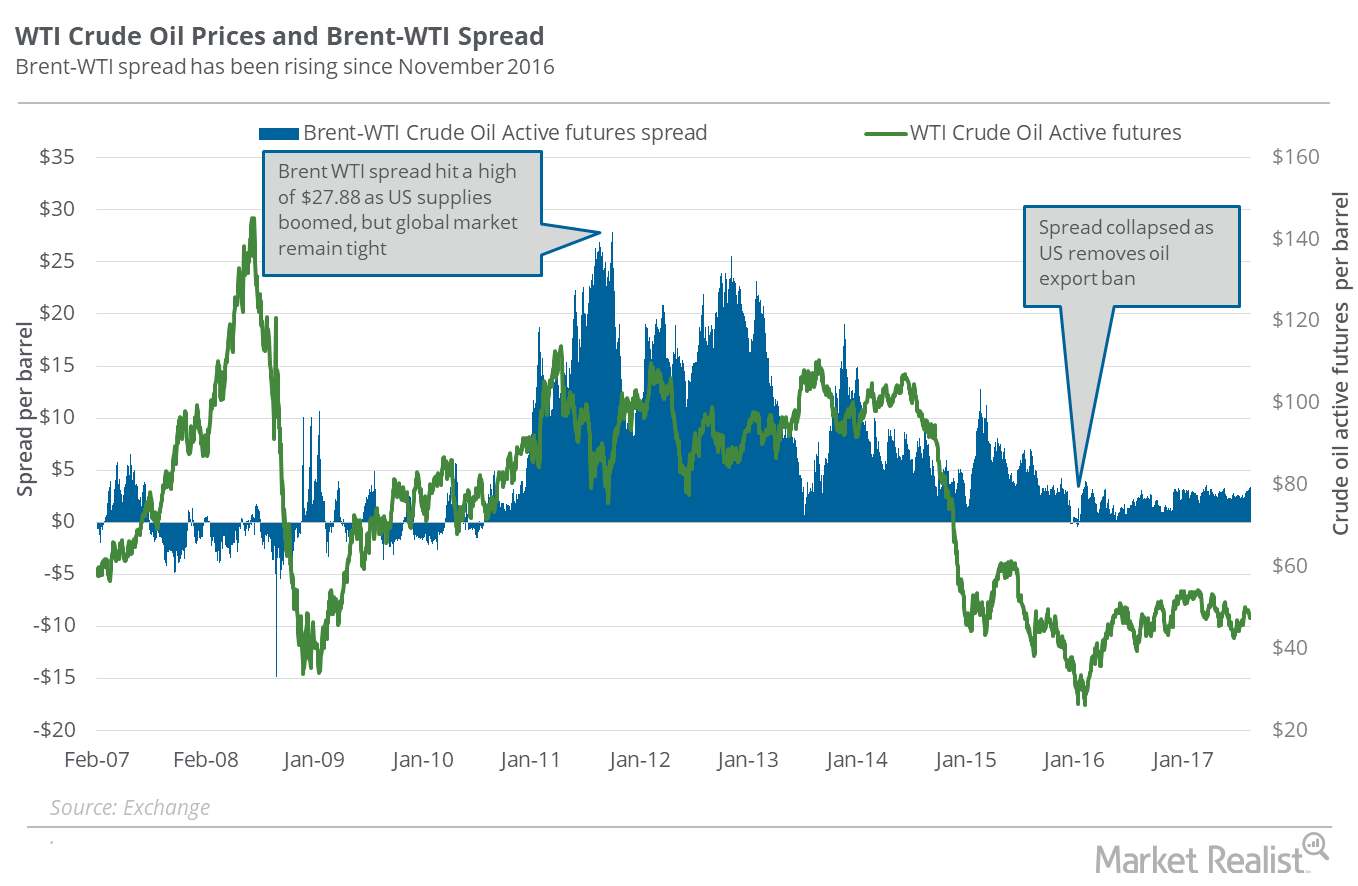

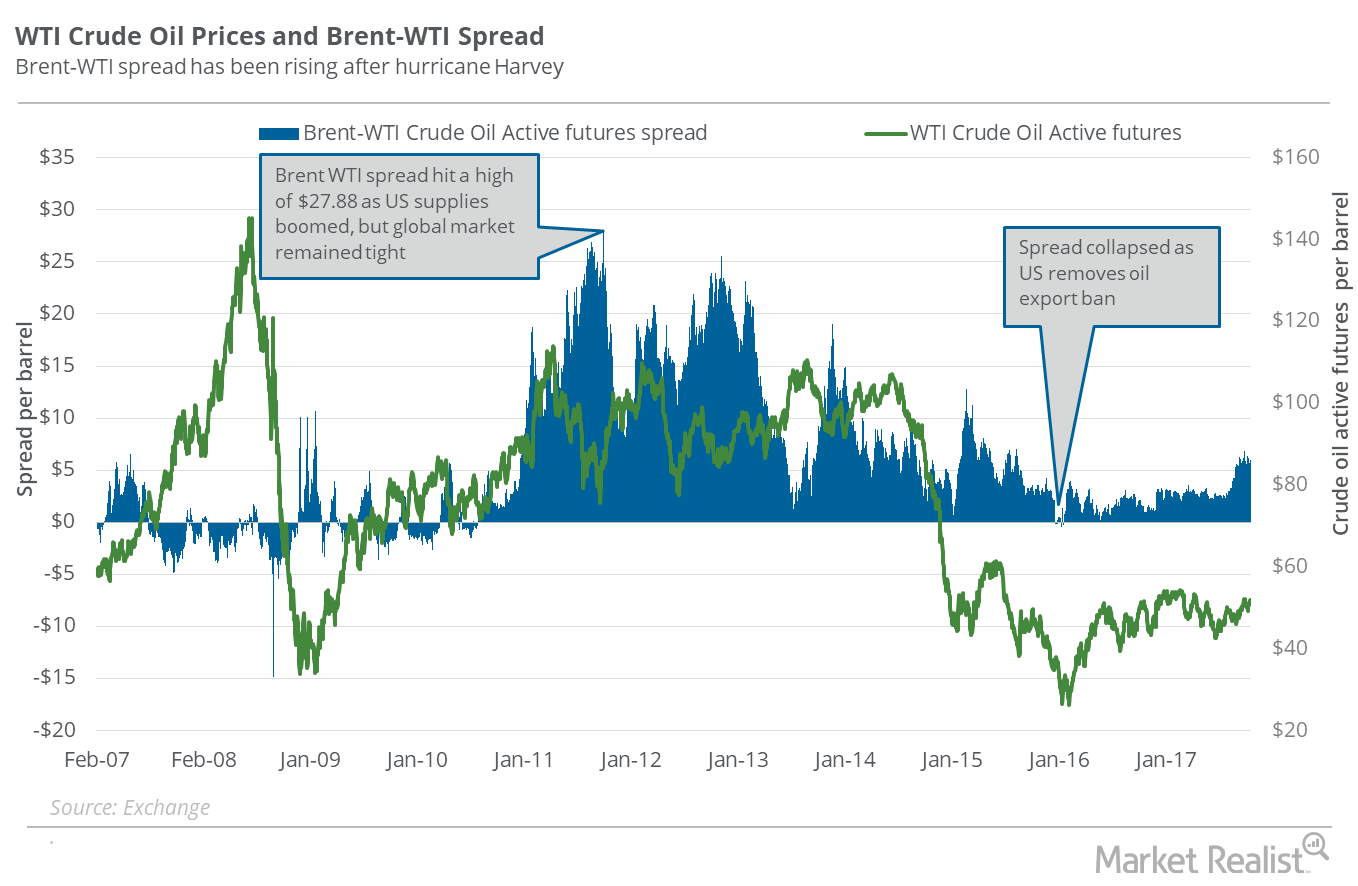

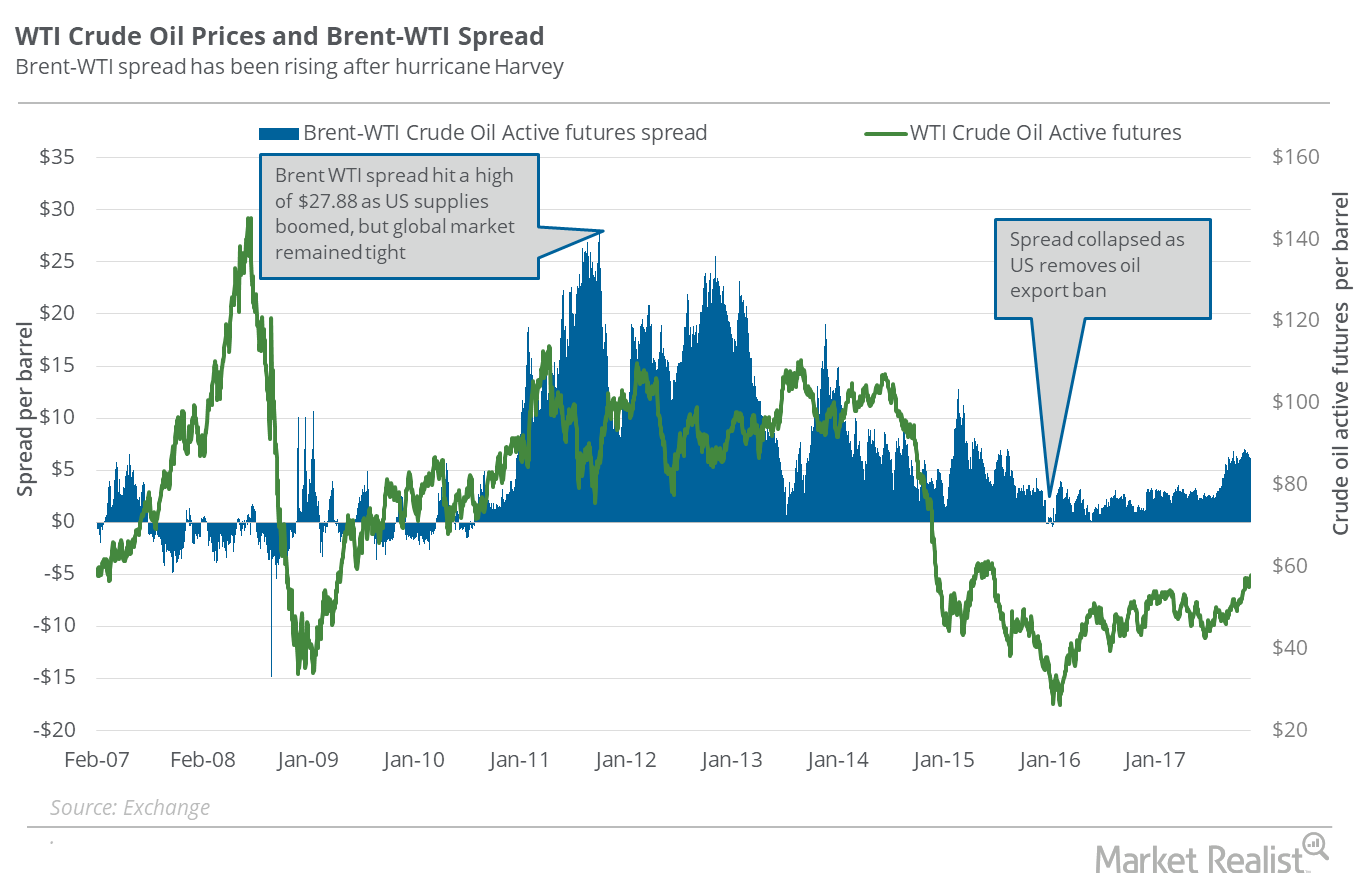

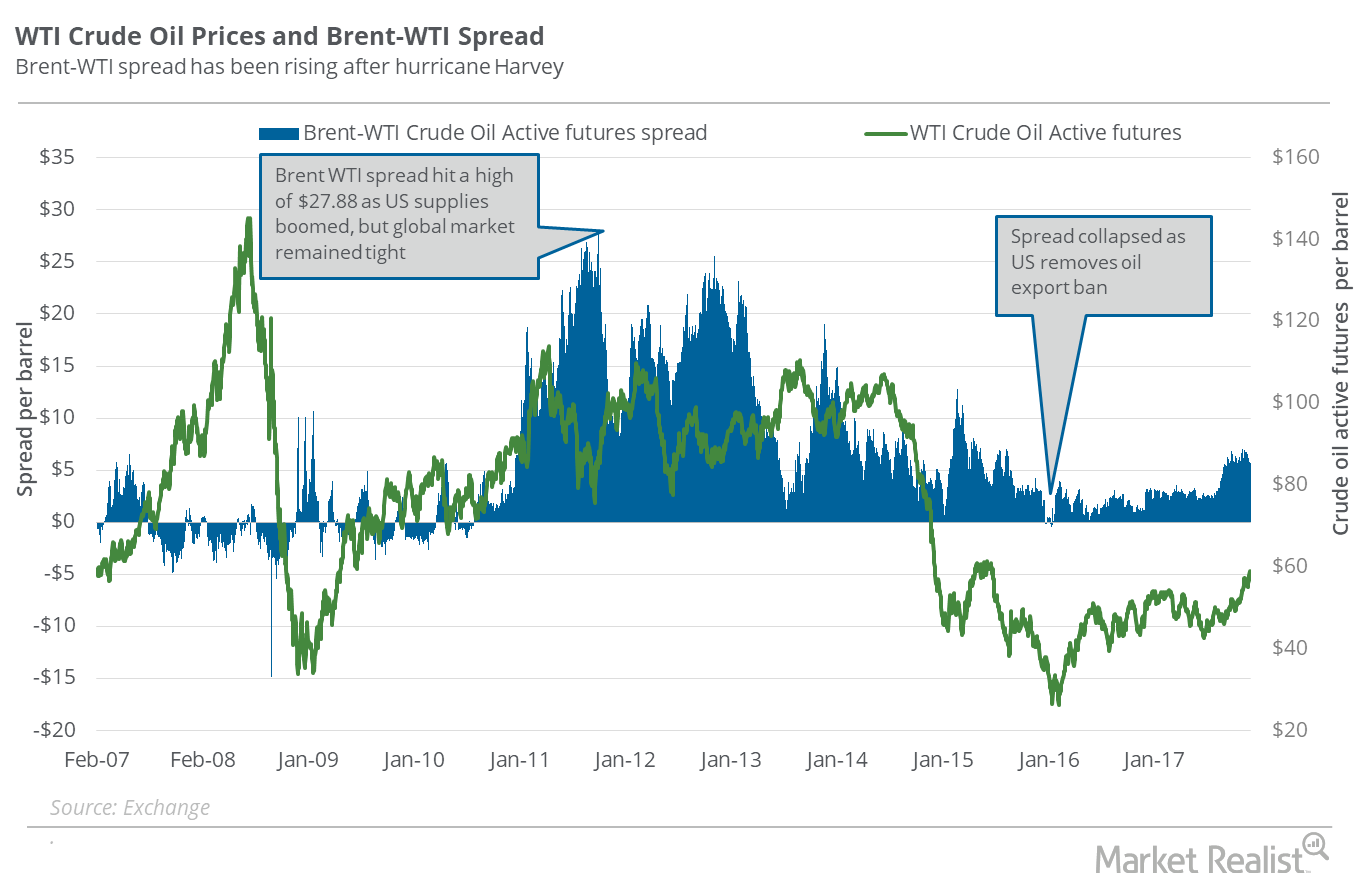

