iShares 1-3 Year Treasury Bond

Latest iShares 1-3 Year Treasury Bond News and Updates

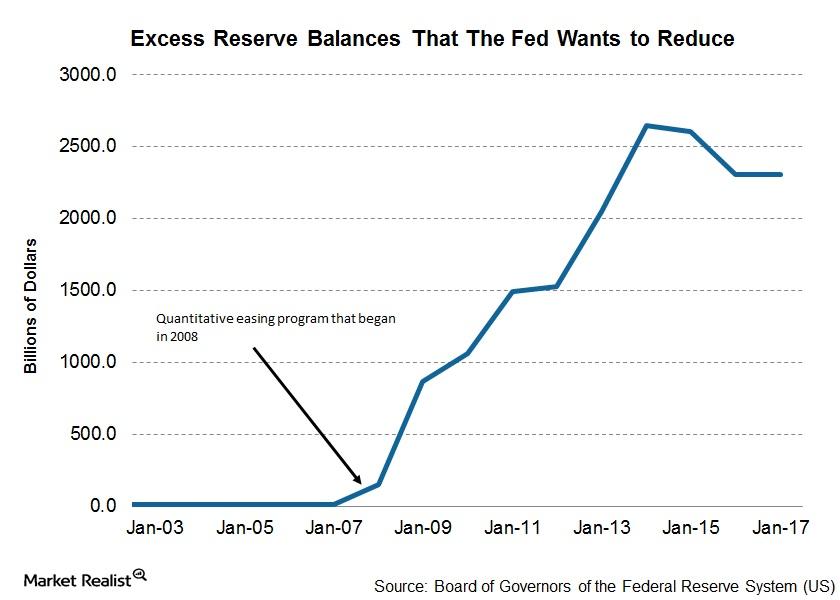

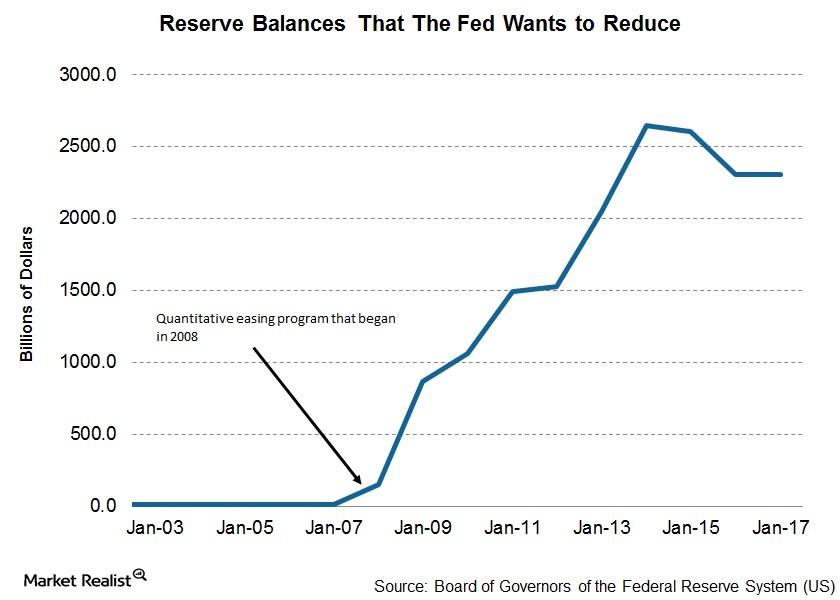

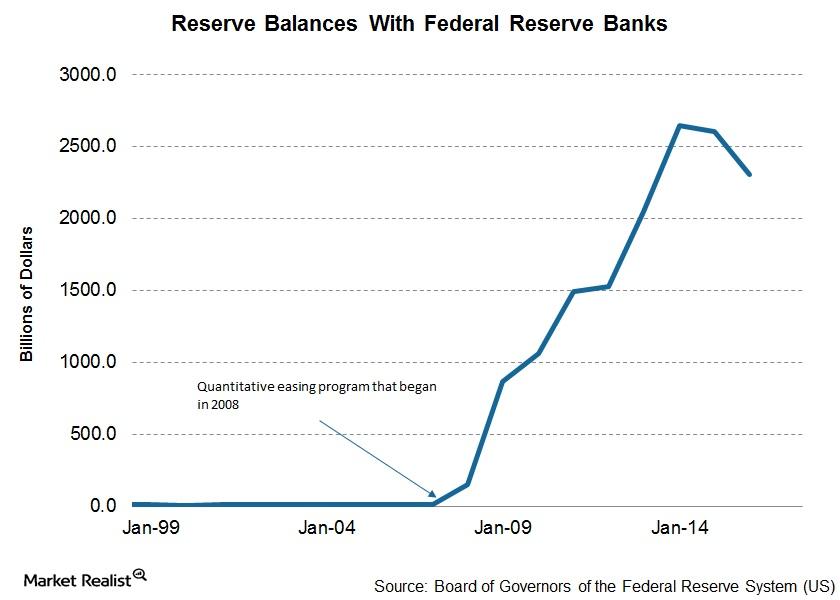

Will the US Balance Sheet Unwind Affect the Markets?

After the July FOMC meeting statement was released, market participants came to believe that the Fed would begin the process of balance sheet normalization soon.

