Reynolds American Inc

Latest Reynolds American Inc News and Updates

The Largest Corporation Settlements in United States History

The largest class action corporation settlements in United States history have staggering price tags. Learn about the gross negligence or harm that led to such enormous settlements.

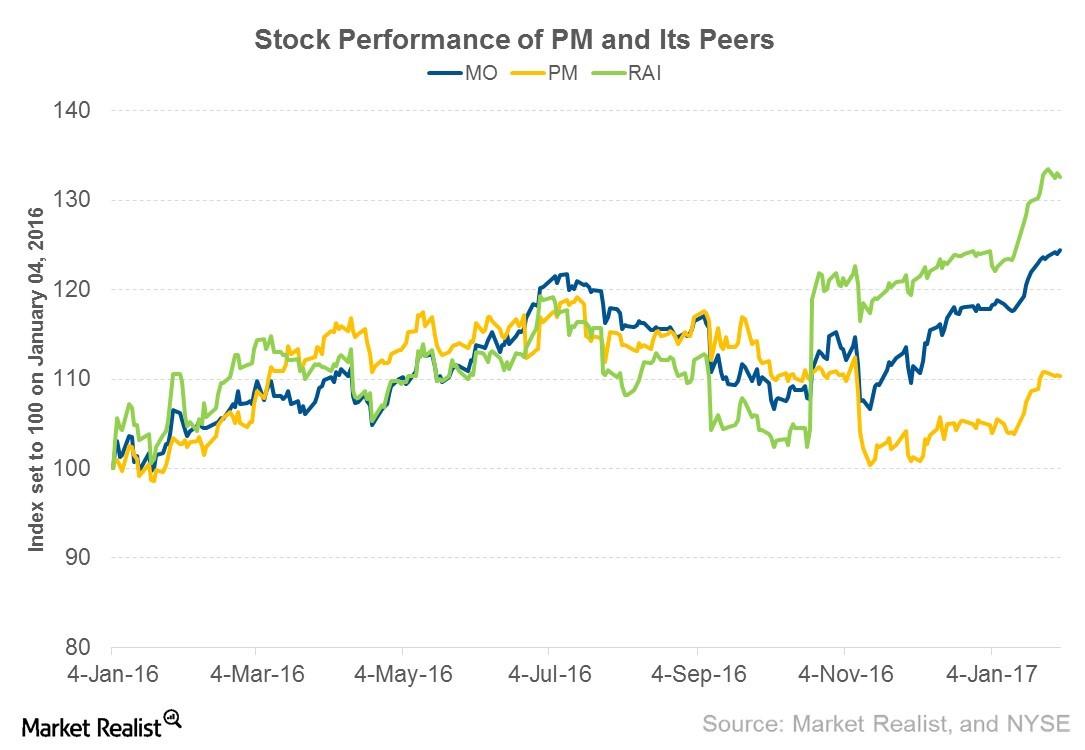

Altria Stock Rose on Strong 4Q16 Earnings

Altria Group (MO) announced its 4Q16 earnings on February 1, 2017. The company posted net revenue of $4.7 billion and EPS (earnings per share) of $5.27.

