iShares Russell 1000

Latest iShares Russell 1000 News and Updates

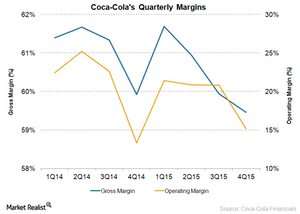

Coca-Cola’s 4Q15 Operating Margin Rose on Productivity Measures

Coca-Cola’s operating margin improved significantly to 15.2% in 4Q15 from 13.3% in the comparable quarter of the previous year.

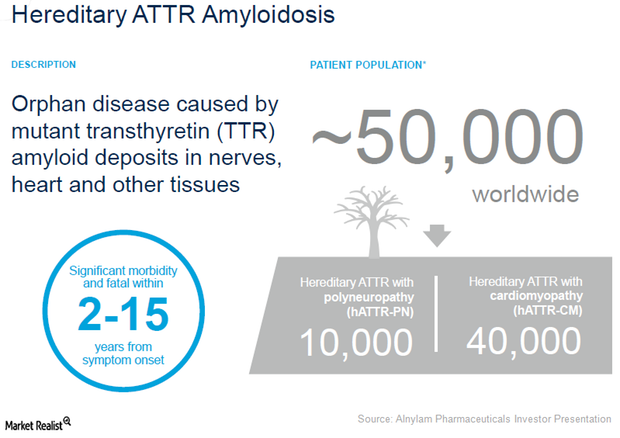

Alnylam Pharmaceuticals: Developing Therapies for Hereditary ATTR Amyloidosis

Alnylam Pharmaceuticals (ALNY) is currently developing three investigational therapies—Patisiran, Revusiran, and ALN-TTRsc02—for the treatment of patients with hereditary ATTR amyloidosis.

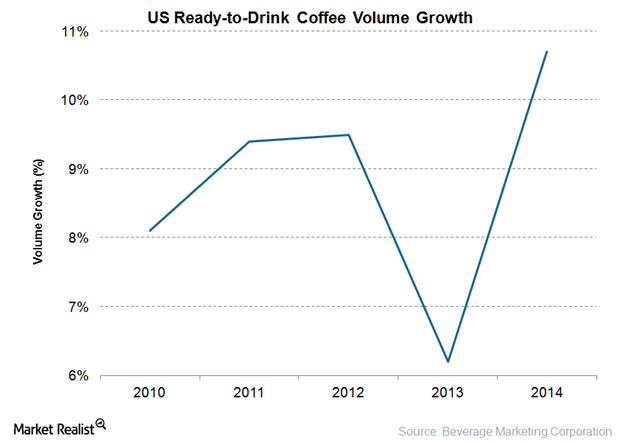

Why Ready-to-Drink Coffee Is Gaining Popularity with US Consumers

Coffee lovers in the United States are boosting ready-to-drink coffee volumes.

Under Armour: The ARMOURY and Its Wholesale Strategic Importance

The ARMOURY stores will cater to the premium segment of the market. They’ll also feature UA product exclusives and occasional visits from star athletes.

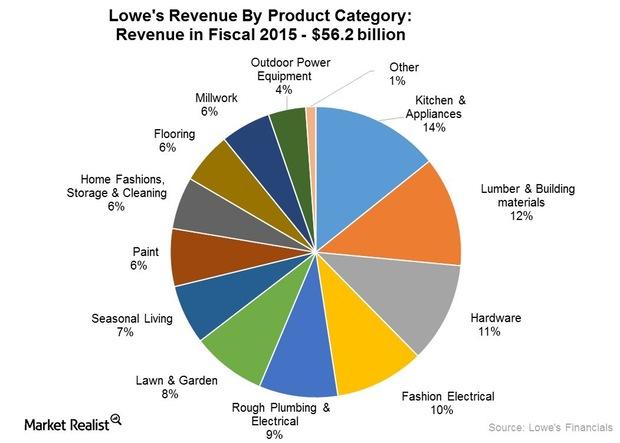

The Lowe’s-Rona Transaction: Sizing Up the Potential Synergies

Lowe’s (LOW) expects the Rona (RON.TO) transaction to be accretive to its earnings per share or EPS from the very first year after the acquisition.