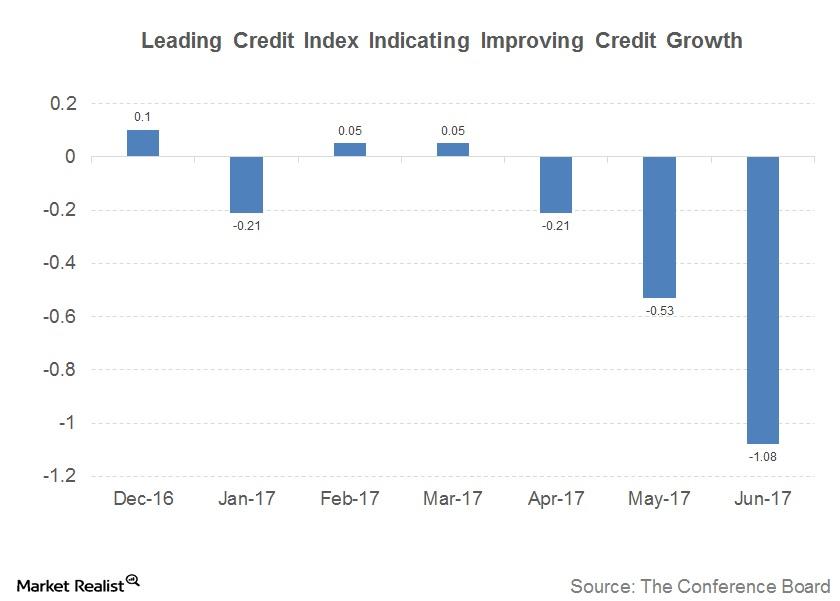

What the Conference Board LEI Tells Us about the Market

The Leading Credit Index is one of the constituents of The Conference Board Leading Economic Index (or LEI), which is reported by The Conference Board on a monthly basis.

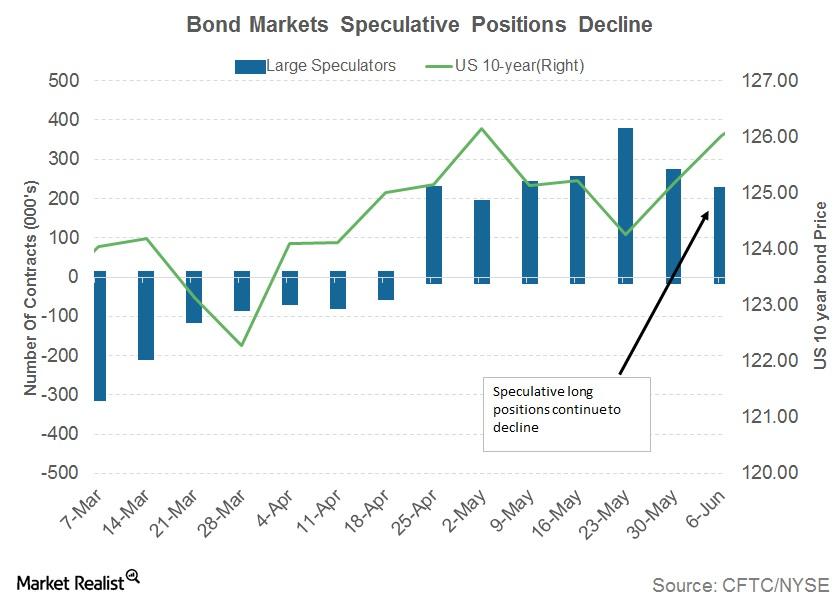

Why Bond Traders Continue to Be Confused

US Treasuries (GOVT) had another roller coaster ride this week due in part to the conflicting views from Fed members and weaker-than-expected economic data.

