CBS Corp

Latest CBS Corp News and Updates

Where Is CBS Co-Host Gayle King Today? Fans Question Her Whereabouts

Gayle King renewed her contract with CBS in January 2022, so her recent absence from 'CBS Mornings' shouldn't be interpreted as her preparing to leave.

ViacomCBS Gave the Green Light to a Reimagined Version of "I Love Lucy"

Who owns the ‘I Love Lucy’ rights? Learn what happened to the hit TV comedy after Lucille Ball and Desi Arnaz gave up Desilu Productions.

South Park Settles $900M Movie Deal With ViacomCBS, Stock Responds

South Park is prepping to launch at least 14 films following a hefty ViacomCBS deal. Founders stock up on capital as VIAC stock responds.

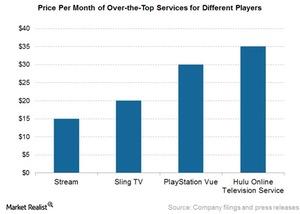

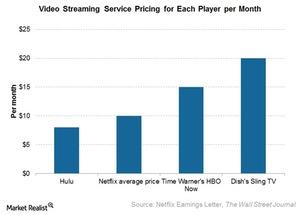

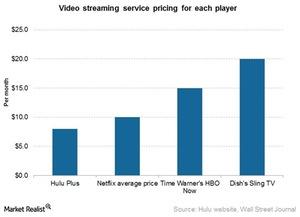

Will Dish’s Sling TV Remain Successful?

As Millennials increasingly move to OTT (over-the-top) services, pay-TV companies like Dish Network (DISH) are also focusing on OTT services.

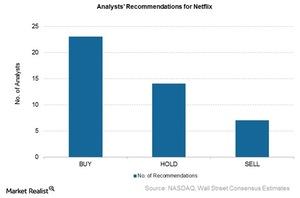

Trading at a Discount, Netflix Has Mixed Recommendations

Of the 44 analysts covering Netflix, 23 have given it a “buy” recommendation, seven have given it a “sell” recommendation, and 14 have given it a “hold” recommendation.

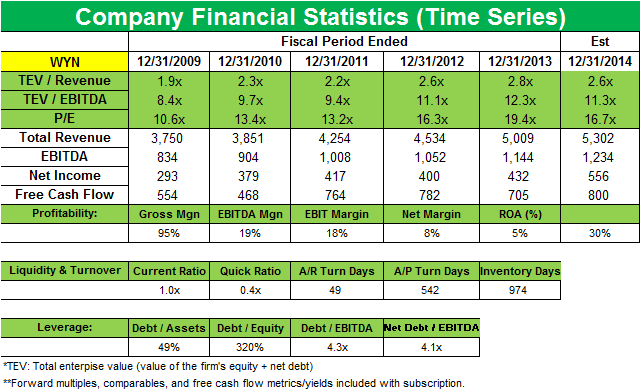

Why Chilton starts new position in Wyndham Worldwide

Approximately 63% of Wyndham’s revenues come from fees for providing services referred to as its “fee-for-service” businesses.

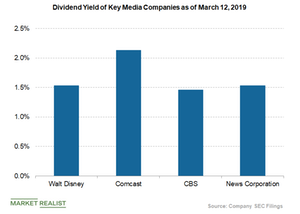

How Viacom and CBS Could Benefit from Potential Merger

Media players Viacom (VIAB) and CBS (CBS) are again talking about a merger.

How Do Media Networks Make Money?

Media networks face stiff competition for acquisition and distribution of content. Quality and exclusivity add to competition across the media value chain.

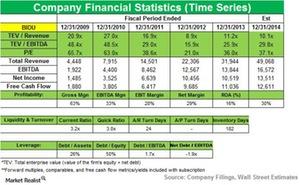

Maverick Capital lowers position in Baidu, Inc.

Maverick Capital lowered its position in Baidu, Inc. in 3Q14. The position accounts for 0.36% of the fund’s total portfolio in the third quarter.

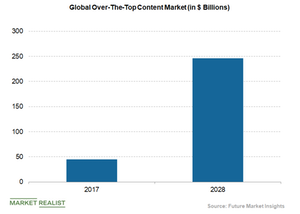

An Overview of the Streaming Services Industry

The pace that internet video streaming has evolved is nothing short of revolutionary. Streaming is a serious threat to the cable TV industry.

Why Did S&P Downgrade Disney’s Rating?

On March 12, S&P Global Ratings reportedly downgraded the Walt Disney Company (DIS) to an A from an A+.

