Yamana Gold Inc

Latest Yamana Gold Inc News and Updates

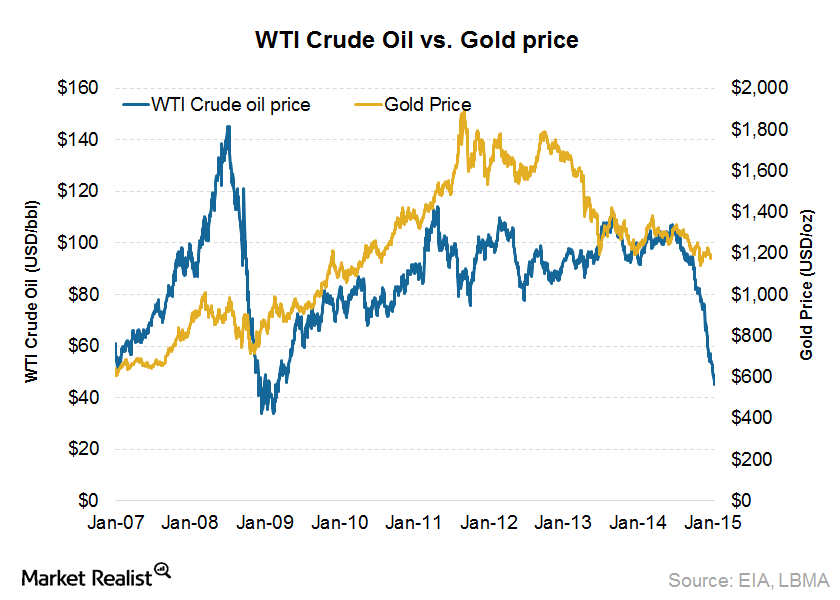

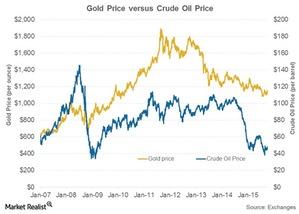

Low crude oil prices impact gold

Cheaper oil means lower inflation. This means gold should be affected negatively since it’s usually considered a hedge against inflation.

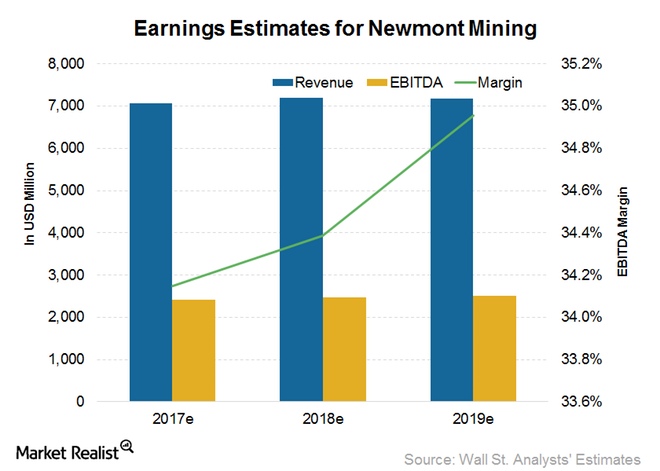

Analysts’ Estimates: Could NEM’s Near-Term Profitability Decline?

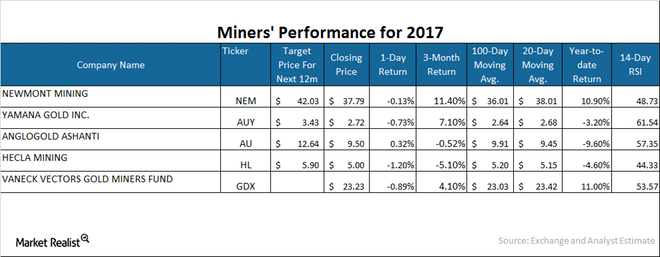

Although 2017 has not been very good for Newmont Mining stock due to short-term issues, its outlook remains strong.

