Biomarin Pharmaceutical Inc

Latest Biomarin Pharmaceutical Inc News and Updates

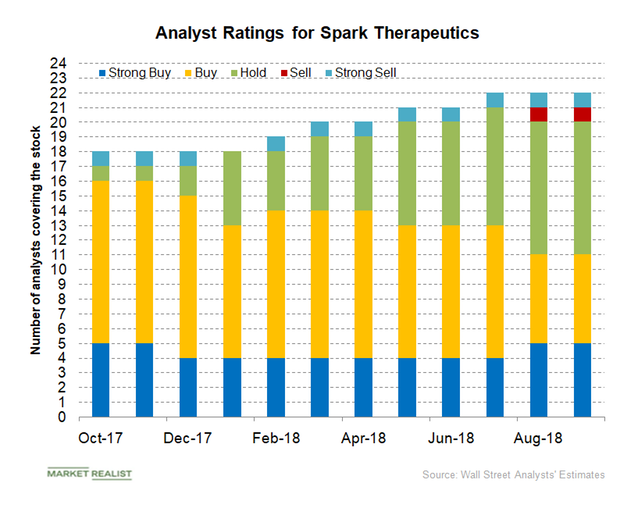

What Spark Therapeutics’ Valuation Trend Indicates

Spark Therapeutics’ (ONCE) operating expenses decreased from $78.48 million in Q2 2017 to $59.78 million in Q2 2018.

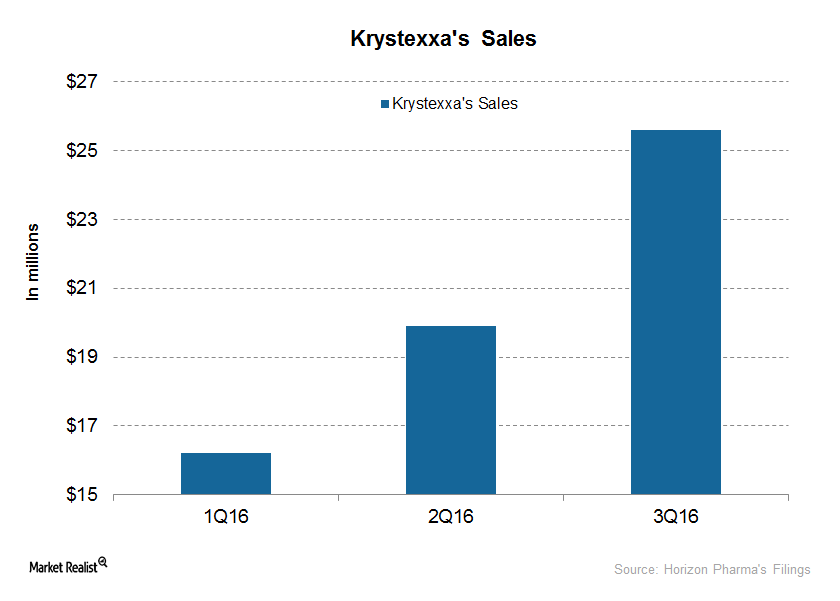

Revenue Drivers for Krystexxa, Horizon’s Orphan Biologic Drug

Horizon plans to drive Krystexxa through increased awareness and outreach, investing in its marketing and medical education as well as commercial infrastructure.

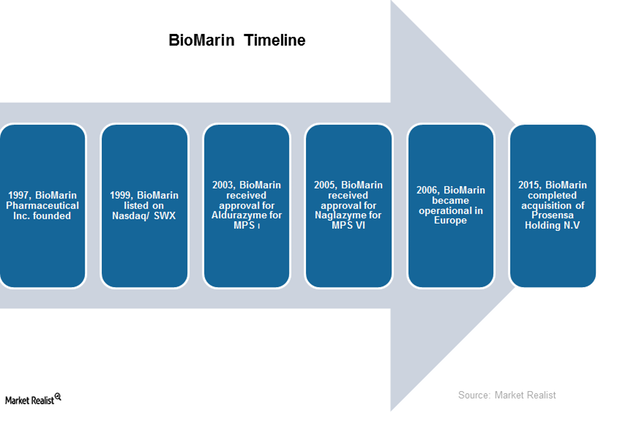

Overview of BioMarin: History and Product Portfolio

Here we present an overview of BioMarin. It’s based in California and was founded in 1997. It focuses on therapies for life-threatening rare genetic diseases.

