Raytheon Co

Latest Raytheon Co News and Updates

Consider These Defense Stocks Amid Russia-Ukraine Tensions

While U.S. stock markets have been weak, defense stocks are looking strong in 2022. What are the best defense stocks to buy now amid Russia and Ukraine tensions?Industrials Comparing Lockheed Martin with other major defense contractors

With total sales of $45,358 million in 2013, Lockheed Martin is the largest defense contractor in the world. The other major defense contractors in the world include The Boeing Company and Raytheon Company.

An investor’s introduction to Lockheed Martin Corporation

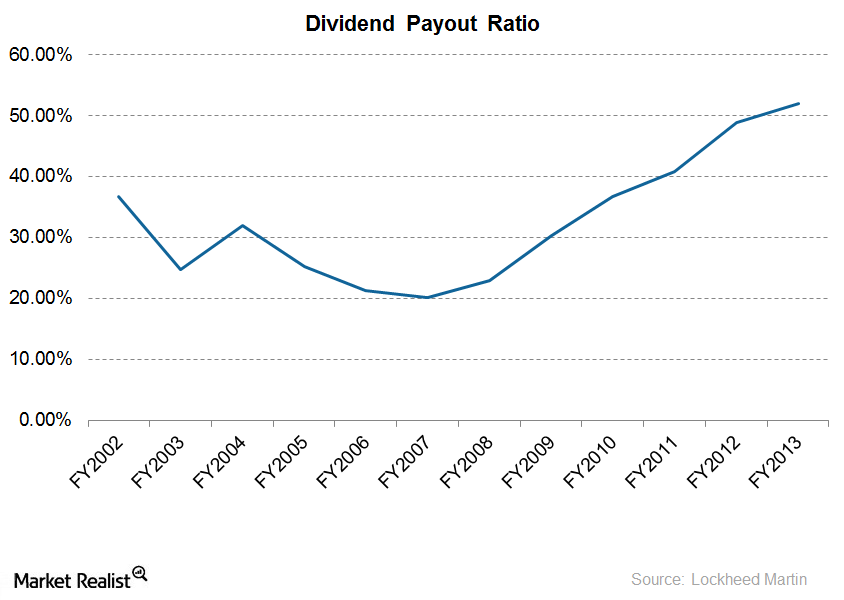

In 2013, Lockheed Martin clocked revenues of $45.4 billion. Of its revenues, 82% come from the U.S. government, around 17% from international customers, and 1% from other U.S. commercial customers.

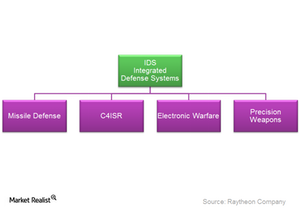

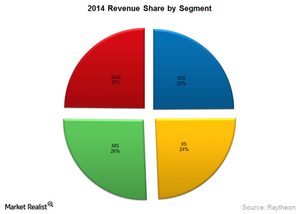

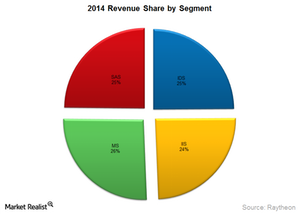

Raytheon Company’s Integrated Defense Systems

Raytheon’s Integrated Defense Systems segment saw marginally lower sales during the year due to lower sales across most of its major programs such as the Patriot program.

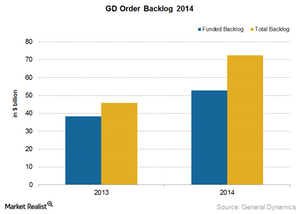

What does General Dynamics’ order backlog reflect?

General Dynamics’ total backlog grew from $45.9 billion at the end of 2013 and to $72.4 billion at the end of 2014. This was a whooping 58% increase.

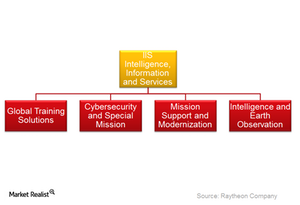

Raytheon’s Intelligence, Information and Services Segment

The Intelligence, Information and Services segment was almost in line with last year. So were the operating income and margins, all of which saw marginal declines.

Raytheon Company: An Introduction

Raytheon is a global technology leader and US defense contractor. It primarily develops and manufactures weapons and military and commercial electronics.

