Market Vectors® Retail ETF

Latest Market Vectors® Retail ETF News and Updates

July’s US Retail Sales Meet Estimates

On August 13, 2015, US retail sales came in at expected levels for July. The increase in the retail sector was broad-based.

Dover Refrigeration & Food Equipment: Keeping It Cool

The Dover Refrigeration & Food Equipment unit is a major provider of refrigerated display cases and kitchen equipment such as cookers, mixers, braising pans, and packaging and processing solutions for the meat and poultry business.

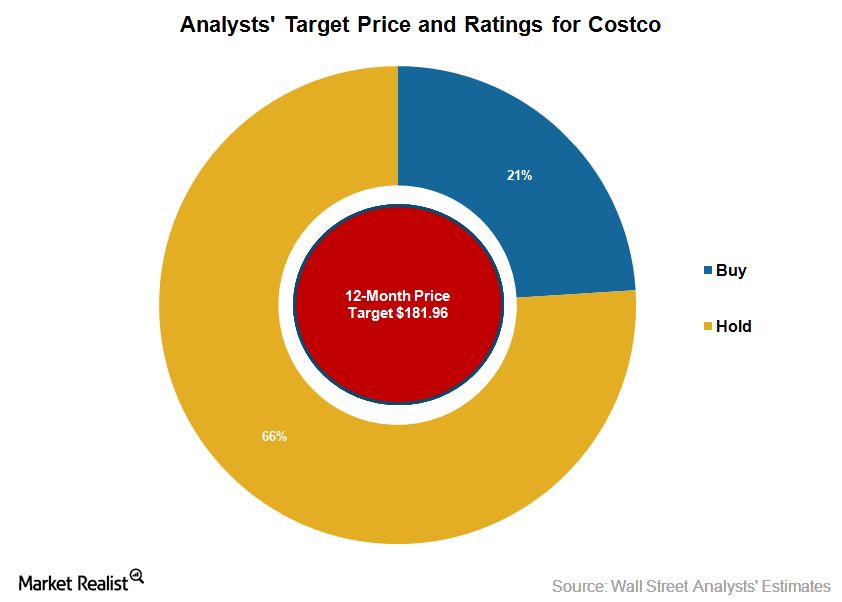

Costco on the Street: Analyst Recommendations

Of the 32 analysts covering Costco (COST), 69.0% have rated the stock as a “buy” as of April 5. The stock has been rated as a “hold” by 31% of these analysts.

Costco’s Industry Positioning: A Porter’s 5 Force Analysis

Costco’s suppliers include companies like PepsiCo (PEP), Procter & Gamble (PG), and the Kraft Heinz Company (KHC). No single supplier accounts for over 5% of revenue.

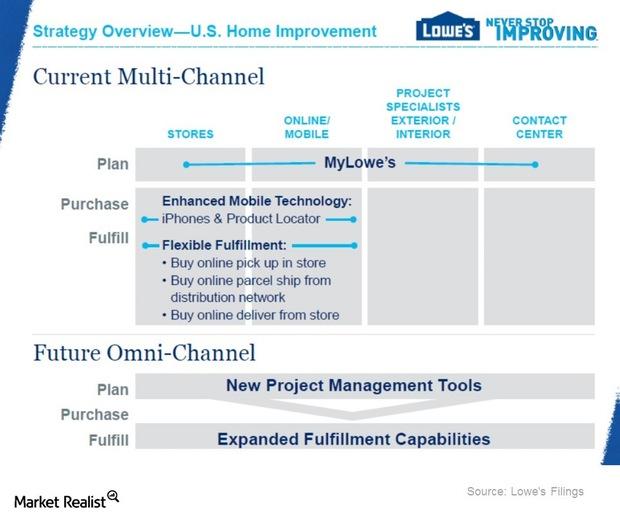

How Lowe’s Is Leveraging Its Omni-Channel Opportunity

Going omni-channel makes natural sense for both Lowe’s and Home Depot. Both retailers have a massive store network in the US, which can double as strategic fulfillment centers.

Kirkland Signature: Costco’s Key Differentiator in Fiscal 2Q16?

