iShares MSCI Global Gold Miners

Latest iShares MSCI Global Gold Miners News and Updates

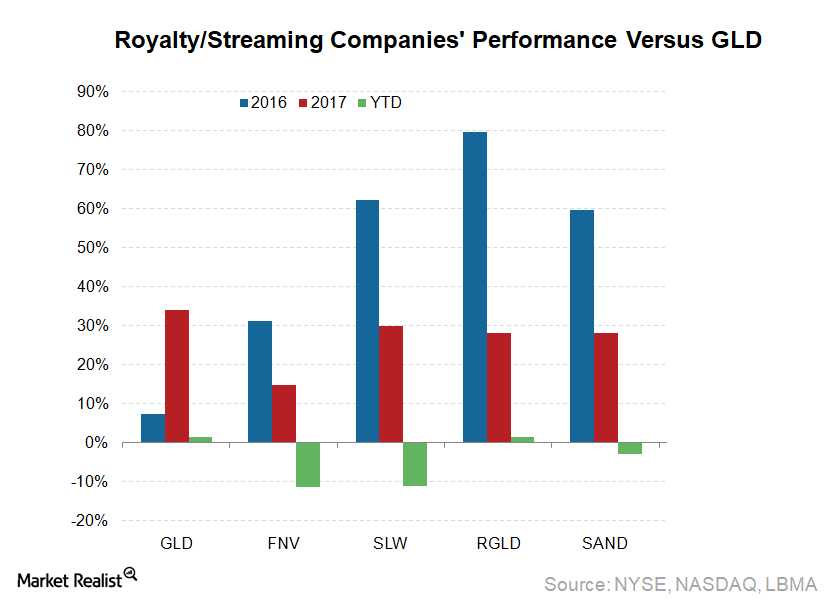

Could Royalty and Streaming Companies Stay Strong in 2018?

Royalty and streaming companies Royalty and streaming companies’ business model differs greatly from that of other precious metal miners (RING), mainly because royalty and streaming companies do not own mines. These companies make upfront payments to gain a right to a fixed percentage of future silver or gold mine production. Additional payments are then made […]

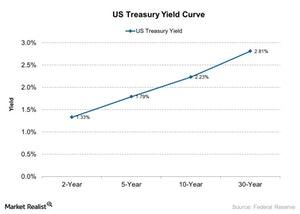

Gundlach on Higher Yield: Watching the Copper-to-Gold Ratio

Billionaire investor and bond guru Jeffrey Gundlach also shared his view on bond yields in an interview with CNBC.

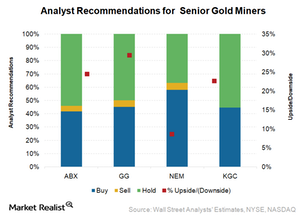

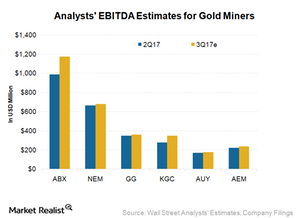

Which Senior Gold Miners Are Analysts Betting On?

As a group, the average gains of North American senior gold miners (GDX) (RING) have been muted.

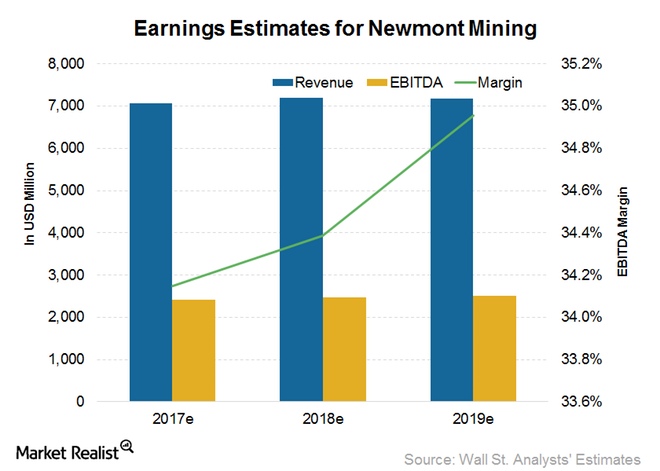

Analysts’ Estimates: Could NEM’s Near-Term Profitability Decline?

Although 2017 has not been very good for Newmont Mining stock due to short-term issues, its outlook remains strong.

