United States Brent Crude Oil Fund

Latest United States Brent Crude Oil Fund News and Updates

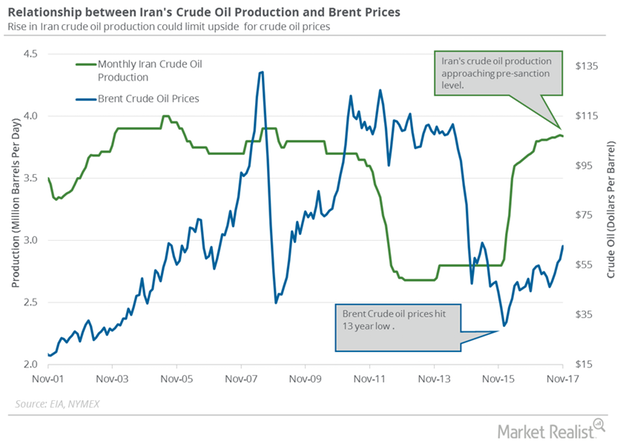

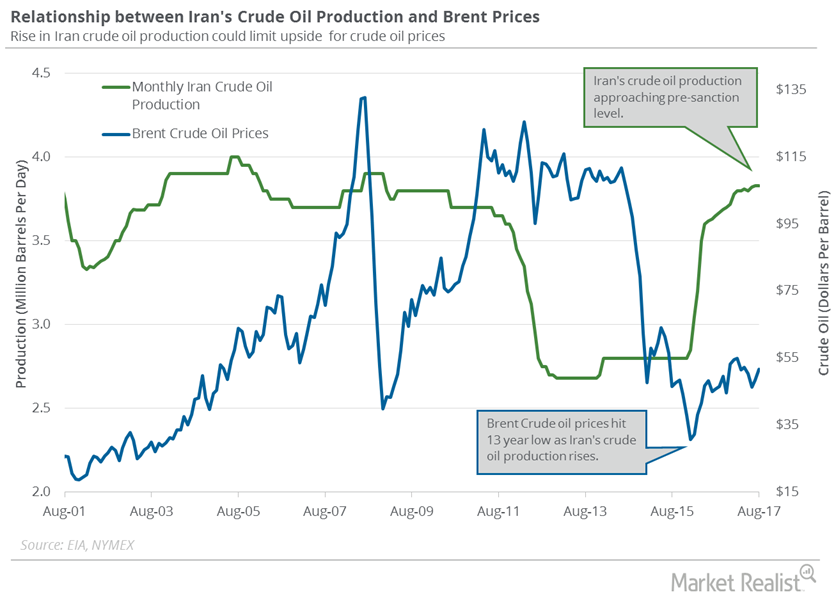

Iran’s Crude Oil Production Is near a 9-Year High

The EIA estimates that Iran’s crude oil production fell by 10,000 bpd or 0.3% to 3,840,000 bpd in November 2017—compared to the previous month.

