Eastman Chemical Co

Latest Eastman Chemical Co News and Updates

Tennesse Chemical Giant Eastman Jolts Neighborhood With Explosion

Eastman Chemical has experienced an explosion that rattled its neighborhood. Overall, the company has a explosion track record. Who owns Eastman Chemical?

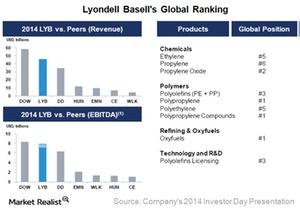

What Are LyondellBasell’s Global Rankings?

LyondellBasell (LYB) is the leading global producer of olefins and polyolefins.

APD’s Q4 2018 Earnings Beat Estimates, Revenues Missed

On November 6, Air Products and Chemicals reported revenues of $2.30 billion for the fourth quarter.

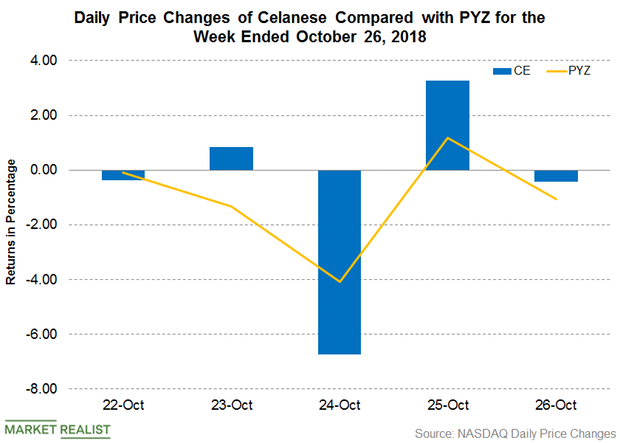

Celanese Increases Prices of Ethyl Acetate in the Americas

On October 22, Celanese (CE) announced that it would be increasing the prices of ethyl acetate in the Americas region.

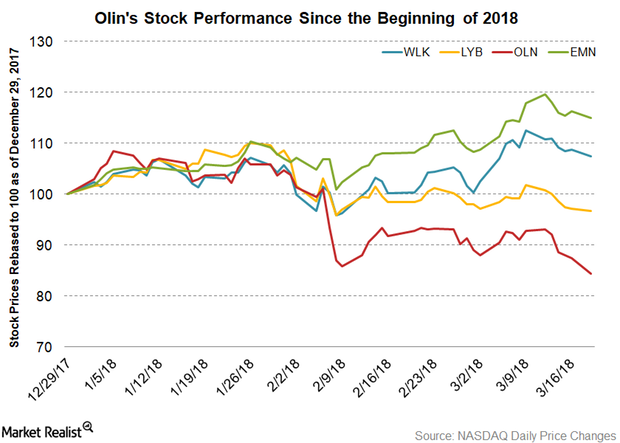

How Olin Stock Has Fared in 2018 Year-to-Date

On a year-to-date basis, until March 19, 2018, OLN stock has fallen 15.5%.

Eastman Chemical’s Demand for Tritan Continues to Grow in Asia

The demand for Eastman Chemical’s Tritan continues to grow.

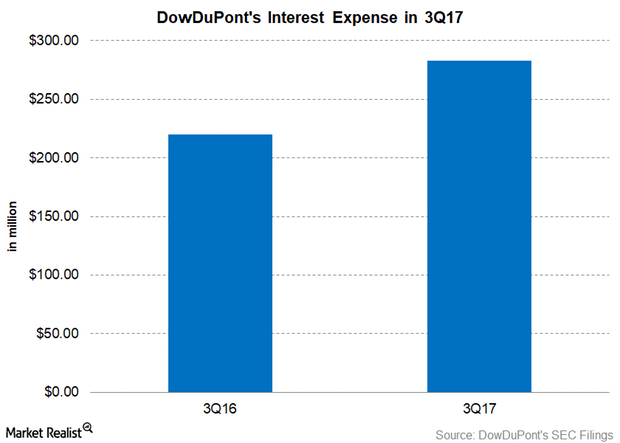

How Strong Is DowDuPont’s Interest Coverage?

In 3Q17, DWDP’s interest expense was reported at $283 million as compared to the $220 million in 3Q16 on a proforma basis.

