Guggenheim S&P 500® Equal Weight ETF

Latest Guggenheim S&P 500® Equal Weight ETF News and Updates

Kansas City Southern: Did Coal Push Volumes in Week 32?

Kansas City Southern (KSU), a US-Mexico railroad, is the smallest Class I railroad in the US.

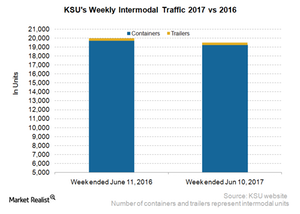

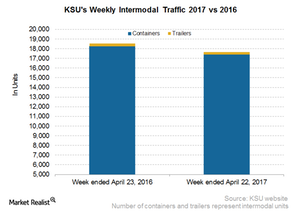

Kansas City Southern: Its Intermodal Volumes in Week 23

KSU’s trailer volumes fell 9.5% in week 23, whereas container traffic contracted by 2.4% in the same week.

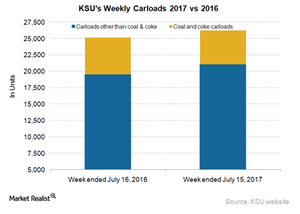

Why Kansas City Southern’s Freight Traffic Just Rose

Kansas City Southern reported a YoY (year-over-year) 4.4% rise in railcars in the week ended July 15, 2017.

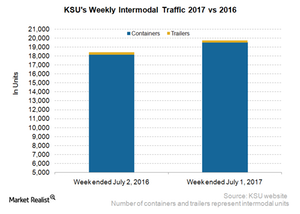

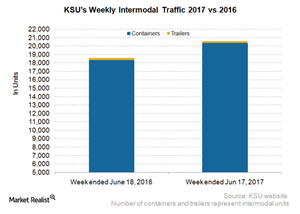

Behind Kansas City Southern’s Intermodal Growth amid Weak Trailers

Kansas City Southern (KSU) reported a 7.2% rise in its overall intermodal volumes of containers and trailers in the week ended July 1, 2017.

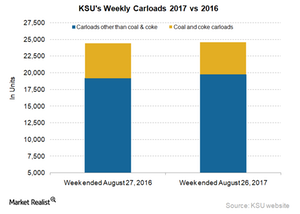

Kansas City Southern: What Led Volume Rise in Week 34?

Kansas City Southern (KSU), the smallest Class I railroad, reported a marginal volume gain in the week ended August 26, 2017.

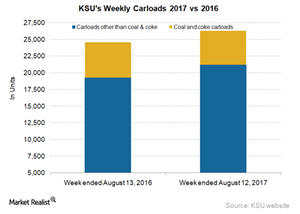

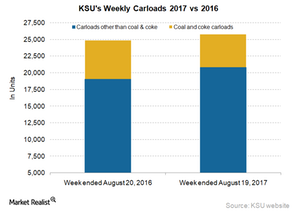

Kansas City Southern: Behind the Freight Volume Rise in Week 33

Kansas City Southern hauled ~26,000 railcars in the same week compared with close to 25,000 units in the week ended August 20, 2016.

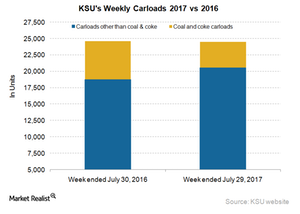

A Deep Dive into Kansas City Southern’s Shipments in Week 30

Kansas City Southern (KSU), the smallest Class I railroad in the US, also operates in Mexico.

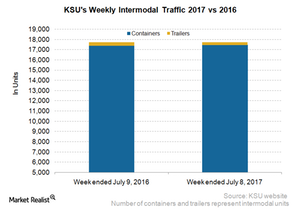

Inside Kansas City Southern’s Trailer Decline Last Week

In the week ended July 8, 2017, Kansas City Southern (KSU) reported a marginal loss in its total intermodal volumes (containers and trailers).