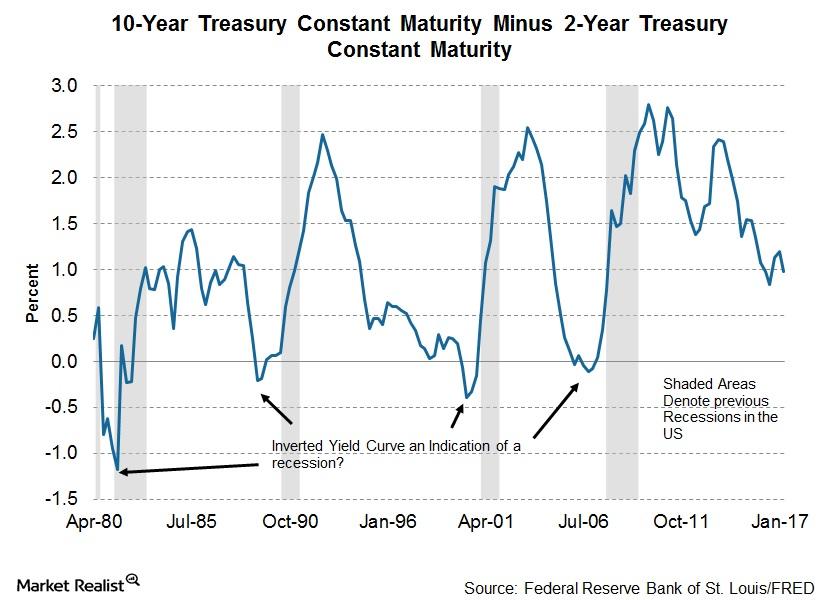

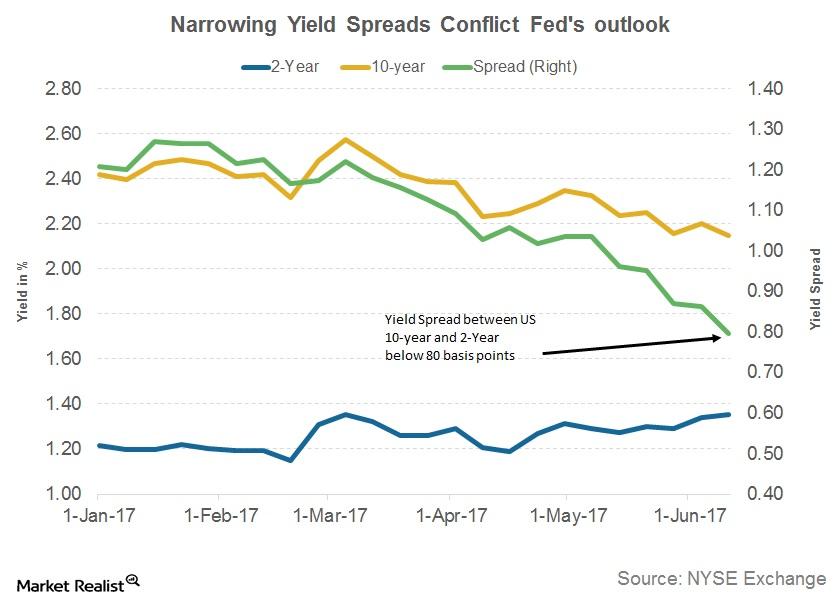

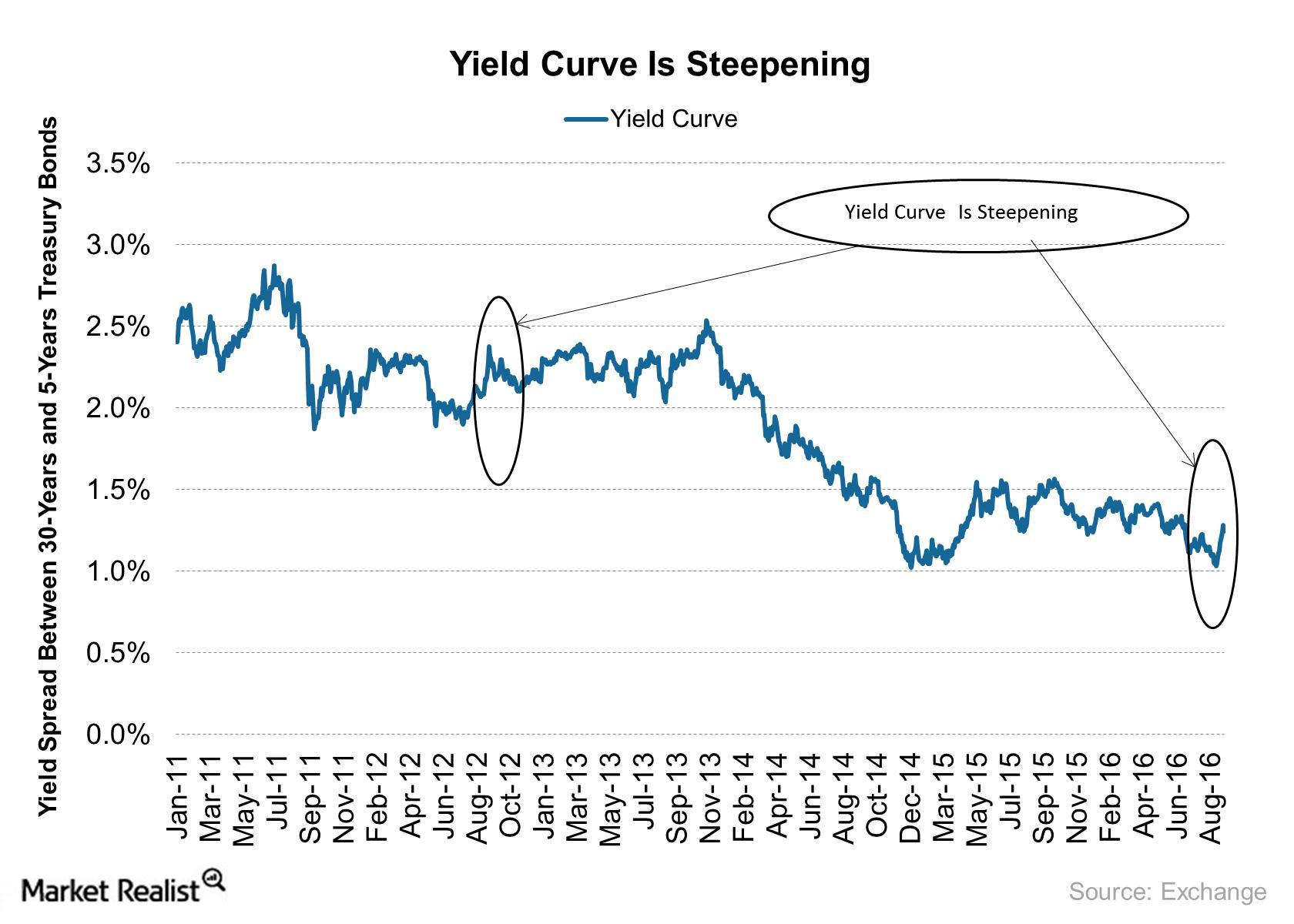

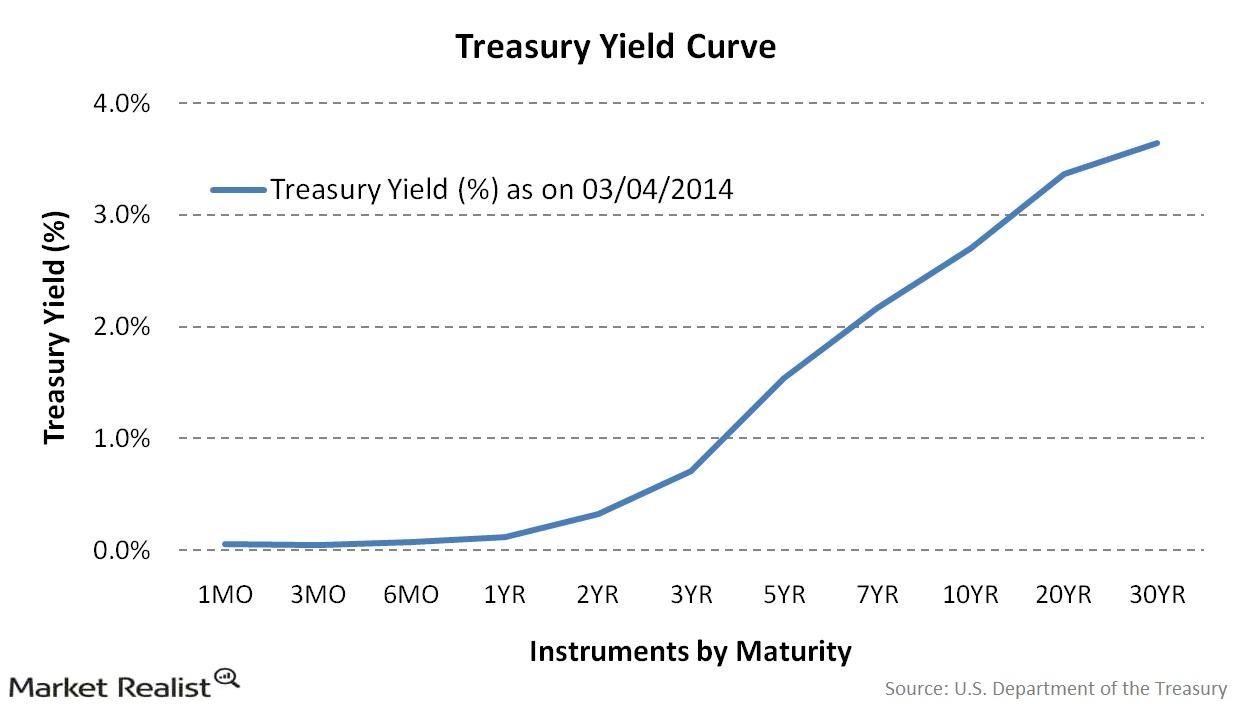

Is a Flattening Yield Curve a Sign of an Impending Recession?

Yields in the shorter timeframe such as the two-year yield (SHY) and T-notes (SCHO) are rising more than the ten-year or the 30-year (TLT) yields.

What Does Rise in US Interest Rates Mean for Bond Markets?

US Treasuries (GOVT) had a mixed response to the FOMC statement and the Fed’s interest rate hike.

What Narrowing Yield Spreads of US Treasuries Could Indicate

The US ten-year yield fell to 2.1% after the weak US data report, US inflation showed a decline of 0.1%, and retail sales fell by 0.3% for May 2017.

Fed Chair Yellen Warns about Its $4.5 Trillion Balance Sheet Unwinding

In her post-meeting press conference, Janet Yellen warned that the Fed could implement its balance sheet unwinding process soon if the economy continues to perform as expected.

Could an FOMC Rate Hike Drive Bond Yields Higher?

Bond yields of U.S. Treasuries managed to recover from the losses of the previous week. Demand for US bonds receded.

Why Bond Yields Were Unaffected by Trump News

US Treasuries (SCHO) rallied all through the previous week supported by heavy safe-haven inflows into US bonds.

