Santiago Solari

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Santiago Solari

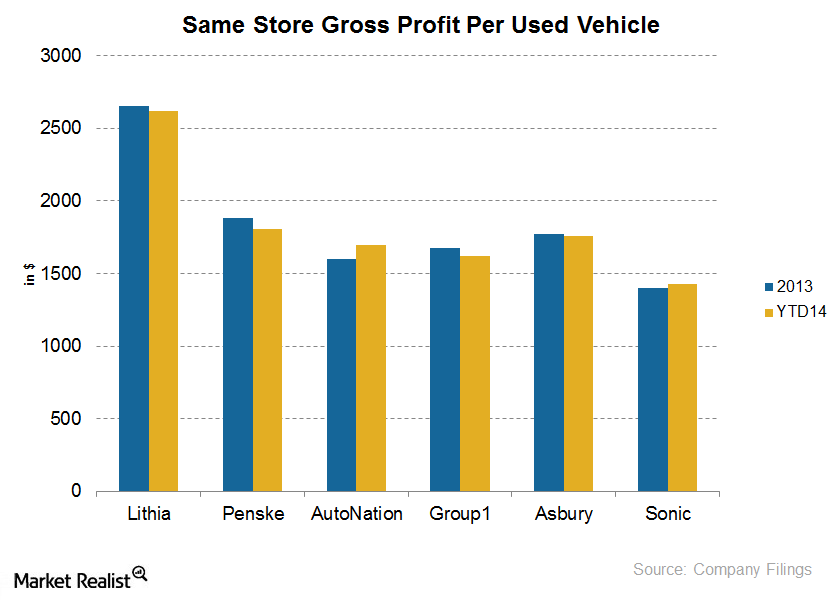

Key analysis of Lithia’s used vehicle operations

The larger share of CPOs and core vehicles in its sales mix drives Lithia’s significant lead in same-store gross profit per vehicle.

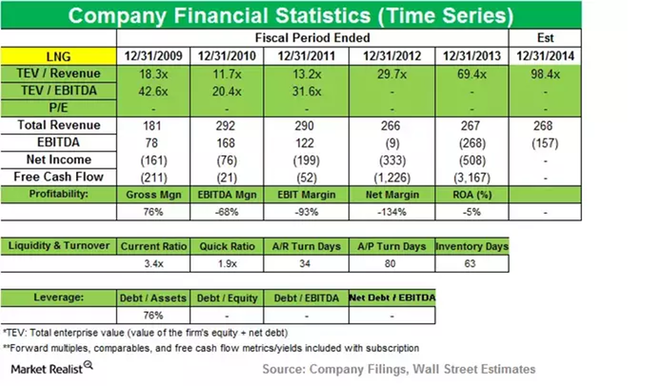

Luxor Capital Establishes New Stake in Cheniere Energy

In February 2015, Cheniere Energy announced that its 4Q14 and full-year results reported a net loss attributable to common stockholders of $158.6 million, or $0.70 per share.

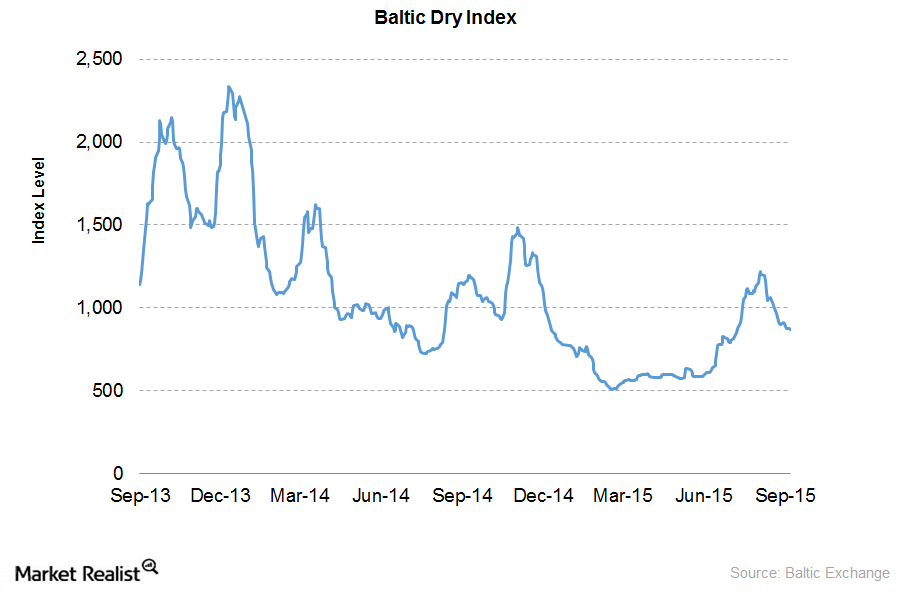

What Do Fundamental Bulk Shipping Indicators Say?