BMN 270: A Big Valuation Catalyst for BioMarin

On March 1, 2016, BioMarin received orphan drug designation for BMN 270 from the FDA. BioMarin’s stock jumped by about 6.96% the same day.

Sarepta Therapeutics Stock Rose 96% in 2018

On January 4, Sarepta Therapeutics (SRPT) stock closed at $115.43, which represents ~8.21% growth from its prior close.

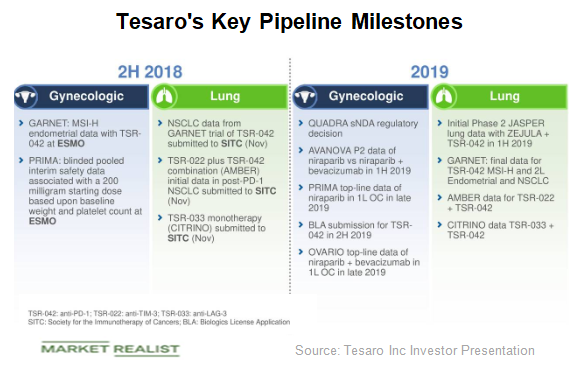

Here’s What Tesaro’s Valuation Trend Indicates

Tesaro stock has been on a downward trajectory for the past 52 weeks. From a high of $135 on September 5, 2017, it has corrected to $27 in August.

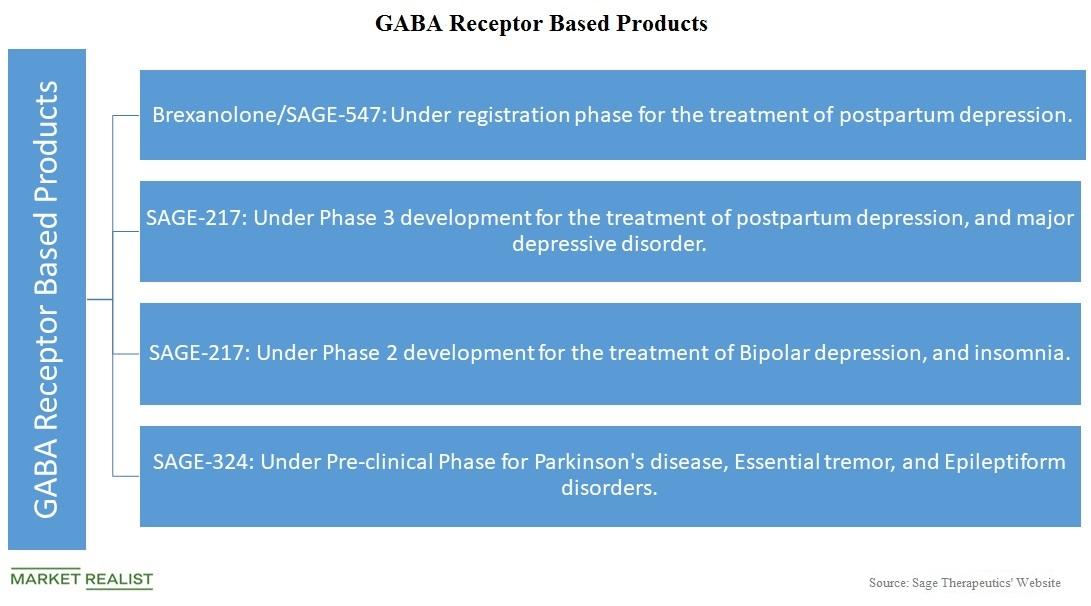

Sage Therapeutics’ GABA Receptor–Based Products

On June 12, Sage Therapeutics announced its expedited development plan for SAGE-217.

Analysts’ Ratings for Spark Therapeutics and Its Peers in April 2018

Of the 20 analysts covering Spark Therapeutics in April 2018, four have given the stock “strong buy” recommendations.