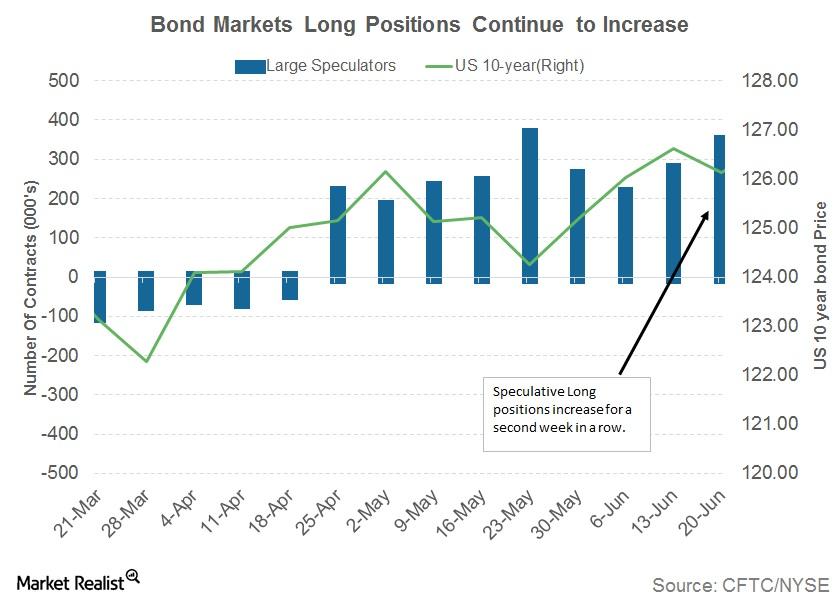

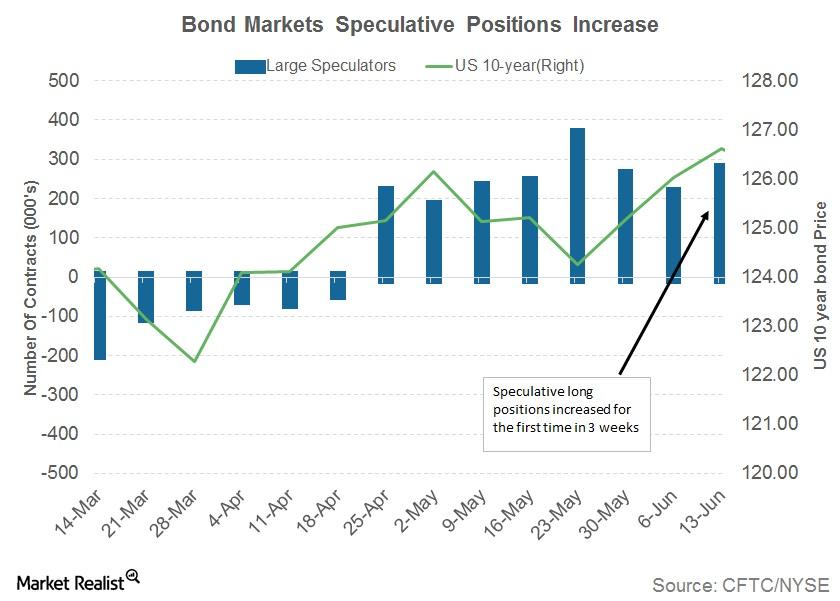

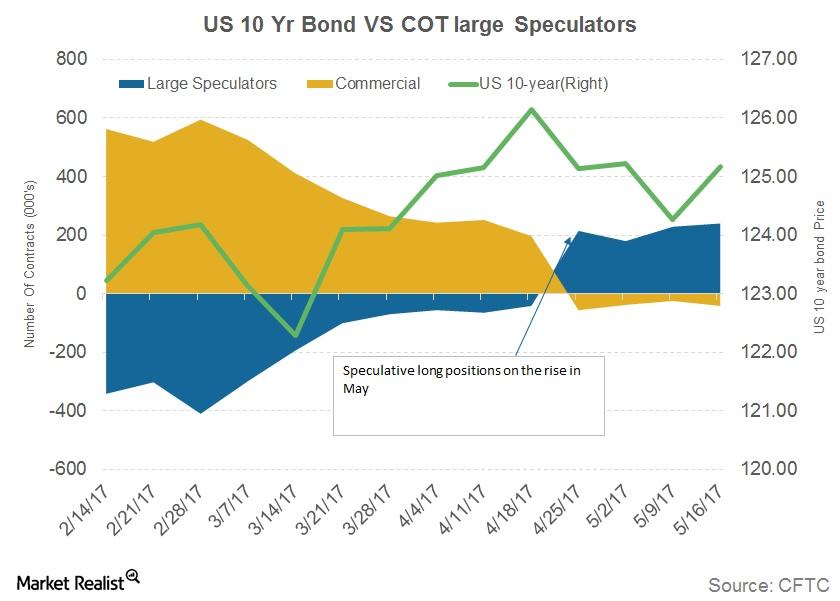

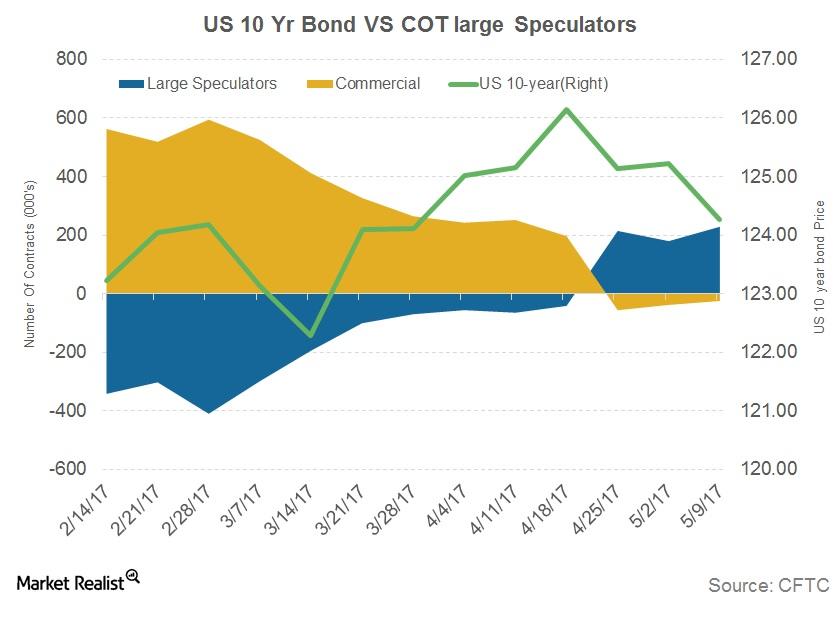

Why Are Bond Traders Increasing Their Net Positions?

