Norsk Hydro ADR

Latest Norsk Hydro ADR News and Updates

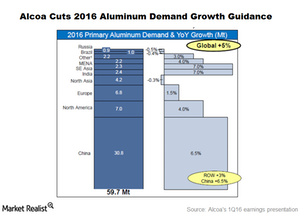

Why It’s No Surprise that Alcoa Cut Aluminum Demand Guidance

Alcoa has revised down its 2016 global aluminum demand growth projection to 5%.

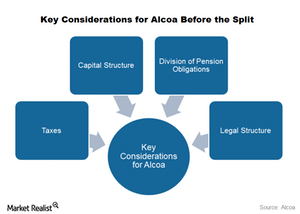

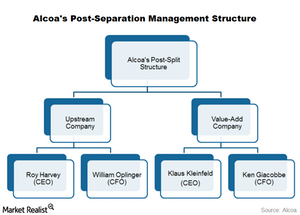

Could Alcoa’s Split Create Shareholder Value?

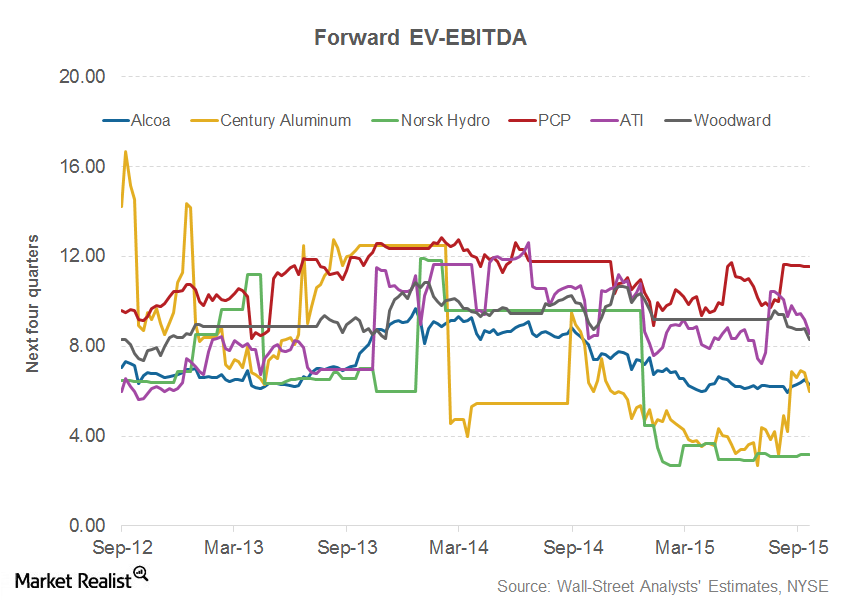

As an Alcoa (AA) shareholder, you might like to know whether the split will create value. The value, in this case, would basically mean whether the two separate companies would be worth more than the combined entity.

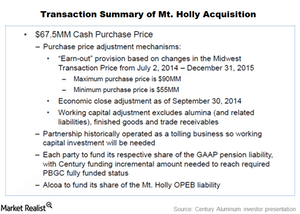

Was Alcoa Smart to Sell Mt. Holly Smelter to Century Aluminum?

In 2014, Alcoa (AA) sold its stake in the Mt. Holly smelter to Century Aluminum (CENX).

Must Know: What Value Can Elliott Management Add to Alcoa?

Elliott Management noted that it plans to engage in a “constructive dialogue” with Alcoa’s (AA) board regarding Alcoa’s split transaction and “additional available opportunities to maximize shareholder value.”

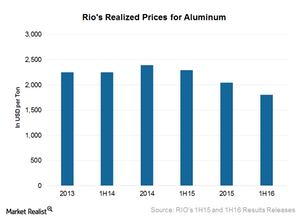

Rio’s Aluminum Division Didn’t Bow to Commodity Price Pressures

Rio Tinto’s (RIO) Aluminum division contributed 19% of its 1H16 underlying EBITDA (or earnings before interest, tax, depreciation, and amortization).

Will Elliott Management Start Taking an Active Interest in Alcoa?

Elliott Management plans to engage in a “constructive dialogue” with Alcoa’s board about Alcoa’s split transaction and “additional available opportunities to maximize shareholder value.”

