PowerShares Intl Div Achiev ETF

Latest PowerShares Intl Div Achiev ETF News and Updates

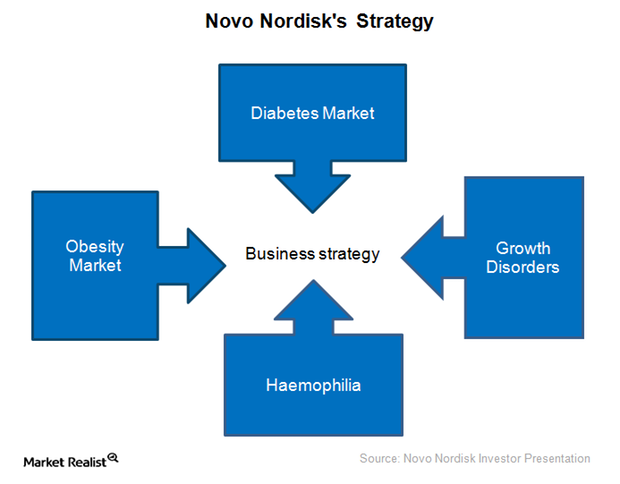

Novo Nordisk Is Focusing on These Strategic Areas in 2016

With 642 million people expected to suffer from diabetes globally by 2040, the disease is expected to offer multiple growth opportunities for Novo Nordisk.

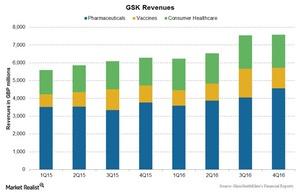

GlaxoSmithKline Increases Top Line in 2Q16

GlaxoSmithKline (GSK) reported a 10.9% increase in its top line in its 2Q16 earnings on July 27, 2016. It met Wall Street analysts’ estimates for revenues and EPS.

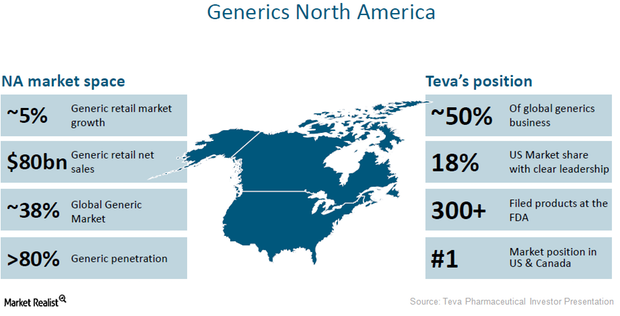

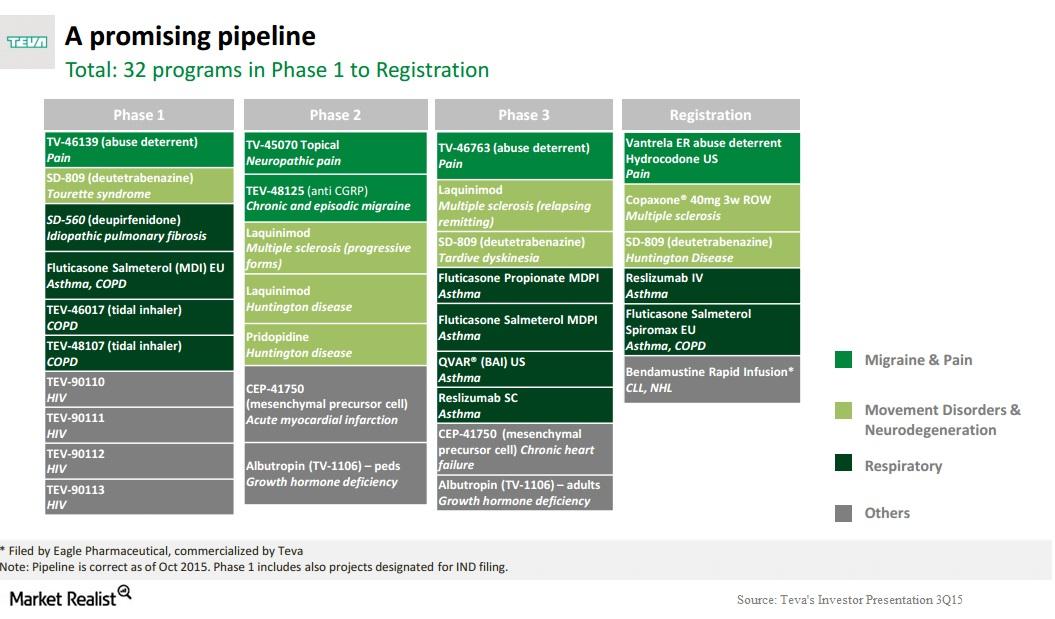

Teva’s Share of the US Generics Market Could Boost Its Stock

Teva Pharmaceutical Industries accounts for 18% of the US generic drug market. This share is significantly higher than those of Mylan, Novartis, and Pfizer.

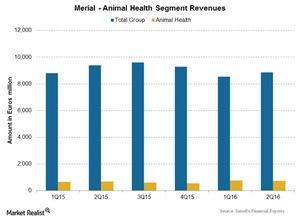

How Merial Contributes to Sanofi’s Growth

Merial, Sanofi’s (SNY) Animal Health segment, reported total revenues of 725 million euros (about $818.6 million), which is a 9.1% increase over 2Q15.