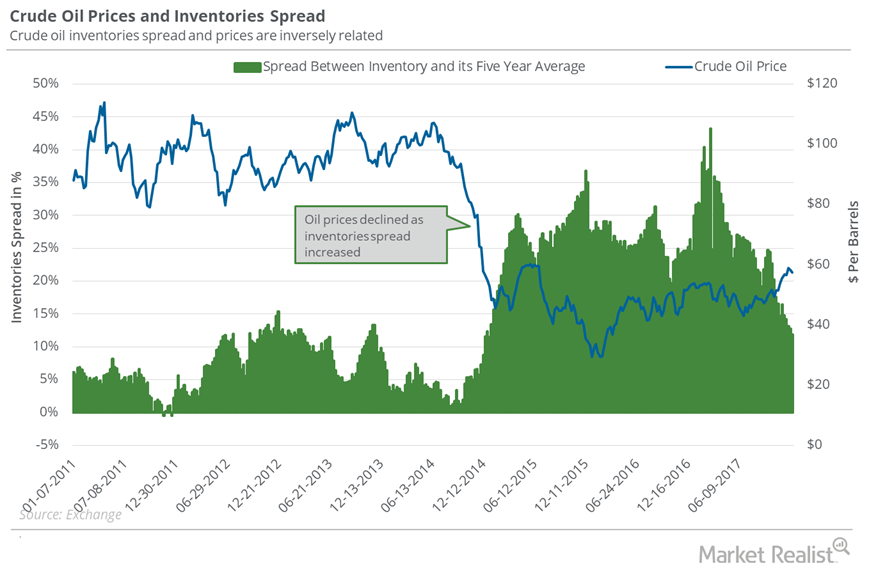

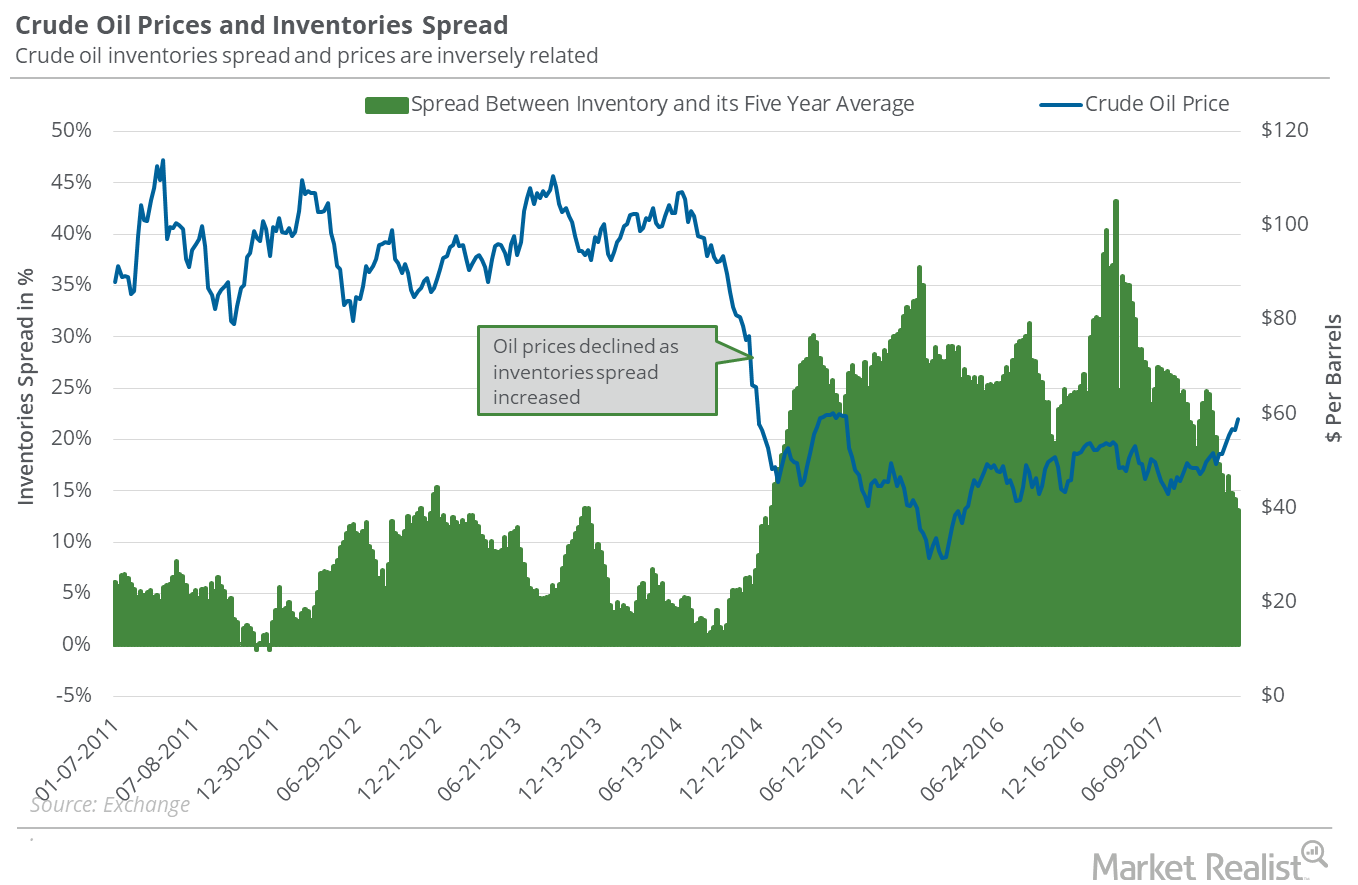

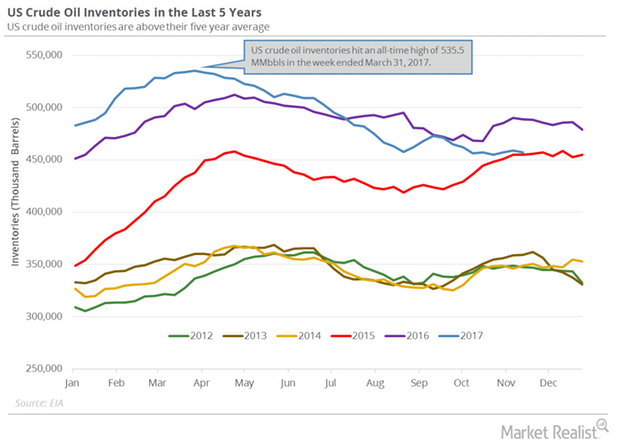

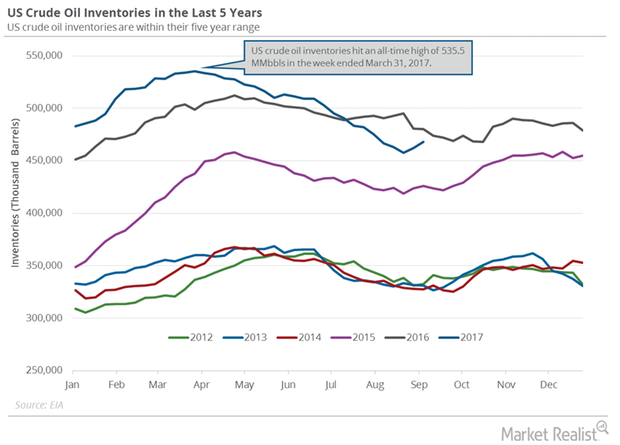

What Oil Bulls Could Expect for Oil Inventories

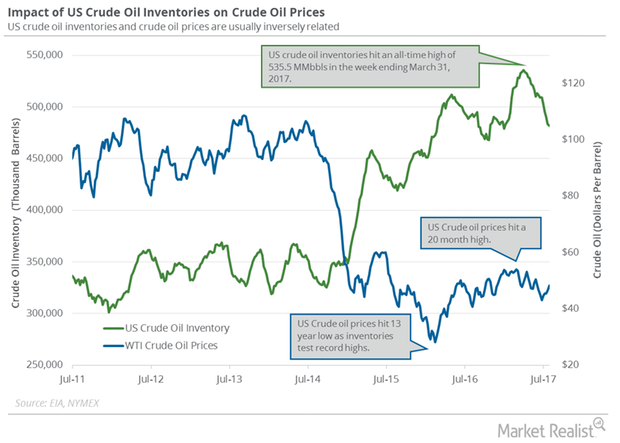

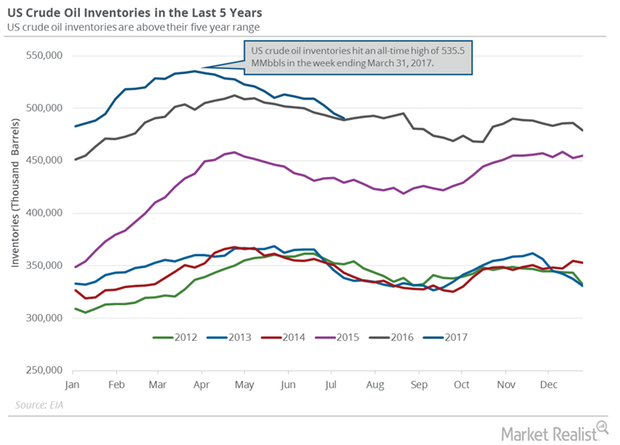

Oil stockpiles In the week ended December 8, 2017, US crude oil inventories fell by 5.1 MMbbls (million barrels) to 443 MMbbls. However, motor gasoline inventories rose 5.7 MMbbls. The data was released by the EIA (U.S. Energy Information Administration) on December 13. That day, US crude oil prices fell 0.9%. Inventory spread The gap between US oil inventories […]

Analyzing Crude Oil Inventories and Oil Prices

In the week ending November 24, 2017, US crude oil inventories fell by 3.4 MMbbls (million barrels) to 453.7 MMbbls.