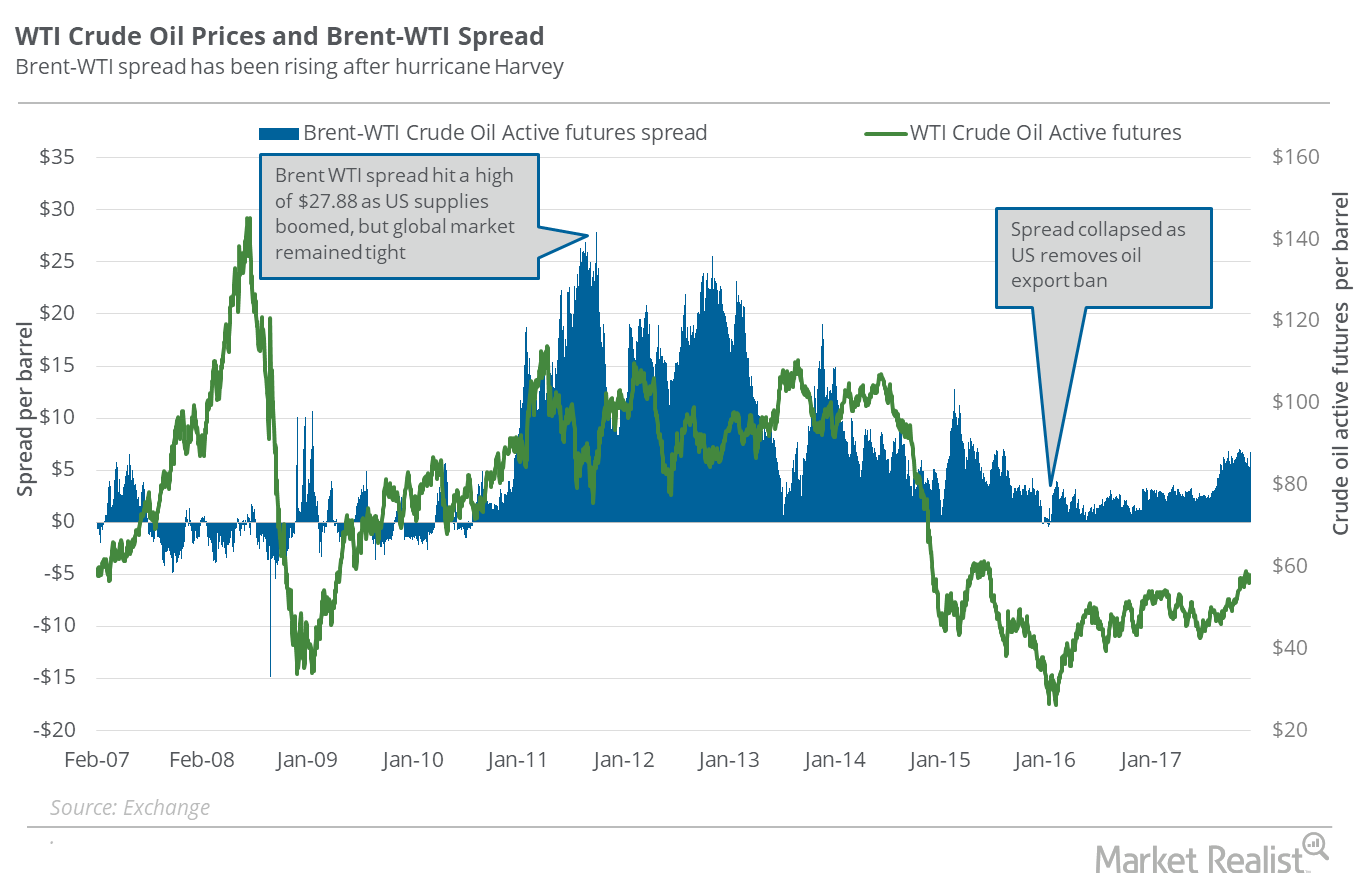

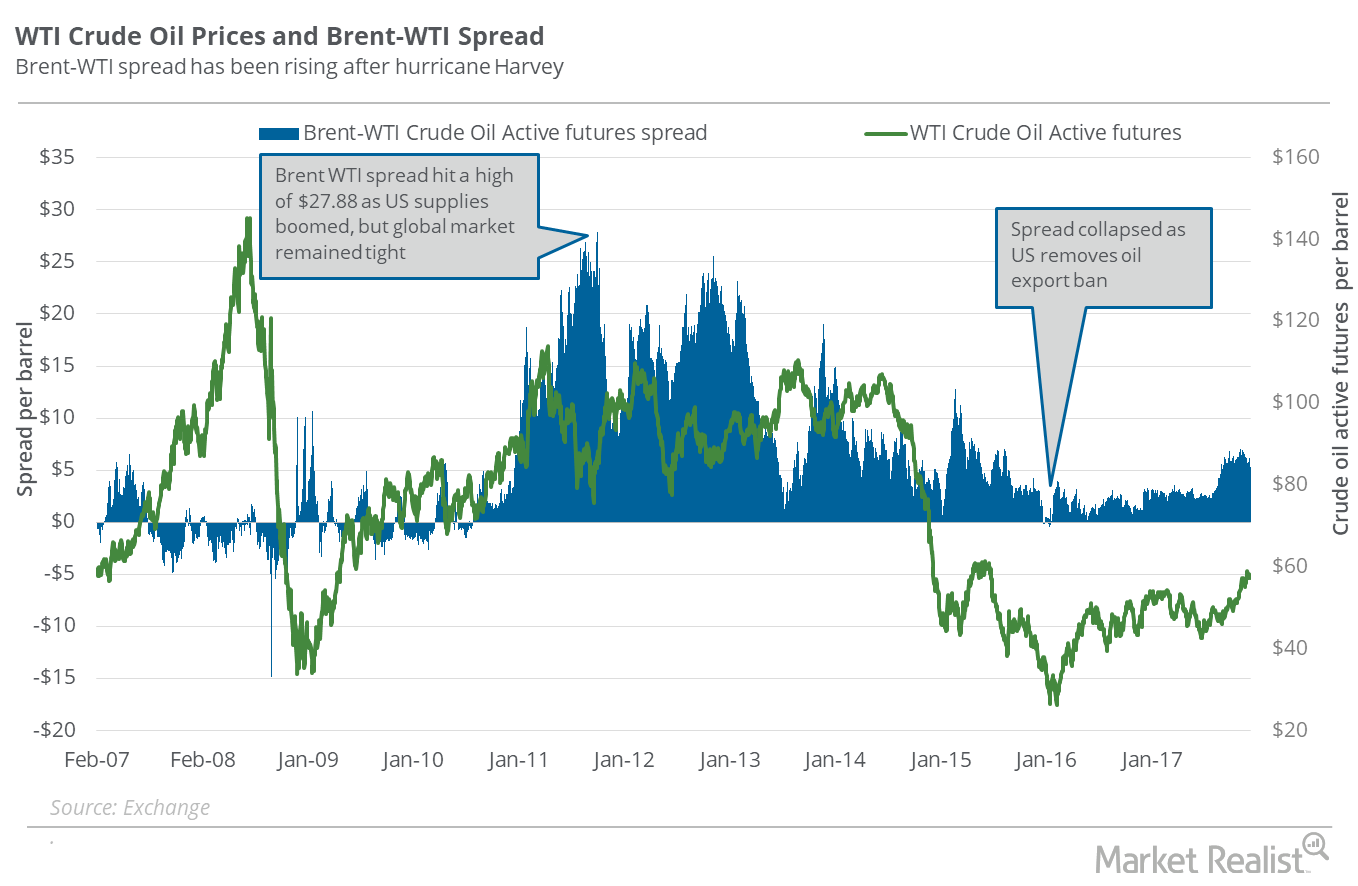

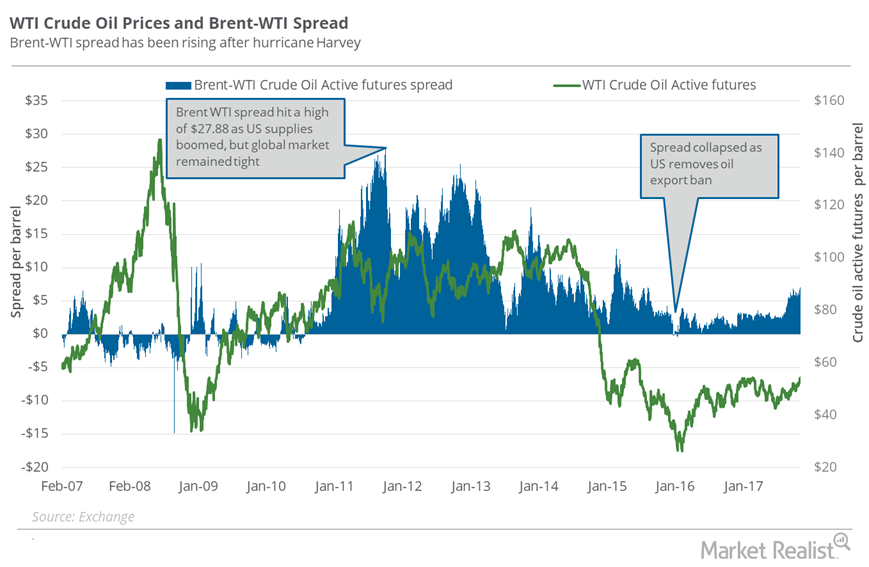

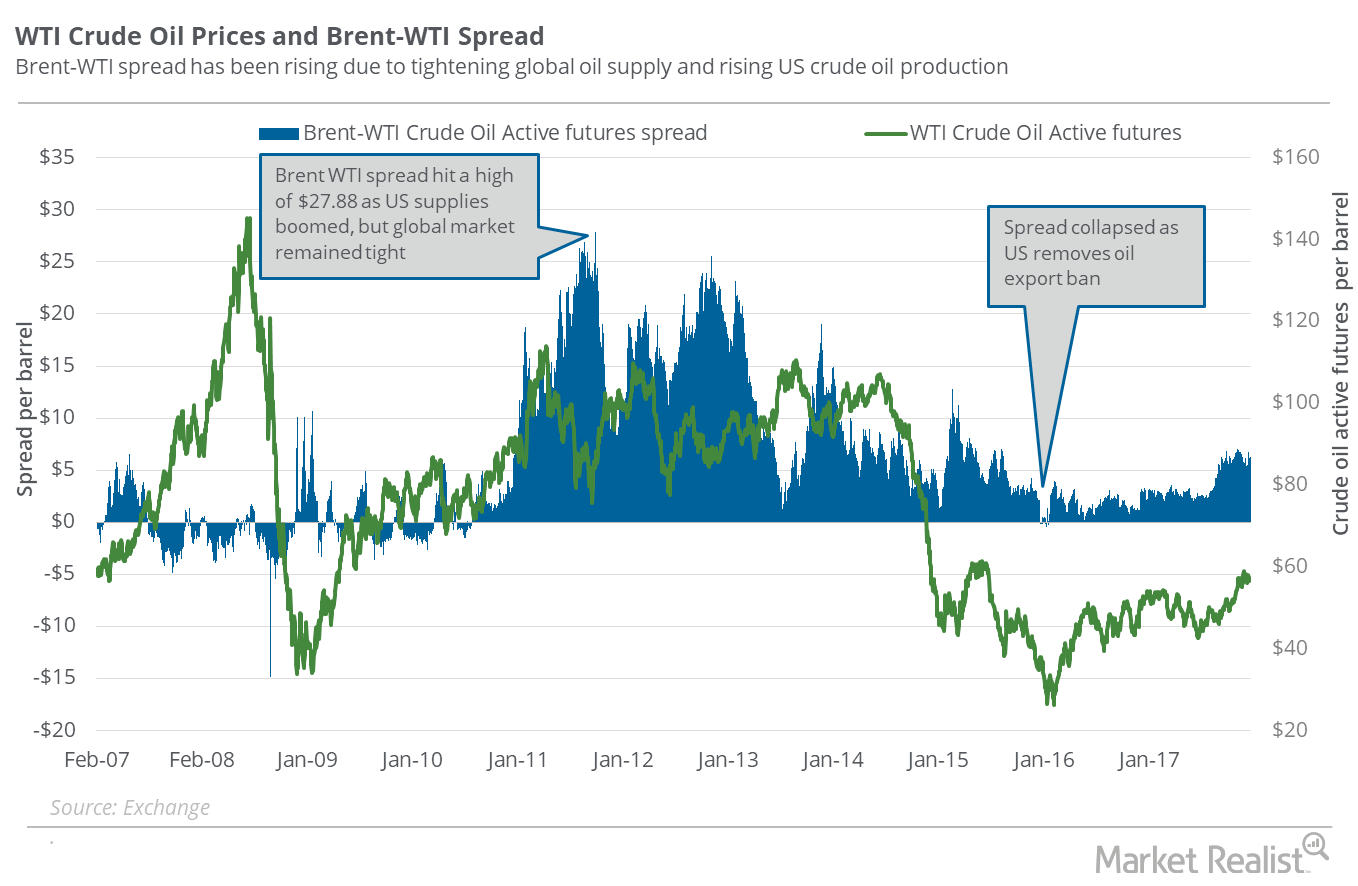