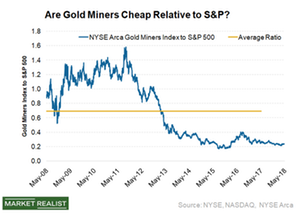

Which Gold Stocks Do Analysts Love and Hate?

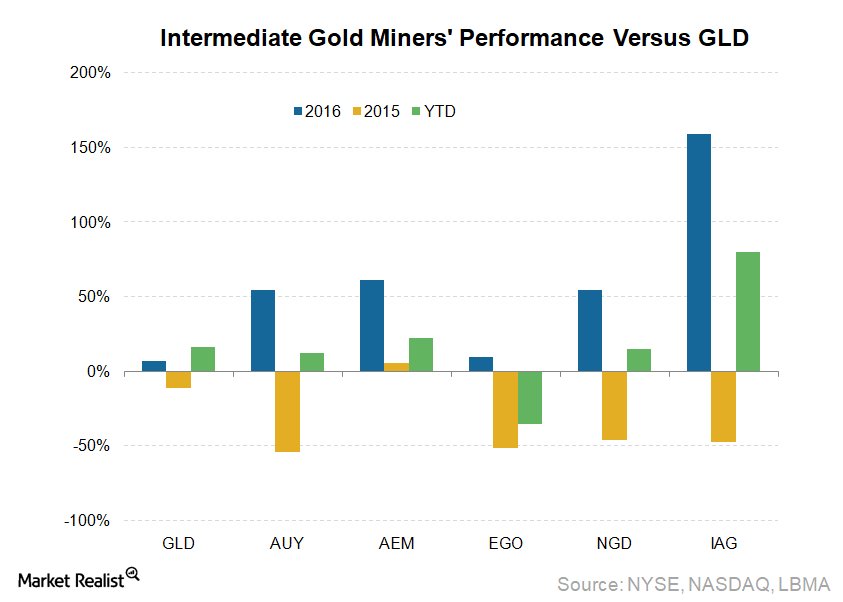

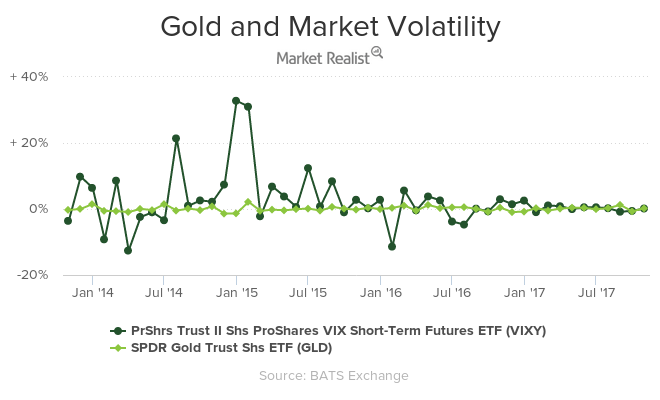

Gold price’s reversal this year has created opportunities in gold stocks. The SPDR Gold Shares ETF (GLD) had gained 11% year-to-date as of Friday.

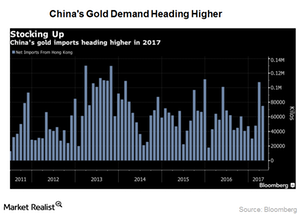

What Rising Physical Gold Demand Could Mean for Prices

After falling 18% in 1Q17, physical demand for gold seems to have picked up in 2Q17.

Which Gold Miners Are Ray Dalio and John Paulson Betting On?

Hedge funds increased their net positions in the SPDR Gold Shares ETF during the first quarter.

Why Are Intermediate Gold Miners so Exuberant?

Intermediate gold miners are smaller than senior gold miners in terms of production and market capitalization, but they are still generally liquid.

