Shake Shack Inc.

Latest Shake Shack Inc. News and Updates

How to Use Shake Shack’s New Bitcoin Rewards Program — Limited-Time Offer

Shake Shack has partnered with Jack Dorsey’s Block for an upcoming Bitcoin rewards program. What is the program and how do you use it?

What Is the Outlook for Shake Shack in 2016?

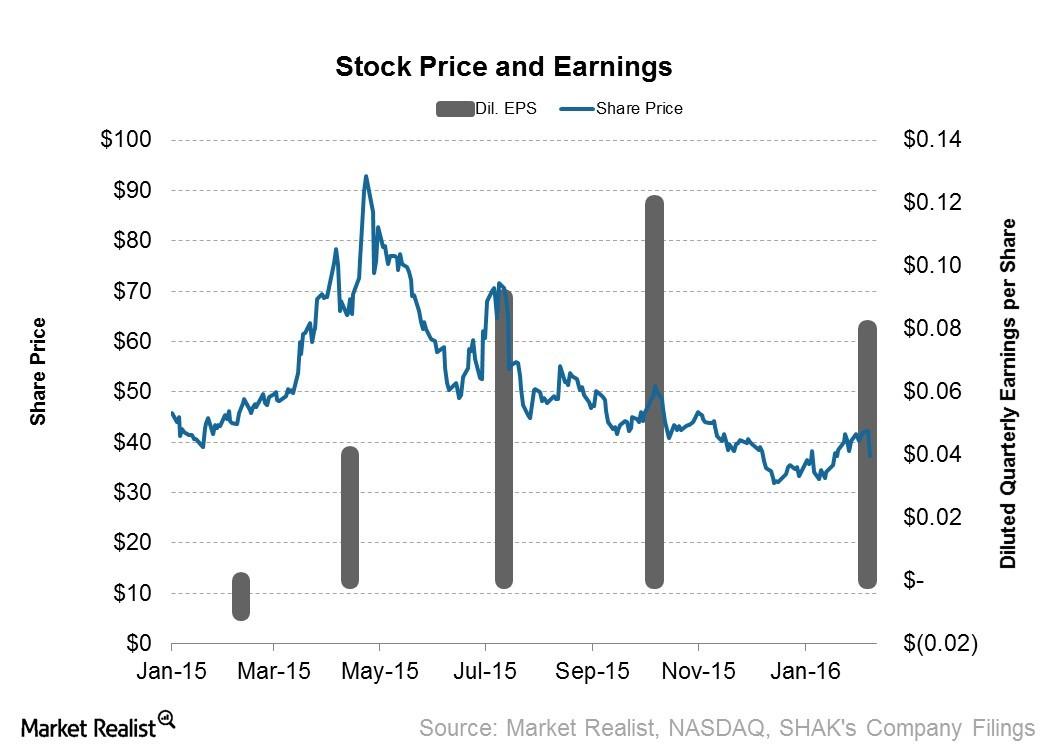

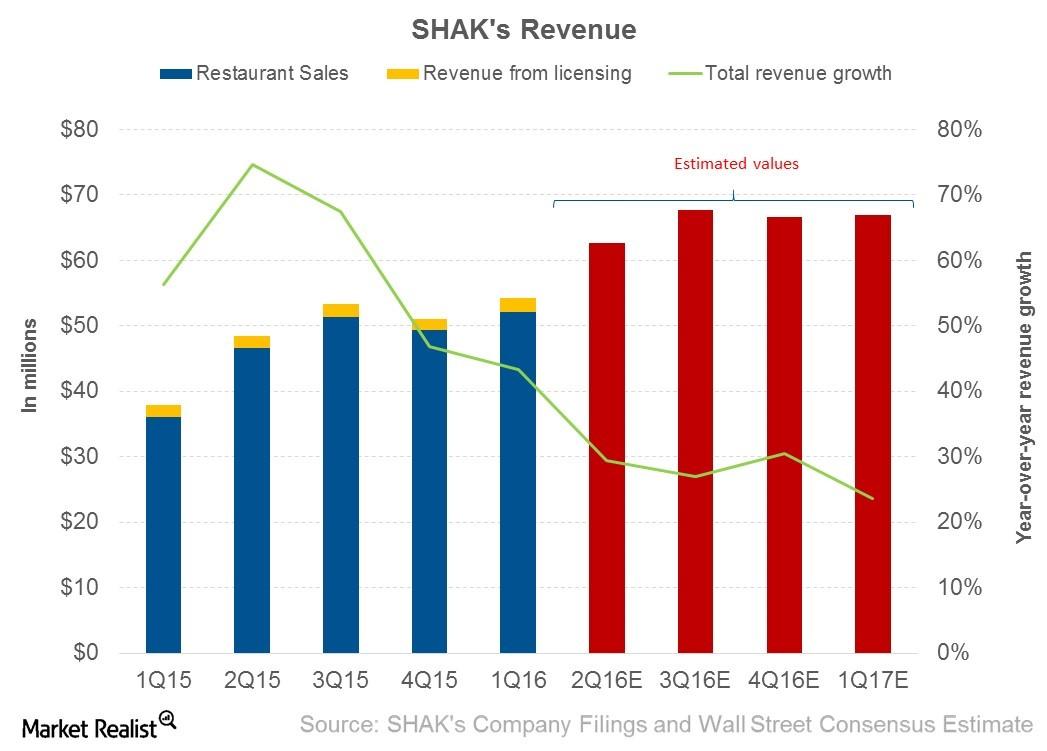

A New York–based fine casual restaurant chain, Shake Shack (SHAK) announced its 4Q15 results on March 7, 2016. SHAK reported an overall revenue of $51.1 million and earnings per share of $0.08.

