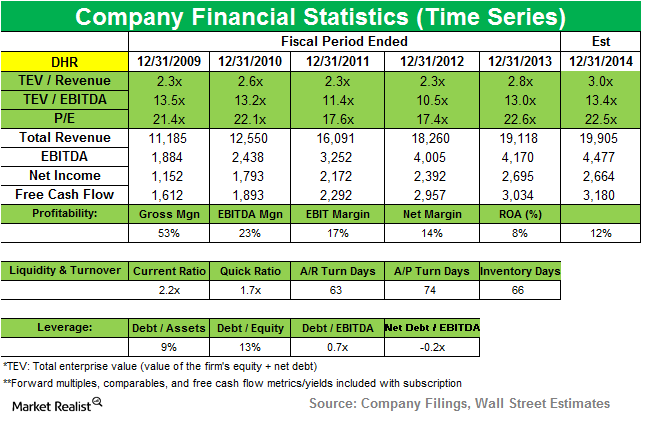

Danaher Corp

Latest Danaher Corp News and Updates

Glenview Capital opens new position in Danaher

Glenview Capital Management added a new position in Danaher Corp. (DHR) in the third quarter. The position accounted for 1.99% of the fund’s total portfolio.

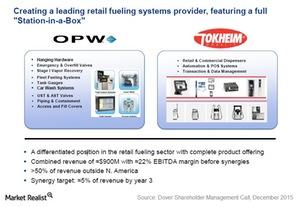

Dover Fluids: A Brief Overview

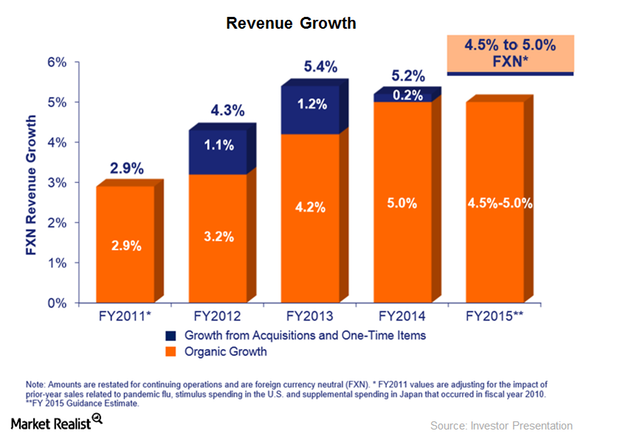

Dover Corporation’s (DOV) Fluids businesses include the Pump Solutions Group (or PSG), which provides pumping solutions to several end markets.

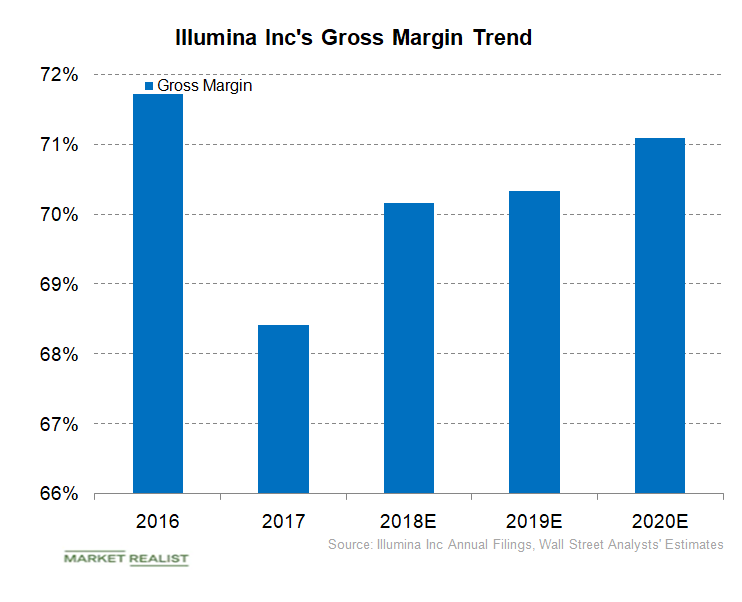

Understanding Illumina’s Gross Margin Trend

Illumina’s cost of product revenue increased from $173.0 million in the third quarter of 2017 to $184.0 million in the third quarter of 2018.