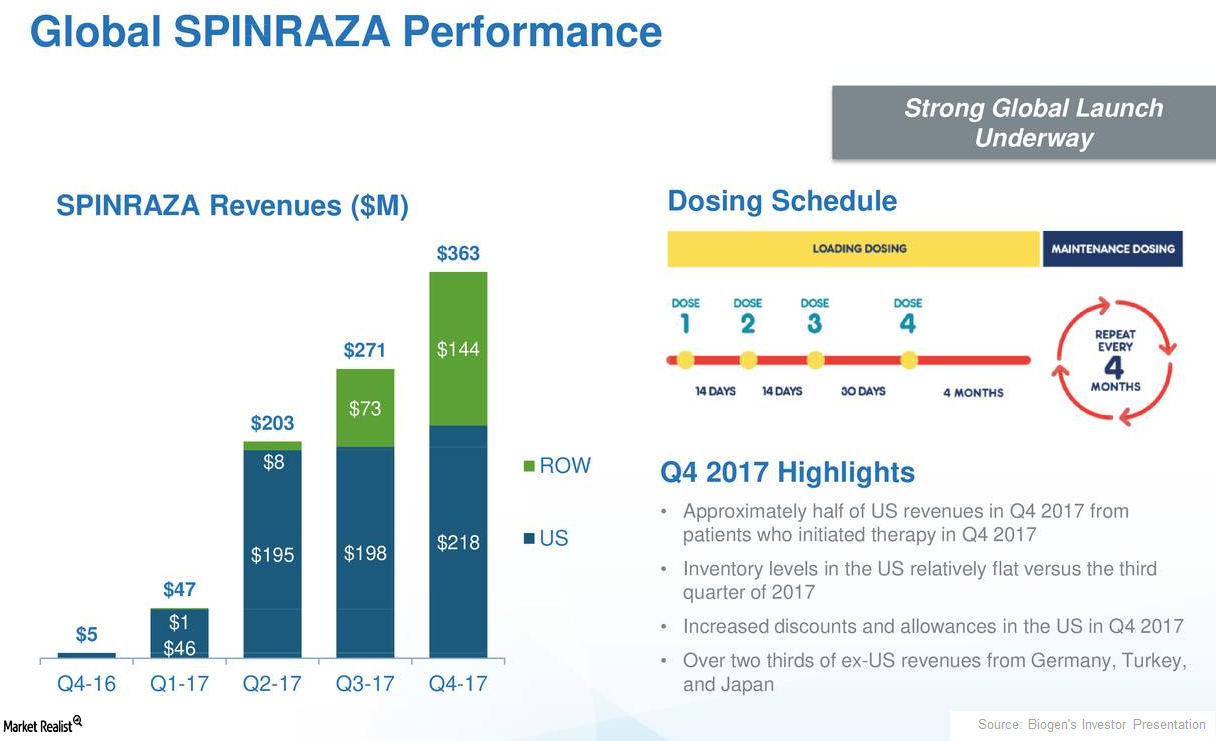

How Biogen’s Spinraza Is Positioned for 2018

In 4Q17, Biogen’s (BIIB) Spinraza generated revenues of $363 million, which reflected 34% quarter-over-quarter growth.

