Yamana Gold Inc

Latest Yamana Gold Inc News and Updates

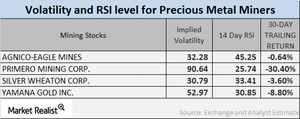

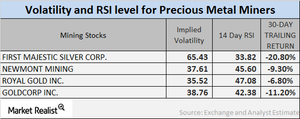

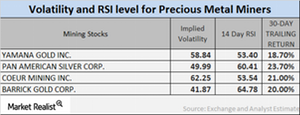

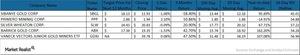

Mining Stocks’ Relative Strength Index Hits Rock Bottom

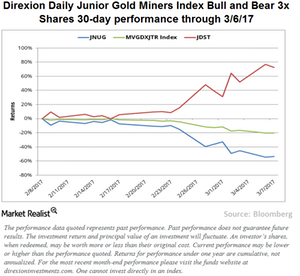

The rise and fall of precious metals also significantly impact mining-based leveraged funds like the Direxion Daily Gold Miners (NUGT) and Proshares Ultra Silver (AGQ).

How Silver-Based Funds Plunged Their Way through April 2017

Precious metals were doing considerably well until the first half of April 2017. As investors’ risk appetites revived, haven assets slumped. Among these metals, silver has plummeted the most.

Reading the Mining Stocks’ Falling RSI Numbers

Newmont Mining, Silver Wheaton, Randgold, and Yamana have RSI levels of 45.5, 37.1, 41.2, and 43.0, respectively.

Why Gold Stocks Edged Higher after Rate Hike

After remaining subdued for the past few months, gold futures last week recorded their highest weekly gain of 2.4% since February 3.

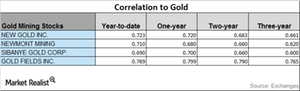

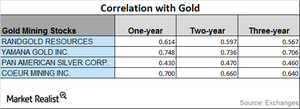

How Did Mining Stocks Correlate with Gold in March 2017?

Yamana’s correlation with gold has increased from a three-year correlation of ~0.74 to a one-year correlation of ~0.80.

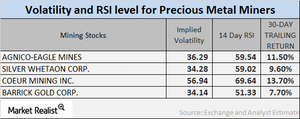

Mining Stock RSI levels: What the Indicators Suggest

NUGT and AGQ have seen YTD rises of 18.6% and 27.5%, respectively. But the volatility of such mining funds can be higher than that of precious metals.

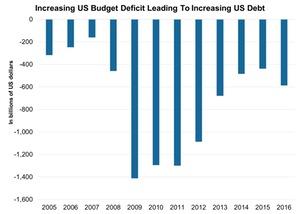

How Big Is the US Debt Compared to Other Nations?

Japan leads the nations with its rising debt-to-GDP ratio. The United States is in seventh place.

Analyzing the Upward-Downward Correlation of Precious Metals

Mining companies with high correlations to gold include Randgold Resources (GOLD), Yamana Gold (AUY), Pan American Silver (PAAS), and Coeur Mining (CDE).

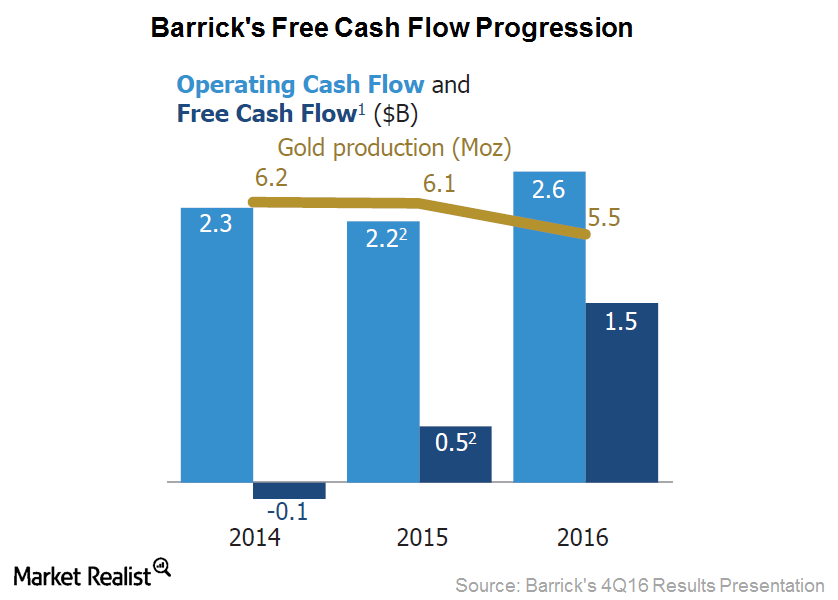

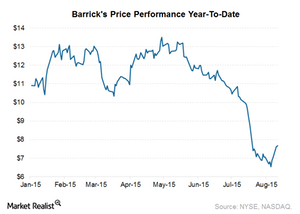

This Is Barrick Gold’s Focus: To Improve Free Cash Flow

Barrick Gold’s (ABX) management has defined value creation for shareholders in terms of FCF (free cash flow) per share.

