Labor Department Redefines Employee vs Independent Contractor Classification; All You Need To Know

In January, the U.S. Department of Labor (DOL) instituted new rules for classifying individuals as employees or independent contractors under the Fair Labor Standards Act (FLSA). The rule, which went into effect on March 11, revised the DOL’s previous guidance on the classification of workers by adopting a six-factor test. Keep reading to know more!

Origin of the Independent Contractor Rule

The Trump-era DOL issued the Independent Contractor Status for consistency in entities covered by the FLSA in 2021. The Prior Rule encompassed a five-factor economic realities test, and it identified two core factors: "the nature and degree of the individual’s control over the work" and "the individual’s opportunity for profit or loss," according to the National Law Review.

With the #DOL rescinding the Trump administration's Independent Contractor Rule, employers should review their #IndependentContractor relationships to ensure accurate classification of workers, especially those entered since 2021. Learn more: https://t.co/vP33n6fWou #LaborLaw pic.twitter.com/sB2pIS8Ywe

— Haynes and Boone LLP (@haynesboone) January 30, 2024

The Prior Rule was slated to go into effect on March 8, 2021, but after the Biden Administration took office, the DOL published a new independent contractor rule on March 4, 2021, delaying the Trump-era rule.

On May 6, 2021, the DOL published a new rule attempting to repeal the Prior Rule. However, it met with litigation and in 2022 a Texas federal court reinstated the Prior Rule.

The Introduction of the Final Rule

After obtaining feedback from relevant stakeholders, the Final Rule was formally enacted in October 2022, rescinding and substituting the Prior Rule. In place of the "core factors," the Final Rule implemented a distinct analysis approach.

🧵Today, @USDOL announced the proposal of a new independent contractor rule to:

— U.S. Department of Labor (@USDOL) October 11, 2022

➡️ Protect workers’ basic rights

➡️ Make it easier for employers to properly classify their workers

➡️ Protect independent businesses that follow the law https://t.co/TASudaNF8w

(1/4) pic.twitter.com/NxOklPtGWS

The Final Rule introduced by the Department of Labor (DOL) outlines six factors that guide the analysis of a worker's relationship with an employer:

1. Scope and opportunity for profit or loss: This factor assesses the worker's ability to negotiate pay, accept or decline jobs, and other functions affecting potential profit or loss.

2. Investments by the employer and the workers: It considers whether the worker has made significant capital or entrepreneurial investments that enable them to work for multiple companies, thus indicating independent contractor status.

3. Permanency of the working relationship: This factor suggests that if a worker is hired for a fixed period, project-based work, or sporadically, they may be classified as an independent contractor.

4. Nature and degree of control over the work: This factor examines whether the worker controls their schedule, is unsupervised, and is not explicitly restricted from working for other entities, indicating independent contractor status.

5. Nature of the work and its integration with the employer's business: If the work performed by the worker is integral to the employer's business, they may not be classified as an independent contractor.

6. Worker's skill and initiative: If the worker brings specialized skills used for marketing or acquiring business from other entities, they may be classified as an independent contractor.

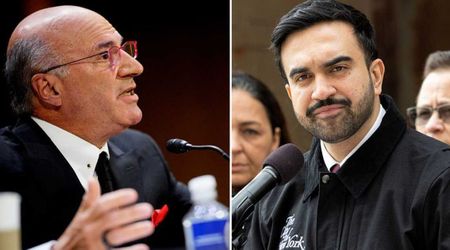

.@SenBillCassidy introduced a Congressional Review Act resolution to overturn DOL worker classification rule that threatens the gig economy and jeopardizes independent contractors. @GOPHELP

— Institute For The American Worker (@Inst4AW) March 6, 2024

w/ @RepKiley & @EdWorkforceCmtehttps://t.co/V3ZDSxdZOS

Impact on Employers

The DOL's new rule is expected to make it challenging for employers to classify workers as independent contractors, potentially leading to more workers being classified as employees eligible for benefits. However, it also increases the risk of employee misclassification, exposing employers to liability for failing to provide the required benefits and protections.

Penalties

Employers found to have misclassified workers may face penalties under the Fair Labor Standards Act (FLSA), including fines of up to $10,000 and potential criminal prosecution.

Legal challenges to the Final Rule are pending in federal courts in Tennessee, Louisiana, and Georgia. Republican Senators have introduced a Congressional Review Act to repeal the Final Rule and reinstate the Prior Rule.