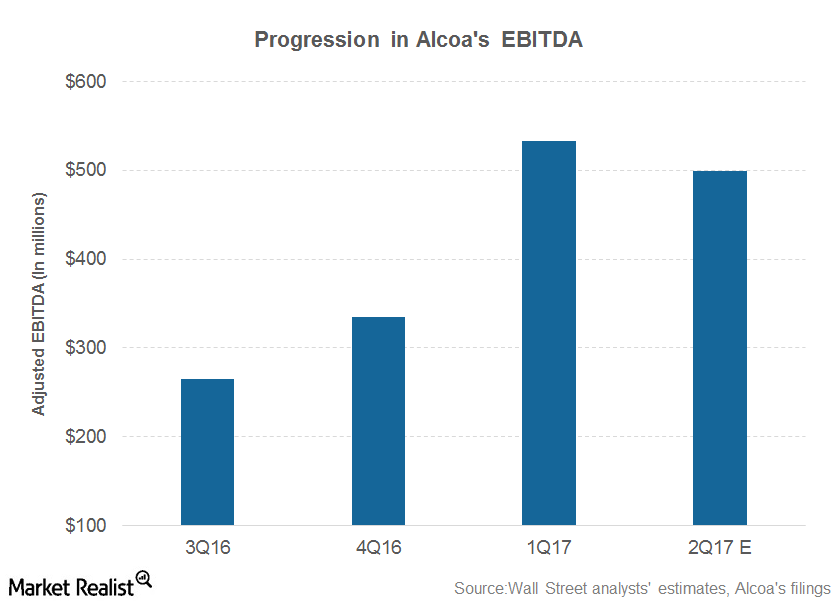

Markets Will Await These Updates from Alcoa’s 1Q17 Earnings Call

In 1Q17, there were rumors that Rio Tinto (RIO) could acquire Alcoa.

Alcoa’s 1Q17 Earnings: What Investors Need to Know

Alcoa (AA) released its 1Q17 earnings on April 24 after the markets (MDY) (MID-INDEX) closed. It held the conference call the same day.

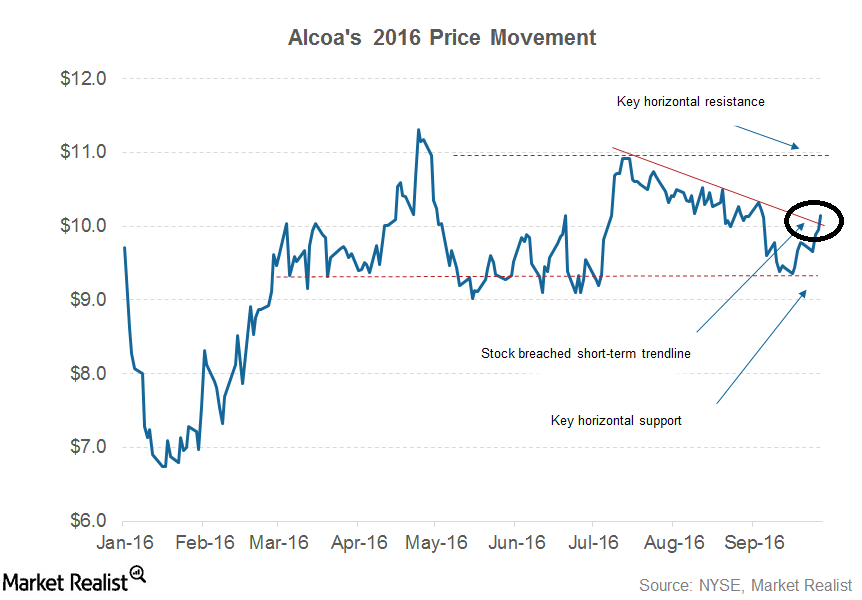

A Look at Alcoa’s Technical Indicators before Its 3Q16 Release

Alcoa’s technical indicators To make market entry and exit decisions, traders and investors analyze technical indicators. Resistance and support levels are among the most commonly used technical indicators. Resistance level Support levels typically act as a floor for stock prices. As a stock approaches its support levels, more buyers emerge while selling pressure generally subsides. […]