Diving into Kansas City Southern’s Week 25 Intermodal Data

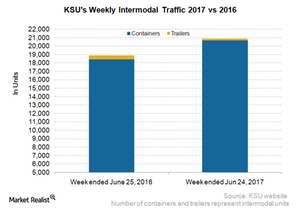

Kansas City Southern’s (KSU) total intermodal traffic in terms of containers and trailers rose 10.6% in the week ended June 24, 2017.

Kansas City Southern’s Containers Rose, Trailers Fell in Week 24

In week 24 of 2017, Kansas City Southern (KSU) saw its overall intermodal volumes rise 10.6%, unlike in the previous two weeks.

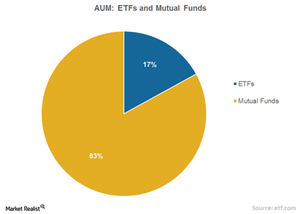

Why ETFs Are Seeing Increased Popularity

Mutual fund ownership of equities is at the lowest level in ~13 years, while ETFs (SPY) (IVV) are gradually increasing their share in the stock market.

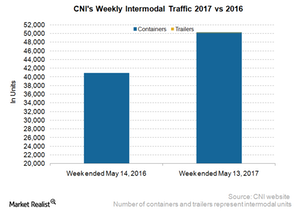

CNI’s Intermodal Growth Continued in Week 19

Canadian National Railway moved more than 50,100 containers in the 19th week of 2017, compared to the nearly 40,900 containers it moved in the corresponding week of 2016.

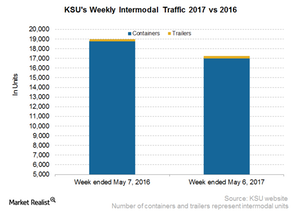

Kansas City Southern: Unfolding Its Intermodal Traffic in Week 18

In the week ended May 6, 2017, Kansas City Southern reported a year-over-year fall of 9.1% in its overall intermodal traffic.

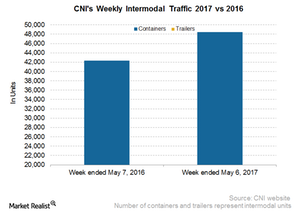

Canadian National Railway: Intermodal Growth Continues in Week 18

Canadian National Railway moved more than 48,400 containers in the 18th week of 2017, compared with nearly 42,300 containers in the corresponding week of 2016.

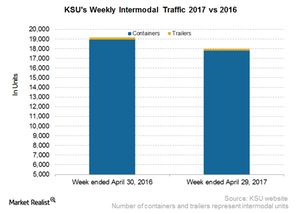

Kansas City Southern: A Look at Its Intermodal Traffic

Kansas City Southern’s intermodal traffic In the past few weeks, Kansas City Southern (Kansas City Southern), the smallest Class I railroad company in the United States, has seen its intermodal traffic slow. In the week ended April 29, 2017, Kansas City Southern reported a YoY (year-over-year) fall of 6.1% in its overall intermodal traffic. Kansas City […]

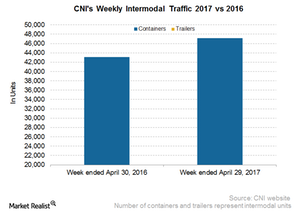

Analyzing Canadian National Railway’s Intermodal Volumes

Canadian National Railway’s intermodal volumes In the 17th week of 2017, Canadian National Railway’s (CNI) overall intermodal volumes rose 9.4%. There was no trailer movement in the week. The company moved more than 47,000 containers in the 17th week of 2017, compared with more than 43,000 containers in the corresponding week of 2016. The rise […]

Trailers Hurt Kansas City Southern’s Intermodal Volume in Week 16

In the past few weeks, Kansas City Southern (KSU), the smallest Class I railroad company in the United States, has seen its intermodal traffic slow.

