Occidental Petroleum Corp

Latest Occidental Petroleum Corp News and Updates

Perfect Storm for Natural Gas—What Are the Top Stock Picks?

With nearly 100 percent gains YTD, natural gas has become one of the top-performing commodities in 2021. What are the best natural gas stocks to buy now?

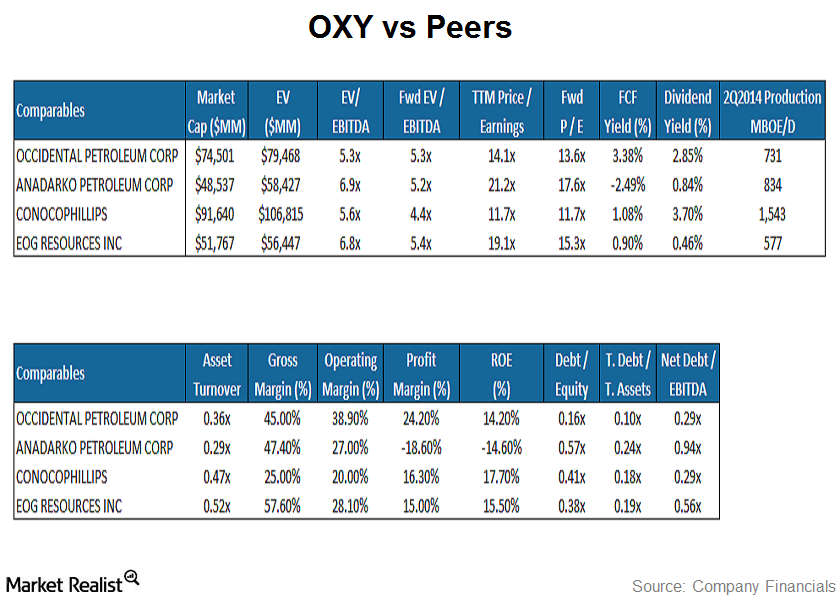

How does Occidental Petroleum compare to industry peers?

In terms of profitability, OXY has the highest profit margins amongst its peers at 24.2%. OXY also has one of the highest dividend yields at 2.85%.

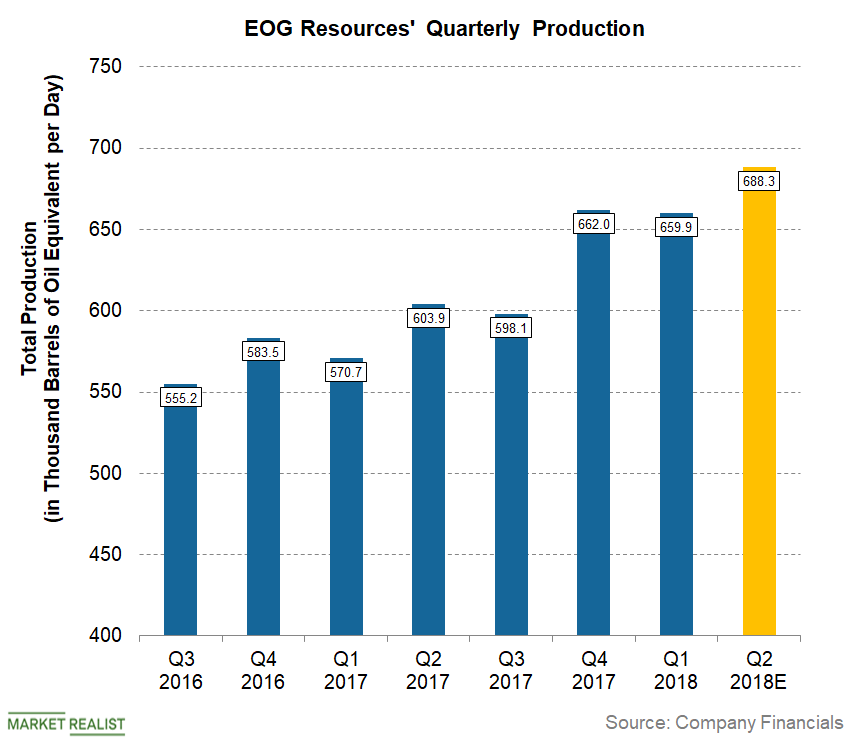

Understanding EOG Resources’ Q2 2018 Production Guidance

For the second quarter, EOG Resources expects total production in the range of 670.3–706.2 Mboepd (thousand barrels of oil equivalent per day).

Analyzing Denbury Resources’ 1Q16 Earnings Call

For 1Q16, Denbury Resources (DNR) reported an adjusted EBITDA of ~$105 million with an EBITDA margin of ~40%. Its EBITDA margin is only ~20% lower.