The BDI (Baltic Dry Index) is a leading indicator for the bulk shipping industry. It’s a measure of the cost of shipping major bulk commodities on a number of shipping routes.

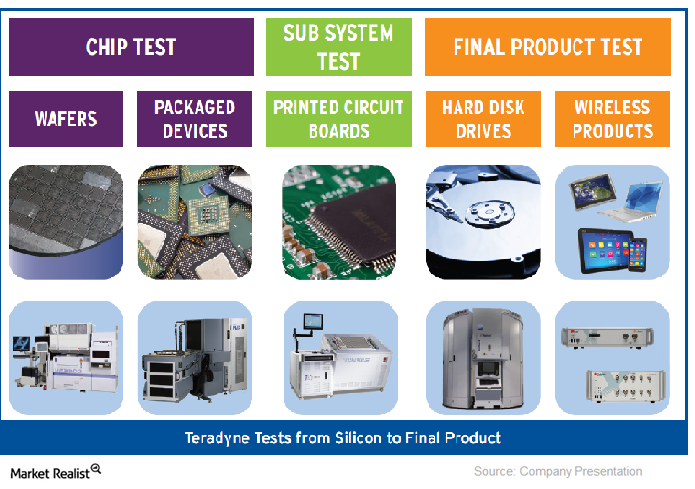

Why Teradyne’s offerings provide value to end-user markets

This article takes a look at Teradyne’s (TER) product line and how it adds value to its customer base.

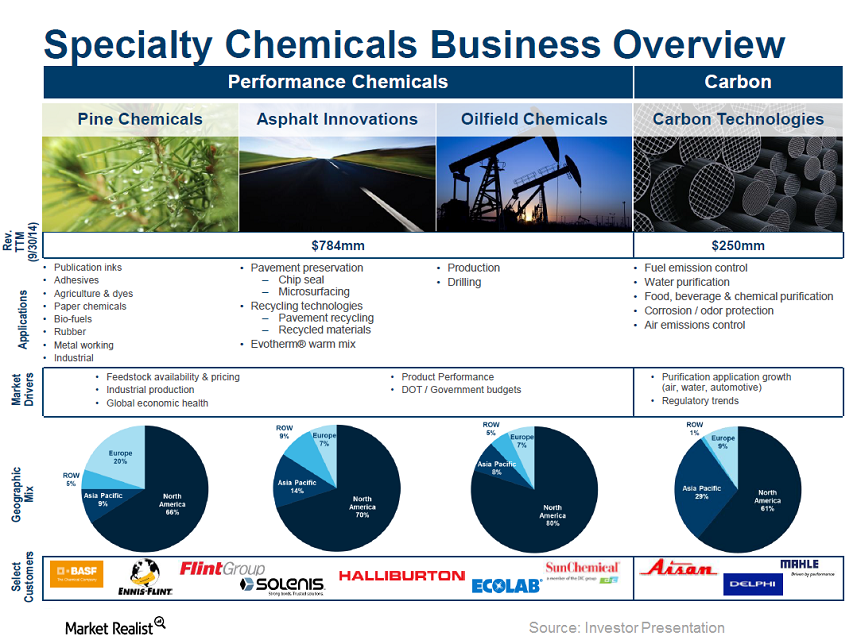

MeadWestvaco to spin off its specialty chemicals business

In January 2015, MeadWestvaco, announced that its board had approved the plan to spin off the specialty chemicals business from the rest of the company.

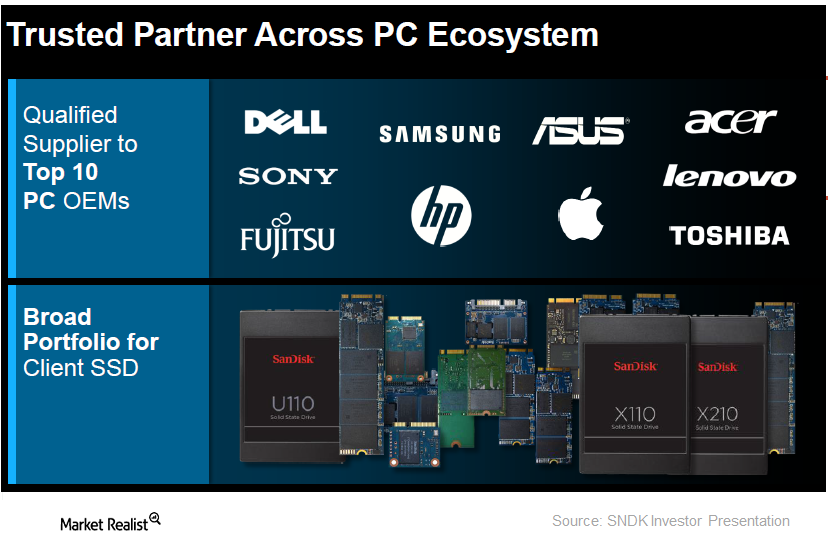

JAT Capital Eliminates Exposure to SanDisk Corporation

JAT Capital sold its position in SanDisk Corporation (SNDK) in 4Q14. The position had represented 1.2% of the fund’s third-quarter portfolio.

