Vivint Solar Inc

Latest Vivint Solar Inc News and Updates

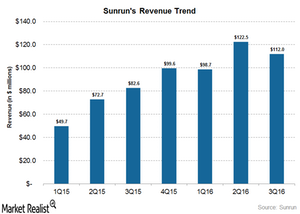

Why Did Sunrun Miss Analysts’ 3Q16 Revenue Estimates?

For 3Q16, Sunrun’s (RUN) consolidated revenue came in at ~$112 million against analysts’ expectations of $135 million.

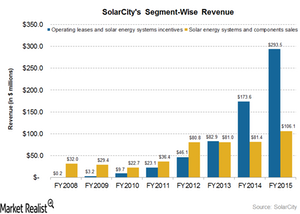

Introducing SolarCity, a Powerhouse in Solar Technology

SolarCity is a vertically-integrated solar company. Despite advancing technology and expanding reach, it has seen negative earnings most years since 2007.

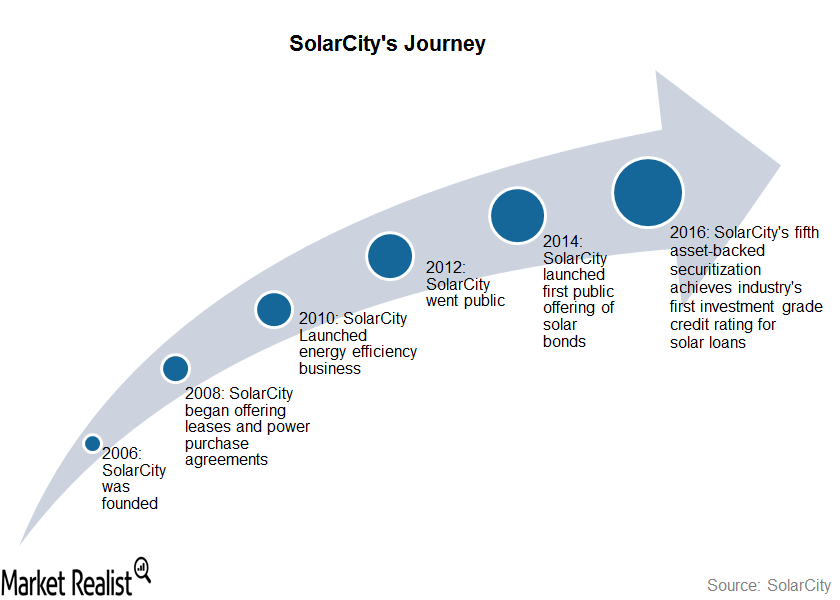

SolarCity: A Quick Trip down Memory Lane

SolarCity was founded in 2006 with the initial focused on selling, financing, and installing solar energy systems for residential and commercial customers.

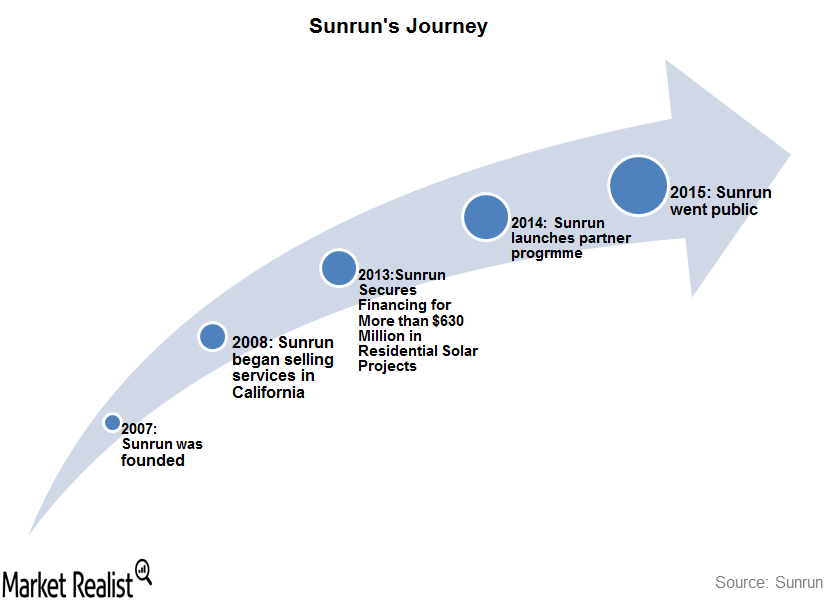

Sunrun: The Beginning of a Residential Solar Major

Sunrun was co-founded in 2007 as a startup by Ed Fenster and Lynn Jurich, with an aim to create worldwide use of solar energy. It began offering solar services in 2008.