The Correlation between Gold and Oil

Oil is widely used in mining exploration, and a surge in oil prices may squeeze miners’ margins, leading to a fall in their share prices.Financials GG’s merger and acquisition strategy is different than its peers

Although every gold miner talks about only doing merger and acquisition (or M&A) strategies that are in shareholders’ best interests, GG sticks to its strategy—unlike most of its peers.Materials Key things to look out for when you invest in junior gold stocks

The junior mining space is very risky, given very limited options in terms of mines and their involvement in early stages. So it’s very important to identify the right junior stock.

Trump, Trade War, Powell: More Upside for Gold Prices?

Gold hit a fresh six-year high on Friday as trade tensions between the US and China escalated. The SPDR Gold Shares ETF (GLD) closed up 2%.

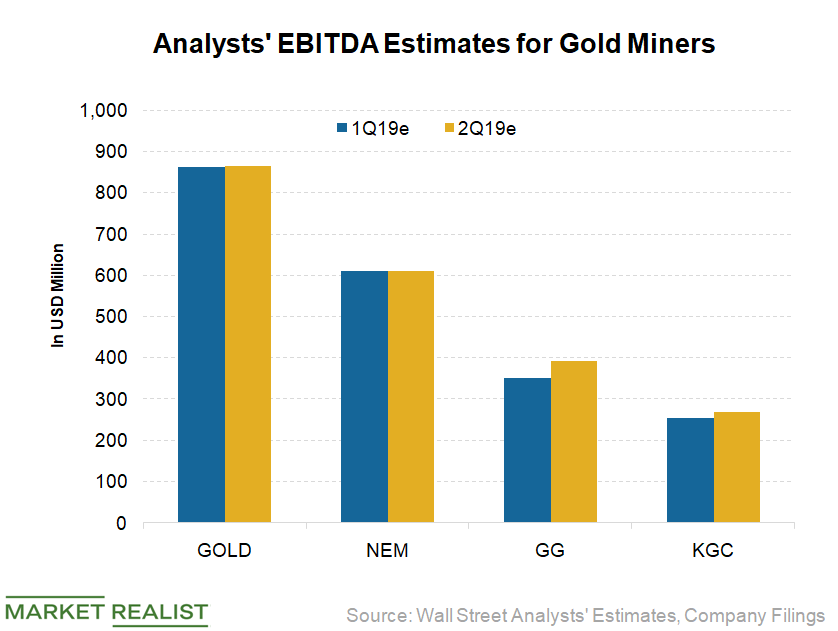

Which Gold Stocks Could Beat Analysts’ Earnings Expectations in Q1?

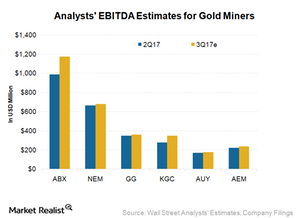

Many gold miners (RING) are set to release their first-quarter results shortly. Analysts expect Barrick Gold’s (GOLD) EBITDA to rise 6.2% YoY (year-over-year) in the first quarter.

How Do Gold Miners’ Leverage Ratios Look?

Barrick has reduced its debt more than 57% in the last four years from $13.4 billion at the end of 2014 to $5.7 billion at the end of 2018.

Can Newmont Mining Outperform Its Peers in 2019?

Newmont Mining (NEM) reported its fourth-quarter earnings results before the market opened on February 21.

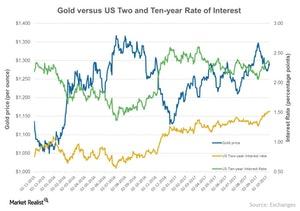

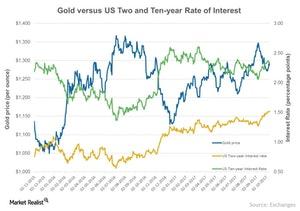

What’s the Impact of Interest Rates on Precious Metals?

Monetary policies have been crucial in determining the movement in precious metals.Materials Are Analysts Optimistic about Miners?

Despite the ongoing slump in the precious metals market, it seems that there could be hope going forward.Miscellaneous How Is the Dollar Affecting Precious Metals?

