Harley-Davidson Inc

Latest Harley-Davidson Inc News and Updates

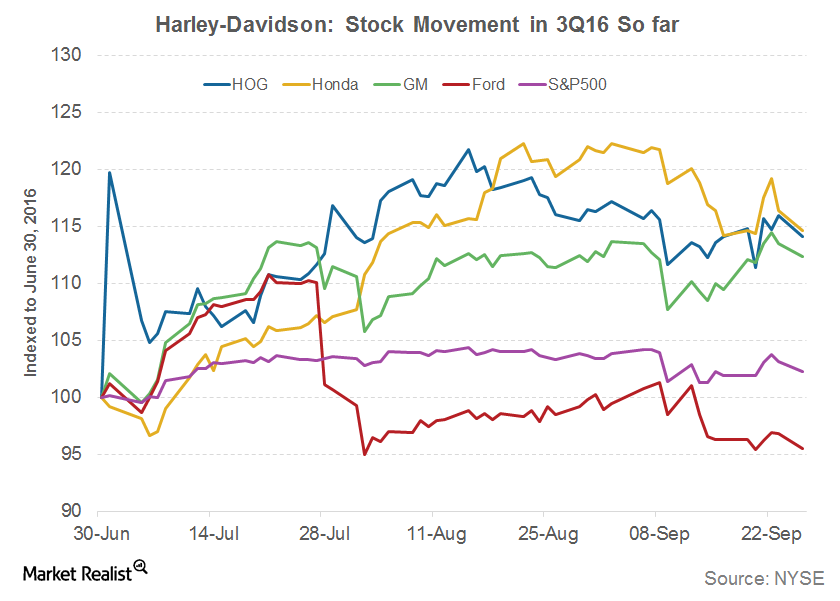

How Has Harley-Davidson Performed so Far in 3Q16?

Harley-Davidson is set to release its 3Q16 earnings report on October 18, 2016. The company is the most popular heavyweight motorcycle brand in the world.

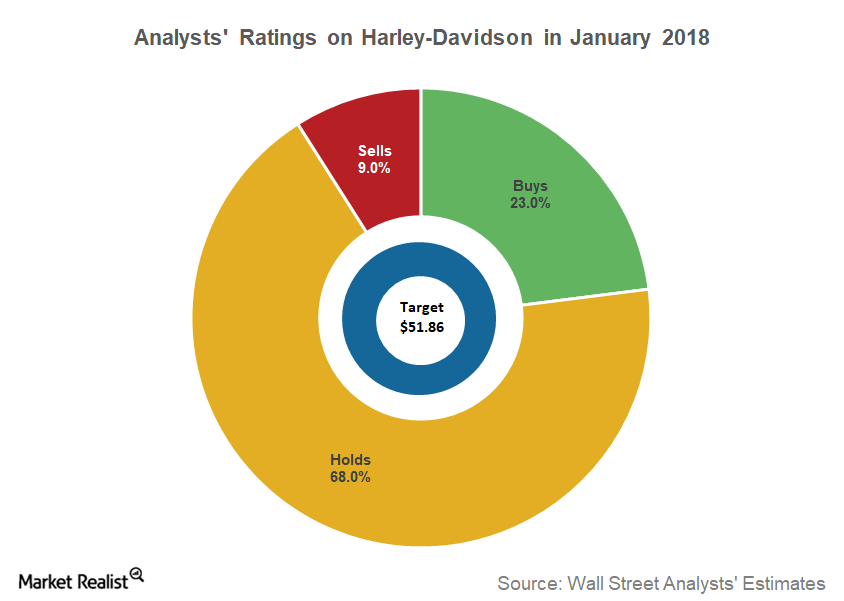

Analysts’ Recommendations on HOG before Its 4Q17 Results

According to data compiled by Reuters, 68% of analysts covering Harley-Davidson stock gave it “hold” recommendations.

