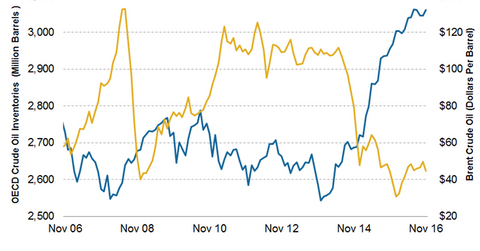

Will OECD Crude Oil Inventories Impact Crude Oil Prices in 2017?

The EIA estimates that OECD crude oil inventories rose by 15.9 MMbbls to 3,061 MMbbls in November 2016—compared to the previous month.

Dec. 28 2016, Updated 7:35 a.m. ET

OECD crude oil inventories

The EIA (U.S. Energy Information Administration) estimates that OECD (Organization for Economic Cooperation and Development) crude oil inventories rose by 15.9 MMbbls (million barrels) to 3,061 MMbbls in November 2016—compared to the previous month. It was at 2,954 MMbbls in November 2015. High OECD crude oil inventories are bearish for crude oil (PXI) (ERX) (IEZ) (DIG) (UCO) (USL) (IXC) (ERY) prices. For more on crude oil prices, read Part 1 of this series.

OPEC’s estimate

OPEC’s (Organization of the Petroleum Exporting Countries) Monthly Oil Market Report stated that OECD countries’ crude oil inventories fell by 25 MMbbls in October to 3,027 MMbbls. It’s 302 MMbbls above the five-year average.

IEA’s estimate

In its monthly Oil Market Report, the IEA (International Energy Agency) stated that OECD crude oil inventories fell by 17.1 MMbbls to 3,068 MMbbls in September 2016.

EIA’s OECD crude oil inventories estimate for 2017

OECD crude oil inventories averaged 2,860 MMbbls in 2015. It averaged 3,035 MMbbls in 2016. The EIA expects OECD crude oil inventories to be higher by an average of 52 MMbbls in 2017—compared to 2016.

Impact of OECD crude oil inventories

The rise in OECD crude oil inventories will pressure crude oil prices. Lower crude oil prices have a negative impact on crude oil and natural gas producers’ revenues such as QEP Resources (QEP), Synergy Resources (SYRG), SM Energy (SM), Marathon Oil (MRO), Chevron (CVX), and W&T Offshore (WTI).

Moves in crude oil prices also impact ETFs such as the iShares US Energy (IYE), the Guggenheim S&P 500 Equal Weight Energy ETF (RYE), the SPDR S&P Oil & Gas Equipment & Services ETF (XES), and the Vanguard Energy ETF (VDE).

In the next part of the series, we’ll take a look at the US dollar and other important crude oil price drivers in 2017.