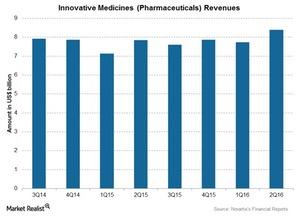

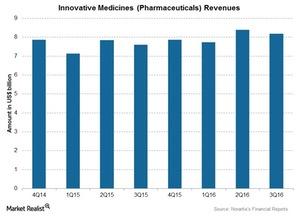

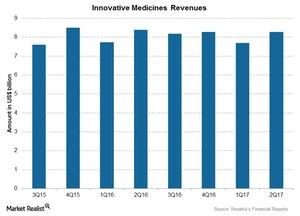

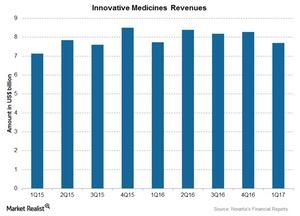

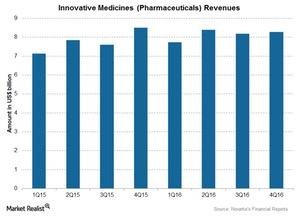

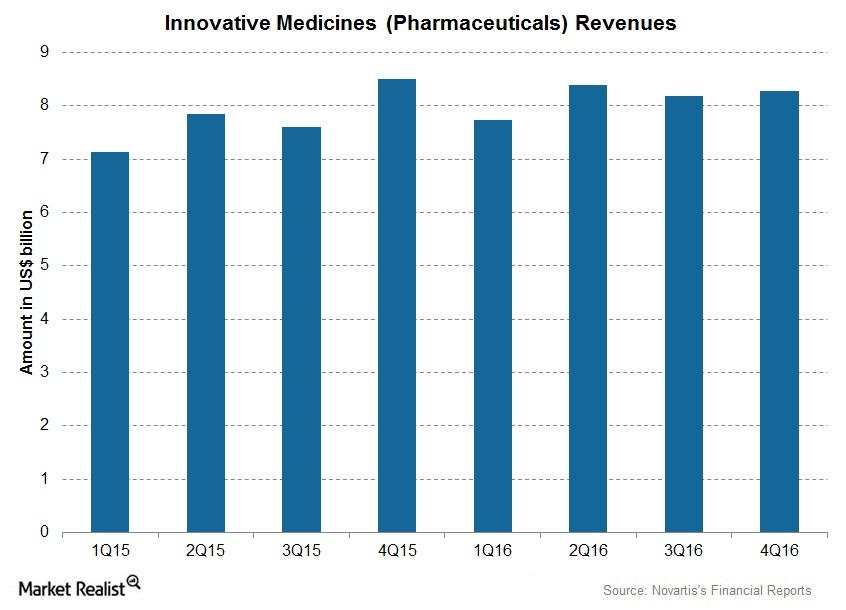

Novartis’s 3Q16 Estimates: Innovative Medicines Segment

Novartis’s Innovative Medicines segment, formerly referred to as the Pharmaceutical segment, consists of products for a variety of therapeutic areas.

Novartis’s 4Q16 Estimates: Innovative Medicines Segment

The overall contribution of the Innovative Medicines segment is ~67% of Novartis’s total revenues.

Teva’s Respiratory Drugs Contribute 11% to Specialty Medicines

Teva’s respiratory drugs franchise provides solutions for asthma, COPD, and allergic rhinitis. Respiratory drugs contributed nearly 11% of total revenues for Teva’s Specialty Medicines in 2014.

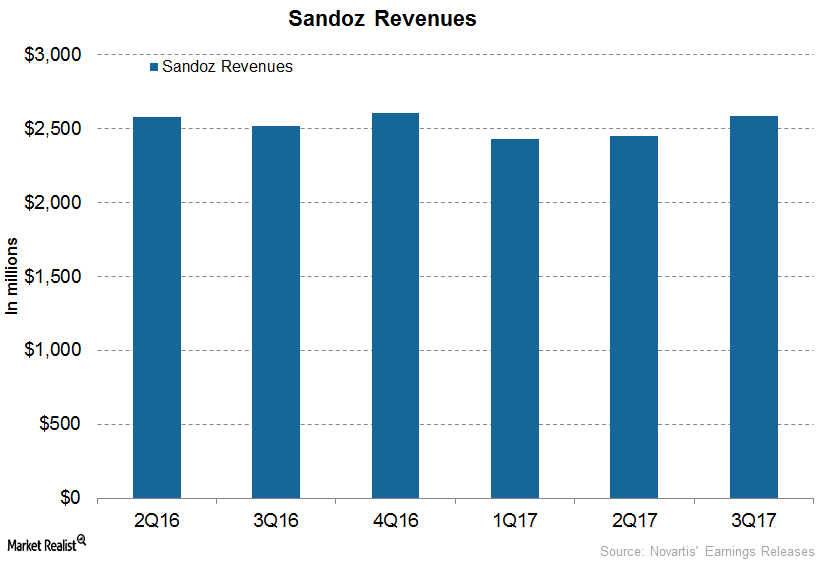

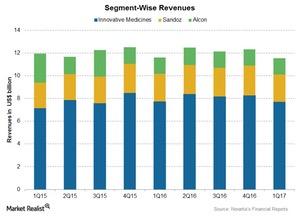

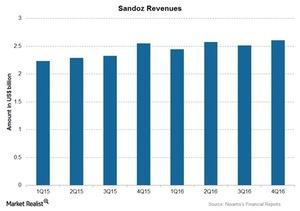

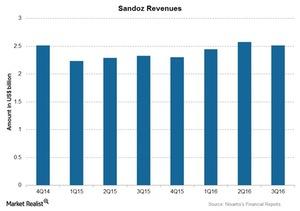

How Is Novartis’s Subsidiary Sandoz Positioned for 2018?

In 1Q17, 2Q17, and 3Q17, Novartis’s (NVS) subsidiary Sandoz generated revenues of $2.4 billion, $2.5 billion, and $2.6 billion, respectively.

Behind Novartis’s 4Q17 Estimates: Innovative Medicines

The Innovative Medicines segment is expected to report growth in operating revenues for 4Q17.

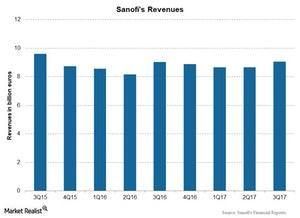

Behind Sanofi’s 3Q17 Revenue Growth

Sanofi (SNY) reported a growth of 4.7% in revenues at constant exchange rates to 9.05 billion euros, compared with 9.03 billion euros in 3Q16.