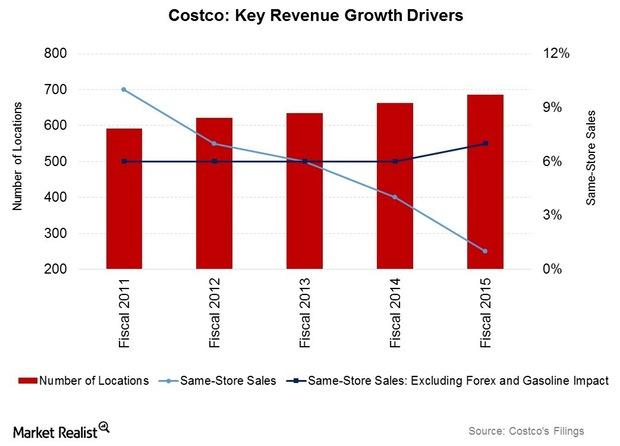

Costco has seen traffic growth averaging 4.3% per year in the period between fiscal 2009 and fiscal 2015. In fiscal 1Q16, club traffic rose by 3.5% YoY.

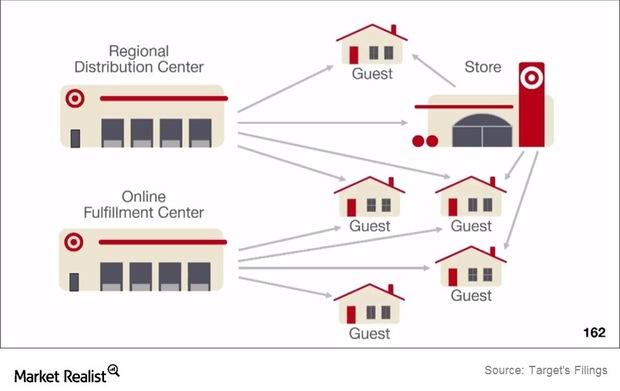

Why Target Is Ramping up on Supply Chain and Digital Investments

Target (TGT) has been making improvements in its supply chain to cope with the additional demand posed by e-commerce and omni-channel retailing (RTH).

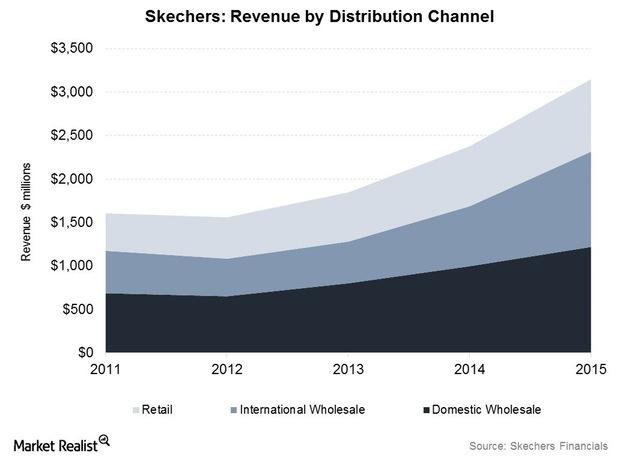

How Skechers Sells Its Products to Its Customers

In 2015, Skechers became the second-largest footwear company in the United States, trailing global market leader Nike (NKE).

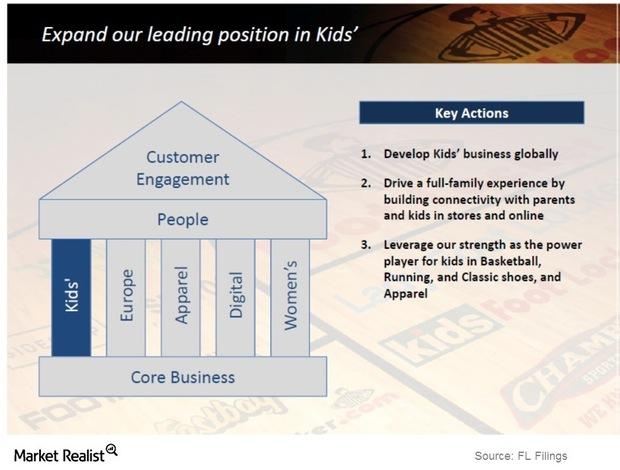

A Look at Foot Locker’s Key Strengths and Weaknesses

Foot Locker (FL) has several key strengths. It’s the largest specialty retailer (XRT) of sporting goods in terms of US store count.