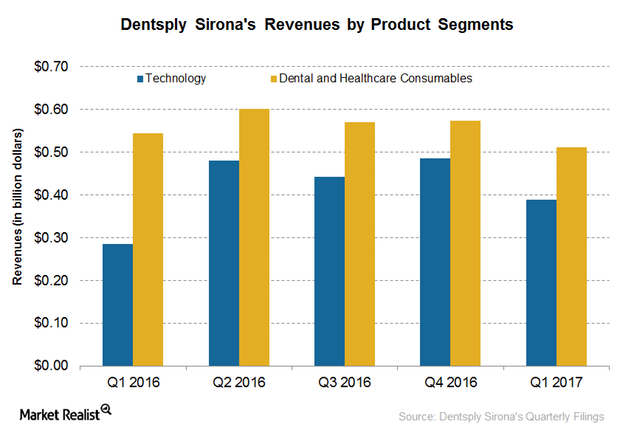

Understanding Dentsply Sirona’s New Organizational Structure

In 4Q17, Dentsply Sirona (XRAY) started reporting its operations under two segments, after a shift to three segments in fiscal 3Q17.

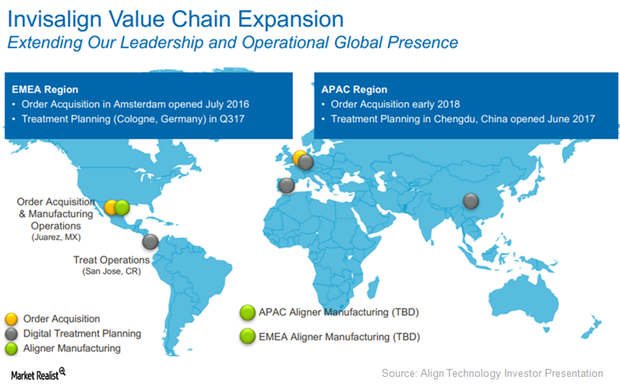

Align Technology Focuses on International Market Strategy

International market strategy In 2Q17, Align Technology (ALGN) reported 85,400 Invisalign case shipments in international markets, which is YoY (year-over-year) growth of ~37.4% and sequential growth of ~13.6%. This growth was mainly attributed to new customers in the EMEA (Europe, the Middle East, and Africa) and Asia-Pacific markets. If Align Technology continues to demonstrate solid […]

Inside Align Technology’s Market Expansion Strategy

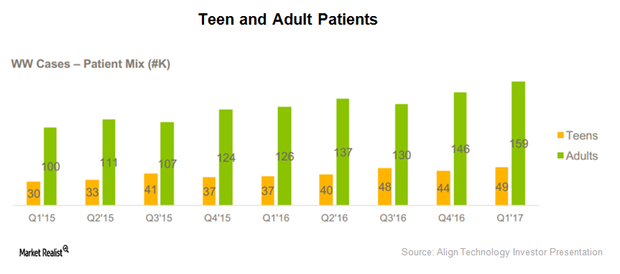

In 1Q17, Align Technology (ALGN) also witnessed a robust rise of around 45.2% in volumes of Invisalign sold in Asia-Pacific markets on a YoY basis.

These Are Align Technologies Key Demand Drivers in North America

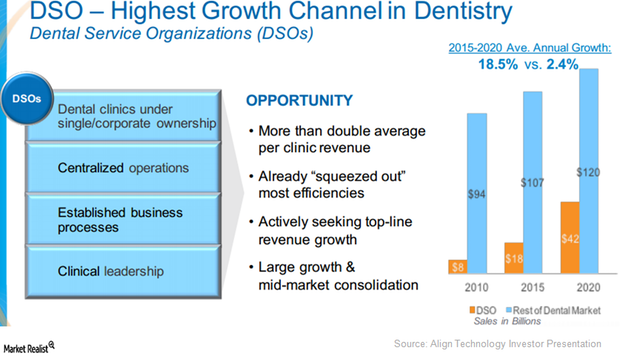

In 1Q17, Align Technology (ALGN) has started selling its new product Invisalign Go in North America, which involves a few DSOs (dental service organizations).