Will the Inventories Spread Impact US Crude Oil?

US commercial crude oil inventories fell by 1.9 MMbbls in the week ending November 17, 2017—0.5 MMbbls more than the market’s expected fall.

The Relationship between US Crude Oil Inventories and Oil Prices

Estimates for US crude oil inventories The EIA (U.S. Energy Information Administration) released its Weekly Petroleum Status Report on November 22, 2017. It reported that US crude oil inventories fell 1.9 MMbbls (million barrels) to 457.1 MMbbls between November 10 and 17, 2017. Inventories were 31.8 MMbbls (6.5%) lower than in the same period in 2016. The market anticipated […]

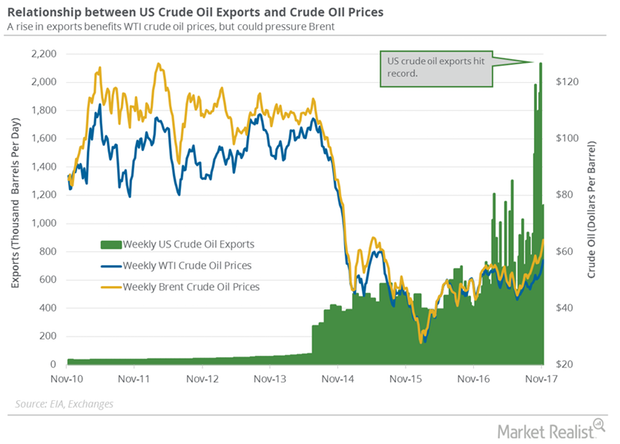

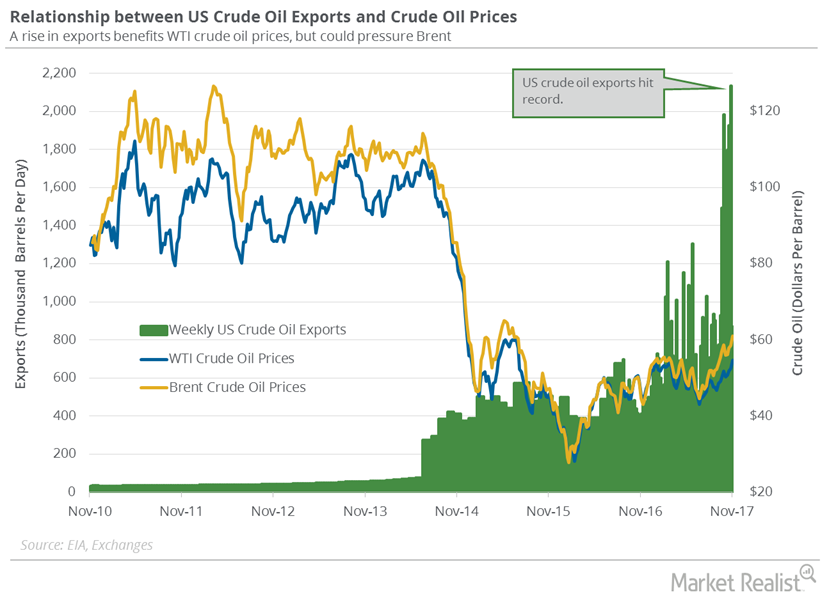

US Crude Oil Exports and Drilling Activity Impact OPEC

According to the EIA, US crude oil exports rose by 260,000 bpd to 1,129,000 bpd on November 3–10, 2017. Exports rose 30% week-over-week.

Russian and US Crude Oil Exports Are Important for Oil Bears

US crude oil exports fell by 1,264,000 bpd or 60% to 869,000 bpd on October 27–November 3, 2017. Exports rose by 459,000 bpd from the same period in 2016.

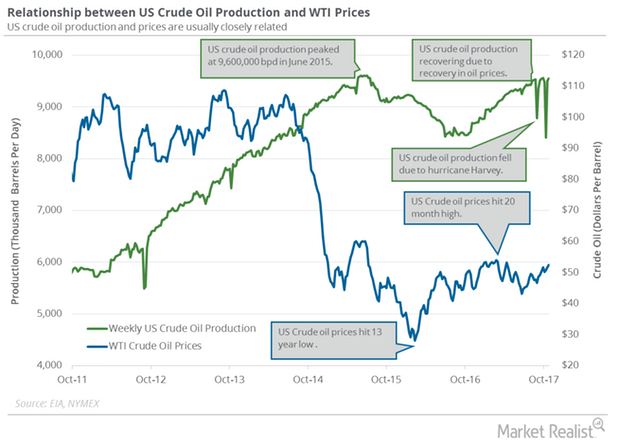

Will Non-OPEC and US Crude Oil Production Impact Oil Prices?

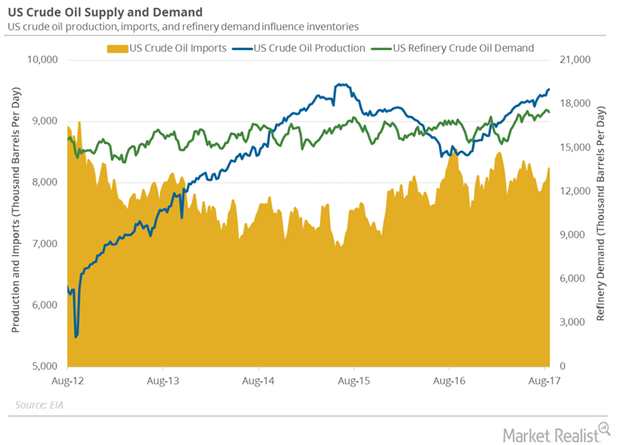

The EIA (U.S. Energy Information Administration) estimates that US crude oil production rose by 46,000 bpd to 9,553,000 bpd on October 20–27, 2017.