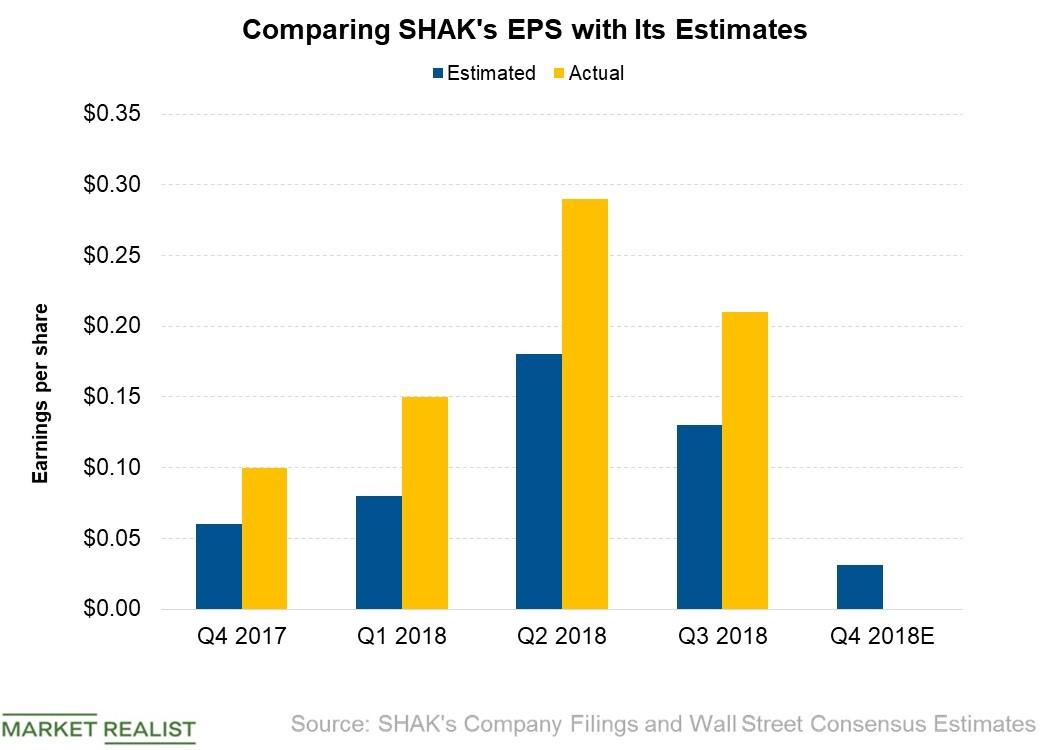

Why Analysts Expect Shake Shack’s EPS to Fall in Q4

In the fourth quarter, analysts expect Shake Shack (SHAK) to post adjusted EPS of $0.03, a fall of 69% from $0.10 in the corresponding quarter of 2017.

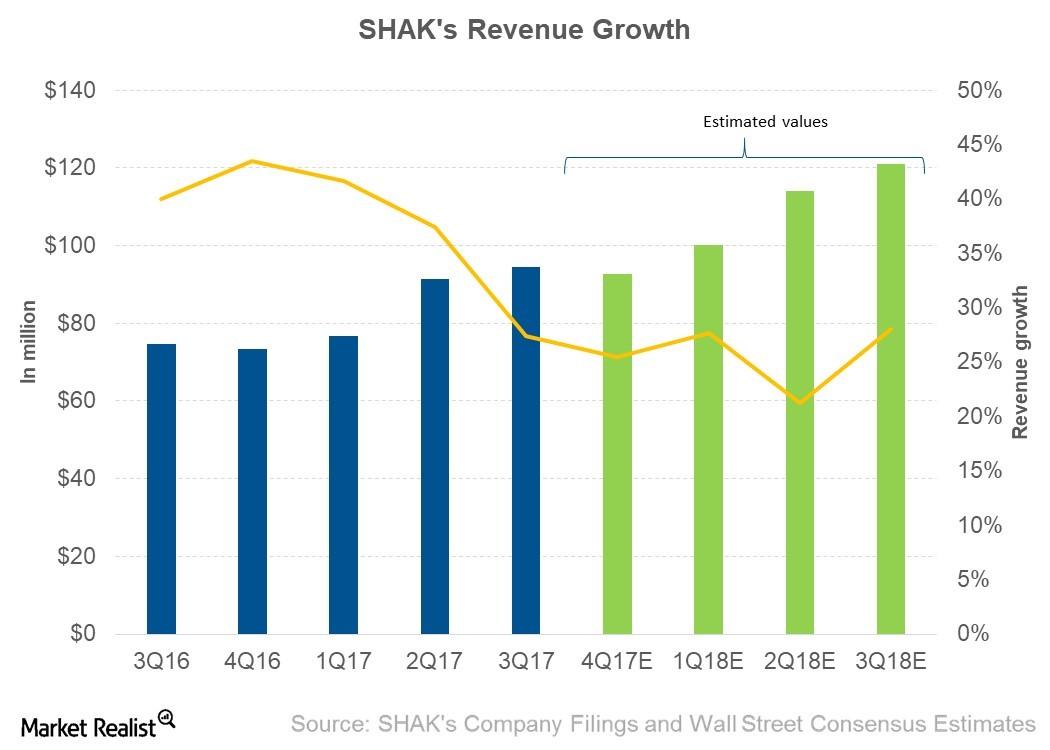

Why Analysts Are Expecting Shake Shack to Rise over the Next 4 Quarters

For the next four quarters, analysts are expecting Shake Shack (SHAK) to post revenues of $427.9 million, which would be a 27.4% YoY (year-over-year) rise.