Behind Align Technology’s North American Expectations for 2017

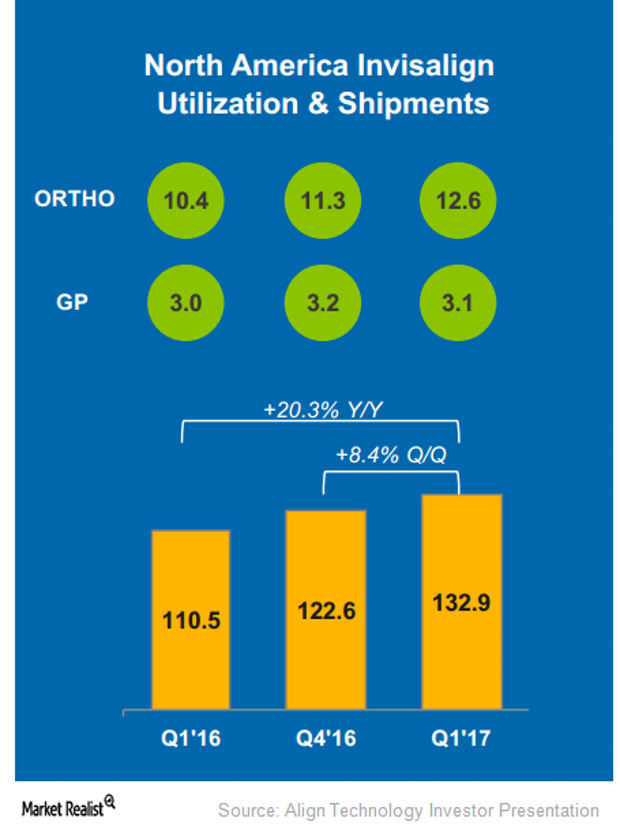

In 1Q17, Align Technology’s (ALGN) Invisalign sales volumes in North American markets rose YoY by 20.3% and QoQ by 8.3%.

Why Align Technology’s Orthodontics Is a Solid Growth Opportunity in 2017

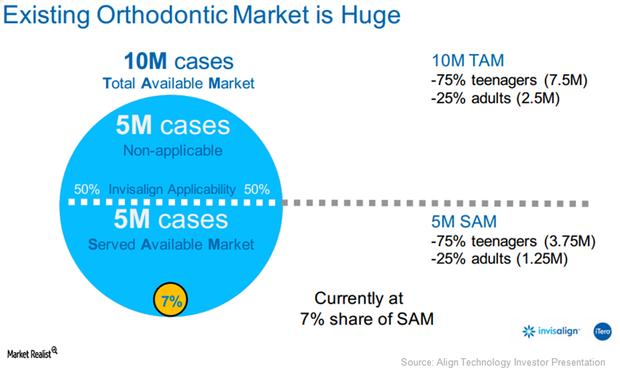

Align Technology (ALGN) is a medical device provider focused on malocclusion or teeth misalignment condition.

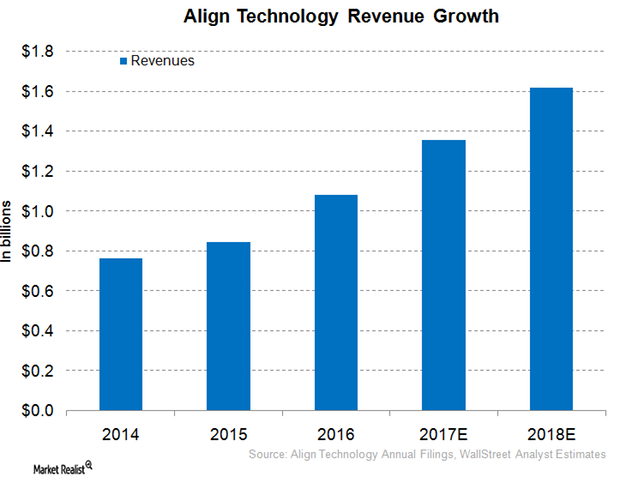

Inside Align Technology’s Robust Revenue Growth Projection for 2017

For fiscal 2017, Align Technology (ALGN) expects its 2017 revenues to grow operationally in the range of 15%–25% YoY.

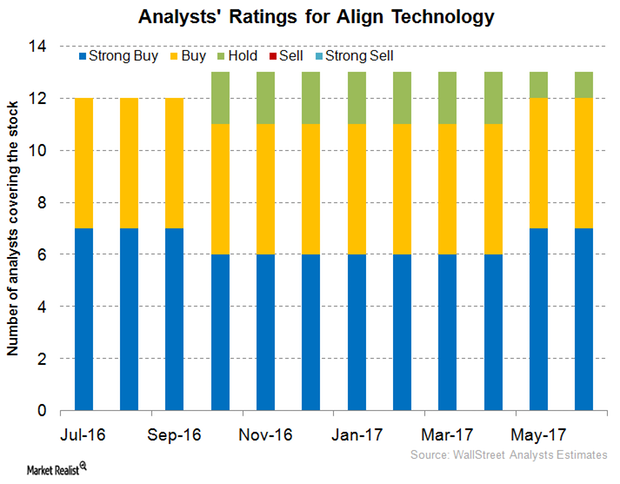

Align Technology versus Peers in June 2017: Analyst Recommendations

For 1Q17, Align Technology (ALGN) reported revenues close to $310.3 million, which represents YoY (year-over-year) growth of around 30.0%.