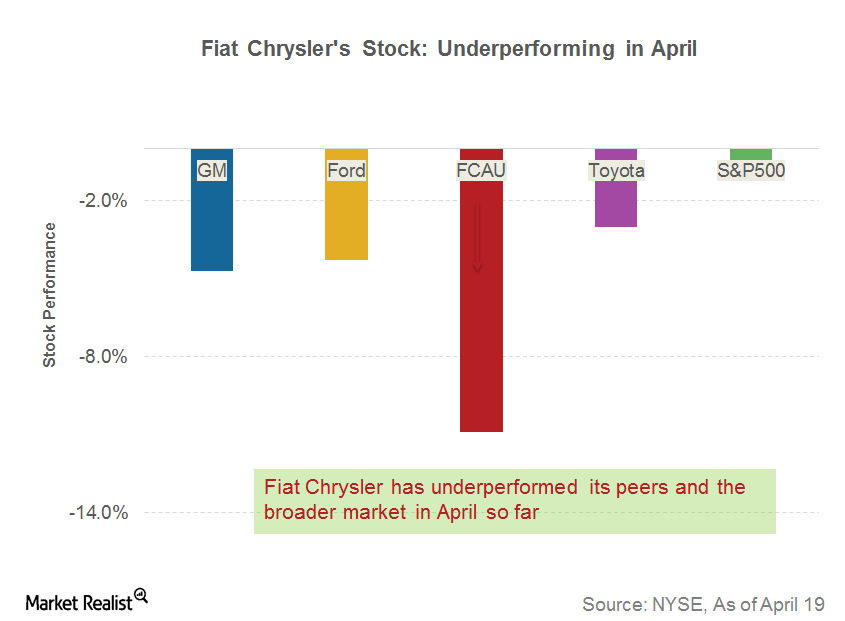

How Has Fiat Chrysler’s Stock Fared in April So Far?

Fiat Chrysler Automobiles (FCAU) is set to release its 1Q17 earnings report on April 26, 2017. By 2016 vehicle sales volume, FCAU was the fourth-largest automaker in the US.

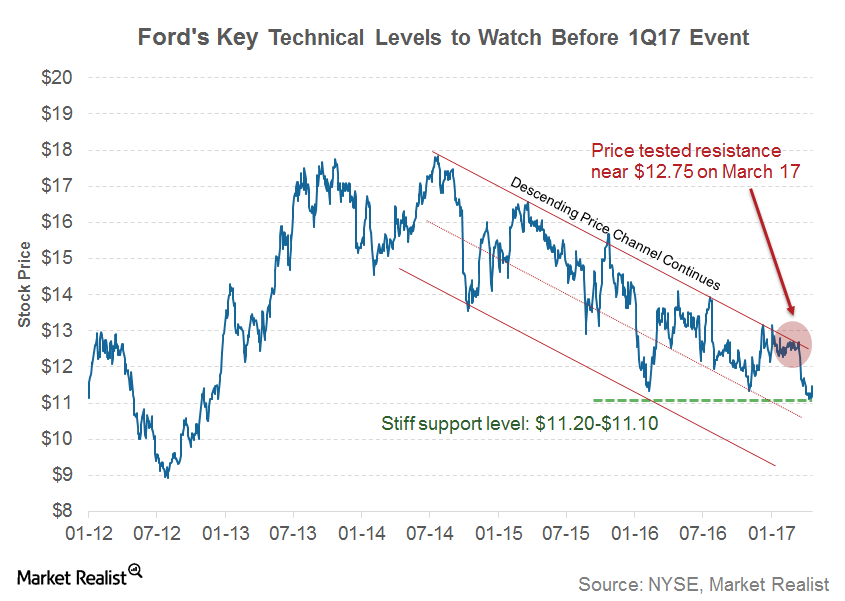

Key Technical Levels in Ford Stock before Its 1Q17 Earnings

On March 17, Ford stock tested the upper range of the descending channel near $12.75. It couldn’t close above the level and turned negative.

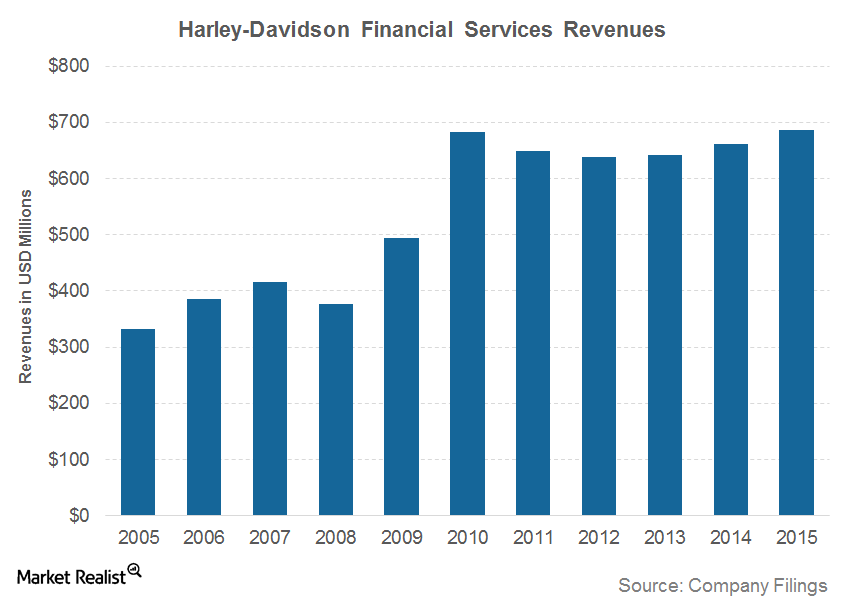

How Harley-Davidson’s Financial Services Complement Its Core Business

Under its retail financial services, Harley-Davidson Financial Services primarily provides installment lending for the purchase of new and used Harley-Davidson motorcycles.