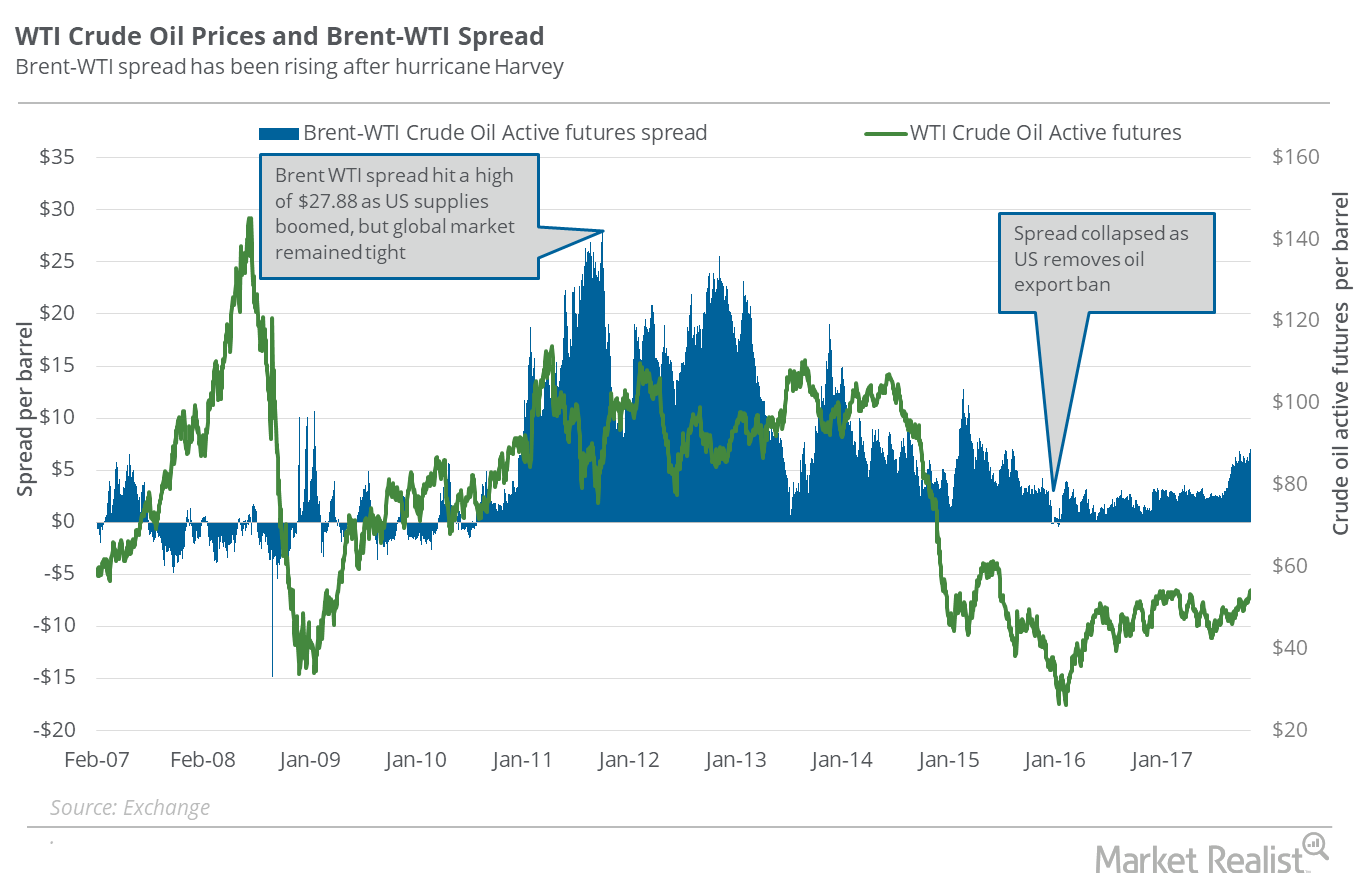

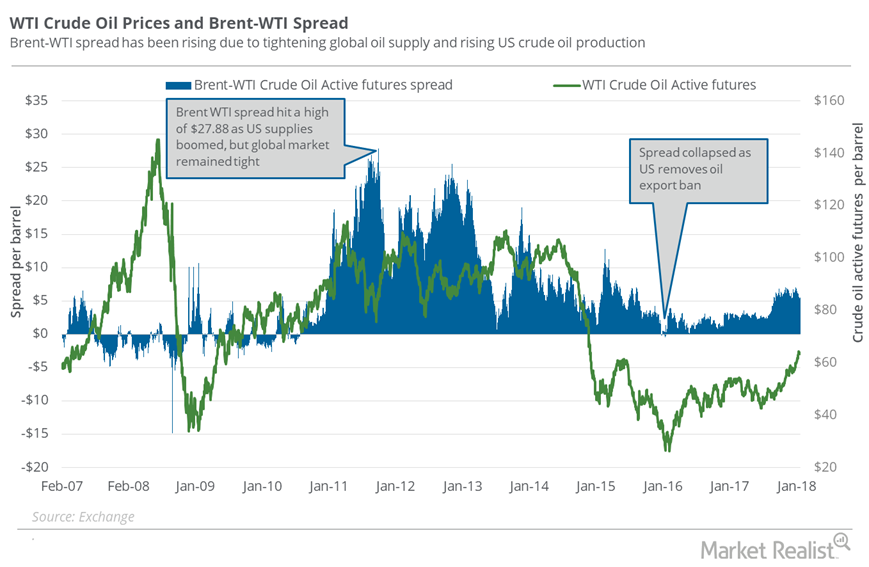

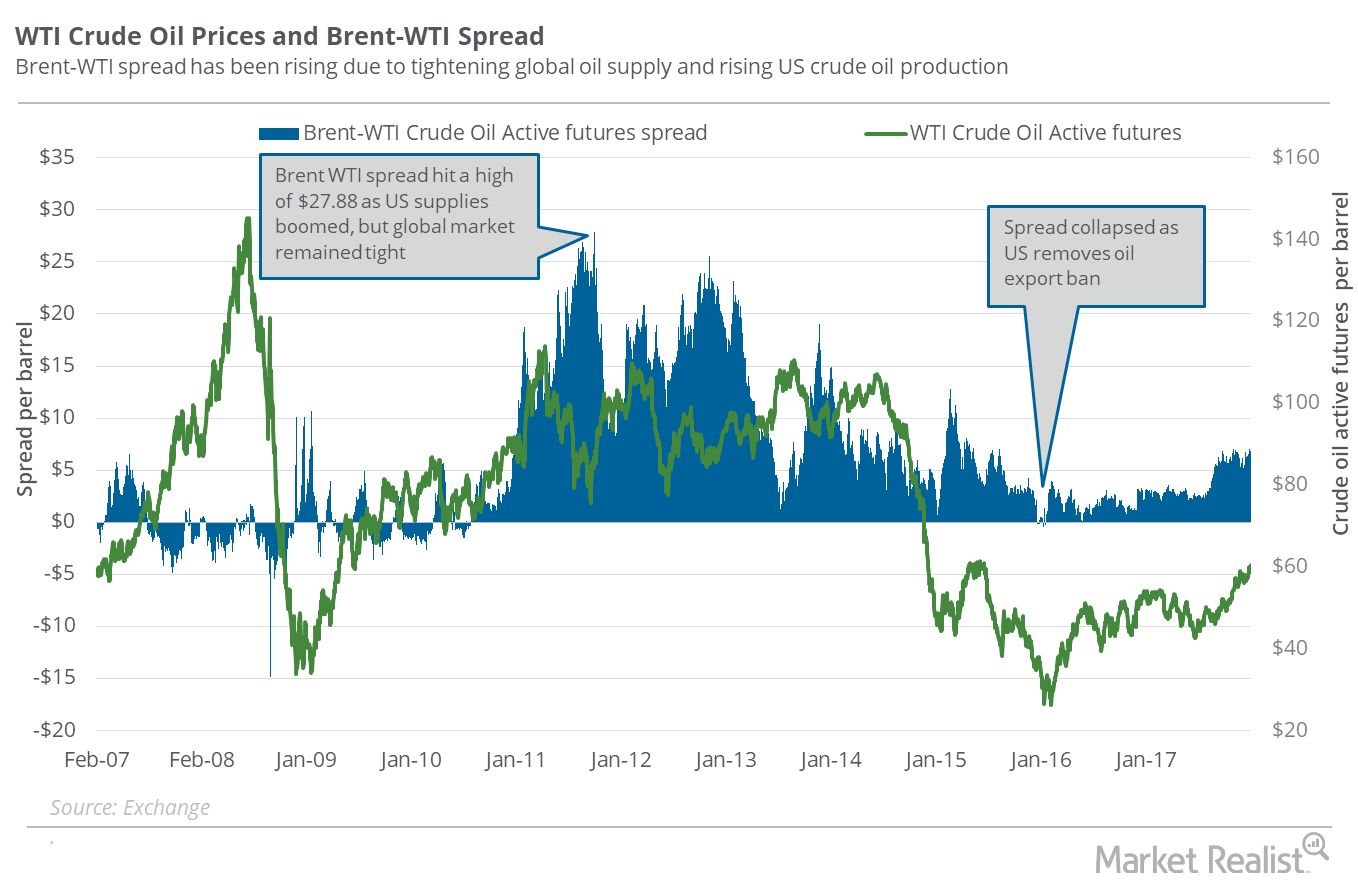

Brent-WTI Spread: Will US Oil Exports Rise Further?

