SBA Communications Corp

Latest SBA Communications Corp News and Updates

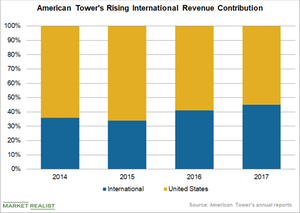

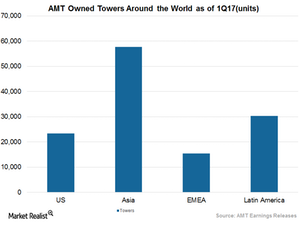

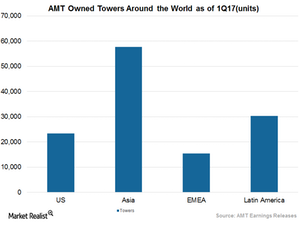

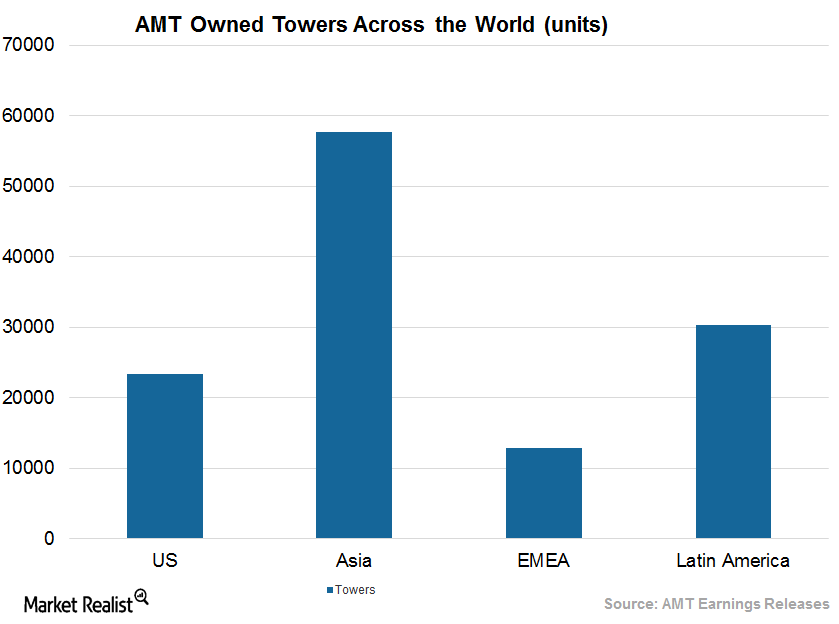

What American Tower’s Global Expansion Strategy Indicates