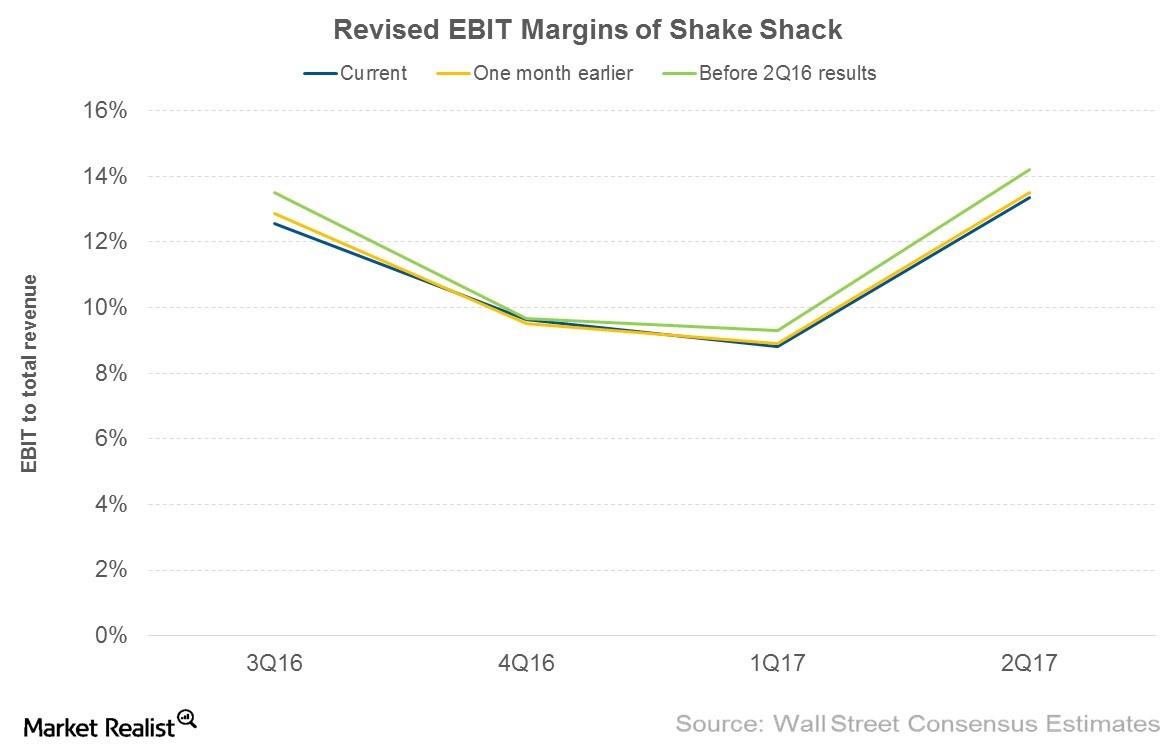

Why Analysts Dropped Their Estimates for Shake Shack’s Earnings

Currently, analysts are expecting Shake Shack (SHAK) to post EBIT margins of 12.6%, 9.6%, 8.8%, and 13.3% in 3Q16, 4Q16, 1Q17, and 2Q17, respectively.

An In-Depth Overview of Panera Bread

Panera Bread is a limited-service fast-casual restaurant company. In July 2017, JAB acquired Panera in a $7.5 billion deal and took it private.

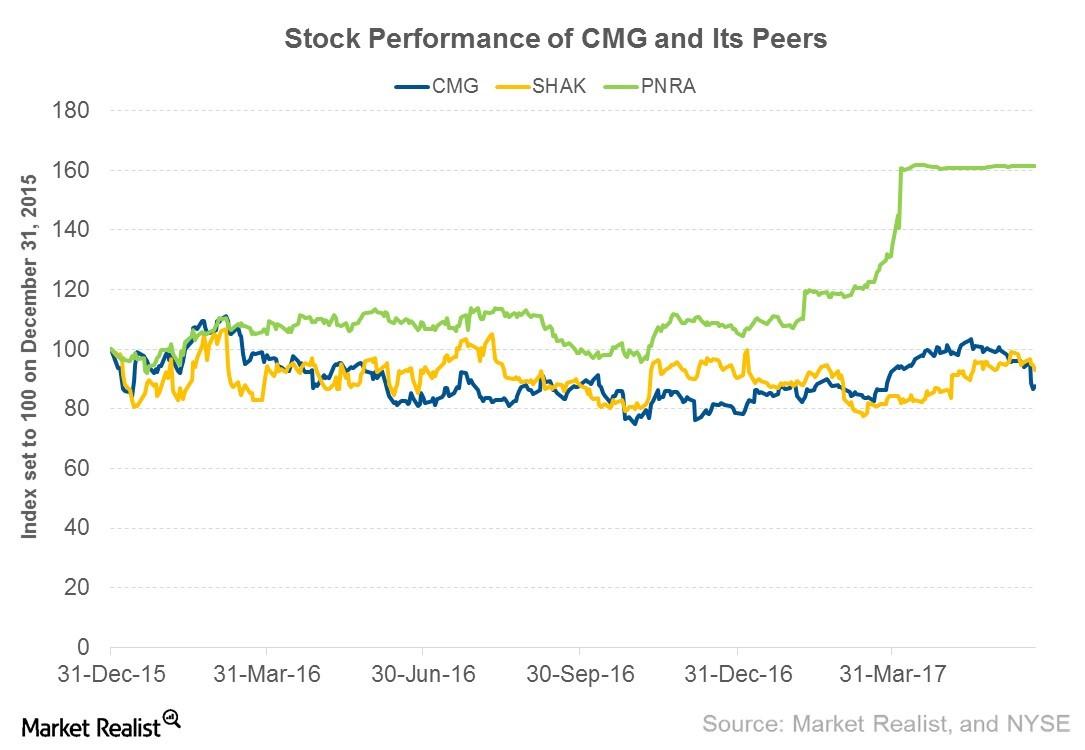

Has Chipotle’s Stock Price Bottomed Out?

After posting better 1Q17 earnings on April 25, Chipotle’s stock price rose to $496.14 by May 16, 2017. Since then, it has experienced downward momentum.

An Investor’s Guide to Chipotle and Its Customers

Chipotle Mexican Grill (CMG) operates more than 1,700 fast-casual restaurants. Here’s everything you need to know about the business.

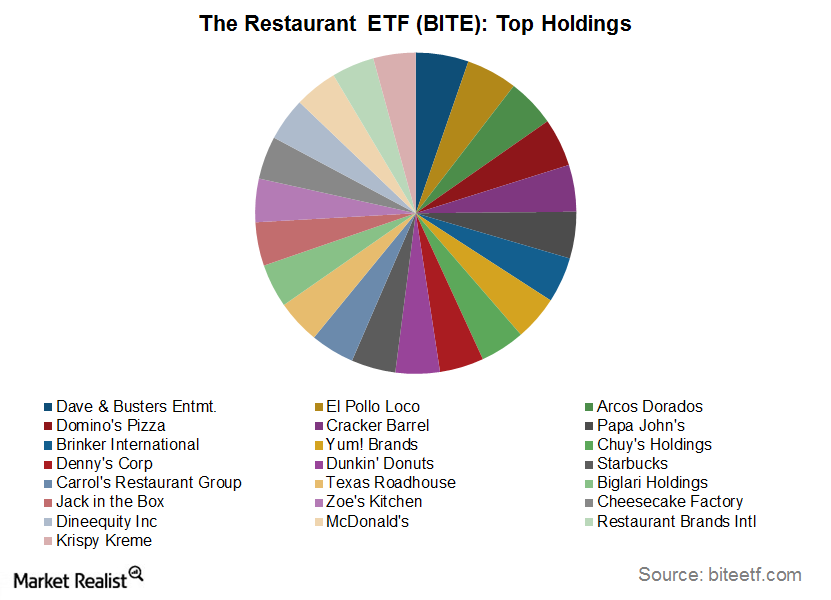

Everything You Need to Know about the BITE ETF

To reap the rewards at both ends of the spectrum, a fund like the Restaurant ETF (BITE) could come in handy!

Shake Shack Stock Falls after Disappointing Business Update

Today, Shake Shack (NYSE:SHAK) provided a business update. The company reported that its total revenue for the second quarter was $91.8 million.

What to Expect from Jack in the Box’s Q2 Earnings

For the second quarter, analysts expect Jack in the Box to report revenue of $211.1 million—a fall of 2.1% from the second quarter of 2019.

Get Real: Big Tech Companies Dominate

In today’s Get Real, we saw updates on big tech companies’ latest happenings. Plus, more earnings results, projections, and expectations.