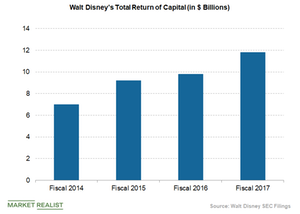

Why Disney Had to Discontinue Its Share Repurchase Program

Disney announced that it would not continue its share repurchase program until it completed its proposed acquisition of media assets from 21st Century Fox.

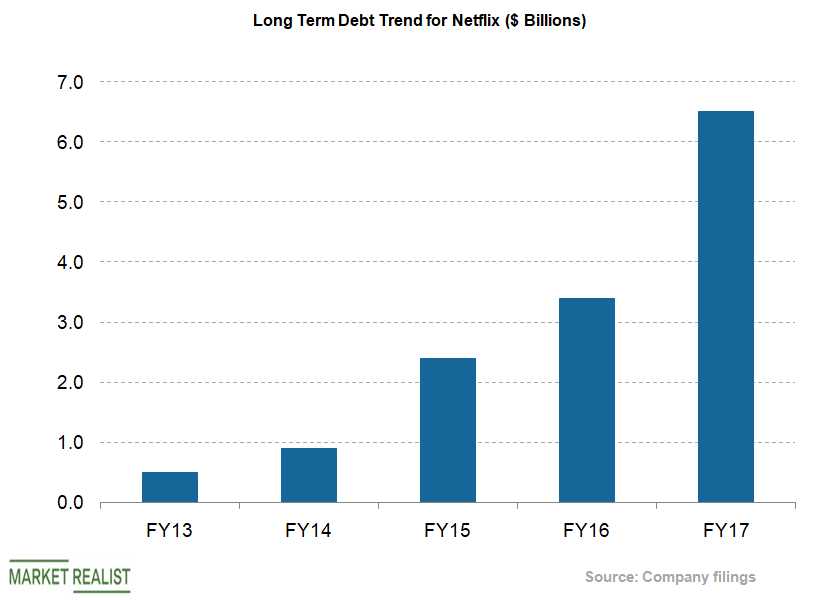

Debt Remains Netflix’s Prime Source of Financing

Netflix (NFLX) considers debt its main source to finance content, given its lower cost of capital.

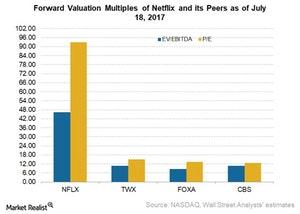

Where Netflix’s Valuation Stands among Its Peers

Netflix is now trading at a PE (price-to-earnings) multiple of 239.61x.

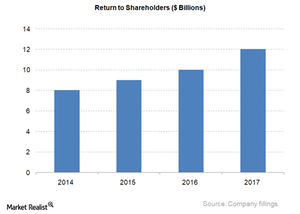

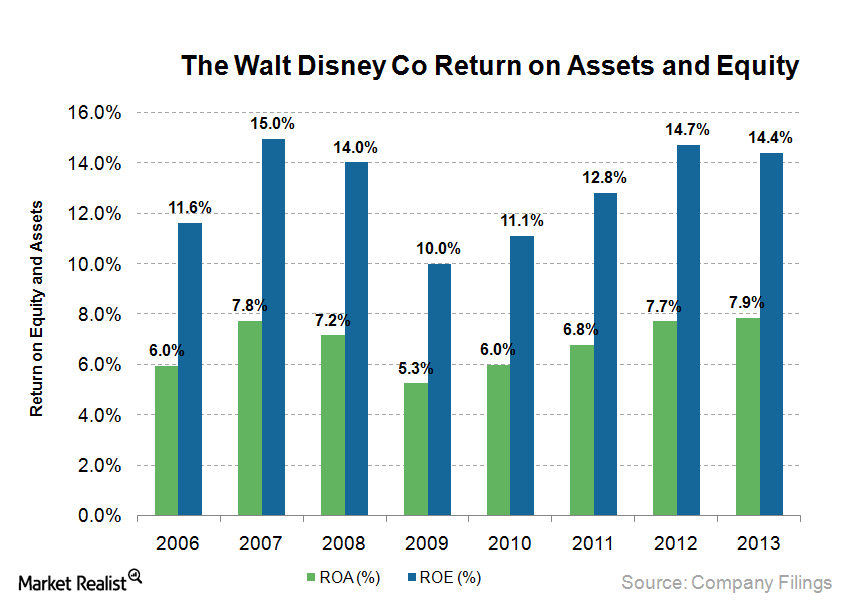

Disney’s Capital Return Policy Looks Attractive

Capital return trends Leading media mogul The Walt Disney Company (DIS) has continued to improve its capital return policy, driven by attractive dividend payments and strong share repurchase programs. In fiscal 2017, the media giant returned ~$11.8 billion to shareholders via buybacks and dividend payments, compared with $9.8 billion in fiscal 2016. In fiscal 2018, the […]