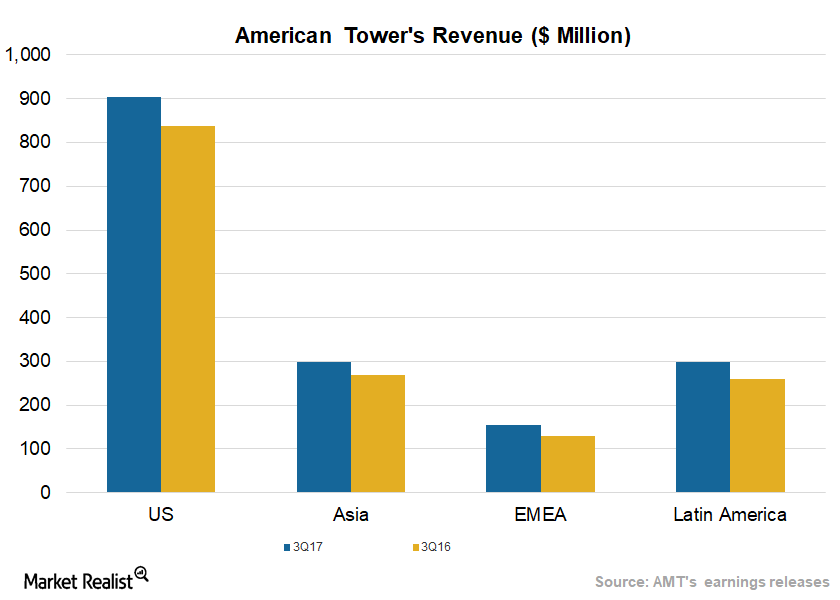

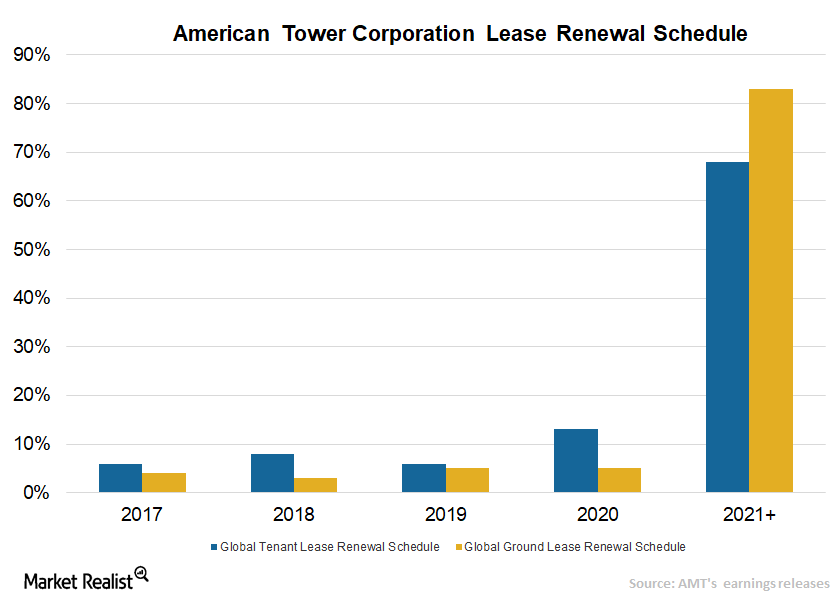

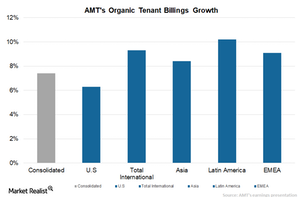

American Tower’s (AMT) global expansion strategy, which includes acquisitions and joint ventures in several countries (mainly in developing nations), is likely to continue supporting its top line.