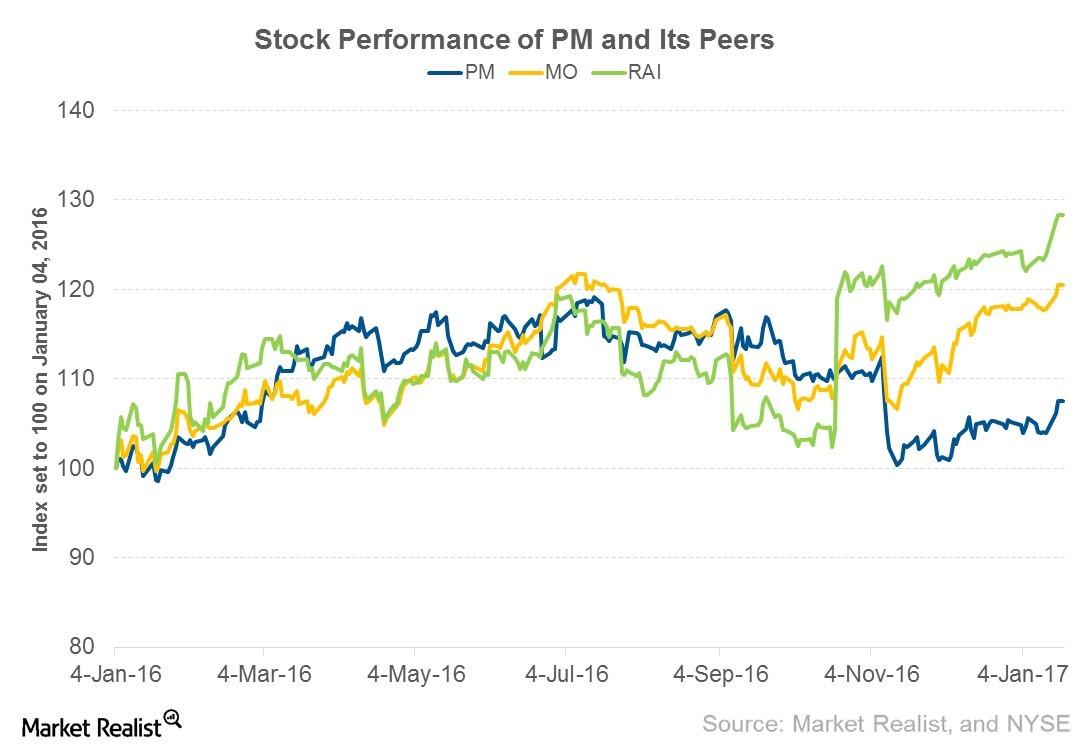

Will Philip Morris’s 4Q16 Earnings Results Boost Its Stock Price?

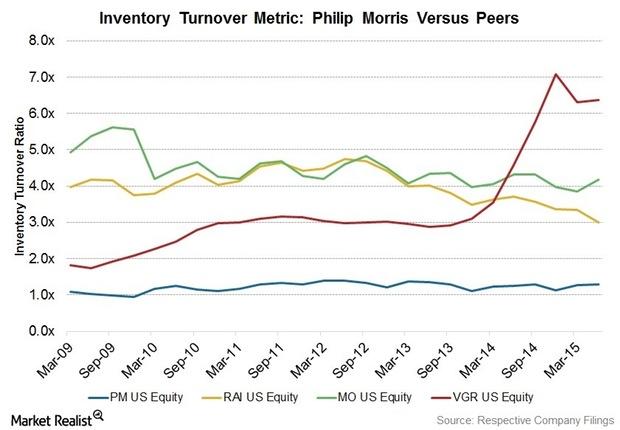

Philip Morris International (PM), a US-based tobacco company, is set to announce its 4Q16 earnings on February 2, 2017, before the market opens.

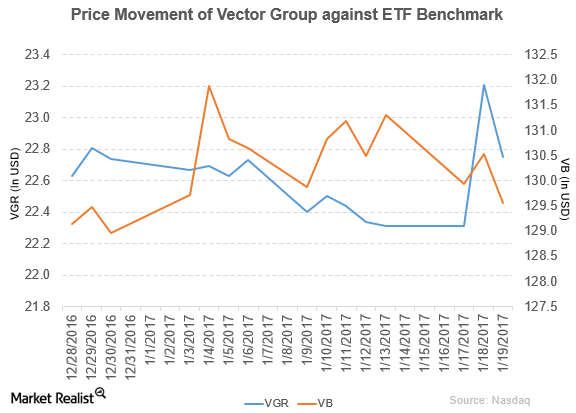

Moody’s Rated Vector Group’s Secured Notes

Vector Group (VGR) has a market cap of 2.9 billion. It fell 2.0% to close at $22.75 per share on January 19, 2017.

Vector Group Declares Dividend of $0.40 per Share

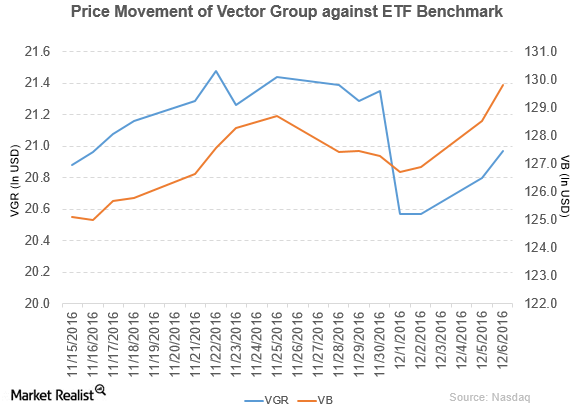

Vector Group (VGR) has a market cap of $2.7 billion. Its stock rose 0.82% to close at $20.97 per share on December 6, 2016.