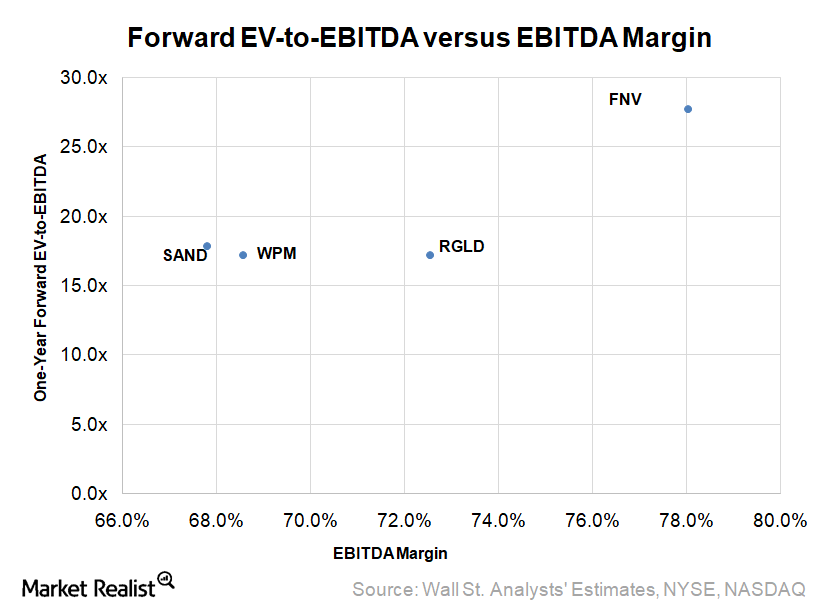

Why Valuation Multiples for Royalty and Streaming Companies Have Risen in 2017

Royalty and streaming mining companies (RING) (SIL) have business models that are considered quite conservative because they don’t own mines.

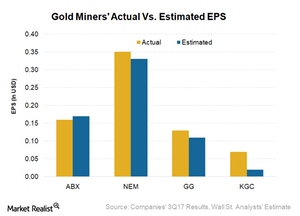

Senior Gold Miners’ Earnings Beats and Misses in 3Q17

All the gold miners (RING)(GDX) we’re covering in this series except for Barrick Gold (ABX) reported earnings beats in 3Q17.

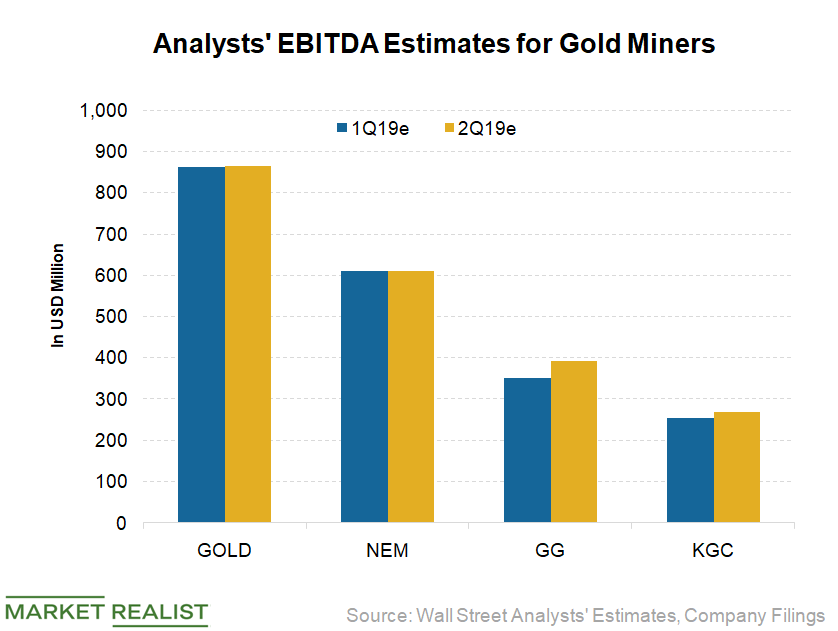

Which Gold Stocks Could Beat Analysts’ Earnings Expectations in Q1?

Many gold miners (RING) are set to release their first-quarter results shortly. Analysts expect Barrick Gold’s (GOLD) EBITDA to rise 6.2% YoY (year-over-year) in the first quarter.