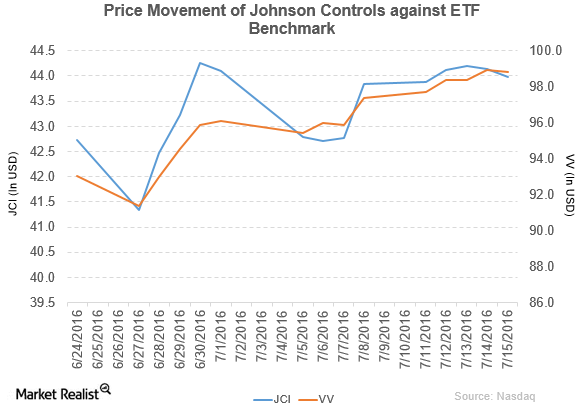

Johnson Controls Settles Its Bribe Charges

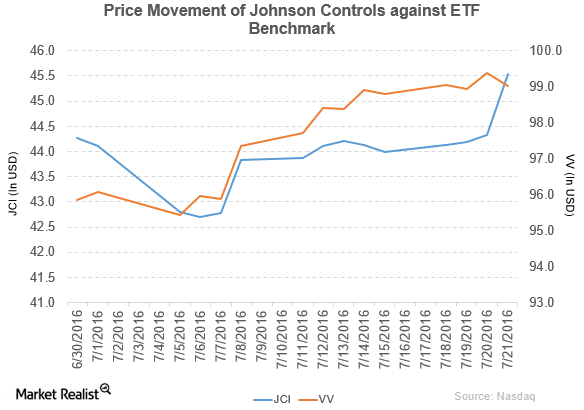

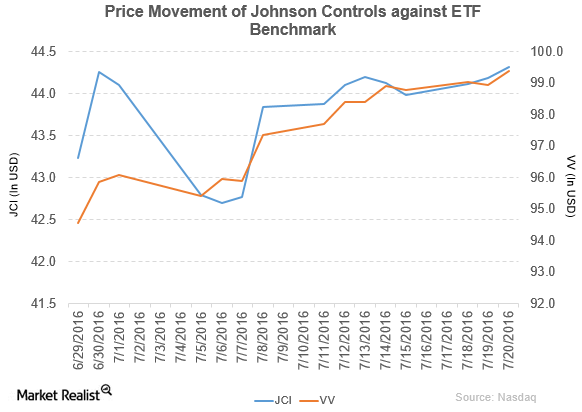

Johnson Controls (JCI) rose by 0.32% to close at $43.98 per share during the second week of July 2016.

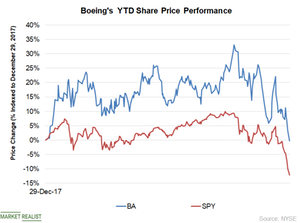

How Boeing Stock Has Fared in 2018

Boeing (BA) stock started 2018 on a positive note and carried this momentum forward up to November 7, with a return of ~26%.

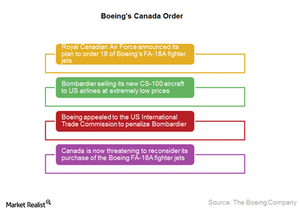

Canada Puts Boeing Defense Order on Hold

The Canadian Air Force placed an order for 65 Lockheed Martin (LMT) F-35 fighter jets for $30 billion. The CAF canceled the order and replaced it with 18 Boeing CF-18 aircraft for $5.2 billion.

Gabelli Downgrades Johnson Controls Stock to ‘Hold’

In fiscal 2016, JCI reported net sales of $37.7 billion, a rise of 1.3% YoY (year-over-year).

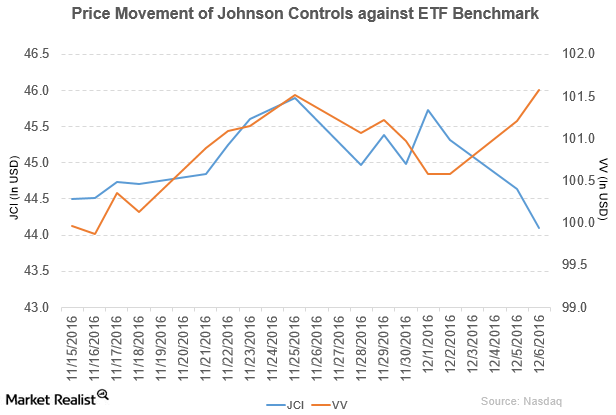

How Did Johnson Controls Perform in 4Q16?

Price movement Johnson Controls (JCI) has a market cap of $41.7 billion. It rose 5.7% to close at $43.94 per share on November 8, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 6.5%, -1.8%, and 40.9%, respectively, on the same day. JCI is trading 1.9% above its 20-day moving average, 2.0% […]

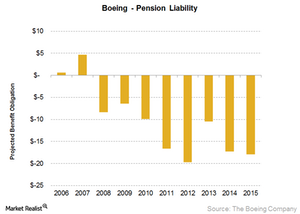

Inside Boeing’s Often Overlooked Risk: Pension Liabilities

For Boeing (BA) to fulfill this promise to its employees, it would require $17.9 billion—a huge sum by any standard.

