Blackstone Group Inc (The)

Latest Blackstone Group Inc (The) News and Updates

American Campus Communities (ACC) Stock Balloons On Acquisition News

The college campus housing market is on fire, and American Campus Communities (ACC) stock is at the center of it all. Here’s a forecast for ACC stock.

Blackstone Closes $5.8 Billion Real Estate Deal To Acquire Preferred Apartment Communities

The U.S. housing market hasn’t peaked yet, apparently. Blackstone just acquired Preferred Apartment Communities in a $5.8 billion deal.

Blackstone-Backed Firm Buys Reese Witherspoon’s Hello Sunshine Production Company

Is Reese Witherspoon a billionaire now? Learn how much the 'Morning Show' actress is earning with the sale of her production company, Hello Sunshine.

Can Blackstone Balance the Real Estate Market With $6B Housing Bet?

With Blackstone investing in the housing market, real estate pricing could falter or find its footing. Will Blackstone's $6 billion housing bet help?

Medline-Blackstone Buyout Leaves a Massive Mark on Corporate Deals

Medline has been bought out by a trio of corporations, including Blackstone. Here's what that means for the greater corporate ecosystem.

Blackstone Is Attracting New Capital

The launch of innovative ideas at the right time can help Blackstone attract a good amount of new capital through its dedicated network.

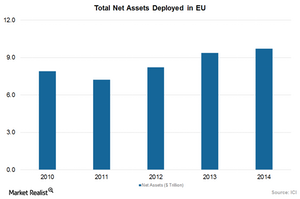

Fund Flows Continue to Rise in the European Union

Fund flows in European equities (EFA) have expanded at a slower pace since 2011. Overall, they’ve grown at an average of 10% over the past three years.

Dimensional Fund Advisors’ Major Holdings in Q3

Dimensional Fund Advisors’ top buys are Apple (AAPL), AT&T (T), Microsoft (MSFT), L3Harris Technologies (LHX), and Verizon Communications (VZ).

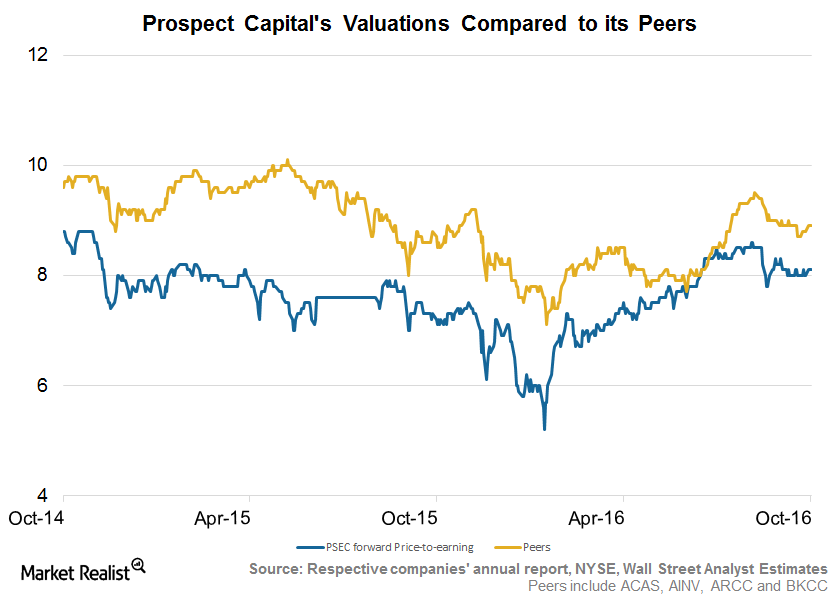

Prospect’s Valuation Discount Consistent on Lower Originations

Prospect Capital’s (PSEC) stock has fallen ~3% in the past quarter, and it has risen ~11% in the past year. The company is currently trading 7% lower than its 52-week high.

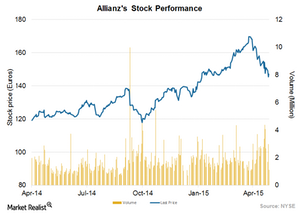

Allianz Reports 11% Revenue Growth Backed by Insurance Business

Allianz Group offer property casualty insurance, life and health insurance, and asset management products and services in over 70 countries. The company’s major operations are in Europe.

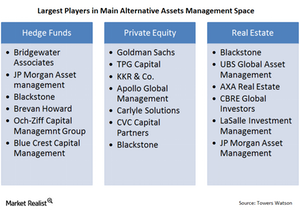

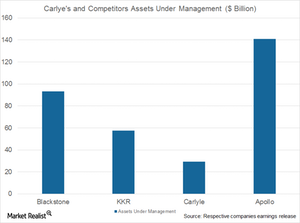

The many players in alternative asset management

Some players are present across the spectrum of alternative assets, but most alternative asset managers are present only in a particular asset area.

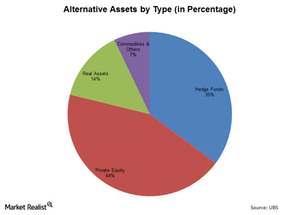

The relative share of the alternative asset management space

Alternative assets account for about 10% of the total global asset management industry that’s valued at $63.9 trillion. Private equity contributes most.