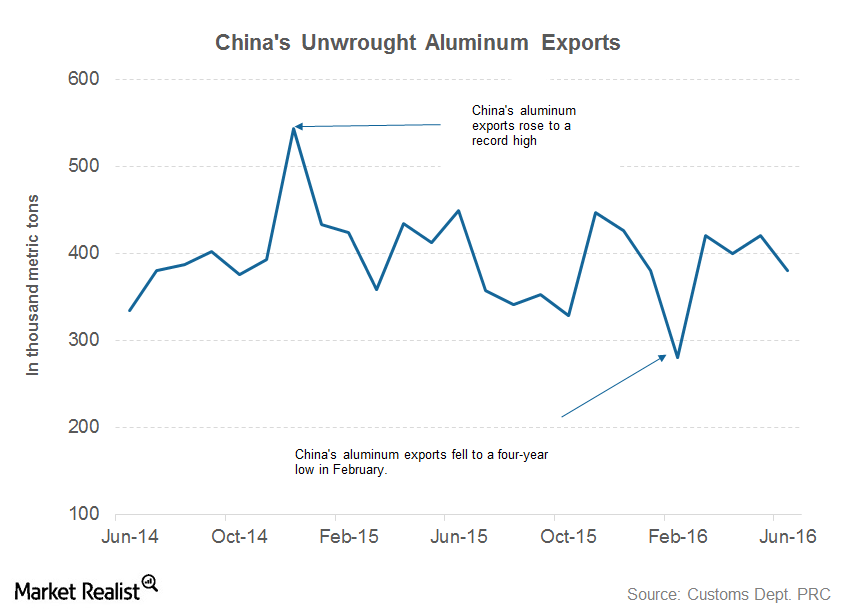

Alcoa Continues Its Rally as China Keeps Its Commitment

China exported 370,000 metric tons of unwrought aluminum in September, compared to 410,000 metric tons in August.