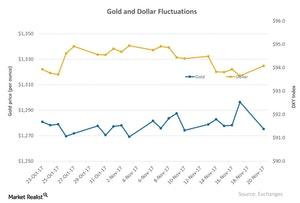

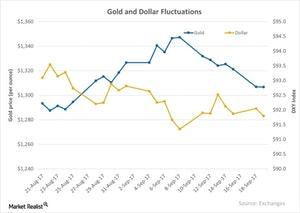

Besides ongoing geopolitical concerns, a crucial factor that gold keeps looking to for directional moves is the US dollar.

A Quick Look at the Precious Metals Revival, Miners’ Performances

Precious metals prices shot up on January 19, 2018, with concerns looming over the shutdown the of the US government.

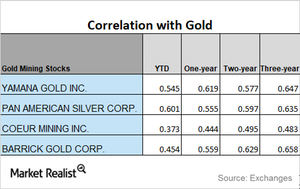

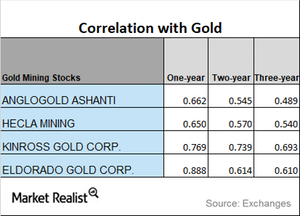

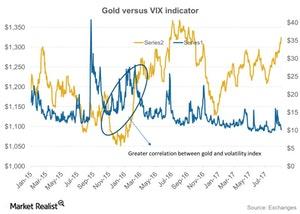

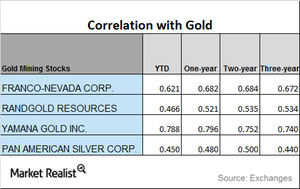

How Are Miners’ Correlations to Gold Trending?

Mining stocks tend to take their cues from gold.

Analyzing the Correlation between Miners and Gold in January

Most mining stocks have risen over the past one month due to the revival in gold prices.

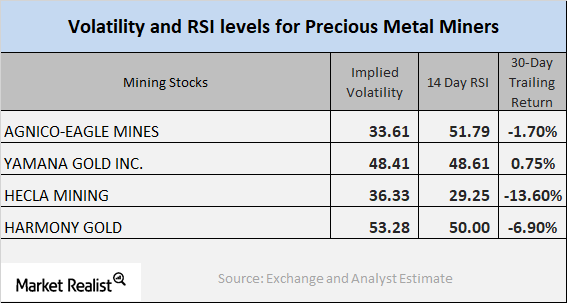

What Mining Stocks’ Indicators at the End of December Tell Us

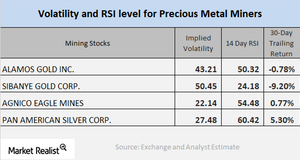

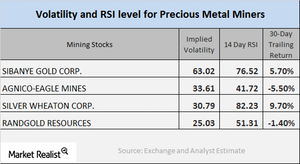

Agnico, Randgold, Yamana, and Barrick have call implied volatilities of 24.3%, 21.1%, 38.8%, and 22.8%, respectively.

Will Gold Maintain Its Close Correlation to Inflation?

The rise in inflation could be a positive sign for the current scenario.

All 4 Precious Metals Rose on December 20, 2017

All four precious metals had an up day on December 20, 2017. Gold increased 0.43% on the day and closed at $1,267.80 per ounce.

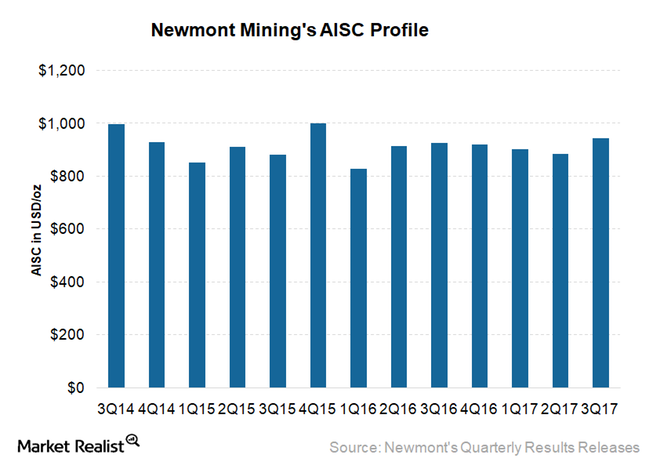

Investors Might See a Bump in Newmont’s Costs in 2018 before Improving

Newmont Mining (NEM) is expecting its newest mines to add production at just $750 per ounce.