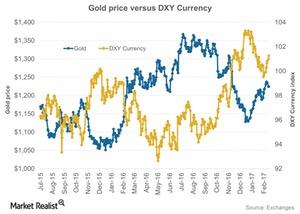

Why Gold and the US Dollar Are Moving in Opposite Directions

Gold prices tumbled on Tuesday, February 14, as the US dollar rose after the US Federal Reserve chair, Janet Yellen, seemed optimistic about raising interest rates.

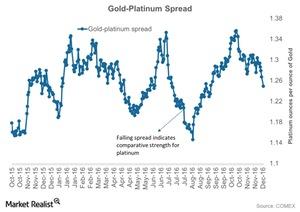

How the Gold-Platinum Spread Could Move More

The demand for platinum has been very fragile over the past few years, affected by the reduced market forecast for sales of diesel-based vehicles.

Analyzing the Volatility of Miners in February 2017

Call implied volatility takes into account the changes in an asset’s price due to variations in the price of its call option.

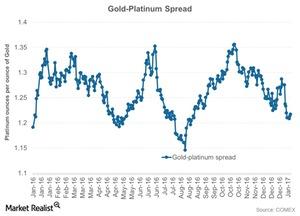

Analyzing the Gold-Platinum Ratio in 2017

The gold-platinum spread was ~1.2 on January 11, 2017. Platinum’s RSI (relative strength index) was 38.

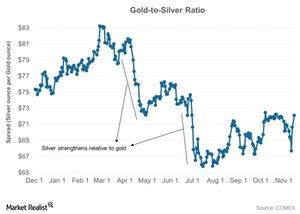

How Has the Gold-Silver Ratio Trended in 2016?

Gold and silver have been strong for the past few days. However, silver has substantially outperformed gold year-to-date.

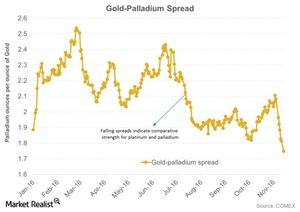

Why the Gold-Palladium Spread Is Falling Drastically

Palladium has seen a YTD rise of a whopping 32.5%, which is higher than the rise in platinum, silver, and gold. Earlier, palladium was underperforming its precious metal peers.

How Palladium Outperformed Gold: The Gold-Palladium Spread

Palladium has seen a year-to-date rise of a whopping 32.5%, which is higher than the rise in platinum, silver, and gold. Earlier, palladium was underperforming its precious metal peers.

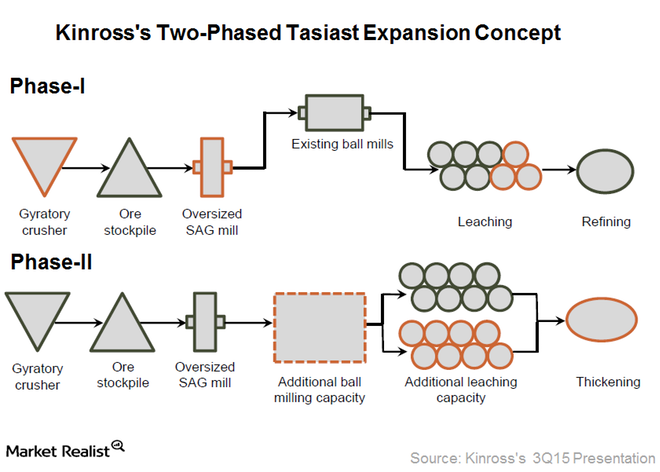

What Tasiast Mine Being Back in Full Swing Means for Kinross Gold

Kinross Gold (KGC) announced in June 2016 that it was temporarily halting its mining and processing activities at the Tasiast mine in Mauritania.

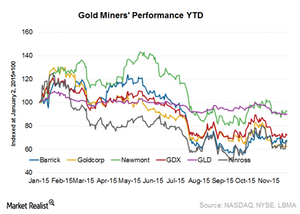

Why Mining Stocks Are Rising post-Brexit

Friday was important. Gold rose to a two-year high due to additional haven bids on the Brexit referendum.