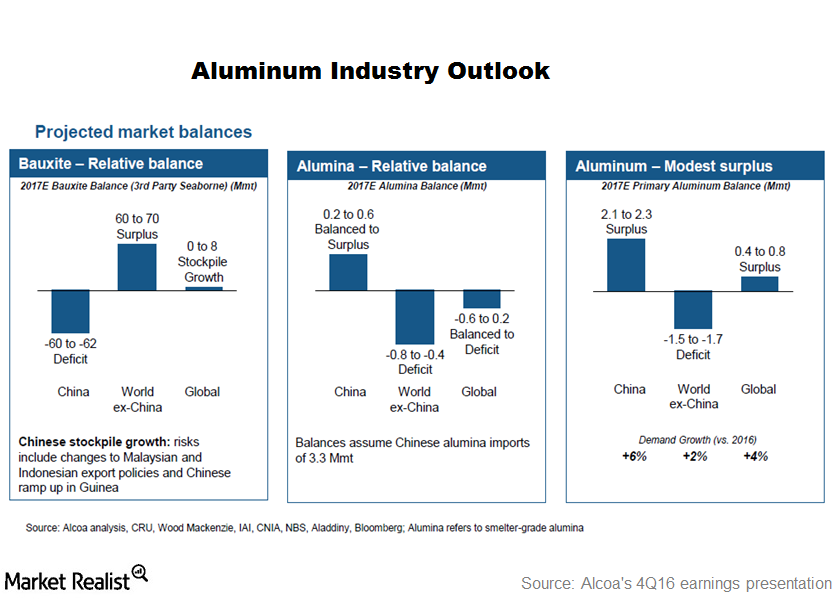

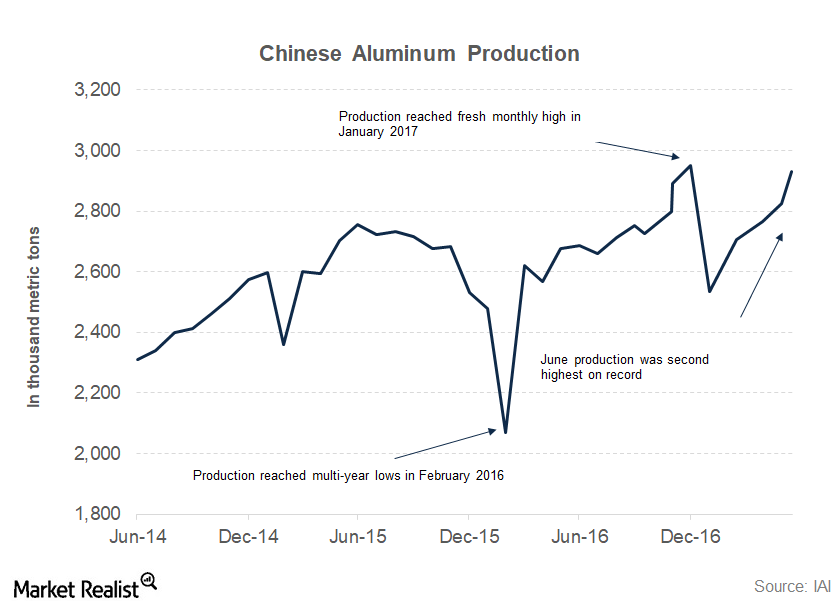

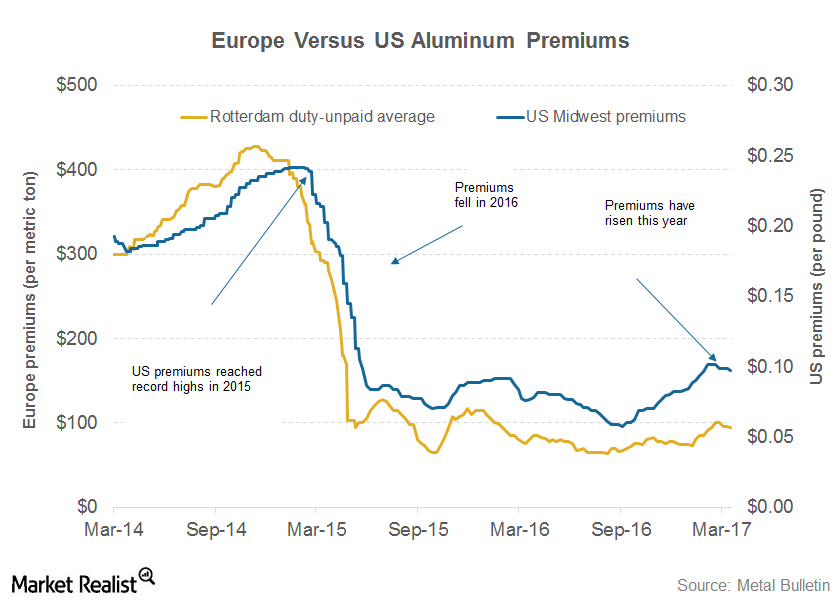

Aluminum’s Outlook: What Investors Can Expect

Aluminum prices have been strong in 2017 and have built on last year’s gains. The entire industrial metals space has come a long way since 1Q16.

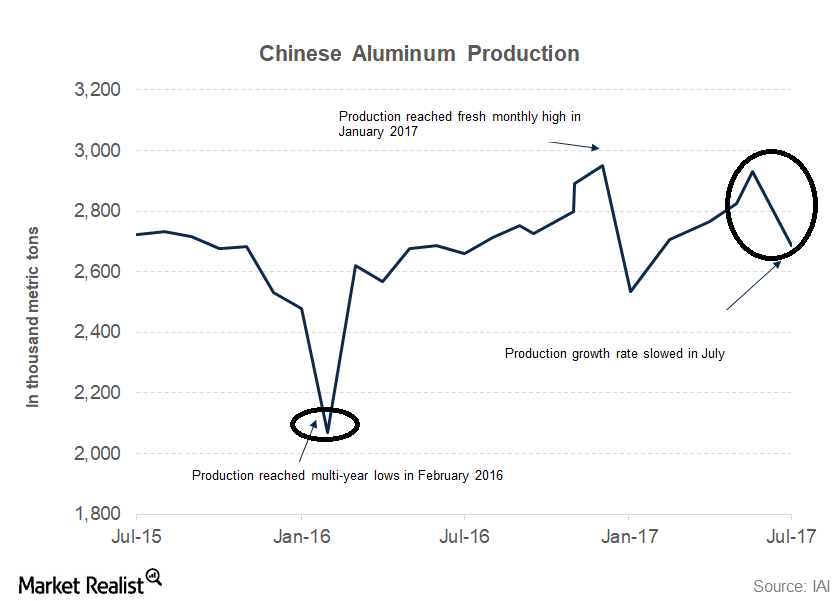

Is China Cutting Aluminum Capacity? Analyzing Producers’ Views

As we noted previously, aluminum prices have been strong this year. Strength has been driven by positive supply and demand dynamics.