The Restaurant Industry: An Overview

More Americans are eating out, and they’re eating out more often. The restaurant industry’s share of the food dollar is 51%, up from 25% in 1955.

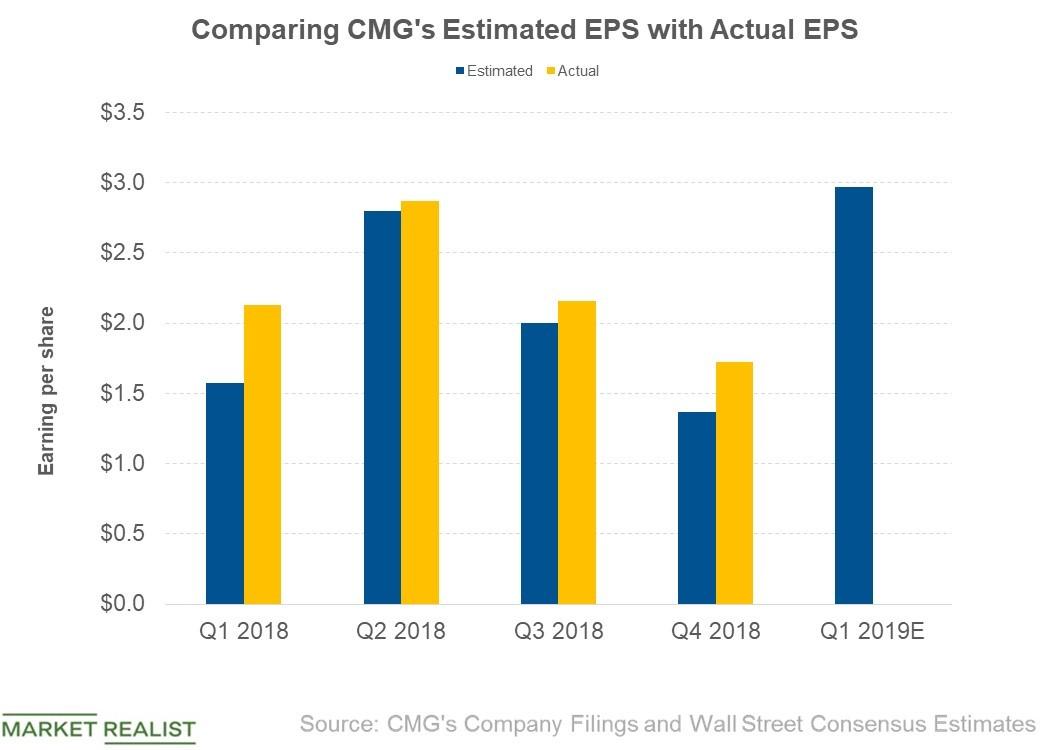

Why Analysts Expect Chipotle’s EPS to Rise in Q1 2019

For 2019, analysts are projecting Chipotle to post adjusted EPS of $12.42, which represents a rise of 37.1% from $9.06 in 2018.

Will Shake Shack’s Q4 Earnings Boost Its Stock Price?

Shake Shack (SHAK) is scheduled to post its fourth-quarter earnings results after the market closes on February 25.