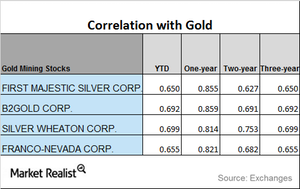

Where Are Miners’ Correlations with Gold Headed?

In this article, we’ll aim to study the correlations of Yamana Gold (AUY), Pan American Silver (PAAS), Coeur Mining (CDE), and Barrick Gold (ABX) with gold.

How Eager Are Precious Metals to Hear the Fed’s Decision?

Gold, silver, and platinum all had a down day on Tuesday, December 13, mainly due to speculations over the Federal Reserve’s pending interest rate decision.

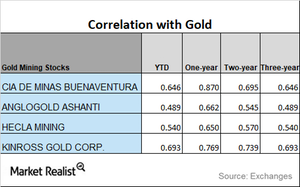

Miners’ Correlation with Gold

Correlation analysis A correlation study of mining stocks to precious metals is important. It gives insights about miners’ potential price movement. Although the mining shares are essentially part of the market’s equity segment, they’re more coordinated with metals’ movement. Gold is the most dominant precious metals. We’ll discuss how Yamana Gold (AUY), Pan American Silver (PAAS), Coeur […]

How Inflation Becomes a Core Determinant of the Price of Gold

The possible interest rate hike is taking a lot of market participants’ attention. Many policymakers are also focusing on inflation numbers.

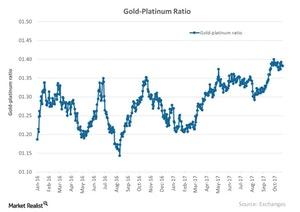

Insight into the Platinum Markets in November 2017

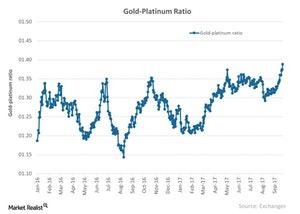

The gold-platinum ratio was ~1.4 on November 22, 2017.

How the Higher Dollar Has Affected Precious Metals

Precious metal slump All four precious metals saw a down day on Monday, November 20. Gold fell 1.6% to $1,275.30 per ounce, after touching a one-month high on Friday, November 17. The fall in precious metals was most likely due to the rise in the US dollar. The US Dollar Index rose 0.45% on Monday. Gold, silver, platinum, […]

The Directional Correlation Move of Mining Stocks in 2017

If we look at the one-year correlation of miners, Barrick Gold has the lowest correlation with gold, while Yamana has the highest.

Mining Stocks: Analyzing Correlation Trends

Mining stocks’ performance usually depends on precious metals’ performance. However, the two can deviate. Correlation analysis can give investors some perspective on how mining stocks relate to gold and silver.

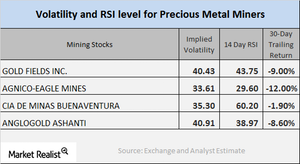

A Brief Analysis of Mining Stocks in November 2017

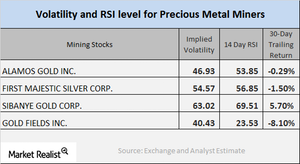

On November 7, Agnico-Eagle Mines (AEM), Yamana Gold (AUY), Hecla Mining (HL), and Harmony Gold (HMY) had implied volatility readings of 33.6%, 48.4%, 36.3%, and 53.3%, respectively.

