VF Corp

Latest VF Corp News and Updates

Where NIKE And Under Armour Win In The Market Share Stakes

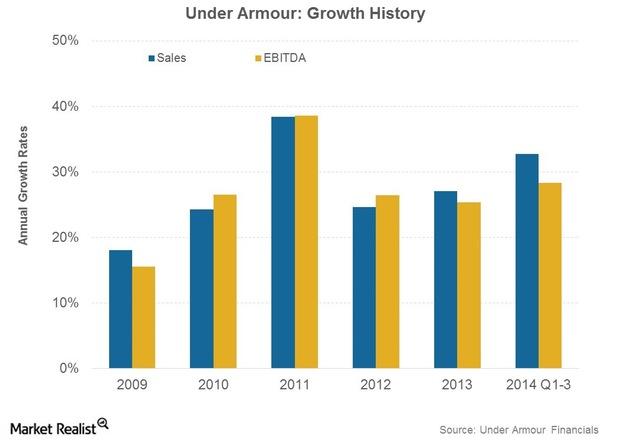

Under Armour’s share of the apparel market rose from 14% to 16%, year-over-year, in the first nine months of 2014.

Supreme Clothing — How to Invest in the Private Company

Luxury streetwear has never been so lucrative. Here are the details on Supreme Clothing, including whether or not the company is public.

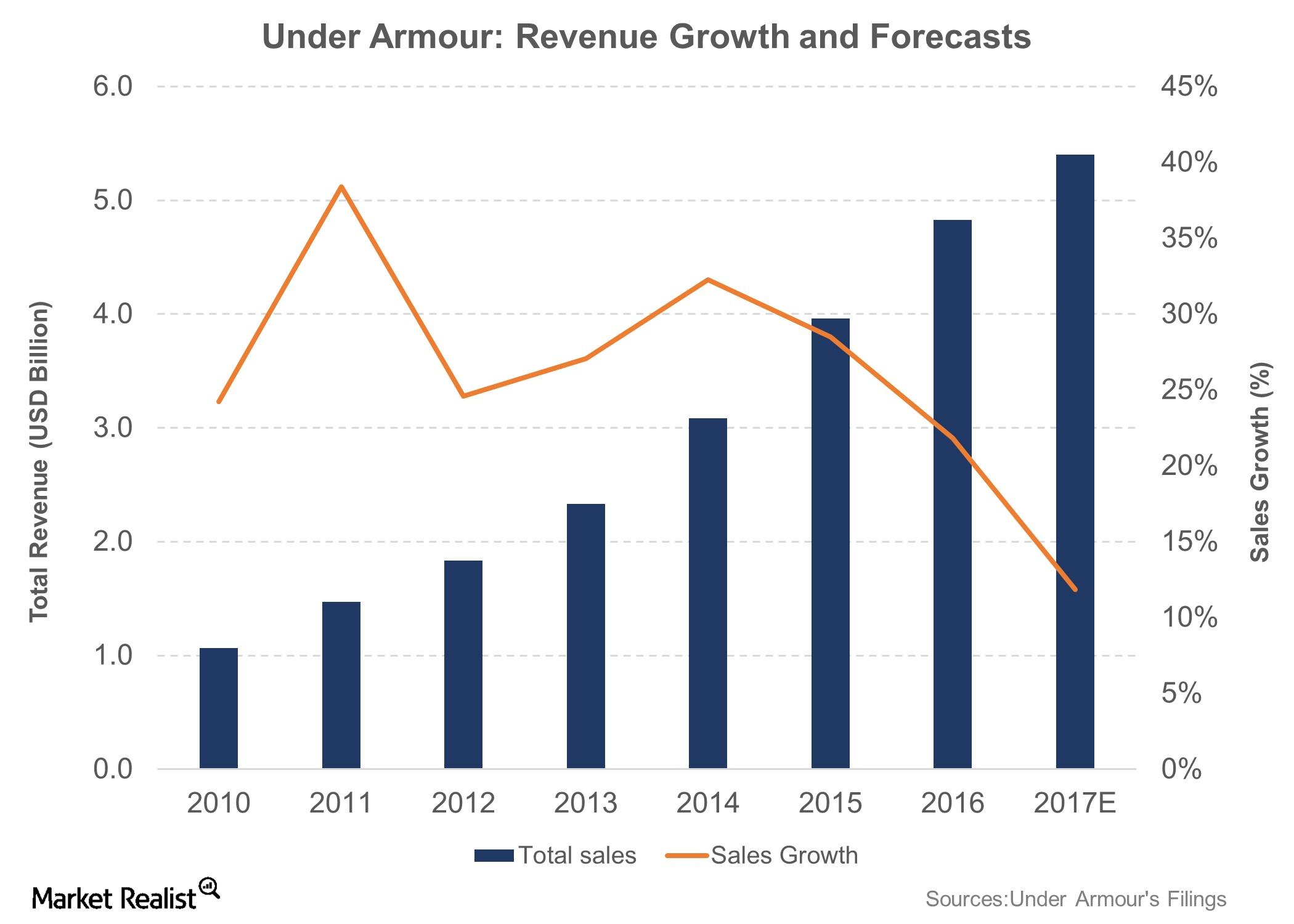

How Markets Are Pricing Under Armour Stock

Markets expect the strong growth trend to continue, and value Under Armour stock higher than the overall market and comparable firms.

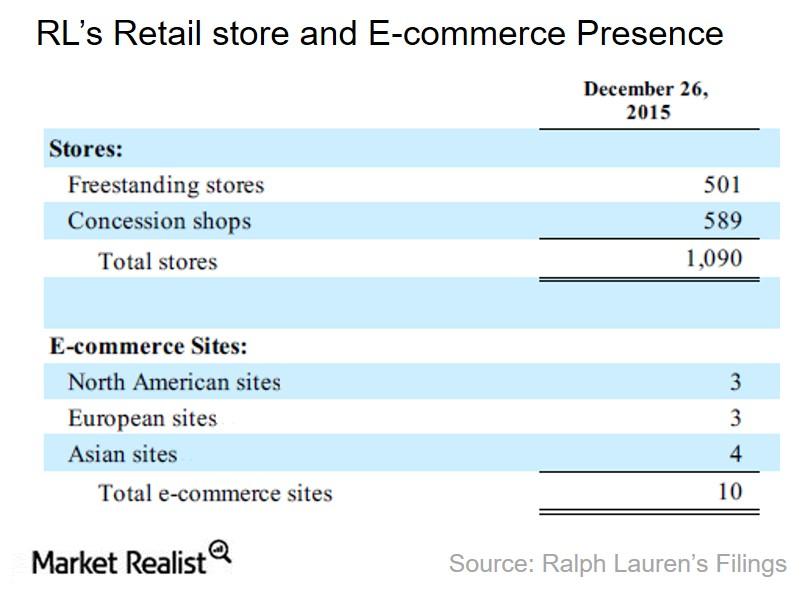

Inside Ralph Lauren’s Key Strengths, Potential Upsides, and Key Risks

Ralph Lauren’s merchandise is available through ~13,000 wholesale distribution channels, 501 retail stores, 589 shops-within-shops, and ten websites.

Will VF Corporation’s Vans Brand Spur Higher Growth in 3Q15?

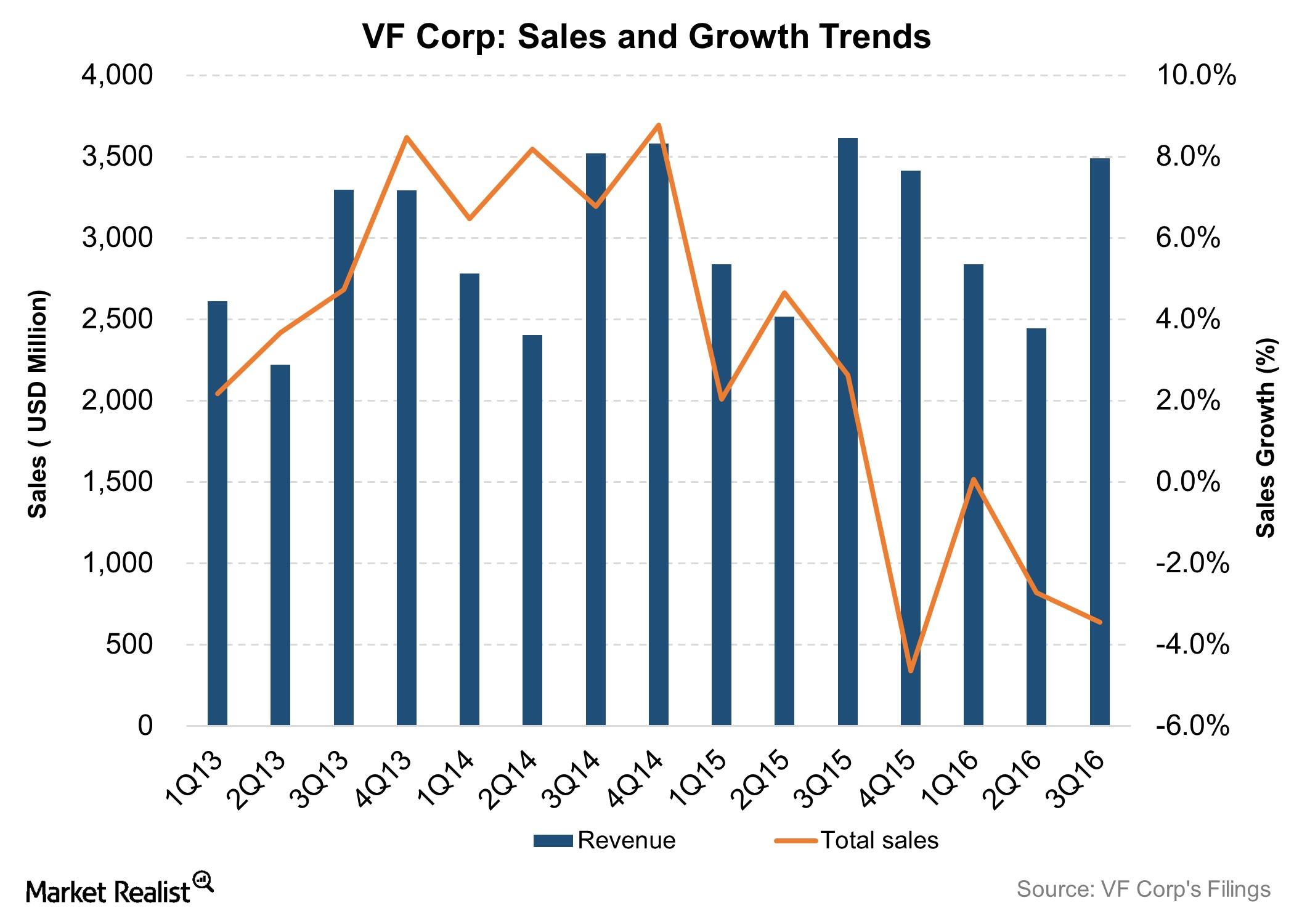

VF Corporation saw sales of $2.5 billion in 2Q15, up 4.7% year-over-year. Its performance was boosted by top brands The North Face, Timberland, and Vans.

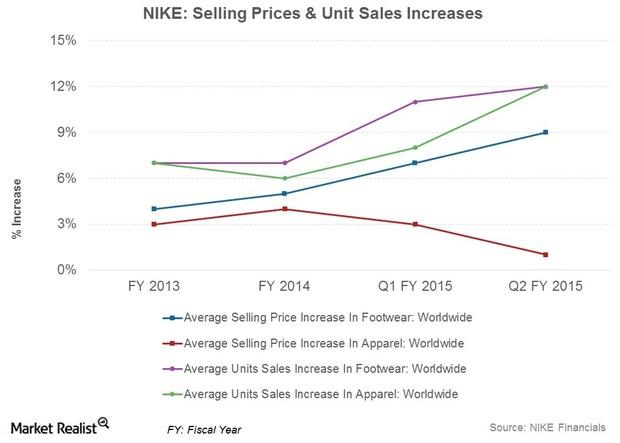

Why Nike Is Able To Sell More Products At Higher Prices

Revenue gains for Nike (NKE) in 1H15 were broad-based. Sales rose for almost all key product categories, with the notable exception of the golf category.

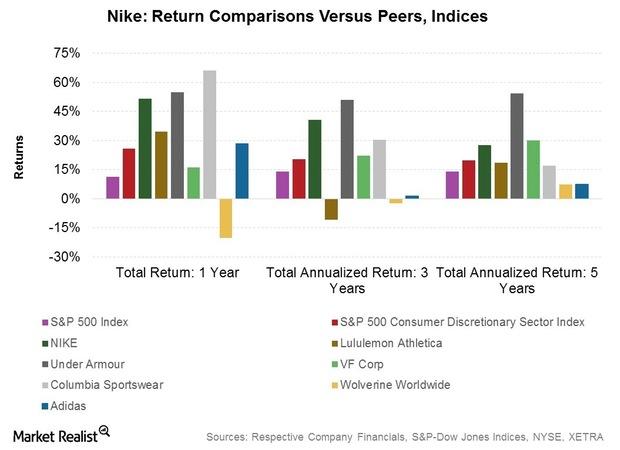

Overview of Nike Earnings, Leverage, and Valuation

Nike (NKE) has a positive earnings surprise history. In simple terms, the company has beat Wall Street’s earnings estimates in the past several quarters.

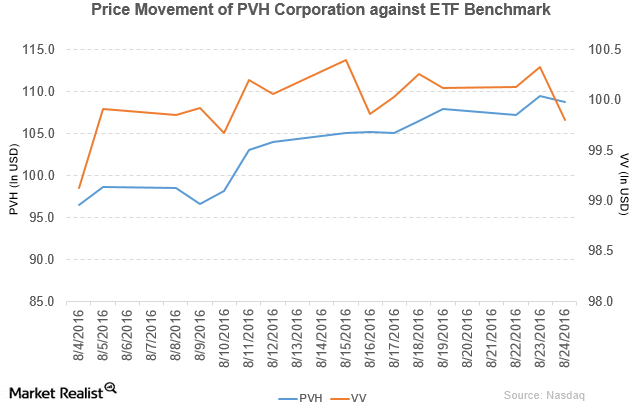

How Did PVH Corporation Perform in 2Q16?