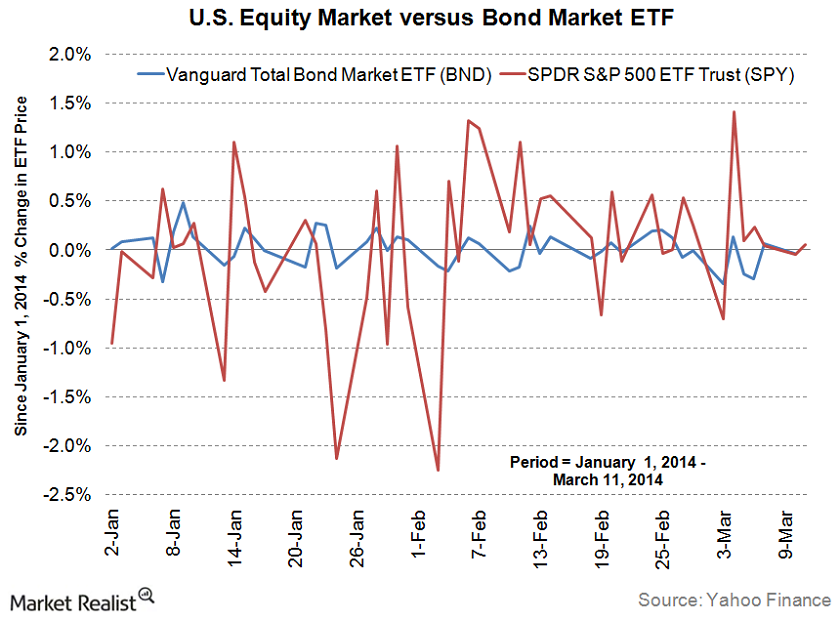

How does the Redbook Index help fixed-income and equity investors?

The Redbook Sales Index compiles and analyzes comparable store sales at more than 9,000 stores.

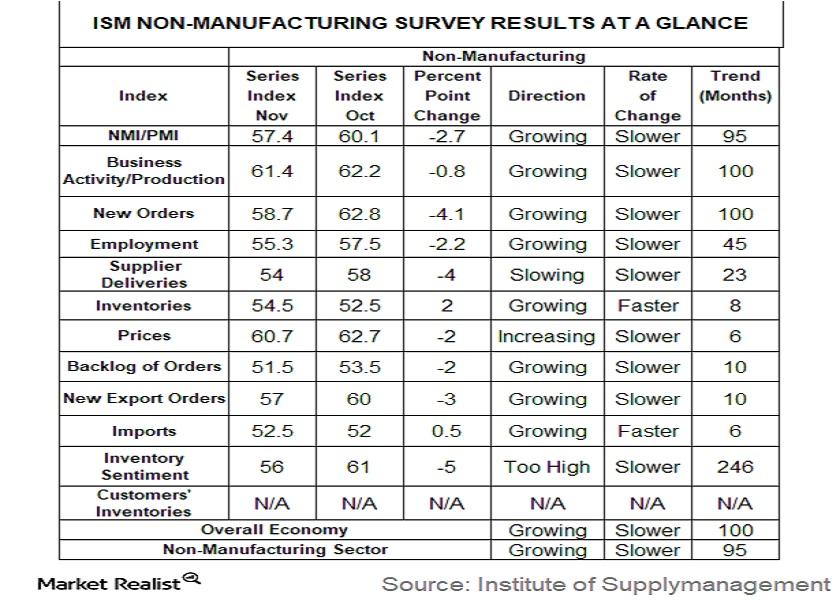

What Rising Services Activity Means for the US Economy

After reaching a lifetime high in October 2017, the ISM (Institute of Supply Management) non-manufacturing index fell 2.7 percentage points to 57.4%.

How Realty Income’s Dividend Yield Looks

Revenue and earnings Realty Income (O), a retail REIT engaged in US real estate investment, recorded 8% revenue growth in 2016, compared with 10% growth in 2015. The growth was driven by rentals and tenant reimbursements. Its operating costs and other expenses (including interest expenses) rose 6% in 2016 and 8% in 2015. Its gains on asset […]