How Iran and Iraq’s Crude Oil Exports Could impact crude Oil Prices

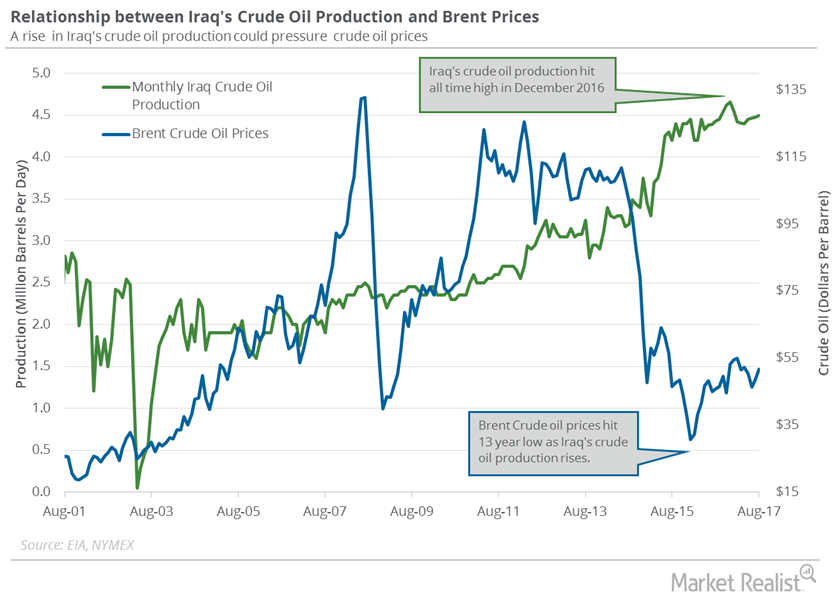

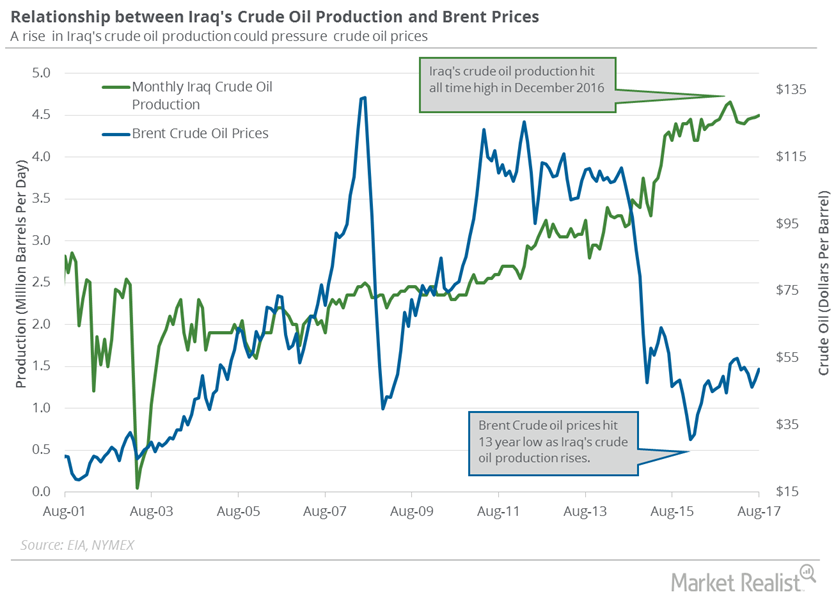

Iraq’s crude oil exports hit 3.98 MMbpd (million barrels per day) in September 2017, according to Bloomberg—its highest level since December 2016.

Why Kurdish Regions Are Crucial for Iraq’s Crude Oil Exports

Iraq is the second-largest OPEC producer. The EIA (U.S. Energy Information Administration) estimates that Iraq’s crude oil production rose by 25,000 bpd (barrels per day) to 4,500,000 bpd in August 2017.

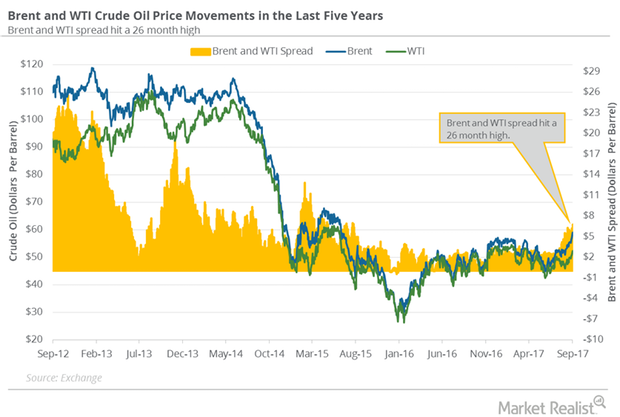

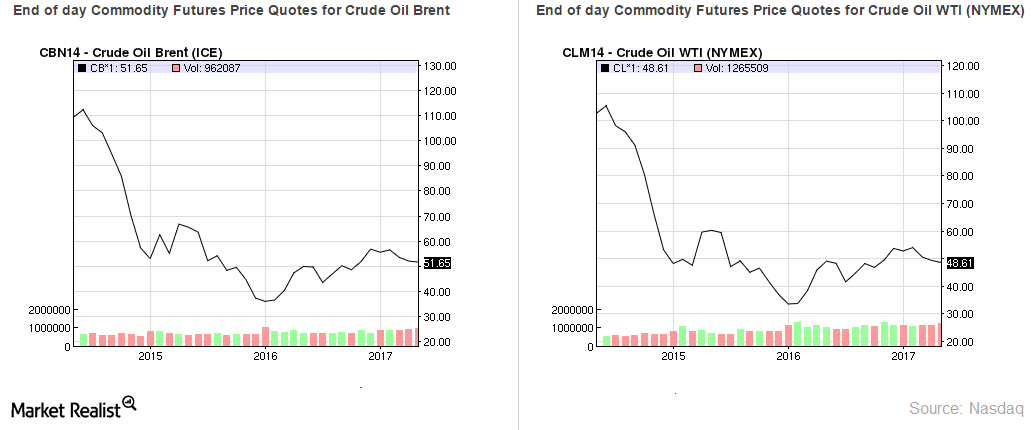

Why the Brent and WTI Crude Oil Spread Hit a 26-Month High

November WTI (West Texas Intermediate) crude oil (UWT)(DWT)(DBO) futures contracts fell 0.2% and were trading at $52.12 per barrel in electronic trading at 2:20 AM EST on September 26.

Hedge Funds Are Turning Bearish on US Crude Oil

Hedge funds reduced their net long positions in US crude oil futures and options by 12,094 contracts to 157,891 contracts on September 5–12, 2017.

Iran’s Crude Oil Production Was Flat in August 2017

The EIA estimates that Iran’s crude oil production was flat at 3.8 MMbpd (million barrels per day) in August 2017—compared to July 2017.