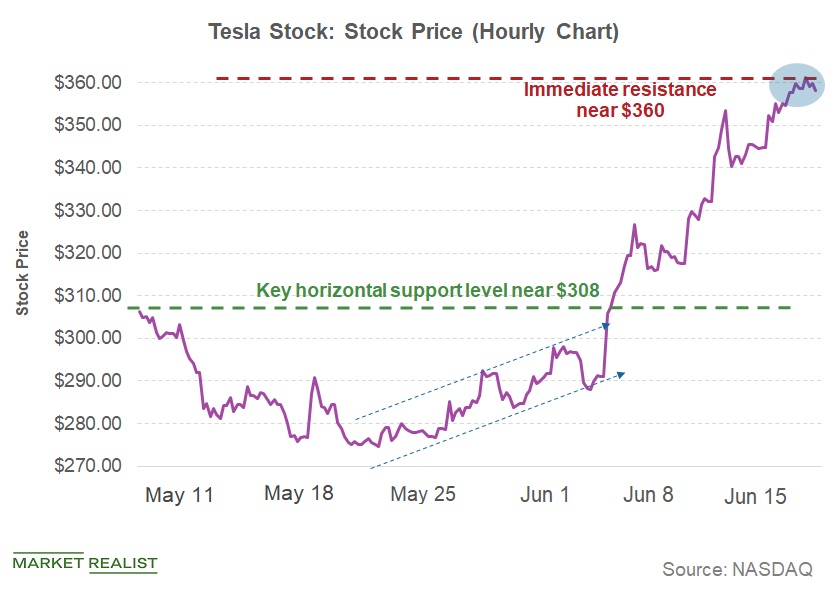

Key Support and Resistance Levels in Tesla Stock This Week

Last week, Tesla stock (TSLA) continued to rise, gaining 12% and closing at $358.17 despite mixed market sentiment.

Why Harley-Davidson Stock Fell 2% after Its Q1 Earnings Report

Heavyweight motorcycle maker Harley-Davidson (HOG) released its earnings results for the first quarter of 2019 on April 23.

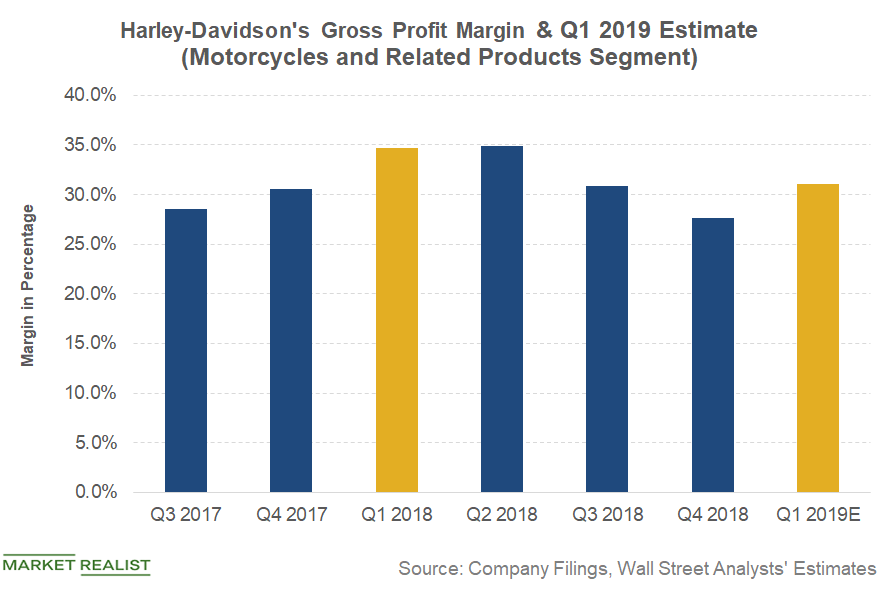

What to Expect for Harley-Davidson’s Q1 Profit Margin

In the fourth quarter, Harley-Davidson’s (HOG) gross profit from motorcycles and related products fell ~17.5% YoY (year-over-year) to $564 million from $320 million, reducing the segment’s gross margin YoY to 27.6% from 30.6%.