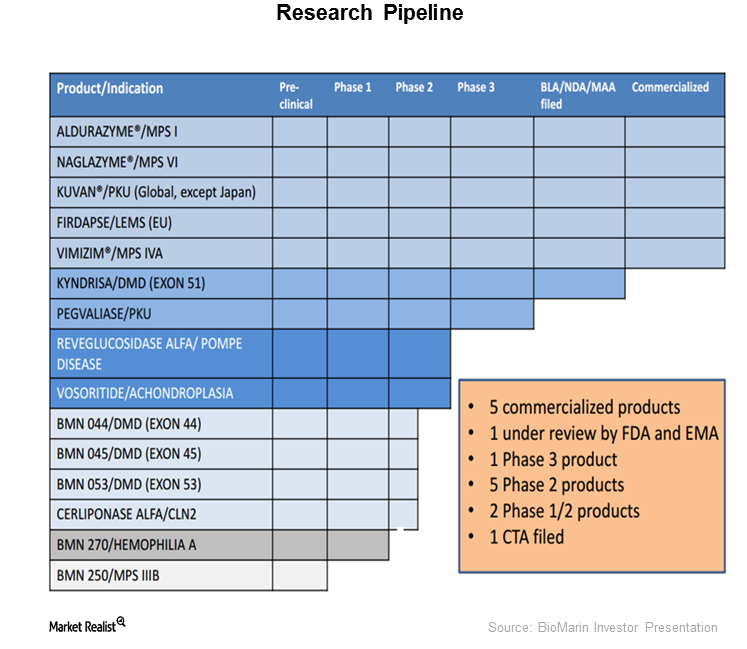

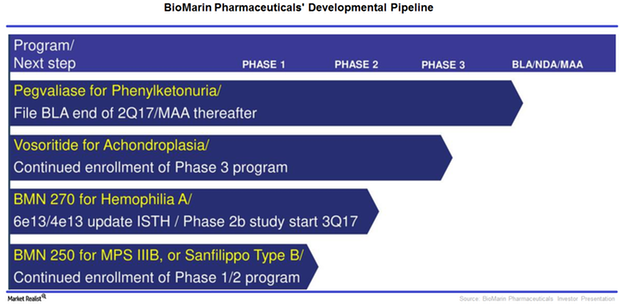

BioMarin’s Strong Pipeline Could Be a Long-Term Growth Driver

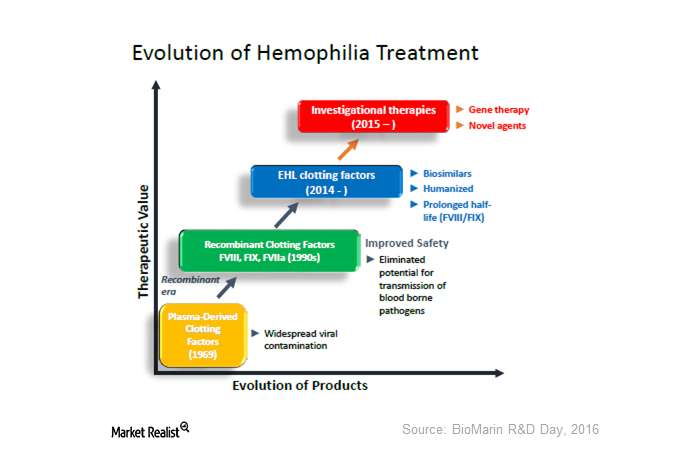

After success in the company’s phase 1/2 trial with BMN 270, an investigational gene therapy for hemophilia A, BioMarin Pharmaceuticals (BMRN) is expected to start phase 3 trials.