Could Wilbur Ross and Donald Trump Be Alcoa’s Saviors?

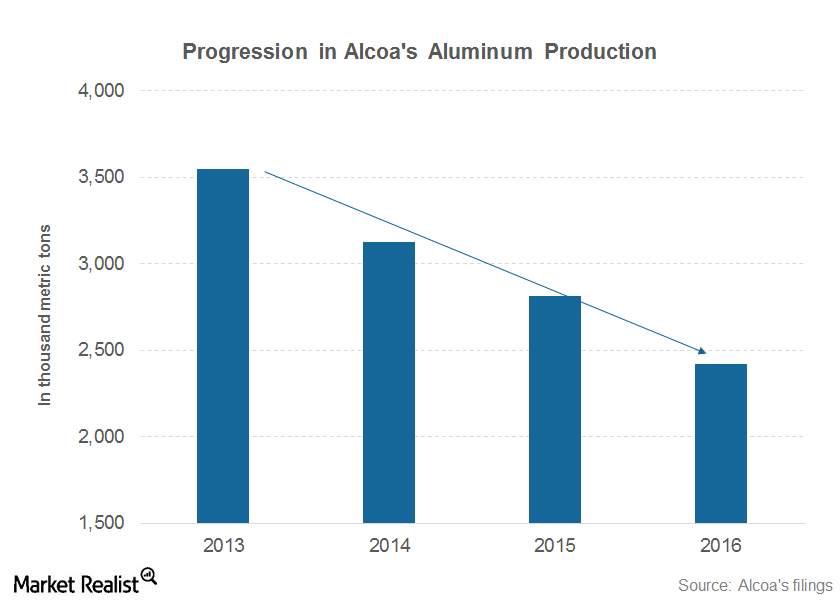

Alcoa and Century Aluminum (CENX) survives the commodity price slump by closing their high-cost capacities and negotiating better power deals for several operating plants.

What Investors Should Know about Century Aluminum’s 1Q17 Results

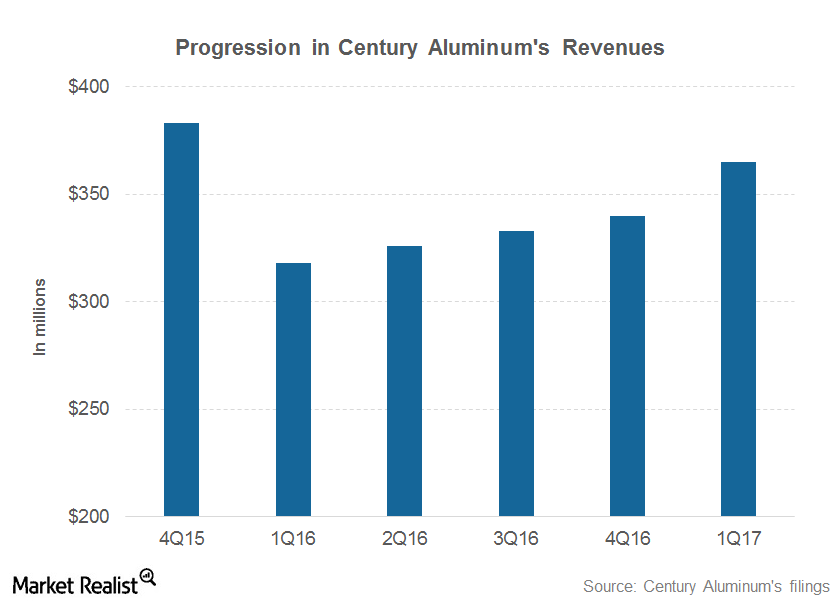

Century Aluminum (CENX) was among the best-performing aluminum stocks (NHYDY) (ACH) (SOUHY) last year with gains of 94%.

What Should Alcoa Investors Make of Aluminum Premiums?

Aluminum premiums are key indicators that investors in primary producers such as Century Aluminum (CENX), Norsk Hydro (NHYDY), and Rio Tinto (RIO) should track.

