Hormel Foods Corp

Latest Hormel Foods Corp News and Updates

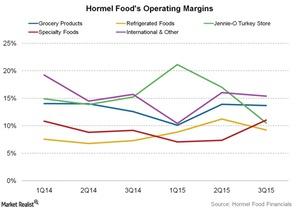

Hormel’s Specialty Food Segment Performed Well in 3Q15

Hormel Foods Corporation, based in Austin, Minnesota, is a multinational manufacturer and marketer of consumer-branded food and meat products.

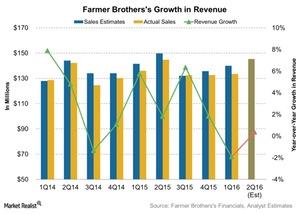

Analysts Expect Positive Revenue Growth in Fiscal 2Q16

The revenue estimate for Farmer Brothers in fiscal 2Q16 isn’t as high. However, it’s still positive. Analysts predict revenue of $145.3 million for fiscal 2Q16

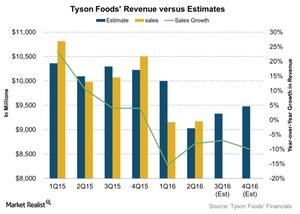

What Could Hamper Tyson Foods’ Revenue in 3Q16?

Tyson Foods is expected to report lower revenue in 3Q16. The export markets will likely be challenged moderately in 2016. This could hamper its revenue.

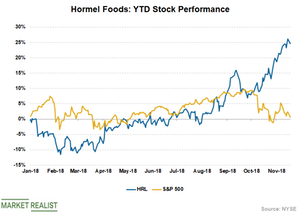

What’s Backing the Uptrend in Hormel Foods Stock?

Hormel Foods (HRL) is another company in the consumer staples industry that has outperformed the broader markets so far this year.

Hormel Foods’ Road Map for Future Growth

Hormel Foods (HRL) has established a road map to boost its financial performance in a challenging food and beverage environment.

Why Hormel Foods’ Stock Price Has Fallen 4% in 2018

Hormel Foods (HRL) has seen its stock price fall 4% on a YTD (year-to-date) basis as of April 6, 2018.

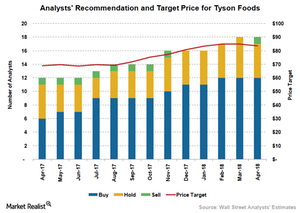

What Analysts Recommend for Tyson Foods

Of the 18 analysts covering Tyson Foods, 67.0% recommend a “buy” on its stock.

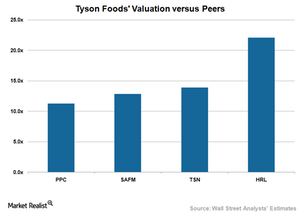

How Tyson Foods Compares with Its Peers in Valuation

As of December 22, 2017, Tyson Foods (TSN) stock was trading at a 12-month forward PE (price-to-earnings) multiple of 13.9x, which could seem attractive to investors.

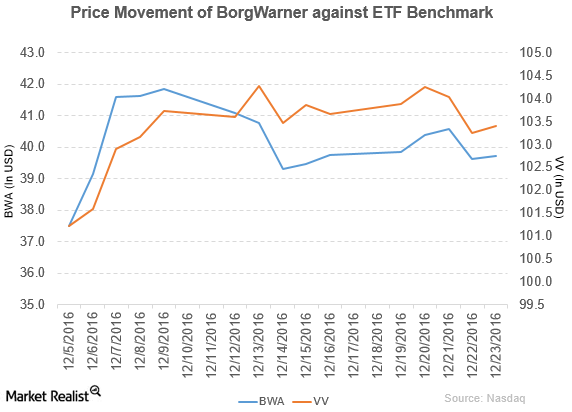

Wells Fargo Downgrades BorgWarner to ‘Market Perform’

BorgWarner (BWA) fell 0.03% to close at $39.73 per share during the third week of December 2016.

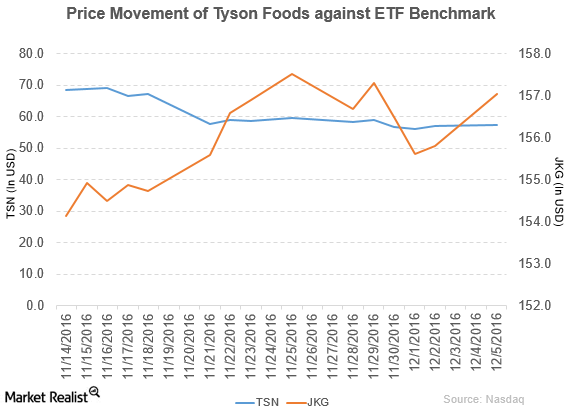

Tyson Foods Forms a New Venture Capital Fund to Focus on Growth

In fiscal 2016, Tyson Foods (TSN) reported sales of $36.9 billion, a fall of 10.9% year-over-year.