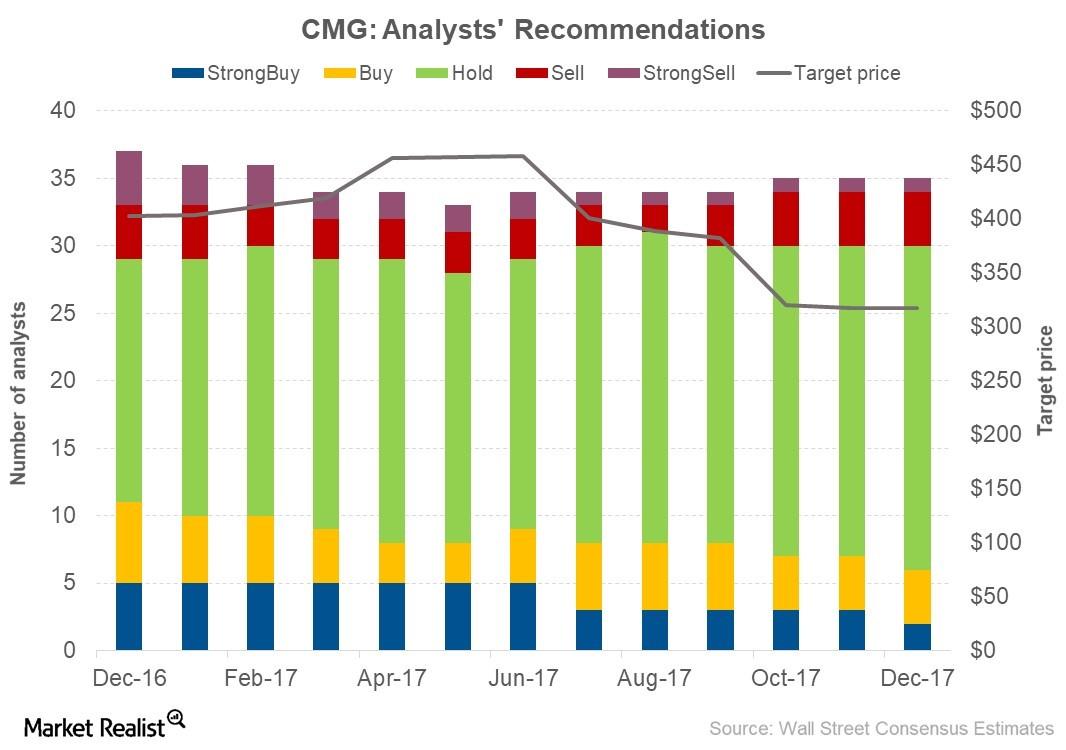

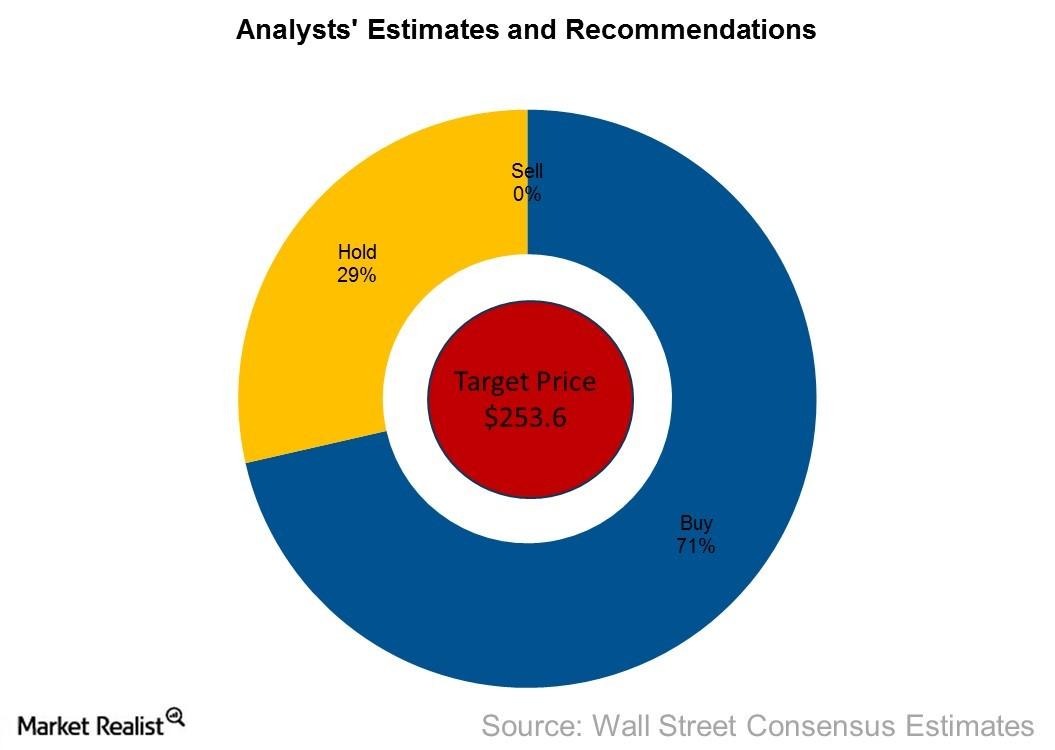

What Analysts Recommend for Chipotle

Target price As of December 28, 2017, Chipotle Mexican Grill (CMG) was trading at $294.06. On the same day, analysts were expecting the stock to reach $317.26 in the next four quarters, which represents a return potential of 7.9%. Before the announcement of Chipotle’s 3Q17 earnings, analysts had forecast a 12-month target price of $375.46. […]

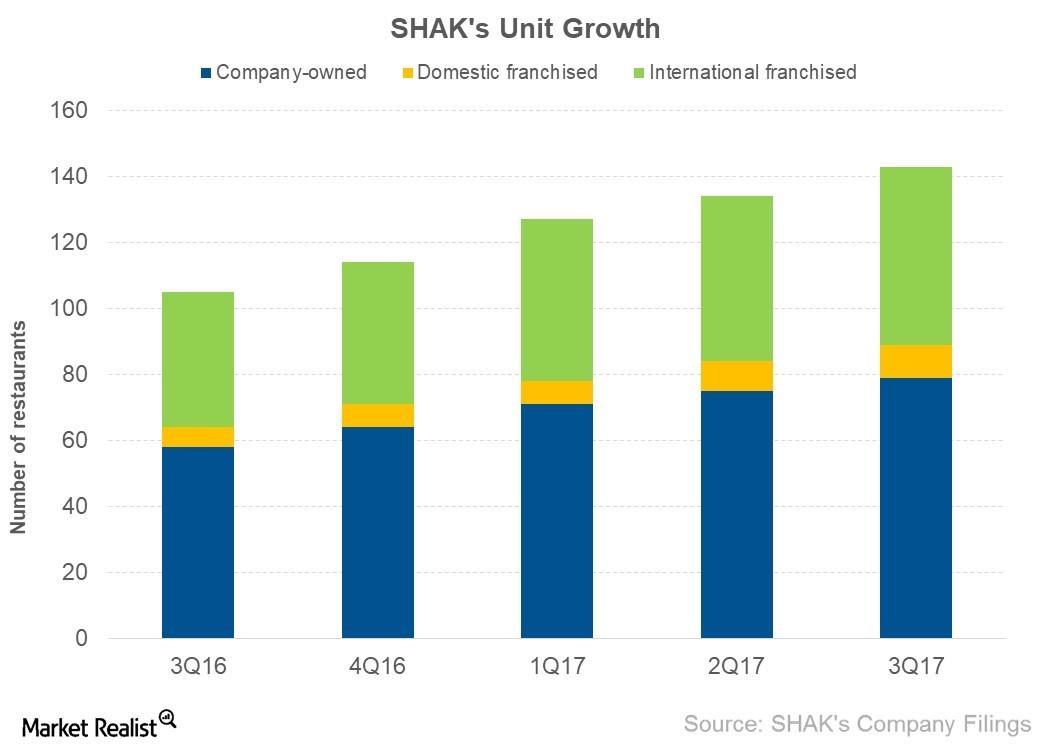

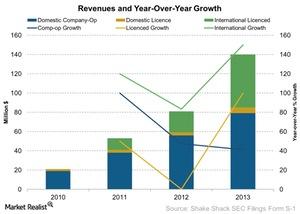

Shake Shack’s Business Expansion Strategy

Unit growth By the end of 3Q17, Shake Shack (SHAK) was operating 143 restaurants—79 domestic company-owned restaurants, ten domestic franchised restaurants, and 54 international franchised restaurants. Unit growth In the last four quarters, Shake Shack has increased its restaurant count by 38 units—21 company-owned restaurants and 17 franchised restaurants. In 3Q17 alone, the company added […]

