How Tropical Storm Harvey Impacts US Crude Oil and Gasoline Prices

WTI (West Texas Intermediate) crude oil (SCO)(BNO)(PXI) futures contracts for October delivery rose 0.4% and were trading at $46.8 per barrel in electronic trading at 2:05 AM EST on August 29.

Aug. 29 2017, Published 1:56 p.m. ET

Crude oil futures

WTI (West Texas Intermediate) crude oil (SCO)(BNO)(PXI) futures contracts for October delivery rose 0.4% and were trading at $46.8 per barrel in electronic trading at 2:05 AM EST on August 29.

Volatility in crude oil (ERY)(ERX) prices impacts oil and gas producers like QEP Resources (QEP), ConocoPhillips (COP), PDC Energy (PDCE), and Sanchez Energy (SN).

Tropical Storm Harvey

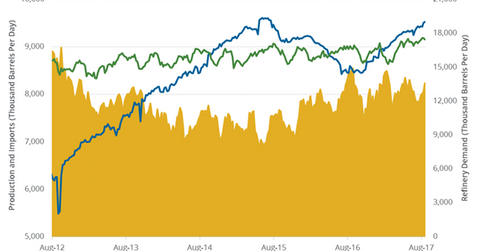

Tropical Storm Harvey hit the Texas on August 26. It’s the strongest storm in the US since 2004. It led to massive rain and flooding. Tropical Storm Harvey could lead to a drop in US refining capacity by 30%. It could also lead to a drop in crude oil production in the US Gulf of Mexico by 19% or 331,400 bpd (barrels per day). The recovery of US crude oil production and refining activity can take several weeks. Ports in Texas have shut down, which could also impact crude oil and product import and export activity.

Citigroup estimates gasoline production may drop more than 2 MMbpd due to the storm. Consequently, gasoline futures rose 2.7% to $1.71 per gallon on August 28—the highest level in four months. However, crude oil prices fell on August 28. For more analysis, read the previous part of this series.

Shell (RDS.A) shut its Deer Park crude oil refinery unit in Texas. The unit produces 325,700 bpd of refined products. ExxonMobil (XOM) also shut its Baytown crude oil refinery unit in Texas. Phillips 66 (PSX) and Valero (VLO) also shut their refineries in Texas.