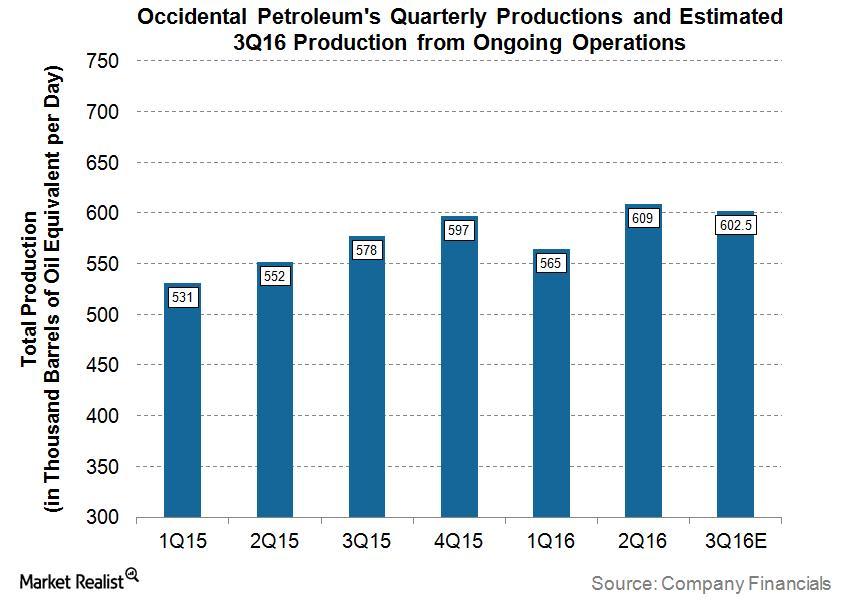

Did Occidental Petroleum Set a High Bar for 3Q16 Production?

For 3Q16, Occidental Petroleum expects its total production from ongoing operations to be in the range of 600–605 Mboe per day.

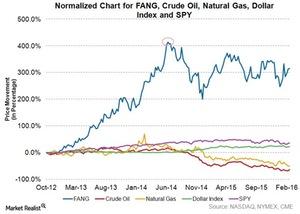

What’s Been Driving Diamondback Energy’s Stock Price Movement?

Diamondback Energy’s stock price saw uptrend from October 2012 to June 2014. When NYMEX WTI crude oil started falling in June 2014, FANG’s stock peaked.

Are You Looking at the Right Oil-Weighted Stocks?

On May 16, US crude oil June futures rose 0.3% and closed at $71.49 per barrel, a more-than-three-year high.

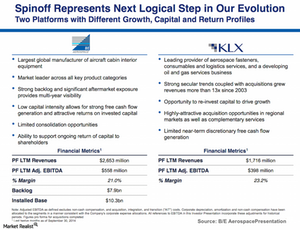

B/E Aerospace spun off KLX business on activist push

On December 17, 2014, B/E Aerospace completed its spin-off of KLX, Inc., from B/E Aerospace, and KLX started trading on NASDAQ under the ticker symbol KLXI.

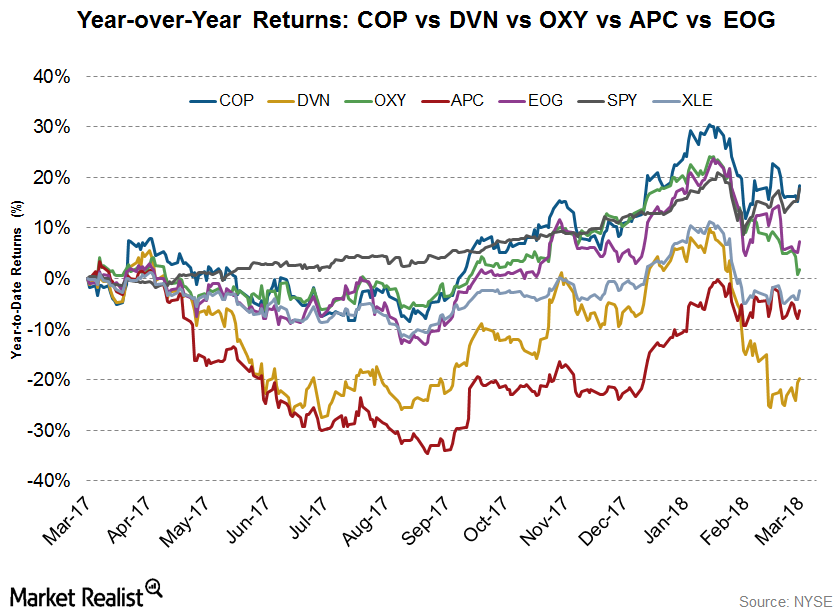

Stock Comparison: How Have COP, DVN, OXY, APC, and EOG Fared?