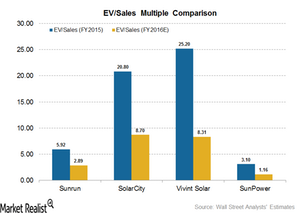

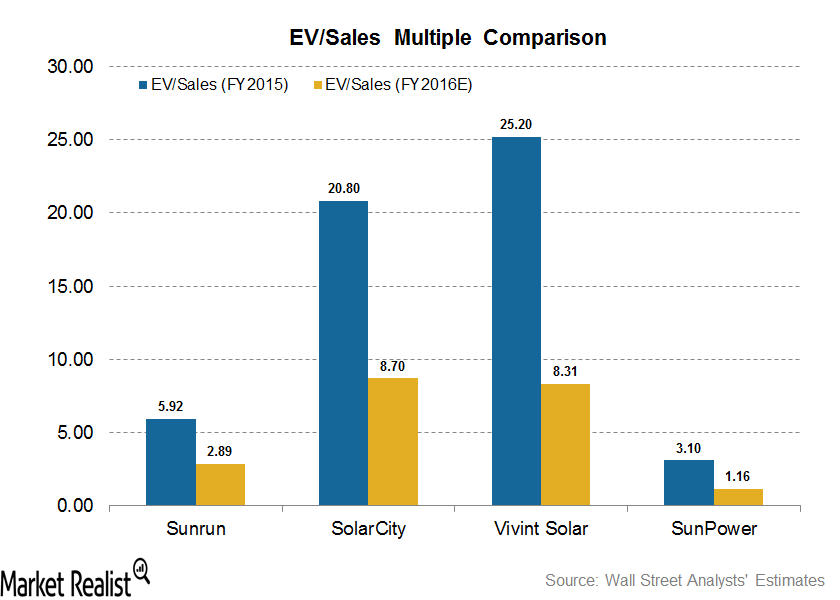

Understanding SolarCity’s Valuation Compared to Peers: Who’s Trading at a Discount?

Among the downstream solar companies, SolarCity (SCTY) has the highest EV-to-sales value of 8.70x, which is closely followed by Vivint Solar at 8.31x.

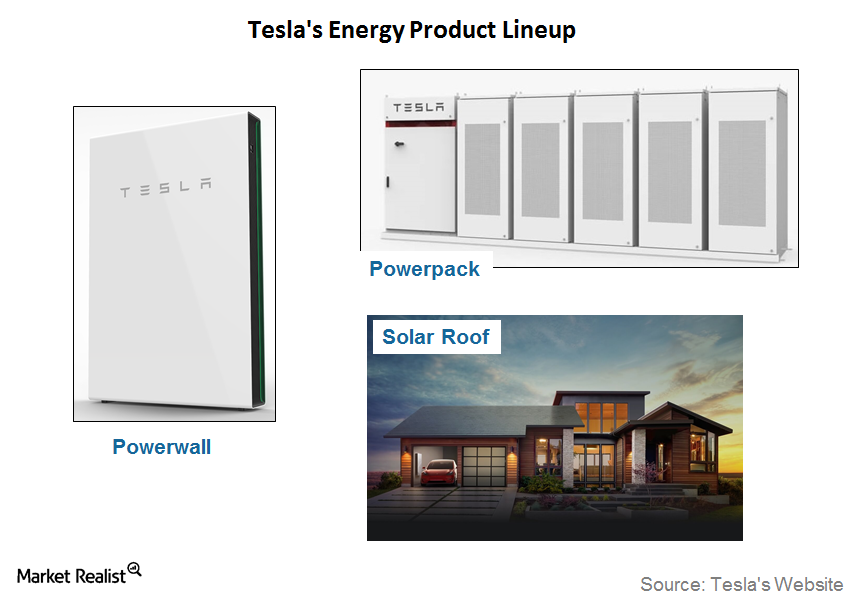

Tesla Solar: Could 2020 Be the Year of the Solar Roof?