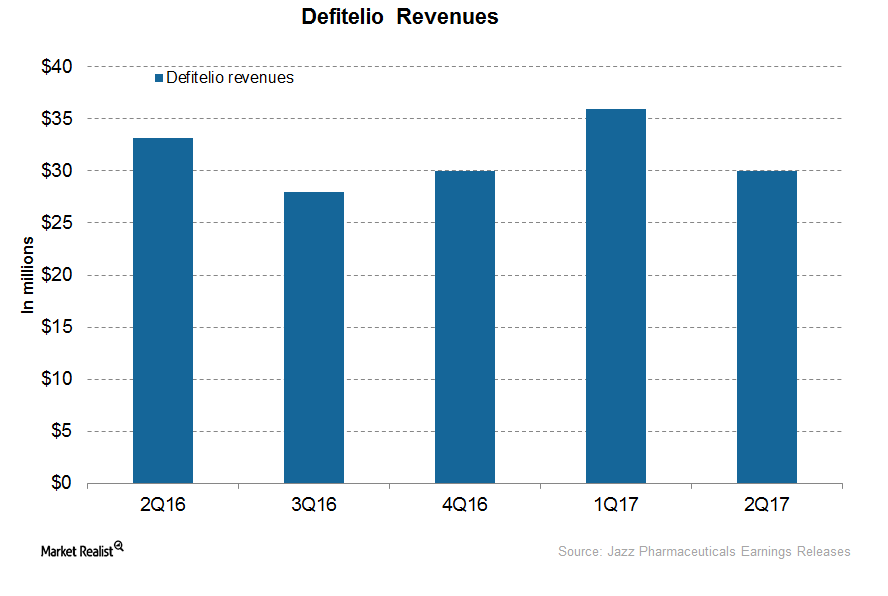

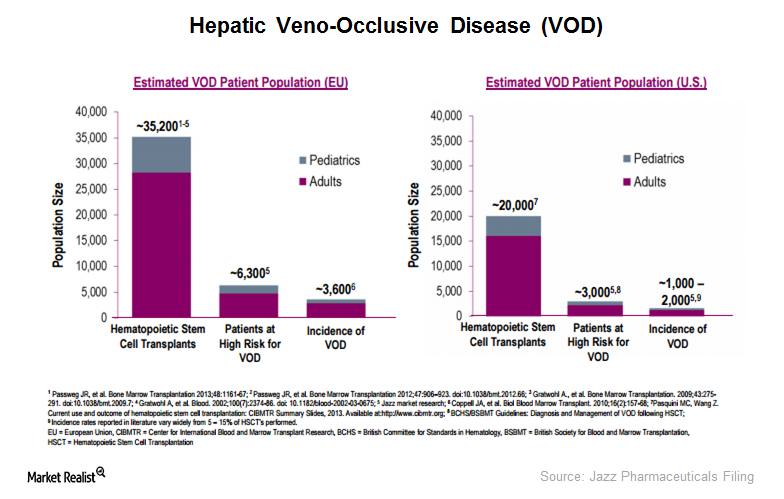

How Is Jazz’s Defitelio Positioned after 2Q17?

In 2Q17, Jazz Pharmaceuticals’ (JAZZ) Defitelio generated revenues of ~$30 million, which represents a ~10% fall YoY and a ~17% fall QoQ.

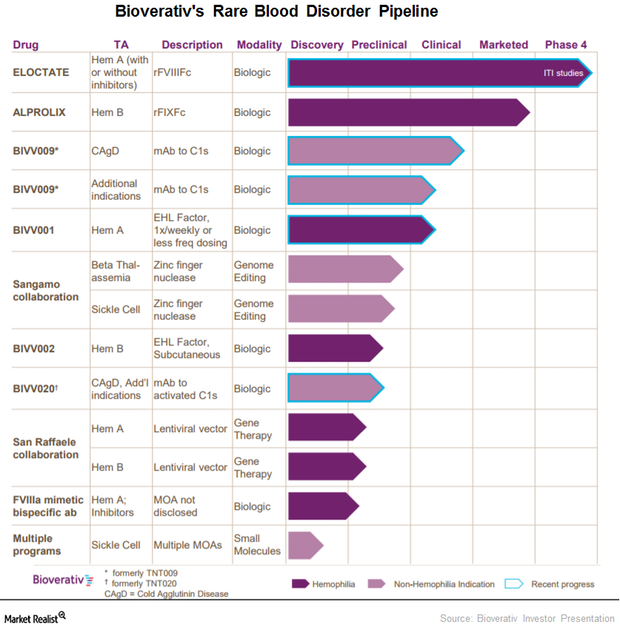

This Part of Bioverativ’s Pipeline Could Be a Major Long-Term Growth Driver

In June 2017, the FDA accepted Bioverativ’s investigative new drug application for BIVV001, a drug designed to treat prophylaxis from bleeding associated with hemophilia A.

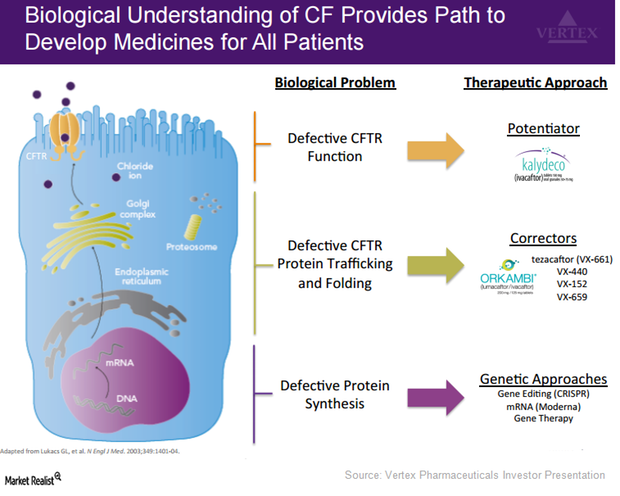

Vertex Has Adopted Multiple Approaches to Treat Cystic Fibrosis

Vertex Pharmaceuticals (VRTX) is aiming to increase the number of patients eligible to be treated with its drugs to include the entire CF patient population.