Stock performance In this article, we’ll discuss the year-to-date (YTD) stock performance of ConocoPhillips (COP), Devon Energy (DVN), Occidental Petroleum (OXY), Anadarko Petroleum (APC), and EOG Resources (EOG), which reported the highest revenue among upstream companies in fiscal 2017. Outliers and underperformers The above image shows that ConocoPhillips (COP) is the outlier among peers. YoY […]

Why US Crude Oil Prices Are Steady

On June 14, Russia and Saudi Arabia announced a bilateral framework to increase cooperation and manage the oil market.

Tesla Institutional Investors: Who All Sold Too Early?

In 2019, Tesla (TSLA) rose 29.3%. The S&P 500 Index gained 29.2%. The top institutional investors were bullish on the electric car manufacturer in Q3 2019.

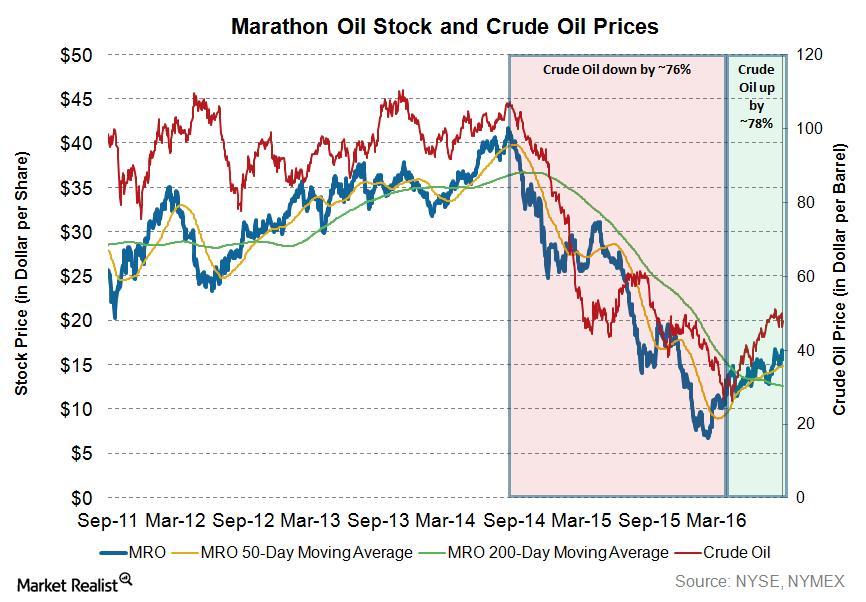

How the Decline in Crude Oil Prices Affected Marathon Oil

Although crude oil prices have rallied ~78% from their lows in February 2016, crude is still trading ~57% lower than its high two years ago.

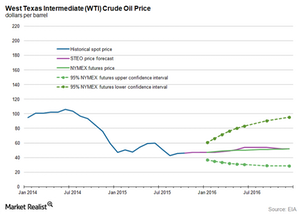

Crude Oil Bear Market: Worst Case Scenarios for 2016

Goldman Sachs (GS) suggests crude oil prices could test $20 per barrel in a worst case scenario in 2016.Energy & Utilities Why the triple top and triple bottom patterns are important

The triple top pattern is formed in the uptrend. In this pattern, three consecutive peaks are formed. The peaks have roughly the same price level.

Should Energy Investors Be Cautious with Oil-Weighted Stocks?

On March 7, US crude oil April futures fell 2.3% and closed at $61.15 per barrel. Here’s what you need to know.

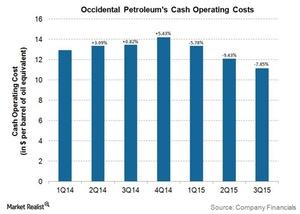

How Is Occidental Petroleum Managing the Falling Energy Prices?

According to Occidental Petroleum’s 3Q15 form 10Q filing, changes in energy prices affected its quarterly earnings by $30 million in crude oil.

Top Oil-Producing Companies’ Stock Prices Fall

Looking at the top US-listed oil-producing companies’ stock prices, ExxonMobil, BP, and Chevron have fallen by 40.5%, 41.6%, and 31.5% in 2020.

How Does the Oil Price Crash Impact Warren Buffett?

For the first time, WTI crude prices fell into the negative zone during trade on Monday. Warren Buffett invested in Occidental Petroleum last year.