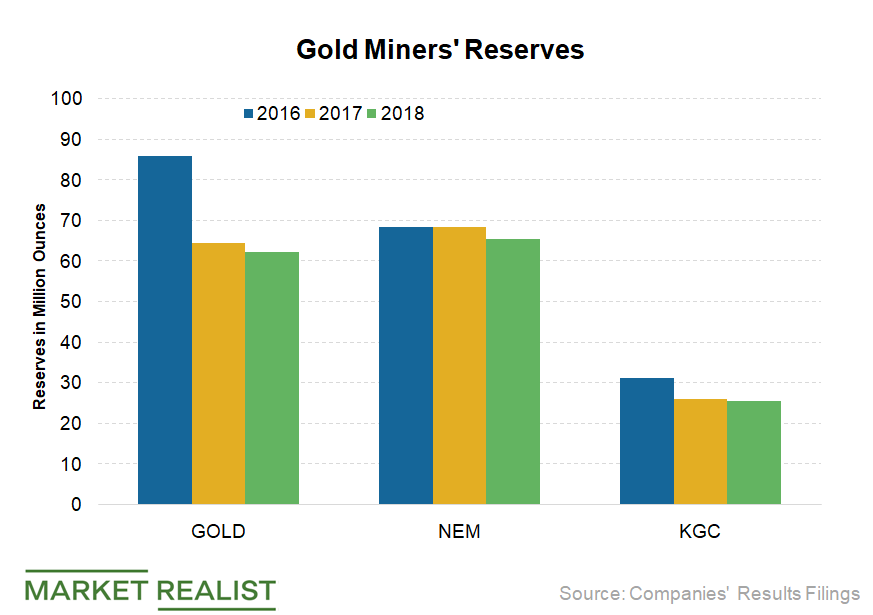

Why Did Barrick Gold’s Reserves Fall in 2018?

At the end of 2018, Barrick Gold (GOLD) reported mineral reserves of 64.5 million ounces—a decline of 3.4% YoY.

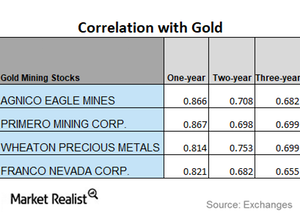

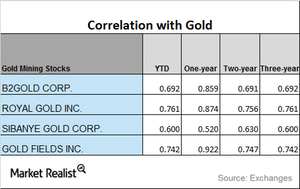

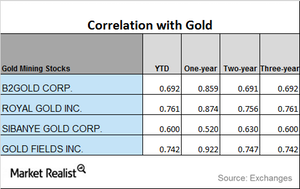

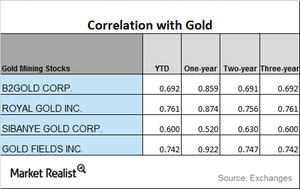

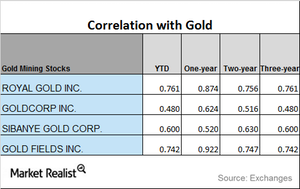

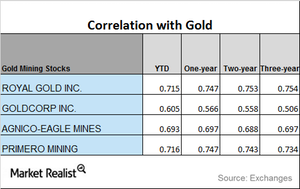

Comparing Mining Stocks’ Correlation with Gold

Mining stocks tend to move with gold prices. In this part, we’ll analyze the correlation between gold and four mining stocks.

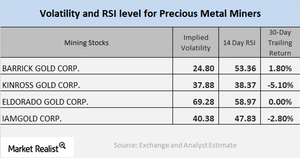

Reading the Technicals and Price Movements of Mining Stocks

In this article, we’ll do a technical analysis of a few select mining stocks. When investing in mining stocks, it’s crucial to read their indicators.

How Are Miners’ Correlations to Gold Trending?

Mining stocks tend to take their cues from gold.

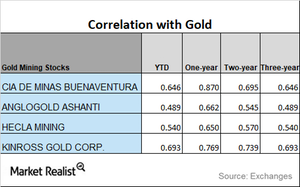

A Look at Miners’ Correlation Trends

AngloGold Ashanti has seen the highest correlation to gold in the past year, while Eldorado Gold has seen the lowest correlation.

Analyzing the Correlation between Miners and Gold in January

Most mining stocks have risen over the past one month due to the revival in gold prices.

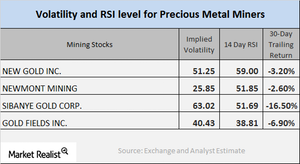

How Do Miners’ Technical Details Look?