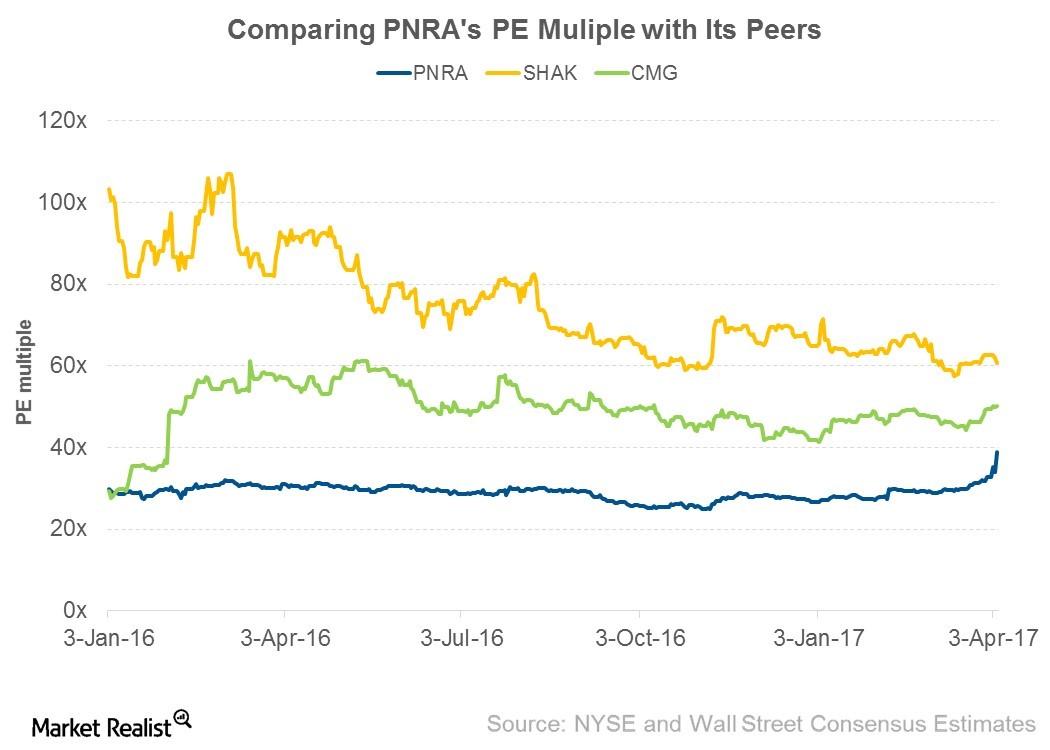

Why Panera’s Valuation Multiple Rose after JAB’s Offer

As of April 5, 2017, Panera was trading at a forward PE multiple of 38.8x—compared to 32.6x before the acquisition rumor started to surface on April 3.

Recommendations for Panera: Why Analysts Favor a ‘Buy’

Of the 28 analysts covering Panera (PNRA), 71.4% have given it a “buy” recommendation, and 28.6% have given it a “hold.”

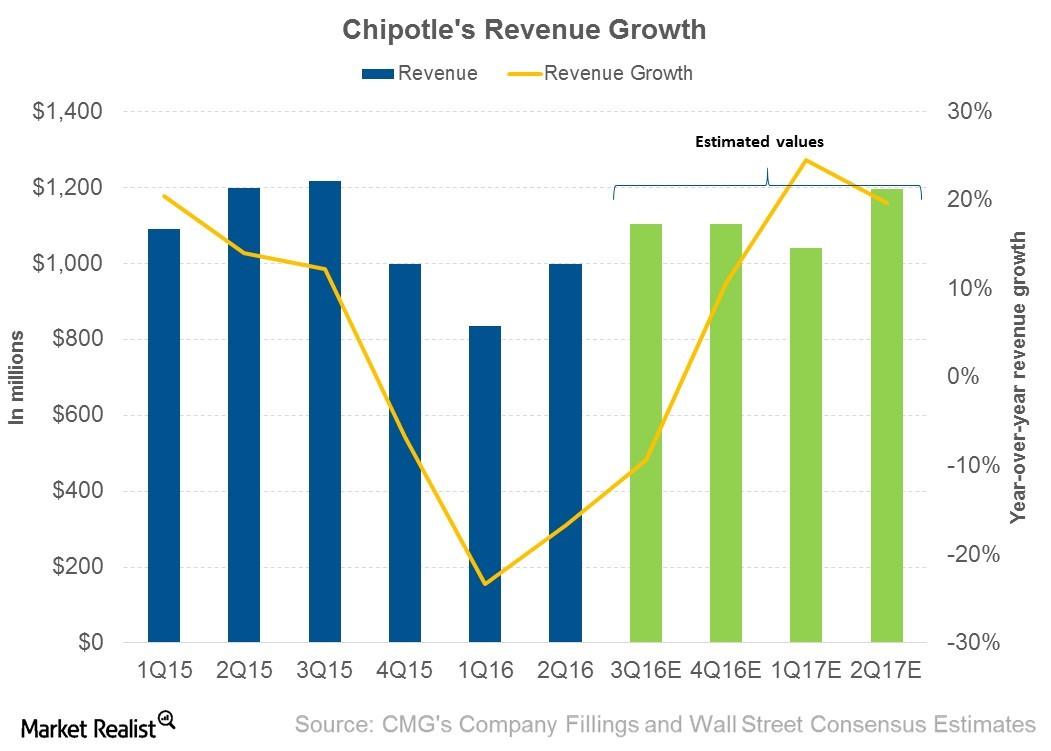

Will Europe Be Key to Chipotle Stemming Its Falling Revenue?

Since the E. coli outbreak in October 2015, Chipotle Mexican Grill’s (CMG) same-store sales growth has been falling. This led to negative revenue growth.

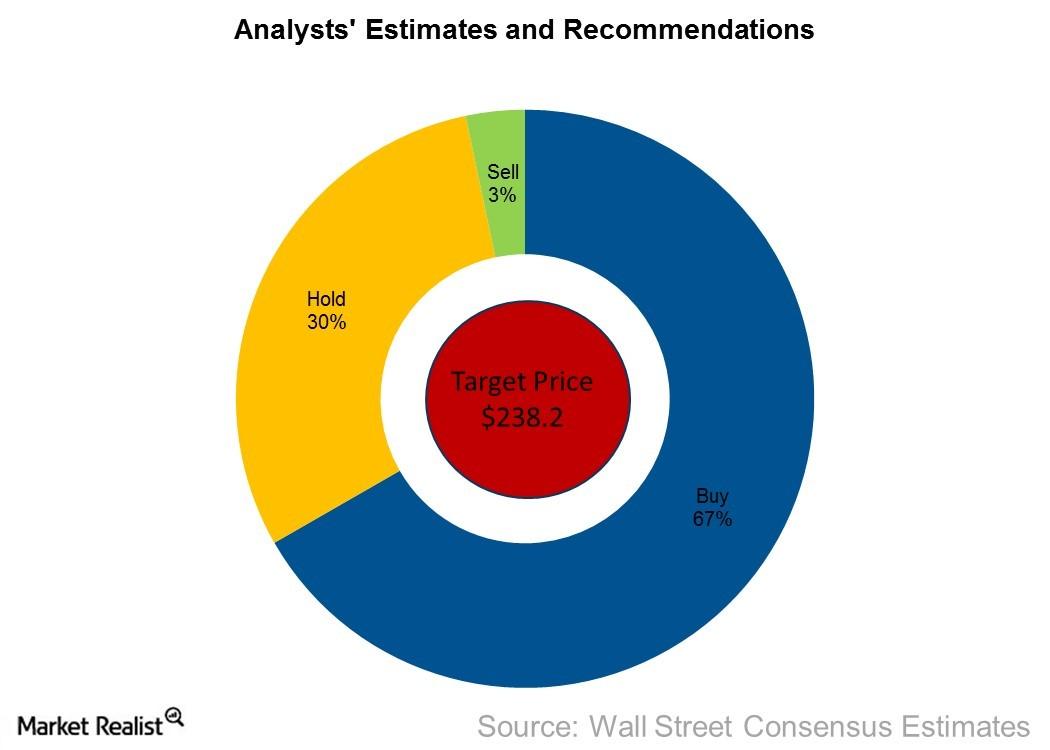

What Are Analysts’ Recommendations for Panera Bread?