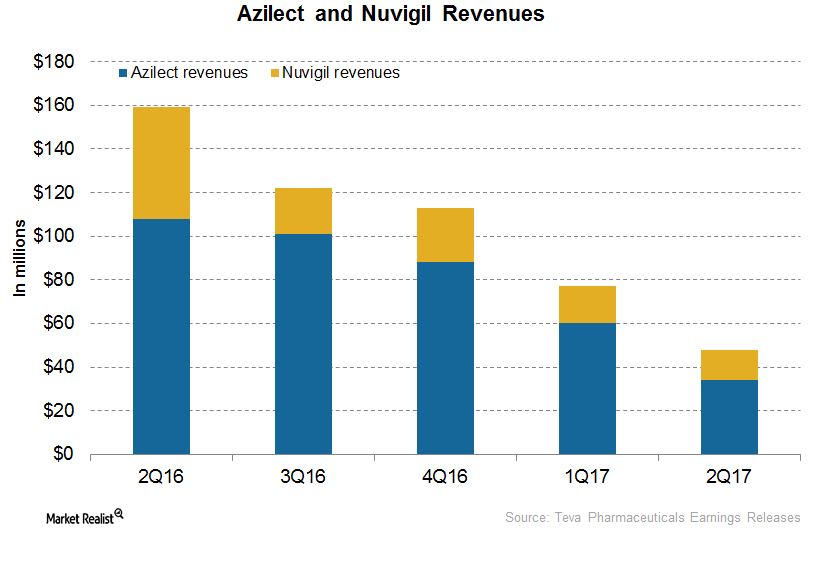

How TEVA’s CNS Drugs Performed in 1H17

In 1H17, Teva Pharmaceutical’s (TEVA) CNS (central nervous system) business generated revenues of ~$2.3 billion, or ~16% lower YoY (year-over-year).

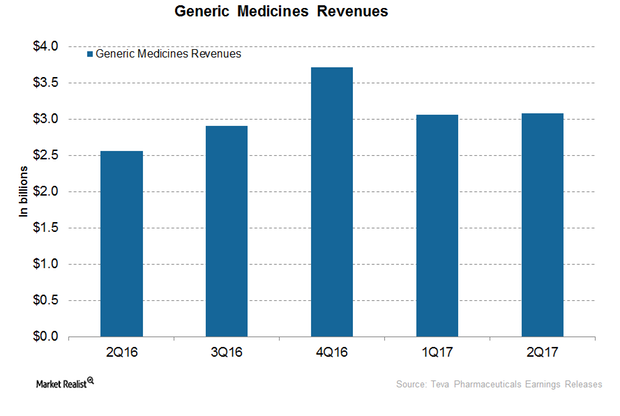

How TEVA’s Generic Medicines Franchise Is Positioned after 1H17

In 1H17, Teva Pharmaceutical’s (TEVA) generic medicines business generated revenues of ~$6.1 billion, or ~22% higher YoY (year-over-year).

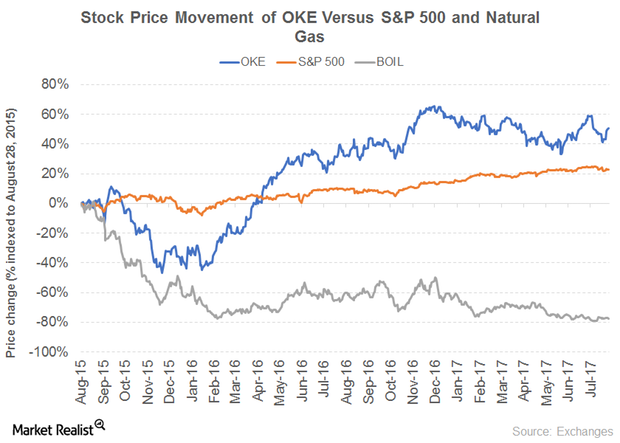

How ONEOK Has Managed Its Impressive Dividend Yield

How ONEOK has maintained a 4% yield ONEOK (OKE), the general partner and 41% owner of ONEOK Partners, owns one of the country’s premier natural gas liquid systems. The company’s revenue grew 15% in 2016 after falling 36% in 2015. The growth was driven by its Natural Gas Gathering and Processing, Natural Gas Liquids, and […]

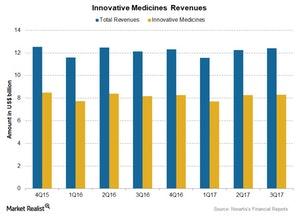

What Happened to Novartis’s Innovative Medicines Business in 2Q17?

Novartis’s Innovative Medicines segment contributed over 67% of NVS’s total revenues at nearly $8.3 billion for the quarter.

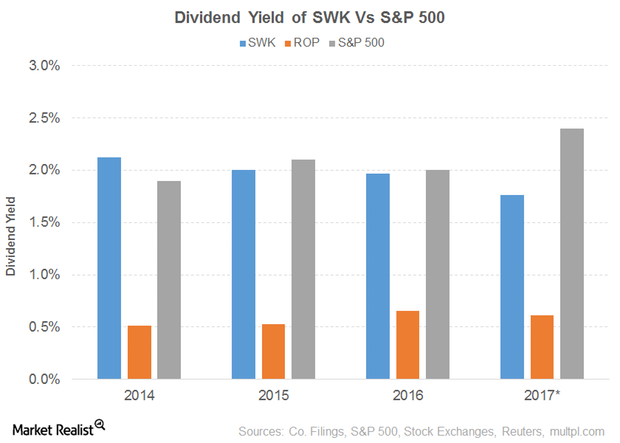

Dividend Yield of Stanley Black & Decker

Stanley Black & Decker’s (SWK) PE ratio of 21.1x is pitted against a sector average of 29.3x. The dividend yield of 1.8% is pitted against a sector average of 1.6%.