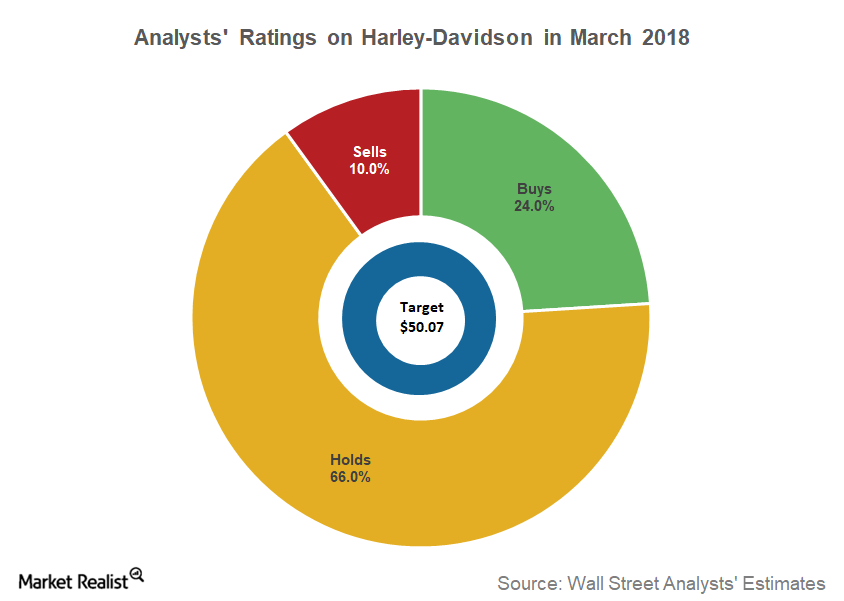

Most Analysts Recommend a ‘Hold’ on Harley-Davidson in March 2018

Harley-Davidson (HOG) maintained the highest US market share in the heavyweight motorcycle sector. Its stock underperformed other auto stocks in 2017 and lost ~12.8%.

Goldman Sachs Rated Harley-Davidson as ‘Neutral’

Harley-Davidson (HOG) reported 3Q16 Motorcycle and Related Products revenues of $1.09 billion, a fall of 4.4% from the $1.14 billion reported in 3Q15.

What RBC Capital Thinks of Harley-Davidson

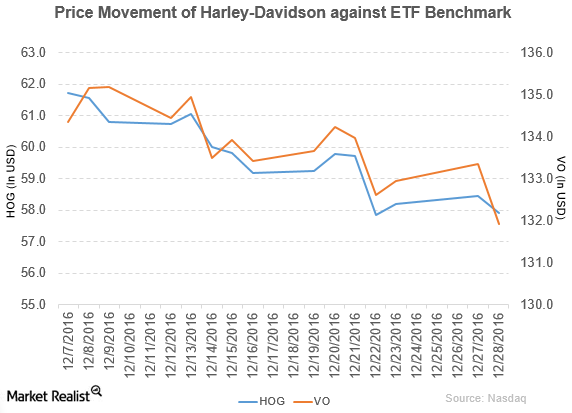

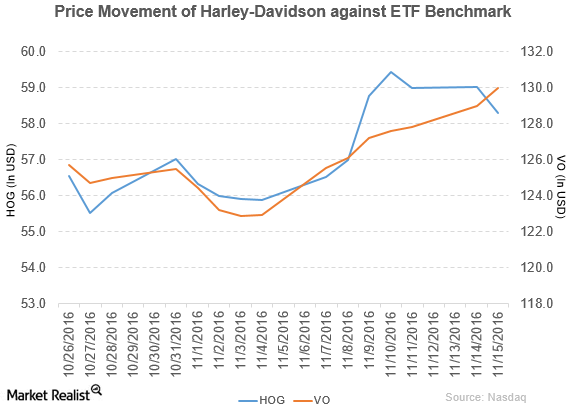

Harley-Davidson (HOG) has a market cap of $10.4 billion. It fell 1.2% to close at $58.29 per share on November 15, 2016.

Polaris Industries Acquired Transamerican Auto Parts for $665 Million

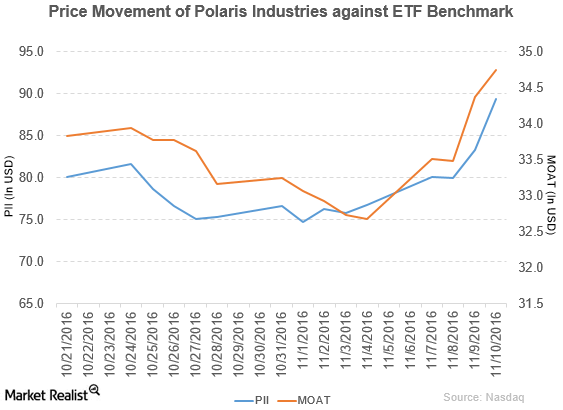

Polaris Industries (PII) reported 3Q16 sales of ~$1.2 billion, which represents a fall of 18.5% from its ~$1.5 billion in sales in 3Q15.

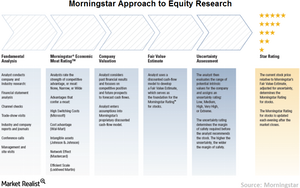

Morningstar: Using Economic Moat to Assess Stocks

The concept of economic moat is the basis of Morningstar’s assessment of a company’s (KO)(ORCL) long-term investment potential.