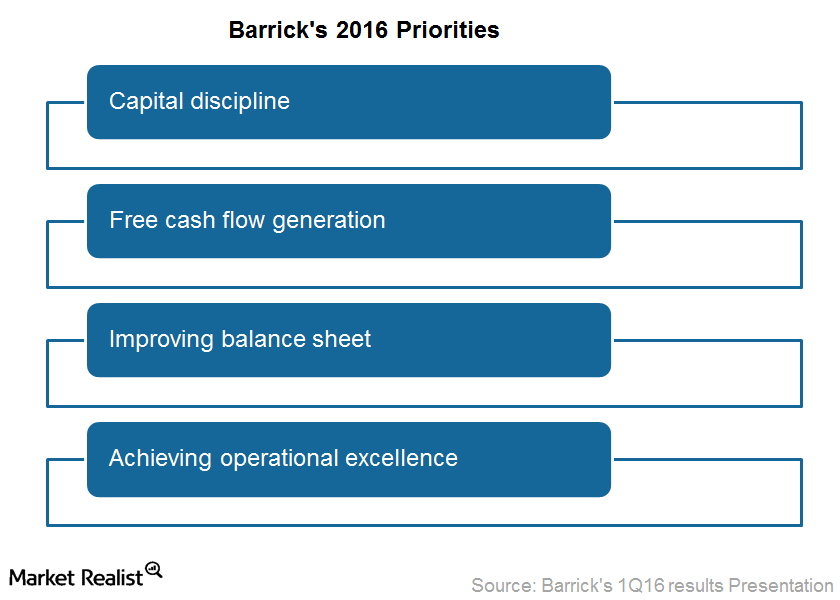

What Will Barrick Gold’s Focus on Its 4 Priorities Achieve?

Barrick Gold (ABX) wants to achieve positive free cash flow even at a gold price of $1,000 per ounce.

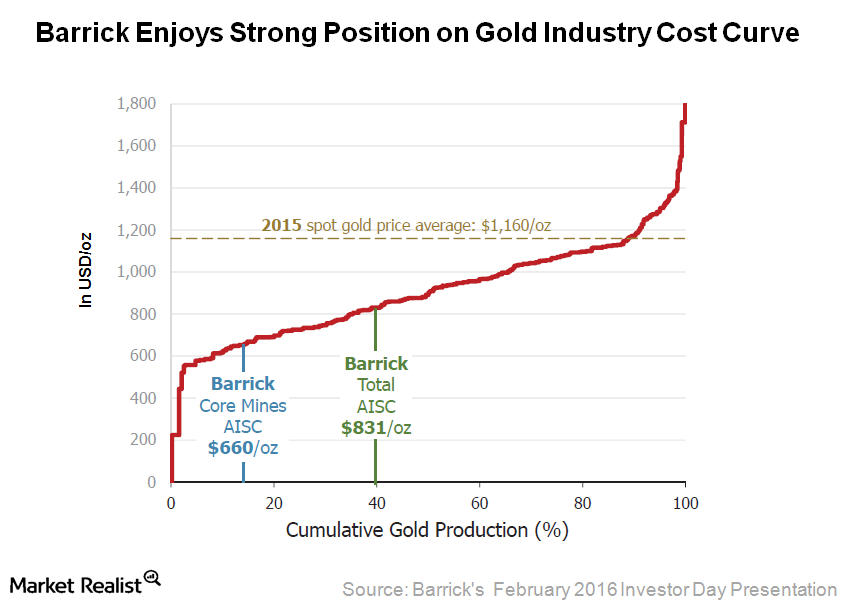

Barrick’s Focus on Costs Places It Favorably on Gold’s Cost Curve

Barrick Gold achieved all-in sustaining costs of $831 per ounce for 2015. This AISC was below the 40th percentile of the global industry cost curve.

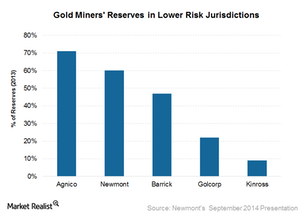

Gold Miners Are Cutting Down on Risky Geographical Exposure

While gold miners (GDX) are trying hard to limit their exposure to safe jurisdictions, it’s important to look at their geographic exposure and the implications it could have on their future prospects.

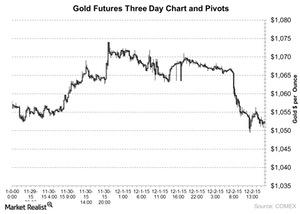

Gold Touched Its Lowest Levels in the Last Six Years on Wednesday

Gold futures trading on COMEX, the commodity division of the New York Mercantile Exchange, fell 0.91% on December 2, 2015. Also, platinum fell 0.36%.