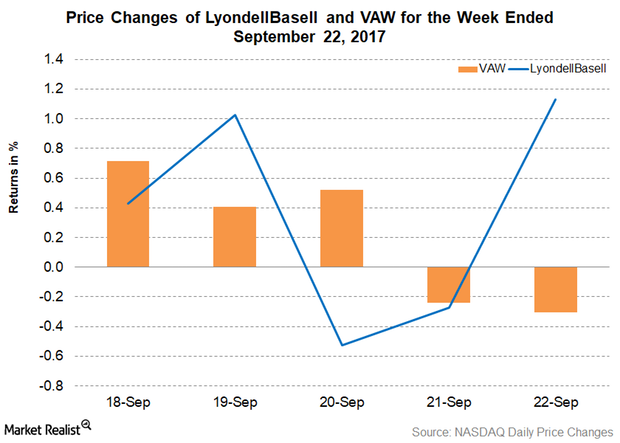

LyondellBasell Starts Polypropylene Production at Dalian, China

On September 21, 2017, LyondellBasell (LYB) announced that it has started manufacturing polypropylene (or PP) from its production facility in Dalian, China.

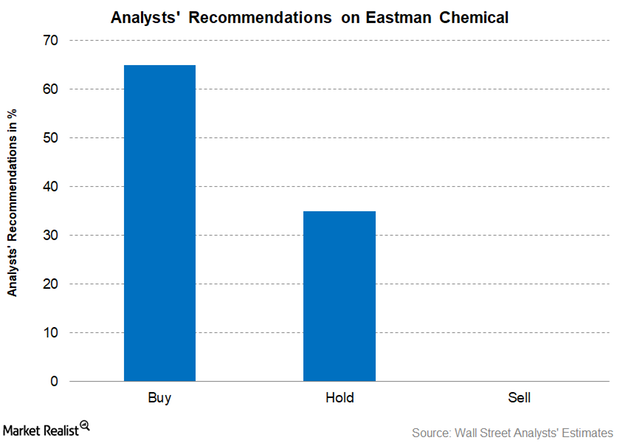

What Analysts Recommend for Eastman Chemical

Analysts’ consensus on EMN’s mean target price is on the rise from $89.92 in July to the current target price of $93.38 as of September 12, 2017.

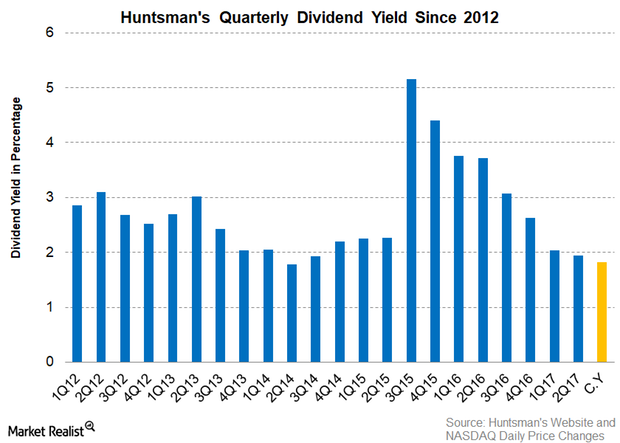

Huntsman’s Dividend Yield Falls as Its Stock Price Rises

Huntsman’s dividend yield Dividend yields are very important for long-term investors, as they fetch a steady income. Investors prefer companies with a strong dividend yield and growth. As Huntsman (HUN) has maintained its dividend rate, we can expect it to pay a fiscal 2017 dividend of $0.50 per share At this dividend rate, Huntsman’s dividend yield […]