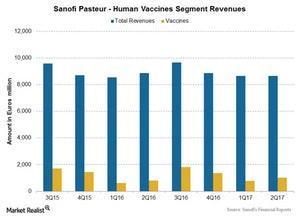

A Look at Sanofi Pasteur’s Performance in 2Q17

Sanofi Pasteur Sanofi Pasteur, Sanofi’s (SNY) human vaccine business, reported 26.2% revenue growth at constant exchange rates to 1.0 billion euros in 2Q17. Sanofi Pasteur reported growth across all product franchises during the quarter. Sanofi Pasteur includes polio/pertussis/Hib (haemophilus influenzae type b) vaccines, adult booster vaccines, meningitis vaccines, influenza vaccines, travel and other endemic vaccines, […]

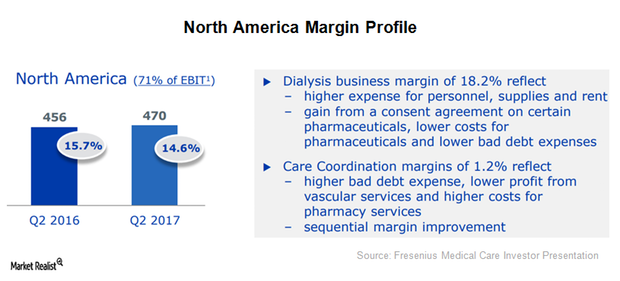

North America: Fresenius Medical Care’s Major Target Market in 2017

In 2Q17, Fresenius Medical Care (FMS) reported revenues close to 3.3 billion euros, which represents year-over-year growth of ~11%.

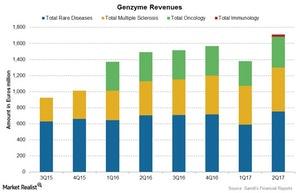

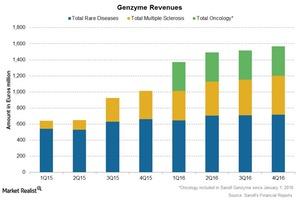

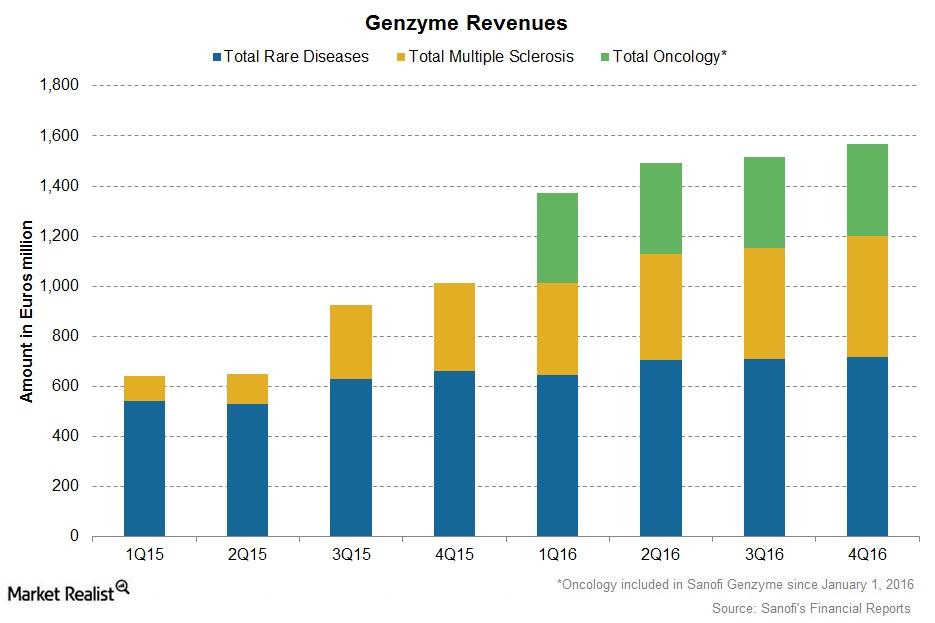

Sanofi Genzyme Continues Driving Revenue Growth in 2Q17

Sanofi Genzyme In 2Q17, Sanofi Genzyme (SNY) reported revenue growth of 13.5% to 1.7 billion euros. Considering a constant structure and constant exchange rates, the growth was 14.4%. Sanofi Genzyme, which includes product revenue from the multiple sclerosis, rare disease, oncology, and immunology franchises, reported a sales increase of ~14.6% to 1.7 billion euros. This rise was […]

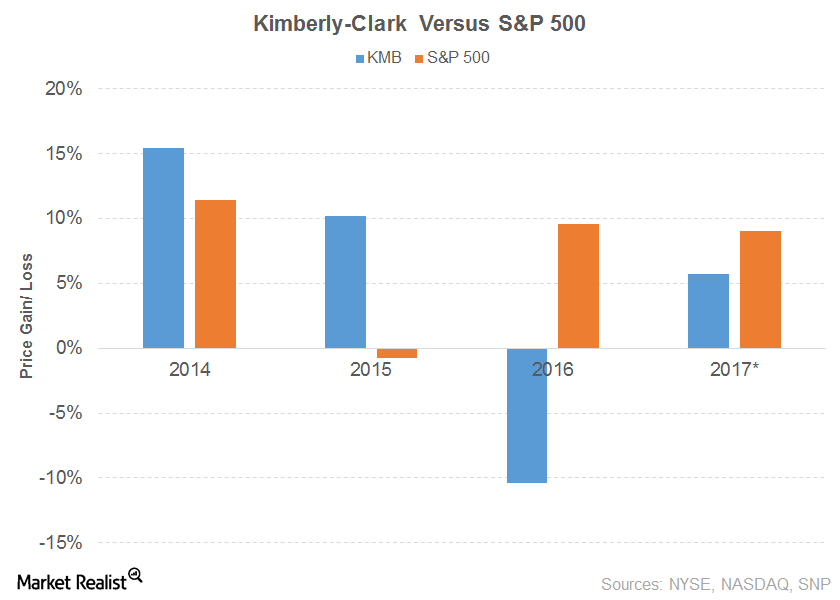

Kimberly-Clark’s Dividend Growth

Kimberly-Clark’s (KMB) 2016 net sales fell 2.0% due to declines in every segment.