Despite the recent fall in Panera’s share prices, analysts are still maintaining their price target of $238.2 for the next year—a return potential of 18.5%.

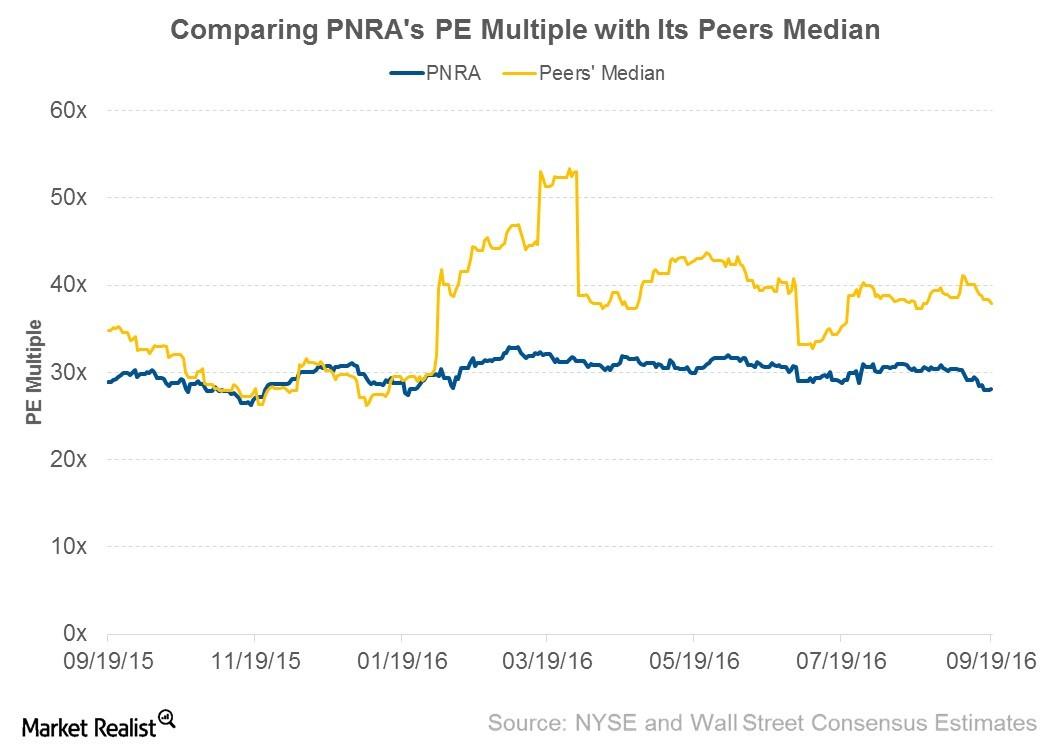

Analyzing Panera Bread’s Valuation Multiples

Lower revenue and EPS estimates made investors skeptical about investing in Panera. As of September 19, it was trading at 28.1x—down from 30.9x on July 28.

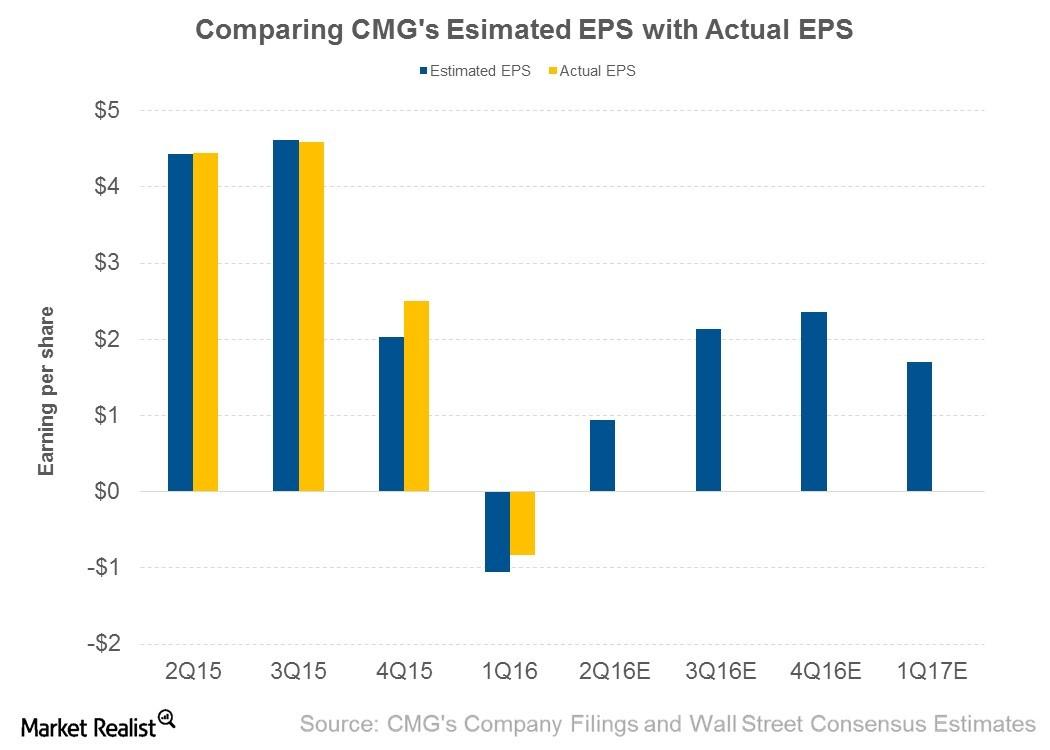

What Analysts Are Expecting from Chipotle’s 2Q16 Earnings

In last four quarters, Chipotle has beaten analysts’ estimates three times. Usually, when the company beats analysts’ estimates, the share price rises.

What Do Analysts Expect from Chipotle’s Revenue in 2Q16?

Revenue sources By the end of 1Q16, Chipotle Mexican Grill (CMG) owned and operated all of its 2,066 restaurants. In 2Q16, analysts are expecting the company to register revenue of $1.05 billion, a decline of 12.1% from $1.2 billion in 1Q15. Factors affecting Chipotle’s revenue Although Chipotle’s management had undertaken several measures to counter the […]

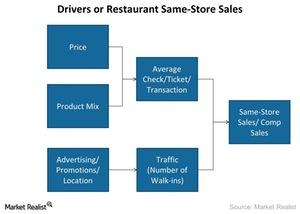

What Really Drove Shake Shack’s Revenue in 1Q16?

In 1Q16, Shake Shack saw a 43.3% rise in revenue over $37.8 million in 1Q15, driven by unit growth and same-store sales growth.