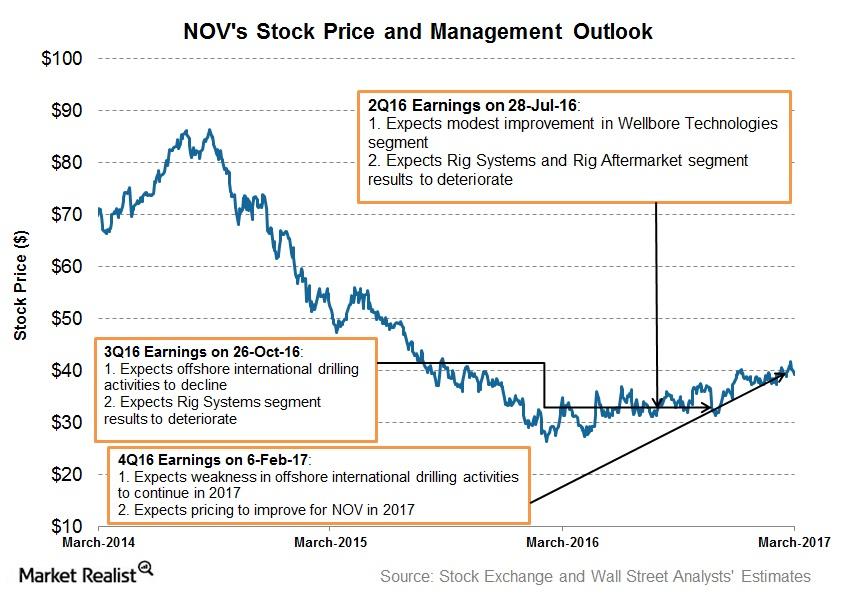

National Oilwell Varco’s Growth Prospects in 2017

National Oilwell Varco’s (NOV) management expects upstream activity in North America’s shale plays to improve in 2017.

Bill Gross: Monetary Policy on Steady but Slow Path

After the release of the FOMC’s November statement, Bill Gross said that monetary policy in the United States is steadily moving toward normalization, though its pace is slow.

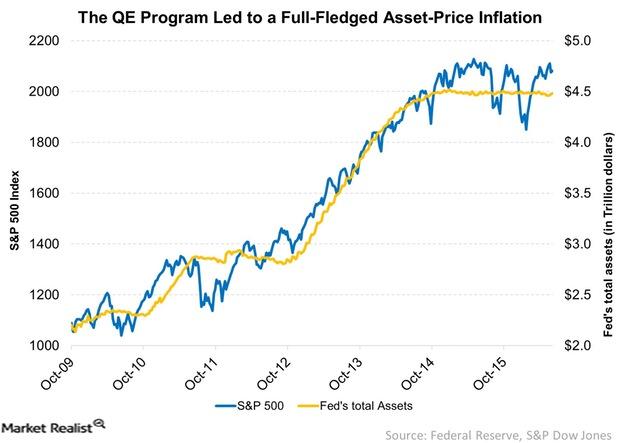

How Central Banks ‘Create’ Inflation

A QE program doesn’t just create inflation; it causes asset prices to rise as well. After the financial crisis of 2008, the Fed resorted to an ultra-accommodative monetary policy.

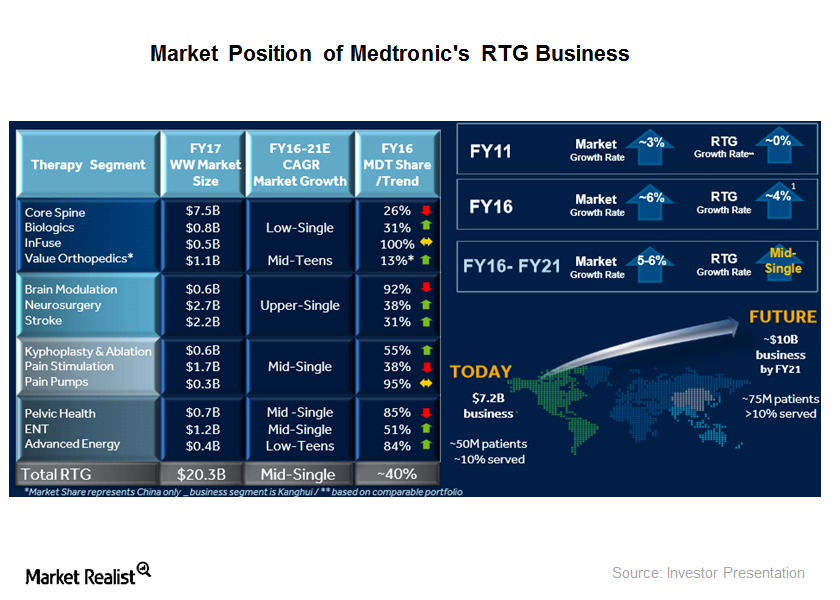

What Drives Medtronic’s Restorative Therapies Group’s Growth?

Medtronic’s (MDT) Restorative Therapies Group (or RTG) segment, formed around seven years ago, has a strong market position today.