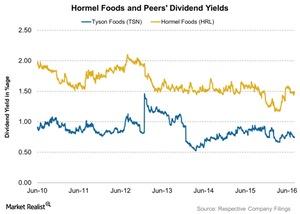

How Much Has Hormel Returned to Shareholders in Fiscal 2016?

Along with its 3Q16 results, Hormel Foods (HRL) also announced the 352nd consecutive quarterly dividend at the annual rate of $0.58 per share.

Why Did Hormel Foods Increase Its Fiscal 2016 Guidance?

Hormel Foods (HRL) increased its fiscal 2016 EPS (earnings per share) guidance to $1.60–$1.64. The earlier EPS guidance range was $1.56–$1.60.

Wall Street Analysts’ Recommendations for Sanderson Farms

Stephens gave Sanderson Farm the highest target price of $108, respectively. This represents a 16% rise from the closing price of $93.17 on August 18.

How Much Has Tyson Foods Returned to Shareholders in Fiscal 2016?

Tyson Foods bought back 6.6 million shares in fiscal 3Q16 and has bought back another 5.4 million shares so far in fiscal 4Q16.

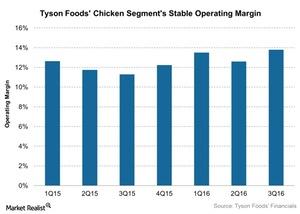

How Is Tyson Foods Improving Its Chicken Operating Margin?

In fiscal 3Q16, Tyson Foods’ Chicken segment reported an operating margin of 13.9% with an improved product mix.

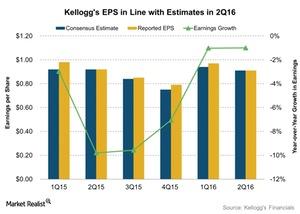

Did Kellogg’s Earnings Beat Estimates in Fiscal 2Q16?

In fiscal 2Q16, Kellogg Company (K) reported EPS (earnings per share) of $0.91, in line with analysts’ estimates.

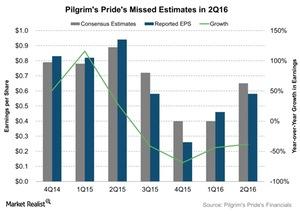

Pilgrim’s Pride in 2Q16: How Much Did Earnings Decline?

Pilgrim’s Pride’s earnings were hit hard again in the second quarter. They fell far below analysts’ expectations, missing estimates by 11%.

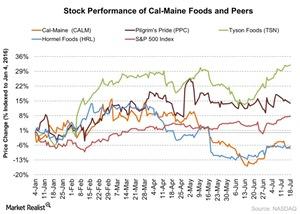

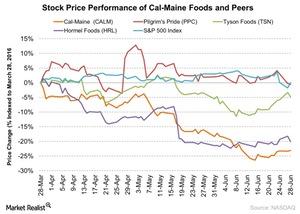

How Did Cal-Maine Foods Stock React to Its Fiscal 4Q16 Results?

Cal-Maine Foods reported its fiscal 4Q16 results on July 18. There wasn’t impact on the stock price even though the company reported a loss for the quarter.