PVH Corporation (PVH) has a market cap of $8.9 billion. It fell by 0.67% to close at $108.82 per share on August 24, 2016.

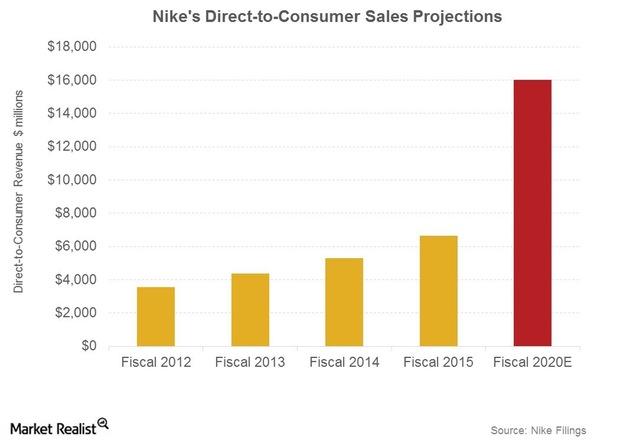

Analysis: Nike’s 5-Year Roadmap to Grow Sales

Nike holds the top position in athletic footwear and athletic apparel. It’s apparel and footwear sales were $8.6 billion and $18.3 billion, respectively, in fiscal 2015.

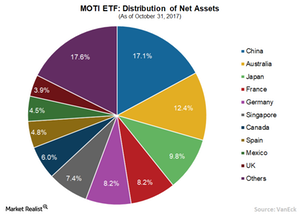

Expanding Investors’ Reach to Global Markets

Building on the success and popularity of VanEck Vectors® Morningstar Wide Moat ETF (MOAT®) and its underlying index’s approach to investing in the U.S., VanEck launched MOTI in 2015 to expand investor access to Morningstar’s core equity research in the international arena.

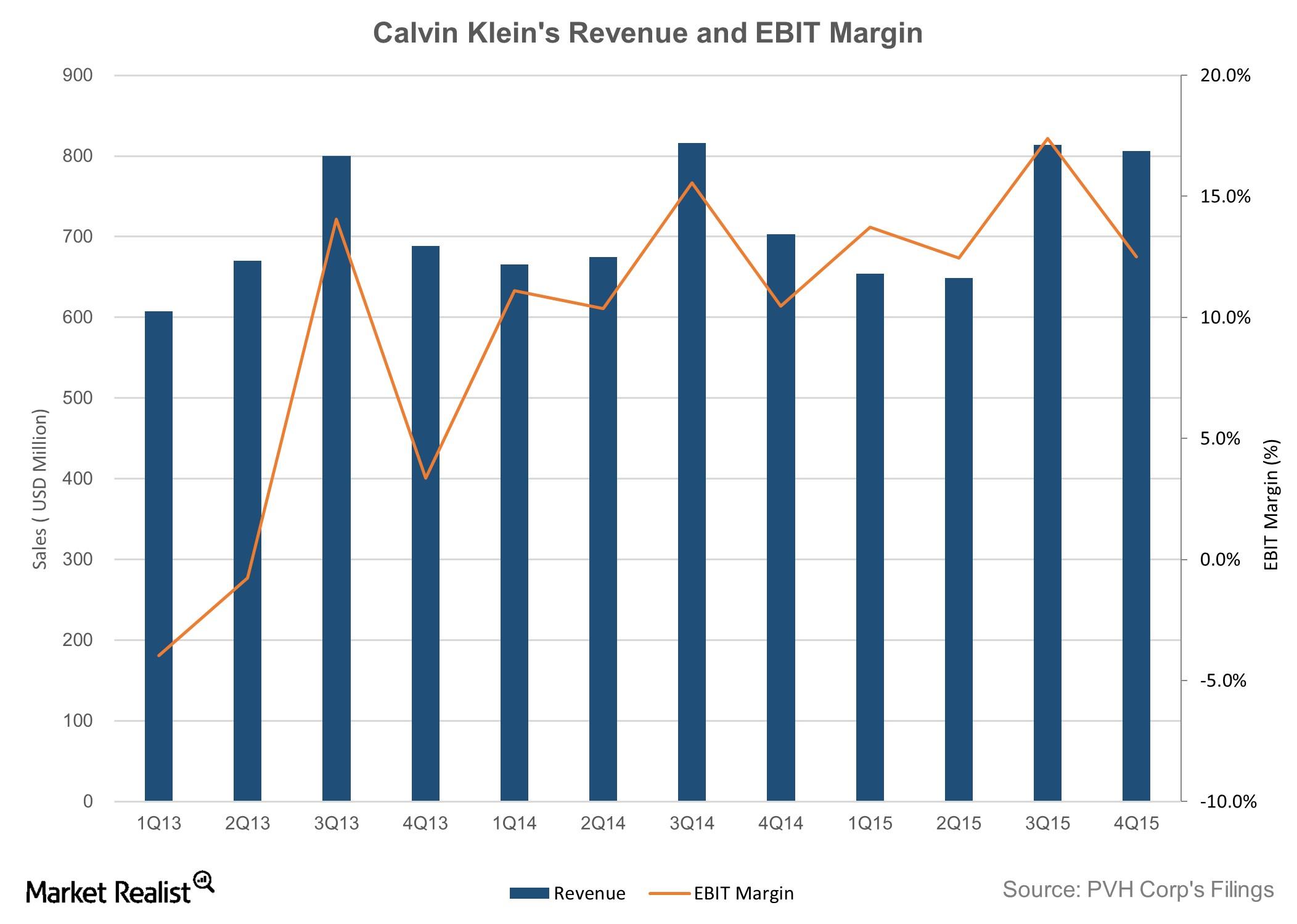

How Calvin Klein Navigated through Tough Macro Conditions

The company derived 46% of its operating income from the Calvin Klein business in fiscal 2015 compared to 37% in fiscal 2014.

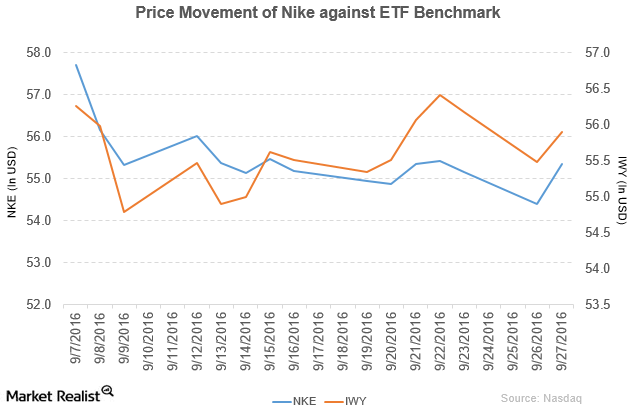

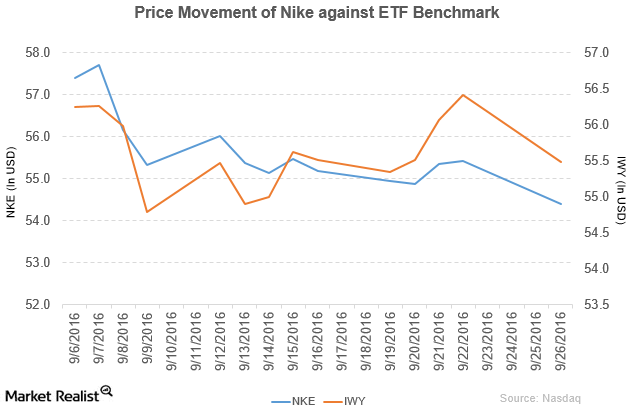

How Did Nike Perform in 1Q17?

Nike (NKE) has a market cap of $92.9 billion. It rose 1.7% to close at $55.34 per share on September 27, 2016.

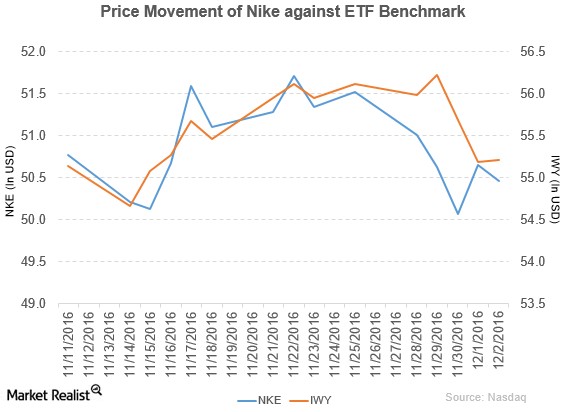

Nike Announces the Launch of New Products

Nike (NKE) fell 1.7% to close at $50.46 per share during the fifth week of November 2016.

Under Armour’s Bonds Downgraded to Junk Status by S&P Global Ratings

S&P Global Ratings lowered the credit rating of Under Armour (UAA) stock to junk status after the company reported weak 4Q16 results and a gloomy sales outlook. The rating on UAA’s bonds dropped from BBB- to BB+.

Why Did Nike Stock Fall on September 26?

Nike (NKE) has a market cap of $91.3 billion. It fell 1.4% to close at $54.40 per share on September 26.

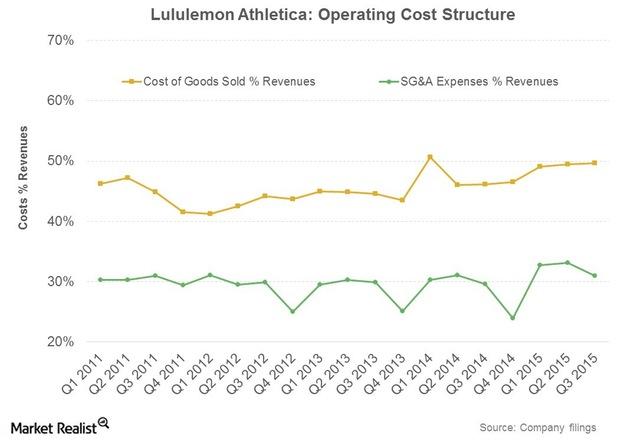

Why Lululemon’s Profit Margins Are Trumping The Company’s Peers’

LULU’s gross profit margin slipped from 55.7% in fiscal 2013 to 52.8% in fiscal 2014. The company’s operating profit margin slipped from 27.5% to 24.6%.

Why Is Nike Focusing on the Direct-To-Consumer Channel?

Nike’s (NKE) DTC (direct-to-consumer) (XLY) (FXD) channel includes sales made online on Nike.com and through its own retail stores.

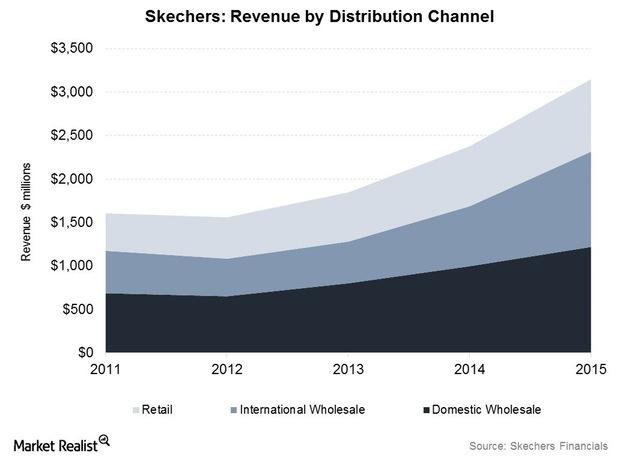

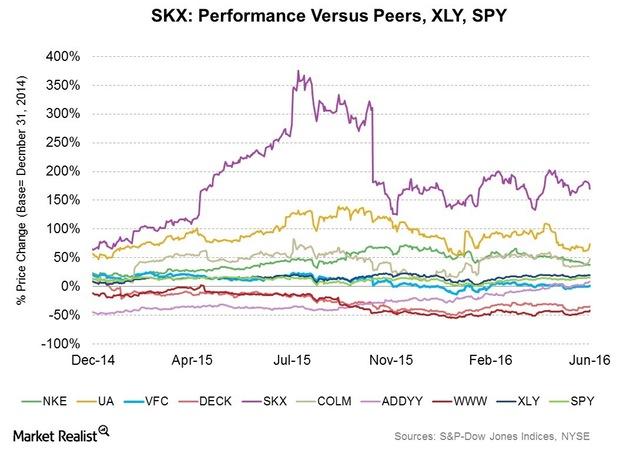

How Skechers Sells Its Products to Its Customers

In 2015, Skechers became the second-largest footwear company in the United States, trailing global market leader Nike (NKE).

Comparing Skechers’ Strengths and Weaknesses

Skechers is quickly establishing its presence in international markets. It made $3.1 billion in sales in 2015, of which 40.4% stemmed from overseas markets.

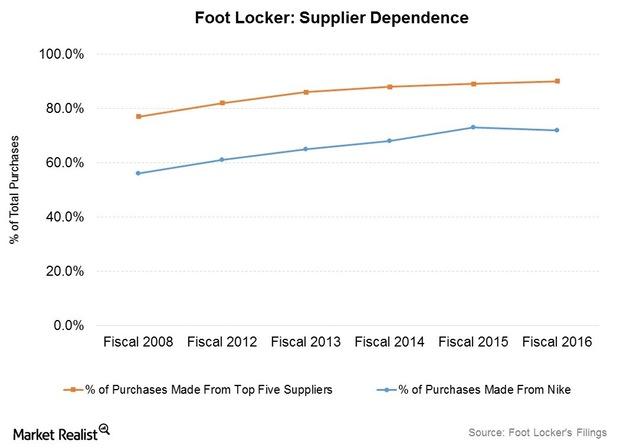

Analyzing the Cogs in Foot Locker’s Supply Chain

Foot Locker’s distribution and supply chain includes five distribution centers around the world. It owns two of them and leases three.

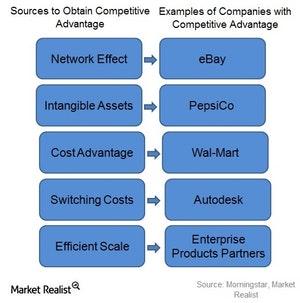

What Are the Sources to Obtain Economic Moats?

“How Moats Translate into Sustainable Competitive Advantages” is a five-part moat investing education series that explores the primary sources of economic moats. The idea of an economic moat refers to how likely a company is to keep competitors at bay for an extended period. According to Morningstar Equity Research, there are five key attributes that […]

Nike Manufacturing and Supply Chain Strategies

Nike’s manufacturing network has over 525 factories. Products move from several distribution centers across a network of thousands of retail accounts.