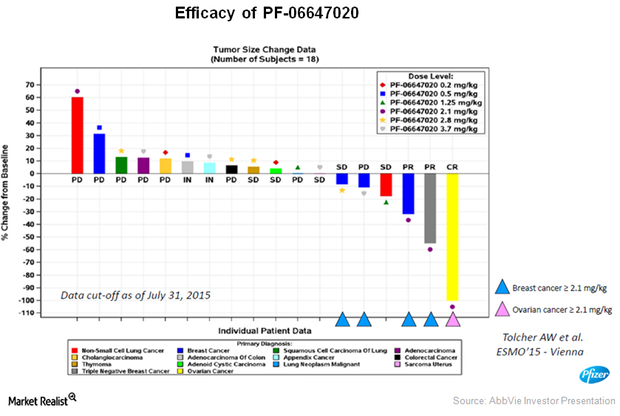

Why AbbVie Expects PTK7 to Enhance Its Oncology Capabilities

Now in its phase-1 clinical trial, AbbVie’s PF-06647020, an ADC targeting protein kinase 7 could become a major therapy for advanced solid tumors.

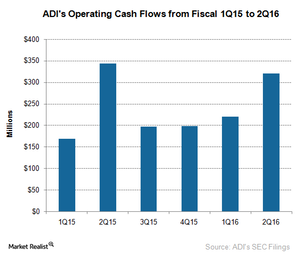

What Is Analog Devices’ Acquisition Strategy?

Analog Devices (ADI) has been using M&A (mergers and acquisitions) to rapidly expand its technology offerings and boost its revenue.

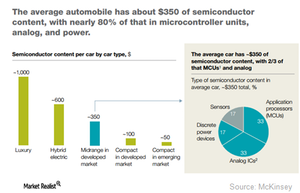

Automotive: The Next Big Thing for Texas Instruments

Texas Instruments (TXN) has increased its exposure in the automotive, industrial, and communications segments, which accounted for 64% of the company’s revenue in fiscal 1Q16.

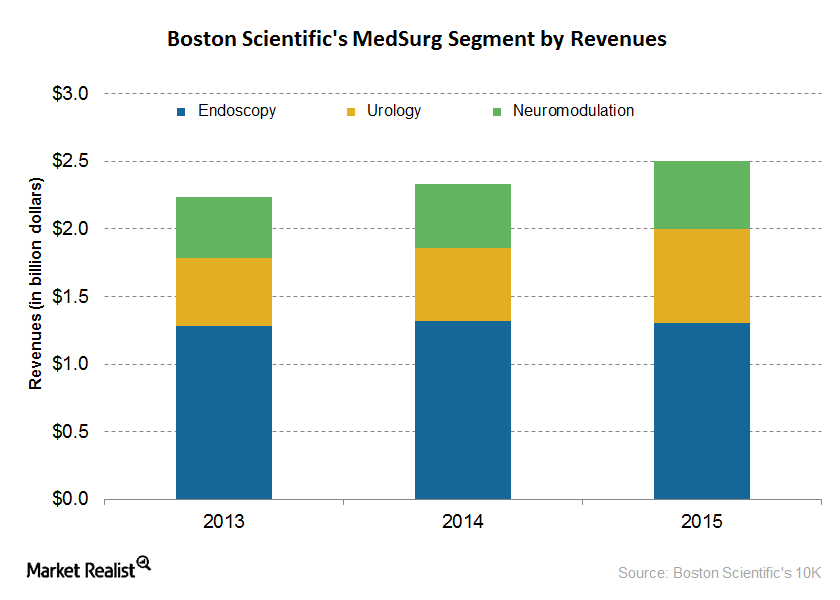

Understanding Boston Scientific’s MedSurg Segment

Boston Scientific’s (BSX) MedSurg segment contributes around 33% to the company’s total revenues and is the company’s second-largest segment.

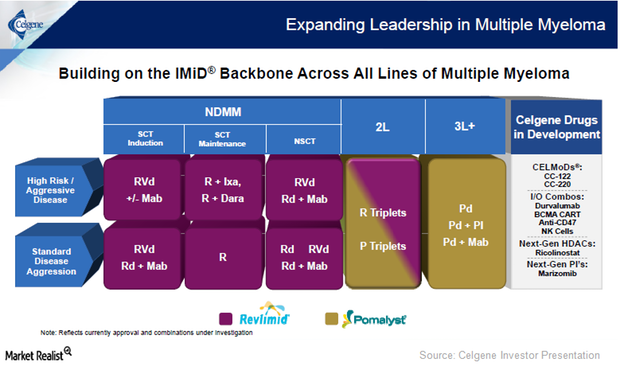

Celgene Continues to Develop New Multiple Myeloma Drugs

Celgene has been working on its immunomodulatory backbone drugs to develop combination therapies for use in treating all lines of multiple myeloma.

