US Crude Oil Inventories Supported Crude Oil Prices

The EIA (U.S. Energy Information Administration) reported that US crude oil inventories fell by 884,000 barrels to 488.1 MMbbls from November 18–25, 2016.

Dec. 1 2016, Published 8:17 a.m. ET

EIA’s crude oil inventories

The EIA (U.S. Energy Information Administration) reported that US crude oil inventories fell by 884,000 barrels to 488.1 MMbbls (million barrels) from November 18–25, 2016. US crude oil inventories fell 0.2% week-over-week, but rose 6.7% year-over-year. US crude oil inventories fell for the eighth time in the last 13 weeks.

A Reuters survey estimated that US crude oil inventories would have risen by 636,000 barrels from November 18–25, 2016. As a result, crude oil prices rose on November 30, 2016, due to the unexpected fall in US crude oil inventories and OPEC’s (Organization of the Petroleum Exporting Countries) production cut deal. For more on crude oil prices and OPEC’s meeting, read Part 1 in this series. In Part 5, we’ll see why US crude oil inventories fell.

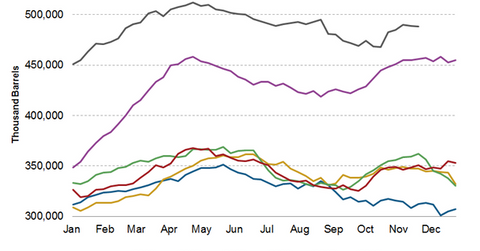

US crude oil inventories by region

The EIA divides the US into five storage regions. Let’s assess the changes in crude oil inventories for these regions from November 18–25, 2016.

- East Coast – a fall of 3.4 MMbbls to 14 MMbbls

- Midwest – a rise of 3.1 MMbbls to 146 MMbbls

- Gulf Coast – a fall of 0.2 MMbbls to 253.4 MMbbls

- Rocky Mountain – a fall of 0.3 MMbbls to 24.2 MMbbls

- West Coast – a fall of 0.1 MMbbls to 50.6 MMbbls

Impact of US crude oil inventories

US crude oil inventories hit an all-time high of 543.6 MMbbls in the week ending April 29, 2016. Since then, they fell 10.2% from the all-time highs.

A fall in inventories could support crude oil (UWTI) (BNO) (PXI) (USL) prices. High crude oil prices could have a positive impact on oil and gas producers’ earnings like Noble Energy (NBL), Chevron (CVX), Comstock Resources (CRK), Northern Oil & Gas (NOG), Contango Oil & Gas (MCF), and Stone Energy (SGY).

The rollercoaster ride in crude oil prices impacts ETFs such as the Energy Select Sector SPDR (XLE), the Direxion Daily Energy Bear 3x ETF (ERY), the Direxion Daily Energy Bull 3x Shares ETF (ERX), the Vanguard Energy ETF (VDE), the Guggenheim S&P 500 Equal Weight Energy ETF (RYE), the ProShares Ultra Bloomberg Crude Oil ETF (UCO), the ProShares Ultra Oil & Gas (DIG), and the SPDR S&P Oil & Gas Equipment & Services ETF (XES).

In the next part of this series, we’ll take a look at US crude oil production.