Nike’s Pricing Power and Brand Drive Its Economic Moat

Giving it a competitive advantage, Nike’s pricing power is supported through premium innovation and a shift toward the direct-to-consumer business.

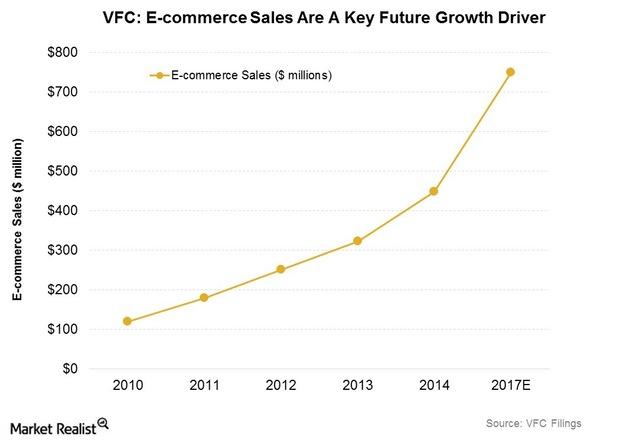

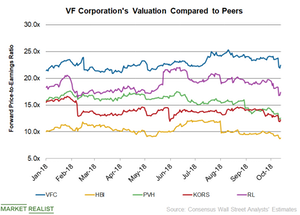

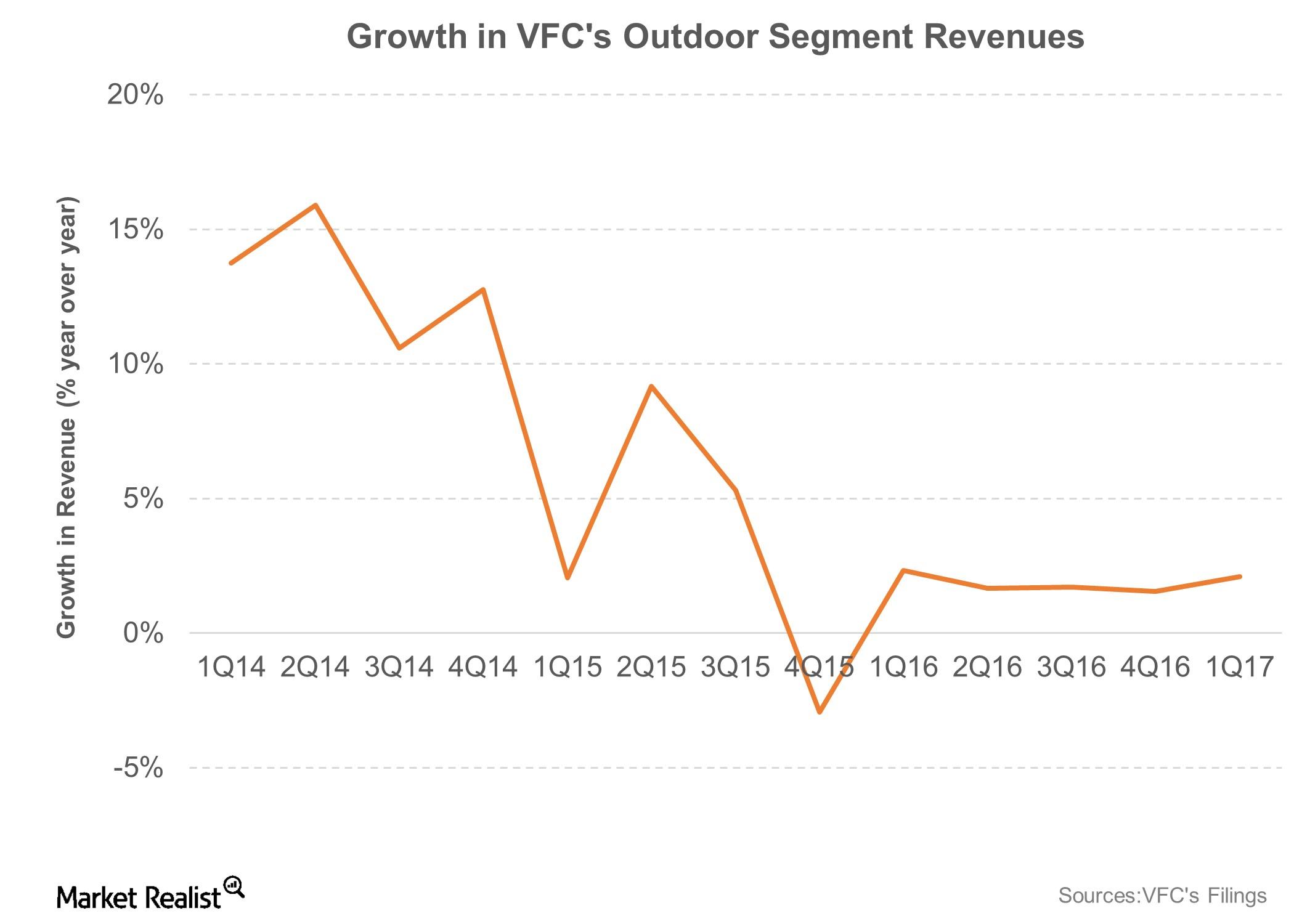

How VFC’s Valuation Compares with Peers

On October 12, VF Corporation’s (VFC) 12-month forward PE (price-to-earnings) ratio was 22.4x.

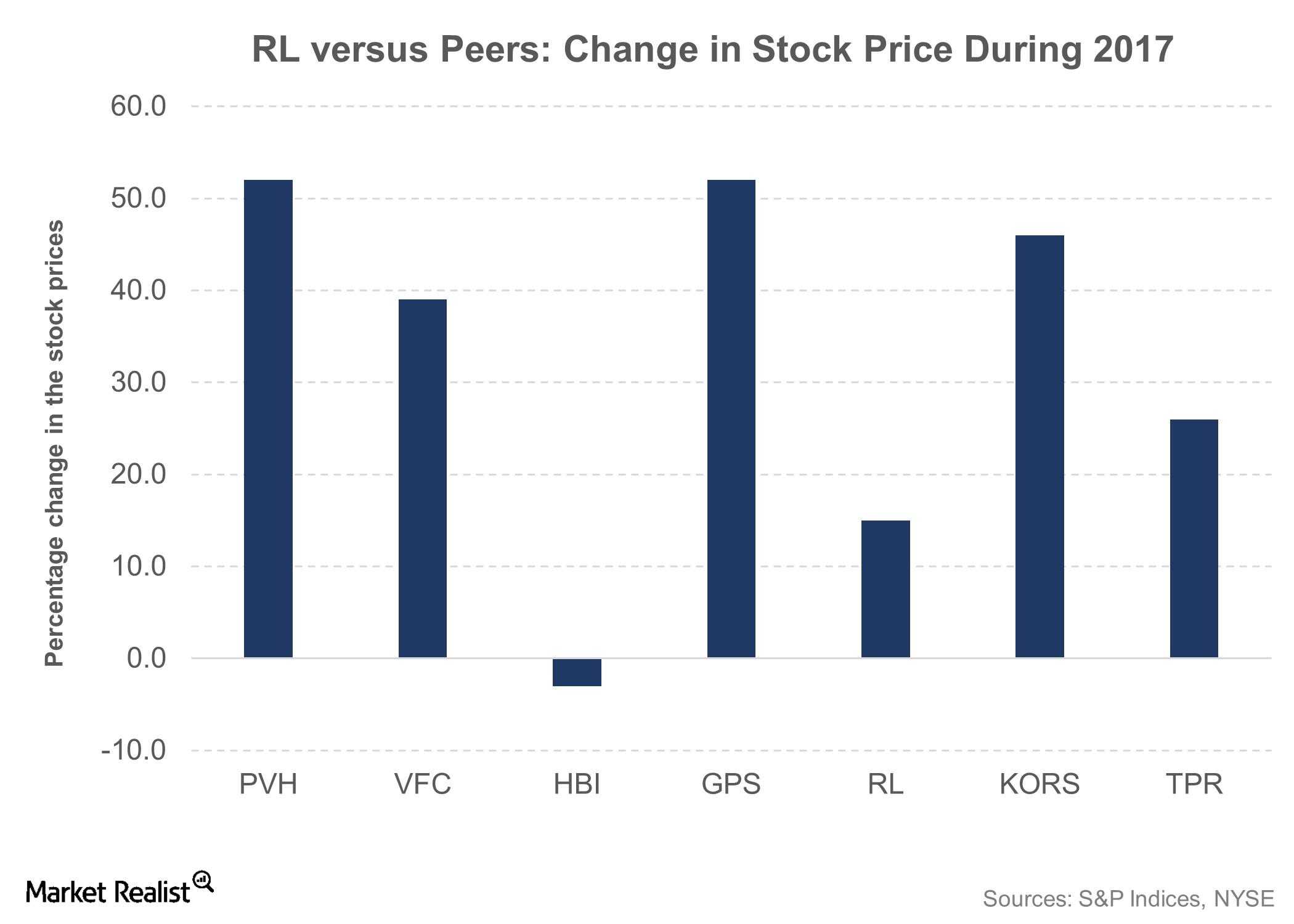

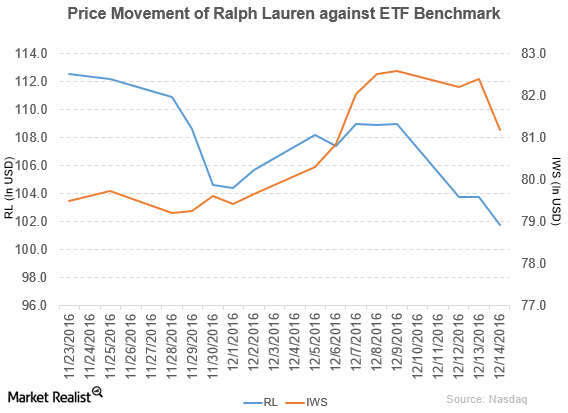

Ralph Lauren: Stock Returns and Valuations

Though Ralph Lauren (RL) has been having a tough time attracting customers, it has been able to impress investors with its stock market gains.