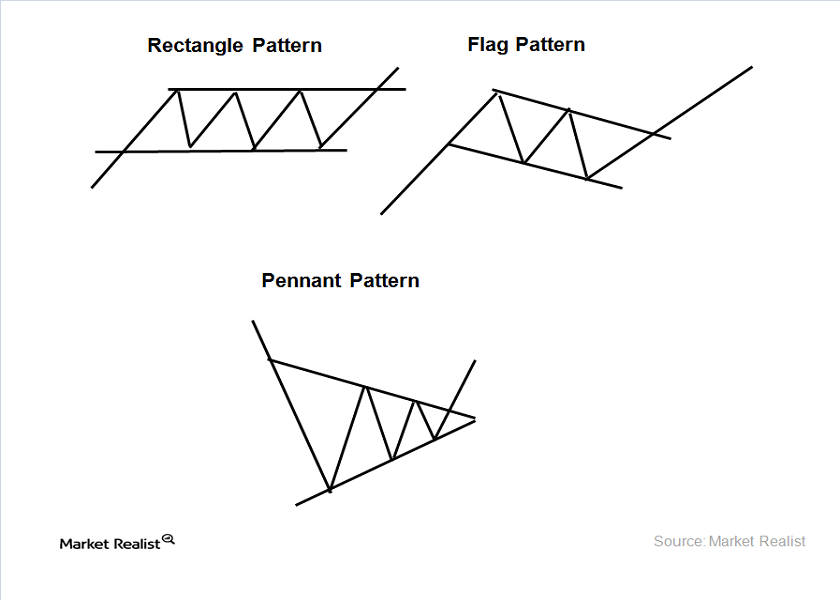

Technical analysis—the rectangle, flag, and pennant patterns

In the rectangle pattern, it’s advisable to buy stock at support and sell at resistance. This pattern is formed in the uptrend and downtrend.

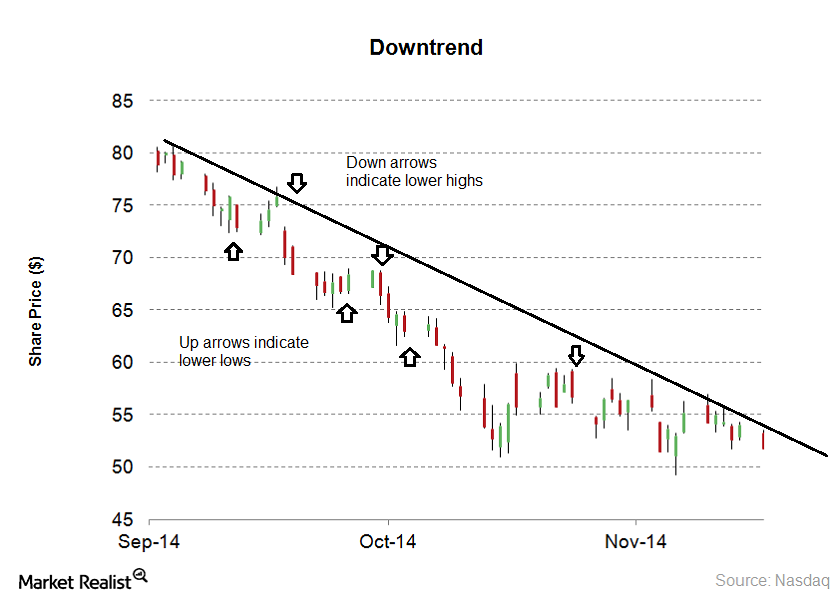

Why downtrends and sideways trends impact investors

It’s advisable to sell stocks on bounces when the stock is in a downtrend. In a sideways trend, it’s advisable to buy stock at support levels and sell at resistance levels.

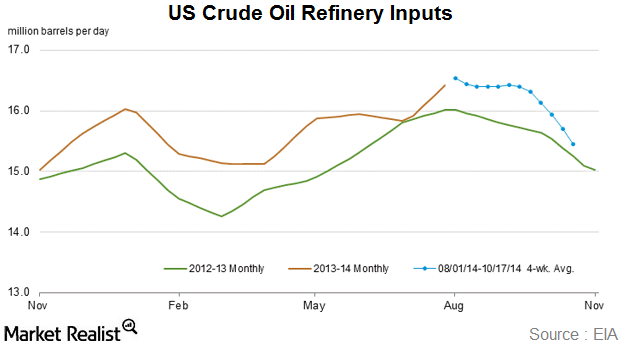

Why peak refinery maintenance season affects crude inventory

U.S. crude oil refinery inputs averaged 15.2 million barrels per day during the week ending October 17. Input levels were 113,000 bpd less than the previous week’s average.