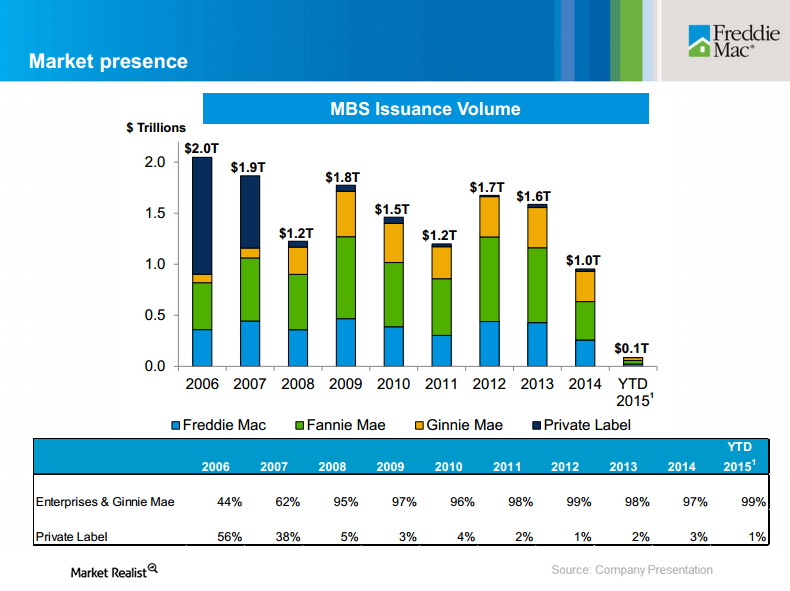

An Update on Fairholme’s Positions in Fannie Mae and Freddie Mac

Berkowitz believes that Fannie Mae and Freddie Mac entities are highly valuable and expects them to generate earnings of at least~$21 billion a year.

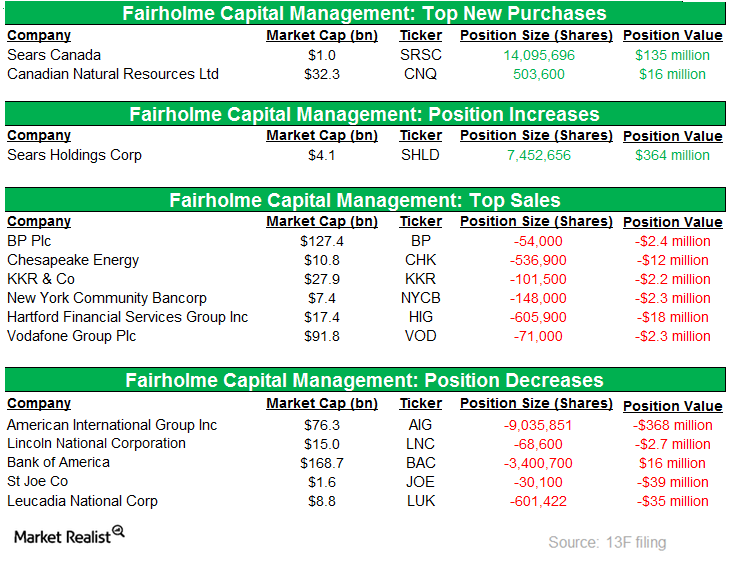

Highlights of Fairholme Capital’s 4Q14 Portfolio

Fairholme Capital’s collective funds hold in excess of ~$7.0 billion in net assets, of which roughly 94% is concentrated in FAIRX.