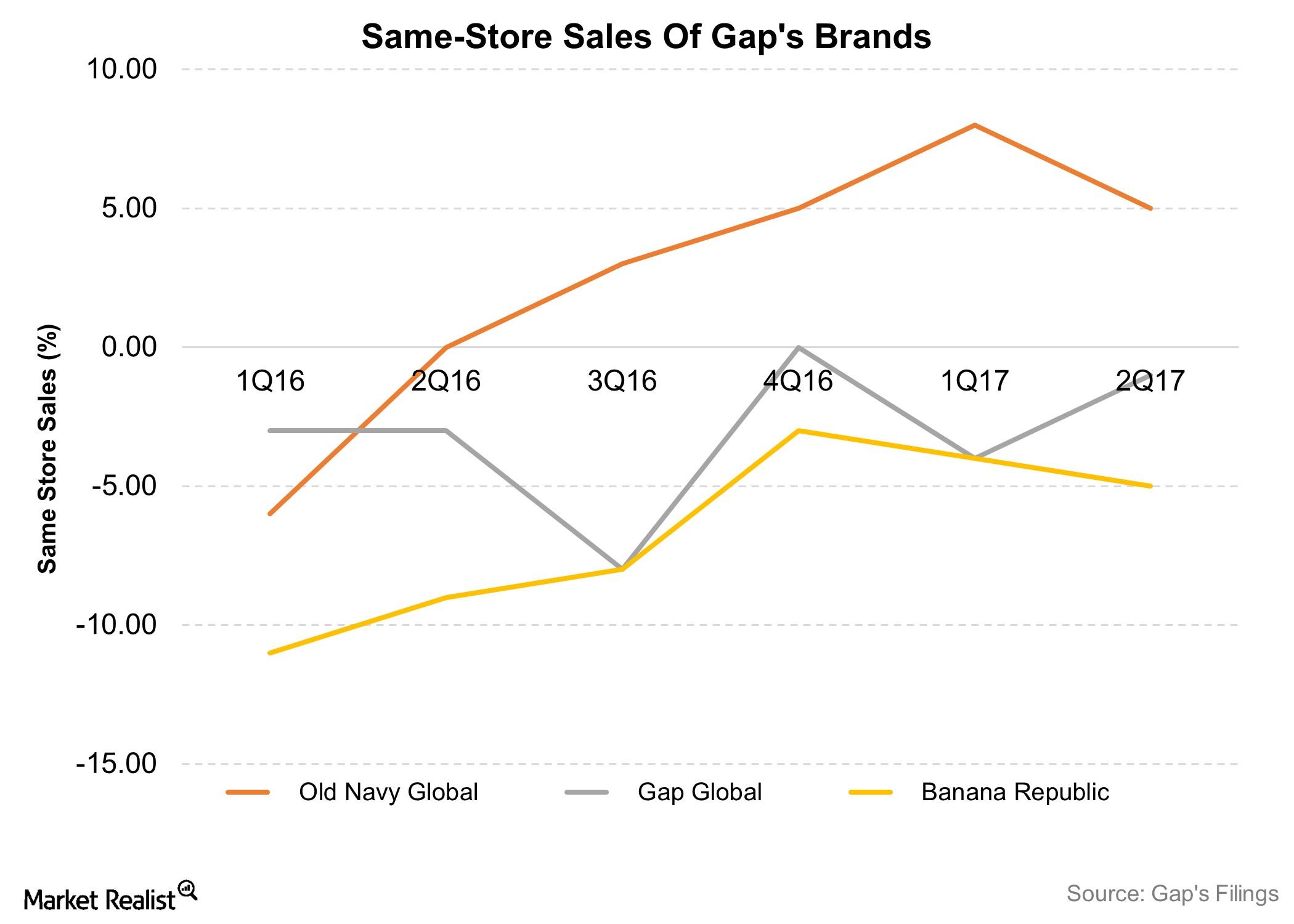

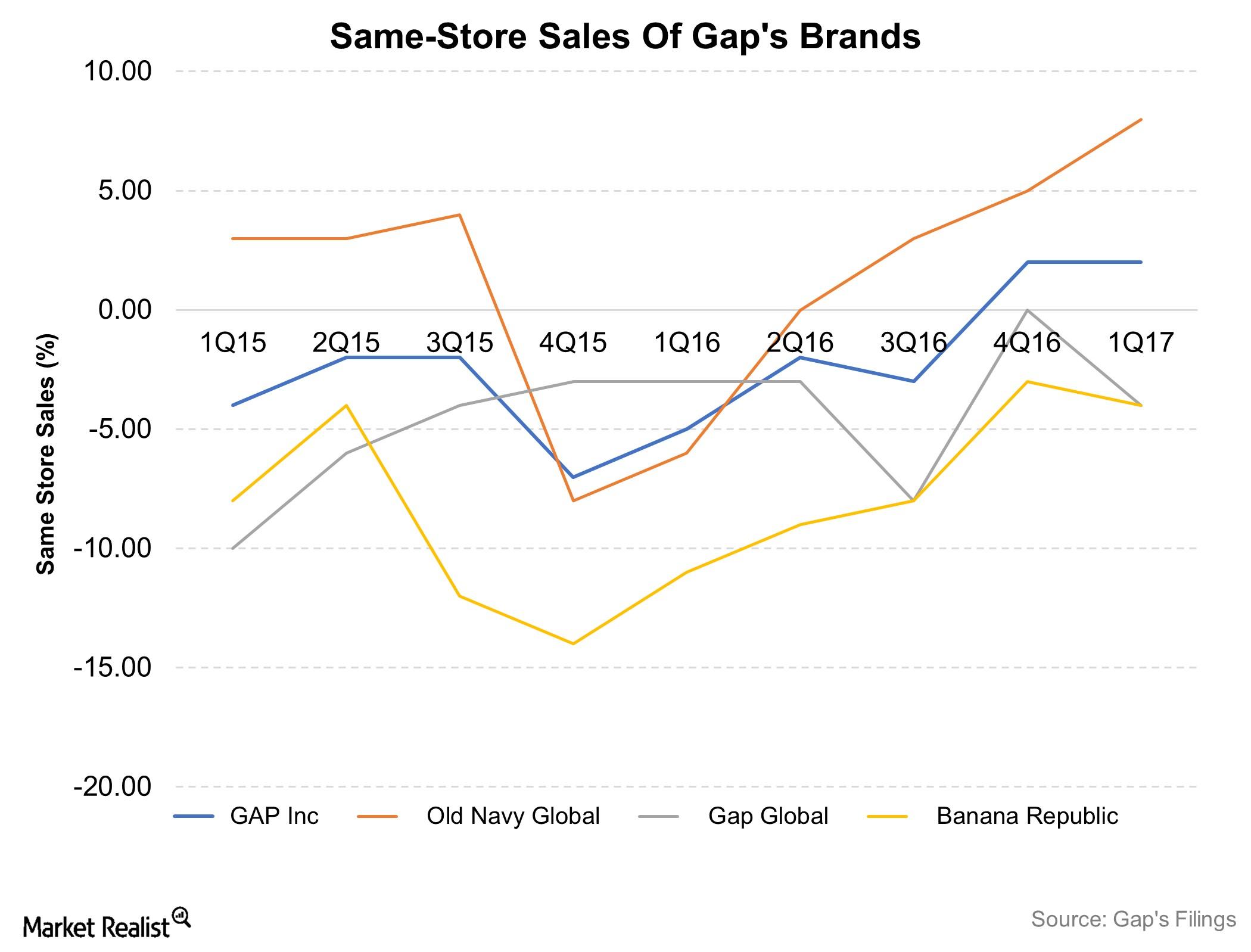

Analyzing Gap’s 2Q17 Top-Line Performance

Gap (GPS) reported total revenues of $3.8 billion in 2Q17 and beat the consensus by $30 million. On a YoY basis, the company’s top line fell 1.4%.

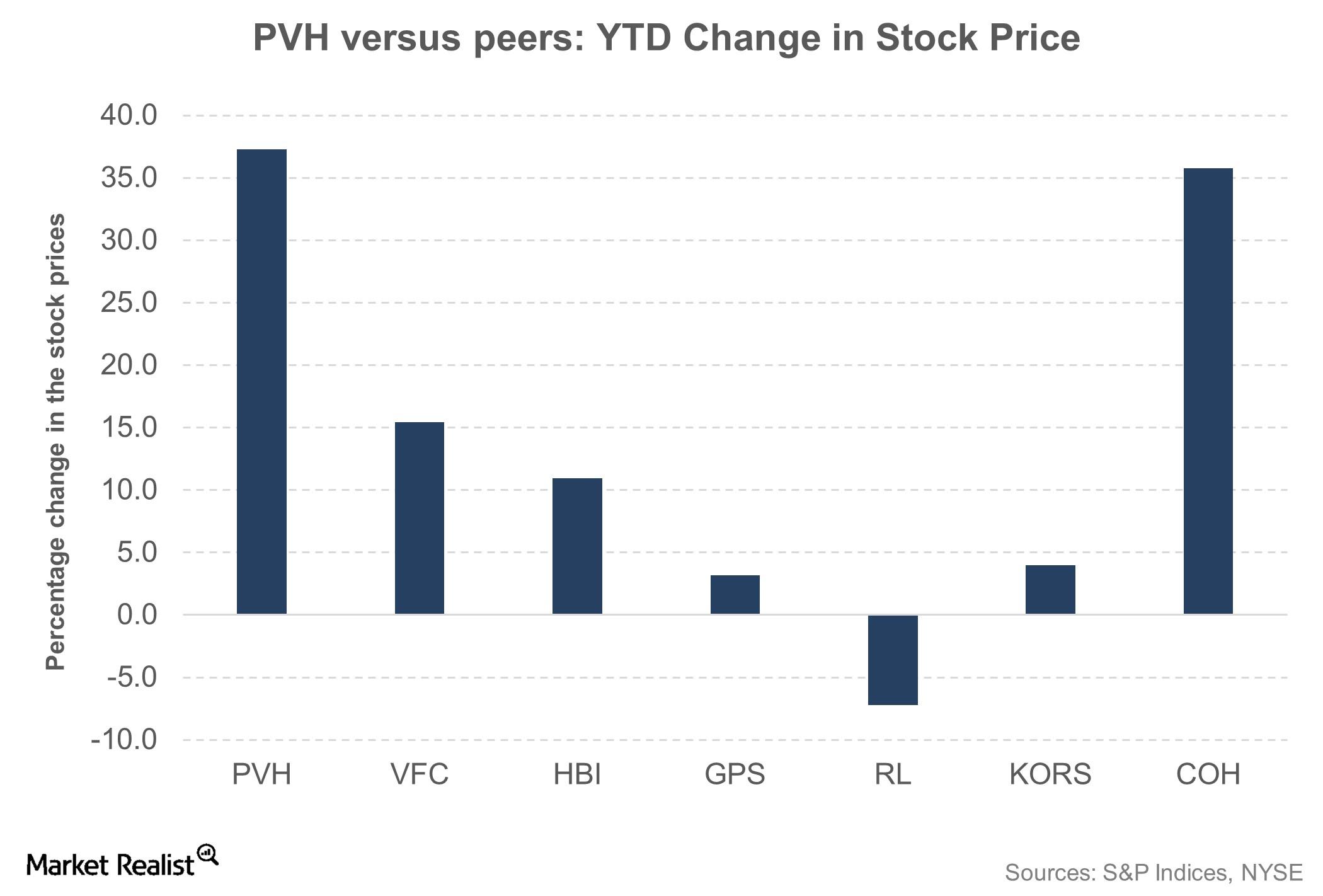

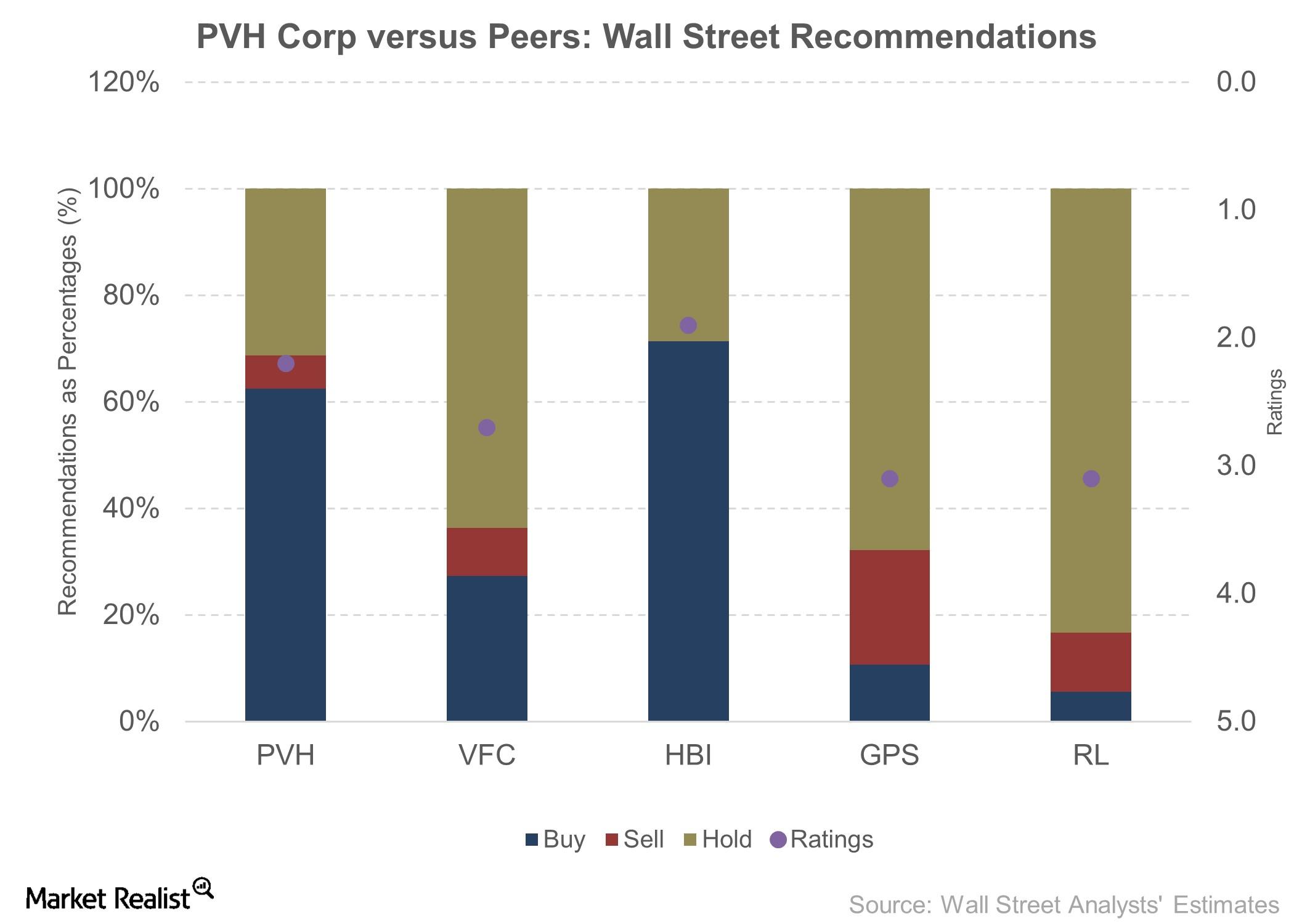

What Wall Street Thinks of PVH Corp Now

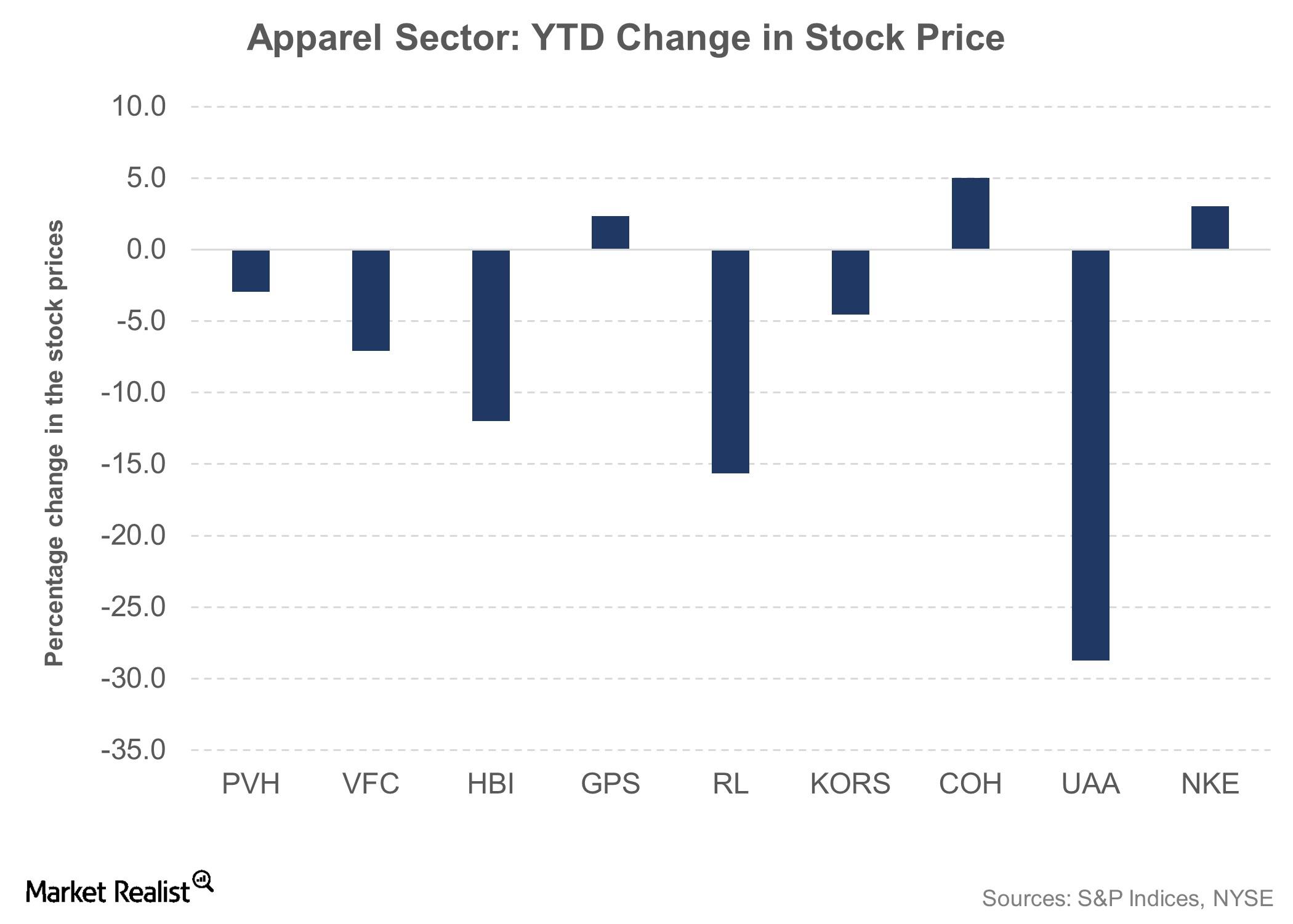

PVH’s YTD gains have outperformed Hanesbrands’ (HBI) 11%, VF Corporation’s (VFC) 15.5%, Michael Kors’s (KORS) 4%, and Ralph Lauren’s (RL) -7.2% gains.