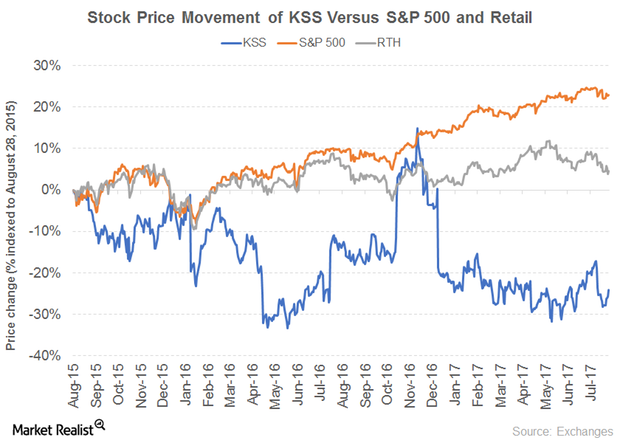

What’s Contributing to Kohl’s Dividend Yield

The story behind Kohl’s rising yield Department store retailer Kohl’s (KSS) saw its sales fall 3% in 2016, driven by lower comparable sales, after recording growth in 2015. Like Macy’s, it was impacted by online competition, store closures, discounts, and advertisements. Its operating income fell 8% in 2015 and 24% in 2016, while its operating […]

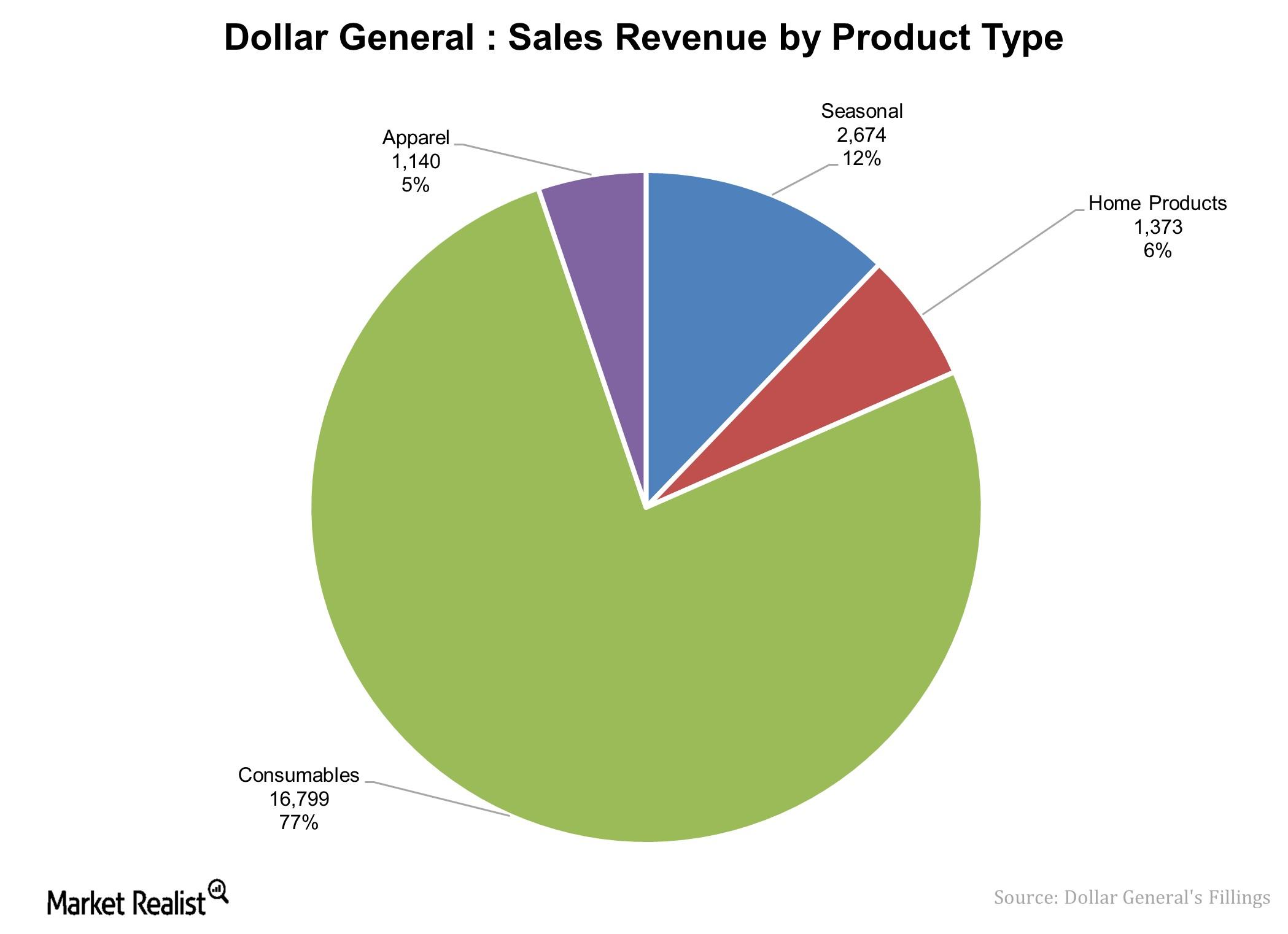

Understanding Dollar General’s Business Strategies

Dollar General’s (DG) business strategy revolves around driving profitable topline growth while enhancing its low-cost operator position and capturing new growth opportunities.