Bernstein Has Rated Johnson Controls ‘Outperform’

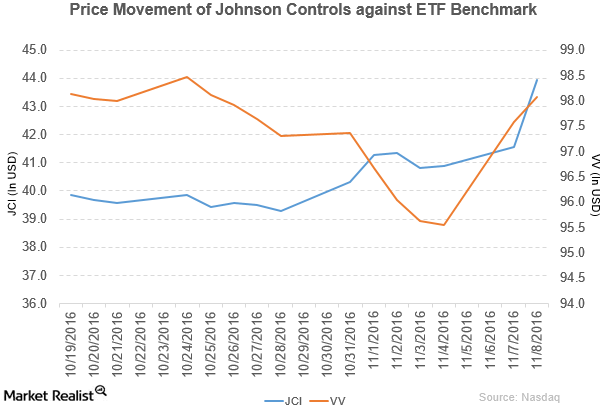

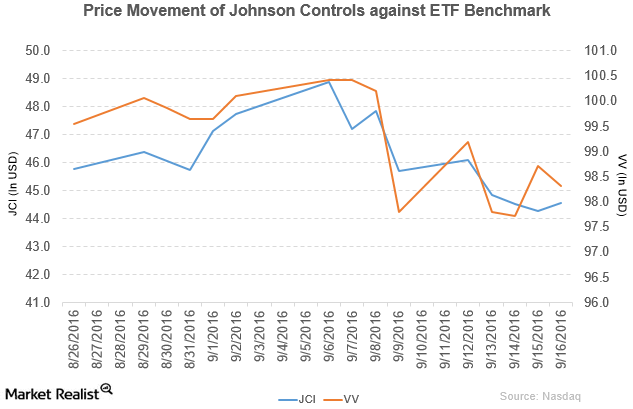

Johnson Controls (JCI) has a market cap of $42.3 billion. It rose 0.61% to close at $44.55 per share on September 16, 2016.

Macquarie Upgrades Johnson Controls to ‘Outperform’

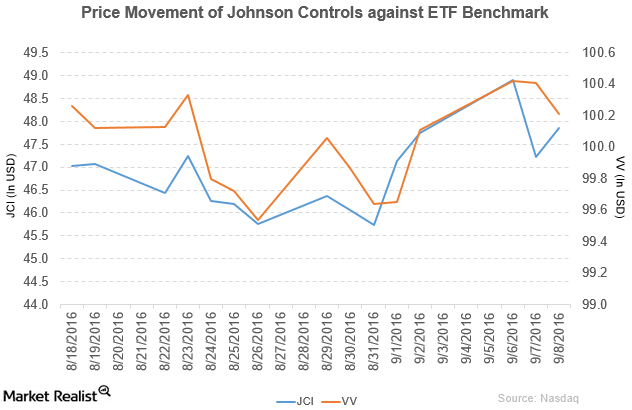

Johnson Controls (JCI) has a market cap of $30.9 billion. It rose by 1.4% to close at $47.86 per share on September 8, 2016.

Why Did Johnson Controls Rise on September 6?

Johnson Controls (JCI) has a market cap of $31.5 billion. It rose by 2.4% to close at $48.90 per share on September 6, 2016.

Moody’s Upgrades Johnson Controls’ Senior Unsecured Rating

Johnson Controls (JCI) has a market cap of $28.1 billion. It fell by 0.34% to close at $43.88 per share on August 31, 2016.

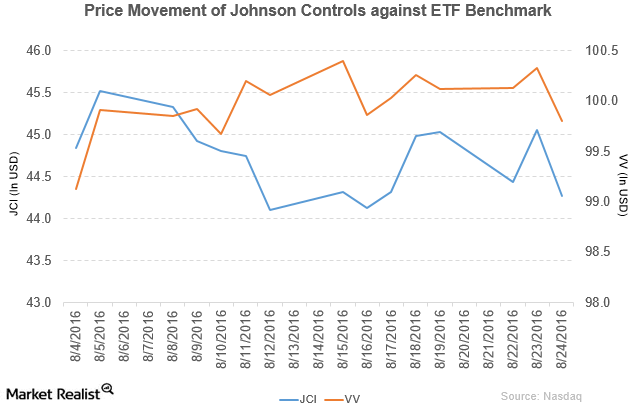

Johnson Controls’ New Contract with Methodist Healthcare

Johnson Controls (JCI) has a market cap of $28.2 billion. It fell by 1.8% to close at $44.27 per share on August 24, 2016.