Most of the mining companies have risen during the past few weeks. The miners tend to move according to precious metal prices rather than the equities market in general.

A Look at the Gold Spreads at the End of 2017

A gold-silver spread of 77.3 suggests that it requires almost 78 ounces of silver to buy a single ounce of gold.

These Factors Are Driving Analysts’ Estimates for Newmont Mining

Newmont Mining’s mean consensus revenue for 2017 is $7.3 billion. This implies year-over-year (or YoY) growth of 8.1%.

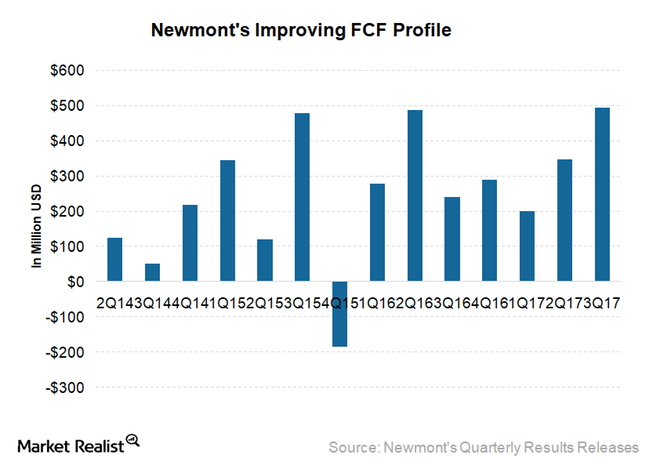

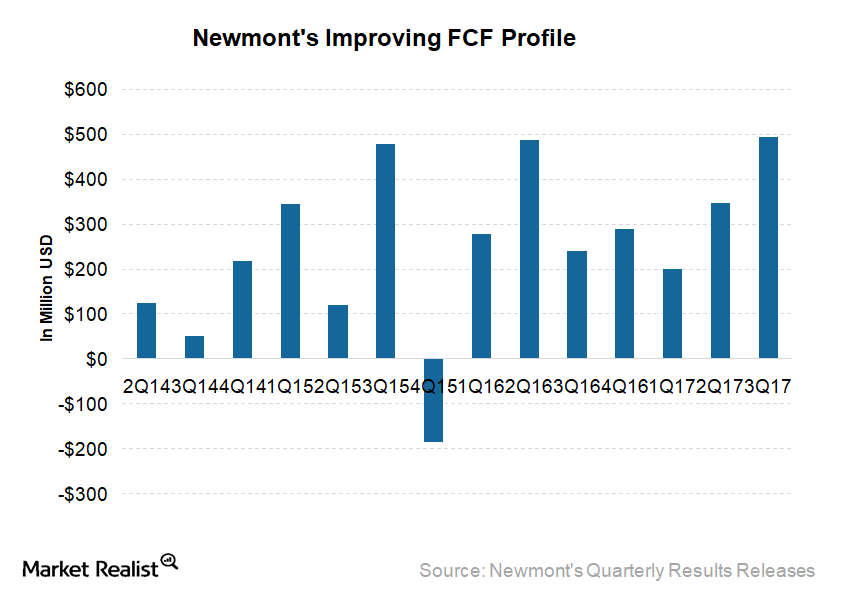

How Newmont Mining Plans to Generate Free Cash Flow in 2018

As NEM’s all-in sustaining costs (or AISC) have fallen 22.0% since 2012, its FCF has improved by $3.60 per share.

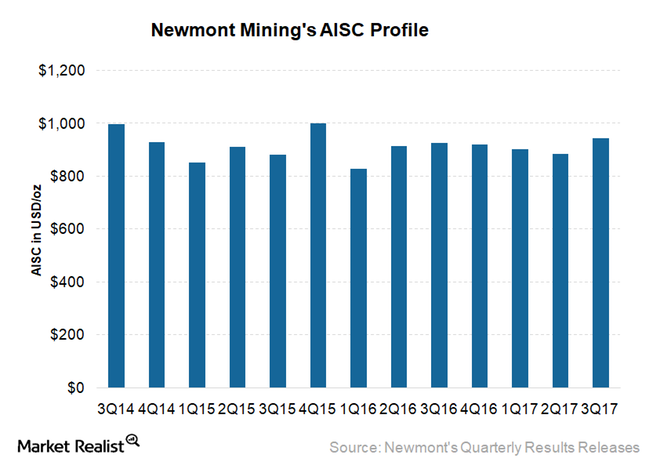

Investors Might See a Bump in Newmont’s Costs in 2018 before Improving

Newmont Mining (NEM) is expecting its newest mines to add production at just $750 per ounce.

