Natural Gas Prices Are Impacted by the US Dollar

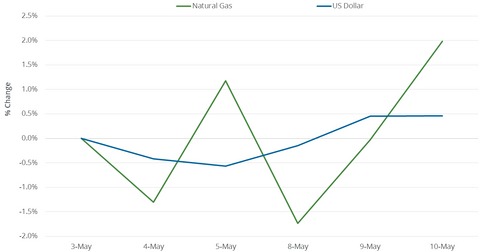

Between May 3 and May 10, 2017, natural gas (GASX) (FCG) (GASL) June futures rose 2%. The US dollar (UUP) (UDN) (USDU) rose 0.5% during that period.

Nov. 20 2020, Updated 3:22 p.m. ET

Natural gas and the US dollar in the short term

Between May 3 and May 10, 2017, natural gas (GASX) (FCG) (GASL) June futures rose 2%. The US dollar (UUP) (UDN) (USDU) rose 0.5% during that period.

In the past five trading sessions, natural gas futures and the US dollar moved in opposite directions two out of five times. The correlation between the two over the past five trading sessions was -4.2%. The figure doesn’t indicate much of a quantitative relationship between the two during that short period.

When the dollar rises, it makes commodities more expensive for importing countries, which has a negative impact on prices. US natural gas wasn’t exported in large quantities outside North America in the past. So, there hasn’t been a strong relationship between natural gas and the dollar in the past.

In February 2016, the US started exporting natural gas in liquefied form from the lower 48 states to outside North America. Currently, natural gas exports to Mexico and Canada through pipelines account for a significant portion of US natural gas exports.

Natural gas and the US dollar in the long term

On March 3, 2016, natural gas futures closed at $1.64 per million British thermal units—a 17-year low. Since then, natural gas active futures have risen ~100.7%, while the US dollar has risen 2.1%. During that period, the US dollar and natural gas prices moved in opposite directions based on their closing prices in 159 of 300 trading sessions.

The correlation was -8% during that period, which shows the lack of a relationship between the two over a longer period. Other factors, such as the weather, were likely driving movements in natural gas during that time.

The Fed hiked the benchmark interest rate on March 15, 2017. It’s expected to hike rates two more times this year, which could strengthen the US dollar. The Fed kept interest rates unchanged in its latest review on May 10, 2017.

Natural gas and President Trump

The Trump Administration’s aggressive energy and climate policies could lead to higher natural gas production and boost natural gas exports. President Trump’s policies could also mean the return of coal as a source of fuel for power generators, which would make even more gas available for export.

As US natural gas becomes a more international commodity, prices could develop a relationship with the US dollar similar to the one between crude oil and the US dollar in the past. Remember, natural gas prices impact ETFs like the Direxion Daily S&P Oil & Gas Exploration & Production Bear 3x ETF (DRIP), the SPDR S&P Oil & Gas Exploration & Production ETF (XOP), the PowerShares DWA Energy Momentum ETF (PXI), the Vanguard Energy ETF (VDE), and the Fidelity MSCI Energy ETF (FENY).

In the next part, we’ll look at natural gas prices and the forward curve.