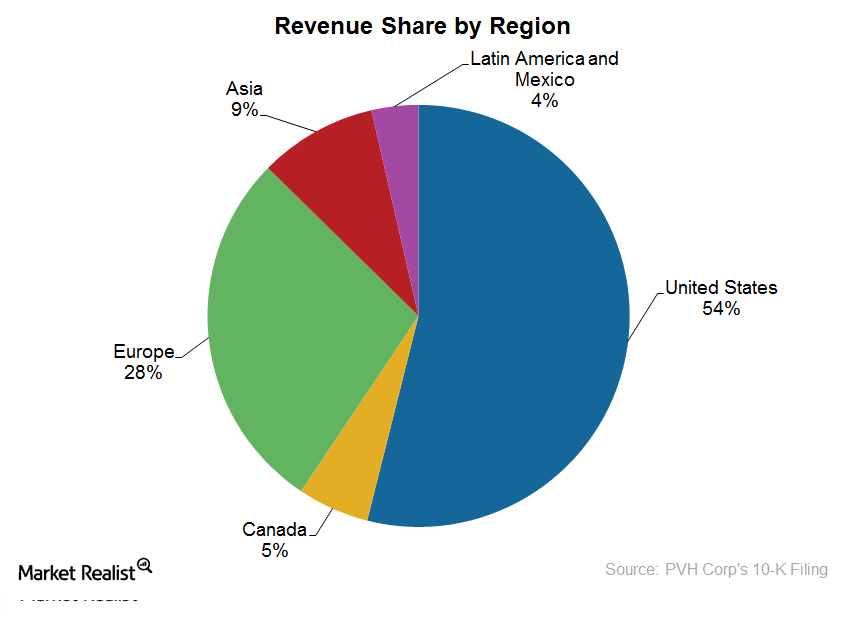

An overview of PVH’s business by geographies

We’ll look at PVH’s operations by geographies. It markets its products in over 100 countries through wholesale partners. It has over 4,700 retail locations.

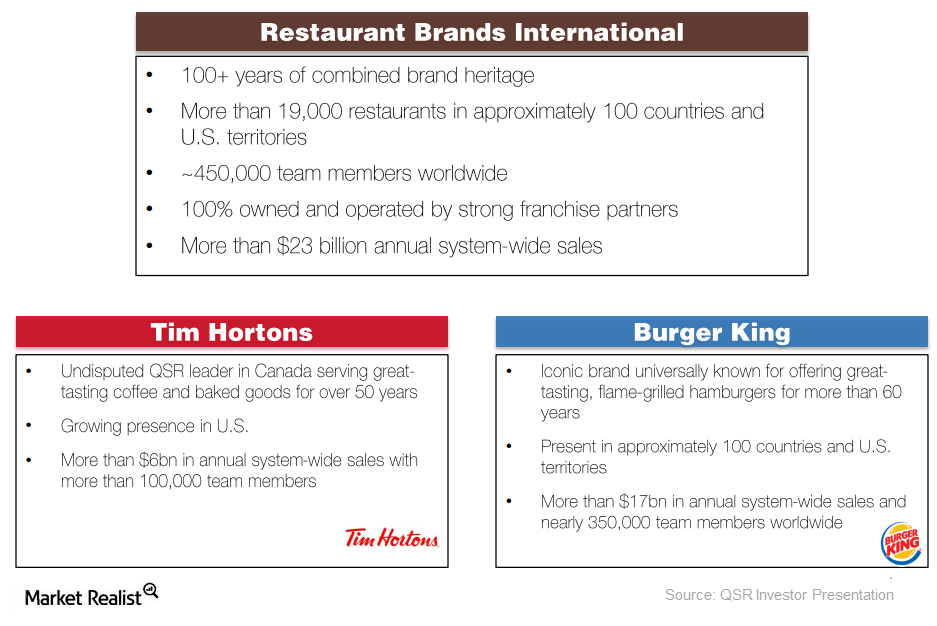

Magnetar Purchases New Stake in Restaurant Brands International

Magnetar Capital added new stake in Restaurant Brands International (QSR) in 4Q14. The position represented 0.73% of its holdings at the end of the year.

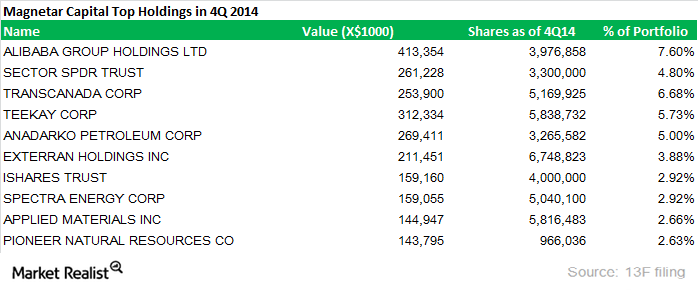

Magnetar Capital Initiated New Positions in 4Q14

Magnetar Capital was established in 2005 by Alec Litowitz and Ross Laser. Currently, the hedge fund manages assets in excess of $12 billion.