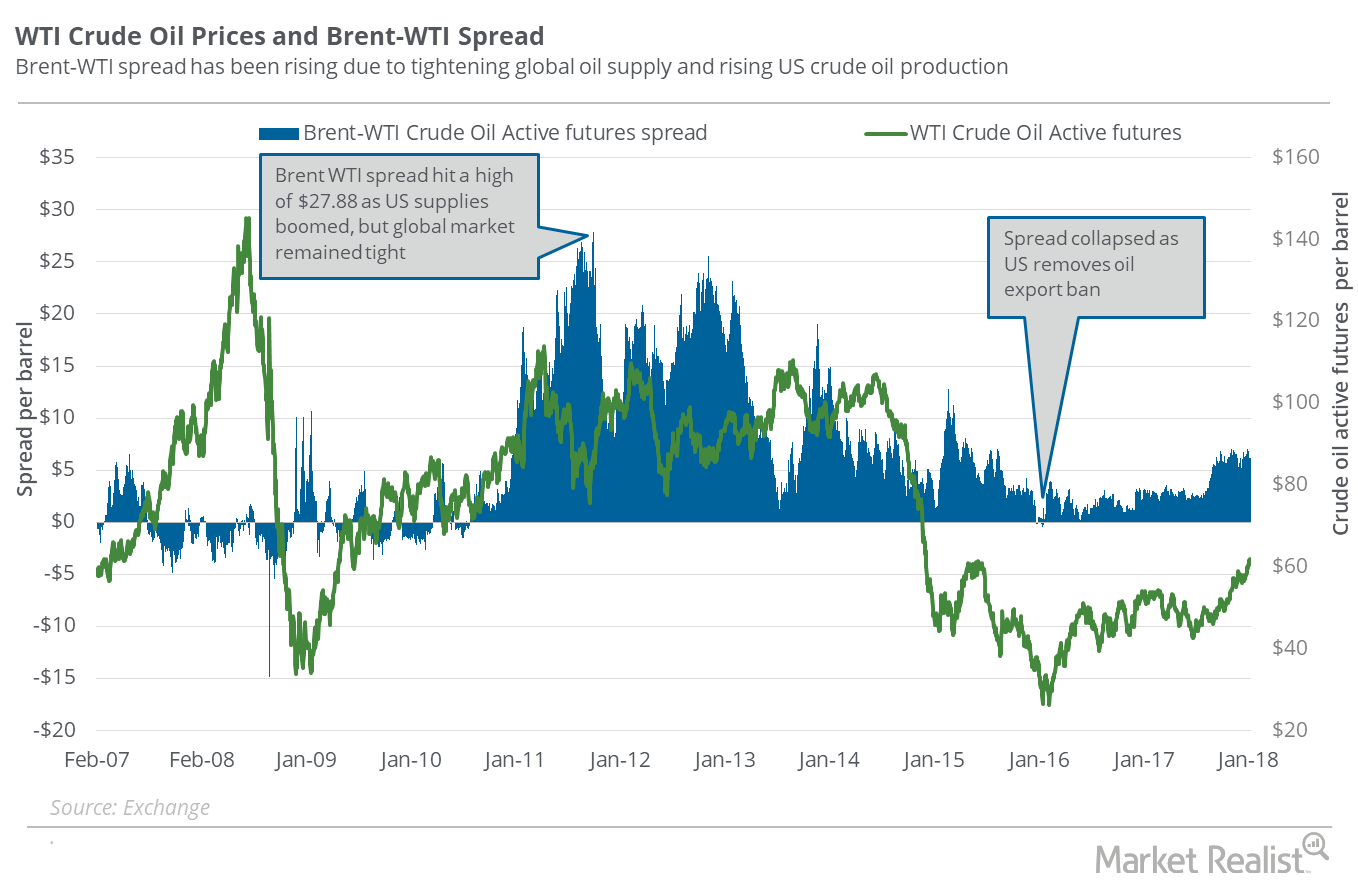

On October 24, 2017, Brent crude oil (BNO) active futures were $5.86 above WTI crude oil active futures.

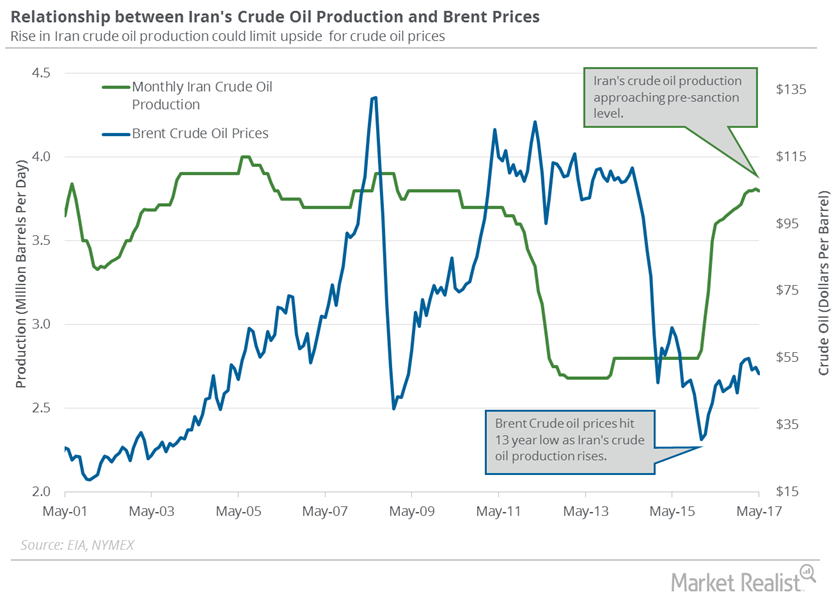

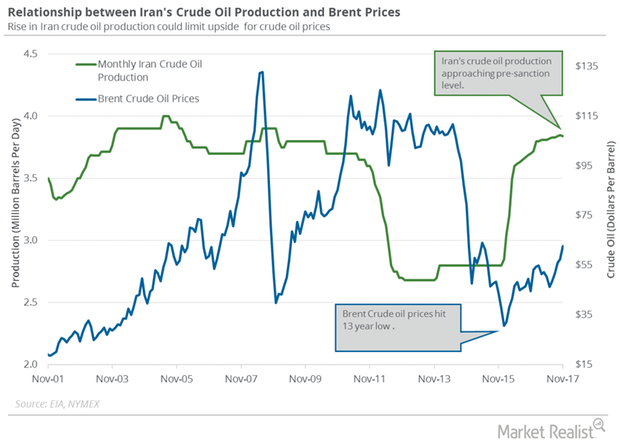

Iran’s Crude Oil Exports Could Impact Crude Oil Prices

The rise in crude oil export capacity suggests that Iran’s getting ready for a massive increase in crude oil production in 2018.

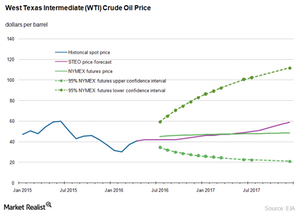

Why Goldman Sachs Revised Its Crude Oil Price Forecast

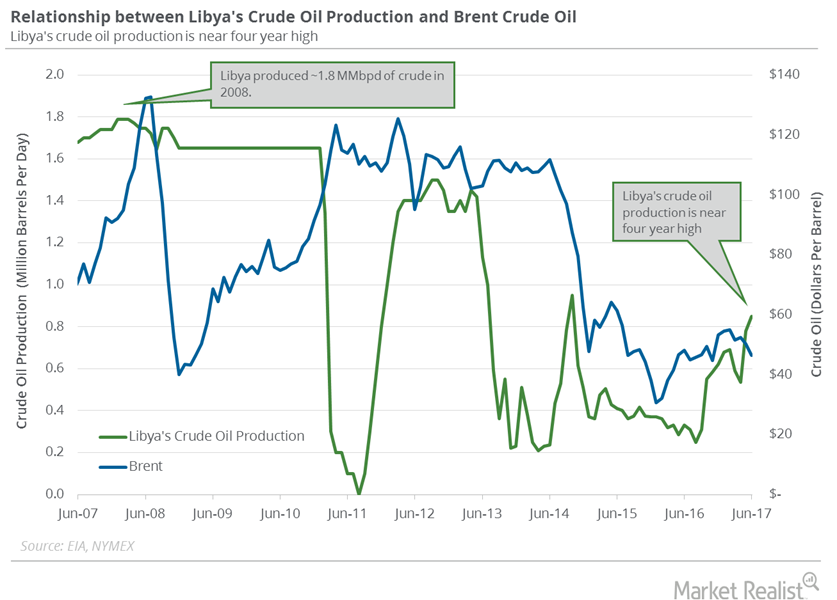

Goldman Sachs (GS) forecast that Brent crude oil prices could test $50 per barrel in 2H16 due to recent supply outages.

Crude Oil Futures Near 7-Week High

September US crude oil (RYE) (VDE) (BNO) futures contracts rose 3.3% to $47.8 per barrel on July 25, 2017.

What the Brent–WTI Spread Indicates

On August 15, Brent crude oil active futures were trading $3.25 more than the WTI crude oil active futures. On August 8, the spread stood at $2.97.