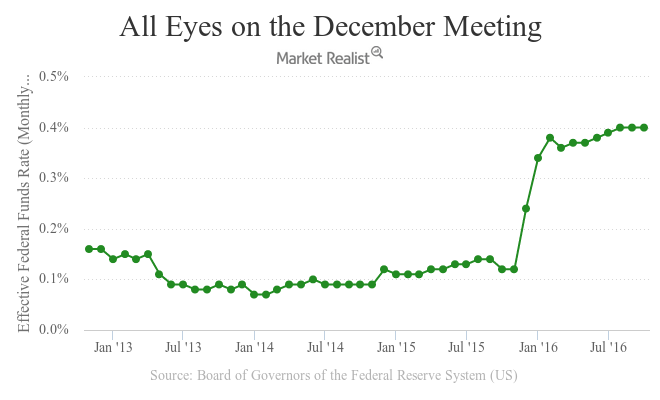

A Pass on a November Hike: It’s Up to December Now

The expected occurred on November 2, 2016, when the FOMC (Federal Open Market Committee) left the federal funds rate unchanged at 0.25%–0.5%.

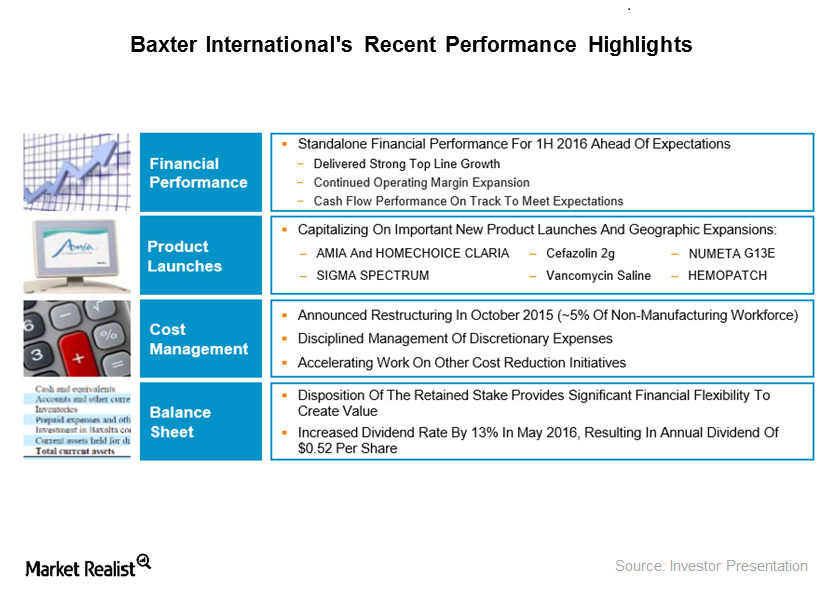

Baxter International’s Recent Product Launches and Partnerships

Baxter International’s R&D investments were around $150 million in 2Q16, which represents a YoY (year-over-year) increase of around 1%.