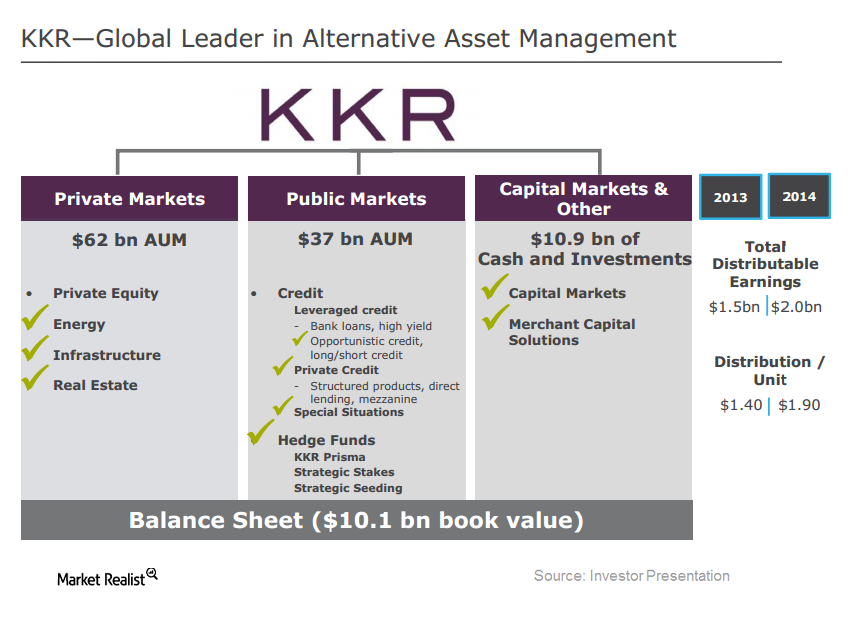

Fairholme Capital Exits Stake in KKR

For the fourth quarter of 2014, KKR reported a net loss of $0.6 million, compared to net income of $277.9 million in 4Q13.

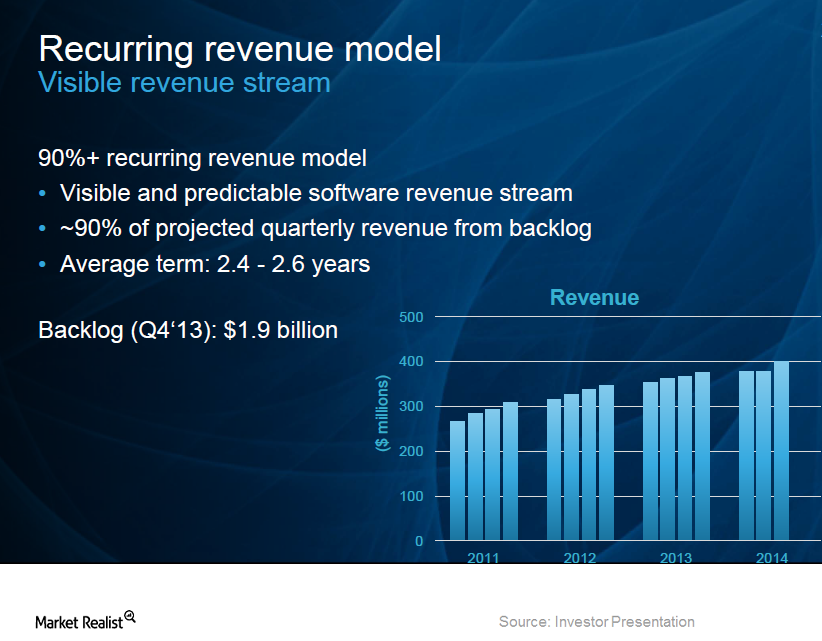

How Cadence generates a steady revenue stream

Aggressive acquisitions and a focus on systems enabled Cadence to grow its revenues at a faster pace than its competition in the last five years.