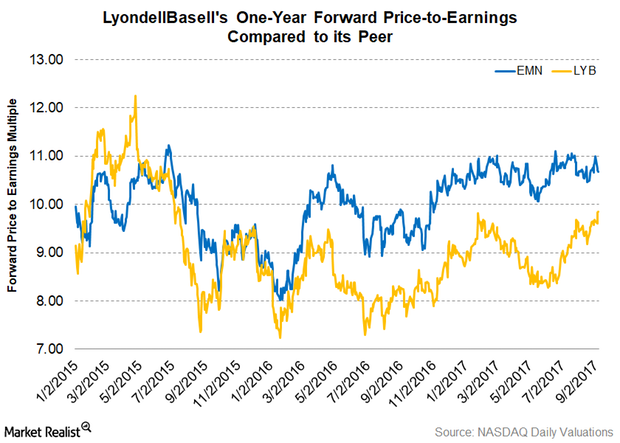

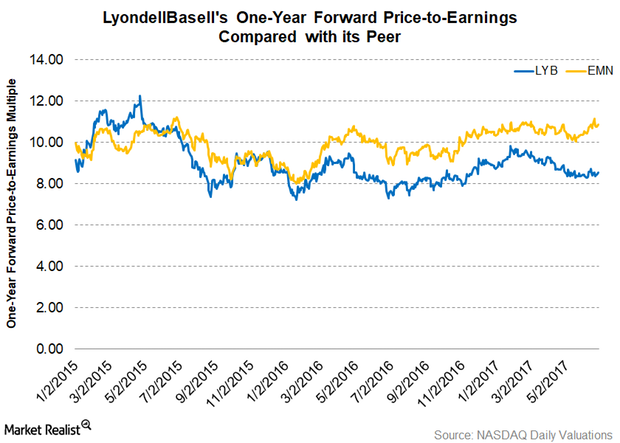

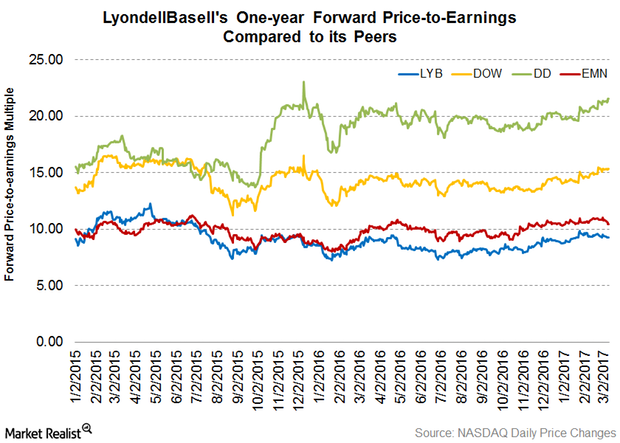

Is LyondellBasell Stock Undervalued Compared to Its Peer?

As of September 7, 2017, LyondellBasell’s one-year forward PE multiple stands at 9.80x, while Eastman Chemical has one-year forward PE multiple of 10.70x.

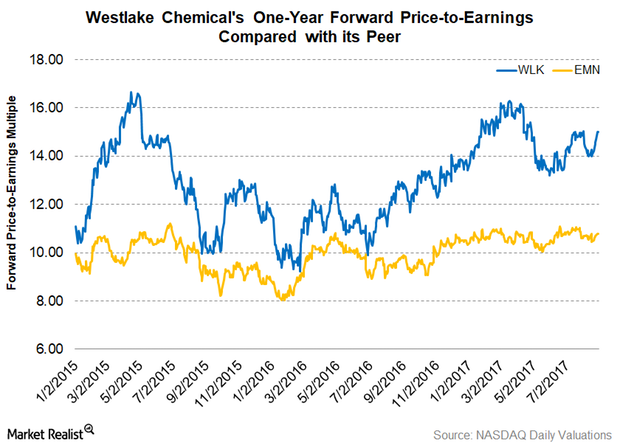

What Do Westlake Chemical’s Valuations Suggest?

Westlake Chemical is trading at a premium to its peer Eastman Chemical. After good earnings in 1H17, analysts expect Westlake Chemical to post EPS of $4.66.