Comparing Netflix’s Valuation Metrics with Its Peers

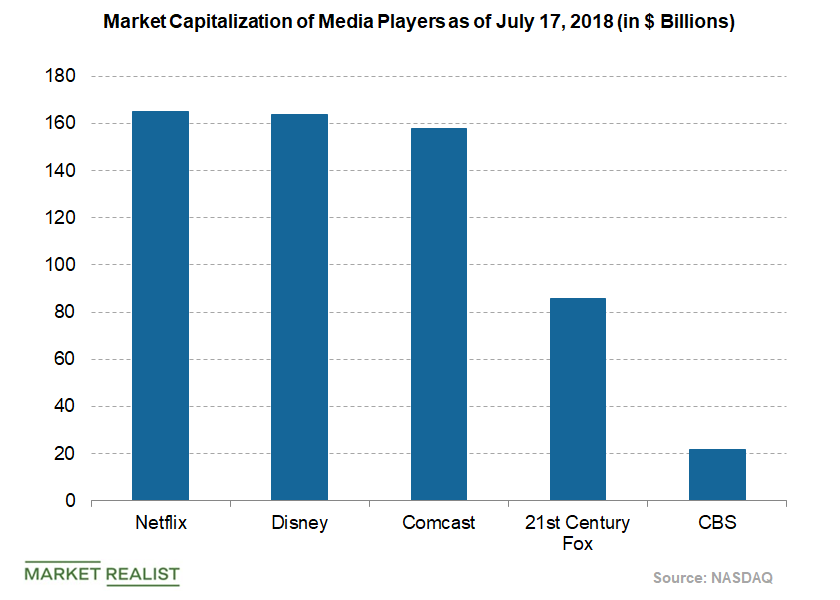

Netflix’s stock price closed at $183.60 on July 18. The company had a market capitalization of $79.4 billion on July 18 with an enterprise value of $81.8 billion.

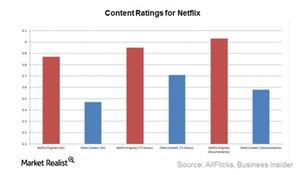

What Is Netflix’s Content Licensing Strategy?

Content licensing is usually for a fixed number of years, and Netflix (NFLX) pays for an exclusive subscription video-on-demand (or SVOD) license for a given title.

Netflix’s View: Original Content versus Content Licensing?

Original programming Netflix (NFLX) expects to spend ~$5 billion on content acquisition in 2016 and $6 billion on content in 2017. Currently, 10% of its content spending is on original content. The company would like to raise that amount to 50%. Netflix believes original content will strengthen its brand and drive up viewing hours. Netflix […]

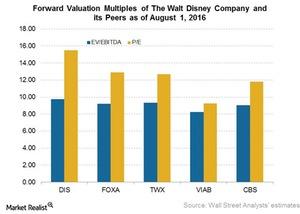

How Disney Is Managing Its Valuation Metrics

Disney stands out from its competitors in the media industry due to its large amount of intellectual property.

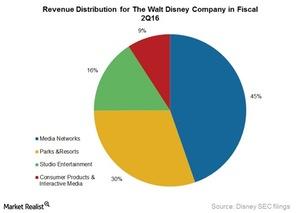

What Is Disney’s Core Strategy for Its US Theme Parks Business?

The Walt Disney Company’s (DIS) theme parks and resorts business is doing extremely well in the United States.Technology & Communications Must-know factors that could drive future growth at Disney

Disney considers itself a creative content company, and creative excellence is the key to its success. It expects to continue to invest both organically and inorganically.

Hulu’s Reinvention of Itself: A Closer Look at Business Strategy

Currently, Hulu’s free service is ad-supported while its $7.99-per-month service provides content with fewer ads.

Hulu: Change of Business Strategy

Hulu is planning to launch an ad-free service priced at $12–$14 per month later this year. Hulu is also looking at programmatic ad buying to better monetize its content.Industrials Paulson & Co. buy a new stake in Verizon Communications in 1Q14

Paulson took a new position in Verizon Communications (VZ) last quarter. The position accounts for 2.04% of Paulson’s $20 billion portfolio.Technology & Communications A guide to Disney’s Consumer Products and Interactive Media segment

The businesses in the Consumer Products segment generate royalty revenue by licensing characters from its film, television, and other properties to third parties.

Why Disney’s Parks and Resorts business is a valuable growth driver

In 2013, Parks and Resorts revenues increased 9%, to $14.1 billion, and segment operating income increased 17%, to $2.2 billion

Exploring revenue and profitability drivers at Disney

For the fiscal year ended September 28, 2013, the company reported record results, with an 8% increase in diluted EPS, to $3.38 compared to $3.13 in the prior year.