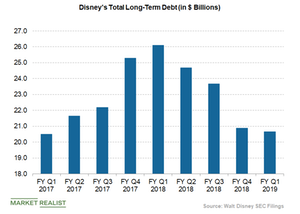

When Can Disney Resume Its Share Buyback Program?

Disney has suspended its share repurchase program temporarily due to its heavy debt load.

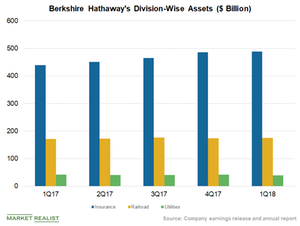

How Will Berkshire Deploy Its Cash Pile of over $100 Billion?

Berkshire Hathaway (BRK.B) was sitting on liquidity of $118 billion at the end of the first quarter.

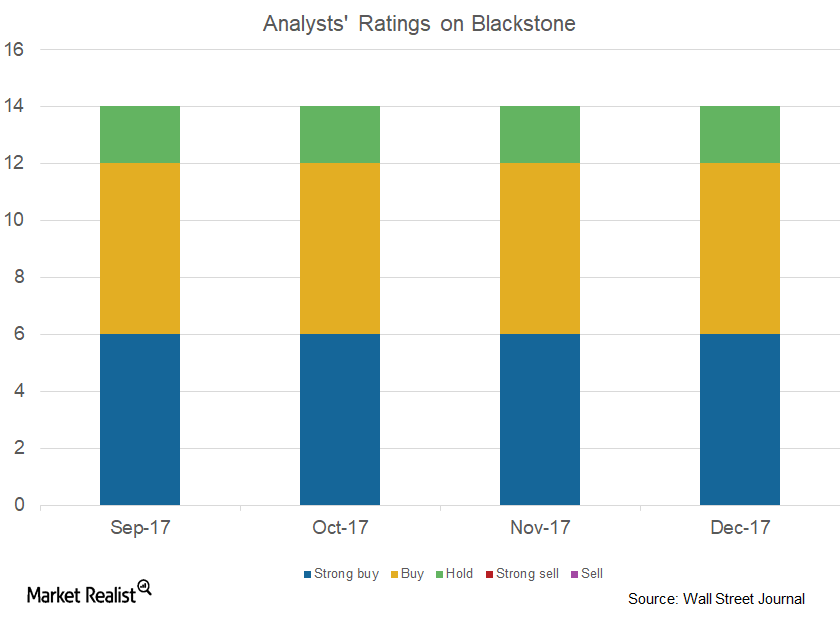

How Analysts View Blackstone

The Blackstone Group (BX) is being tracked by 14 analysts in December 2017. Six have given it “strong buy” ratings, two have suggested “hold” ratings, and six have recommended “buys.”

Blackstone’s Private Equity Division Saw a Strong Performance

The Blackstone Group’s (BX) private equity division posted total revenue of $1.4 billion in the first nine months of 2017, compared to $895.3 million in the first nine months of 2016.