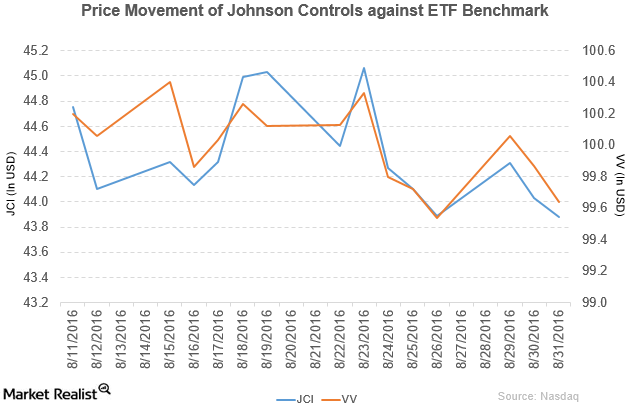

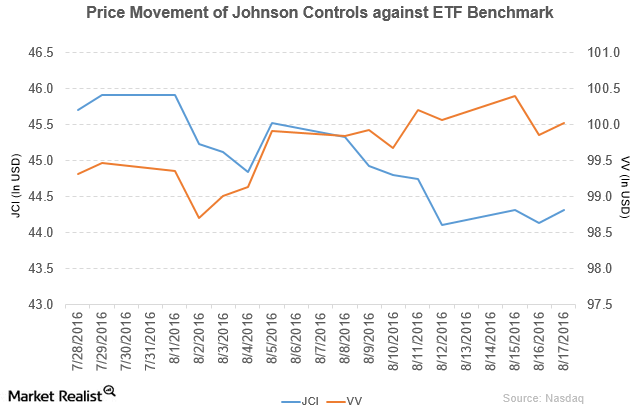

Johnson and Tyco Shareholders Approved Merger

Johnson Controls (JCI) has a market cap of $28.7 billion. It rose by 0.43% to close at $44.32 per share on August 17, 2016.

How Did Johnson Controls Perform in 3Q16?

Johnson Controls reported 3Q16 net sales of $9.5 billion, a fall of 1.0% compared to net sales of $9.6 billion in 3Q15.

Johnson Controls Declares $0.29 Per Share Dividend

Johnson Controls (JCI) has a market cap of $28.8 billion. It rose by 0.29% to close at $44.32 per share on July 20, 2016.

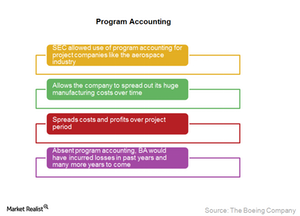

What Is Boeing’s Program Accounting Issue About?

Boeing (BA) uses program accounting, a technique that allows the company to spread out its huge manufacturing costs over time by cutting the cost per plane in the early stages of a project, and smoothening profit margins over time.

The Boeing Company: From the Beginning

Boeing is the world’s largest aerospace company. It is the largest commercial jet manufacturer in the US and the world’s second largest behind Airbus.

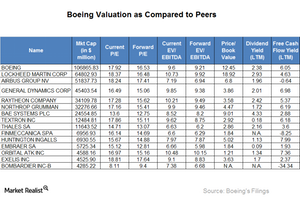

Comparing Boeing’s Valuation to Its Peers

Boeing is the largest company by market capitalization among our selected peers, while Bombardier is the smallest.

What Should Investors Know About Raytheon?

Raytheon is a leading technology company. It provides products and services in the defense, civil, and security markets globally.

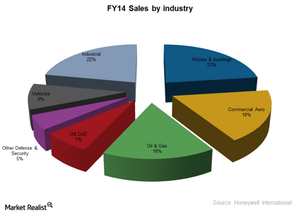

Analyzing how Honeywell makes money

Honeywell International Inc. (HON) is headquartered in Morristown, New Jersey. It was incorporated in 1985. It’s a Fortune 100 company.

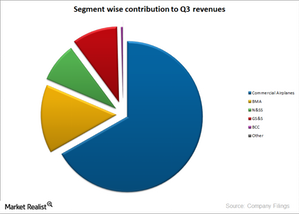

An overview of BA’s business segments

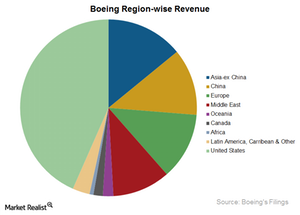

BA’s business segments are Boeing Commercial Airplanes (or BCA) and Boeing Defense, Space & Security (or BDS).