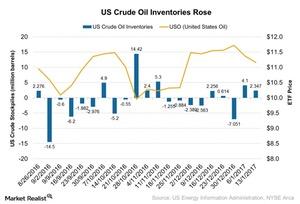

Why US Crude Oil Inventories Rose Again

On September 13, the EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report.

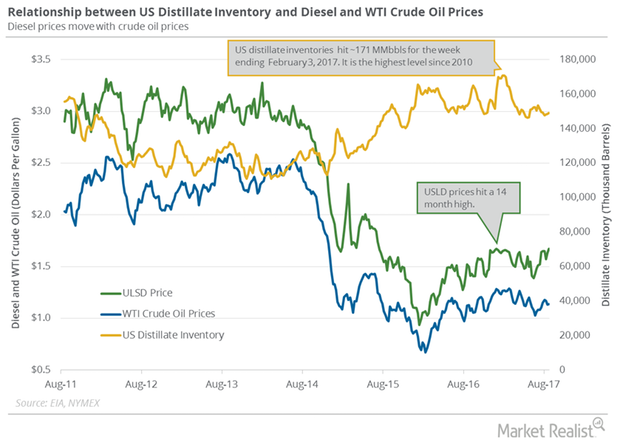

US Distillate Inventories Rise for a Third Week

US distillate inventories On August 30, 2017, the EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report. The EIA estimates that US distillate inventories rose by 0.5% to 149.1 MMbbls (million barrels) between August 18 and 25, 2017. Inventories fell by 5.6 MMbbls, or 3.6%, from the same period in 2016. Inventories […]

Why September Gasoline Futures Hit a 2-Year High

September gasoline futures contracts rose 4% and closed at $1.78 per gallon on August 29, 2017—the highest settlement in more than two years.

How Tropical Storm Harvey Impacts US Crude Oil and Gasoline Prices

WTI (West Texas Intermediate) crude oil (SCO)(BNO)(PXI) futures contracts for October delivery rose 0.4% and were trading at $46.8 per barrel in electronic trading at 2:05 AM EST on August 29.

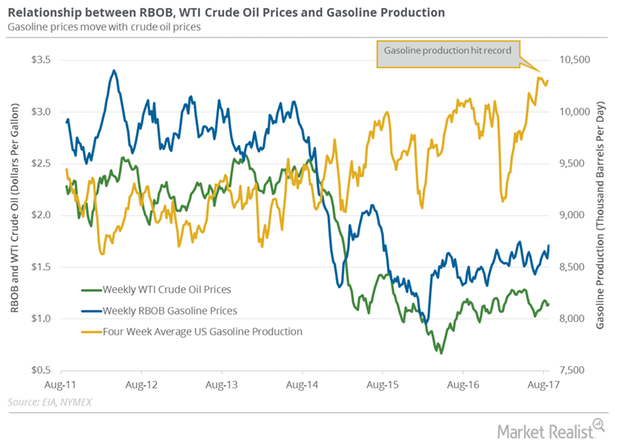

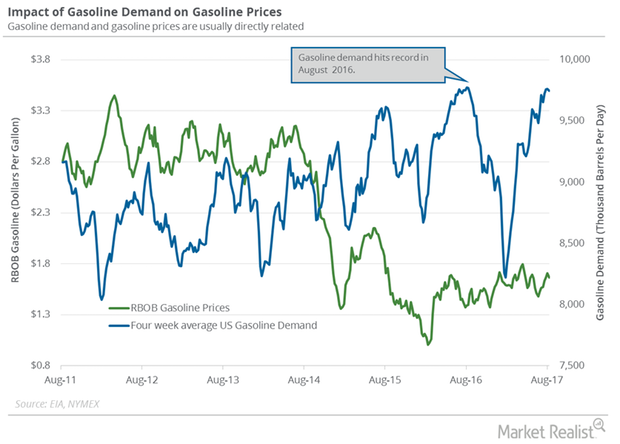

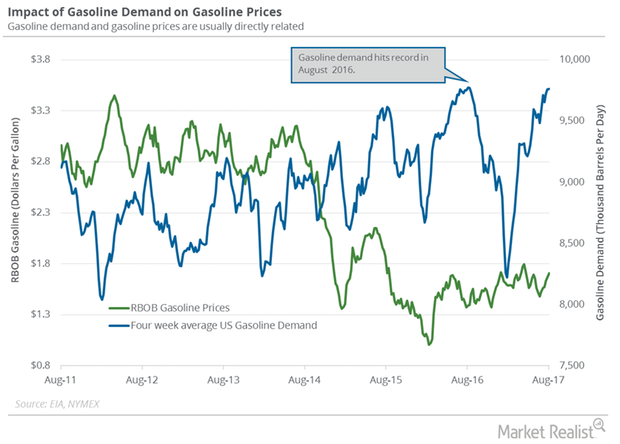

Could US Gasoline Demand Fall in the Coming Months?

The EIA estimates that US gasoline demand will fall 275.0 Mbpd (thousand barrels per day) to 9.5 MMbpd (million barrels per day) August 4–11, 2017.

What to Expect from US Gasoline Demand

The EIA (U.S. Energy Information Administration) estimates that weekly US gasoline demand fell by 45,000 bpd (barrels per day), or 0.45%, to 9,797,000 bpd between July 28 and August 4, 2017.

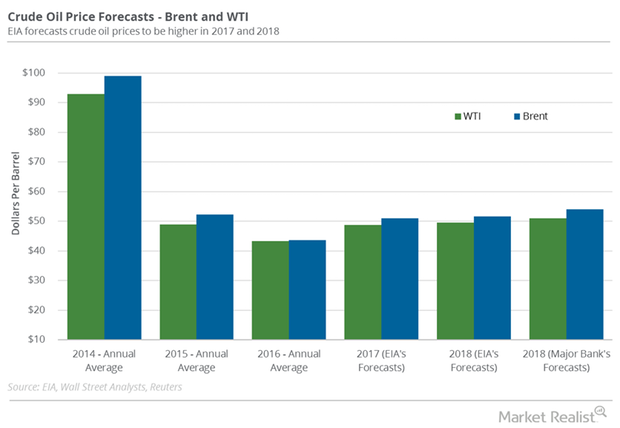

Crude Oil Futures Fell despite OPEC’s Meeting and API Data

September US crude oil futures contracts fell 0.4% to $49.17 per barrel on August 8. Brent crude oil futures fell 0.4% to $52.14 per barrel on the same day.