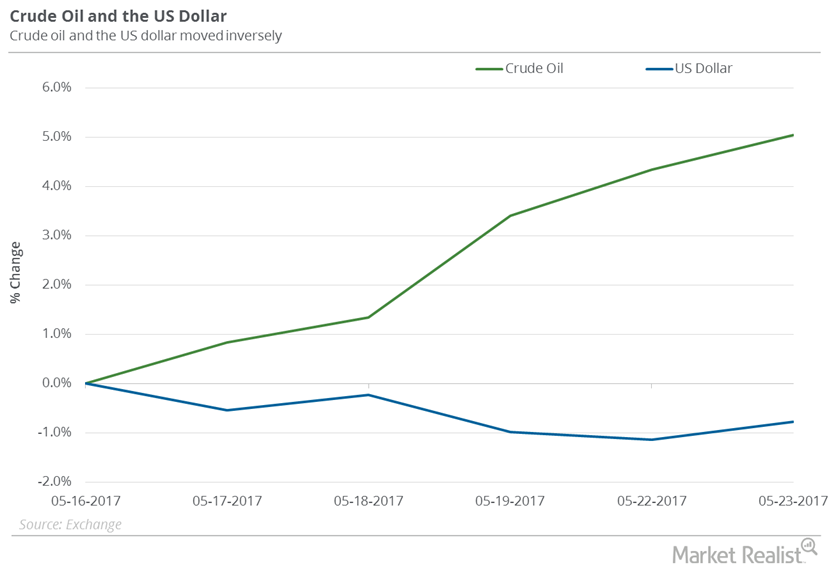

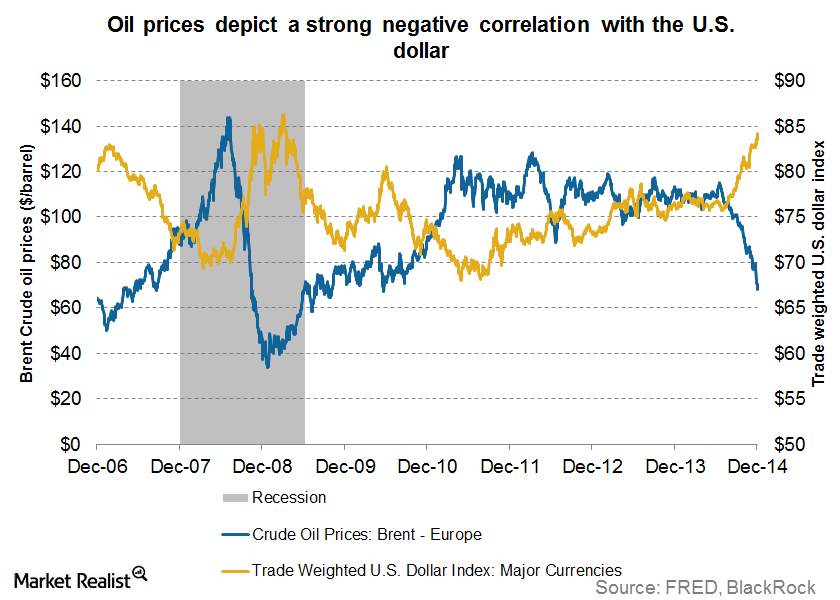

How the Dollar Is Affecting Oil

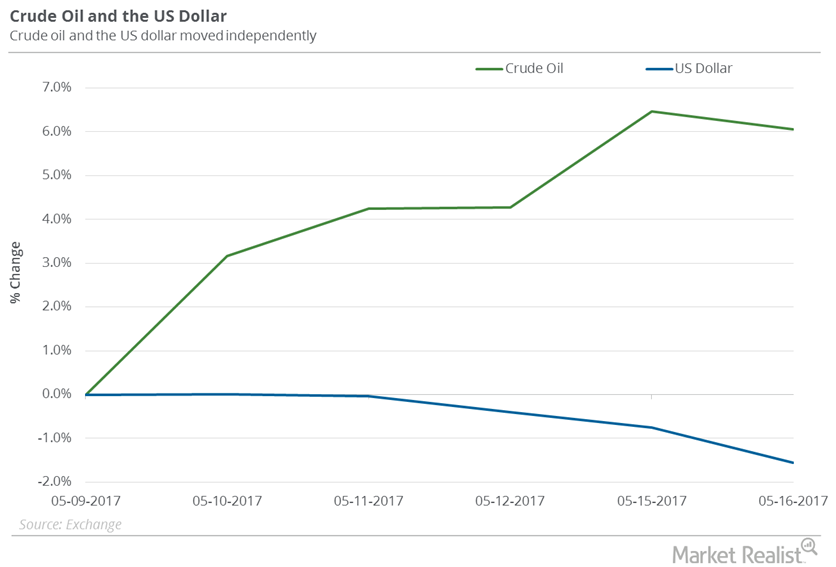

US crude oil (DBO) (USL) (OIIL) July futures rose 5% between May 16 and May 23, 2017.

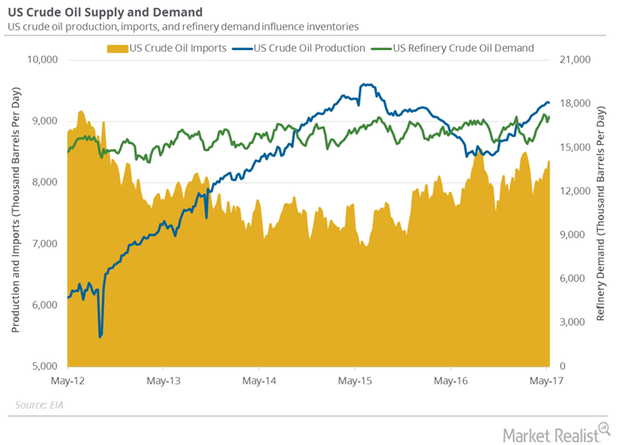

US Refinery Demand Impacts Crude Oil Inventories

US refineries operated at 93.4% of their operable capacity in the week ending May 5, 2017. The rise in refinery demand is bullish for crude oil prices.

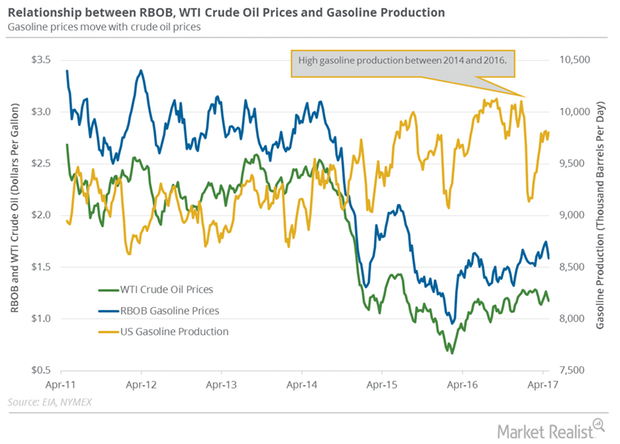

US Crude Oil and Gasoline Futures Moved Together

June gasoline futures contracts rose 1.3% to $1.53 per gallon on May 3, 2017. Prices rose due to the less-than-expected rise in US gasoline inventories.

Why the Brent-WTI Spread Could Make Global Oil Supplies Rise

On October 17, 2017, Brent crude oil (BNO) active futures closed $6 above the WTI (West Texas Intermediate) crude oil futures.

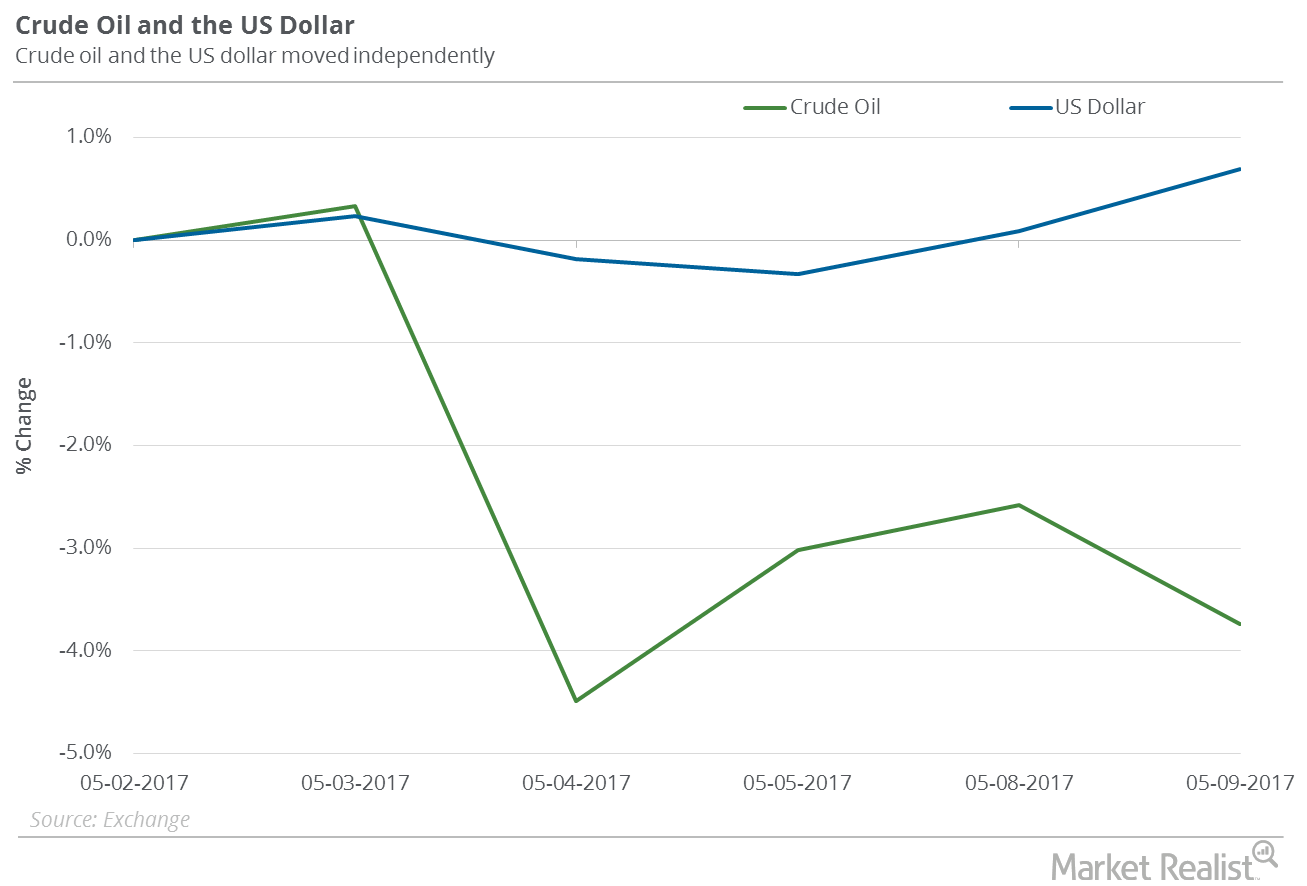

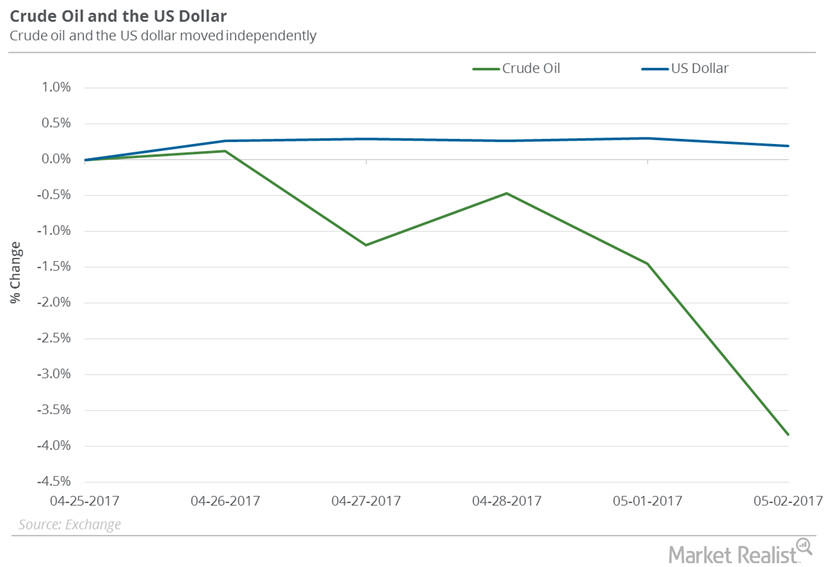

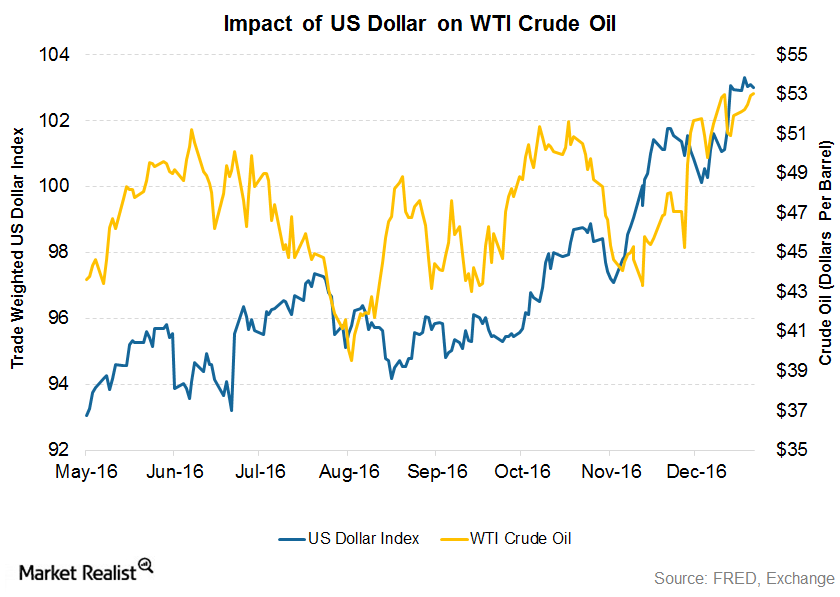

Oil Bulls, Don’t Worry About the Rising US Dollar

US crude oil futures contracts for June 2017 delivery fell 3.7% between May 2, and May 9, 2017, while the US Dollar Index rose 0.7%.