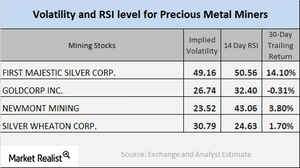

Miners: Analyzing Core Indicators for Investors

A brief analysis of mining stocks is crucial when investors are parking their money in the precious metals market, specifically in mining companies.

Where Are Miners’ Correlations with Gold Headed?

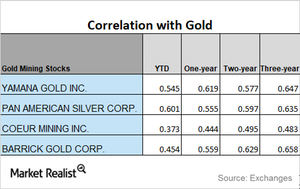

In this article, we’ll aim to study the correlations of Yamana Gold (AUY), Pan American Silver (PAAS), Coeur Mining (CDE), and Barrick Gold (ABX) with gold.

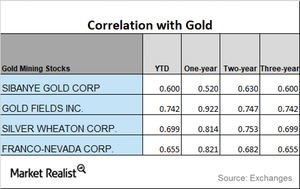

The Correlation Trends of Miners in 2017

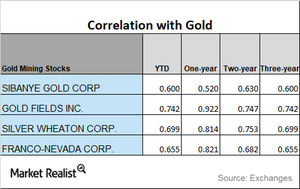

If we look at the YTD correlations of the select mining shares to gold, there has been a reasonable fall. On a YTD basis, Sibanye Gold has the least correlation to gold.

A Correlation Study of Miners in December 2017

If we look at the YTD (year-to-date) correlations of the select mining shares to gold, there has been a reasonable fall.

What Are Miners’ Correlation Trends?

Gold is the most dominant among the four precious metals. It’s important that investors analyze how miners are moving compared to precious metals.

Analyzing Trends in Mining Stocks’ Correlation

Gold remains the most dominant among the four precious metals. It’s crucial that investors analyze how the miners are moving versus precious metals.

The Directional Correlation Move of Mining Stocks in 2017

If we look at the one-year correlation of miners, Barrick Gold has the lowest correlation with gold, while Yamana has the highest.

Mining Stocks: Analyzing Correlation Trends

Mining stocks’ performance usually depends on precious metals’ performance. However, the two can deviate. Correlation analysis can give investors some perspective on how mining stocks relate to gold and silver.

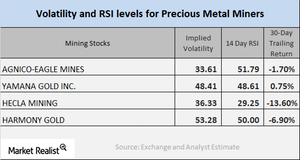

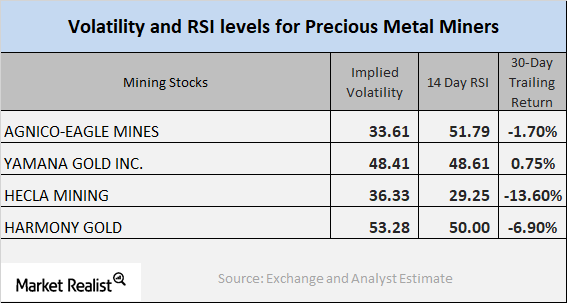

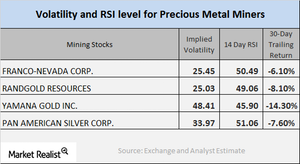

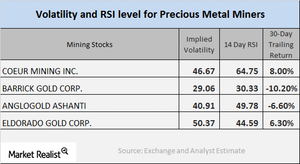

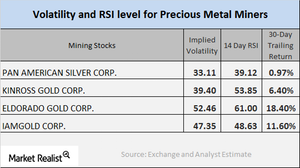

Mining Stocks: Analyzing the Technical Details

In this part, we’ll concentrate on the technical readings of key mining stocks, including their call implied volatilities and RSI (relative strength index) levels.

Your Brief Correlation Study of Major Mining Stocks Last Week

The iShares MSCI Global Gold Min (RING) and the VanEck Vectors Junior Gold Miners (GDXJ) have seen YTD (year-to-date) gains of 6.4% and 9%, respectively.