US bond markets are trading on the expectation of an interest rate hike by the US Federal Reserve in June 2017. Last week, bond yields extended their slides.

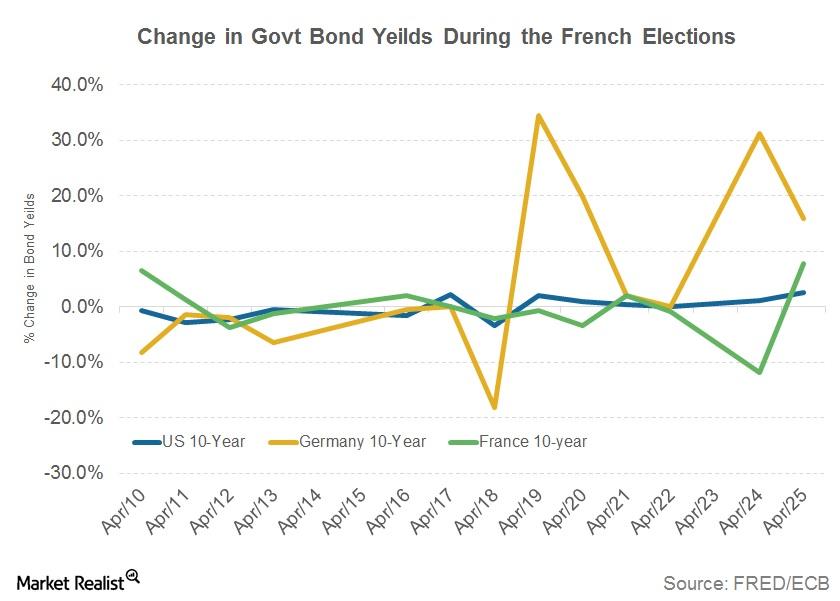

How Did Fixed Income Markets React to the First Round?

Demand for fixed income securities will likely be subdued because of excess supply this week, which would mean additional support for bond yields.

Your Update on the FOMC March Meeting Minutes

The minutes from the FOMC meeting on March 14 and 15 were reported on April 5 and revealed the tone of the conversation among members to be hawkish.

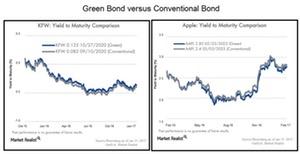

Green Bonds and Conventional Bonds: What’s the Difference?

There isn’t much difference between a conventional bond and a green bond (GRNB), also known as a climate bond. Both have similar risk-return profiles.

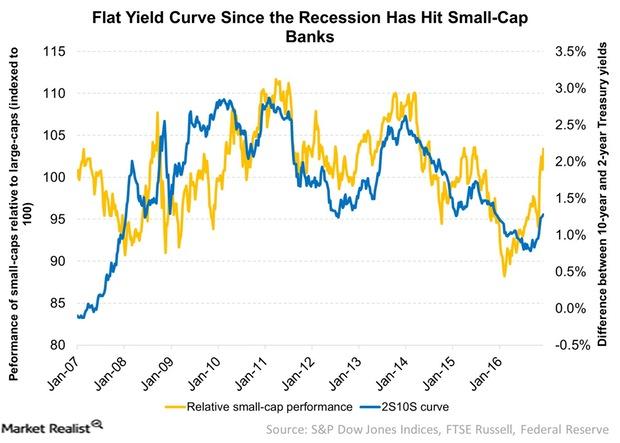

Analyzing How the Yield Curve Impacts Small Caps

Another factor that impacts small-cap stocks’ performance is the yield curve. The yield curve has remained on the flatter side since the recession.

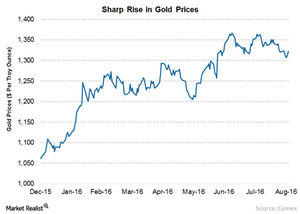

Richard Bernstein: Be Safe on Your Quest for Safety

After expressing his thoughts on the Baby Boomer generation’s having become risk-averse, Richard Bernstein moved on to the topic of the safety of “safe” investments.

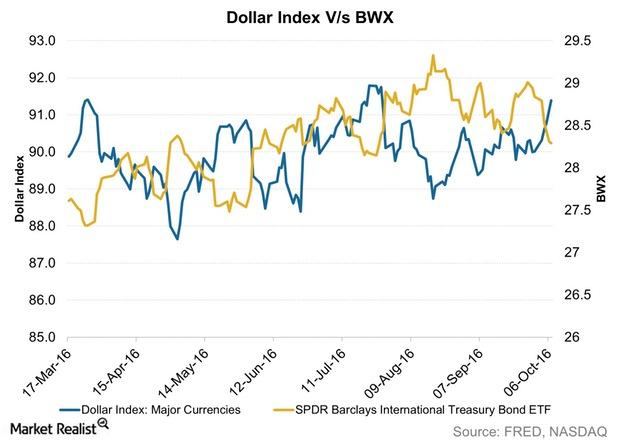

How Does a Strong Dollar Impact International Bonds?