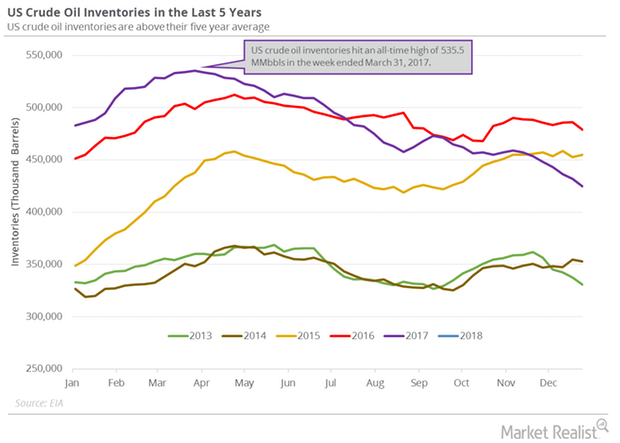

US Crude Oil Production Fell and Boosted Oil Futures

US crude oil production fell by 290,000 bpd (barrels per day) or 3% to 9,492,000 bpd between December 29, 2017, and January 5, 2018.

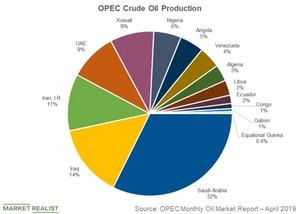

OPEC’s Role in World Oil Production

OPEC (the Organisation of the Petroleum Exporting Countries) aims to “coordinate and unify the petroleum policies of its Member Countries.”

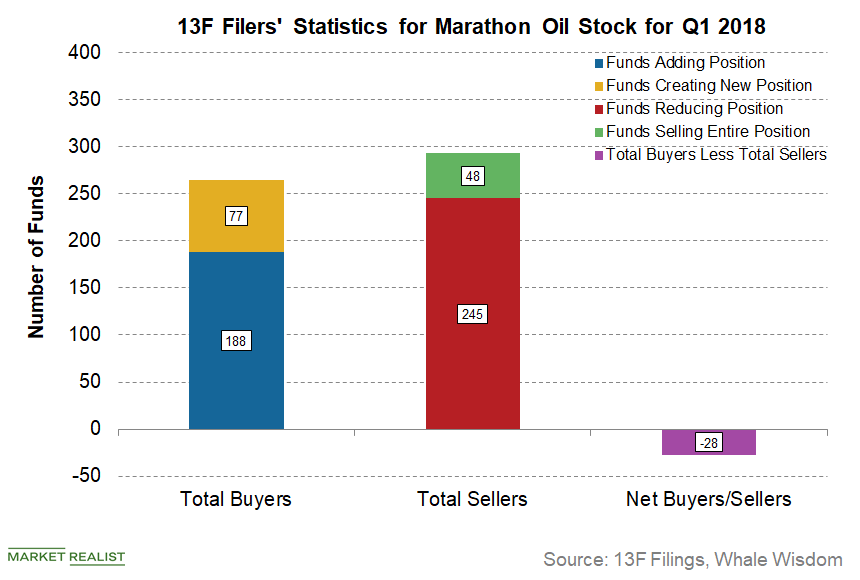

Are Institutional Investors Selling Marathon Oil Stock?

In Q1 2018, 265 funds were “buyers” of Marathon Oil (MRO) stock, either creating new positions or adding to existing positions.

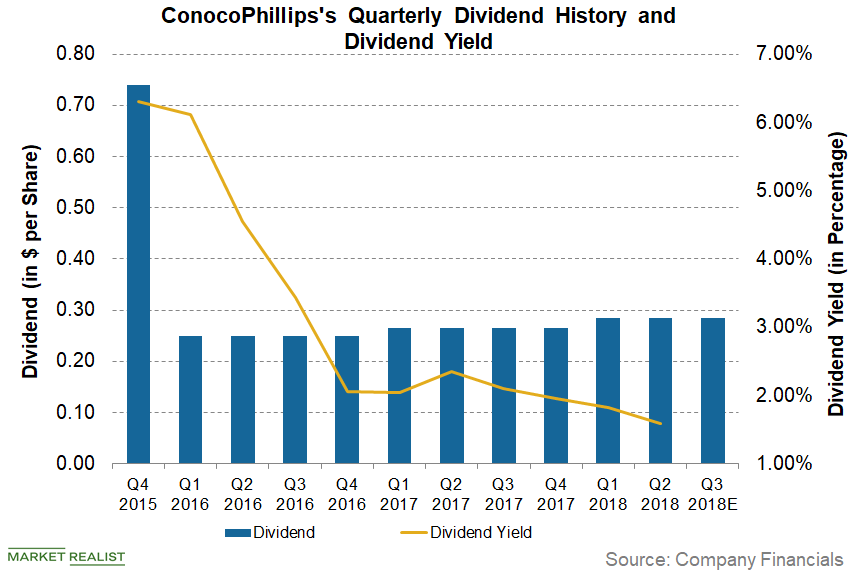

Analyzing ConocoPhillips’s Dividend and Dividend Yield

On July 11, ConocoPhillips (COP) announced a dividend of $0.285 per share on its common stock.