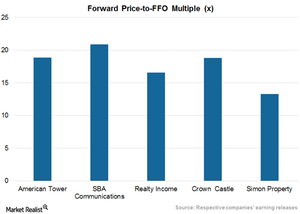

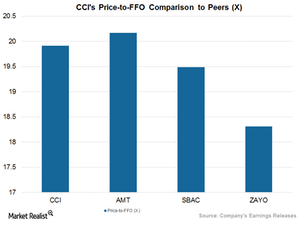

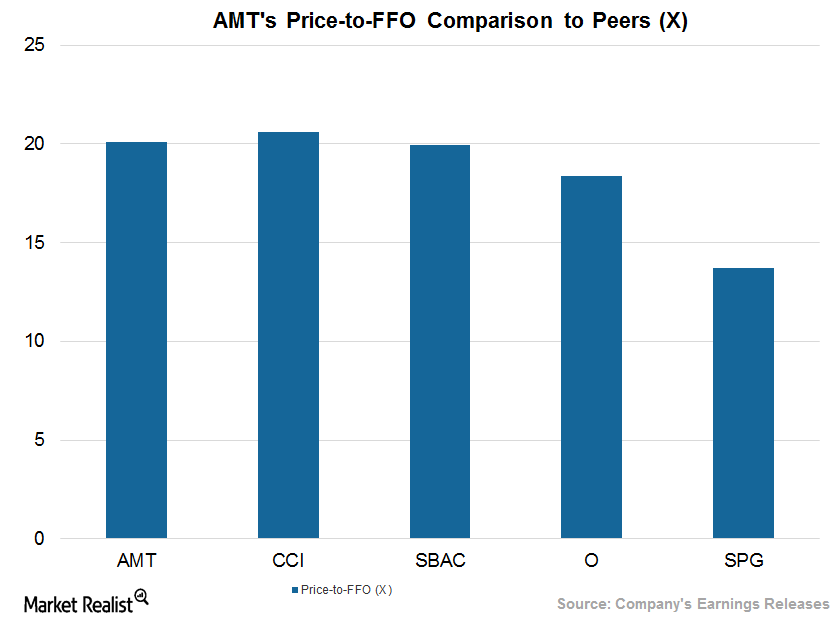

American Tower Is Trading at High Multiples amid Global Expansion

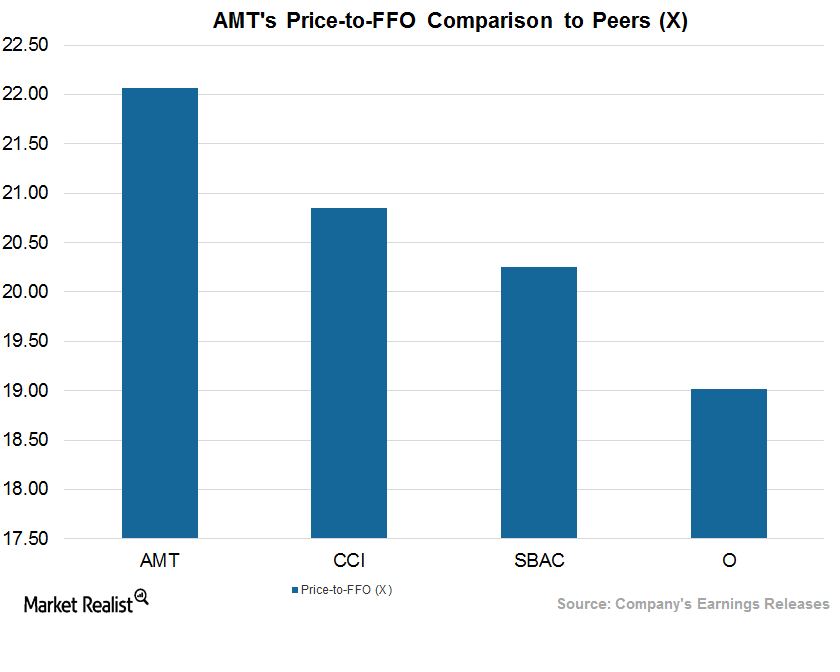

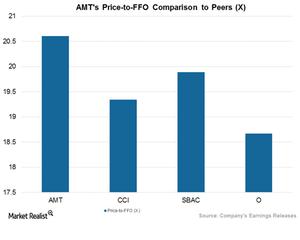

American Tower (AMT) is currently trading at a trailing-12-month price-to-FFO ratio of 20.2x.