Can Investors Expect Momentum from Altria’s 3Q16 Earnings?

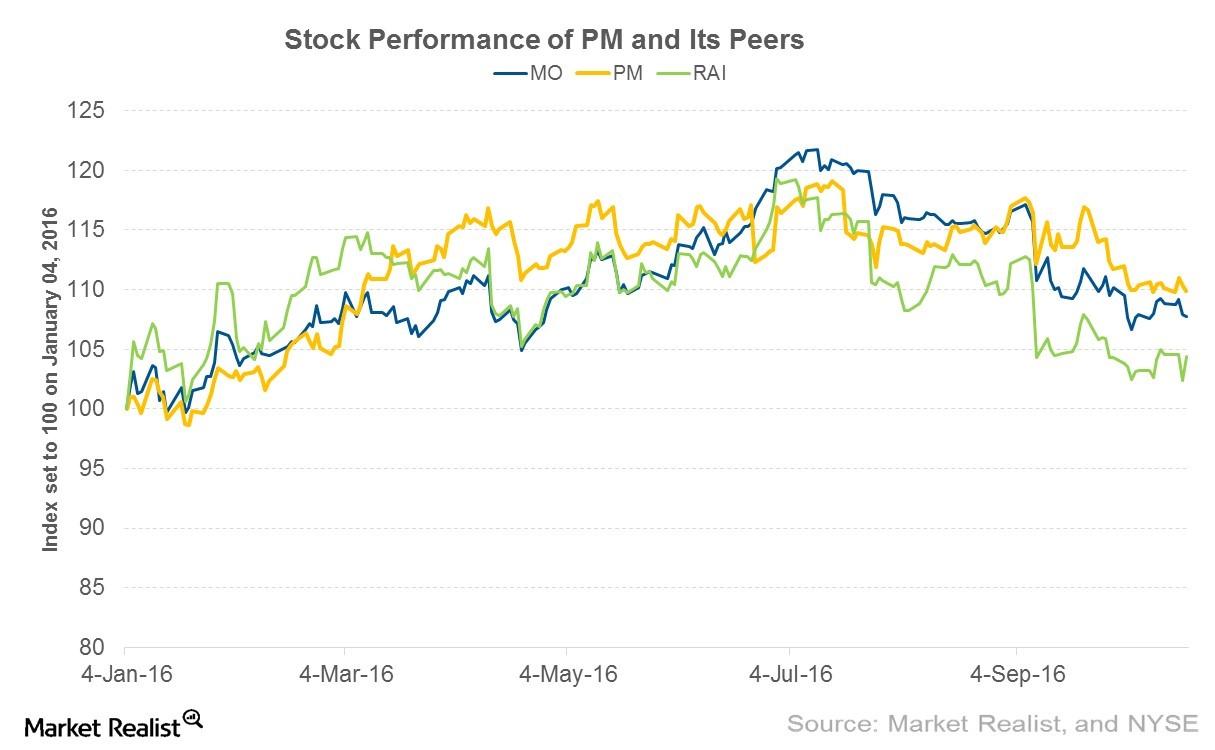

In 2016, Altria’s share price has risen 7.8% YTD. During the same period, peers Philip Morris and Reynolds American have risen 9.9% and 4.4%, respectively.