US Crude Oil Inventories Could Fall below the 5-Year Average

The EIA estimates that US crude oil inventories fell by 4.7 MMbbls (million barrels) to 490.6 MMbbls on July 7–14, 2017.

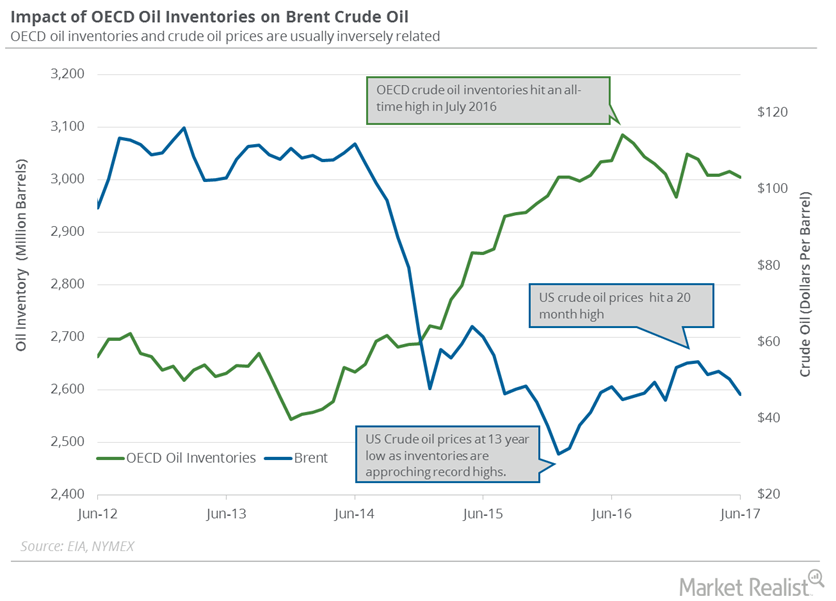

Will OECD’s Crude Oil Inventories Fall below the 5-Year Average?

The EIA estimates that OECD’s crude oil inventories fell by 10.13 MMbbls (million barrels) to 3,005 MMbbls in June 2017—compared to May 2017.

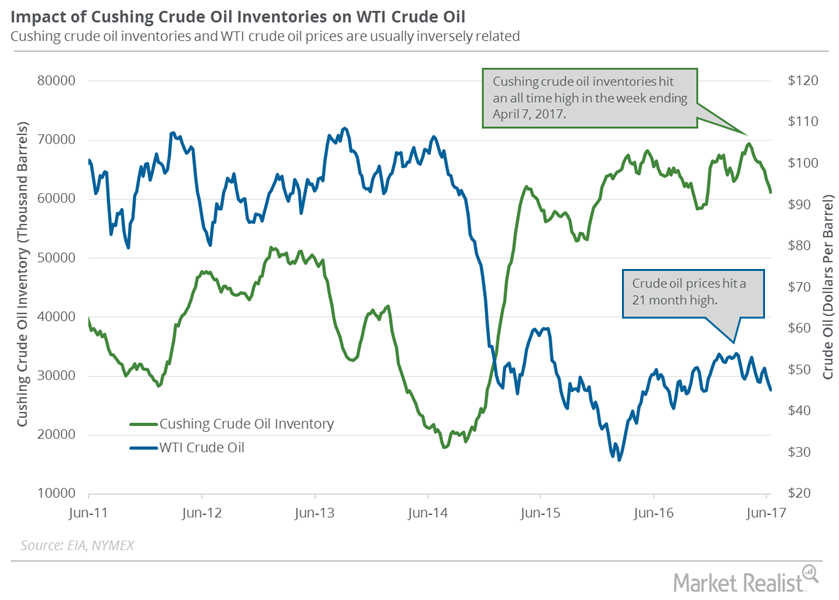

Cushing Inventories Fell for the Ninth Time in 10 Weeks

The EIA (U.S. Energy Information Administration) will release weekly data on crude oil and gasoline inventories on June 28, 2017.