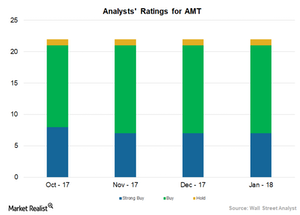

Analysts’ Views of American Tower

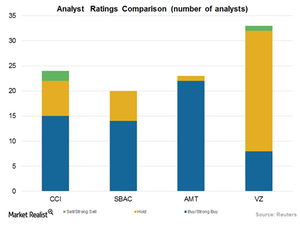

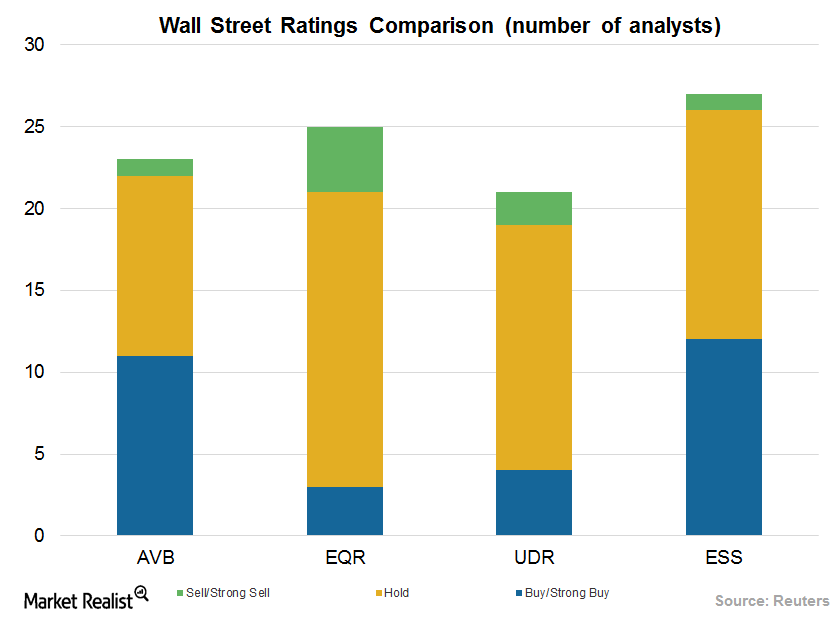

As of January 2018, 21 of the 22 analysts covering American Tower stock have given it a “buy” or “strong buy” rating. The remaining analyst gave it a “hold” rating.

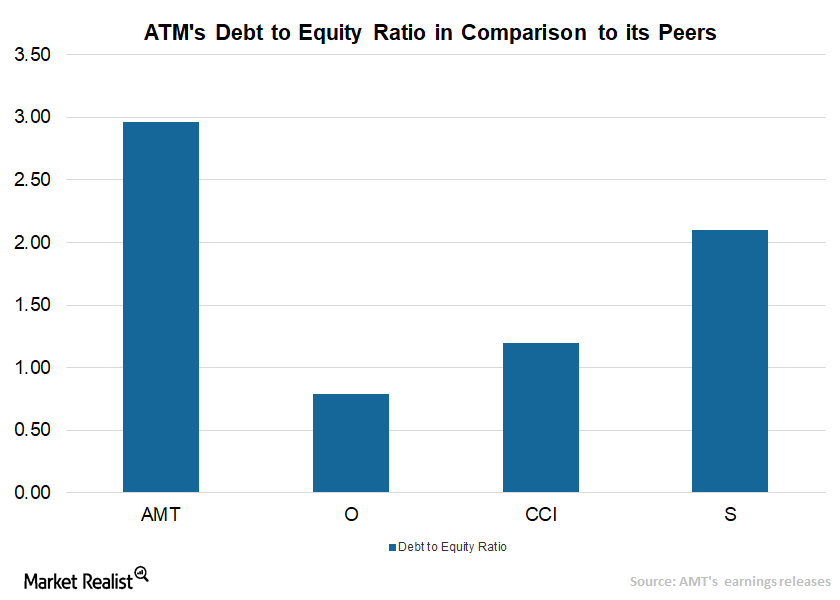

A Look at American Tower’s Well-Built Balance Sheet

During 3Q17, American Tower (AMT) strengthened its revenues on higher organic growth in domestic and international markets such as India and Mexico.

American Tower’s Strong Hold in the International Market

Mexico is one of American Tower’s (AMT) vital international markets. AMT has entered into an agreement to acquire certain telecommunication assets in Mexico.

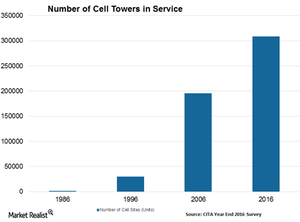

These Factors Are Helping American Tower’s Growth

Data usage is increasing in international markets due to smartphone penetration.