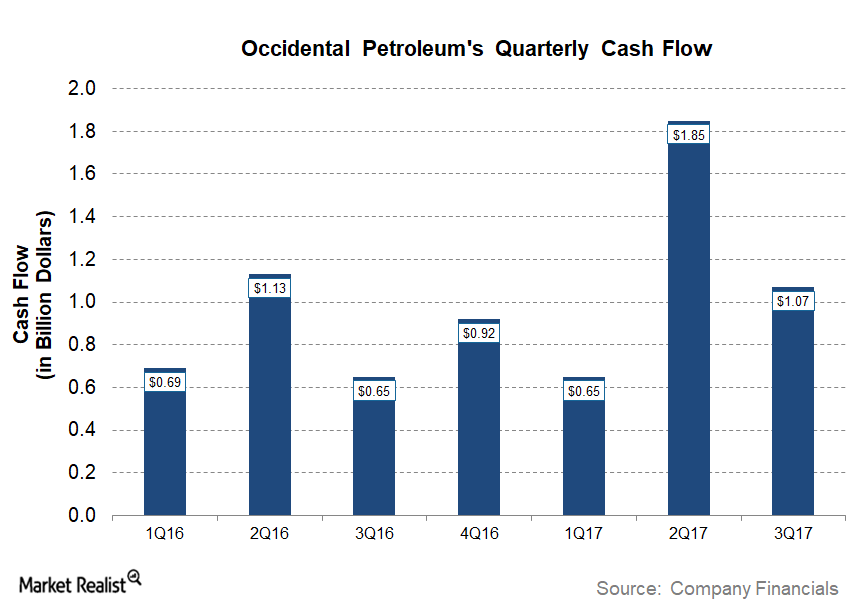

Did Occidental Petroleum Generate Positive Free Cash Flow in 3Q17?

On a year-over-year basis, OXY’s 3Q17 operating cash flow was ~65% higher than the ~$650 million it generated in 3Q16.

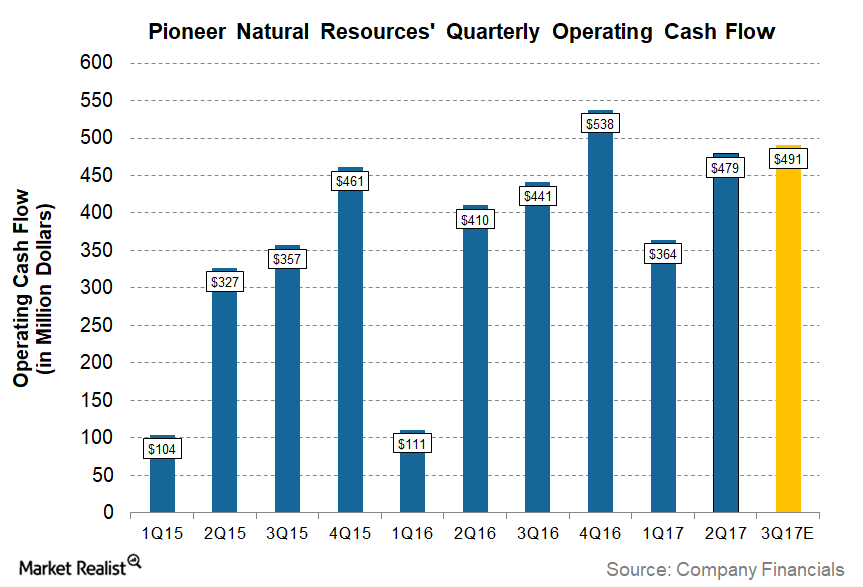

What to Expect from Pioneer Natural Resources’ Cash Flow in 3Q17

Wall Street analysts expect Pioneer Natural Resources (PXD) to report year-over-year higher cash flow of ~$491 million in 3Q17 compared to ~$441 million in 3Q16.

Analyzing Short Interest in Occidental Petroleum Stock

On July 14, 2017, Occidental Petroleum’s (OXY) total shares shorted (or short interest) stood at ~10.9 million, and its average daily volume was ~4.8 million.