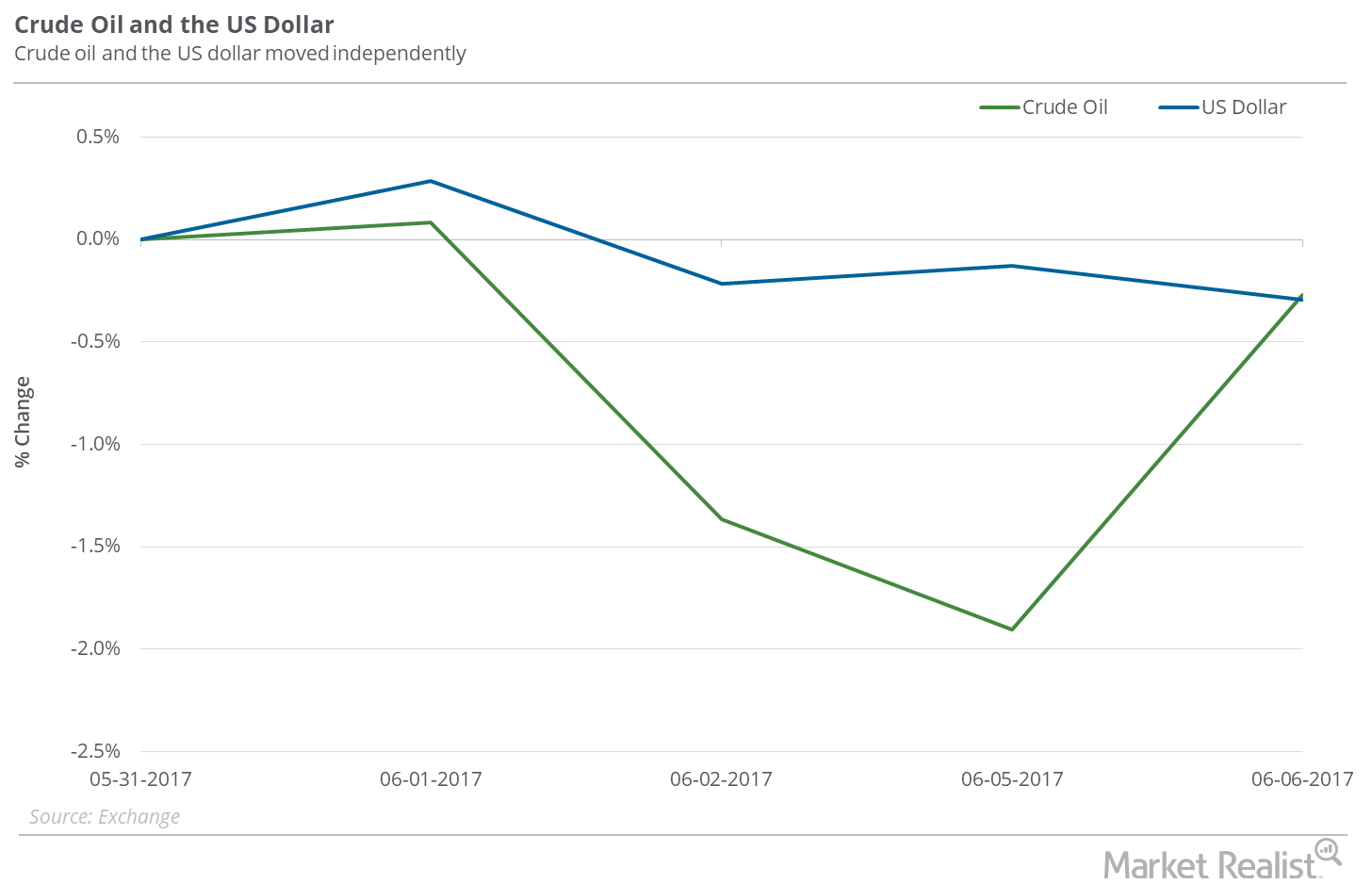

Is Crude Oil Ignoring the Falling Dollar?

Between May 30 and June 6, 2017, the US dollar (UUP) (USDU) (UDN) fell 0.7%, and crude oil (USO) (OIIL) July futures fell 3%.

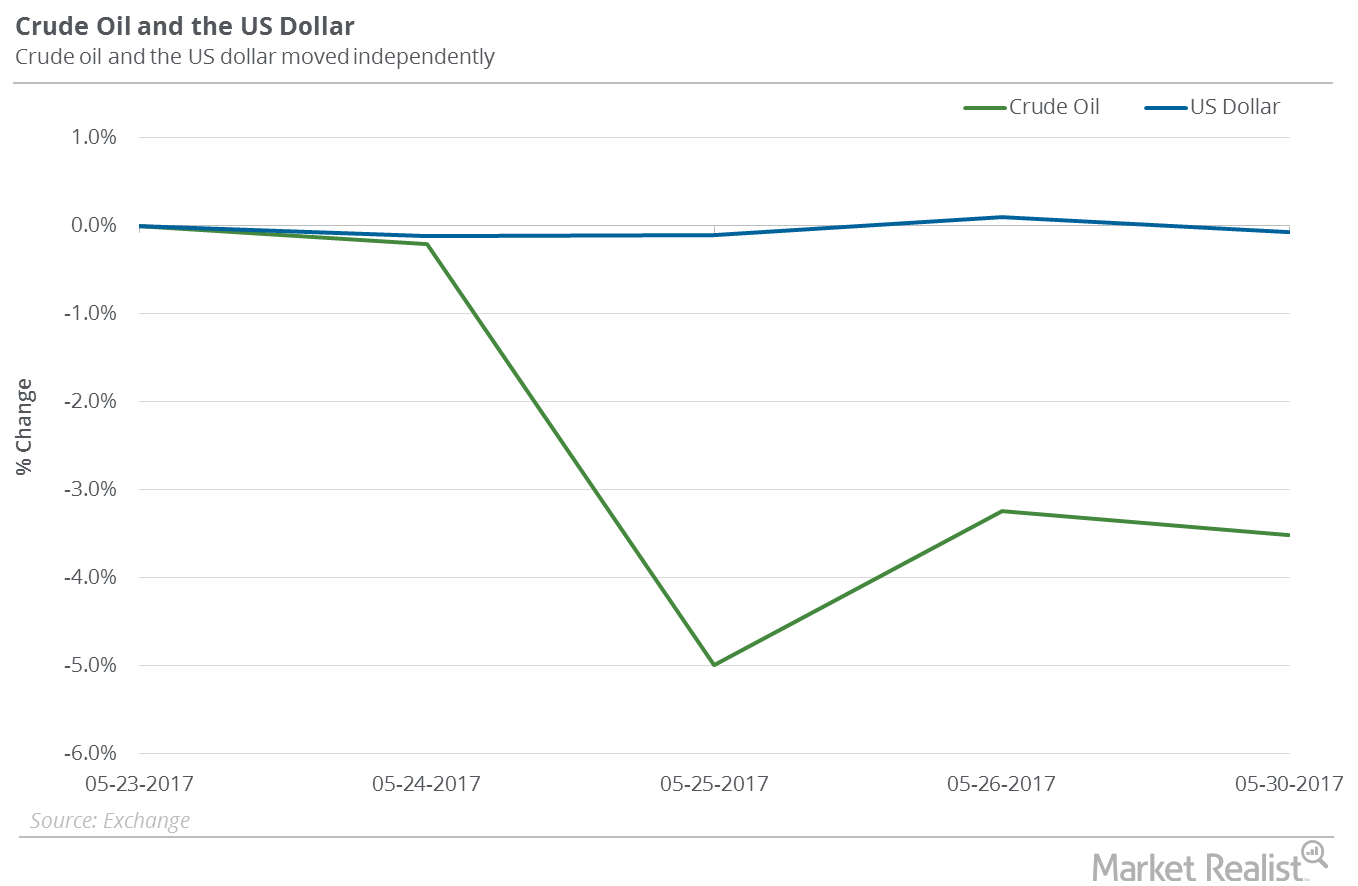

Is the US Dollar Impacting Oil’s Downturn?

In the trailing week, the US dollar fell 0.1%. Despite a fall in the US dollar, crude oil July futures fell 3.5% between May 23 and May 30, 2017.

