REX American Resources Corp

Latest REX American Resources Corp News and Updates

Natural Gas Prices Could Overshadow the Increasing Stockpile Data

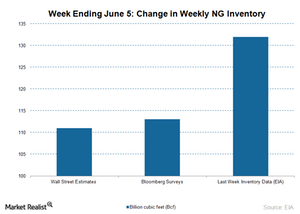

The EIA will publish the weekly natural gas in storage report on June 11. US commercial natural gas inventories rose by 132 Bcf for the week ending May 29.

US Natural Gas Futures Could Continue to Fall

Hedge funds’ net long positions in US natural gas futures (UGAZ) (UNG) and options contracts were at 5,318 for the week ending January 2, 2018.

US Natural Gas Inventories Could Help Natural Gas Futures

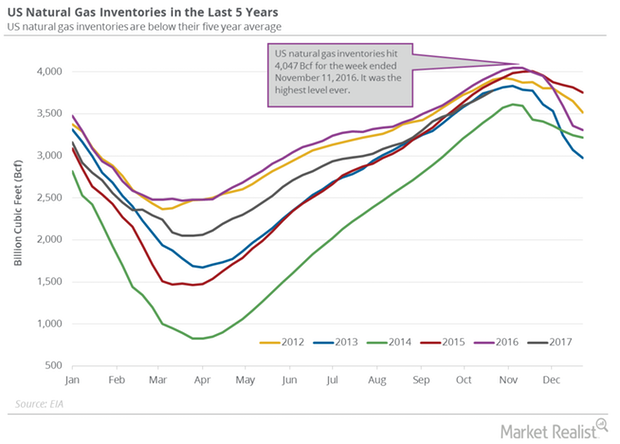

The EIA reported that US natural gas inventories rose by 65 Bcf (billion cubic feet) to 3,775 Bcf on October 20–27, 2017.

How Weather Affects Natural Gas Prices

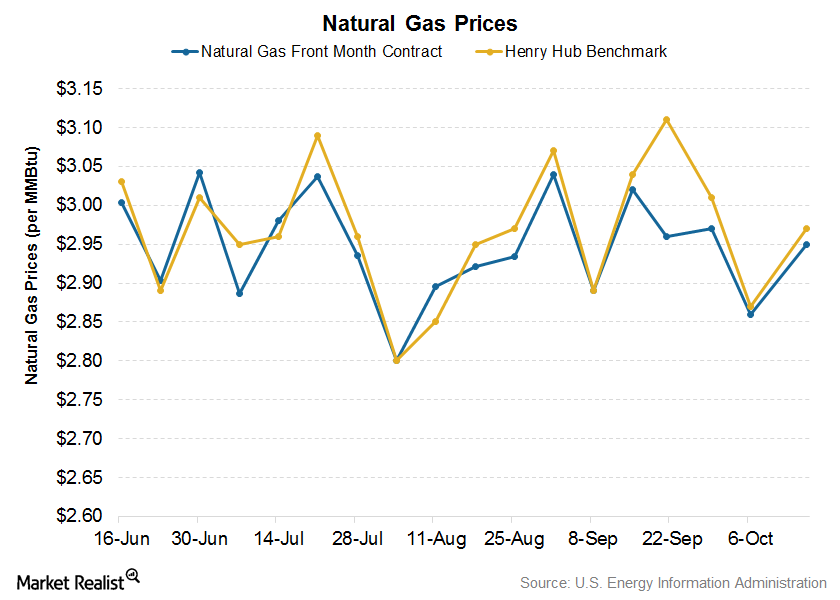

On October 16, the November US natural gas futures contract price was reported as $2.95 per MMBtu.

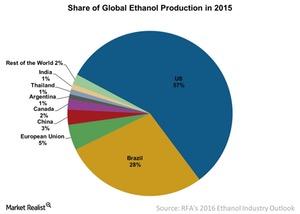

Why the US Ethanol Industry Matters from a Global Perspective

Fossil fuels are non-renewable, and a shortage can wreak havoc on the economy. It was the desire for alternative energy that gave rise to the ethanol industry.