2Q17 Performances for VF’s North Face, Vans, and Timberland

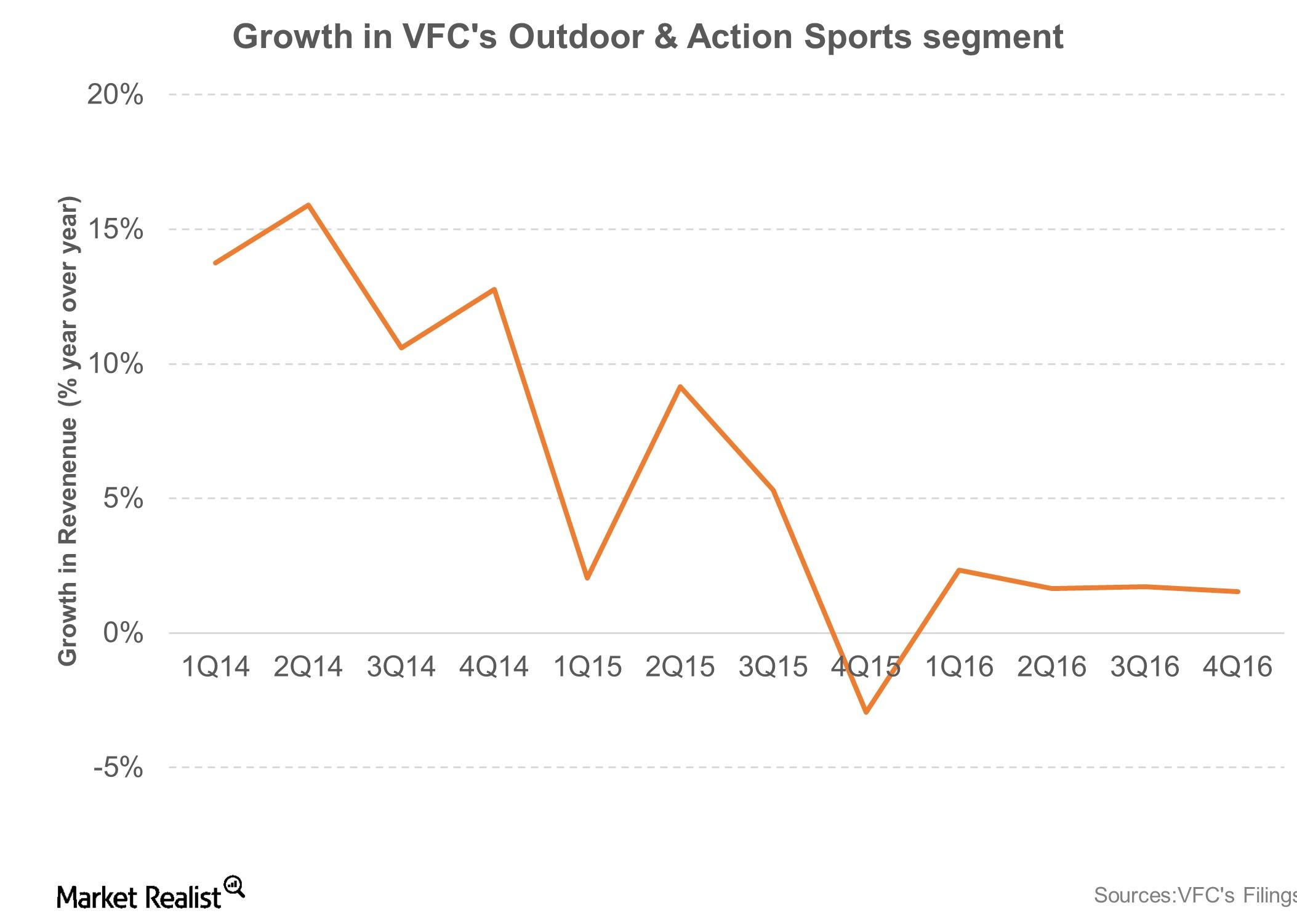

VF’s Outdoor & Action Sports segment, which focuses on Vans, North Face, and Timberland, recorded a 4.0% YoY rise in sales to $1.5 billion.

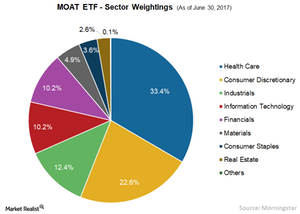

How to Take Exposure to Moat Stocks

The VanEck Vectors Morningstar Wide Moat ETF (MOAT) tracks the price and yield performance of the Morningstar Wide Moat Focus Index.