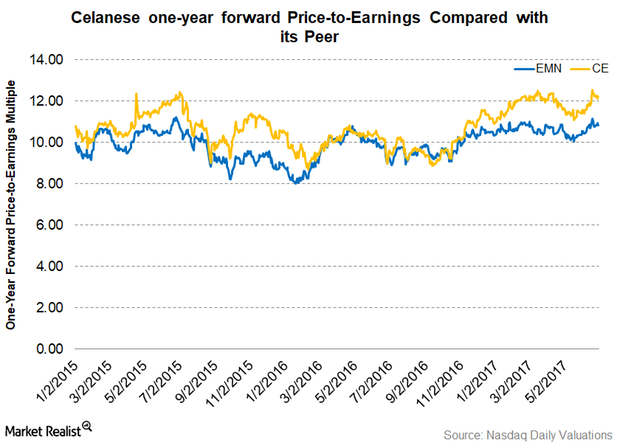

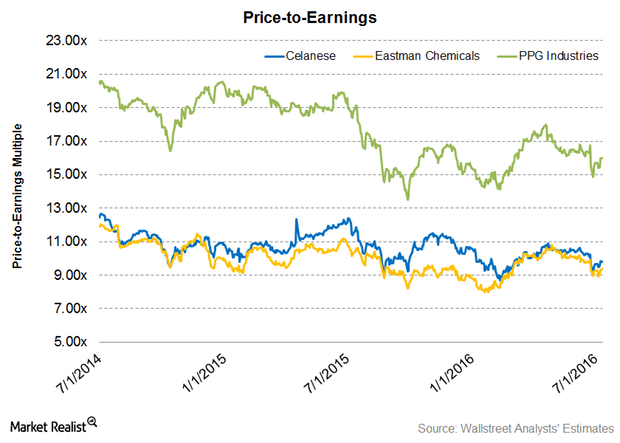

What Are Celanese’s Latest Valuations?

As of June 29, 2017, Celanese’s one-year forward PE (price-to-earnings) multiple stood at 12.20x.

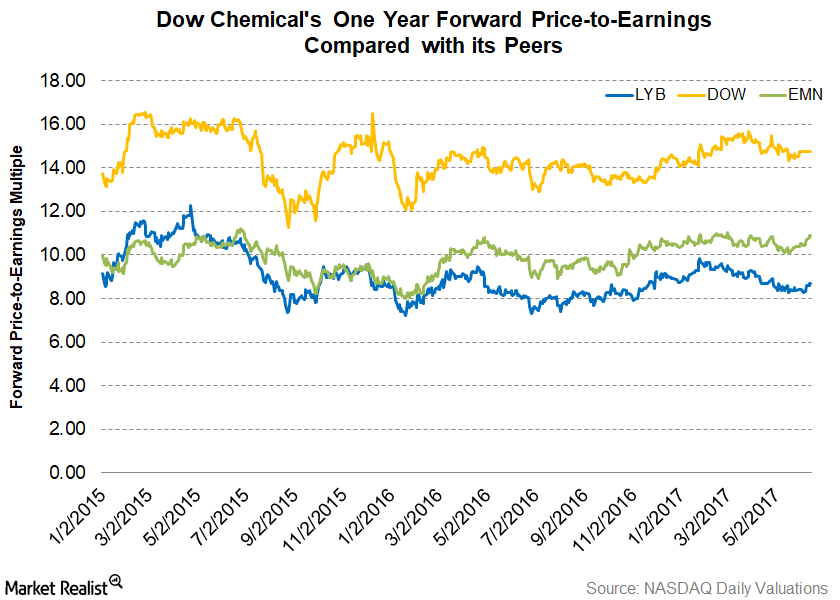

Why LyondellBasell Is Trading at a Discount to Peers

As of June 26, 2017, LyondellBasell’s one-year forward PE (price-to-earnings) multiple stood at 8.50x.