American Tower Riding High with Strong Organic Growth

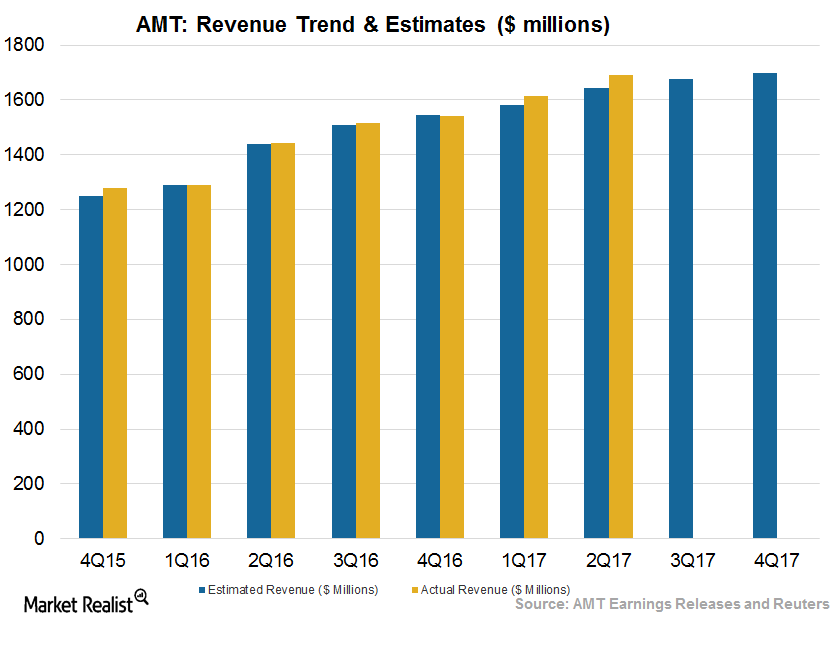

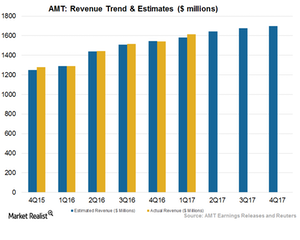

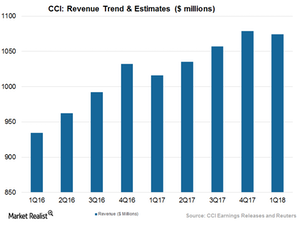

American Tower (AMT) has increased its 2017 revenue outlook to $6.55 billion from $6.53 billion, an addition of $15 million and a 0.2% increase.

American Tower’s Place among Peers after 2Q17

AMT’s current price-to-FFO multiple stands at ~22.1x. After 2Q17, American Tower offers a next-12-month dividend yield of 1.9%.

The Story behind American Tower’s Strong Balance Sheet

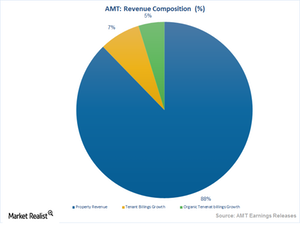

In 2Q17, American Tower (AMT) topped its 2Q16 results on higher organic tenant billing and prudent cost controls.

Can American Tower Maintain Consistent EBITDA Growth after 2Q17?