Alcoa’s 2017 Guidance: Everything You Need to Know

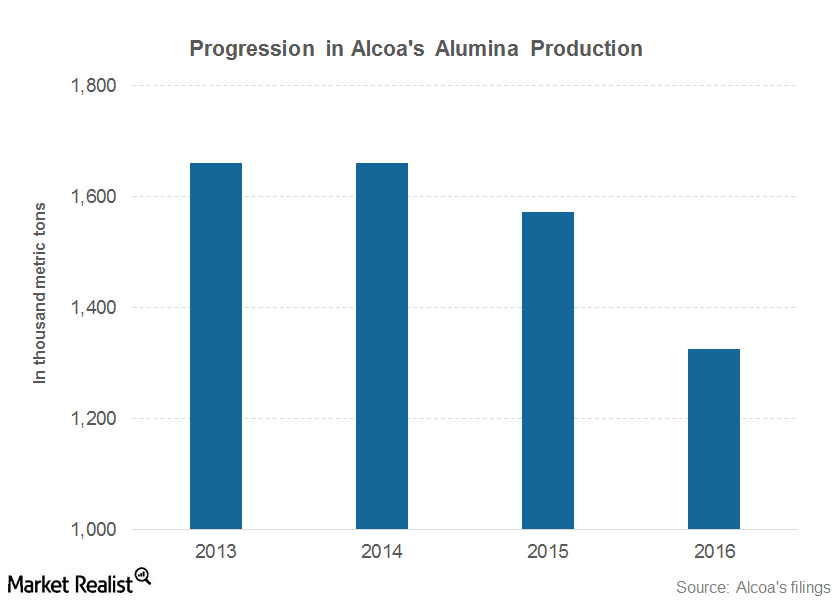

Alcoa (AA) expects its alumina shipments to range from 13.8 million–13.9 million metric tons in fiscal 2017 compared to 13.2 million metric tons in fiscal 2016.

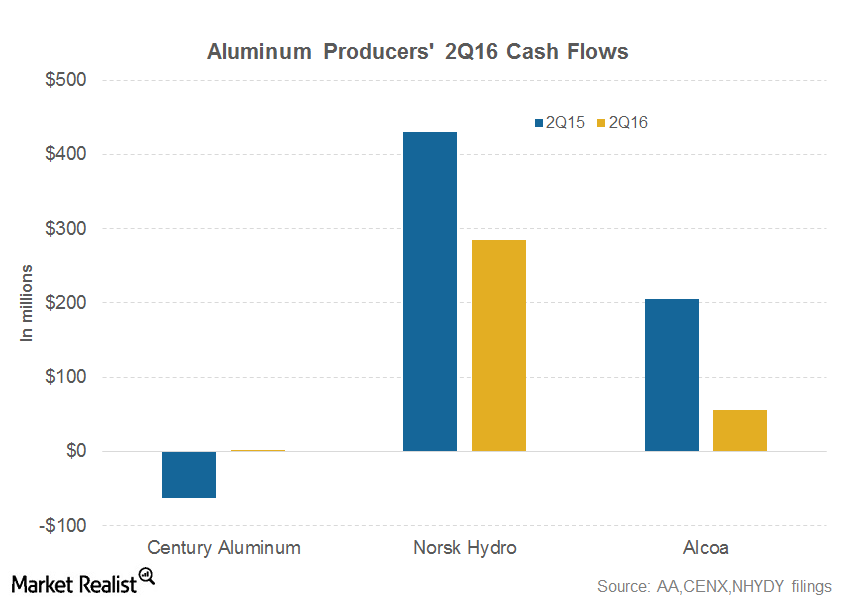

Can Alcoa Generate Positive Free Cash Flows in 2016?

Alcoa (AA) generated free cash flows of $55 million in 2Q16—compared to $205 million in the same quarter last year.