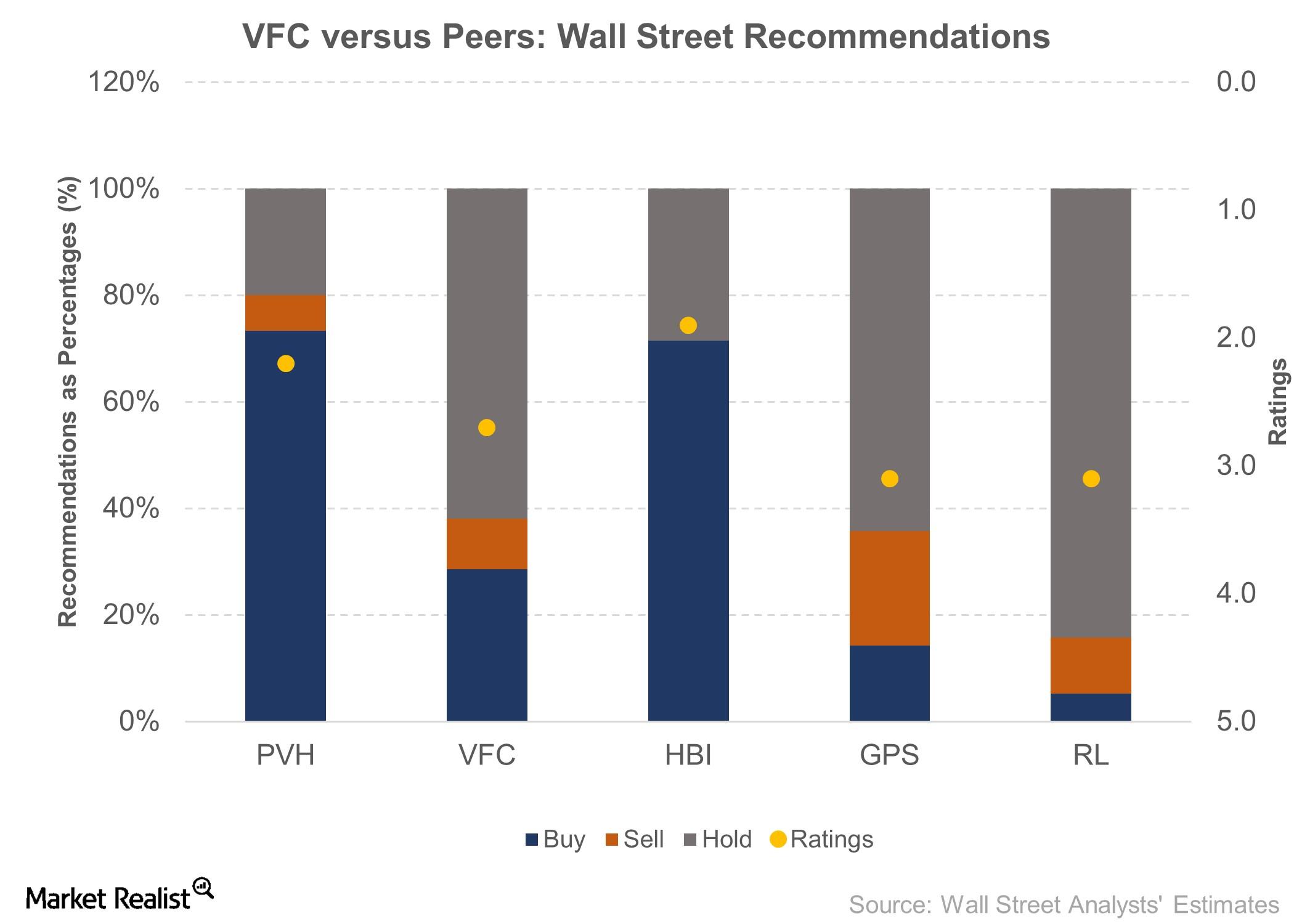

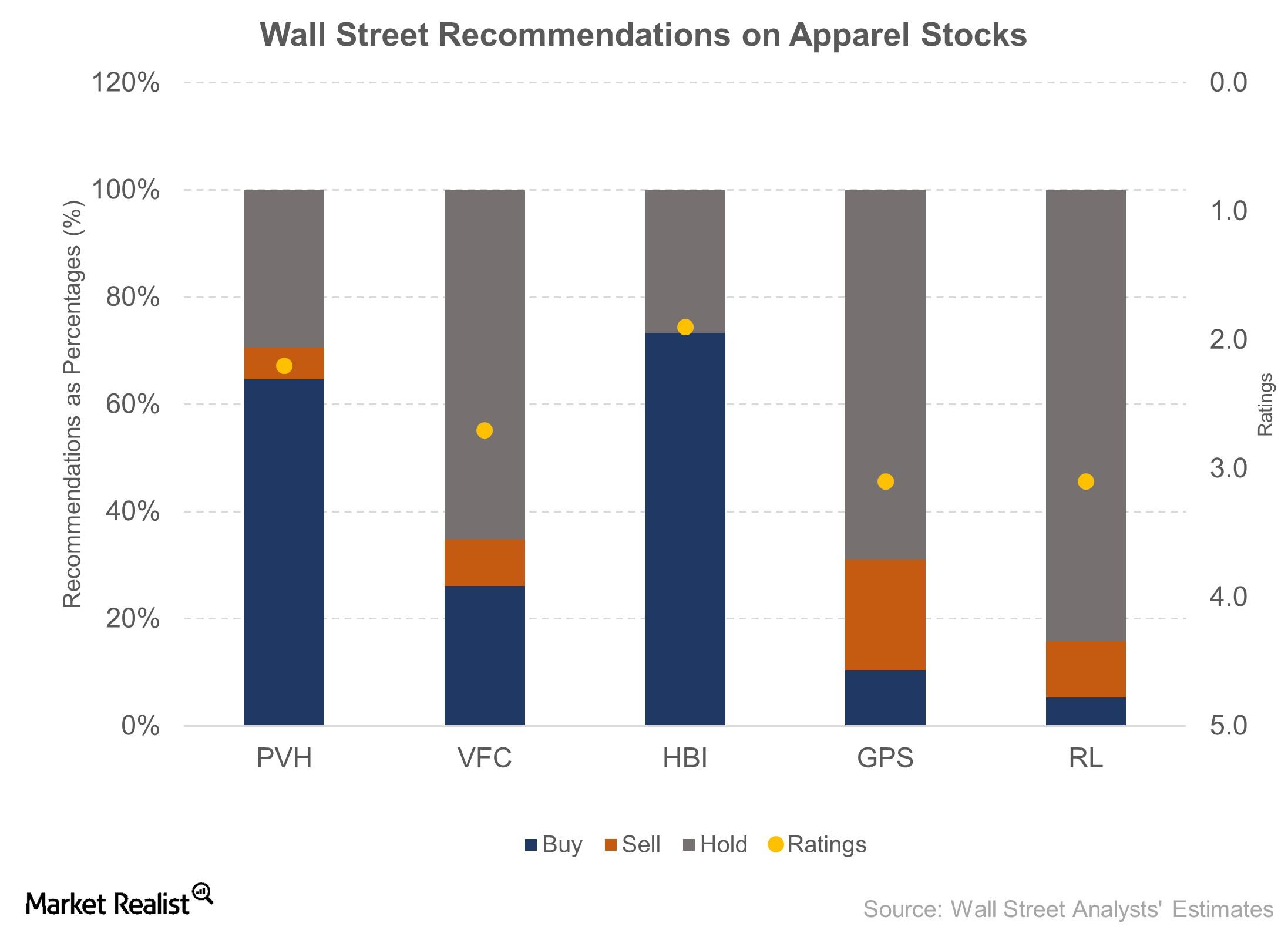

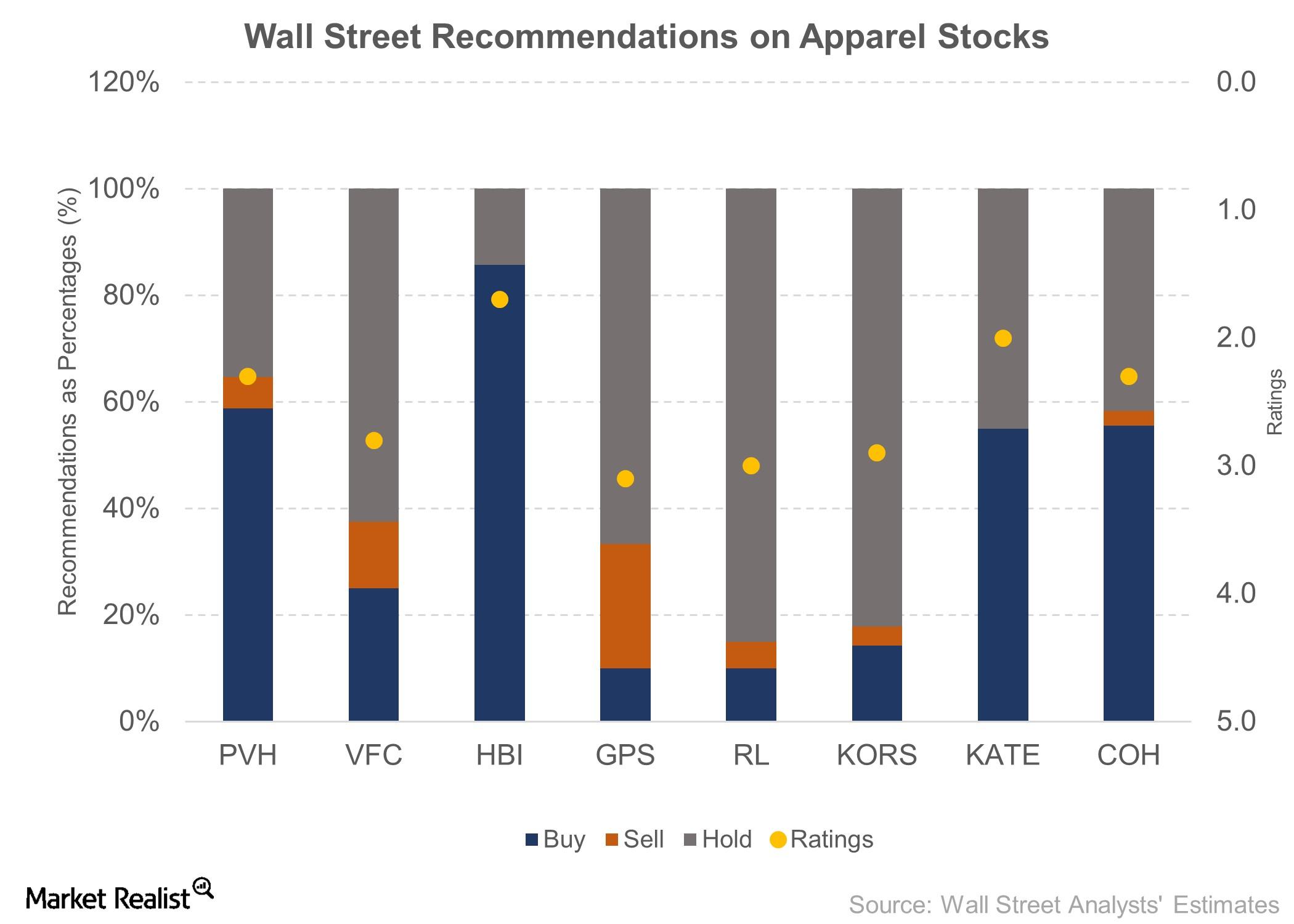

What Wall Street Recommends for VFC ahead of 2Q17 Results

VFC is covered by 21 Wall Street analysts. It has received a 2.7 rating on a scale where one is a “strong buy” and five is a “strong sell.”

PVH Stock Rises 5% following Its 1Q17 Results

PVH Corporation (PVH) reported a strong 1Q17 on May 24, 2017, beating analysts’ consensus estimate on both its top and bottom lines.

Gap’s 1Q17 Top-Line Growth Driven Entirely by Old Navy

Gap (GPS) reported total revenues of $3.4 billion in fiscal 1Q17, beating the consensus by $50.0 million. YoY, its top line remained almost flat.

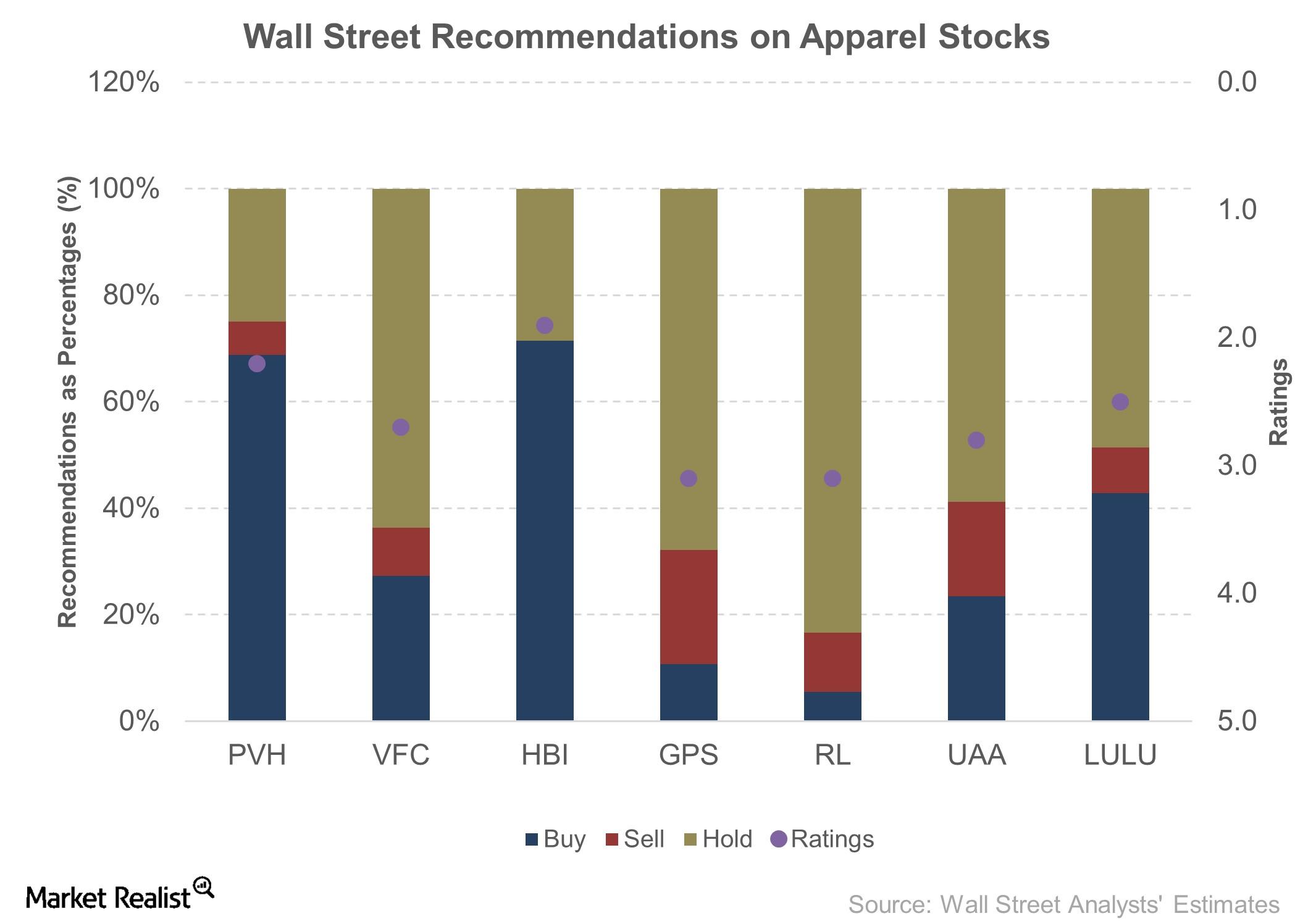

Wall Street Analysts’ View on PVH Corp Is Positive

PVH Corp stock is covered by 16 analysts—63% of the analysts recommended a “buy,” 31% recommended a “hold,” and 6% recommended a “sell.”

The North Face and Vans Drive VF Corporation’s 1Q17 Top Line

VFC’s Outdoor & Action Sports segment, which mainly focuses on Vans, The North Face, and Timberland, recorded a 2.1% YoY rise in sales to $1.7 billion.

Why VF Corporation Stock Has a Downside of 4%

VFC stock is currently trading at $56.44, which is ~17.0% below its 52-week high price.

Wall Street Sees a 1% Upside on VFC Stock

VFC is covered by 23 Wall Street analysts who have a neutral view on the company. Plus, 26% of these analysts recommended a “buy,” 61% recommended a “hold,” and 13% recommended a “sell” on the stock.

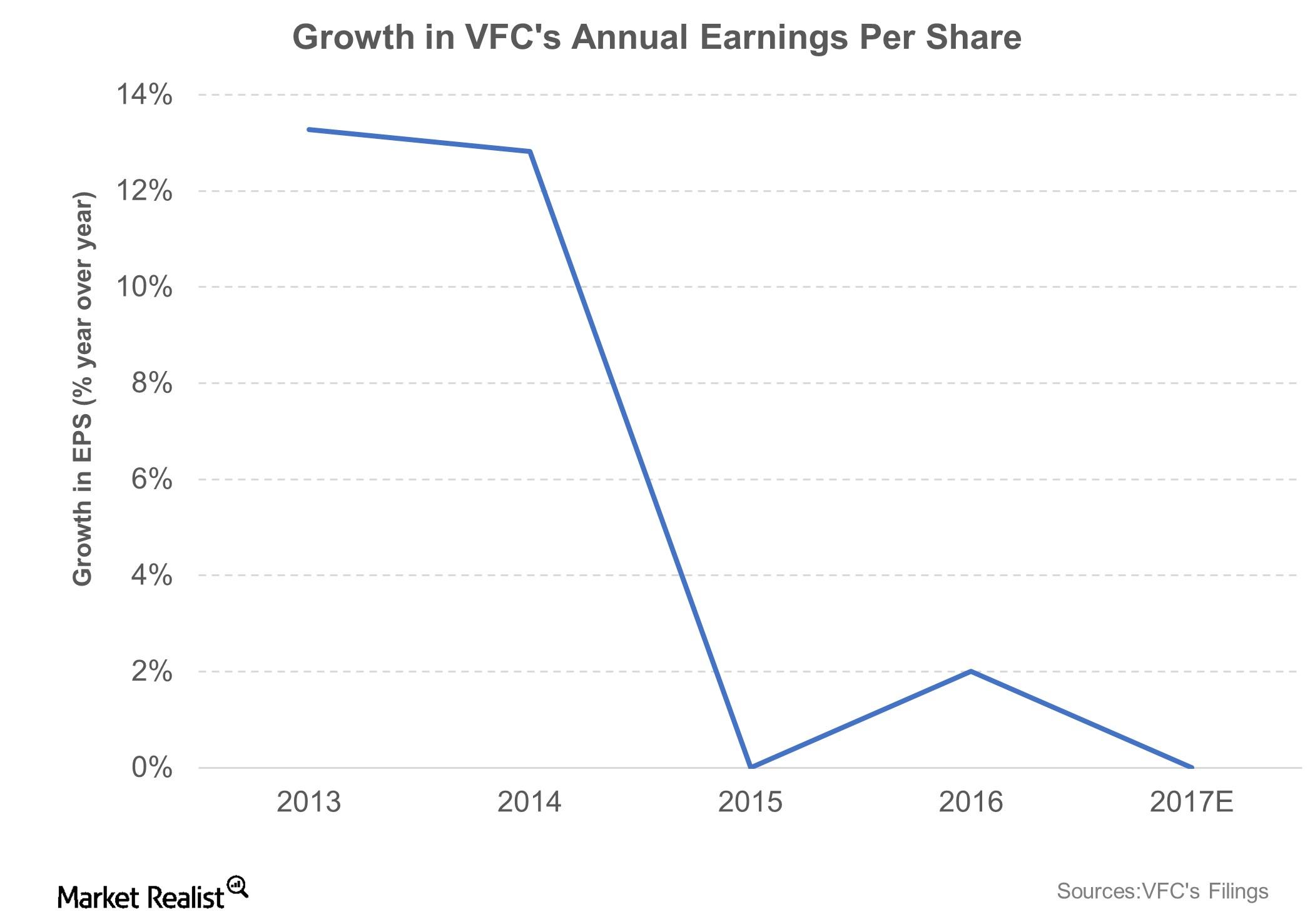

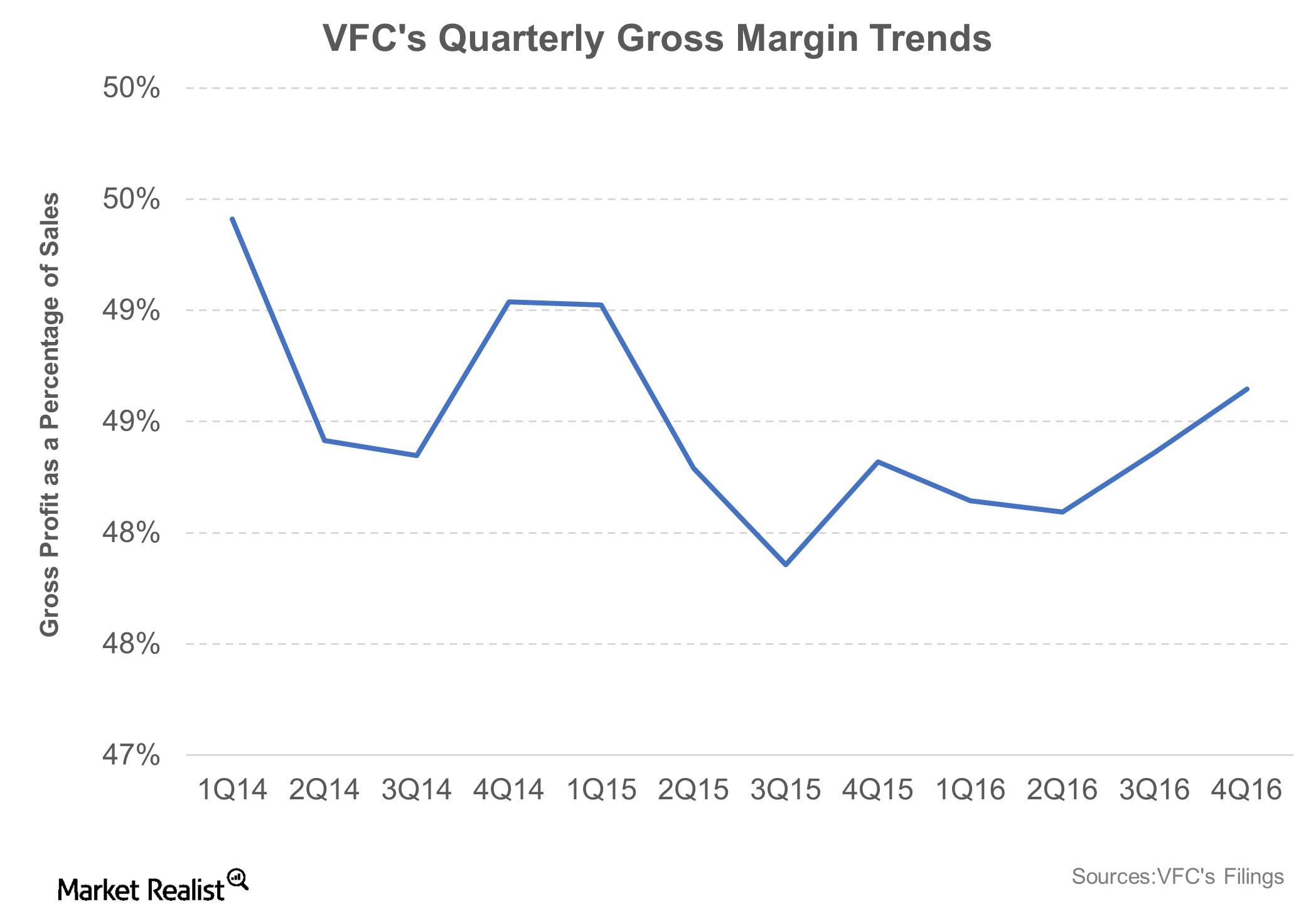

Management Expects VFC’s EPS to Contract in Fiscal 2017

VFC’s gross margin is likely to remain flat at 48.6% and would include 70 basis points of negative impact from currency adjustments.