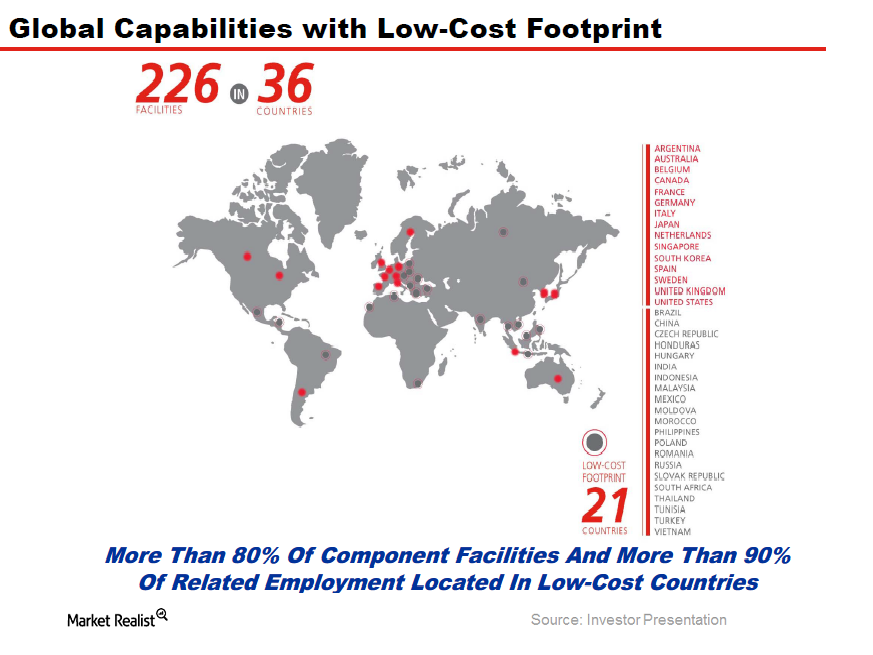

How Lear became one of the largest automotive parts suppliers

Lear (LEA) is one of the largest automotive parts suppliers with FY14 revenues of $17.7 billion.

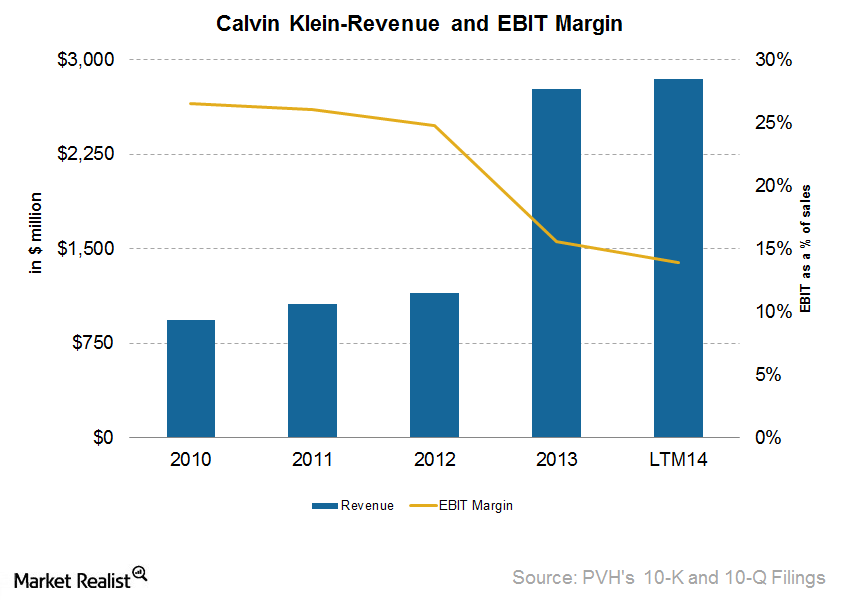

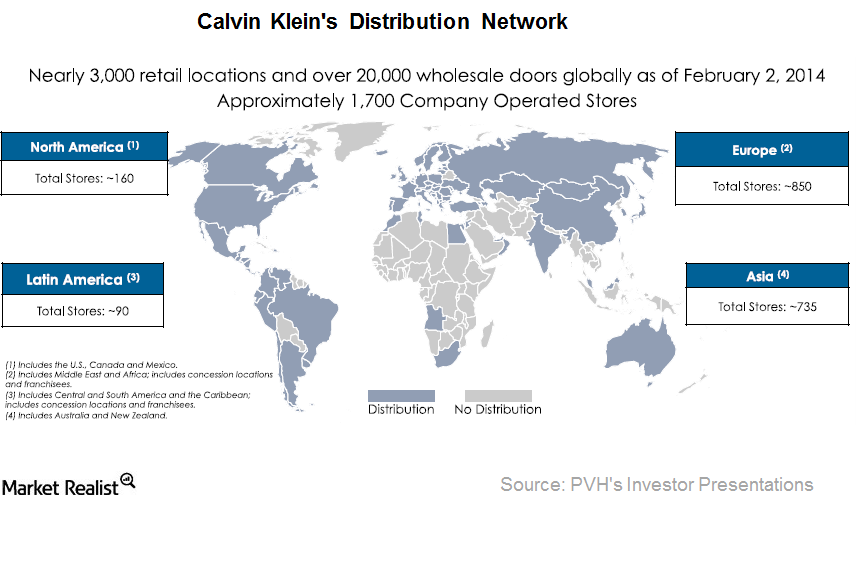

Calvin Klein’s financial performance and growth opportunities

Calvin Klein’s North American operations had a 2% increase in same-store sales growth. However, the international operations decreased by 4%.