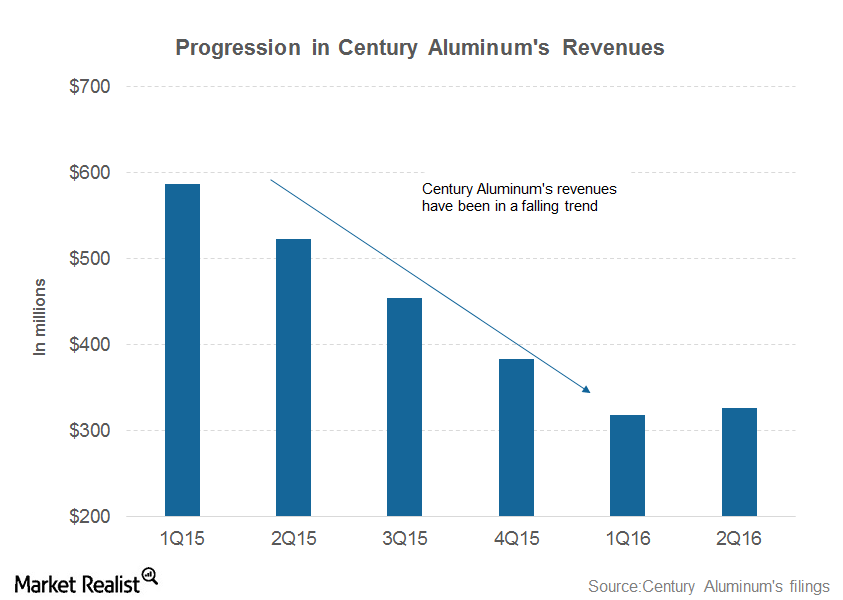

Century Aluminum Misses 2Q16 Revenues: Should You Be Concerned?

Century Aluminum reported revenues of $326 million in 2Q16. The revenue miss shouldn’t be a major concern given its performance on other metrics.

Can Higher Commodity Prices Boost Alcoa’s 3Q16 Earnings?

Alcoa expects its fiscal 2016 net income to rise by $160 million for every $100 per metric ton rise in aluminum prices.

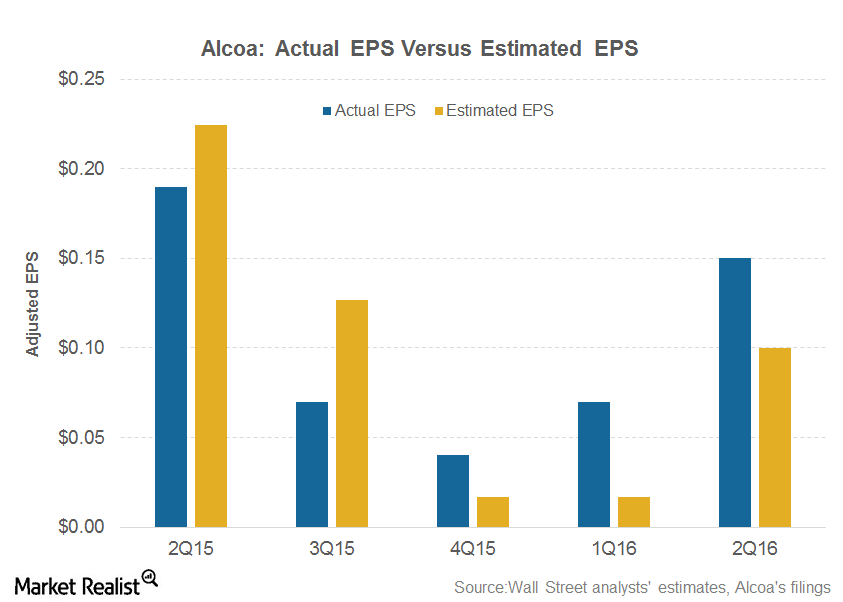

Alcoa’s 2Q16 Earnings: Everything You Need to Know

Alcoa (AA) reported its 2Q16 earnings yesterday after the market closed. Here’s what you should know.

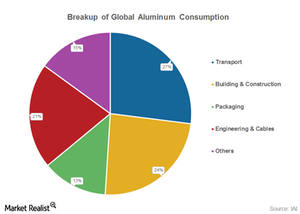

Will Aluminum Demand Grow 6% as Alcoa Is Projecting?

There are valid reasons for aluminum producers to feel upbeat about aluminum demand growth.

Why Are Alumina Prices a Key Driver for Aluminum Companies?

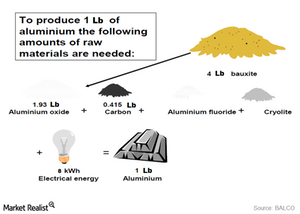

It can take almost two pounds of alumina to produce one pound of aluminum. Naturally, changes in alumina prices would impact aluminum’s production cost.

What Would a Stronger US Dollar Mean for Alcoa?

Alcoa’s value-add company will get a major portion of its revenues from Europe and is thus negatively impacted by a stronger US dollar.