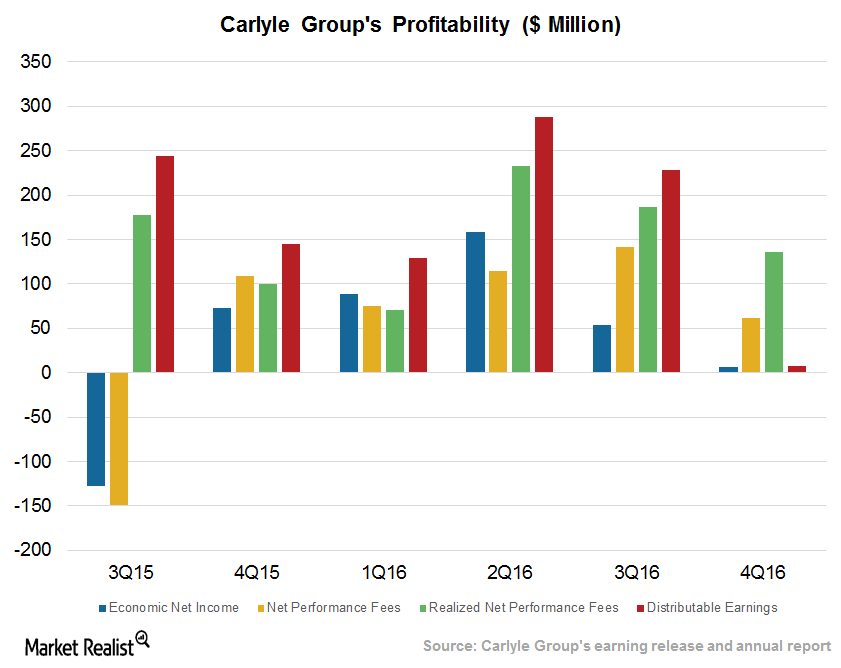

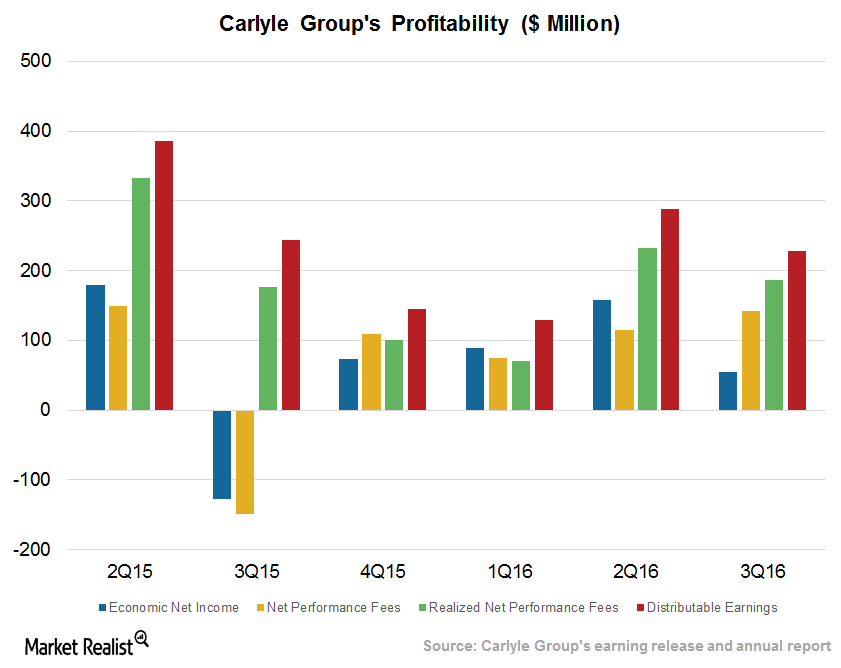

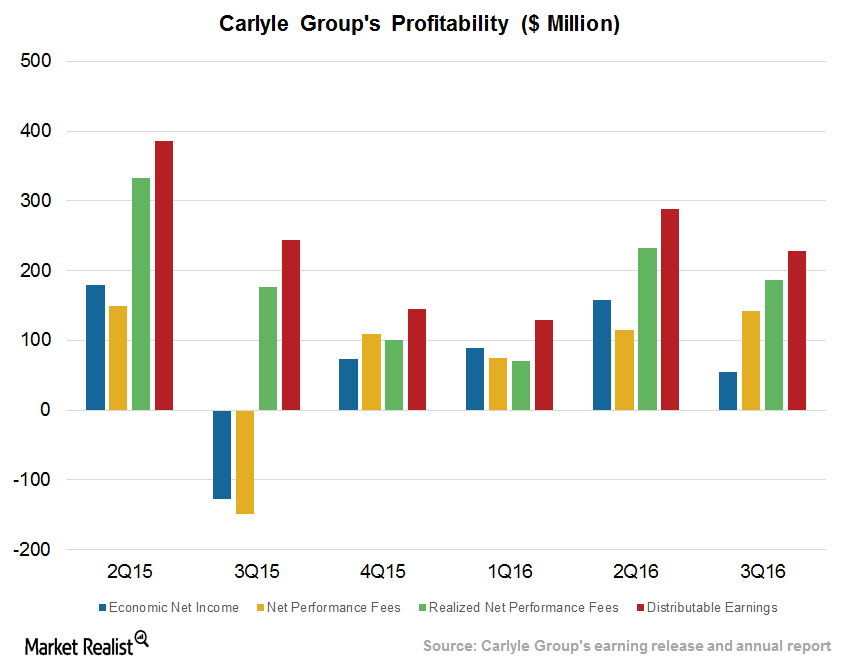

Carlyle Group’s Corporate Private Equity Division

In 3Q17, the Carlyle Group’s (CG) Corporate Private Equity division saw a marginal decline in distributable earnings, from $209 million in 3Q16 to $207 million in 3Q17.

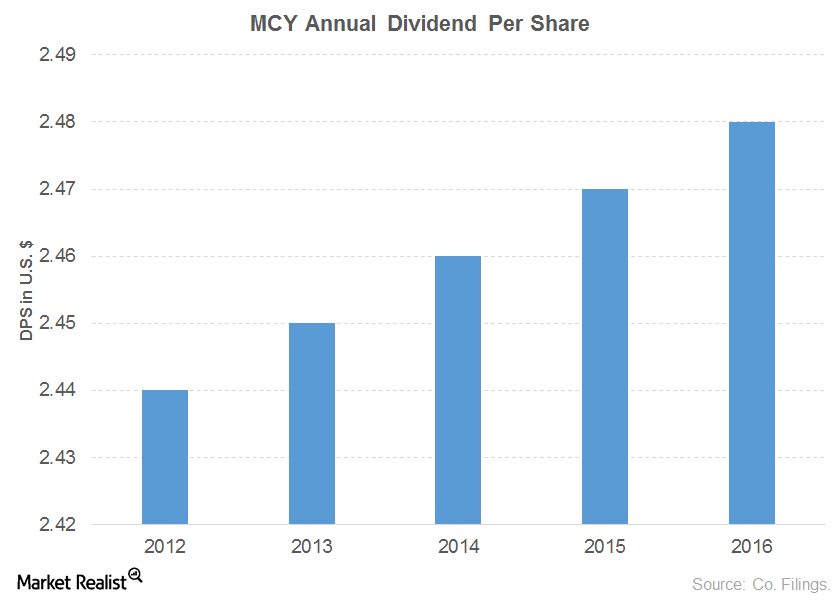

The Top Dividend-Growing Financial Sector Stocks

Mercury General (MCY) has consistently recorded revenue growth since fiscal 2011, except for a minor decline in fiscal 2015