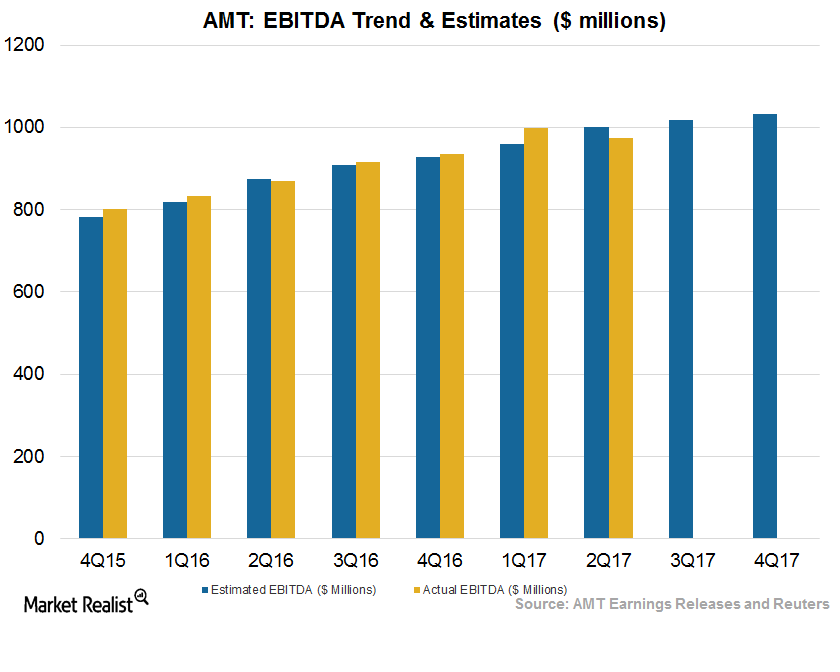

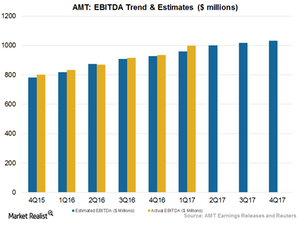

American Tower’s (AMT) 2Q17 EBITDA grew 17.5% to $1.02 billion. These results surpassed the analysts’ expectations of $1 billion.

American Tower’s 2Q17 Growth Rode on This

American Tower’s (AMT) total deployment consisted of $79 million for acquisitions and over $400 million for stock repurchases.

Behind American Tower’s Robust 2Q17 Revenue Growth

For 2Q17, American Tower (AMT) has reported robust double-digit revenue growth of 15.3%, backed primarily by higher tenant billing growth.

What Lies Ahead for American Tower

For fiscal 2017, American Tower expects to report property revenues that would be 14% higher on a year-over-year basis, or by $25 million.