A Brief Analysis of Mining Stocks in November 2017

On November 7, Agnico-Eagle Mines (AEM), Yamana Gold (AUY), Hecla Mining (HL), and Harmony Gold (HMY) had implied volatility readings of 33.6%, 48.4%, 36.3%, and 53.3%, respectively.

Analyzing the Correlation of Mining Stocks to Gold

Kinross Gold’s correlation has risen from a three-year correlation of 0.69 to a one-year correlation of 0.77, which suggests that Kinross has moved in the same direction as gold 77% of the time.

Behind the Correlations of Key Miners Today

On a YTD (year-to-date) basis, the correlations of the above mining stocks appear to be weak when compared with last year.

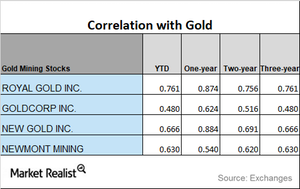

Analyzing Miners’ Trends in October

Mining stocks’ correlation with precious metals Most of the time, mining stocks’ performance follows that of precious metals. However, they can deviate. Correlational analysis can give investors some insight into how mining stocks relate to gold and silver. In this part of our series, we’ll compare Royal Gold (RGLD), Goldcorp (GG), New Gold (NGD), and Newmont Mining (NEM). Mining […]

A Brief Analysis of Mining Stock Correlations with Gold

The iShares MSCI Global Gold Min (RING) and the Sprott Gold Miners (SGDM) rose with metals on Monday, climbing 1.2% and 0.83%, respectively.

These Factors Could Drive Newmont’s Free Cash Flow

Generating FCF (free cash flow) is very important for miners (GDX)(RING) as it helps them optimize their financial leverages, invest in projects supporting long-term value, and provide shareholder returns.

Reading the Correlation Movements of Precious Metal Miners with Gold

The iShares MSCI Global Gold Min (RING) and the VanEck Vectors Junior Gold Miners (GDXJ) fell 2.6% and 1.5%, respectively, on October 26.

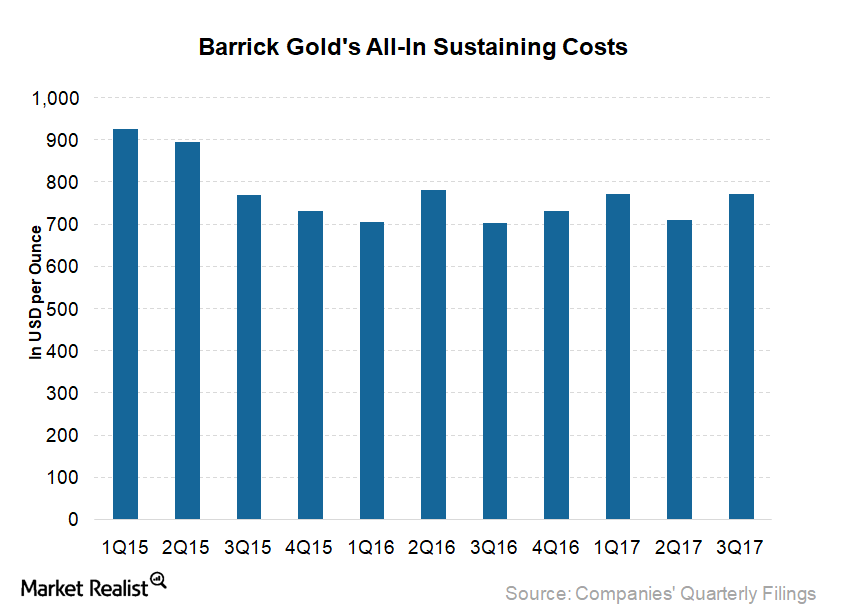

Is Barrick Gold behind in Achieving Its Unit Cost Target?

Barrick Gold (ABX) reported AISC (all-in sustaining costs) of $772 per ounce in 3Q17, which is 10% higher year-over-year and 9% higher sequentially.

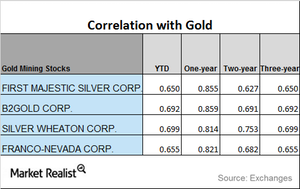

A Look at the Correlation Trends for Miners

Franco-Nevada and Silver Wheaton have seen an upward trend in their correlations with gold.

A Brief Correlation Study of Mining Stocks as of October 23

The iShares MSCI Global Gold Min (RING) and the VanEck Vectors Gold Miners (GDX) have fallen 1.3% and 1.4%, respectively, on a five-day-trailing basis.