Will API Inventory Report Limit Upside for Crude Oil Prices?

November WTI (West Texas Intermediate) crude oil futures contracts rose 0.32% to $50.97 per barrel in electronic trade at 5:10 AM EST on October 12, 2016.

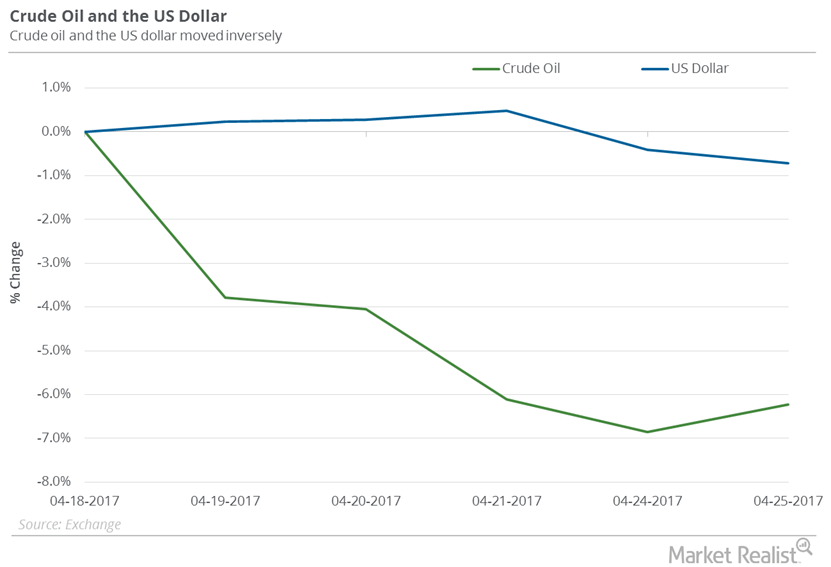

How the US Dollar Could Be Crucial to Oil Investors

US crude oil futures contracts for June delivery fell 6.2% between April 18, 2017, and April 25, 2017. Meanwhile, the US Dollar Index fell 0.7%.

US Dollar near 9-Month High: Is It Bearish for Crude Oil Prices?

December WTI crude oil futures contracts rose on October 21, 2016, due to expectations of OPEC and Russia reaching an agreement to cap production.

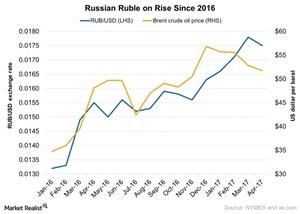

Why the Ruble Is on the Rise

The recovery of oil prices in the latter half of 2016 has helped the Russian ruble to appreciate along with improved exports.

How the Dollar Could Impact Oil’s Recovery

US crude oil (DBO) (USL) (OIIL) futures contracts for June 2017 delivery rose 3.7% between May 10 and May 17, 2017.

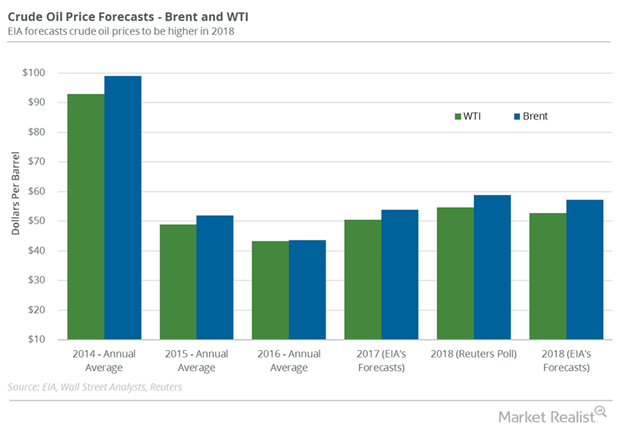

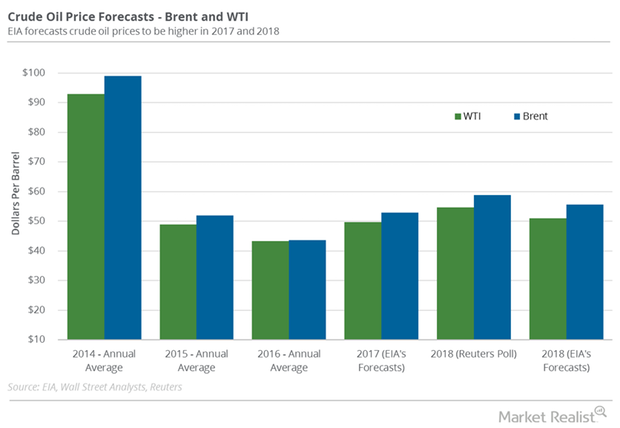

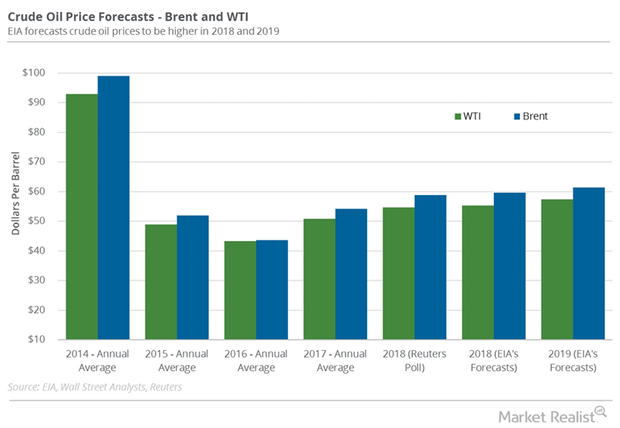

Will Crude Oil Prices Start 2018 on a Positive Note?

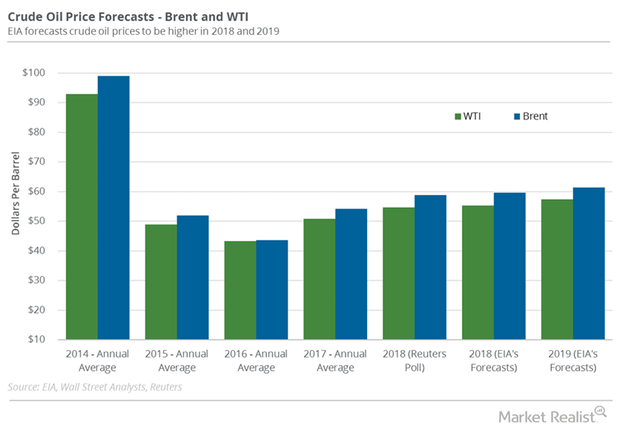

A Reuters survey estimated that Brent and US crude oil prices could average $58.84 per barrel and $54.78 per barrel in 2018.

Did the US Dollar Impact Oil Prices Last Week?

US crude oil (DBO) (USL) (OIIL) futures contracts for June 2017 delivery fell 3.8% between April 25, 2017, and May 2, 2017.

Libya’s Crude Oil Production Nears 4-Year High: What’s Next?

Libya is an OPEC member but was exempt from the production cut deal due to political and economic instability.

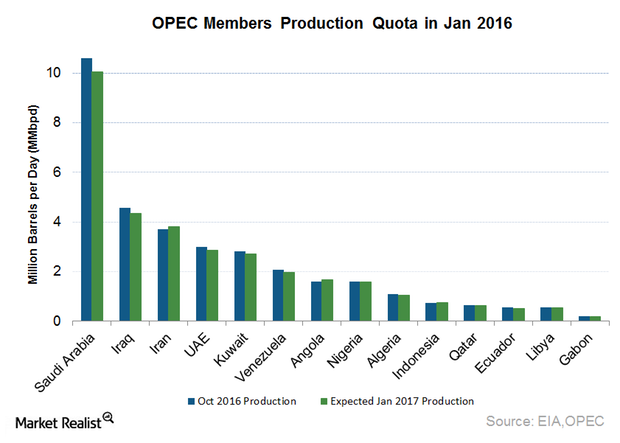

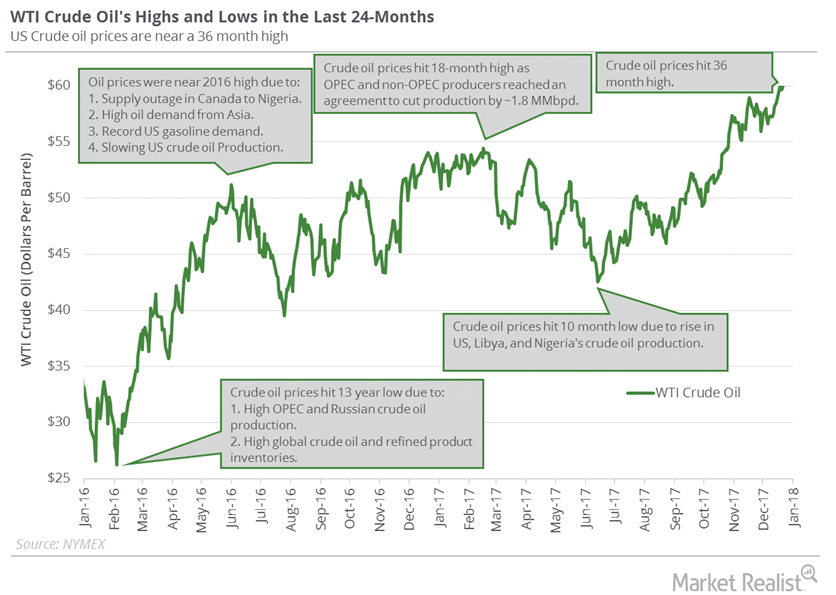

Crude Oil Prices Skyrocket as OPEC Agrees to Cut Production

Crude oil prices hit a one-month high as OPEC reached an agreement to cut production by 1.2 MMbpd in its meeting in Vienna.

Is WTI Crude Oil Outdoing Brent?

On November 21, Brent crude oil (BNO) active futures closed $5.74 above US crude oil (USO)(UCO) active futures. In other words, the Brent-WTI (West Texas Intermediate) spread was $5.74.

Will Crude Oil Futures and S&P 500 Move in the Same Direction?

February US crude oil (UWT) (USL) futures contracts rose 0.5% to $61.73 per barrel on January 8. Prices are near the highest level since December 2014.

WTI Crude Oil Is Rising Faster than Brent

On November 28, 2017, Brent crude oil (BNO) active futures closed at $5.62 higher than US WTI crude oil (USO) (UCO) active futures.

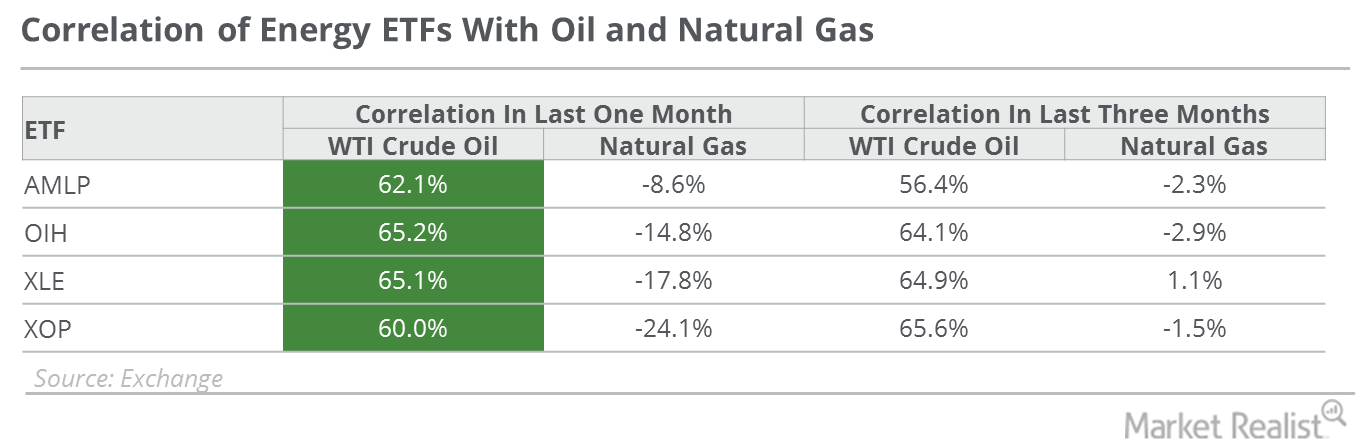

How Energy ETFs Are Correlated to Falling Oil Prices

At ~65.2%, the VanEck Vectors Oil Services ETF (OIH) showed the highest correlation with US crude oil between April 4–May 4, 2017.