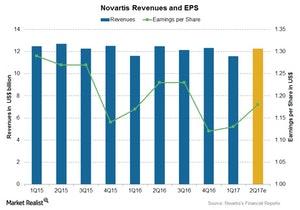

Analysts Expect Novartis’s Revenues to Fall in 2Q17

Analysts expect Novartis’s (NVS) revenues to fall ~1.6% to $12.3 billion in 2Q17 due to the effects of the acquisition and divestiture of some of its products.

Inside Novartis’s Segment-Wise Performance in 1Q17

Novartis is largely exposed to currency risk, as ~50% of its total revenues are reported from international markets.

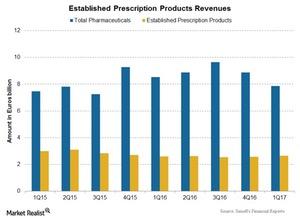

Performance of Sanofi’s Established Prescription Products in 1Q17

Revenues from Sanofi’s Established Prescription Products rose 0.6% at constant exchange rates during 1Q17 and reported revenues of ~2.6 billion euros in 1Q17.

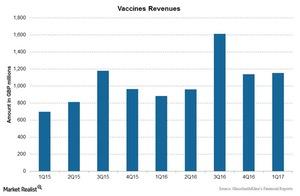

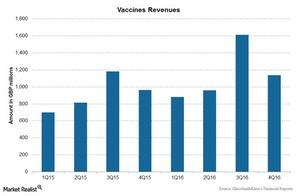

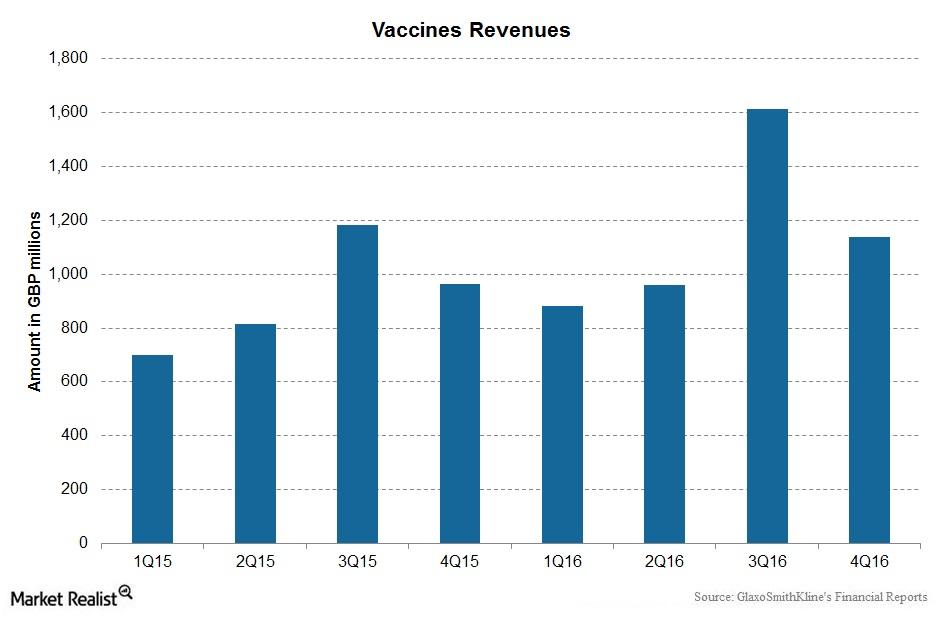

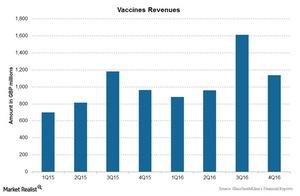

How GlaxoSmithKline’s Vaccines Business Performed in 1Q17

GlaxoSmithKline (GSK) is focused on strengthening its vaccines business, so it acquired the meningitis and other vaccines business from Novartis (NVS).

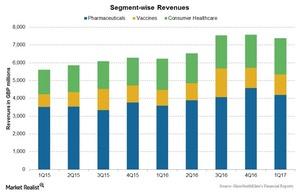

How GlaxoSmithKline’s Business Segments Performed in 1Q17

The company reported operational growth of 5% in its revenues to 7.4 billion pounds for 1Q17.

Novartis’s 1Q17 Earnings: Innovative Medicines Segment

Novartis’s (NVS) Innovative Medicines segment contributed ~66.6% to overall 1Q17 revenue, or $7.7 billion.

GlaxoSmithKline’s 1Q17 Estimates: Vaccines Business

The Novartis acquisition has improved sales for GSK’s Vaccines business, mainly driven by the sales of meningitis vaccines Bexsero in Europe and Menveo in the US and Europe.