When we talk about the relationship between the US dollar and bonds and how currency movements impact bonds, we’re essentially talking about international bonds.

Why Did Treasury Bonds Record a Fall in Yield?

The yield on US ten-year Treasury securities fell below the 1.6% mark for the first time on September 26, 2016 due to a rise in demand.

Yield Curve Is Steepening: What Does It Indicate for the Market?

In this series, we’ll compare yields across various developed markets (EFA) (VEA). We’ll also look at how a steepening yield curve affects the financial sector (XLF).

Why Caution Holds the Key

The UK has taken over other countries as the most sought-after bond market destination, especially after the Brexit vote.

Richard Bernstein Discusses the Risk of Seeking Safety

In his July 2016 Insights newsletter, Richard Bernstein stated, “Safe investments are safe until everyone wants them.”

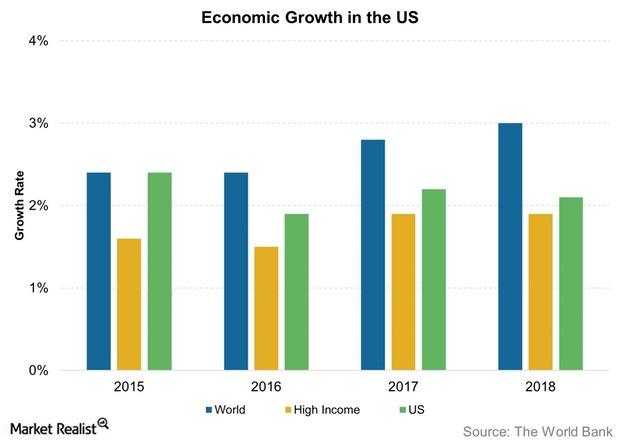

What the World Bank Thinks Now about US Economic Growth

The World Bank expects the pace of US economic growth to be 1.9% this year—a sharp correction from the 2.7% pace the bank projected in January 2016.

Why Is ‘Carry’ Compressed in Financial Markets?

In his investment outlook for June 2016, Bill Gross asserted that “carry” is compressed in nearly every form. It has more risk than return.

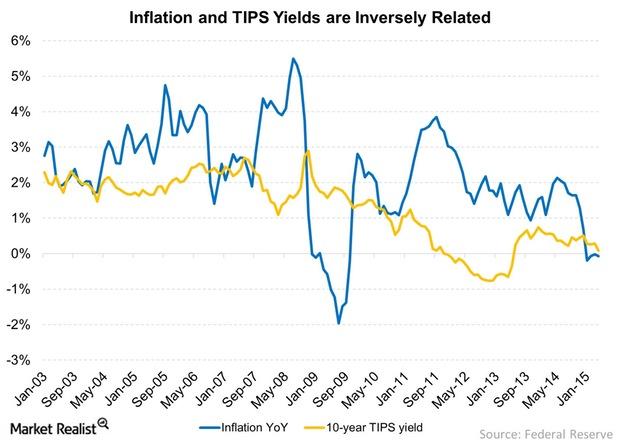

The Impact of Rising Interest Rates on TIPS

With interest rates likely to go up by the end of the year, TIPS with shorter maturities look more attractive.

What are alternative investments?

Alternative investments seek to provide a hedge against various market risks by following hedge fund-like strategies.

