Despite $1.3 Million Net Worth, This Couple Feels Broke

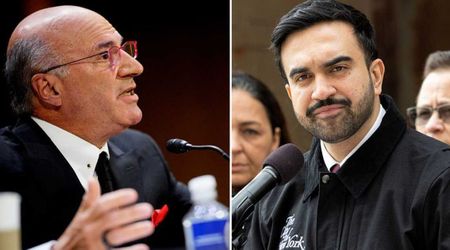

Sandra, 46, and Brad, 48, seem to have accomplished significant milestones in wealth-building: they possess a sizable net worth and maintain a meticulous record of their monthly expenditures. However, despite all this, Sandra remains dissatisfied with their financial situation. During a recent conversation with self-made millionaire Ramit Sethi on his "I Will Teach You to be Rich" podcast, she expressed her feelings, indicating that while they appear financially stable on paper, it doesn't feel that way in reality.

Married for 25 years, the couple has amassed a net worth of $1.3 million. Despite their financial stability, they find themselves at odds with each other regarding their respective approaches to money management. Throughout their marriage, Brad has been the primary breadwinner, although his income fluctuated from month to month.

Sandra, on the other hand, only began contributing significantly to their finances a little over a year ago. Her main role involves meticulously tracking their income and expenses, especially during periods of financial strain, which were prevalent earlier in their marriage.

Sandra's approach involves maintaining multiple spreadsheets to monitor various financial goals and spending categories. However, managing their finances independently and having to restrict spending when necessary causes her considerable stress and guilt, particularly when she has to inform Brad. In contrast, he feels that he is doing his utmost to achieve their financial goals but believes he can never meet his partner's exacting standards.

Sethi highlights that the underlying issue lies beyond mere numbers, emphasizing that tracking every cent doesn't equate to true financial control. According to him, one of the key factors contributing to Sandra's perpetual anxiety about money stems from the volatile nature of Brad's income, which has ranged from $60,000 to $70,000 monthly in good years in the mortgage industry.

However, leaner periods have forced him to rely on income from an event business and savings from more prosperous years. This inconsistency has left Sandra feeling perpetually insecure, even during months of high earnings. Conversely, he tends to compensate for lower-earning periods with risky investments, further exacerbating her concerns.

Moreover, the couple's focus on budgeting around Brad's fluctuating income has hindered their ability to set long-term financial goals effectively. Sethi believes that they may be fixating on minor details that ultimately have minimal impact on their financial well-being.

He emphasizes the importance of focusing on high-value areas, such as defining their "rich life," establishing appropriate spending categories, and making critical decisions about savings and debt management.

Another significant challenge lies in the couple's communication breakdown regarding their financial goals. Despite sharing a desire to ensure their family's financial security, they struggle to align their visions and often find themselves in repeated arguments.

"I get very frustrated with that same conversation over and over again, whether we’ve got a lot of money in the bank or whether we’ve got very little money in the bank. I feel like we’re playing a very opposite game," Brad told Sethi.

Ultimately, Sethi advises Brad and Sandra to prioritize effective communication and collaborative problem-solving to overcome their financial challenges. By understanding each other's perspectives and working together to find viable solutions, they can establish a financial plan that meets their needs and alleviates the tension surrounding their finances.

"Collaborating to find solutions that work for both partners, can help them figure out a financial plan that fits their needs, allowing them to stop fighting over every dollar," he adds.