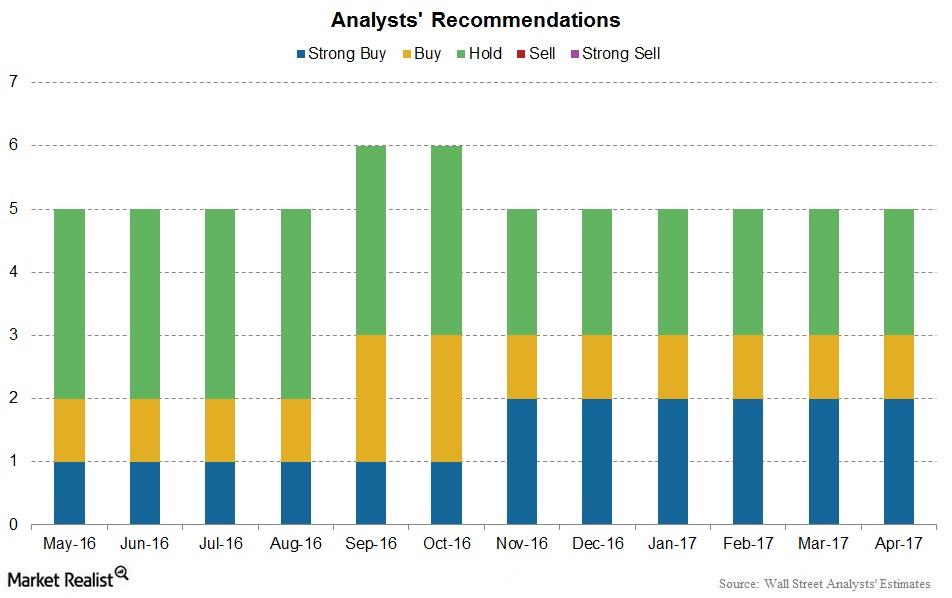

Analyst Ratings and Recommendations for Novartis

As of April 21, 2017, there are five analysts tracking Novartis. Of those, two have recommended a “strong buy,” and one has recommended a “buy.”

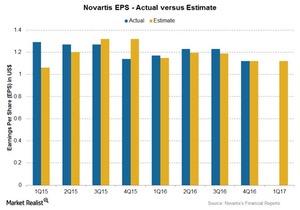

Analyst Estimates for Novartis’s 1Q17 Earnings

Novartis is set to release its 1Q17 earnings on April 25, 2017. Analysts estimate its 1Q17 EPS at $1.12 with revenues of ~$11.7 billion.

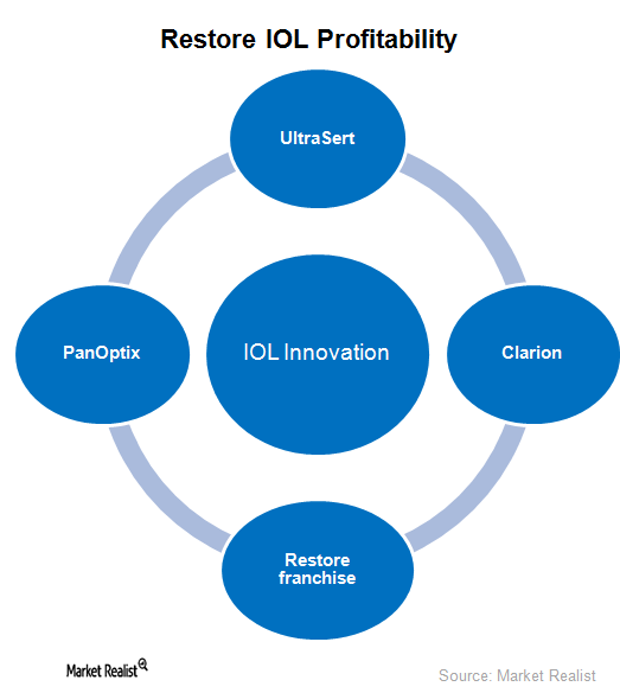

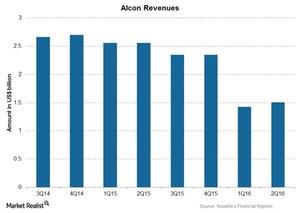

Novartis Expects to Restore Alcon’s Profitability in the Future

Novartis (NVS) has focused its efforts on improving its customer service levels and entering into lucrative partnering deals to boost profitability for its Alcon business.

Sanofi Genzyme Continued Growth in 2016

Sanofi’s (SNY) 2016 revenues were mainly driven by Sanofi Genzyme and Sanofi Pasteur.

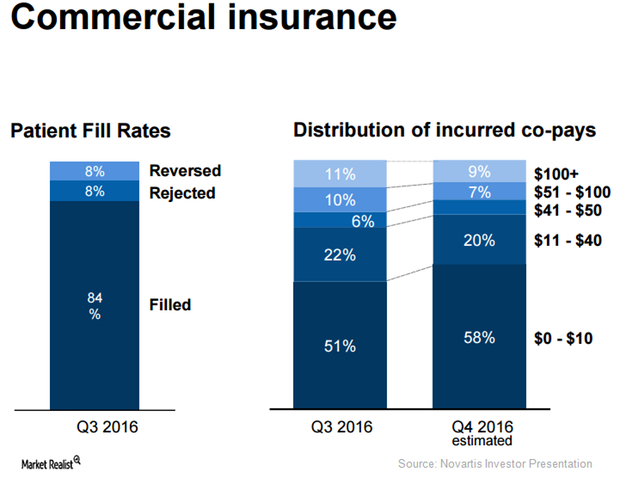

Reduced Co-pays May Boost Demand for Entresto

Compared to 43% at the end of 2015, Novartis’s (NVS) Entresto managed to attain a preferred formulary position in 66% of commercial plans in the US at the end of 2016.

Performance of GlaxoSmithKline’s Vaccines Business in 2016

GSK’s Vaccines business reported growth of 14% to ~4.6 billion pounds in 2016.