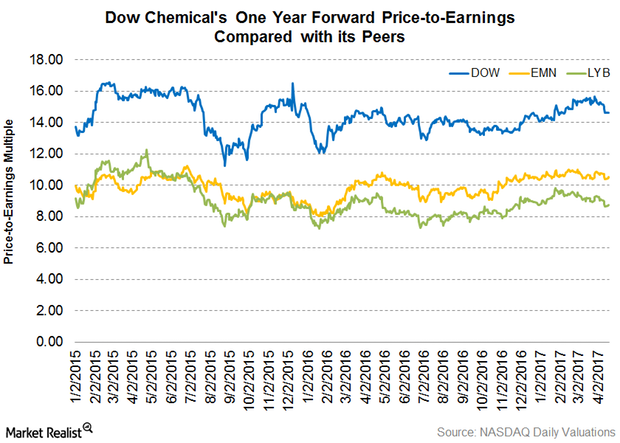

Dow Chemical’s Latest Valuations

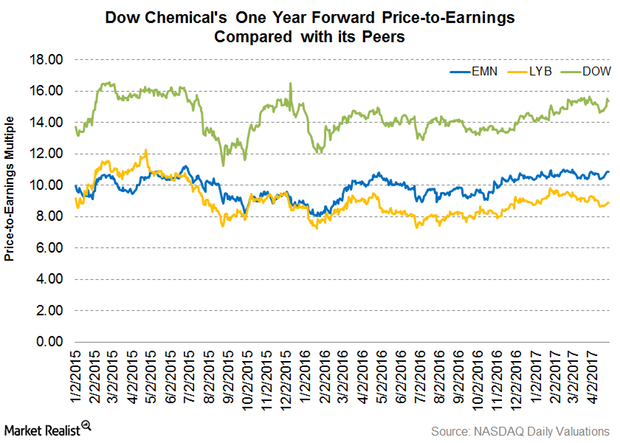

As of June 13, 2017, Dow Chemical (DOW) was trading at a one-year forward PE ratio of 14.70x, compared to 10.9x for Eastman Chemical (EMN).

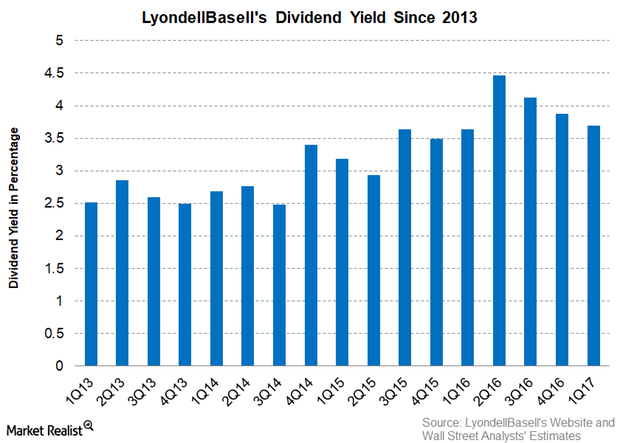

How LyondellBasell’s Dividend Yield Has Changed

On May 25, 2017, LyondellBasell (LYB) stock closed at $80.67. With LYB’s 2Q17 quarterly dividend of $0.90 per share, its current dividend yield is 4.4%.

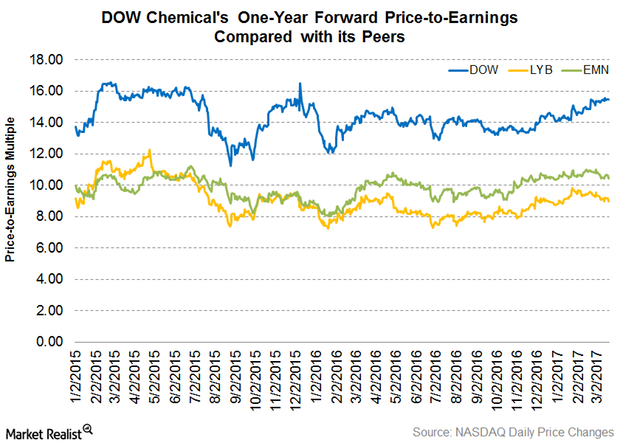

Dow Chemical’s Latest Valuations Post 1Q17 Earnings

As of April 27, 2017, Dow Chemical (DOW) was trading at a one-year forward PE ratio of 15.4x, compared to Eastman Chemical (EMN) and LyondellBasell (LYB) at 10.9x and 8.9x, respectively.

What Are Dow Chemical’s Valuations ahead of 1Q17 Earnings?

As of April 19, 2017, Dow Chemical (DOW) traded at a one-year forward PE ratio of 14.60x.

Dow Chemical Trades at a Premium to Its Peers

As of March 21, Dow Chemical (DOW) traded at a one-year forward PE multiple of 15.50x—compared to its peers Eastman Chemical and LyondellBasell.