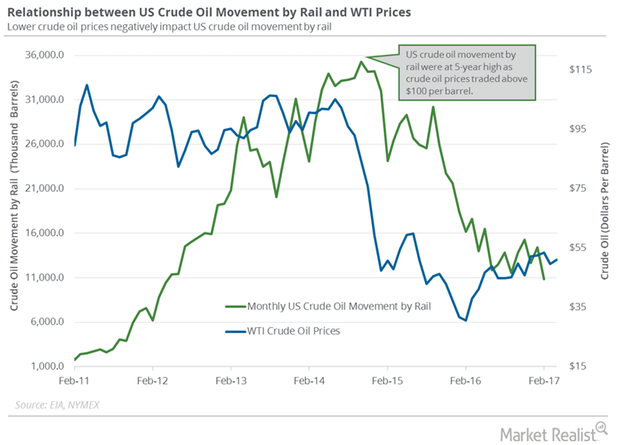

How Did Crude Oil Movement by Rail Trend in February 2017?

The US Energy Information Administration estimates that US crude oil movement by rail fell by 3,546,000 barrels to 10,850,000 barrels in February 2017.

Will Fallen Angel Bonds Continue to Capture Solid Returns?

VanEck How fallen angels may complement high yield portfolios Income investors may want to consider fallen angels as a complement to their high yield bond allocations given their higher credit quality. Fallen angels’ higher average credit quality than original-issue high yield bonds may help absorb more of the potential broader market volatility that may occur […]

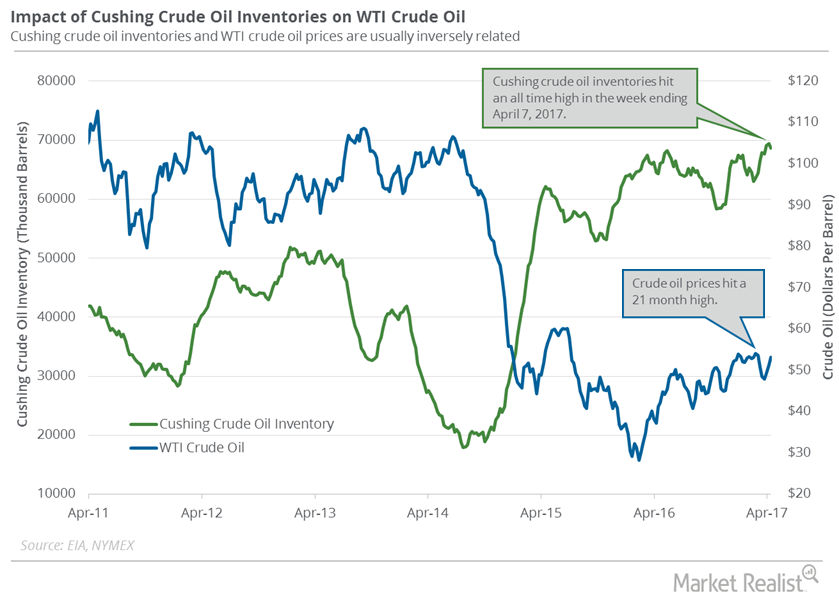

Cushing Crude Oil Inventories Fell from an All-Time High

For the week ending April 14, 2017, the EIA reported that Cushing crude oil inventories fell by 0.8 MMbbls (million barrels) to 68.6 MMbbls.

How Will Rise in Crude Oil Inventories Affect Crude Oil Movement?

According to the EIA’s (US Energy Information Administration) report on January 18, 2017, US crude oil inventories rose ~2.35 MMbbls (million barrels) for the week ended January 13, 2017.

How OPEC’s Decision Will Impact Crude Oil’s Movement

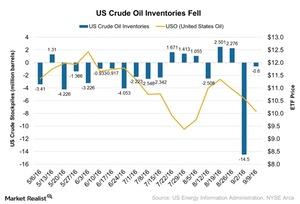

According to the EIA’s (U.S. Energy Information Administration) report on September 14, 2016, US crude oil inventories fell 0.6 MMbbls (million barrels) for the week ending September 9.

Why US Crude Oil Inventories Fell for 9th Consecutive Week

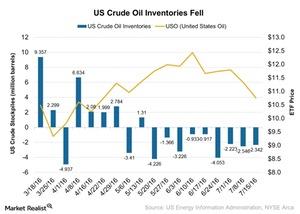

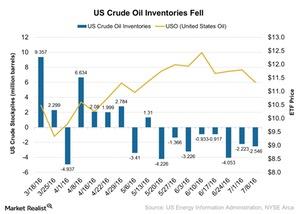

According to the July 20, 2016, U.S. Energy Information Administration report, US crude oil inventories declined by 2.3 MMbbls for the week ended July 15, 2016.

US Crude Oil Inventories Fell for the 8th Week: What It Means

According to the EIA’s report on July 13, 2016, US crude oil inventories fell by 2.5 MMbbls (million barrels) in the week ended July 8, 2016.

Why Did Crude Oil Prices Diverge before OPEC’s Meeting?

July WTI (West Texas Intermediate) crude oil futures contracts trading in NYMEX fell by 0.47% and settled at $49.1 per barrel on Tuesday, May 31, 2016.

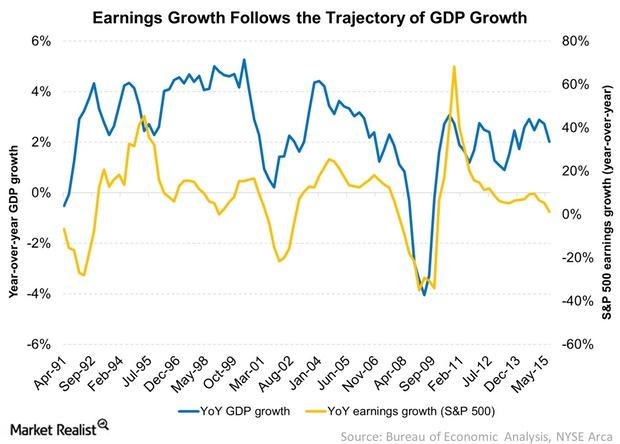

What’s the Biggest Driver of Earnings Growth?

Economic growth is the biggest driver of earnings growth. Earnings growth seems to follow the same trajectory of GDP growth.

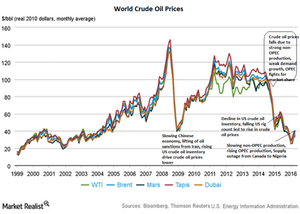

Russia’s sovereign credit rating downgraded to junk

Russia’s sovereign credit rating now stands on par with countries such as Turkey and Indonesia. The oil price crisis isn’t helping matters.