Brent Is Outperforming WTI Crude Oil

On December 11, 2017, Brent crude oil (BNO) active futures settled $6.7 more than WTI (West Texas Intermediate) crude oil (USO) (UCO) active futures.

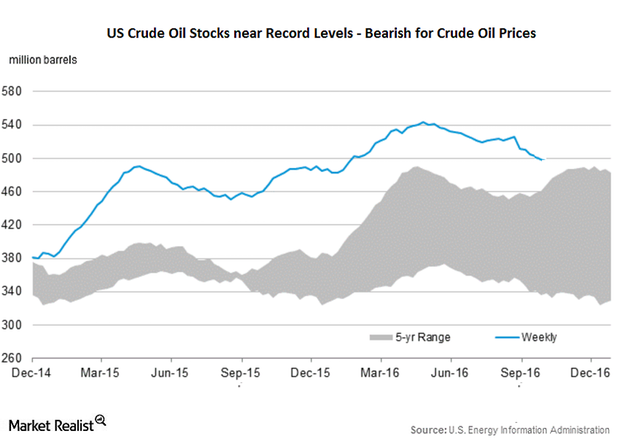

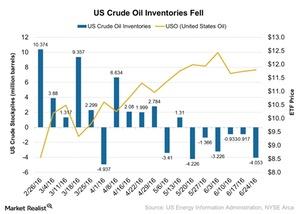

US Crude Oil Inventories Fall Again: How Is Crude Oil Reacting?

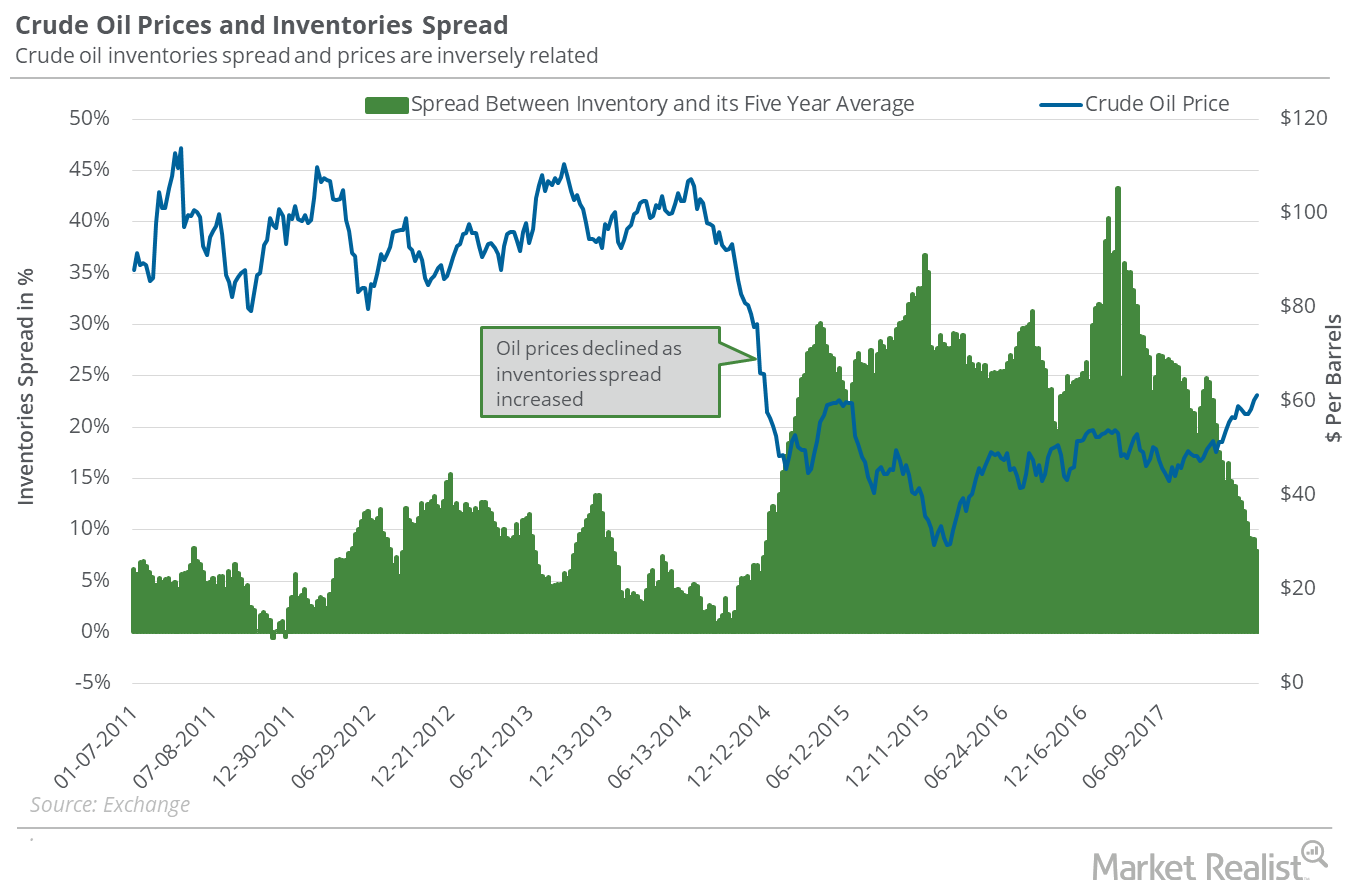

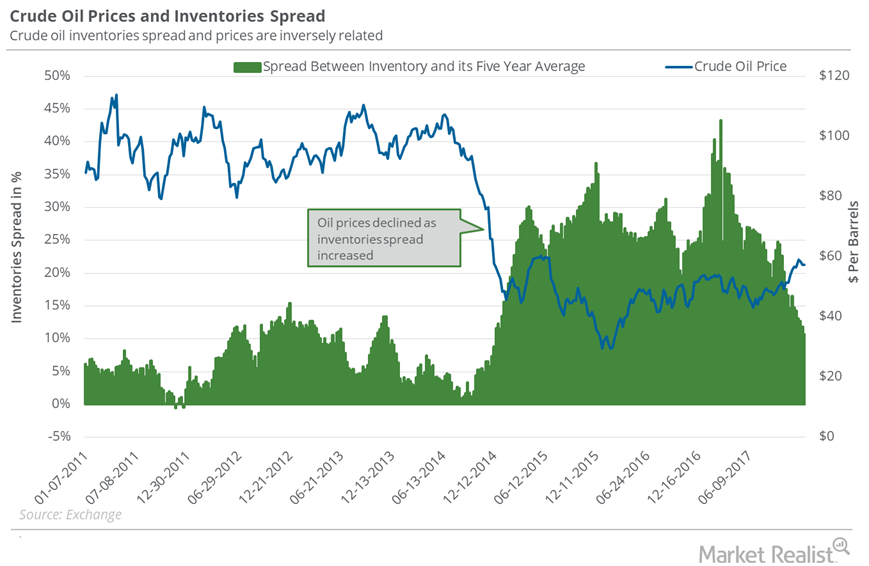

According to the U.S. Energy Information Administration’s report on June 29, 2016, US crude oil inventories fell by 4.1 MMbbls in the week ended June 24, 2016.

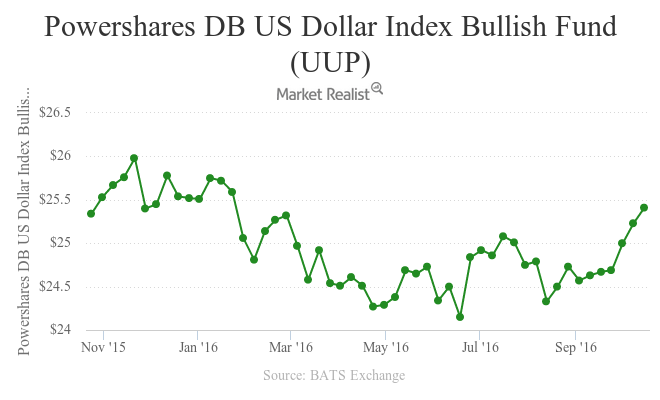

How Will the US Dollar Affect Crude Oil Prices in 2017?

February 2017 WTI (West Texas Intermediate) crude oil (PXI) (ERX) (USL) (ERY) futures contracts rose 0.1% and settled at $53 per barrel on December 23, 2016.

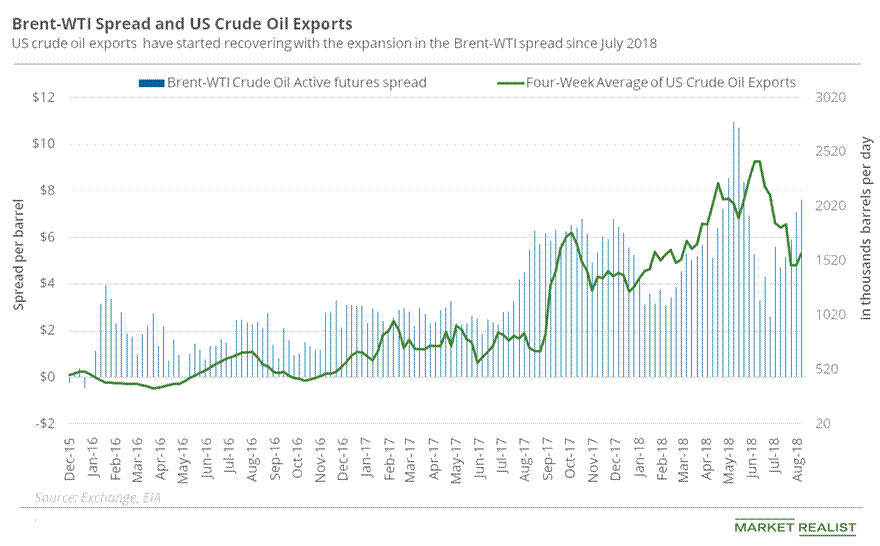

Oil Traders Should Watch US Oil Exports

On December 5, 2017, Brent crude oil (BNO) active futures were priced $5.24 higher compared to WTI crude oil (USO) (UCO) active futures.

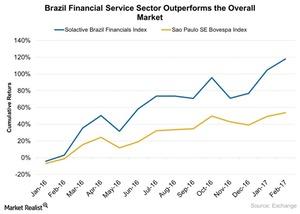

Why the Service Sector’s Contribution to Brazil Is Important

The service sector is the main contributor to Brazil’s GDP and job creation, but it’s currently suffering from structural weakness and poor international performance.

US Crude Oil Exports Could Be at a Tipping Point

On October 31, 2017, Brent crude oil (BNO) active futures were ~$7 above US crude oil (UCO) futures.

How The Rising Dollar Is Causing Oil Prices To Fall

A rising dollar has and will continue to put downward pressure on oil prices, causing trouble for the energy sector (XLE).