A Look at Harley-Davidson’s 3Q16 Performance

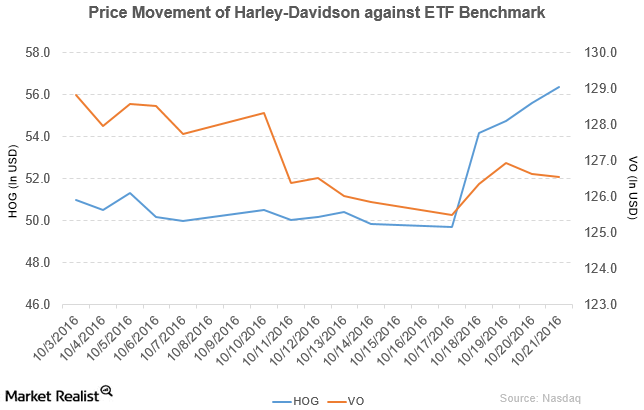

Price movement Harley-Davidson (HOG) rose 13.1% to close at $56.37 per share during the third week of October 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 13.1%, 8.5%, and 27.2%, respectively, as of October 21. HOG is trading 9.2% above its 20-day moving average, 8.1% above its 50-day moving average, and […]

Jefferies Is Rating Harley-Davidson a ‘Hold’

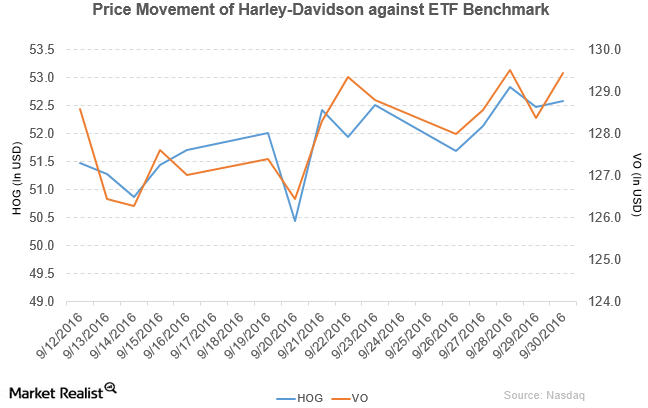

Harley-Davidson (HOG) has a market cap of $9.4 billion. It rose 0.21% to close at $52.59 per share on September 30, 2016.

Harley-Davidson Rose Again on Rumors

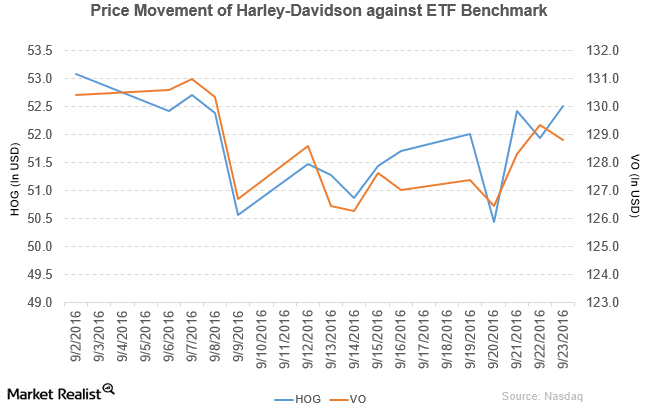

Harley-Davidson (HOG) rose 1.6% to close at $52.52 per share during the third week of September 2016.

Why Did Harley-Davidson Cut Jobs?

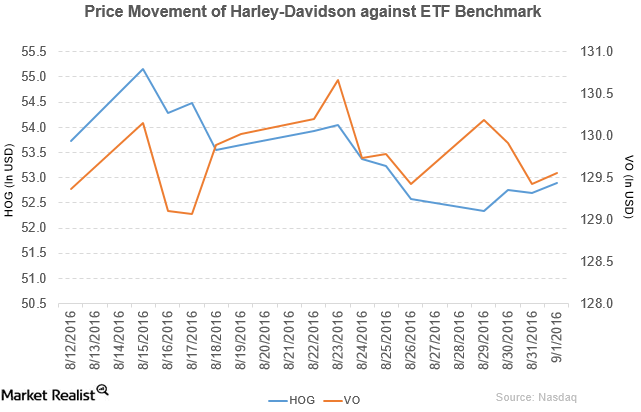

Harley-Davidson rose by 0.36% to close at $52.89 per share on September 1, 2016. Its weekly, monthly, and YTD price movements were -0.66%, 2.4%, and 18.5%.