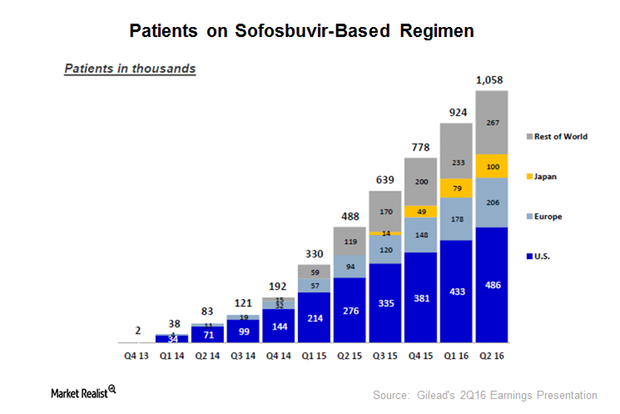

How Gilead Dominates the HCV Space

In January 2012, Gilead Sciences (GILD) acquired Pharmasset and got access to sofosbuvir. In December 2013, the FDA approved sofosbuvir under the brand name Sovaldi.

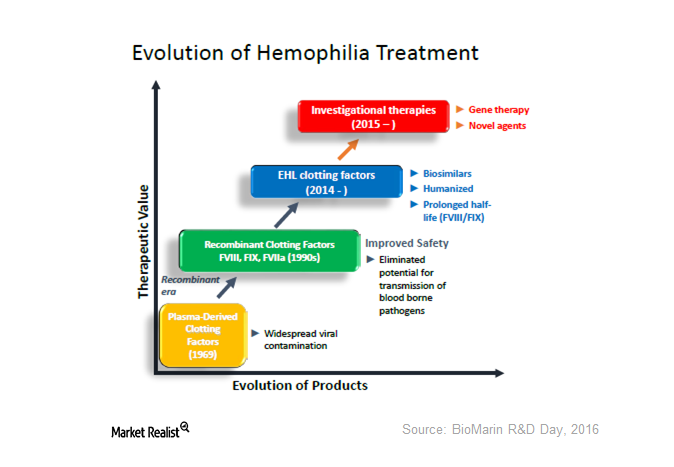

The Evolution of Hemophilia Treatment—And What It Means for BioMarin

BioMarin’s BMN 270 is a gene therapy being investigated for hemophilia A. On April 20, it announced early data of the phase-1 and phase-2 study of BMN 270.