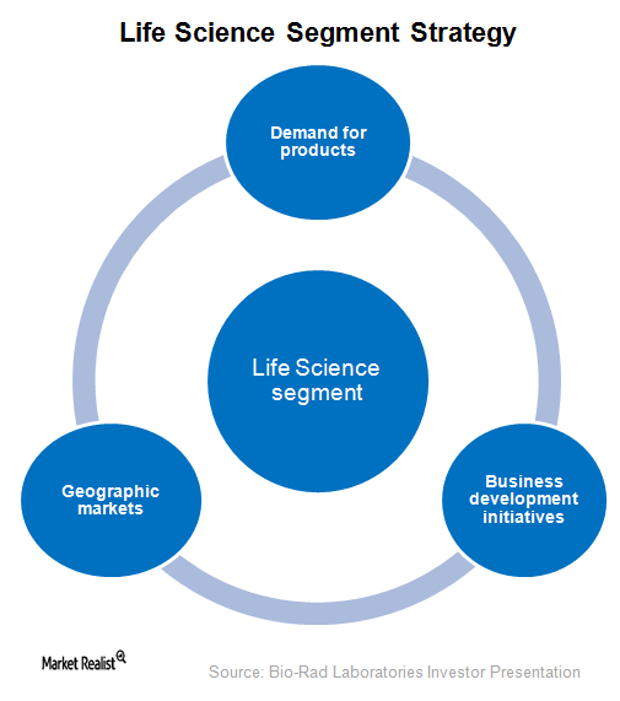

What Bio-Rad Laboratories Expects from Life Science

In 1Q17, Bio-Rad Laboratories’ (BIO) Life Science segment reported revenues of ~$174.3 million, which represents a YoY rise of ~5.1%.

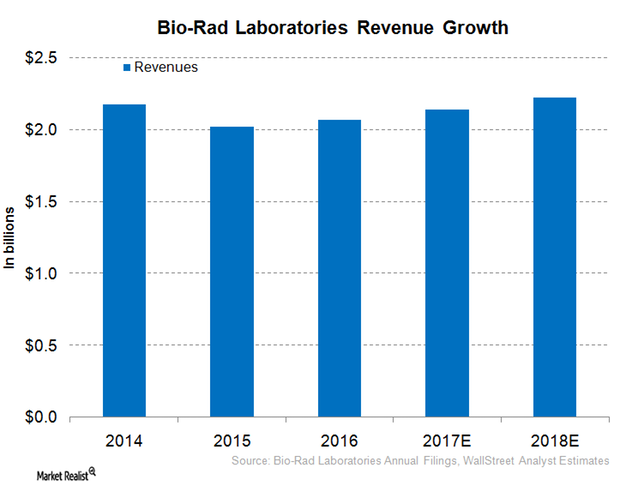

Inside Bio-Rad Laboratories’ Robust Revenue Growth Projection for 2017

On March 13, 2017, Bio-Rad Laboratories (BIO) provided a long-term, currency-neutral revenue growth target of around 3%–5%.

Dentsply Sirona’s New Growth Strategy to Accelerate Digital Dentistry Penetration

Dentsply Sirona is the largest dental equipment and solutions manufacturer in the United States. Digital dentistry is a megatrend in the market.

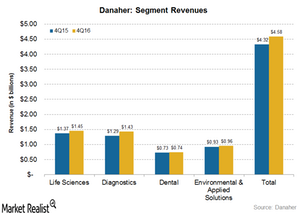

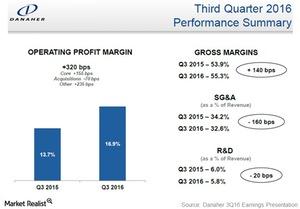

How Did Danaher’s Operating Segments Fare in 4Q16?

Currently, Danaher (DHR) reports its revenue under four operating segments: Life Sciences, Diagnostics, Dental, and Environmental & Applied Solutions.