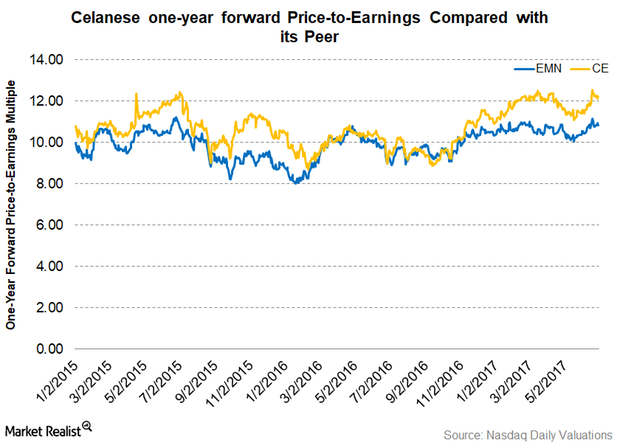

What Are Celanese’s Latest Valuations?

As of June 29, 2017, Celanese’s one-year forward PE (price-to-earnings) multiple stood at 12.20x.

What’s Happening Now with Carlyle’s Investment Solutions Segment?

Carlyle Group (CG) raised new capital of $3 billion in 1Q17, which included $1.4 billion from its Investment Solutions segment and $1 billion from Real Assets.

Inside Carlyle’s Expected Performance in Real Estate Assets

Real estate experts have an optimistic view of the industry, backed by a rising number of allocations in core and opportunistic funds by investors.

Understanding Carlyle’s Improved Performance despite Rate Hike Expectations

Carlyle Group has a number of credit strategies in place, and for its LPs (limited partnerships), the company is planning to invest in new credit strategies.

This Segment Is Driving Carlyle’s Numbers

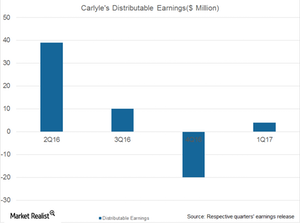

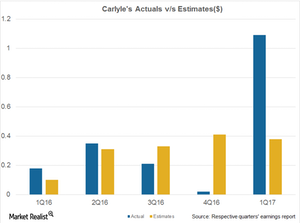

For 1Q17, Carlyle Group reported higher economic net income in its Corporate Private Equity segment, from $32 million in 1Q16 to $313 million in 1Q17.

Carlyle Saw Impressive 1Q17 Results, but Can It Sustain?

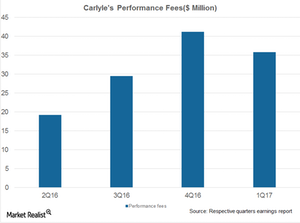

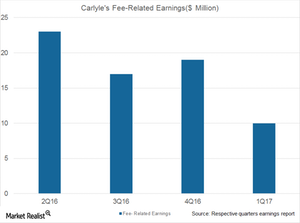

After a subdued performance in 4Q16 and heavy losses in its Global Market Strategies segment, Carlyle Group (CG) reported improved numbers in 1Q17.

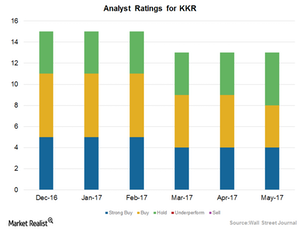

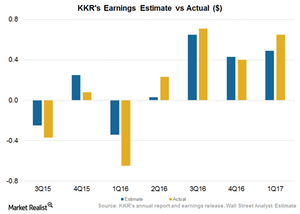

How Wall Street Analysts View KKR’s Performance in 2017

Analysts gave KKR an average target price of $21.42 from the current price, suggesting a rise of 14.3%.