During Tesla’s Q3 call, Musk said that he thinks Tesla’s solar segment could be as big or even bigger than the company’s electric vehicle business.

Generac Challenges Enphase Energy, SolarEdge Duopoly

Short-seller Citron Research noted that Generac Holdings could challenge solar microinverter makers Enphase Energy and SolarEdge’s duopoly.

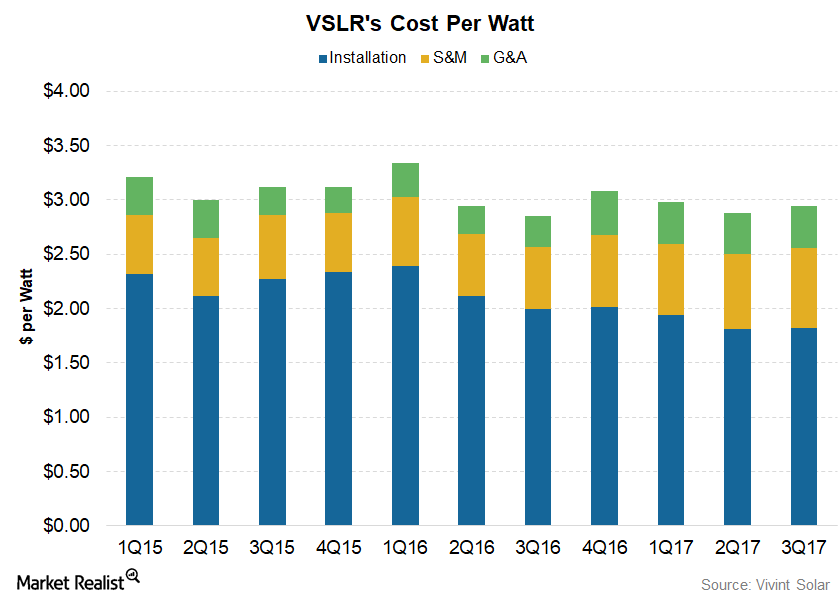

Vivint Solar Reported Rise in Estimated Retained Value in 3Q17

Vivint Solar (VSLR) reported a cost per watt of $2.94 for 3Q17, higher than the $2.88 it reported in 2Q17 and $3.85 in 3Q16.

Analyzing Tesla’s Updated Energy Products

In October, Tesla unveiled the second version of the Powerwall and Powerpack. The second version comes with higher energy storage capacity.

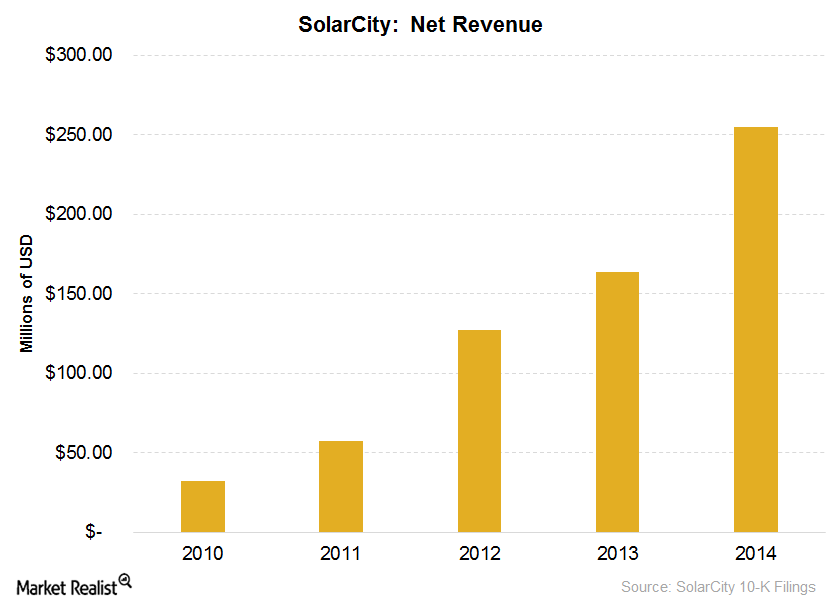

How Does SolarCity Make Money?