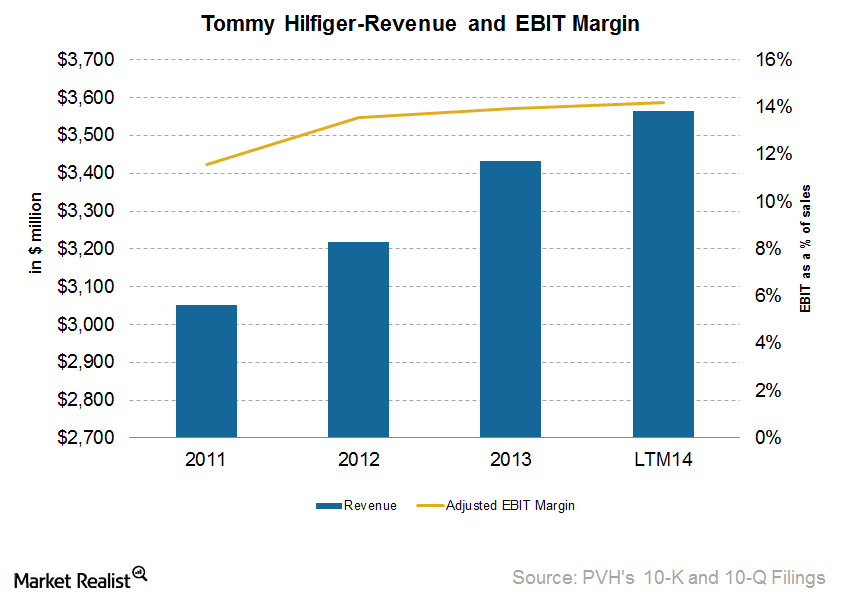

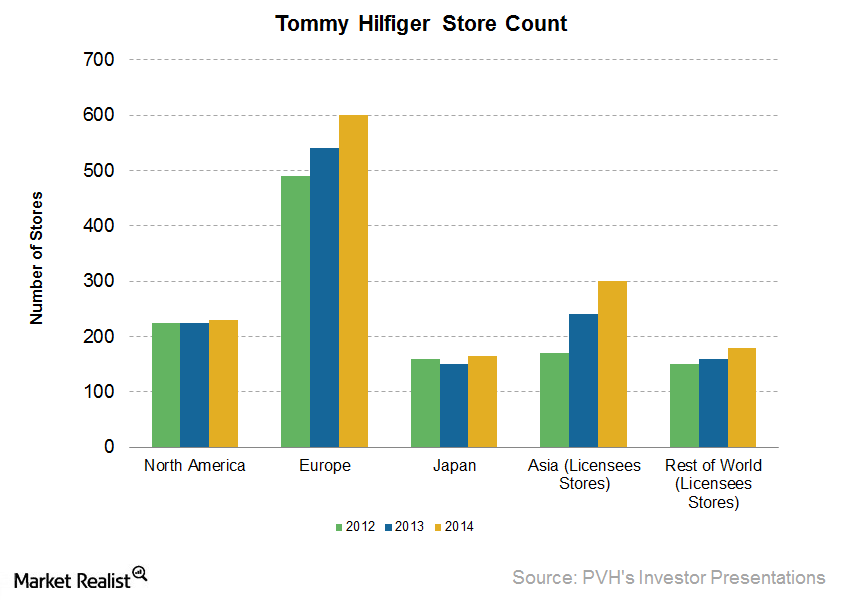

Assessing Tommy Hilfiger’s business performance

PVH Corp. (PVH) gets ~44% of its revenue from Tommy Hilfiger’s business division. It’s the largest of all three of the reporting segments.

Tommy Hilfiger—the proven lifestyle brand

Tommy Hilfiger was founded in 1985. Along with Calvin Klein, it’s one of PVH’s two flagship brands. For 2013, Tommy Hilfiger’s global retail sales were $6.4 billion.

Analyzing the Calvin Klein business

Products sold under the Calvin Klein banner had gross revenue of $7.8 billion in 2013. Of the revenue, PVH reported $2.8 billion.