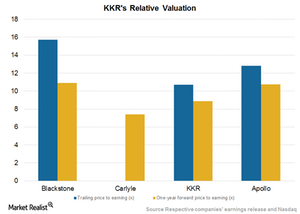

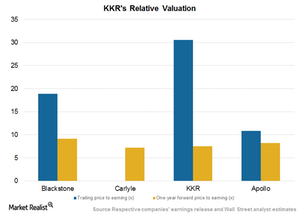

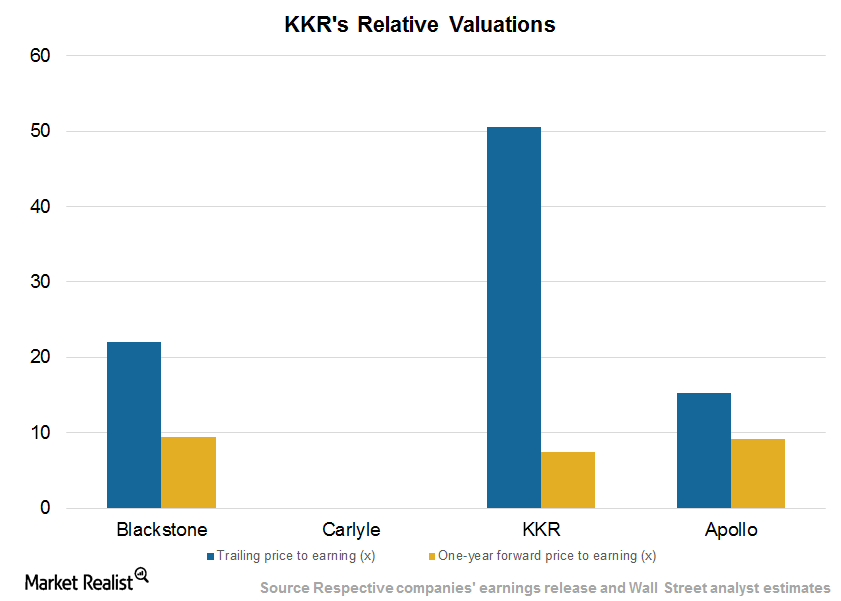

KKR’s Valuation amid Rising Equity Valuations in 2017

KKR & Co. (KKR) has posted earnings per share (or EPS) of $1.76 over the last four quarters.

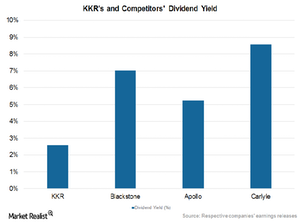

KKR’s Distribution Policy: A Reward for Unit Holders

KKR & Co. (KKR) paid a fixed dividend of $0.17 in May 2017 according to its policy announced in 2016.

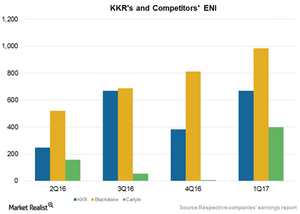

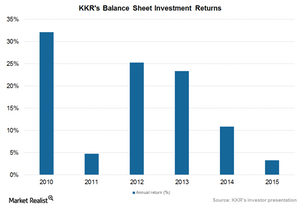

How KKR Is Performing in Relation to Alternative Managers

KKR & Co. (KKR) has reported an increase in its economic net income (or ENI) to $668.5 million in 1Q17 compared to $383.2 million in 4Q16.

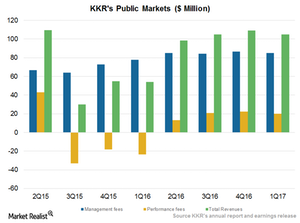

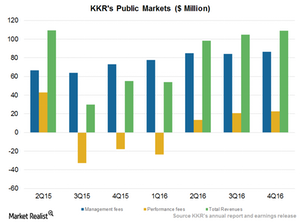

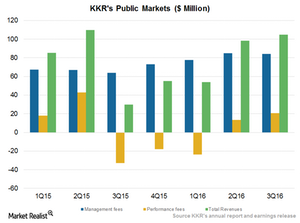

What Could Lead KKR’s Public Market Segment to Rise or Fall?

KKR has seen a decline in its base fees to $85.5 million in 1Q17 compared to $86.7 million in 4Q16.

KKR’s 2Q17 Performance on Deployments, Rise in Holdings

In 1Q17, KKR & Co. (KKR) deployed ~$5.4 billion in its Public Markets and Private Markets segments. KKR is expected to post EPS of $0.49 in 2Q17 and $2.15 in fiscal 2017, representing year-over-year growth of 113% and 216%, respectively.

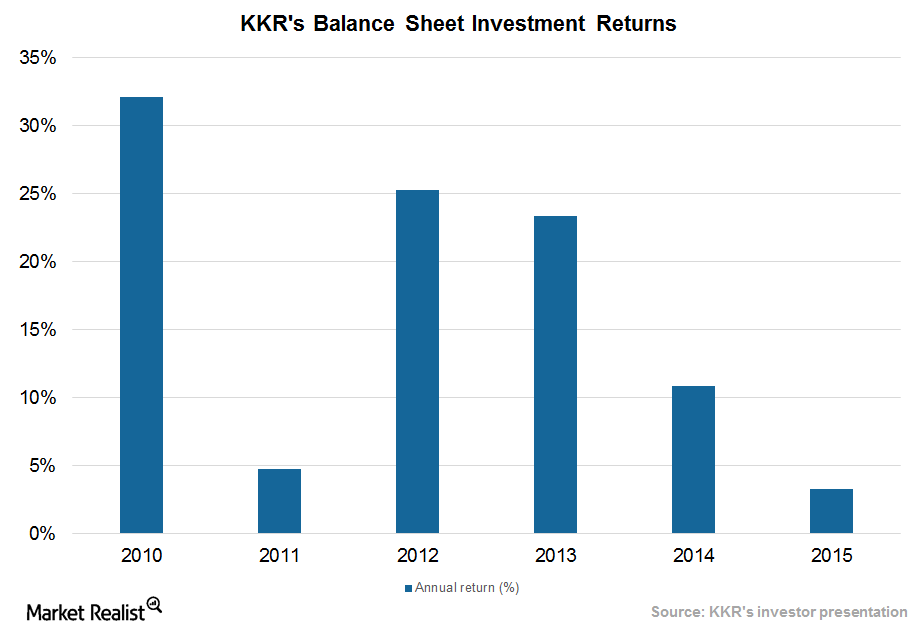

Alternatives’ Deployments May Remain Stable on Fundamentals

In 2016, alternatives saw higher investments as well as exits on the back of improved liquidity, rising markets, higher valuations, and distressed pricing in corporate credit.