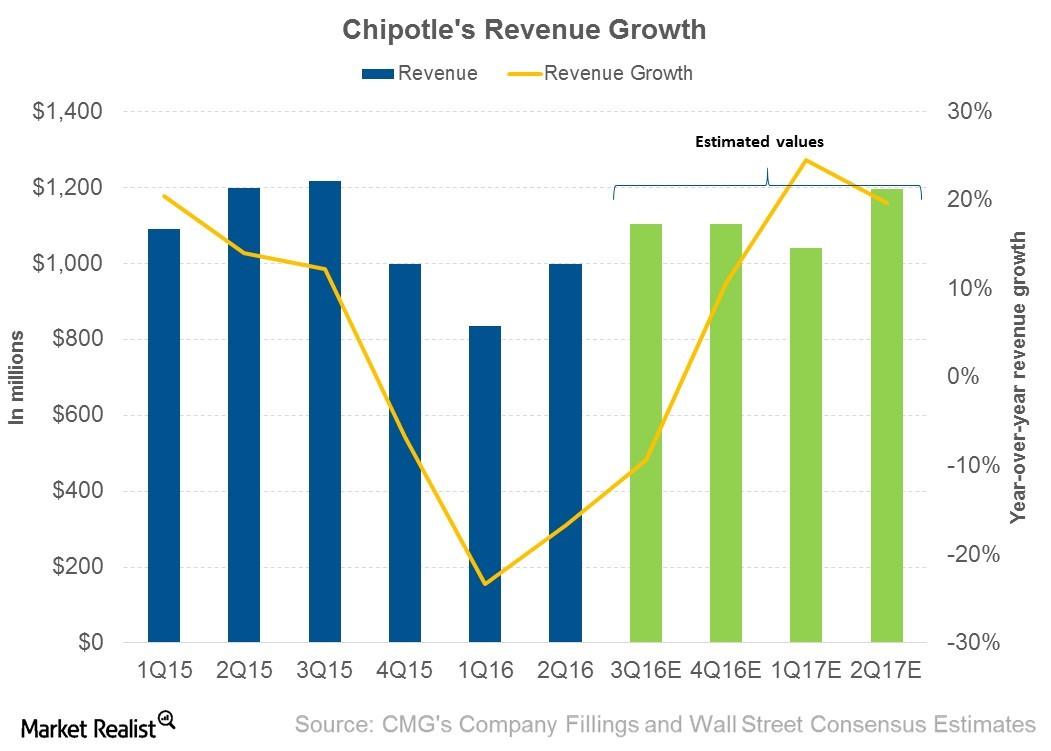

Will Europe Be Key to Chipotle Stemming Its Falling Revenue?

Since the E. coli outbreak in October 2015, Chipotle Mexican Grill’s (CMG) same-store sales growth has been falling. This led to negative revenue growth.

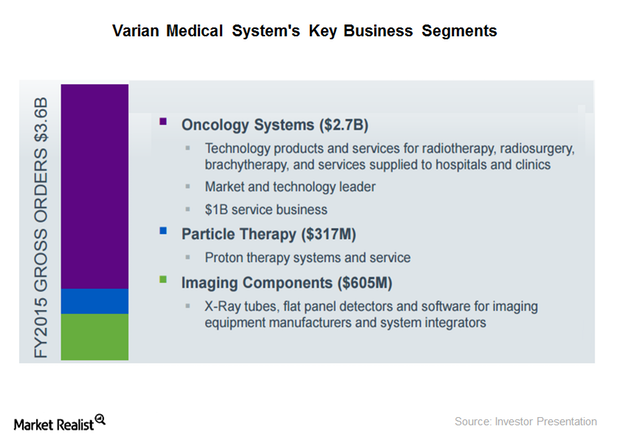

Where Does Varian Medical Systems Get Most of Its Revenue?

Varian Medical Systems’ Imaging Components segment accounts for approximately 19% of the company’s total revenue. The segment reported a revenue decline of ~10% in 2015.

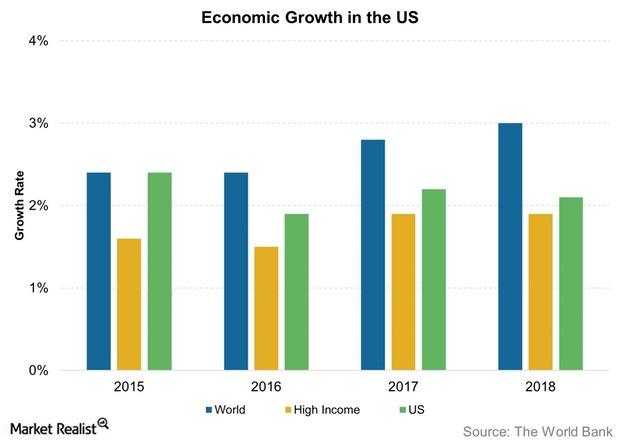

What the World Bank Thinks Now about US Economic Growth

The World Bank expects the pace of US economic growth to be 1.9% this year—a sharp correction from the 2.7% pace the bank projected in January 2016.