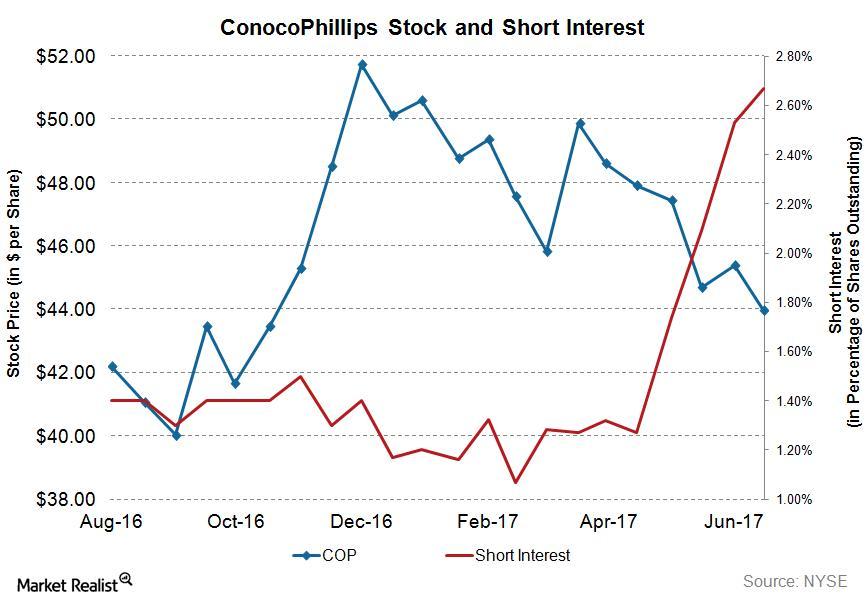

Analyzing Short Interest in ConocoPhillips Stock

On March 31, 2017, 1,282 13F filers held ConocoPhillips (COP) stock in their portfolios. However, only 19 filers featured COP in their top ten holdings.

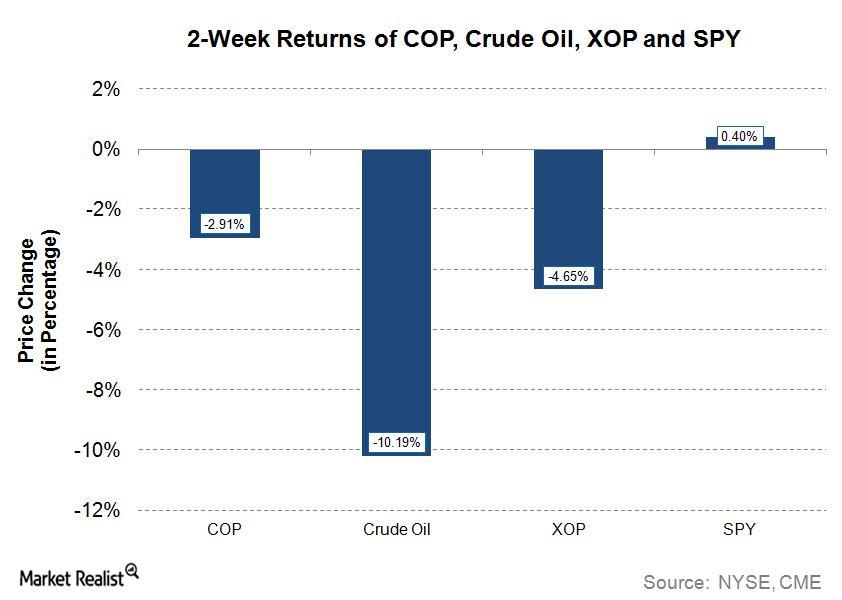

Why ConocoPhillips Stock Is Outperforming Crude Oil and Peers

In the last two weeks, the stock of ConocoPhillips (COP), a crude oil (USO) and natural gas (UNG) producer, has outperformed crude oil prices.

Are Companies That Have Done Acquisitions Outperforming?

