Decoding the World Oil Supply and Demand Gap in 2017

The EIA estimates that the world oil supply and demand gap averaged 780,000 bpd (barrels per day) in 1H16. It’s expected to average 650,000 bpd in 2H16.

Dec. 28 2016, Updated 7:36 a.m. ET

World oil supply and demand gap

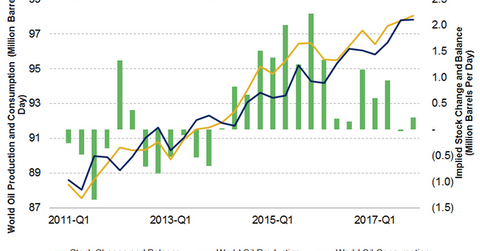

The EIA (U.S. Energy Information Administration) estimates that the world oil supply and demand gap averaged 780,000 bpd (barrels per day) in 1H16. It’s expected to average 650,000 bpd in 2H16. The narrowing world oil supply and demand gap would support crude oil (USO) (UCO) (RYE) (IEZ) (XOP) (ERY) (USL) prices. For more on crude oil prices, read Part 1 of this series.

The world oil supply and demand gap fell 29% to 150,000 bpd in 3Q16 compared to 2Q16. The world oil supply and demand gap fell 93% from the same period in 2015. The rise in consumption despite strong production narrowed the world oil supply and demand gap. Read the next part of the series for more on consumption and global economic growth.

Highs and lows in the last five years

The world oil supply and demand gap averaged 2,220,000 bpd in 4Q15—the highest in the last five years. Brent crude oil prices averaged $43.7 per barrel in 4Q15. It also averaged $30.7 per barrel in January 2016—the lowest in the last 12 years. A high world oil supply and demand gap has a negative impact on crude oil prices. High OPEC (Organization of the Petroleum Exporting Countries) and non-OPEC production led to the rise in global crude stocks.

The world oil supply and demand gap averaged 110,000 bpd in 2Q13—the lowest in the last five years. Brent crude oil prices averaged $103 per barrel in 2Q13. It also averaged $110 per barrel in 3Q13. Relatively lower OPEC and non-OPEC production led to the fall in global crude stocks. A low world oil supply and demand gap has a positive impact on crude oil prices.

Estimates for 2017

The EIA estimates that the world oil supply and demand gap would average 600,000 bpd, 950,000 bpd, and 40,000 bpd in 1Q17, 2Q17, and 3Q17, respectively. The world oil supply and demand gap would narrow due to major oil producers’ production cut deal. The deal could curb oversupply in the market. OPEC and non-OPEC producers agreed to cut crude oil production by 1.8 MMbpd (million barrels per day) from January 2017 onwards. Strong demand would also help to remove surplus oil from the market.

Impact

The expectation of the narrowing world oil supply and demand gap would have a positive impact on crude oil prices in 2017. High crude oil prices have a positive impact on oil and gas exploration and production companies such as ExxonMobil (XOM), Chevron (CVX), Comstock Resources (CRK), Sanchez Energy (SN), ConocoPhillips (COP), and Bonanza Creek Energy (BCEI).

Volatility in crude oil prices impacts ETFs and ETNs such as the Guggenheim S&P 500 Equal Weight Energy ETF (RYE), the Vanguard Energy ETF (VDE), the Energy Select Sector SPDR ETF (XLE), the PowerShares DWA Energy Momentum ETF (PXI), the First Trust Energy AlphaDEX ETF (FXN), and the Direxion Daily Energy Bear 3X ETF (ERY).

Next, we’ll analyze the relationship between crude oil prices, world oil consumption, and global economic growth.