Understanding Dollar General’s Key Product Offerings

Dollar General (DG) is the largest discount store retailers in the United States in terms of total revenue generated.

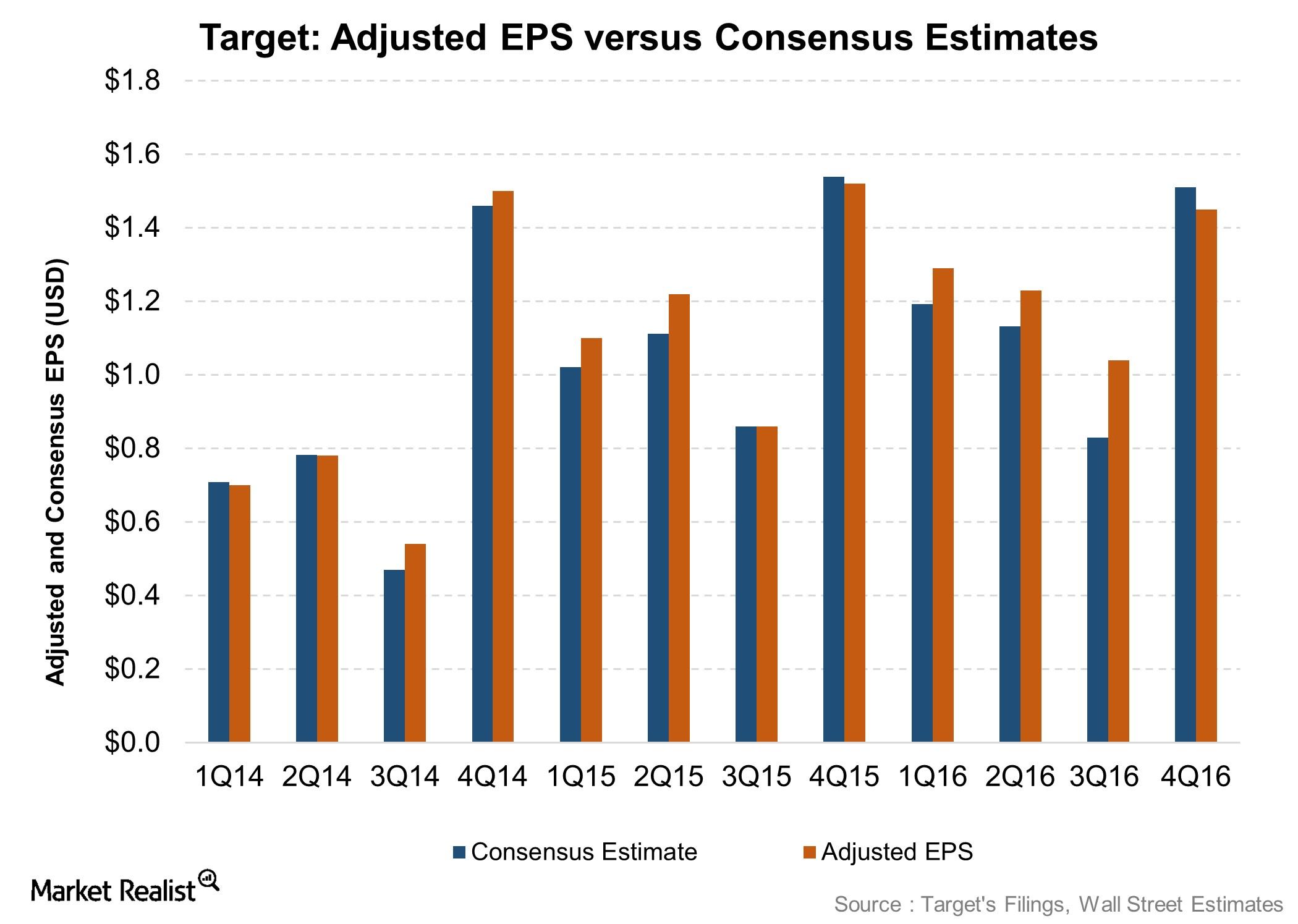

Target Stock Plunges after 4Q16 Earnings and Revenue Miss

Target (TGT), the third-largest mass merchandiser in the US, declared results for 4Q16 on February 28, 2017.