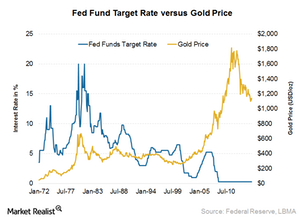

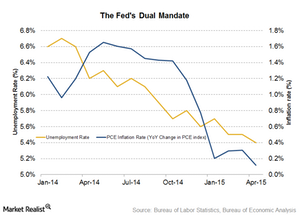

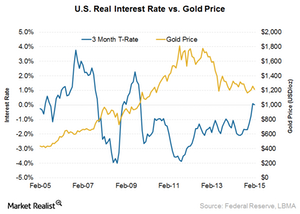

How the Fed Interest Rate Hike Is Expected to Affect Gold Prices

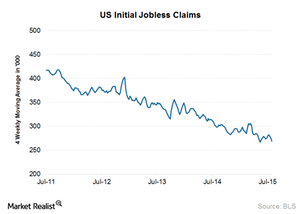

The Fed rate hike has been a major driver for gold prices since mid-2015. Higher interest rates usually diminish gold’s appeal due to its non–interest yielding nature.

What Can You Learn from the Recent Gold Price Swings?

After getting a good start to the year—driven by strong demand from Asia, the Greek crisis, and the Swiss currency cap removal—gold prices started pulling back in April.

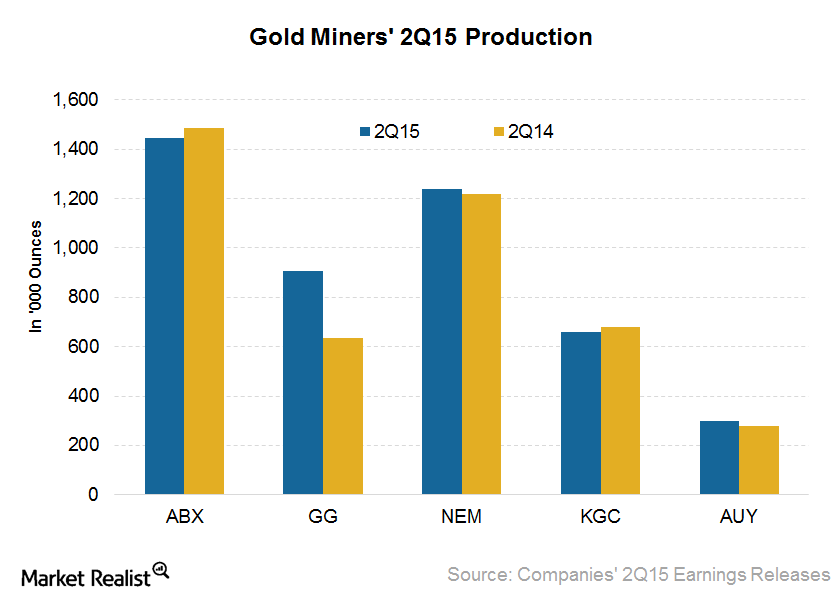

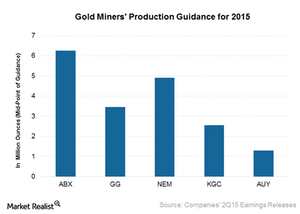

Comp: A Look at Gold Miners’ 2Q15 Production Profile

Gold miners’ (GDX) production profile is very important for investors. According to the WGC, gold mine production rose by 3% YoY to 786.6 tons in 2Q15.

Comp: Which Gold Miners Expect Production Growth Going Forward?

Yamana Gold (AUY) expects higher gold production in the second half of the year compared to the first half of the year. It’s expected to be more than 15% higher.

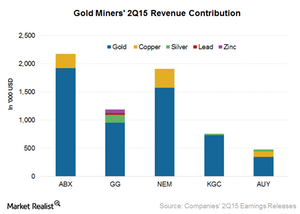

Comp: Do Gold Miners with an Exposure to Copper Face Downside?

Newmont Mining (NEM) has exposure to gold and copper. In 2Q15, it generated 18% of its revenue from copper. The rest of its revenue was from gold sales.

Investors Are Excited about Barrick Gold’s 2Q15 Results, but Why?

In this series, we’ll analyze Barrick Gold’s 2Q15 results. Barrick stock reacted positively to its earnings report, its improved cost guidance, and its progress toward reducing its debt.

US Employment Report: Will It Keep the Hopes of a Rate Hike Going?

Since the current set of data were better than the market expectations, the market’s hopes for a September rate hike are still on.

Rate Hike Expectations: How They Shape the Price of Gold

An interest rate hike by the Fed will lead to pressure on the price of gold. When alternative investments are attractive due to an increase in the interest rate, money flows from gold.

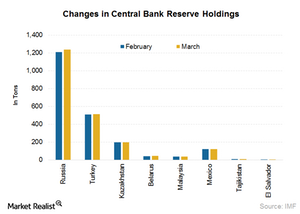

Russia on Gold Buying Spree, El Salvador Surprises with Sell-Off

After a break of two months, Russia resumed its gold buying spree in March, buying close to 30 tons of gold. Since 2005, Russia’s gold reserves have nearly tripled.

What Do Declining US Real Interest Rates Mean for Gold?

Gold is used as an investment alternative because investors perceive it as a way to protect money’s purchasing power.