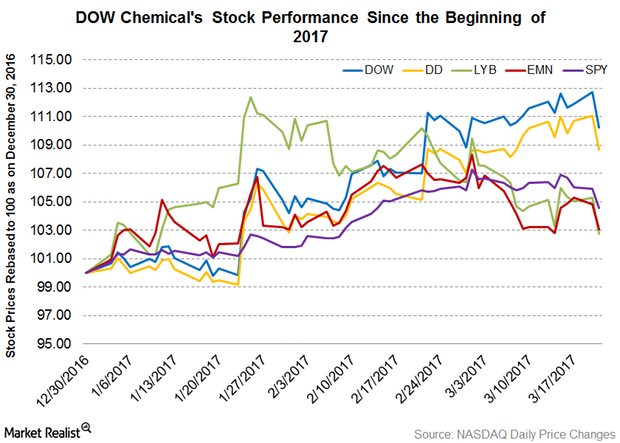

Analyzing How Dow Chemical Stock Has Performed in 2017

From the beginning of 2017 to March 21, 2017, Dow Chemical (DOW) has been an outstanding performer. It rose 10.20% and outperformed SPY.

Can LyondellBasell’s Valuation Come Out of Its Peers’ Shadow?

As of March 9, 2017, LyondellBasell (LYB) was trading at a one-year forward PE (price-to-earnings) multiple of 9.3x.

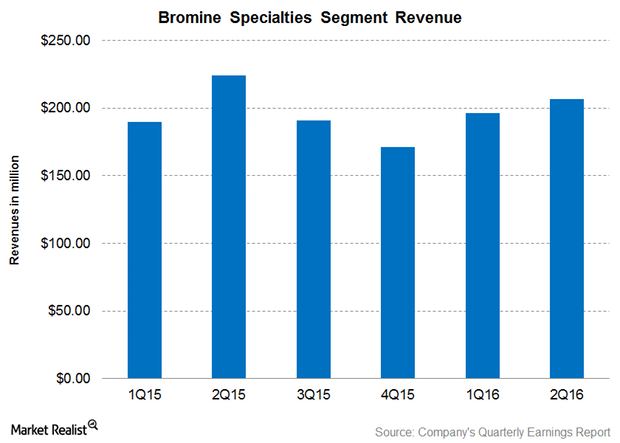

Albemarle’s Bromine Specialties Segment: Why Revenue Fell in 2Q16

In 2Q16, Albemarle’s (ALB) Bromine Specialties segment reported revenue of $206.9 million, representing 30.9% of Albemarle’s total revenue.

Where Do Celanese Valuations Stand before Its 2Q16 Earnings Report?

On July 11, Celanese’s forward EV-to-EBITDA ratio stood at 7.5x.

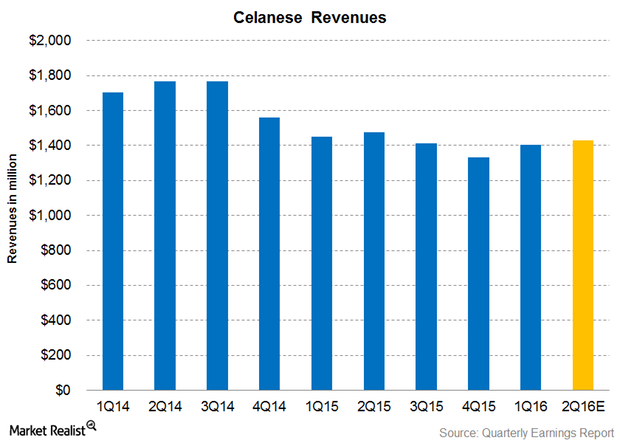

Can Celanese Outperform Analysts’ Revenue Estimates in 2Q16?

Celanese (CE) will announce its 2Q16 earnings report on July 26, 2016. In this series, we’ll look at the company’s 2016 guidance and valuations, analysts’ expectations, and other factors that could help investors make informed decisions.