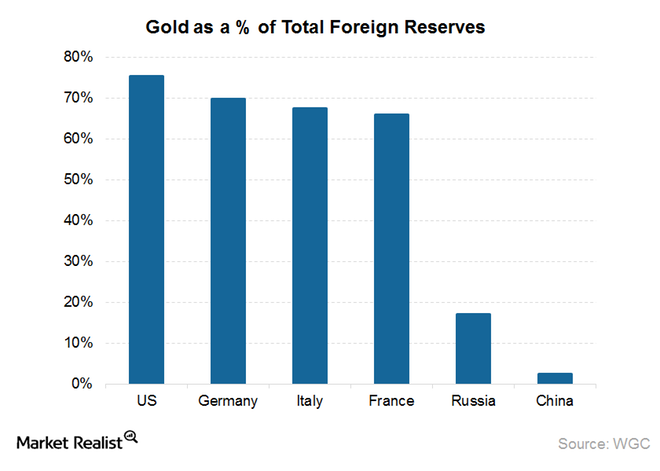

How Central Banks’ Gold Buying Spree Coud Benefit Prices

While China and Russia have the fifth and sixth largest gold reserves globally, the movements in them are the most watched by gold investors the world over mainly because these economies have been quite vocal about adding gold reserves.

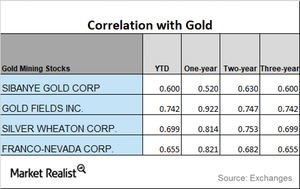

Behind the Correlations of Key Miners Today

On a YTD (year-to-date) basis, the correlations of the above mining stocks appear to be weak when compared with last year.

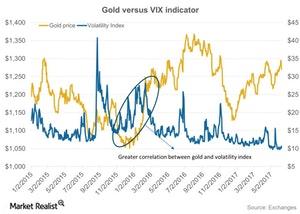

Gauging Global Risk against Gold

All four precious metals rose on Monday, October 30, as multiple speculations in the market gripped investors’ attention.

A Technical Analysis of Mining Shares as of October 27

On October 26, 2017, Royal Gold, Newmont, Sibanye, and Yamana had call implied volatilities of 24.8%, 25.9%, 63%, and 48.4%, respectively.

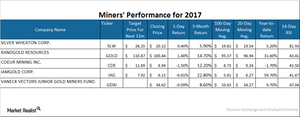

How Gold Companies Have Performed in 2017

Gold stock indices also traded near their highs for the year, but then followed the gold price lower. During September the NYSE Arca Gold Miners Index (GDMNTR) retreated 6.5%.

What Mining Stocks’ Implied Volatility Tells Us

As of October 24, 2017, Silver Wheaton (SLW), Yamana Gold (AUY), Barrick Gold (ABX), and AngloGold Ashanti (AU) had implied volatility readings of 30.8%, 48.4%, 29.1%, and 40.9%, respectively.

Platinum Ratio Analysis: Which Way Is Platinum Moving?

The gold-platinum spread was ~1.38 on October 23. The RSI (relative strength index) level for the gold-platinum spread is now at 93.9.

Mining Shares’ Directional Move in October

Most of the mining shares saw a downside move in the price on October 19, 2017, but gold and silver had an up day.

What Analysts Are Forecasting for Gold Miners’ 3Q17 Earnings

Analysts expect Barrick Gold’s (ABX) EBITDA to fall 17% YoY in 3Q17 to $988 million.

A Brief New Look at the Technical Indicators of Mining Stocks

The Physical Silver Shares (SIVR) and Physical Swiss Gold Shares (SGOL) witnessed rises on Friday, October 16, climbing 0.98% and 0.81%, respectively.

The Latest in Correlation Trends between Mining Stocks and Gold

Among the four miners that we’re analyzing here, Sibanye Gold has the lowest correlation with gold on a one-year basis, while Gold Fields has the highest.

Precious Metals, Miners and the Scaling Dollar

Later in the day on September 20, after rising gold prices fell on the US Federal Reserve’s indication of one more interest rate hike in 2017.