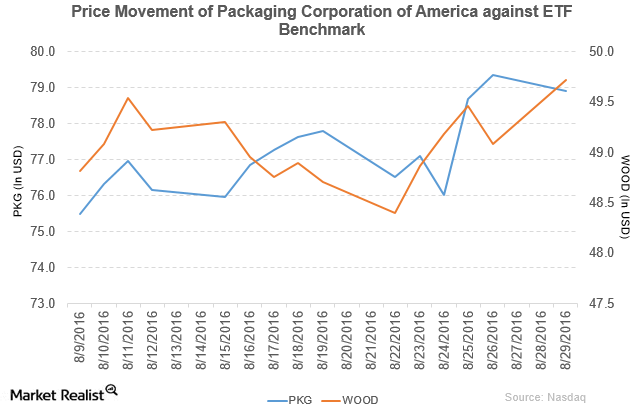

Packaging Corporation of America Completes Acquisition of TimBar

Packaging Corporation of America (PKG) has a market cap of $7.4 billion. It fell by 0.57% to close at $78.91 per share on August 29, 2016.

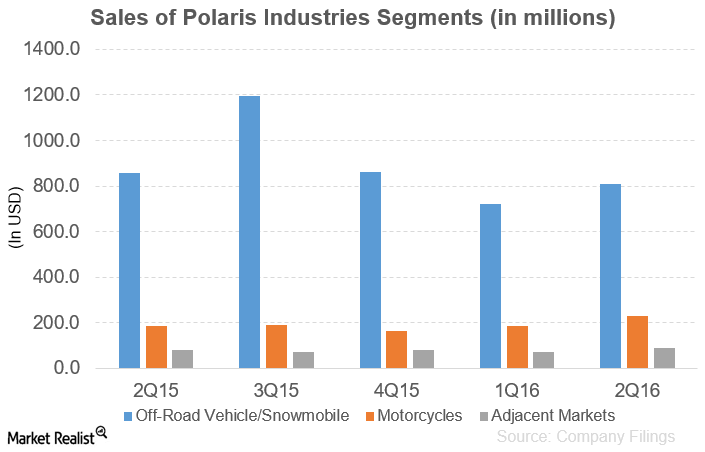

How Did Polaris Industries’ Segments Fare in 2Q16?

In 2Q16, Polaris Industries (PII) reported sales of $1,130.8 million, a fall of 0.58% compared to the corresponding period last year.

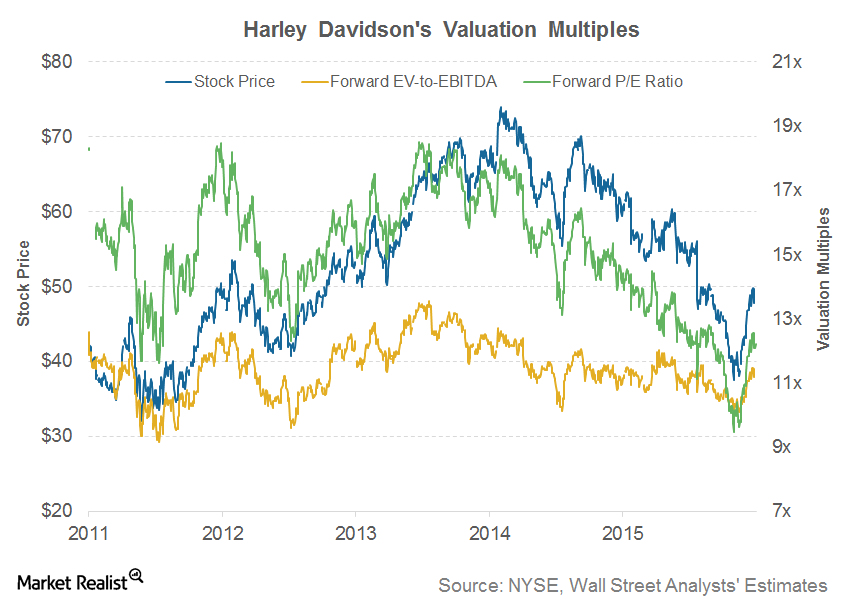

What Are Harley-Davidson’s Valuation Multiples?

As of March 29, 2016, Harley-Davidson’s forward EV/EBITDA multiple is 11x for the next 12 months.

What Is Harley-Davidson’s Marketing Strategy?

It’s important for investors to take a look at an automaker’s marketing strategy to understand how the company differentiates its strategy to market its offerings.

Could Harley-Davidson’s Electric Motorcycle Be a Reality Soon?

One such innovation that could soon become large in the two wheeler segment is electric motorcycles.