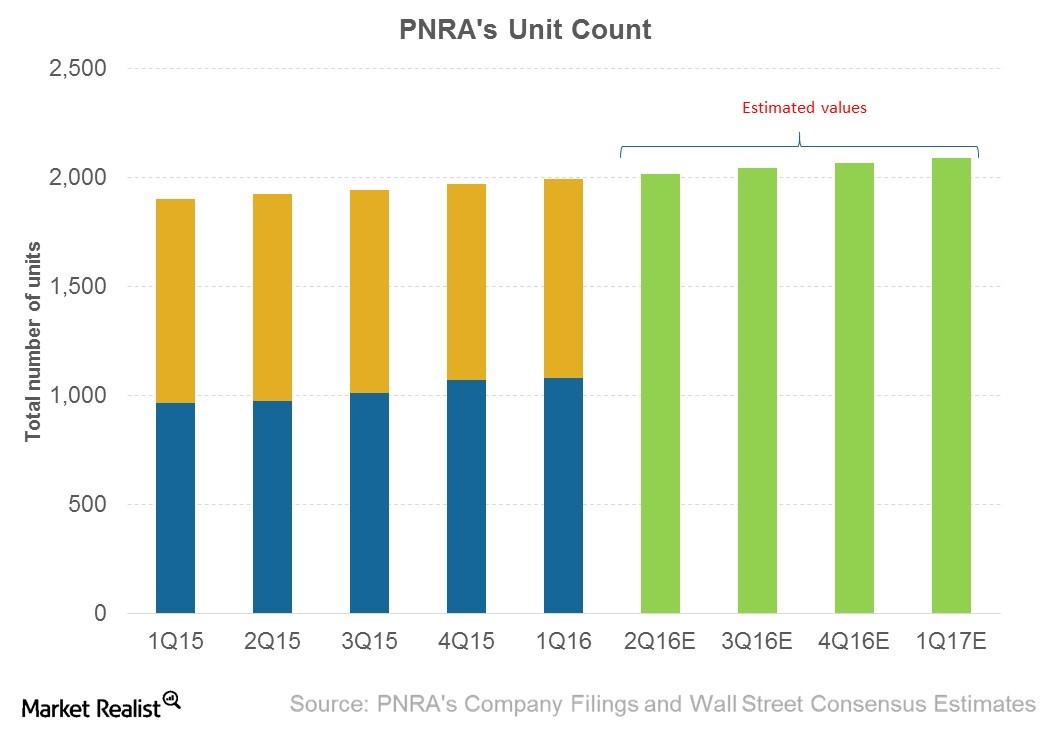

How Is Panera Bread Expanding Its Business?

From the beginning of 2Q15 to the end of 1Q16, Panera Bread (PNRA) increased its unit count by 96, of which 25 units were added in 1Q16.

How Limited-Time Offers Can Help Shake Shack’s Top Line

Shake Shack stated that its limited-time offers, the ShackMeister Burger and Roadside Shack, have been “big drivers” for its ticket and traffic growth.

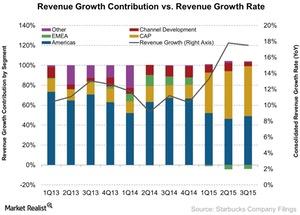

Starbucks’ Key Segments for Its 4Q15 Earnings

Starbucks (SBUX) operates restaurants in 65 countries around the world. However, 83% of its revenue comes from the Americas and the CAP segments.

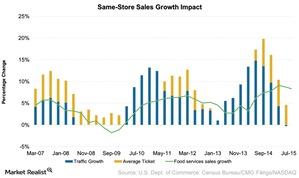

Will Chipotle Report Low Same-Store Sales Growth in 3Q15?

Chipotle (CMG) experienced tremendous same-store sales growth in 2014, with most of its quarters reporting a double-digit growth.

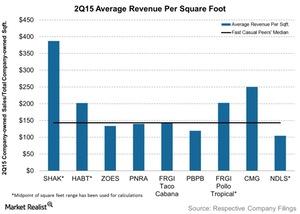

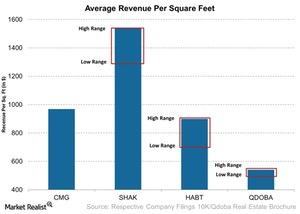

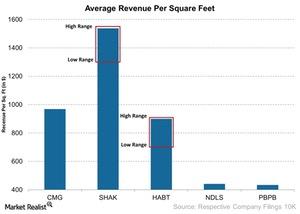

Comp: Average Revenue per Square Foot of Fast Casual Restaurants

Average revenue per square foot gives us insight into how efficiently a company is able to generate sales. Naturally, the higher the number, the better.

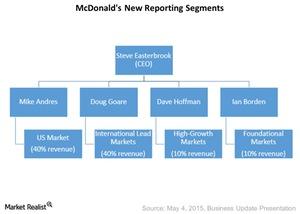

Is McDonald’s Turnaround Plan Working?

McDonald’s (MCD) turnaround plan, which went into effect on July 1, 2015, will take several months to yield results as far as the company’s performance goes.

Chipotle’s Revenue Per Square Foot: Two Times More than Qdoba’s

Chipotle’s average restaurant size is about 2,550 square feet. With an average restaurant volume of $2.4 million, the revenue per square foot comes to $969.

How Shake Shack’s Revenue Per Square Foot Compares with Peers

The recent rally in Shake Shack’s share prices—without any new catalyst—may indicate that investors are optimistic about the company’s prospects.

Where Does Shake Shack Get Its Revenue Sources?

Domestic means all of the restaurants in Shake Shack’s domestic market—the US. Revenue from this segment was $78.5 million in 2013.

Why Should You Care About Shake Shack’s AUV?

Shake Shack (SHAK) calculates its AUV (average unit volume) by dividing the total company-operated sales by the total company-operated units.

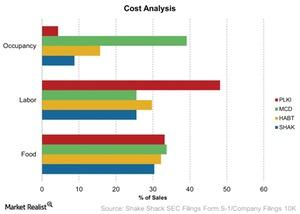

Understanding Shake Shack’s Three Key Costs

We’ve looked at Shake Shack’s (SHAK) revenues and drivers. It’s also important to understand how the company has been managing its key costs.

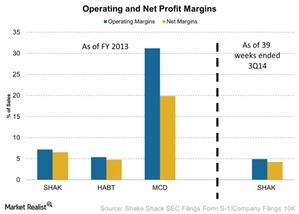

Analyzing Shake Shack’s Profitability

We’ll look at Shake Shack’s profitability in terms of its operating and net profit margins. In 2013, it had an operating profit of $5.9 million.