Inside American Tower’s 2Q17 Results: What You Need to Know

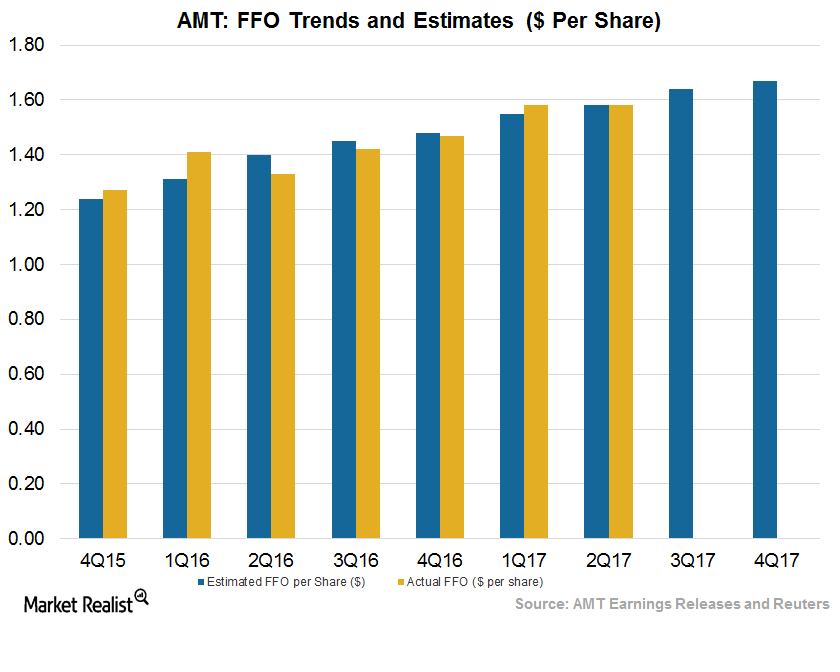

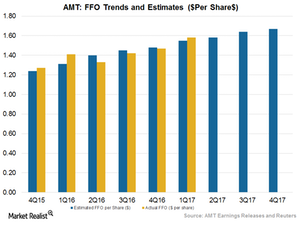

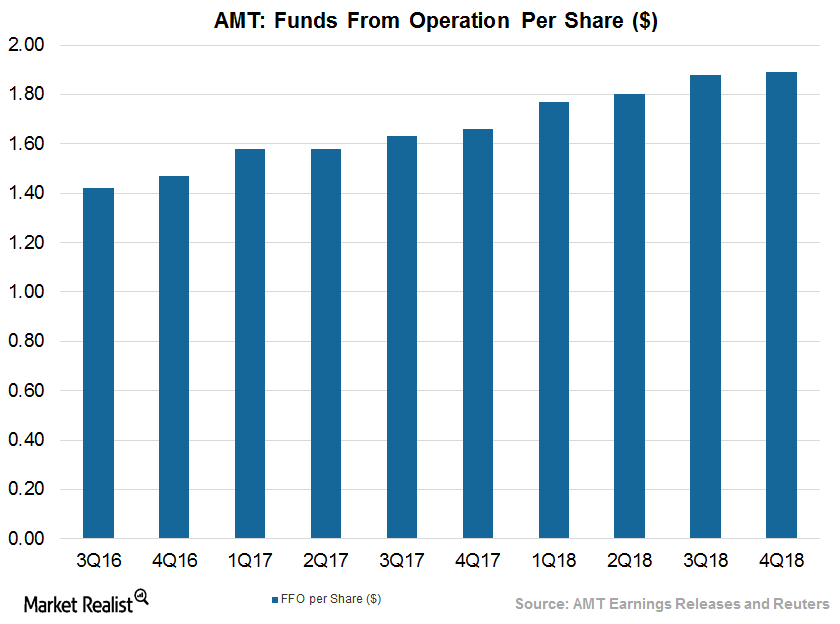

For 2Q17, American Tower (AMT) reported adjusted funds from operation of $1.58 per share, meeting Wall Street estimates and topping 2Q16 by 18.8%.

American Tower: A Peer Comparison

AMT’s current price-to-FFO ratio stands at 20.06x. The company has undertaken several acquisitions and strategic partnerships to boost its presence in high-demand geographies.

Will AMT’s Business Model Drive Higher Earnings in 2Q17?

According to Wall Street analysts, American Tower (AMT) is expected to report EBITDA (earnings before income tax, depreciation, and amortization) of $1 billion in 2Q17.

What Are the Main Contributors to AMT’s 2Q17 Revenue Growth?

Wireless tower owner American Tower (AMT) is expected to post flat year-over-year (or YoY) top and bottom line results when it releases its 2Q17 earnings on July 27, 2017.

Will American Tower Ride High on Its Top Line in 2Q17?

Analysts expect wireless tower operator American Tower (AMT) to report revenue of $1.6 billion in its 2Q17 earnings call on July 27, 2017.

What to Expect from Wireless REIT American Tower in 2Q17

American Tower is scheduled to report its 2Q17 earnings on July 27, 2017. Analysts expect it to report adjusted funds from operations per diluted share of $1.58.

Crown Castle on the Street: Inside the Analyst Ratings

Analysts have given CCI a mean price target of $106.83, implying a rise of 7.1% from its current level of $99.75.

Where Crown Castle Stands among the Biggest Industry Players

CCI’s higher price-to-FFO multiple reflects the company’s ability to yield consistent capital value and its distribution of reliable and steady dividends.

Crown Castle amid the 5G Threat to Cell Towers

Many wireless providers are now opting for 5G (fifth-generation) technology for higher speeds and network reliability.

Why Crown Castle Expects to See Revenue Growth

Crown Castle is expected to keep riding high on its current growth trajectory, driven by strategic investments and exposure to the booming small cell business.

How Wall Street Analysts Rate American Tower

Analysts gave AMT a mean price target of $143.14, implying a rise of 8.7% from its current level of $131.70. In May 2017, 22 of 23 analysts covering AMT stock issued “buy” or “strong buy” ratings.

Comparing American Tower with Retail REITs in Its Industry

AMT’s current price-to-FFO multiple is ~20.1x.