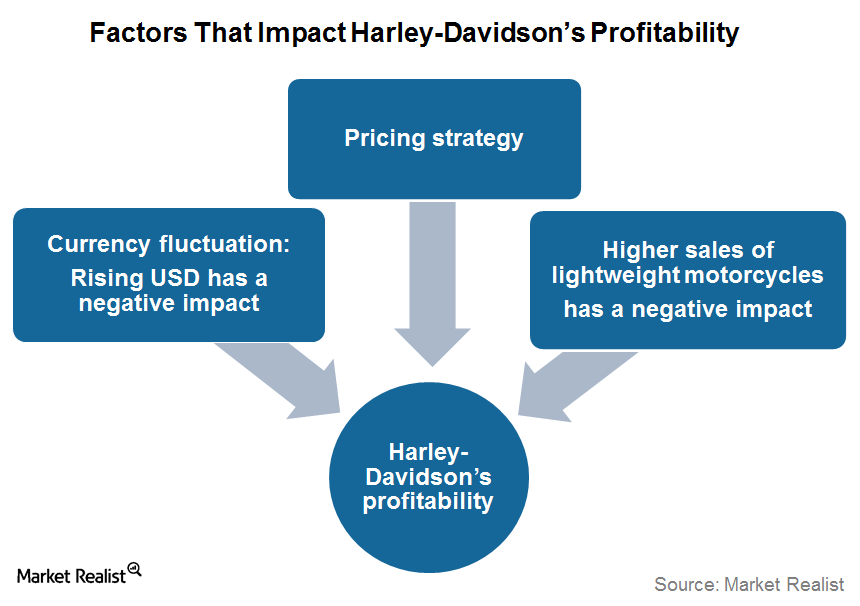

What Factors Could Affect Harley-Davidson’s Profitability?

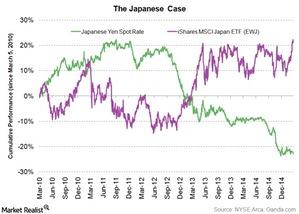

Last year, currency headwinds stole nearly 4.4% of the company’s total revenues, which resulted in an unfavorable impact on Harley-Davidson’s profitability and margins.

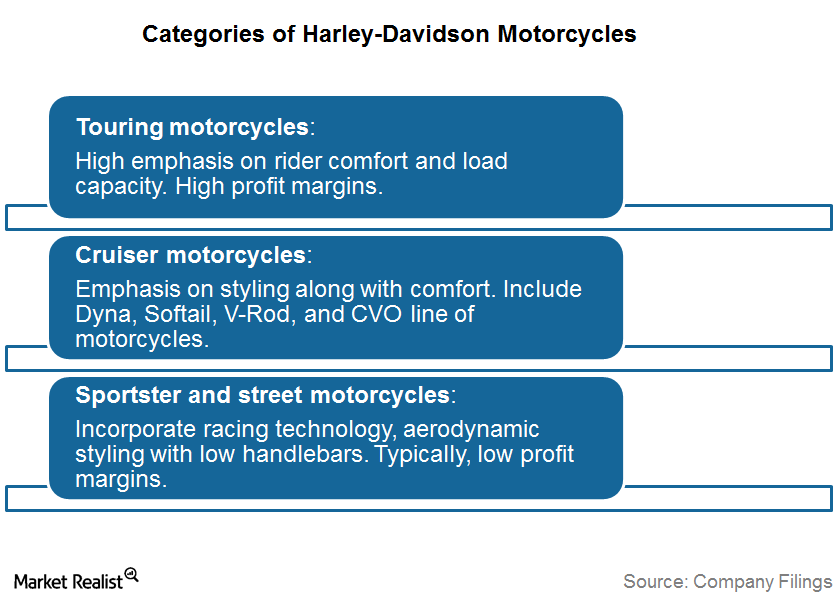

What Are the Broad Categories of Harley-Davidson Motorcycles?

Harley-Davidson (HOG) is a well-known global motorcycle brand that currently produces a variety of motorcycle models. These models range from lightweight motorcycles to large heavyweight motorcycles.

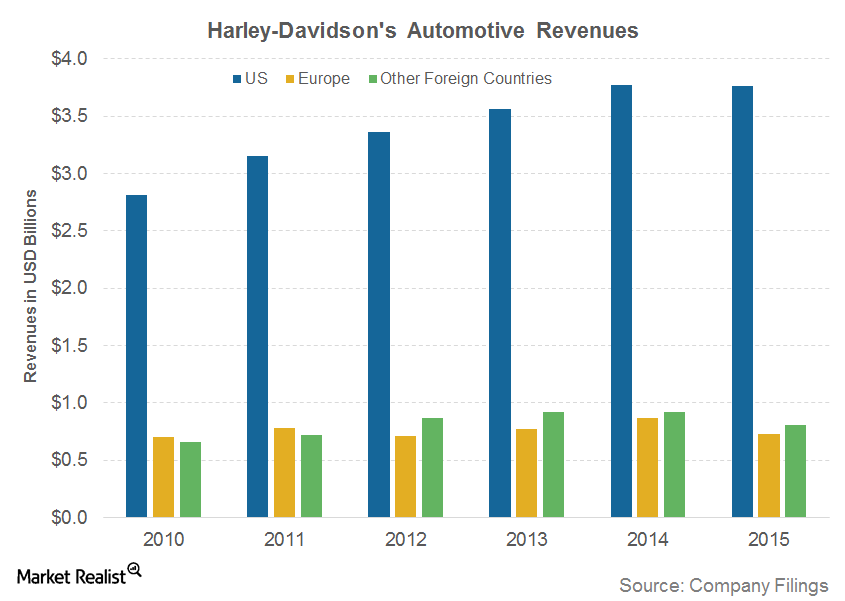

What Are the Key Geographical Markets for Harley-Davidson?