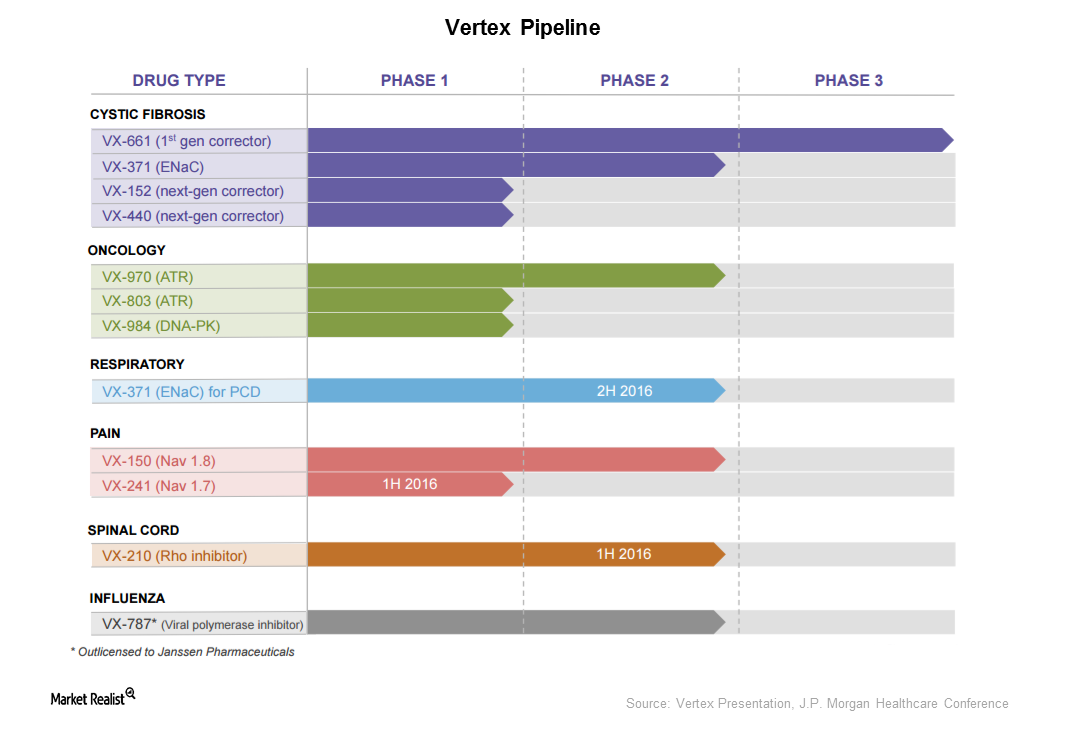

How Does Vertex Plan to Expand Beyond Cystic Fibrosis?

Vertex is trying to expand its product base beyond cystic fibrosis. It holds molecules in the oncology, respiratory, pain, spinal cord, and influenza spaces.

Could Gene Therapy Be a Next-Generation Treatment for Hemophilia?

Gene therapy is the emerging platform for hemophilia care. If approved, it would be a paradigm.

Defitelio: Volume and Pricing Challenges

Jazz Pharmaceuticals’ Defitelio is the first and only approved treatment that increases survival in VOD patients with multi-organ dysfunction (or MOD).

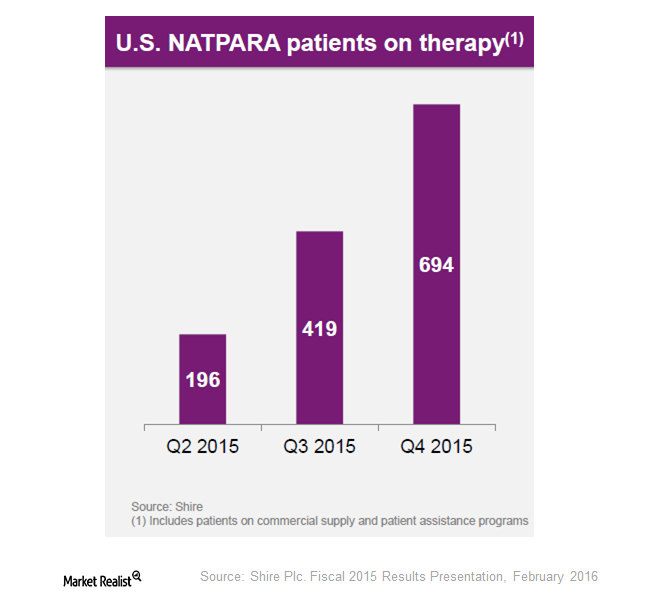

Shire’s Acquisition Gives It Natpara and Gattex

Gattex is the first and only analog of glucagon-like peptide-2 (or GLP-2) indicated for short bowel syndrome. The drug is known as Gattex in the United States and Revestive in Europe.

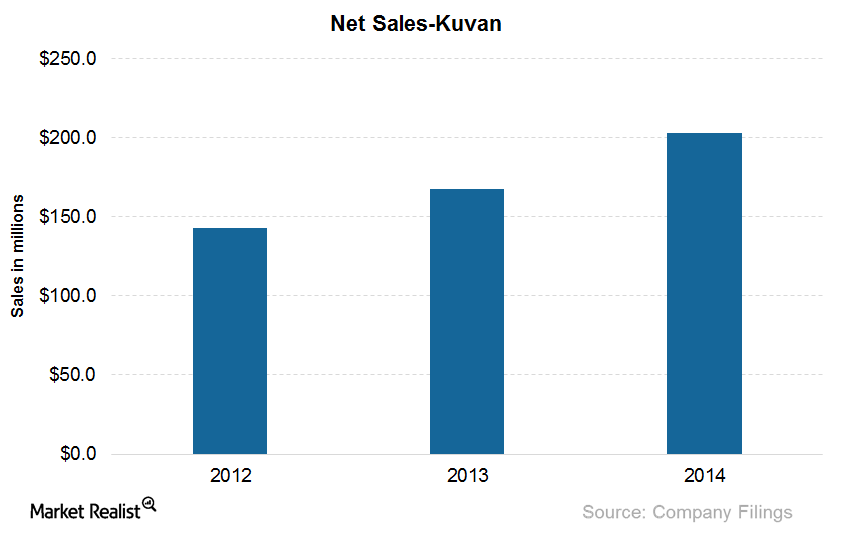

What Are BioMarin’s Products for Treating Phenylketonuria?