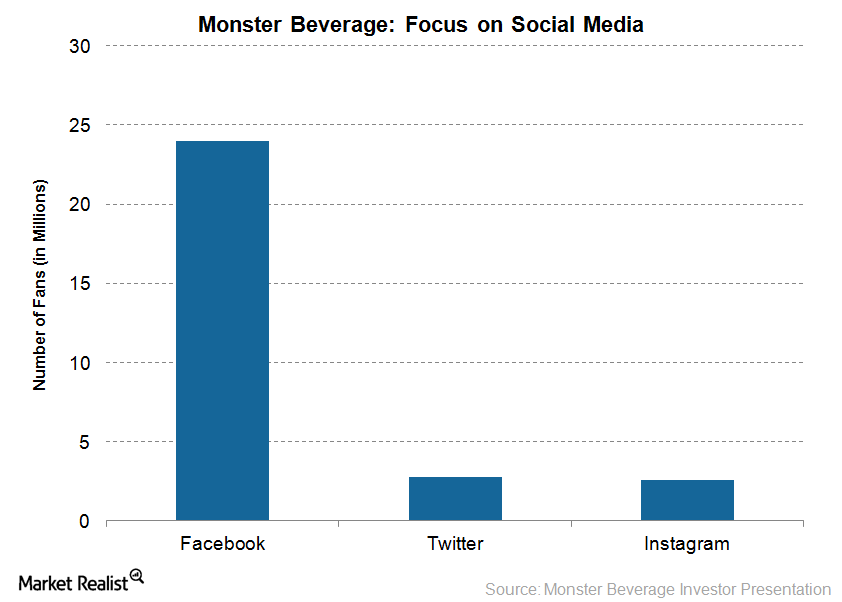

Monster Beverage Increases Its Advertising Efforts

Monster Beverage enjoys huge popularity on social media. It has 24 million fans on Facebook (FB), 2.8 million fans on Twitter (TWTR), and 2.6 million fans on Instagram.

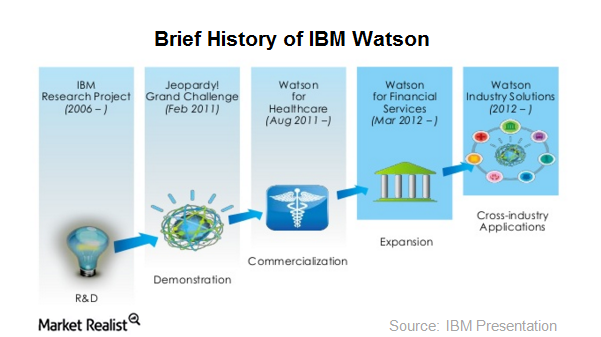

Which IBM Partnerships and Acquisitions Have Boosted Watson?

Apart from acquisitions to further push the chances of Watson Health’s success in the healthcare space, IBM has partnered with Apple (AAPL), Johnson & Johnson (JNJ), and Medtronic (MDT).

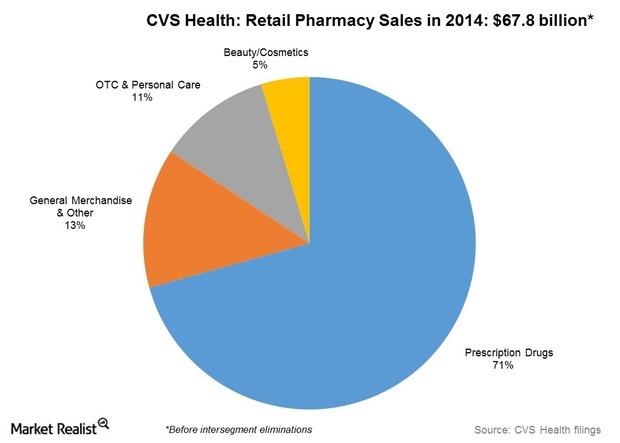

Major Factors Driving CVS’s Retail Pharmacy Segment Growth

CVS Health (CVS) expects Retail Pharmacy sales growth between 0.5% and 2% year-over-year in 2Q15. Total same-store sales are expected to be in the range of -1.25% to 0.25%.

Why Do We Need to Analyze Sprint Promotions?

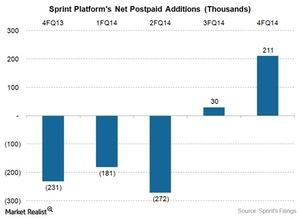

After Sprint CEO Marcelo Claure joined the company, Sprint added ~30,000 postpaid connections in fiscal 3Q14 and ~211,000 postpaid connections in fiscal 4Q14.