How This Emerson Sales Strategy Is Reeling in Big Box Retailers

Emerson Electric’s (EMR) omnichannel sales strategy is a multichannel approach that provides an integrated shopping experience.

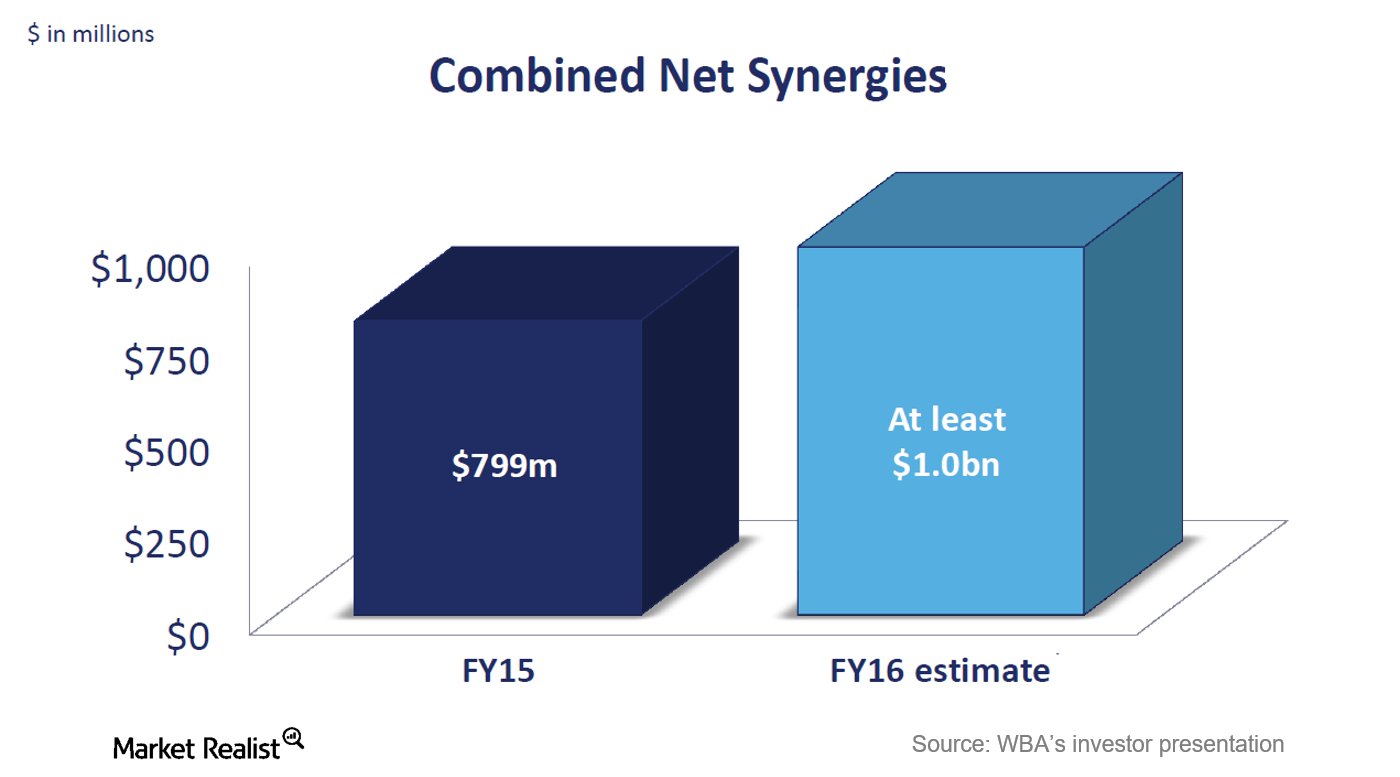

Walgreens Boots Alliance: Merger of Walgreens and Alliance Boots

Walgreens became a wholly owned subsidiary of Walgreens Boots Alliance after a merger.