Kuvan, with the active ingredient sapropterin dihydrochloride, is effective in reducing blood phenylalanine levels in PKU (or phenylketonuria) patients.

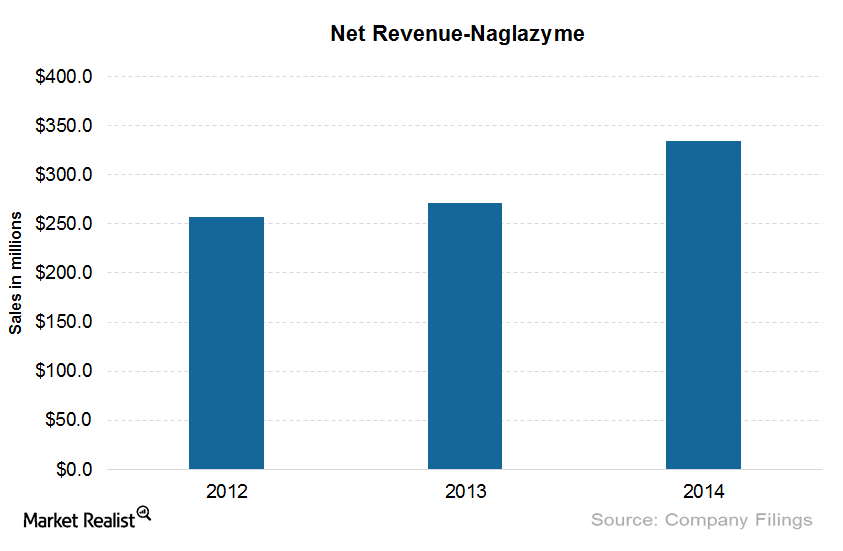

Naglazyme: One of the Costliest Drugs in the United States

The wholesale cost per patient for Naglazyme is around $485,747 per year. The drug has been effective in improving walking and stair-climbing capacity.

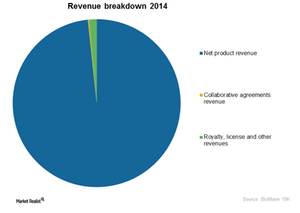

BioMarin’s Business Model and Its 3 Sources of Revenue

Let’s discuss BioMarin’s business model. It derives revenue from three sources, including product revenue. The latter accounts for ~98% of total revenue.

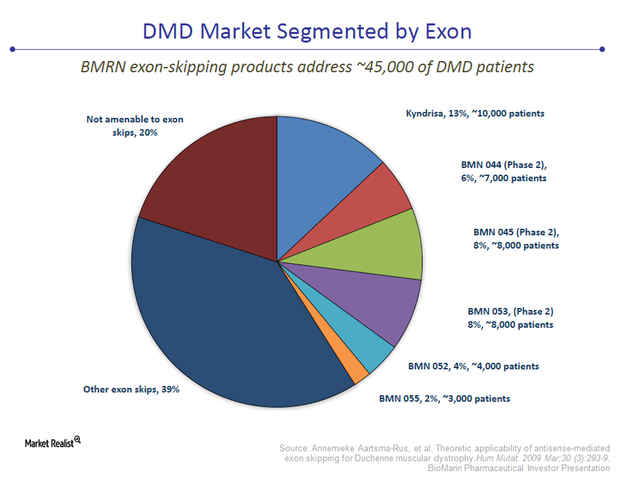

How Would Kyndrisa Treat Duchenne Muscular Dystrophy?

The FDA advisory committee has given an unfavorable opinion to Kyndrisa. But most analysts estimate the probability of FDA approval for the drug to be about 50%.