Why Danaher Stock Rose after Its 4Q16 Results

Danaher Corporation (DHR) announced its 4Q16 and 2016 earnings results before the market opened on January 31, 2017. Let’s take a look.

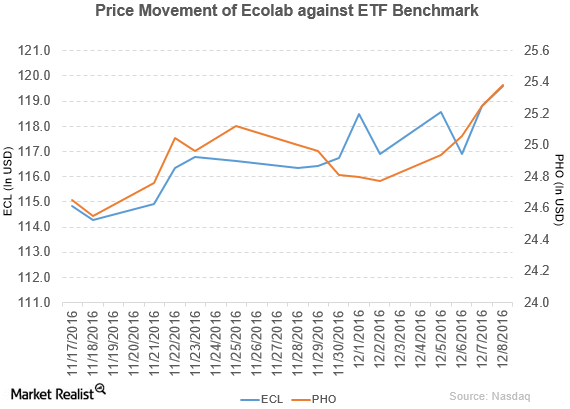

Ecolab Declares a Dividend of $0.37 per Share

Price movement Ecolab (ECL) has a market cap of $35.4 billion. It rose 0.67% to close at $119.61 per share on December 8, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 0.95%, 5.3%, and 5.5%, respectively, on the same day. ECL is trading 3.0% above its 20-day moving average, 2.7% above […]

With Phenomenex, Danaher Has an Attractive Consumables Asset

On October 12, Danaher announced its an agreement to acquire Phenomenex, a privately held manufacturer of separation and purification consumables.

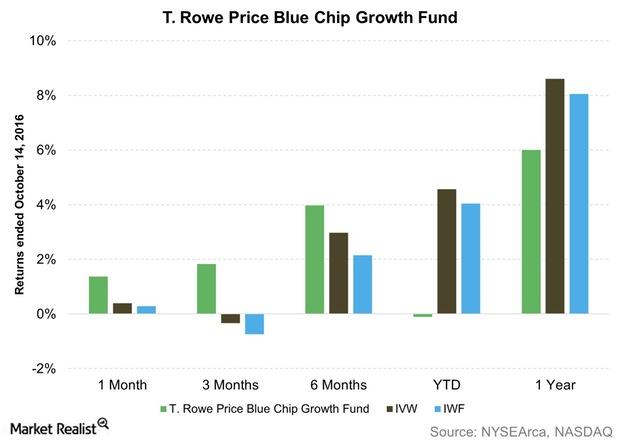

Why the T. Rowe Price Blue Chip Growth Fund Has Had a Rough 2016

TRBCX has had quite a poor run in 2016 so far. The fund places in the bottom three in the YTD period among the 12 funds in this review.

What Made Cepheid Attractive to Danaher?

On September 6, 2016, Danaher (DHR) announced that it has entered into a definitive agreement to acquire Cepheid (CPHD) for $4 billion.

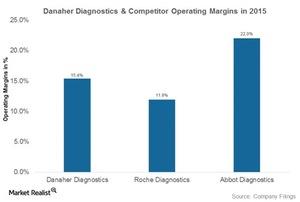

How Danaher Diagnostics Fares against Its Competition

Danaher’s Diagnostics unit had operating margins of 15.4% in 2015 and 17.2% in 1H16.

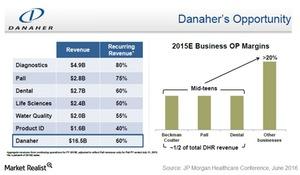

The Key Product Lines That Make Up Danaher’s Diagnostics Business

Danaher’s (DHR) Diagnostics unit, established through the acquisition of Radiometer in 2004, earned $4.9 billion in sales in 2015.

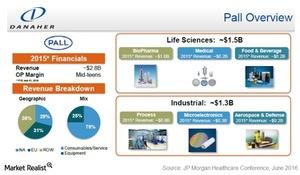

Pall Acquisition Gave Birth to Danaher’s Filtration Business

Danaher’s filtration business came into existence through the acquisition of Pall in 2015.

Understanding the Skeleton of Danaher’s Life Sciences Business

Customers in the Danaher life sciences business generally look at how the technology offered by a company can fit into their workflows.