In 2015, the company shipped ~95,000 motorcycles outside the US. Australia, Mexico, and Canada are also some of the other key markets for Harley-Davidson motorcycles.

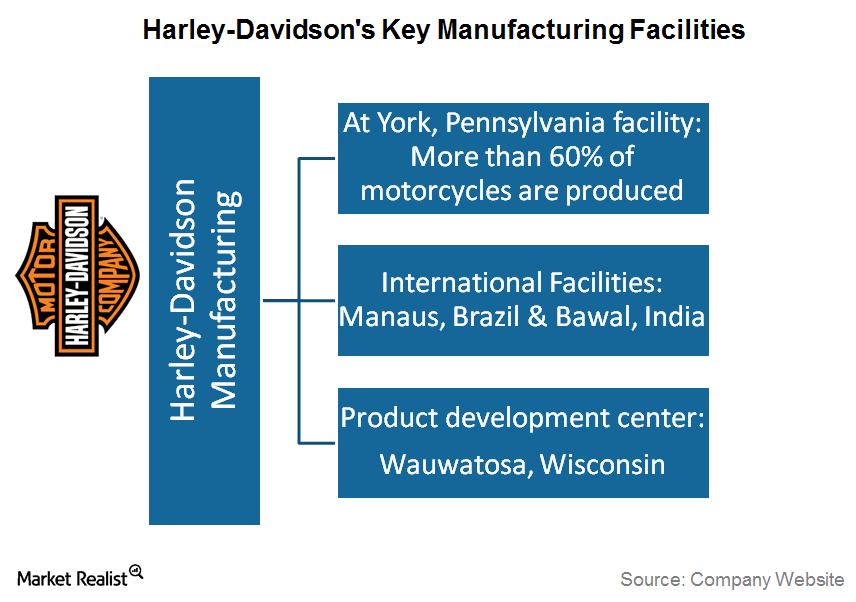

Where Are Harley-Davidson Motorcycles Manufactured?

Most of Harley-Davidson’s (HOG) manufacturing and assembly plants are located in the US.

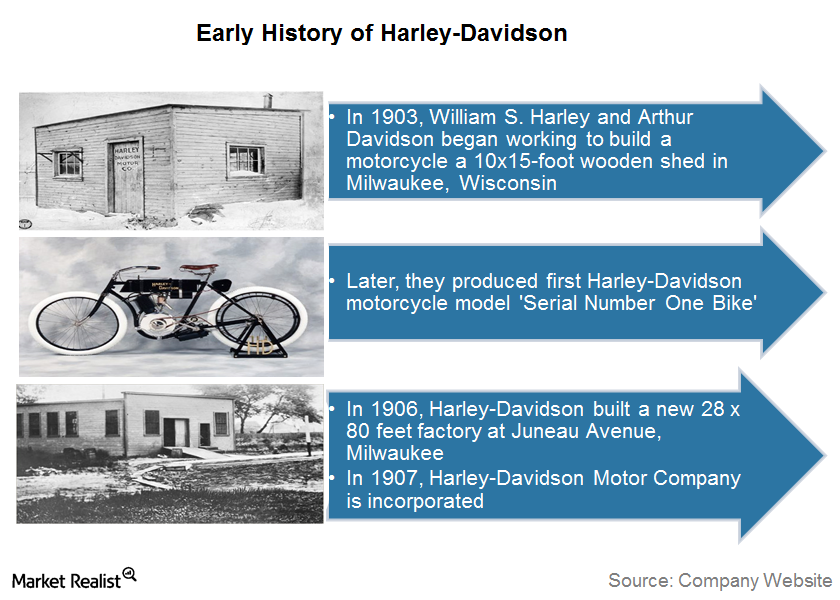

The Early History of Harley-Davidson: The Motorcycle Pioneer

Harley-Davidson has become a synonym for power, passion, and class among motorcycle enthusiasts around the world.

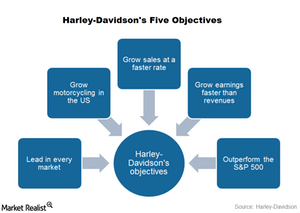

Harley-Davidson’s 5 Objectives: Investor Takeaways

In its 3Q15 earnings conference call, Harley-Davidson outlined five objectives for the company, including growing sales and outperforming the S&P 500 Index.

Currency war: Did it boost growth in Japan?

Japan is a classic case of how depreciating currency can boost economic growth. The stimulus package, launched in October 2010, worked over the short term.