How Gold, Silver, and Mining Companies Performed on September 18

On September 18, gold fell 1.1% and closed at $1,306.90 per ounce. Of the precious metals, silver fell 3.1% and closed at $17.10 per ounce.

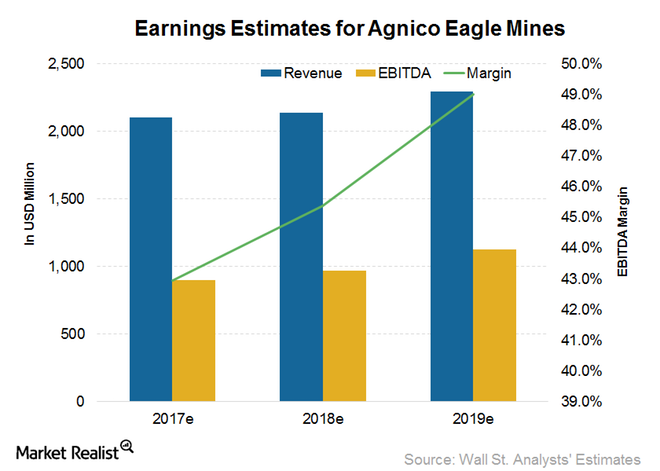

How Analysts Estimate Agnico Eagle Mines’ Earnings in 2017 and Beyond

Despite just 0.7% expected growth in revenues for 2017, Agnico Eagle Mine’s EBITDA is expected to grow 5.6% YoY in 2017.

How North Korea Has Affected the Precious Metal Market

Precious metals have been buoyed by tension in North Korea. If North Korea does another missile test, it could prompt investors to move to haven assets such as gold, silver, Treasuries, and major currencies.

How Gold Is Coping amid Market Turmoil

Precious metals have maintained upward movement over the past month as geopolitical tensions hover.

Reading the Correlation Analysis of Mining Shares in August 2017

Yamana Gold has the highest correlation with gold, while Pan American Silver has the lowest correlation.

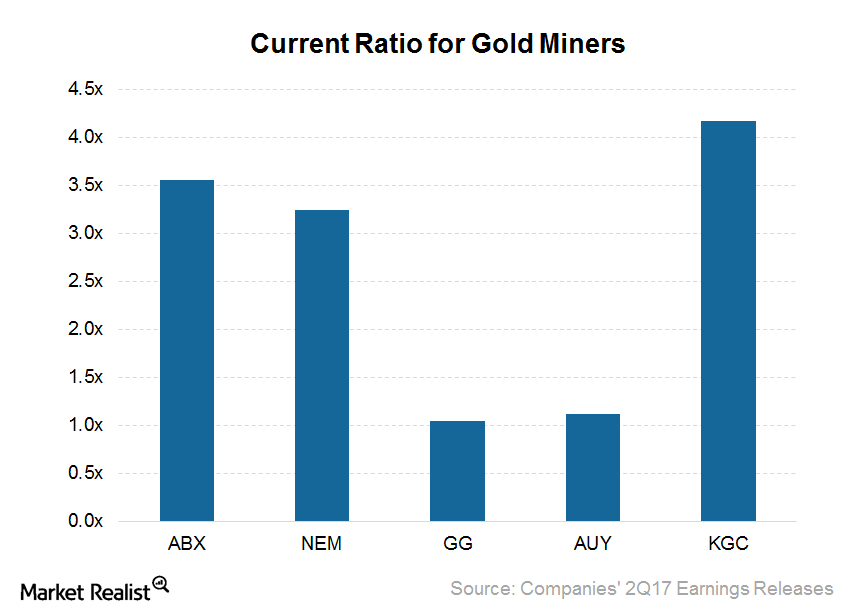

Is Liquidity a Concern for Gold Miners after 2Q17 Earnings?

Newmont Mining had $5.5 billion in liquidity, including $3.1 billion in cash at the end of 2Q17. It has one of the best credit ratings in the sector.