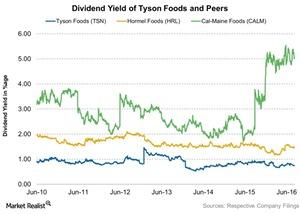

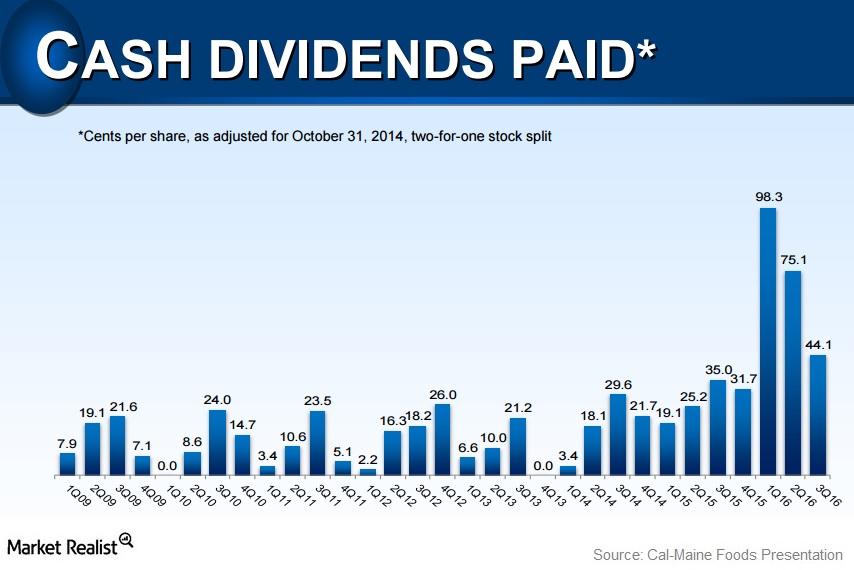

Analyzing Cal-Maine Foods’ Variable Dividend Policy

Cal-Maine has a variable dividend policy in place. It has a dividend yield of 5.8% as of June 28. Management raised the dividend at a CAGR of 15.3% over five years.

Cal-Maine Plans to Increase Its Value-Added Specialty Egg Business

Cal-Maine Foods (CALM) plans to grow its specialty egg business by meeting consumer demand in the rapidly growing segment.

Why Did Cal-Maine Shares Fall 23% in the Last 3 Months?

Cal-Maine Foods (CALM) saw declining growth in its shares in the last three months. The company’s shares are trading close to its 52-week low.

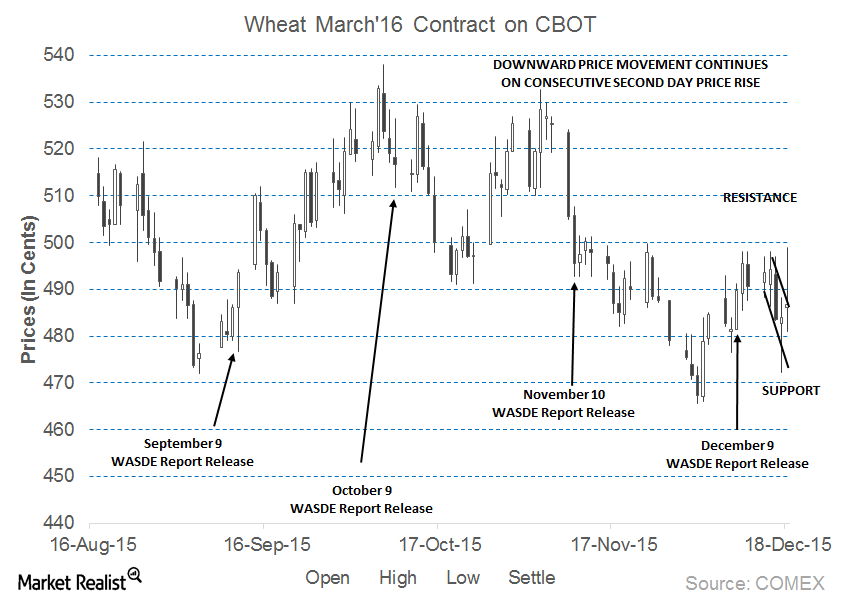

Wheat Prices Trade above 20-Day Moving Average

Wheat futures contracts for March expiry were trading above the key support level of 485 cents per bushel on December 18, 2015.

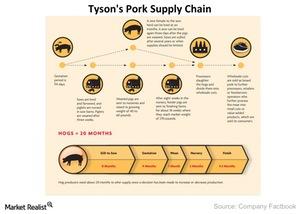

Tyson Foods Pork Biz In The Top Three

The Tyson Foods Pork segment processes live hogs into primal, sub-primal cuts, case-ready pork ready to be sold at retail stores, and fully cooked products.

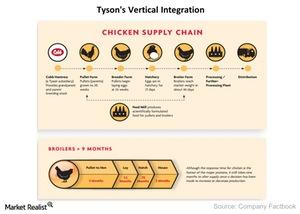

Vertical Integration Keeps Tyson Foods On Top Of Chicken Market

Vertical integration involves a single company owning and controlling all the various stages in the production chain.

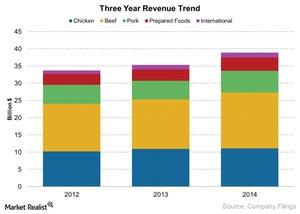

Tyson Foods Revenue Segments

Tyson Foods revenue is reported in five segments: Beef, Chicken, Pork, Processed Foods, and International. The Beef segment accounted for 43% of revenues.

Tyson Foods Commands 24% Of The Beef Market

According to Cattle Buyers Weekly, in 2014, four producers controlled 75% of the market share. Tyson Foods controls 24% of the beef market.