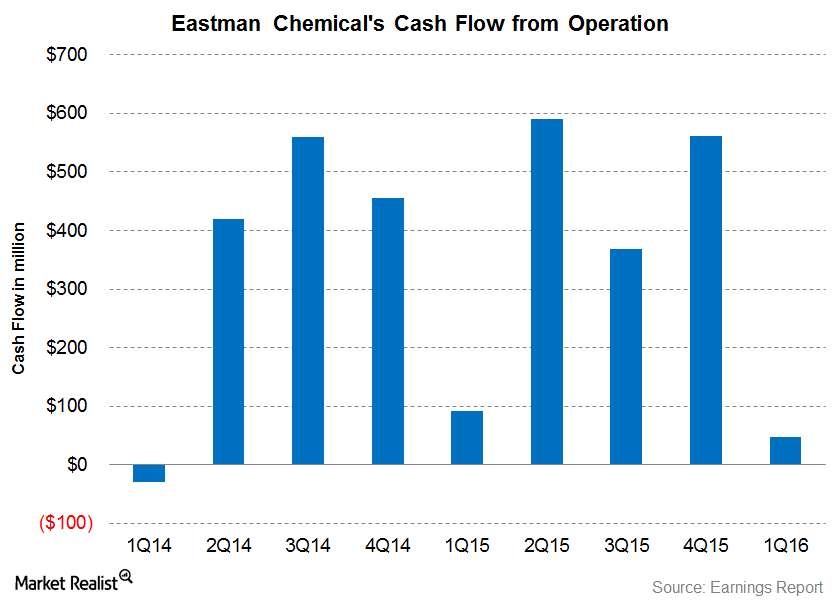

Can Eastman Chemical Generate Higher Operating Cash Flows?

In 1Q16, Eastman Chemical (EMN) reported operating cash flow of $47 million compared to $91 million in 1Q15. The decline was primarily due to the seasonal increase in working capital.

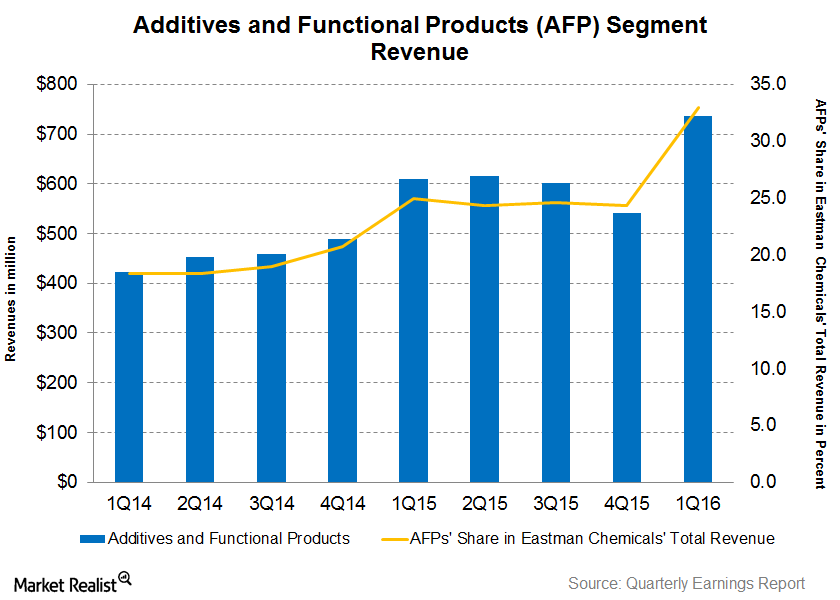

Can Eastman’s Additives & Functional Products Segment Deliver?

Eastman Chemical’s (EMN) Additives & Functional Products segment is the company’s strongest segment. It has grown significantly since 1Q14.

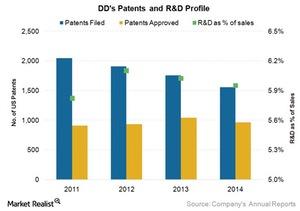

DuPont’s Research and Development Spending Compared to Its Peers’

DuPont is a technology and research and development driven company. It spent an average of 6% of its revenues on R&D activities during the 2011–2014 period.

What Will Drive Dow Chemical’s Future Growth?

The Dow Chemical Company has significantly changed its business model to improve its earnings profile and returns to shareholders.

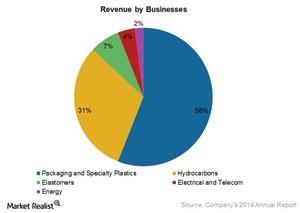

Understanding Dow’s Largest Segment, Performance Plastics

Dow’s Performance Plastics segment contributed 39% and 46% to Dow’s total revenue and EBITDA, respectively, in 2014.