Looking Ahead: What Could Drive VFC in Fiscal 2017?

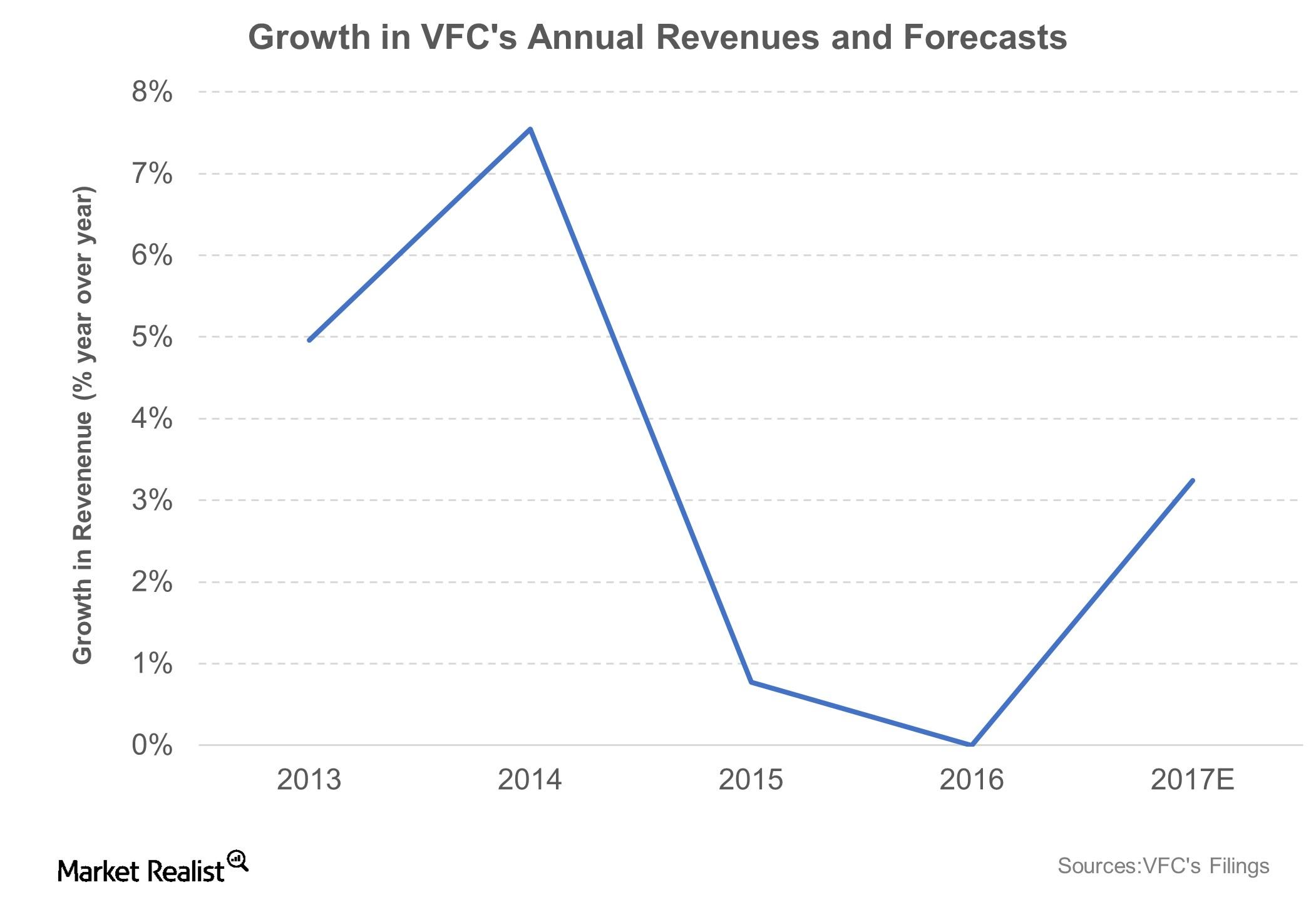

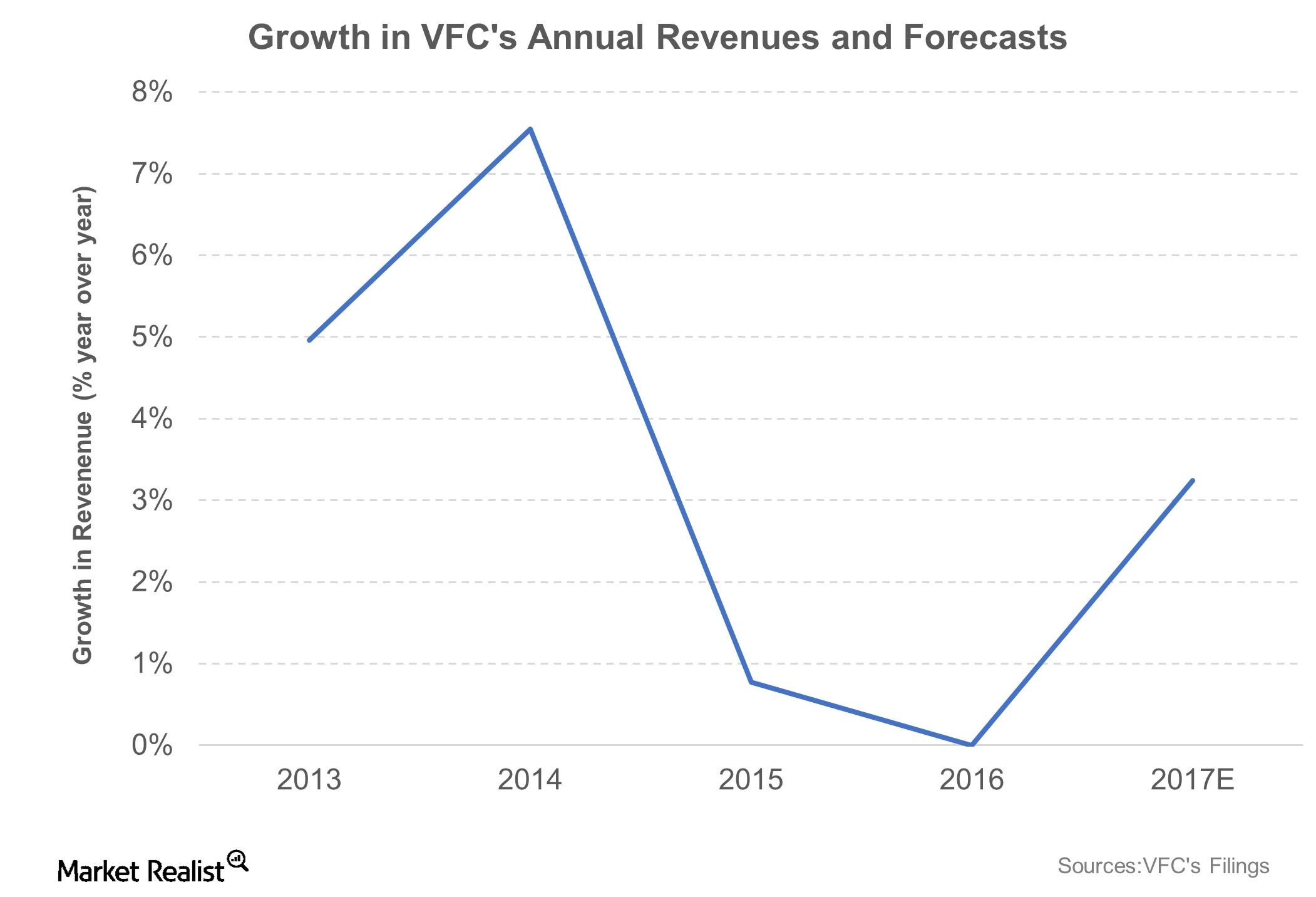

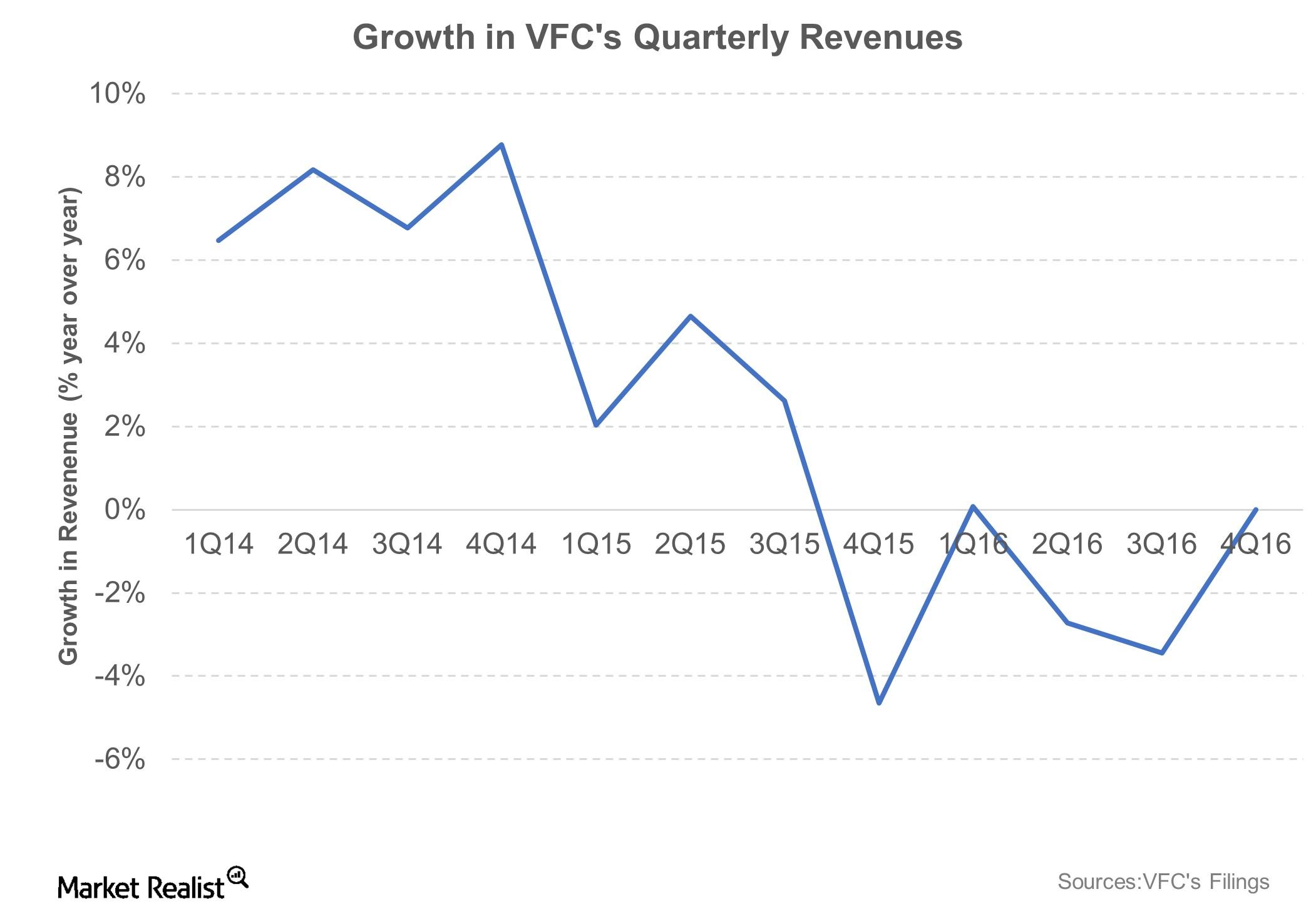

After reporting flat top-line growth in fiscal 2016, VF Corporation’s (VFC) management is looking for a low single-digit percentage increase in the company’s fiscal 2017 top line.

VFC Posts a 2% Jump in Fiscal 2016 EPS despite Forex Headwinds

For fiscal 2016, VFC’s adjusted earnings per share rose 2% to $3.11. On a constant currency basis, the increase was ~7%.

A Quick Look at VFC’s Fiscal 2016 Revenue Drivers

VF Corporation’s (VFC) Outdoor & Action Sports revenues grew 2% in fiscal 2016 to $7.5 billion.

Another Robust Quarter by Vans Boosts VFC’s Fiscal 4Q16 Top Line

Revenues from VFC’s Outdoor and Action Sports segment rose 2% YoY to $2.1 billion, slightly below the company’s expectations.

Key Drivers of VF Corporation’s Top Line in Fiscal 4Q16

VF Corporation’s D2C revenues rose 11% YoY, gaining strength from a mid-teen surge in the Outdoor & Action Sports and a low double-digit rise in Jeanswear.

VFC: Wholesale versus Direct-to-Customer Channel

VFC’s Direct-to-Customer channel is likely to grow more slowly than the company had expected earlier.