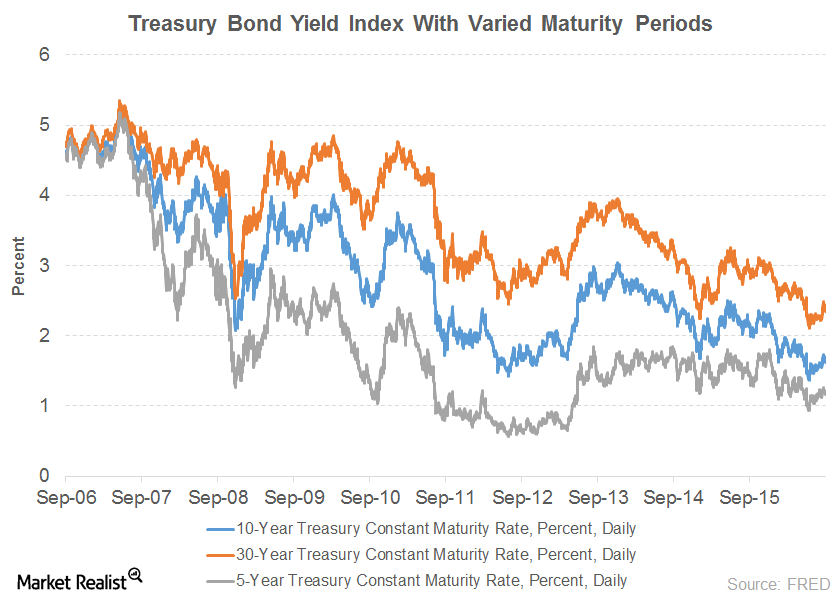

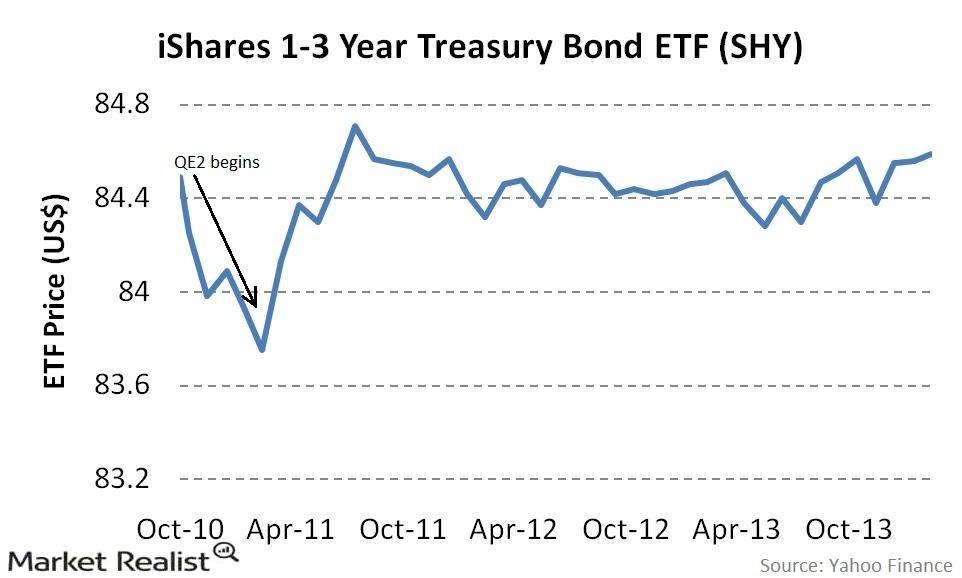

Must know: How the Fed’s monetary policy affects short-term yields

The Fed directly influences the short-term yields by either buying or selling short-term Treasuries or affecting the Fed funds rate.

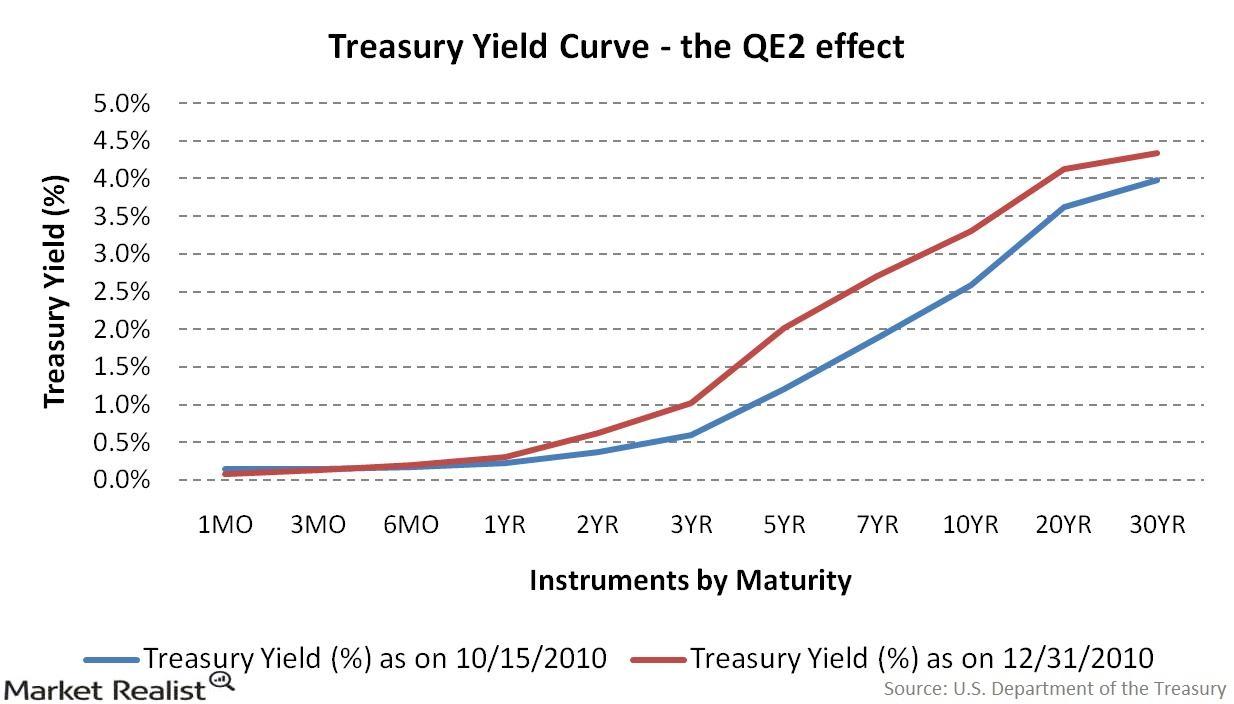

How does the Fed’s monetary policy affect the yield curve?

When it comes to changes in the shape of the yield curve, there is no bigger factor driving these changes than the Federal Reserve.

The yield curve: An indicator of the monetary policy implications

Intelligent investors have an opportunity to earn profits and avoid losses, if they understand how the yield curve may move when the Fed acts.