What Analysts Are Forecasting for Gold Miners’ 3Q17 Earnings

Analysts expect Barrick Gold’s (ABX) EBITDA to fall 17% YoY in 3Q17 to $988 million.

Inside Mining Stock Technicals on October 12

Most precious metals had a down day on Tuesday, October 10, despite the recent overall upward movement in precious metals.

Relative Strength Index Indicators of Mining Shares in October

On October 11, 2017, Randgold Resources, Pan American Silver, Barrick Gold, and Kinross Gold had implied volatility readings of 25.0%, 34.0%, 29.1%, and 41.6%, respectively.

Mining Stocks so Far in 2017: A Correlation Study

Among these four mining stocks, Goldcorp has the lowest correlation with gold on a YTD basis, while Royal Gold (RGLD) has the highest correlation.

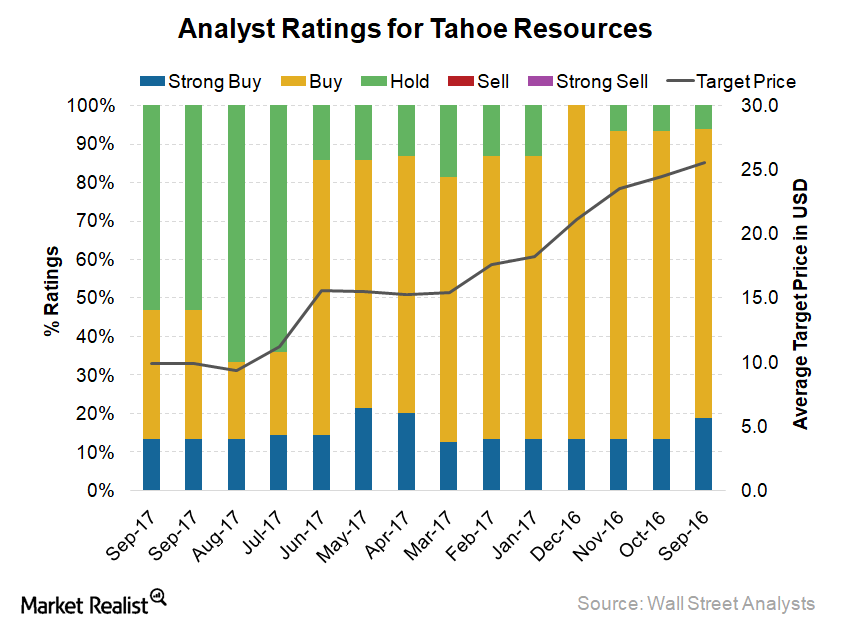

How Do Analysts View Tahoe Resources despite Its Underperformance?

Tahoe Resources (TAHO) stock has lost 44.1% of its value year-to-date until the end of September.

Precious Metals and Companies That Mine Them

Precious metal miners got a boost on Tuesday, October 3, 2017, despite the marginal fall of precious metals.

Chart in Focus: Correlation of Mining Stocks with Gold

New Gold has a three-year correlation of 0.67 and a one-year correlation of 0.88 to gold.

The Latest in Correlation Trends between Mining Stocks and Gold

Among the four miners that we’re analyzing here, Sibanye Gold has the lowest correlation with gold on a one-year basis, while Gold Fields has the highest.

Understanding Mining Company Technicals amid Today’s Turbulence

Many mining stocks saw a revival in prices on Monday, September 25, 2017, since precious metals saw an upswing.

Reading the Correlation of Mining Shares

Monday, September 25, 2017, was a day of revival for mining shares as tensions in North Korea resurfaced.

Analyzing Miners’ Technicals in September 2017

On September 22, 2017, First Majestic Silver, Goldcorp, Newmont Mining, and Silver Wheaton had volatilities of 49.1%, 26.7%, 23.5%, and 30.8%, respectively.

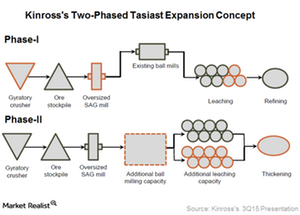

Why the Tasiast Expansion Is Key to Kinross Gold’s Potential

The Tasiast Phase One expansion is expected to increase mill throughput capacity from 8,000 tons per day to 12,000 tons per day.