American Express Co

Latest American Express Co News and Updates

High Annual Fees? Here's How to Get Retention Offers From Amex

Some rewards credit cards come with high annual fees. Here's a script for how to get retention offers from Amex if you hold an annual-fee credit card.

Creator Sofia Bella Shares Her Tips for Small Businesses Getting Started on TikTok (EXCLUSIVE)

TikTok influencer Sofia Bella is teaming up with American Express for Small Business Saturday and sharing her post ideas for succeeding on TikTok.

Amex Platinum Card Has More Lounge Access Than Chase — Details

Amex concierge is better than Chase concierge in some areas. However, most of the difference comes down to personal choice. Here's what we know about both companies.

What Credit Score Do You Need to Get an American Express Card?

American Express is one of the top credit card distributors. What credit score does American Express look for when approving applications?

Shop Local with American Express During Small Business Saturday

In 2020, American Express Small Business Saturday falls on Nov. 28. What do shoppers need to know about the event?

American Express Points Don't Expire, but You Can Lose Them!

Although American Express points don't expire, you can lose your points if your card is inactive.Must-know: Concur is the biggest acquisition in SAP’s history

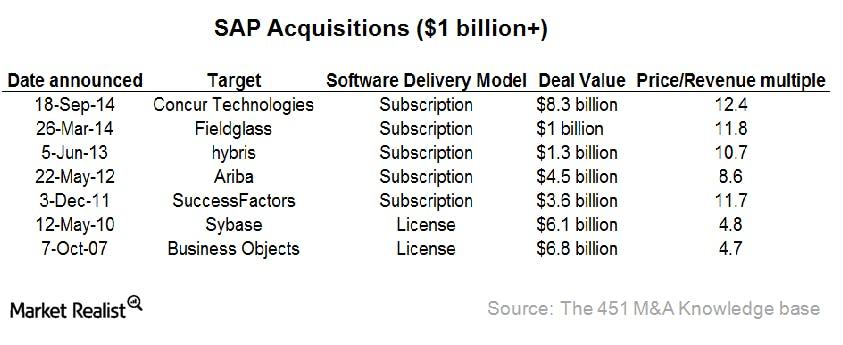

Since 2010, SAP AG (SAP) spent more than ~$12 billion on acquisitions. Concur Technologies is the largest acquisition in SAP’s 42-year history. In its 2Q14 results, most of SAP’s growth was from its cloud business—approximately $1 billion annually. Concur’s management mentioned that they expect to end fiscal year 2014 with ~$690 million.

Is AXP Stock a ‘Sell’ after Its Q1 Earnings?

Today at 7:02 AM ET, AXP stock rose 1.1% to $84.10 in the pre-market session. The company reported its first-quarter earnings results on April 24.

What Berkshire Hathaway Really Does, Says Buffett

Berkshire Hathaway is a huge conglomerate with diverse operations. The company’s operations are complex, so let’s take an easy-to-understand approach.

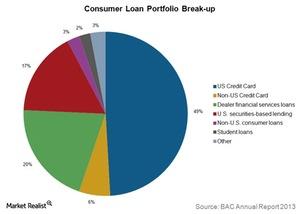

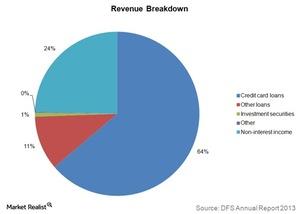

Card loans rule Bank of America’s consumer loan portfolio

Credit card loans account for more than half of Bank of America’s total consumer loan portfolio.

US GDP Shatters Expectations, Pessimists Run for Cover

The US GDP increased at an impressive rate of 1.9% for the third quarter. The growth beat the expectations of around 1.6% for the quarter.

Dow Jones Index Falls after Rising for Eight Days

The Dow Jones Industrial Average Index has fallen 0.4% or by 115 points today. The index is trading lower after rising for eight consecutive trading sessions.

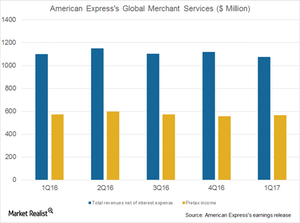

Inside American Express’s Global Merchant Services Segment

American Express’s (AXP) Global Merchant Services segment is expected to see a marginal increase in its net income in 2Q17.

American Express to Ride on Partnerships, Digitization

American Express (or Amex) (AXP) has entered into digital partnerships with Airbnb, Facebook (FB), and Uber in order to offset the revenue loss from Costco (COST).