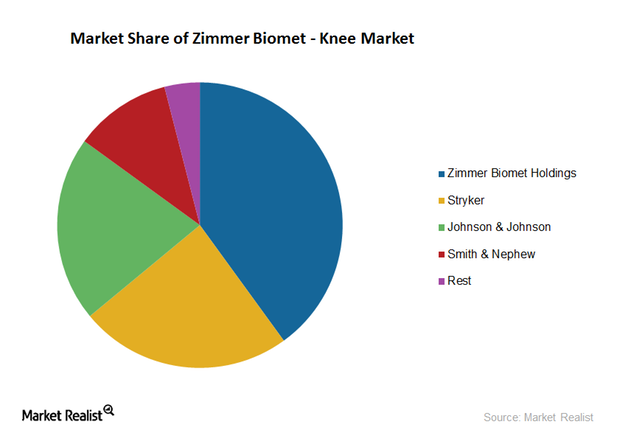

Zimmer Biomet Faces Market Share Erosion in the Knee Implant Market

Zimmer Biomet (ZBH) is the leading provider of knee implants in the United States. It has approximately 40% market share, followed by Stryker, Johnson & Johnson, and Smith & Nephew.

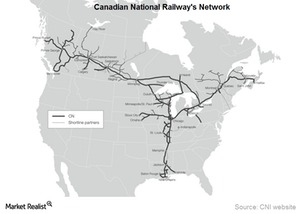

Canadian National Railway: Class I Railroad with a Robust Network

A Class I railroad in the US, or a Class I railway in Canada, is one of the largest freight railroads based on operating revenue. US Class I Railroads are line haul freight railroads with 2014 operating revenues of ~$475.75 million.

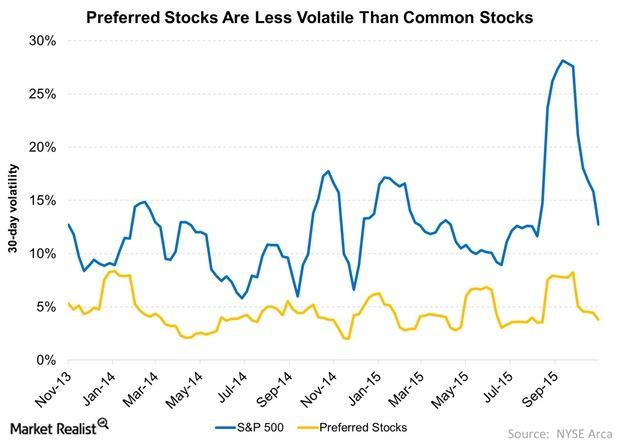

Why Preferred Stocks Are Less Volatile than Common Equities

Preferred stocks are less volatile compared to common equities. This is mainly because a larger portion of the returns comes from dividends, which tend to be stable.

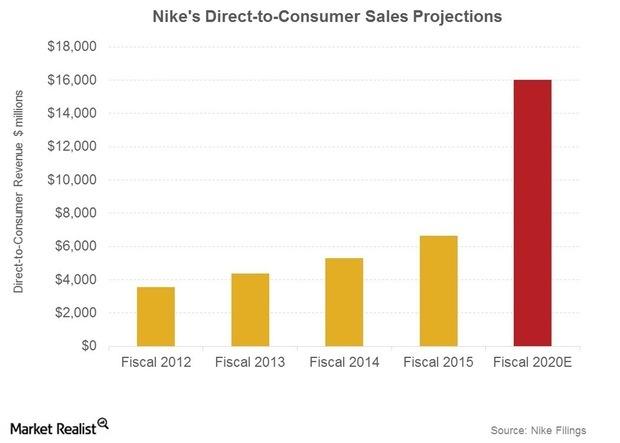

Why Nike Is Projecting Explosive Growth in Retail and Web Sales

Nike’s rival Adidas (ADDYY) is targeting over 2 billion euros from web sales by 2020, as detailed in its latest five-year plan unveiled in March 2015.