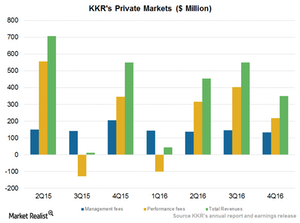

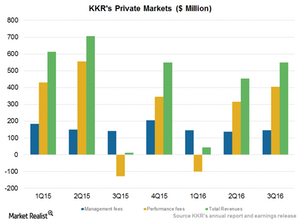

KKR Private Markets Segment Projects Deployment and Growth in 2017

KKR & Company’s (KKR) Private Markets segment contributed almost 71% of the company’s total revenues in 4Q16.

Why KKR’s Valuations Could Rise in 2017

First Data (FDC) is one of KKR’s major holdings. The stock has risen 7.8% in 4Q16 as compared to a substantial decline in 1H16.

KKR Enhances Dividends and Repurchase Program on Growth

KKR & Company (KKR) is creating value for shareholders through share dividends and repurchases.

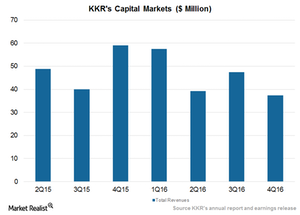

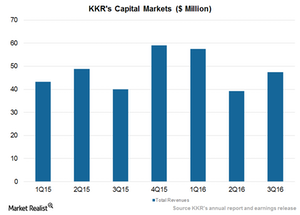

KKR’s Capital Markets Segment Was Subdued amid Lower Activity

KKR’s (KKR) Capital Markets and Principal Activities segment complements its activities in both private and public markets.

KKR Public Markets Could See Slower Growth in 2017 on Rate Hikes

Public markets have performed well over the past couple of quarters mainly due to a rebound in energy prices (USO), which has led to rising prices of distressed credit.