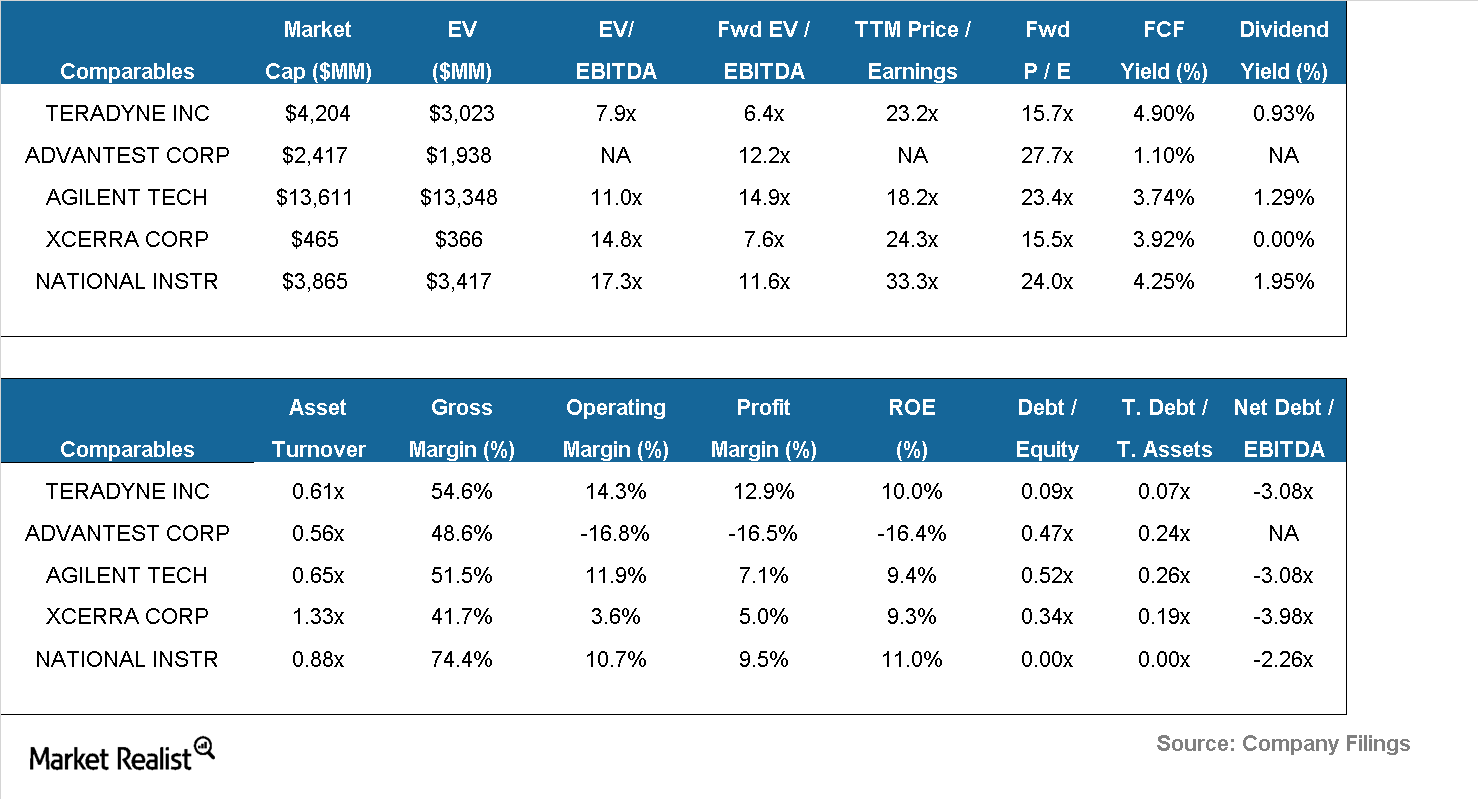

Is Teradyne fairly valued relative to its peers?

Presently, ten analysts have given Teradyne a buy rating, and four have issued a neutral rating, for a consensus target price of $22.17.

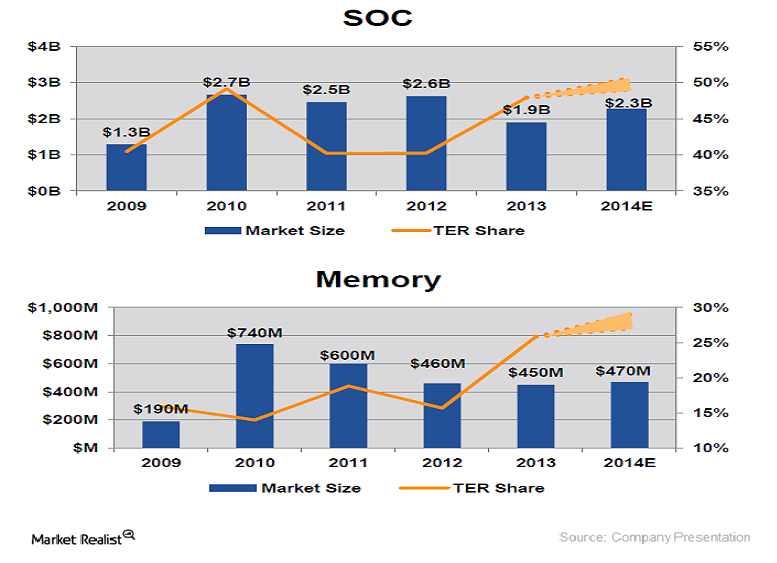

Teradyne boasts encouraging market share gains

Teradyne has about 26% share of the $470-million memory testing market. The company expects to gain 3 to 5 points of share this year.