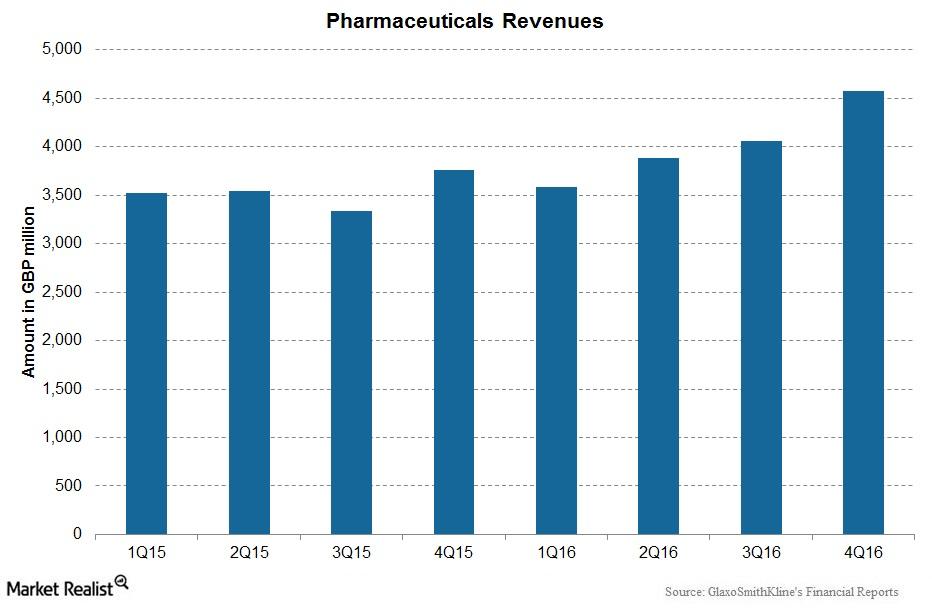

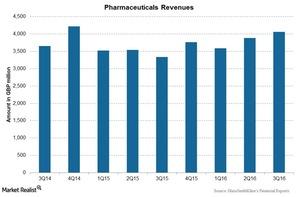

GlaxoSmithKline’s Pharmaceuticals Segment Performance

Overall, the Pharmaceutical segment’s contribution to GSK’s total revenues was 57.7% in 2016.

Sandoz: Novartis’s Generics Business in 2016

Sandoz, the generics arm of Novartis (NVS), is the number two generic medicines provider worldwide, and it’s number one in differentiated generics.

Novartis’s Innovative Medicines Segment in 2016

Novartis’s Innovative Medicines segment, formerly referred to as its Pharmaceuticals segment, consists of products for therapeutic areas including oncology, respiratory, and established medicines.

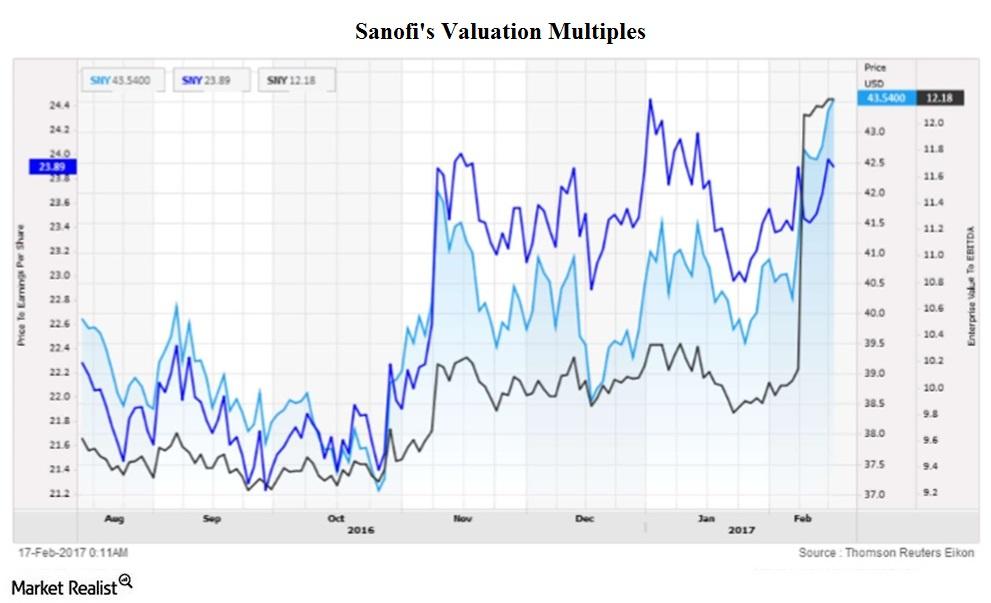

What Happened to Sanofi’s Valuation after 4Q16?

On February 16, 2017, Sanofi was trading at a forward PE multiple of ~13.9x, as compared to the industry average of 15.7x.

This Keeps Driving Sanofi’s Growth

Sanofi’s (SNY) 4Q16 revenues were mainly driven by Genzyme and Sanofi Pasteur.

GlaxoSmithKline’s Vaccines Business Reported Growth in 4Q16

GSK’s Vaccines segment reported a rise of 18.0% to 1.1 billion pounds in 4Q16. The Novartis acquisition has improved sales for the segment.

4Q16 Performance of GlaxoSmithKline’s Business Segments

Revenues for GSK’s Pharmaceuticals segment saw a shift in product performance, falling due to lower sales of its key products Seretide and Advair.

Novartis’s Innovative Medicines Segment in 4Q16

The overall contribution from NVS’s Innovative Medicines segment was ~67%, reaching $8.3 billion in 4Q16.

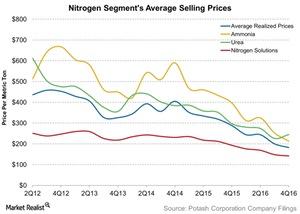

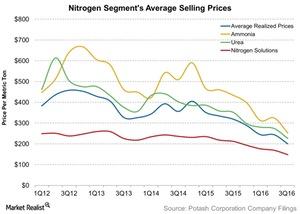

PotashCorp in 4Q16: Nitrogen Prices Added Salt to the Wound

In 4Q16, the overall average nitrogen selling price fell 37.0% to $182 per ton, from $288 per ton in 4Q15.

How Did Novartis’s Generics Business Perform in 3Q16?

Sandoz reported a decline of 1% in 3Q16 revenues at constant exchange rates.

How GlaxoSmithKline’s Pharmaceuticals Segment Has Performed

GlaxoSmithKline’s (GSK) Pharmaceuticals segment fell substantially in 2015 due to its divestment of its oncology business to Novartis (NVS) in March 2015.

How Sandoz Performed for Novartis in 3Q16

Sandoz, the generics arm of Novartis (NVS), is the number-two generic medicines provider worldwide. It’s number one in differentiated generics.