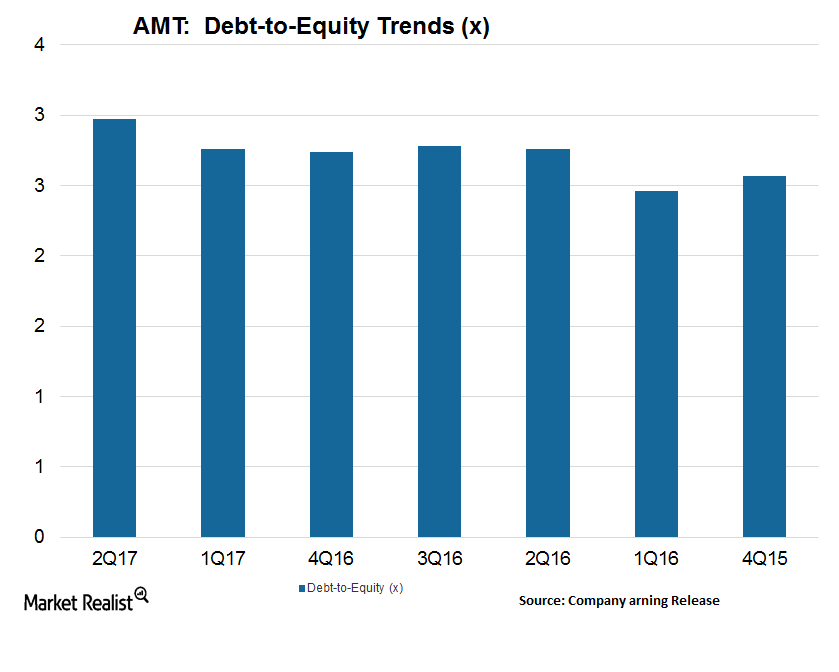

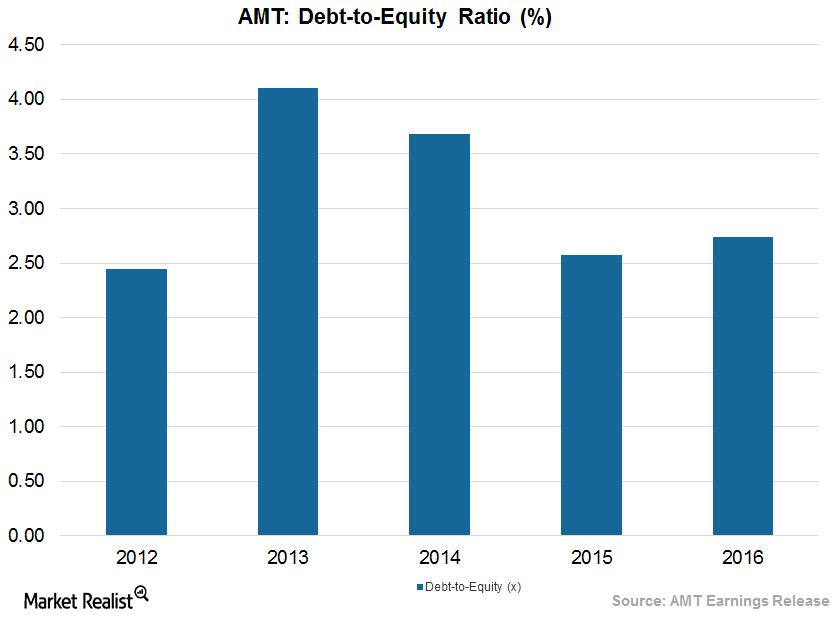

How Well Does American Tower Manage Its Balance Sheet?

AMT reported a debt-to-equity ratio of ~2.8x in 1Q17. The industry median debt-to-equity ratio is ~1.1x.

How Telecom Industry Ownership Could Affect American Tower

Under the leadership of Ajit Pai and Jeffrey Eisenach, the FCC is expected to unblock several stalled deals as well as pave the way for some new deals.

American Tower Rises above Uncertainty in Wireless Tower Sector

For fiscal 2017, American Tower (AMT) expects to report adjusted funds from operations exceeding $2.8 billion. This figure is $55 million, or ~2%, higher than expected by the company.