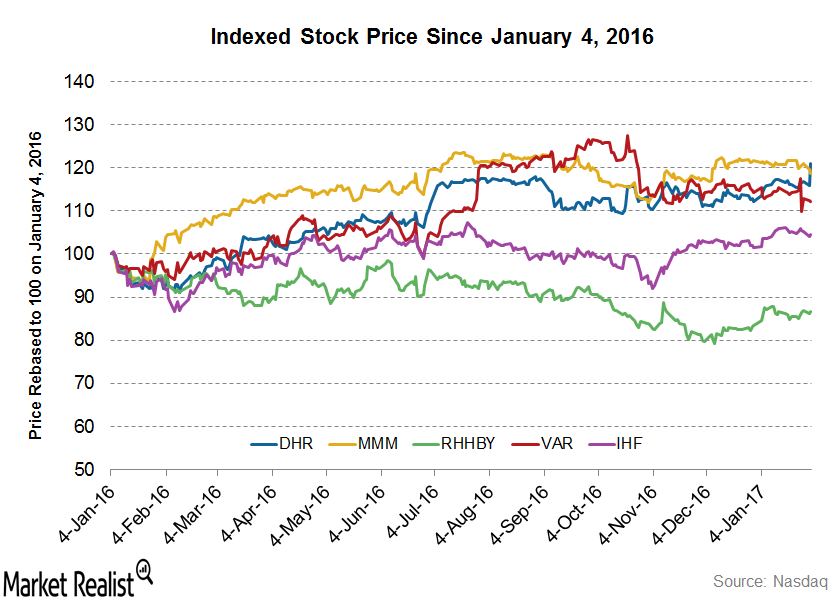

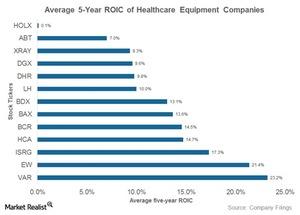

How Are Danaher’s Returns Compared to Its Industry Peers’?

Danaher’s ROIC fell steadily from 15.5% in 2006 to 8.5% in 2015, indicating that it has probably had fewer high return reinvestment opportunities since then.

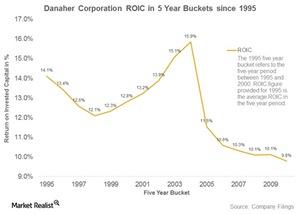

Is Danaher Losing Its Competitive Advantage?

We analyzed Danaher’s (DHR) ROIC in the 20-year period between 1995 and 2015 and classified the period of study into 16 buckets of five years each.

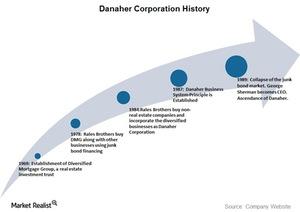

Danaher’s Journey from Corporate Raider to Corporate Statesman

Danaher (DHR) was the brainchild of brothers Steven and Mitchell Rales. It was incorporated as a holding company in 1984.

Parker-Hannifin’s 2017 Guidance Suggests Slowdown in Industrials

Parker-Hannifin has guided its fiscal 2017 adjusted EPS at $6.40–$7.10. The midpoint of this range is roughly 4.5% higher than $6.46 in fiscal 2016.

How 3M Company Differs from Other Industrial Conglomerates

While 3M’s peer group includes industrial conglomerates such as Honeywell and General Electric, these companies hardly share any similarities with 3M.

Understanding Dover Corporation’s Corporate Profile and History

Dover Corporation (DOV) is a machinery manufacturer that operates in four diverse segments: Energy, Engineered Systems, Fluids, and Refrigeration & Food Equipment.

Becton, Dickinson and Company’s Acquisitions and Collaborations

Becton, Dickinson and Company’s (BDX), or BD’s, growth strategy includes acquisitions and collaborations.

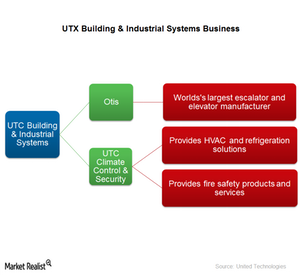

What Is UTC Building & Industrial Systems?

UTC offers some products and services through UTC Building & Industrial Systems, a combination of two segments, Otis and UTC Climate, Controls & Security.

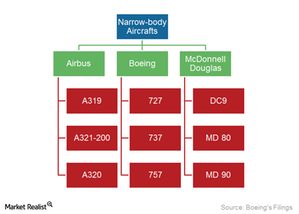

The Boeing Company’s Narrow-Body Aircraft

The Boeing 737 is the best-selling commercial airliner in history. Reliable and economical, the 737 dominates the short- and medium-haul markets.