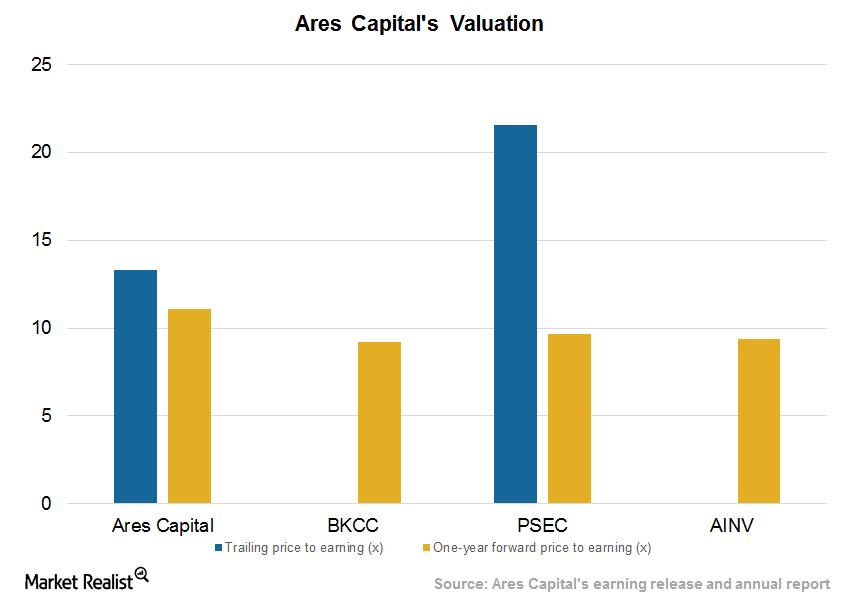

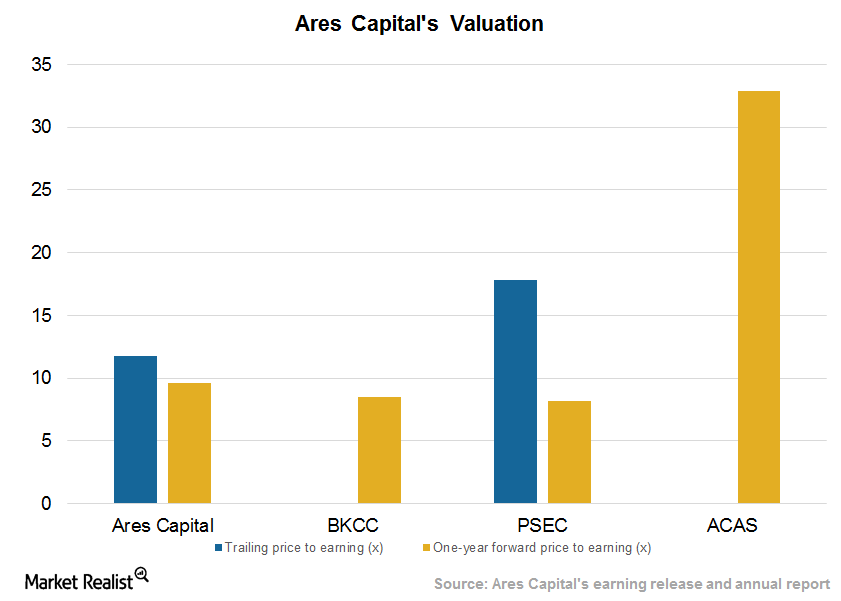

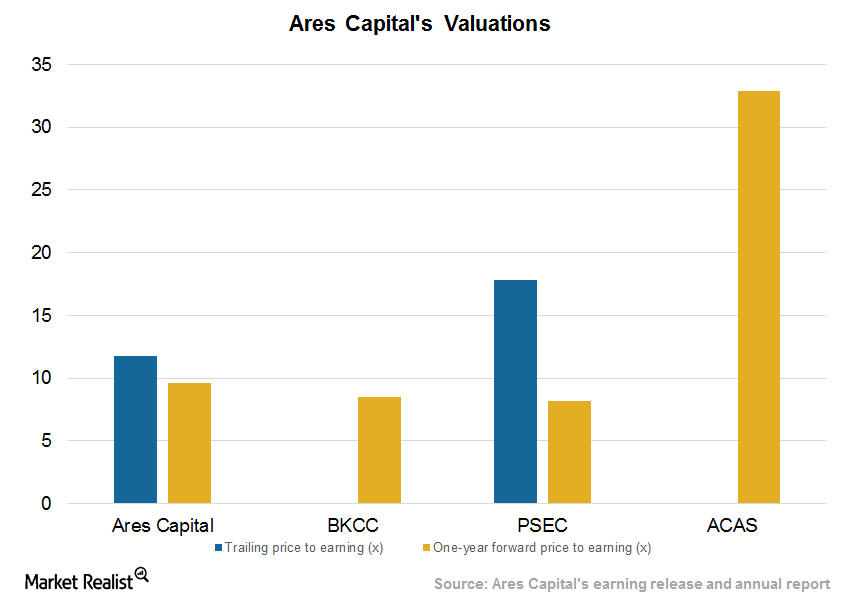

Ares Capital Valuations at a Premium on Relative Outperformance

Ares Capital stock has risen ~11.7% over the past six months. The company saw a strong performance in 4Q16 on higher deployment, stable yields, and expense management.

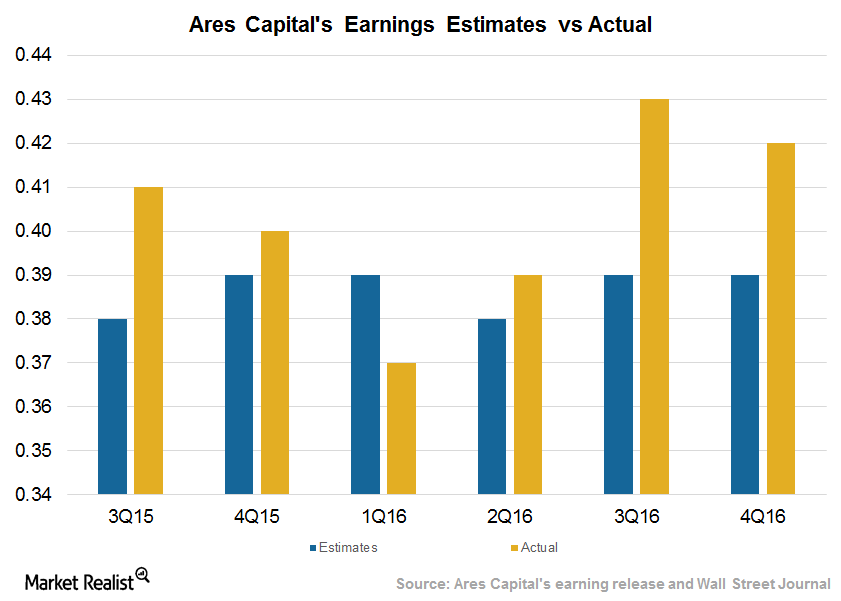

Ares Capital Beat Estimates for Deployments, Yields in 4Q16

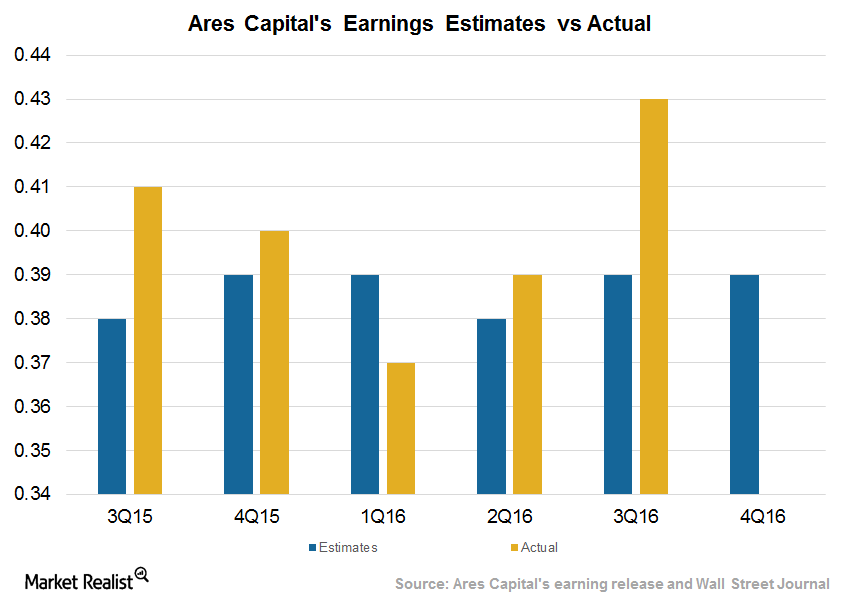

Ares Capital (ARCC) posted EPS (earnings per share) of $0.42, beating Wall Street analysts’ consensus estimate of $0.39 in 4Q16.