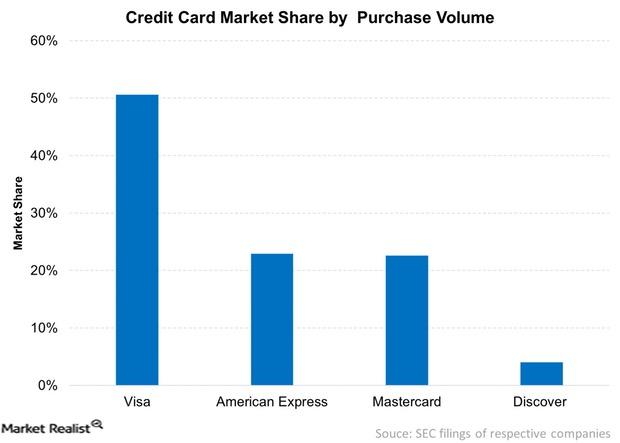

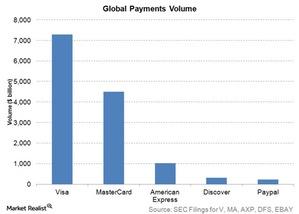

How Visa Created a Network Effect

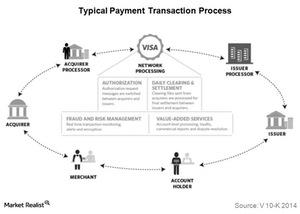

Visa (V) boasts a significant advantage in terms of its worldwide acceptance. This availability lent to the network effect’s being the source of the company’s moat.

Will Payment Processors Keep Seeing the US Dollar Impact in 2017?

Payment processors are now seeing improved performances on increased spending, new technologies, expansion into global markets, and the stable US dollar.

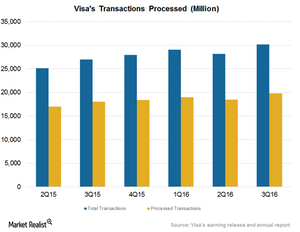

International Use to Boost Visa’s Fiscal 4Q16 Processed Transactions

Visa (V) reported total transactions of $30.2 billion in fiscal 3Q16, compared to $27 billion in fiscal 3Q15—a growth of 11.8% year-over-year.

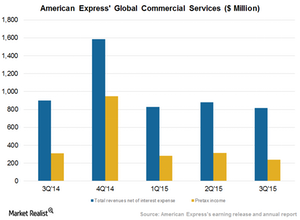

American Express Is Focusing on Its Global Commercial Services

American Express’s Global Commercial Services’ total revenues net of interest expense fell by 9% to $817 million in 3Q15, forming 10% of its total revenues.

What investors should know about Discover Financial Services

Discover Financial Services (DFS) is a direct bank and electronic payment services company in the US. It offers an array of banking products.

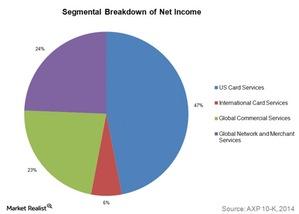

American Express and Its Four Operating Segments

Of the four American Express segments, the Global Network and Merchant Services segment has shown the highest growth over the last two years.

What Happens When You Swipe a Visa Card?

Visa’s open-loop payments network connects and manages the exchange of information between issuers and acquirers.

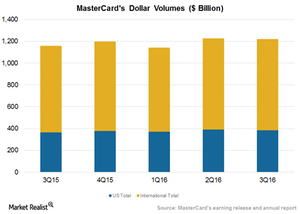

MasterCard Operates in an Intensely Competitive Payments Industry

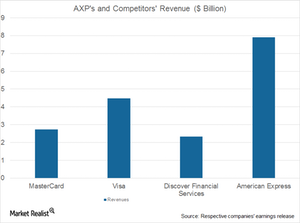

Cash and checks constitute ~85% of the retail payment transactions worldwide. However, electronic payment methods are increasingly replacing cash and check payments globally.

MasterCard Does Not Look Overvalued Compared to Historical Levels

MasterCard focuses on growth in its core business of credit, debit, prepaid offerings, and processed transactions. It seeks to diversify its customer base, including smaller merchants and consumers who still use cash and checks.

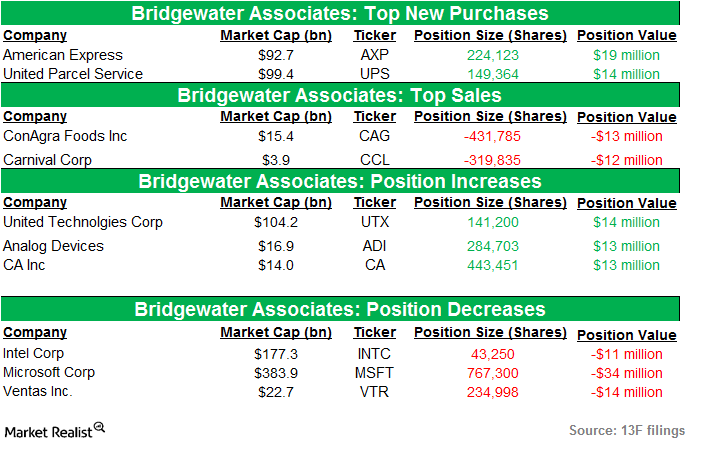

Analyzing Bridgewater Associates’ positions in 3Q14

Bridgewater Associates is an American hedge fund. It was founded in 1975 by Ray Dalio. The firm manages ~$157 billion in global investments.