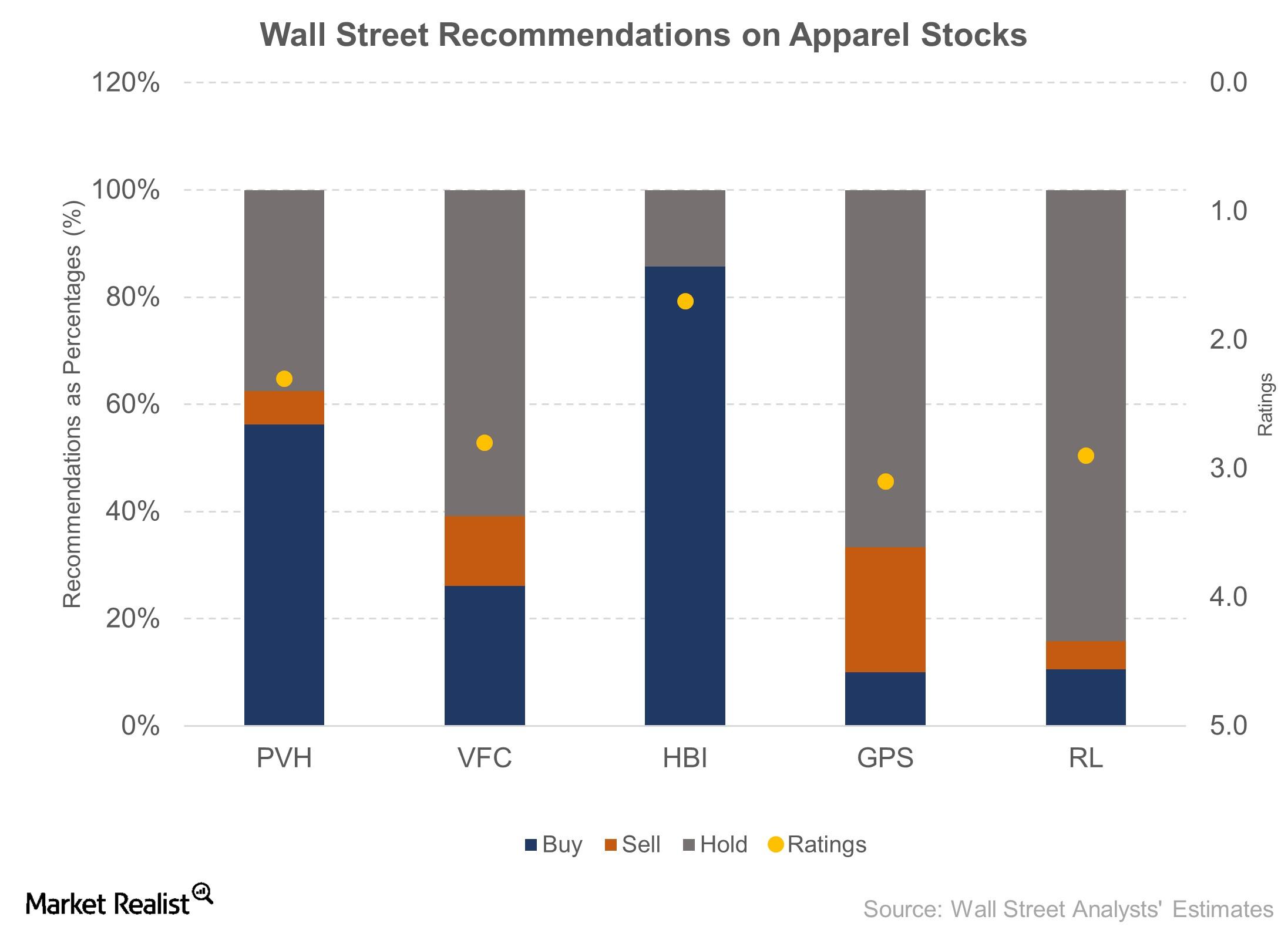

Hanesbrands Stock: Understanding Wall Street’s View

In this part of the series, we’ll look at Wall Street’s recommendation on Hanesbrands (HBI) and discuss Wall Street’s take on the company.

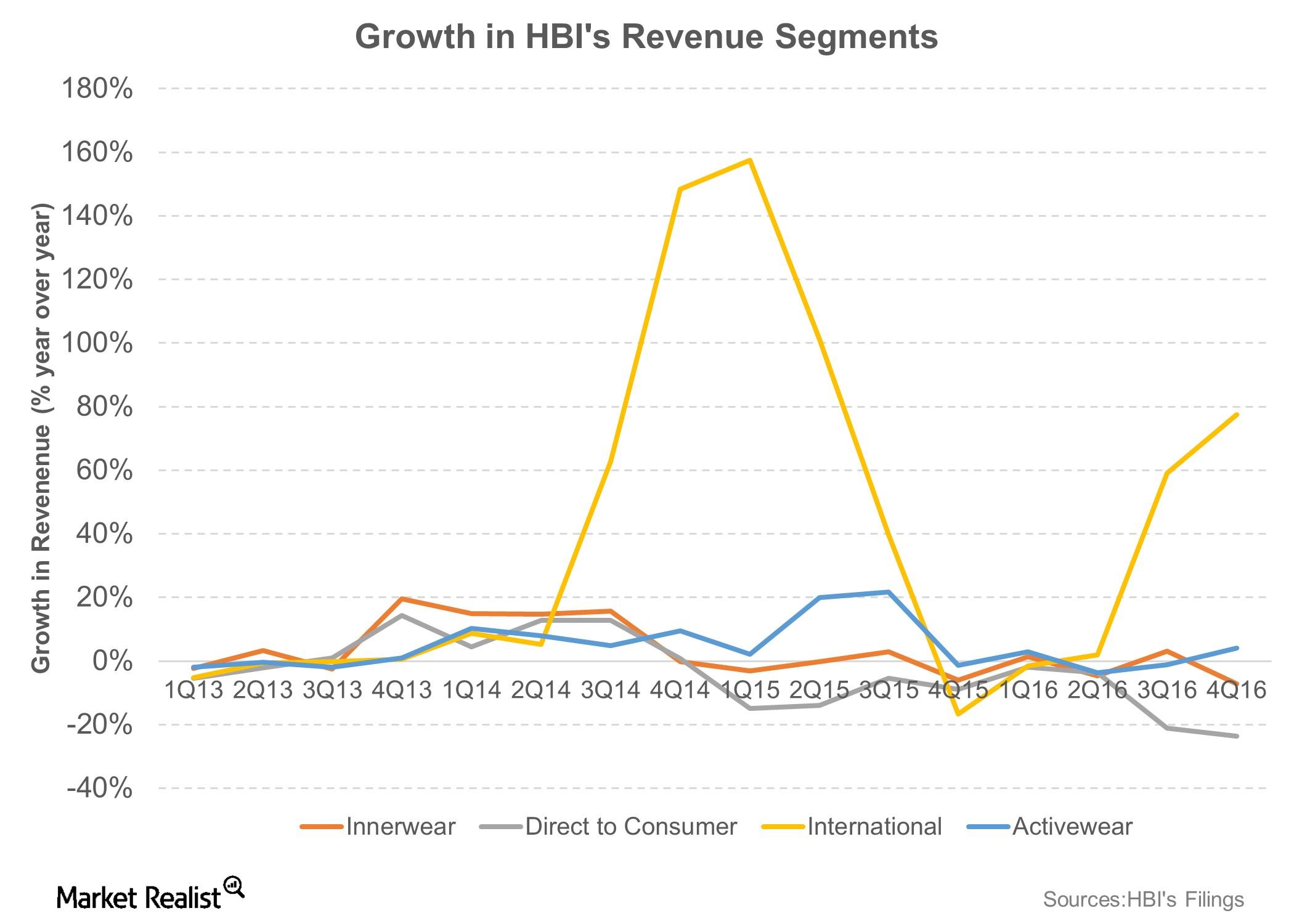

Why Hanesbrands’ Weak Innerwear Sales Drove Its Top Line Miss

With trailing-12-month sales of over $6 billion, Hanesbrands (HBI) is one the largest marketers of basic apparel in the United States.

Hanesbrands Stock Reacts to Weak Results and Gloomy Guidance

Shares of Hanesbrands (HBI) tumbled 16% on Friday, February 3, as the company posted weaker-than-expected fourth quarter results and lackluster guidance.

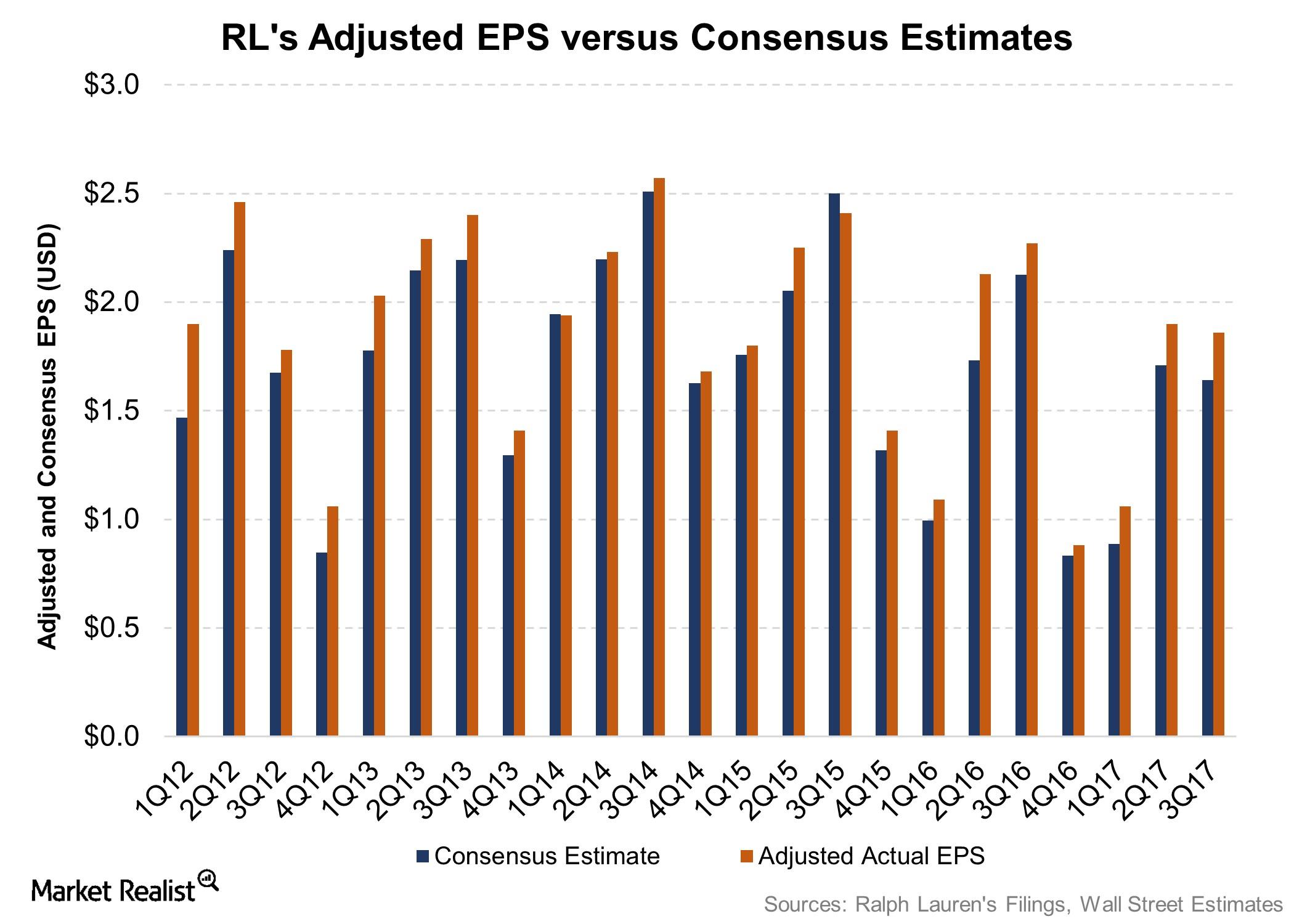

Inside Ralph Lauren’s Fiscal 3Q17 Results

RL delivered better-than-expected earnings and in-line revenues, but its EPS fell 18% YoY to $1.86.

What’s the Latest News on PVH Corporation?

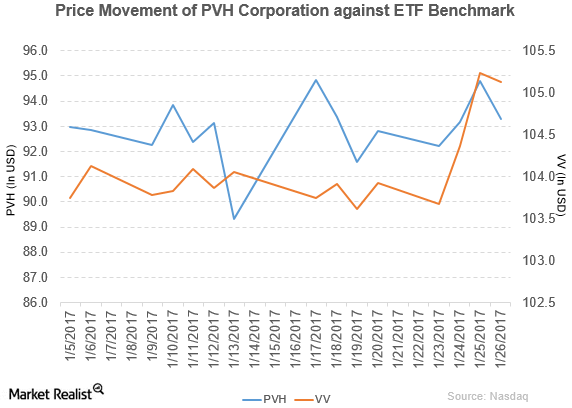

PVH Corporation (PVH) has a market cap of $7.5 billion. It fell 1.6% and closed at $93.30 per share on January 26, 2017.

Ralph Lauren Declares a Dividend

Ralph Lauren declared a regular quarterly dividend of $0.50 per share on its common stock. The dividend will be paid on January 13, 2017, to shareholders.

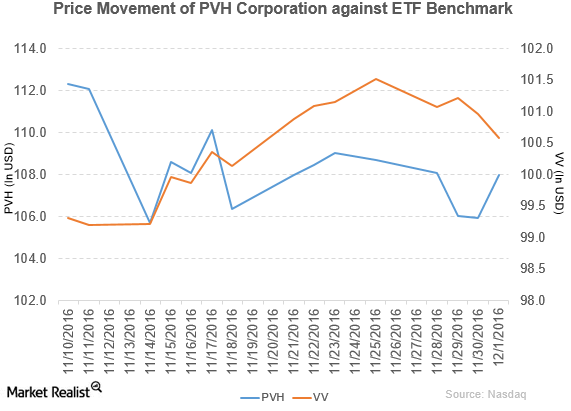

PVH Corporation and Grupo Axo Close Their Joint Venture

PVH Corporation (PVH) has a market cap of $8.7 billion. It rose 1.9% and closed at $107.99 per share on December 1, 2016.