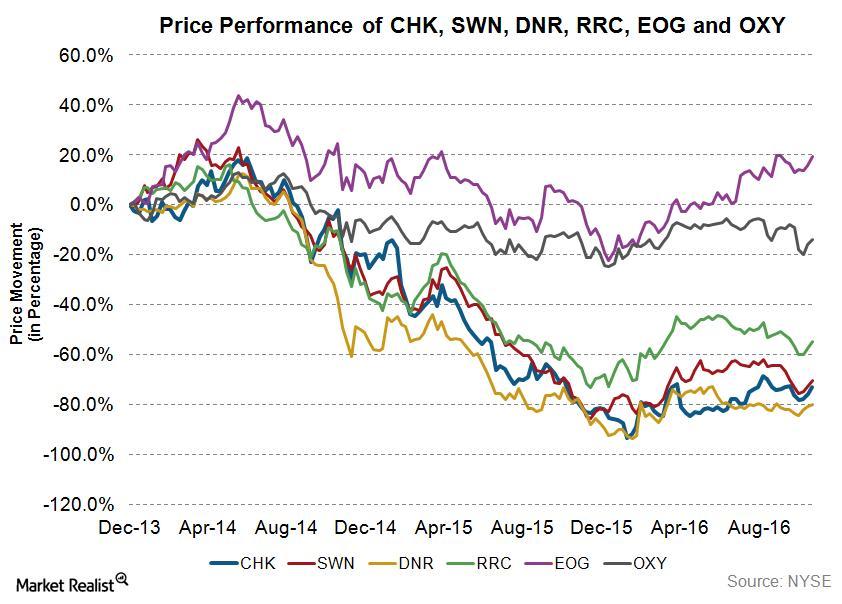

Upstream companies’ performance In the last two parts of this series, we have seen that some upstream companies, namely Range Resources (RRC), EOG Resources (EOG), and Occidental Petroleum (OXY), have taken advantage of lower crude oil (USO) and natural gas (UNG) prices through acquisitions. In this part, we’ll see if these companies are outperforming Chesapeake […]

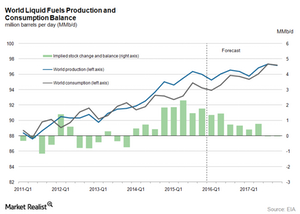

Why Is There a Crude Oil Supply and Demand Gap in 2016 and 2017?

The EIA estimates the global crude oil supply and demand gap to average 1 MMbpd in 2016 and 0.2 MMbpd in 2017. It reported that global consumption should grow 1.2 MMbpd in 2016 and 1.5 MMbpd in 2017.

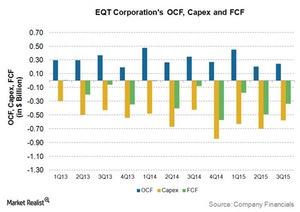

The Downward Trend of EQT’s Free Cash Flow

EQT has been reporting negative free cash flows since 2Q13. In 3Q15, EQT’s free cash flow was -$334 million.

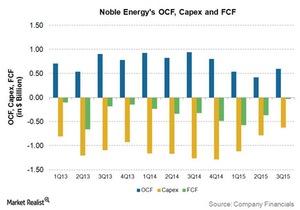

A Look at Noble Energy’s Free Cash Flow Trends

Noble Energy reported negative but improving free cash flows in 2015.

EOG Resources Failed to Hold above Its 200-Day Moving Average

In 3Q15, excluding the one-time items, EOG reported a profit of $0.02 per share, $0.32 better than the analyst consensus for a loss of $0.30 per share. Its revenues fell ~58% year-over-year to ~$2.17 billion.

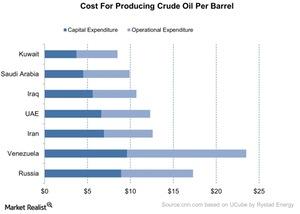

What’s the Break-Even Cost for the Top Oil Exporters?

Venezuela accounted for 17.5% of the world’s total proved crude oil reserves in 2014. BP (BP) conducted a study. It’s break-even cost is ~$23.50.

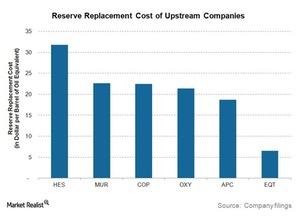

Weighing the Reserve Replacement Cost Metric of Upstream Energy Companies

The Reserve Replacement Cost metric gives us the cost incurred by an upstream company by considering the per-barrel-of-oil equivalent of a new reserve.

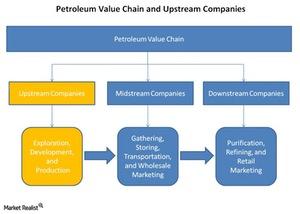

Where Do Upstream Energy Companies Sit along the Petroleum Value Chain?

Upstream energy companies are the starting point of the petroleum value chain and are involved in exploration, appraisal, development, and production.

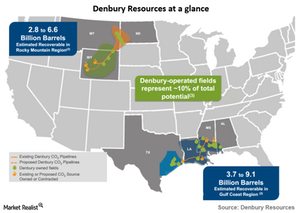

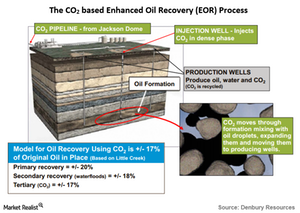

Introducing Denbury Resources

Denbury Resources primarily extracts oil and gas via carbon dioxide–based enhanced oil recovery (or EOR). This is also called tertiary oil recovery.

What’s special about Denbury Resources’s oil recovery method?

ConocoPhillips produces oil and gas via primary or secondary recovery methods. Denbury Resources mainly uses a tertiary, EOR method to produce its oil.