Whole Foods’ Low Sales Growth versus Impressive Margins

Whole Foods’ sales for fiscal 2015 earned $15.3 billion—a 8.4% rise over the previous fiscal year, and a 9.6% average rise over the past three fiscal years.

Analyzing Whole Foods’ Store Performance and Profitability

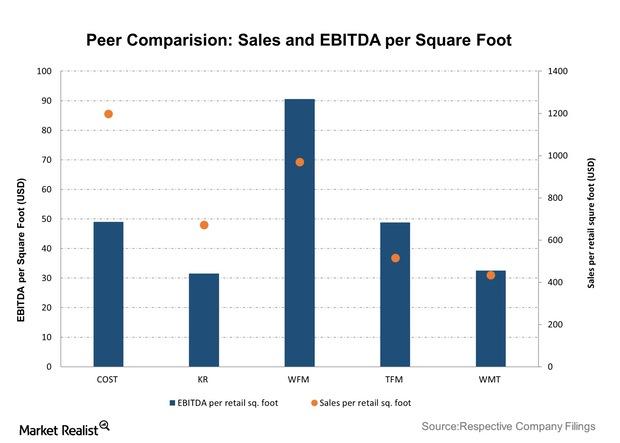

Whole Foods has only trailed Costco in per-foot sales metrics. Costco averaged more than $1100 between fiscal 2011 and fiscal 2015.

Can Lululemon Keep Seeing Traction in Same-Store Sales?

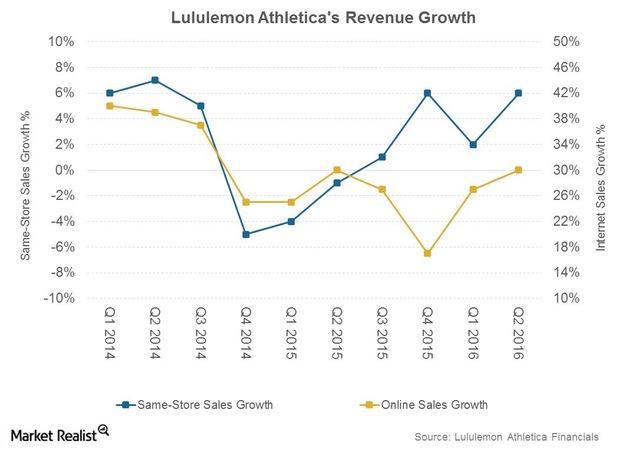

Lululemon’s same-store sales performance was healthy in 2Q16. There’s been a reversal in the negative trend that dogged the retailer for much of last year, particularly in its brick-and-mortar channel.

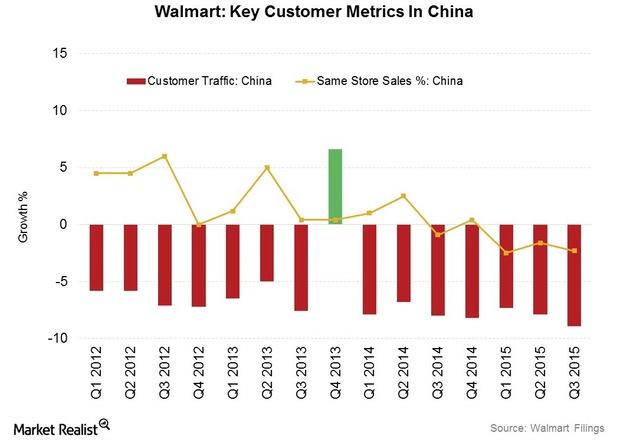

Why Walmart Isn’t A Heavyweight In China

In 2013, Walmart closed 29 underperforming stores in China. It also announced a revamp. It planned to open 110 new stores in focused geographies.

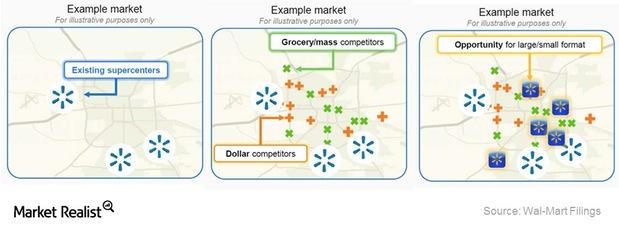

What The Supercenter Format Contributes To Walmart

Walmart (WMT) has been concentrating on expanding the store count of its larger supercenter format. A supercenter averages ~179,000 square feet in size.