Comparing WTI’s and Brent’s Performance

The Brent-WTI spread On December 18, 2017, Brent crude oil (BNO) active futures’ premium to WTI (West Texas Intermediate) crude oil (USO) (UCO) active futures was $6.30. On December 11, 2017, the Brent-WTI spread was $6.70. On December 11, 2017, the shutdown of the Forties Pipeline System boosted Brent oil prices. That day, the spread expanded […]

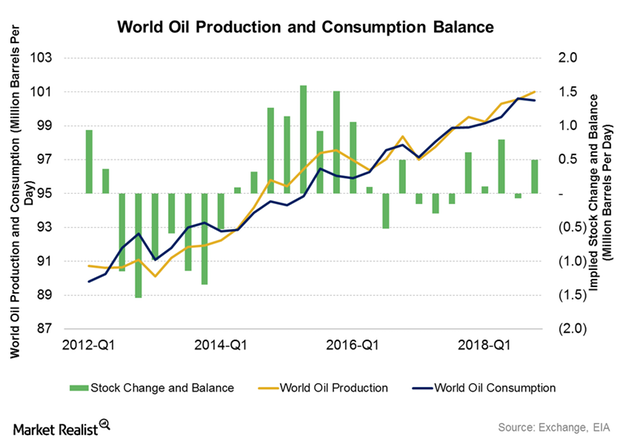

Inside the Global Crude Oil Supply-Demand Gap

The EIA estimated that the global crude oil supply-demand gap averaged 0.58 MMbpd (million barrels per day) in 1H16.

US Crude Oil Exports: Will They Affect OPEC’s Production Cut Deal?

On November 7, 2017, the difference between Brent crude oil (BNO) active futures and US crude oil (USO) active futures, or the Brent-WTI (West Texas Intermediate) spread, was $6.50.

Crude Oil Prices Could End 2017 on a High Note

A Reuters poll estimated that WTI crude oil (USL) prices could average $54.78 per barrel in 2018 after extending the production cuts.

Crude Oil Futures: Next Important Resistance Level

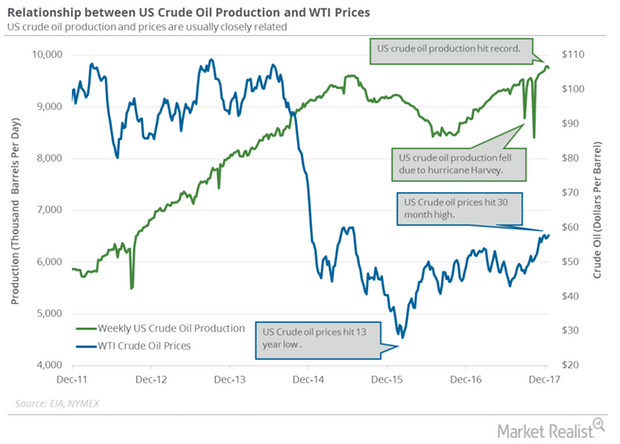

WTI crude oil (UCO) futures closed at $62.01 per barrel on January 4, 2018—the highest level since December 2014. WTI prices rose ~12.4% in 2017.

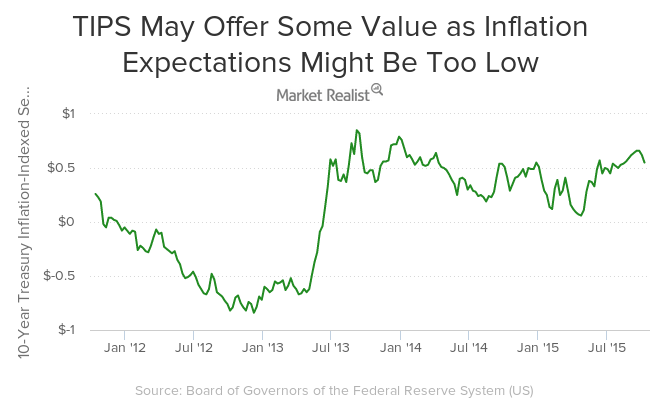

Why Treasury Inflation-Protected Securities May Offer Some Value

TIPS may offer some value as inflation breakeven seems modest. TIPS provide investors a hedge against inflation just like gold (GLD) and other commodities (DBC).

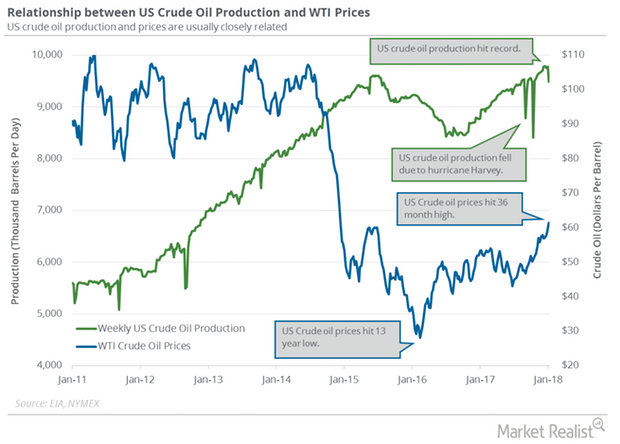

Will US Oil Production Pressure Crude Oil Futures?

February WTI crude oil futures contracts fell 0.9% to $63.73 per barrel on January 16. Brent oil futures fell 1.6% to $69.15 per barrel on the same day.

Traders Could Start Booking a Profit in Crude Oil Futures

On January 16, 2018, Goldman Sachs said that crude oil prices could exceed its forecast in the coming months.

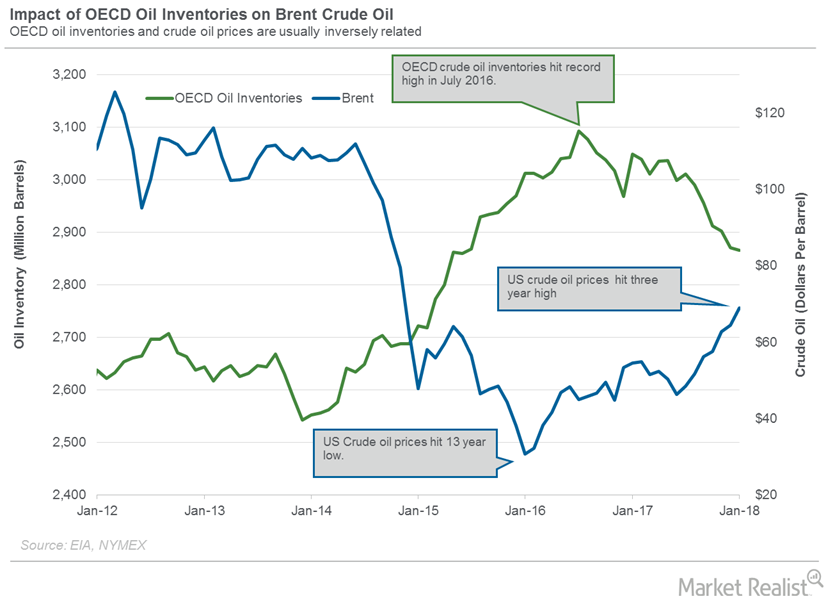

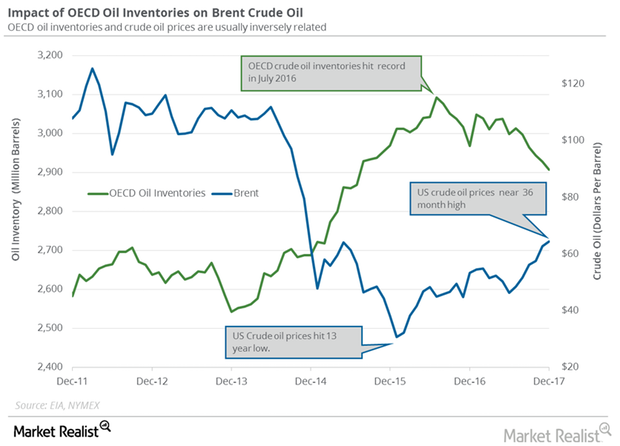

OECD’s Crude Oil Inventories Are near June 2015 Low

According to the EIA, OECD’s crude oil inventories declined 0.2% to 2,865 MMbbls in January 2018—compared to the previous month.

Brent-WTI Spread Might Push Oil Exports and Downstream Stocks Up

On September 10, 2018, Brent crude oil November futures settled ~$9.83 higher than WTI crude oil October futures, the highest level for the Brent-WTI spread since June 19, 2018.

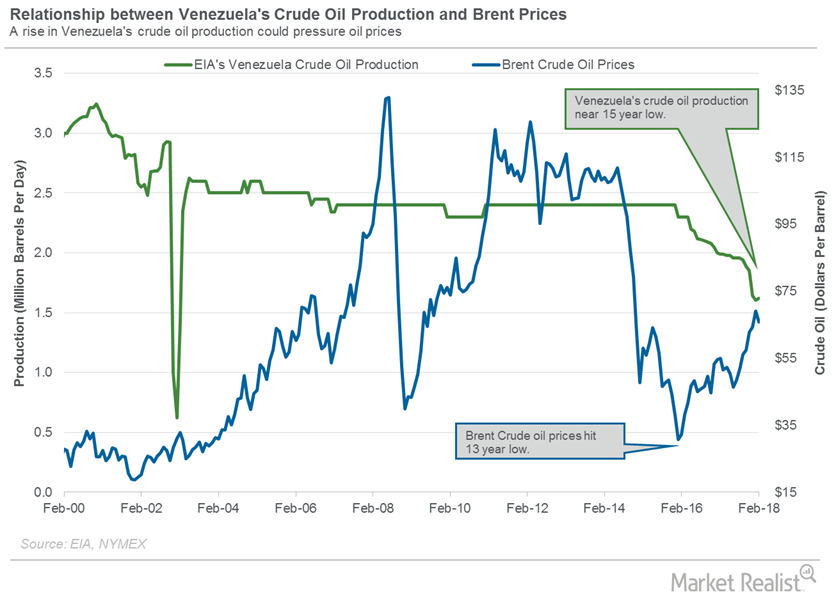

Crude Oil Traders Track Venezuela’s Oil Production

The EIA estimates that Venezuela’s crude oil production increased by 15,000 bpd to 1,620,000 bpd in February 2018—compared to January 2018.

US Oil Exports Could Threaten International Oil Prices

In the week ending January 12, 2018, US crude oil exports were at ~1.25 MMbpd—234,000 barrels per day more than the previous week.

OECD’s Crude Oil Inventories: Trump Card for Crude Oil Bulls?

The EIA estimates that global crude oil inventories could rise in 2018 and 2019, which is bearish for oil prices.

Oil Inventory Data Could Push Oil Higher

In the week ending January 5, 2018, US crude oil inventories fell by 4.9 MMbbls (million barrels)—1 MMbbls more than the market’s expected fall.

EIA Upgraded Crude Oil Price Forecasts for 2018

The EIA forecast that Brent (BNO) crude oil would average $59.74 per barrel in 2018—4.3% higher than the previous estimates in December 2017.

US Oil Exports Are Crucial for Oil Prices in 2018

On January 8, 2018, Brent crude oil (BNO) active futures were $6.05 stronger than WTI (West Texas Intermediate) crude oil (USO) (UCO) active futures.

How Much Fall in Inventories Could Support Oil This Week?

In the week ended December 22, 2017, US crude oil inventories were 431.9 MMbbls (million barrels), a fall of 4.6 MMbbls compared to the previous week.

Should Oil Traders Follow US Oil Exports in 2018?

On December 29, 2017, the price difference between Brent crude oil (BNO) active futures and WTI (West Texas Intermediate) crude oil (USO) (UCO) active futures was $6.45.

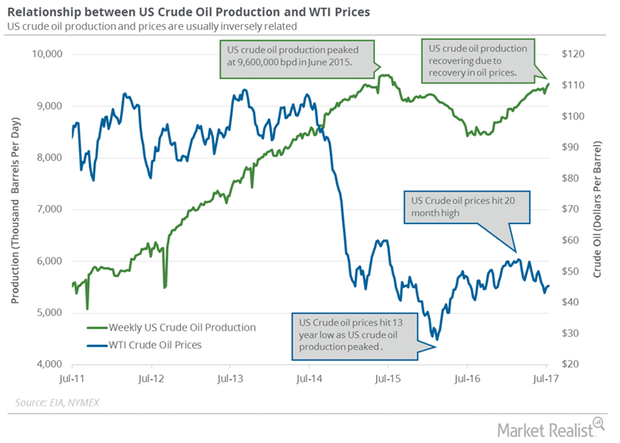

Weekly US Crude Oil Production Fell for the 1st Time since October

US crude oil production declined by 35,000 bpd (barrels per day) or 0.4% to 9,754,000 bpd from December 15 to 22, 2017, per the EIA.