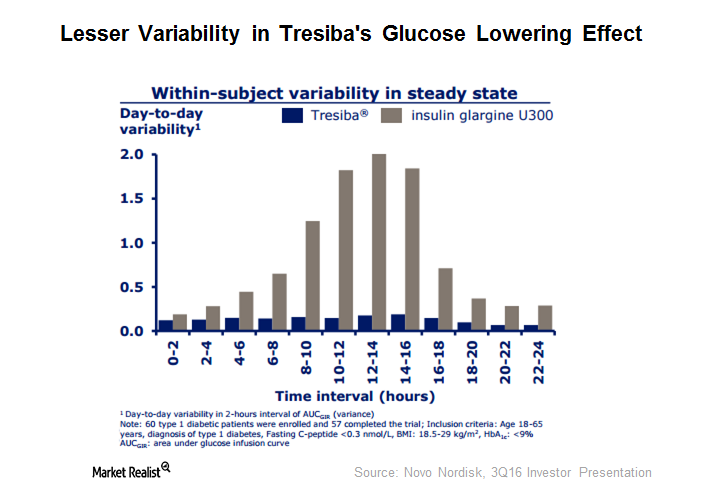

How Tresiba Helps Novo Achieve Its Growth Targets

During the first nine months of 2016, Novo’s (NVO) new generation portfolio garnered 2.8 billion Danish kroner.

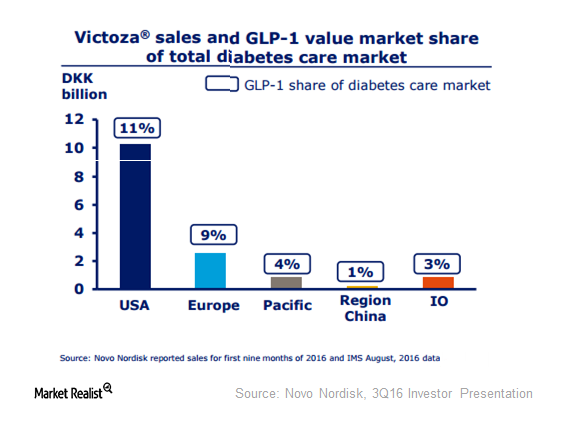

Victoza Dominates Global GLP-1 Class

Novo’s (NVO) Victoza is a glucagon-like peptide-1 (or GLP-1) therapy for type 2 Diabetes patients.

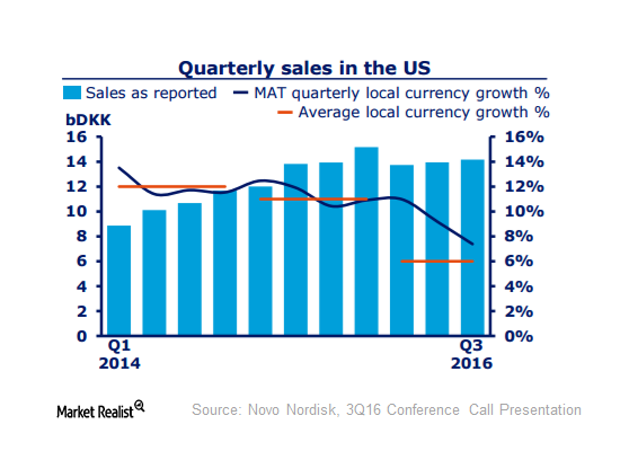

US Still the Largest Market for Novo Nordisk

During 3Q16, Novo’s sales in the US rose 2% in local currency terms to 14.2 billion Danish kroner.

Why Did PotashCorp’s Nitrogen Prices Fall in 3Q16?

Nitrogen selling prices PotashCorp (POT) sells nitrogen fertilizers such as ammonia, urea, and nitrogen solutions. It competes with other natural gas–based nitrogen producers such as CF Industries (CF) and Terra Nitrogen (TNH), which primarily produce and sell nitrogen fertilizers. Agrium (AGU), which is a part of the PowerShares International Dividend Achievers ETF (PID), produces nitrogen fertilizers […]

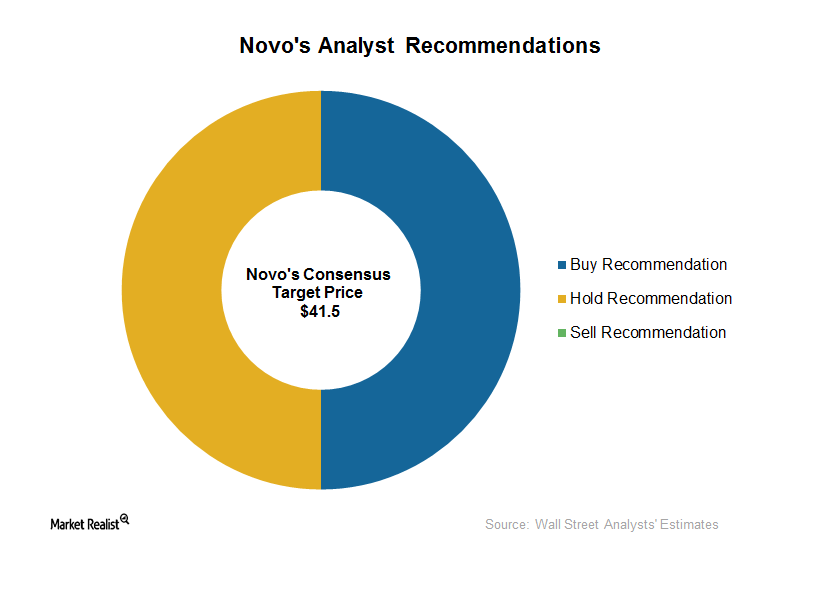

How Much Is the Return Opportunity for Novo Nordisk in 3Q16?

A Bloomberg survey of two brokerage houses on October 24, 2016, reflected a 50% “buy” rating and a 50% “hold” rating for the stock.

Novartis’s 3Q16 Estimates: Will Alcon Recover Its Growth?

Alcon, Novartis’s (NVS) eye care segment, researches, develops, manufactures, and markets eye care products in over 180 countries worldwide.