Record Withdrawal in US Natural Gas Inventories

US natural gas inventories fell by 359 Bcf (billion cubic feet) to 2,767 Bcf between December 29, 2017, and January 5, 2018, according to the EIA.

Jan. 12 2018, Updated 10:40 a.m. ET

Natural gas futures

February US natural gas (UGAZ) (DGAZ) futures contracts rose 1.2% to $3.12 per MMBtu (million British thermal units) at 1:15 AM EST on January 12, 2018. Prices are near a two-month high. It benefits funds like the Guggenheim S&P Equal Weight Energy (RYE) and the Energy Select Sector SPDR ETF (XLE). These funds have exposure to US energy companies.

The E-Mini S&P 500 (SPY) futures contracts for March delivery rose 0.01% to 2,769.5 at 1:15 AM EST on January 12, 2018.

Natural gas inventories

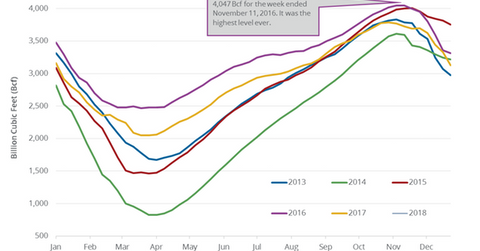

On January 11, 2018, the EIA released its weekly US natural gas inventories report. US natural gas inventories fell by 359 Bcf (billion cubic feet) to 2,767 Bcf between December 29, 2017, and January 5, 2018, according to the EIA. It’s a record weekly withdrawal in inventories for this time of the year. Inventories fell due to cold weather across the US during this period.

A Reuters poll estimated that US natural gas inventories could have fallen by 333 Bcf between December 29, 2017, and January 11, 2018. Inventories fell by 151 Bcf during the same week a year ago. The five-year average natural gas withdrawal for this period of the year was at 162 Bcf. Inventories fell by 206 Bcf on December 22–29, 2017.

A record withdrawal in US natural gas inventories supported natural gas (GASL) (UNG) prices on January 11, 2018. Natural gas (BOIL) prices rose more than 6% on January 11, 2018, to more than a one-month high. Higher energy prices favor energy producers (RYE) (IXC) like Gulfport Energy (GPOR), Sanchez Energy (SN), and Rex Energy (REXX).

Impact

US natural gas inventories hit a record 4,047 Bcf for the week ending November 11, 2016. Since then, inventories have fallen by 1,280 Bcf or 31.6%. Inventories are also 12.1% below their five-year average. If the momentum continues, it’s bullish for natural gas (FCG) prices. In contrast, an increase in US natural gas inventories above the five-year average would pressure natural gas (UGAZ) prices.

Next, we’ll discuss US natural gas production.