What Boosted Ares Capital’s Valuation?

Stock performance Ares Capital (ARCC) stock has risen ~14% over the past six months and 37% over the past year due to improved operating performance. In 3Q16, the company saw higher deployments and yields, and lower expenses. The company declared a dividend of $0.38 per share in 3Q16, in line with that of 3Q15. With a dividend […]

Ares Capital’s 4Q16 Quarterly Earnings: What to Expect

Ares Capital (ARCC) is expected to post EPS (earnings per share) of $0.39 in 4Q16, compared with $0.40 in 4Q15 and $0.43 in the previous quarter.

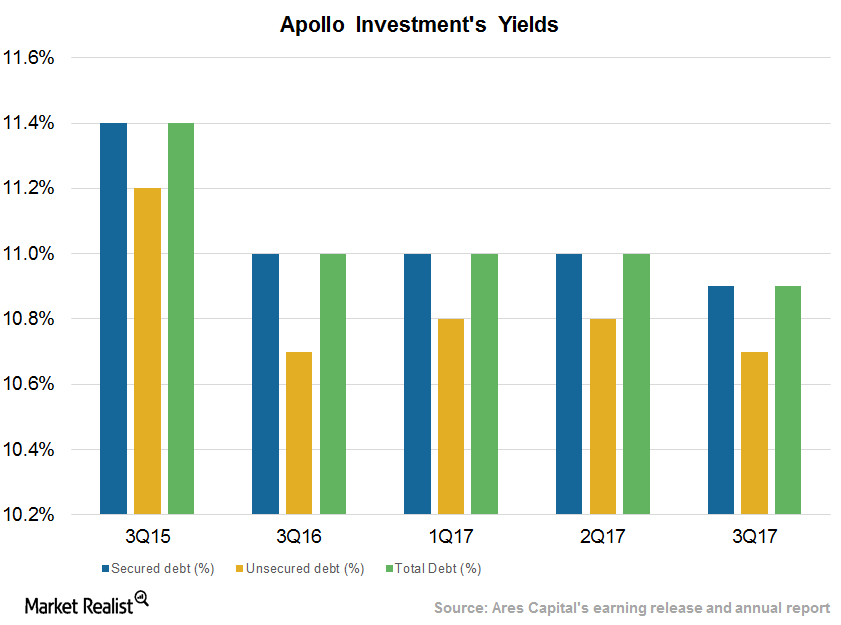

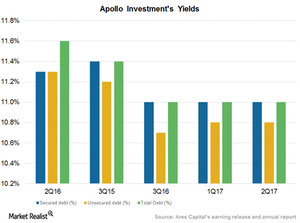

Apollo Investment’s Yields Stabilize on First and Second Liens

Apollo Investment’s (AINV) yields have declined and stabilized at ~10.9%, on par with average returns garnered by other closed-end funds.

Alternatives to See Improved Realizations and Deployments in 2017

In 2016, alternative asset managers saw higher exits and investments on the back of improved liquidity. The trend is expected to continue in 2017.

Apollo Investment’s Yields Stabilize, Reduced Exposure in Energy

At the end of fiscal 2Q17, Apollo Investment’s (AINV) oil and gas investments represented 9.7% of its total portfolio, or $246 million.

Blackstone and KKR Deployments Rise in 2016 on Valuations

Blackstone Group (BX), the world’s largest alternative manager, invested $2.9 billion during the September 2016 quarter.

KKR Valuations Fair amid Volatile Performance and Capital Raises

KKR & Company (KKR) expects to post EPS (earnings per share) of $0.41 in 3Q16, reflecting a subdued performance compared to its 3Q15 numbers.

KKR Maintains Dividends, Continues with Repurchases in 3Q

As of October 2016, KKR has bought back 31.5 million common units for $457 million of its announced $500 million share repurchase program in December 2015.

KKR Capital Markets Manages Higher Revenues on Deal Making

KKR’s Capital Markets and Principal Activities segment saw revenues of $47 million in 3Q16, as compared to $40 million in 3Q15 and $39 million in 2Q16.

KKR Public Markets’ Performance Rises on Improved Credit Pricing

In 3Q16, KKR’s Public Markets segment reported total revenues of $84 million in 3Q16, as compared to $64 million in 3Q15.

KKR Private Markets Segment Rises on Performance Fees in 3Q

In 3Q16, KKR’s Private Markets segment reported revenues of $549 million in 3Q16, as compared to $12 million in 3Q15 and $453 million in 2Q16.

Ares Capital Stock and Valuations Rise on Strong Performance

Ares Capital (ARCC) stock has risen ~1.6% over the past six months. The company saw a strong performance in 3Q16 on higher deployment, yields, and lower expenses.