SolarCity’s business is divided into two segments: Operating Leases and Solar Energy Systems Incentives and Solar Energy Systems and Component Sales.

Is Vivint Solar Trading at a Discount Compared to Its Peers?

One out of four analysts covering Vivint Solar (VSLR) has rated the stock a “buy,” two analysts rated the stock a “hold,” and one analyst recommends a “sell” for the stock.

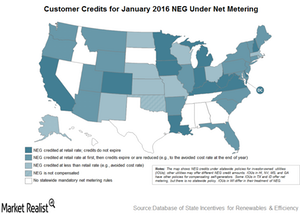

How Vivint Solar’s Customers Benefited from Solar Tax Credits

ITCs (investment tax credits) are a dollar-for-dollar reduction on an income tax bill. It is applicable to both residential and commercial deployment of solar systems.

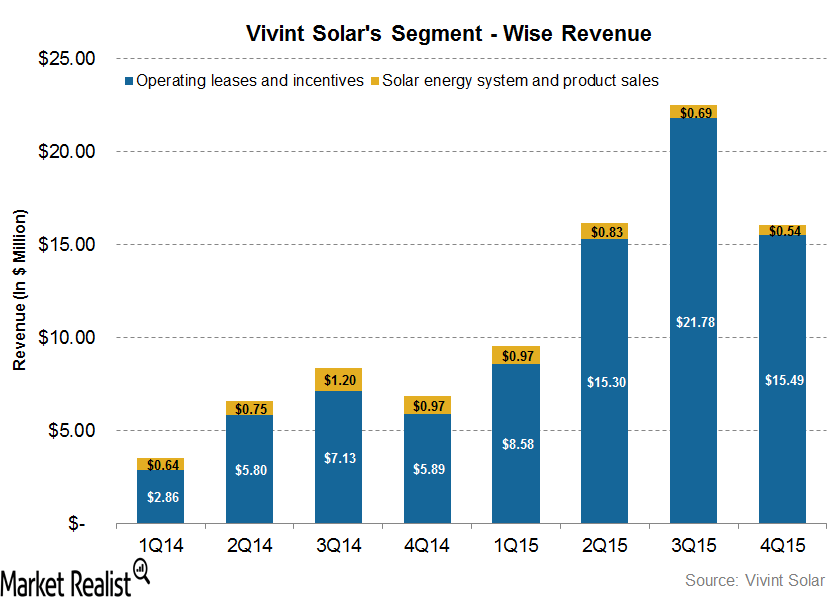

How Does Vivint Solar Make Money?

Vivint Solar’s business model is divided into two revenue segments: Operating Leases and Incentives and Solar Energy Systems and Product Sales.

Analyzing Key Elements of Sunrun’s Business Strategy

Unlike its peers, Sunrun is building an open platform of services and tools to provide a differentiated customer experience and, at the same time, gaining a wide customer base.

Need to Know: Sunrun’s Major Acquisitions

In February 2014, Sunrun (RUN) acquired the residential business of REC Solar, AEE Solar, and SnapNrack from Mainstream Energy Corporation for $78.8 million.

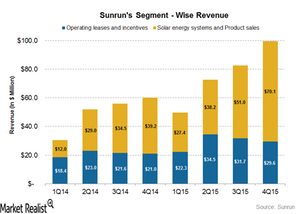

How Does Sunrun Make Money?

Extension of ITCs for investments in solar energy has been key for the rapid expansion of downstream solar companies like Sunrun, Vivint Solar (VSLR), SolarCity (SCTY), and SunPower (SPWR).

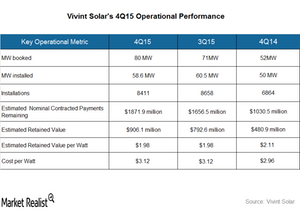

Behind Vivint Solar’s Key Operational Metrics

Vivint Solar’s estimated nominal contracted payments remaining increased by $251.4 million during 4Q15, compared to $214 million during 3Q15.