Why Philip Morris’s iQOS Sales in Japan Are Promising

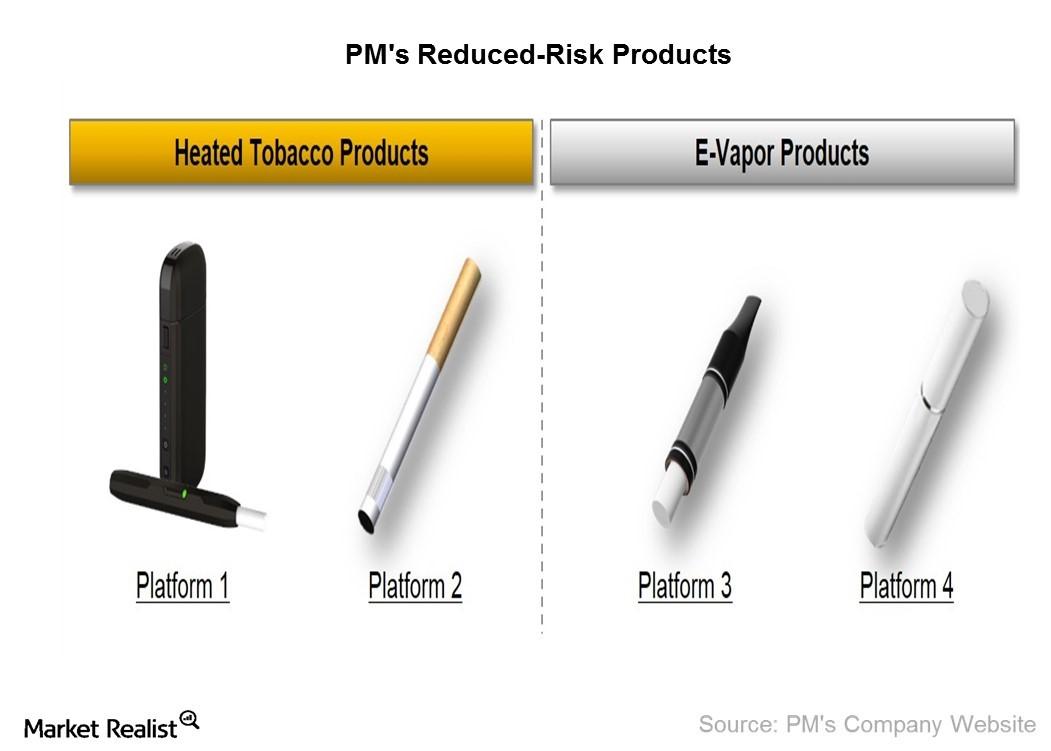

According to the WHO, under the current regulatory regimes, the percentage of the cigarette smoking population is expected to fall from 22% to 19% by 2025.

Jefferies Gave Philip Morris International a ‘Hold’ Rating

Jefferies has initiated coverage of Philip Morris International with a “hold” rating and set the stock’s price target at $96 per share.

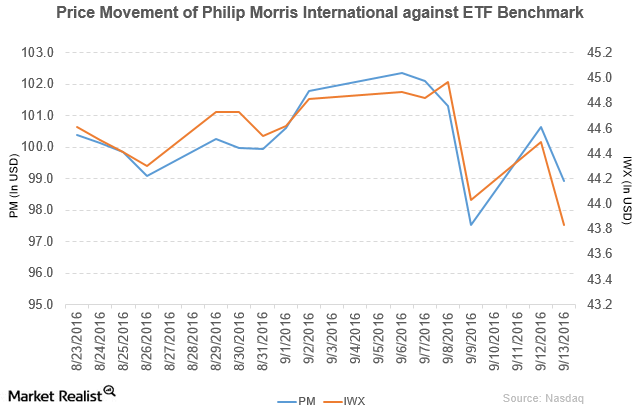

Citigroup Gave Philip Morris International a ‘Neutral’ Rating

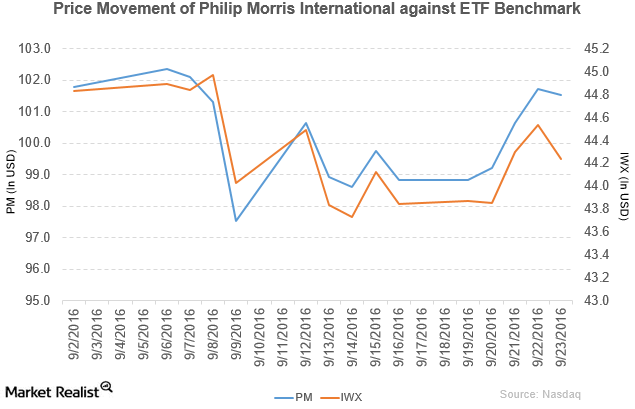

Philip Morris International (PM) has a market cap of $159.4 billion. It fell 1.7% to close at $98.93 per share on September 13, 2016.

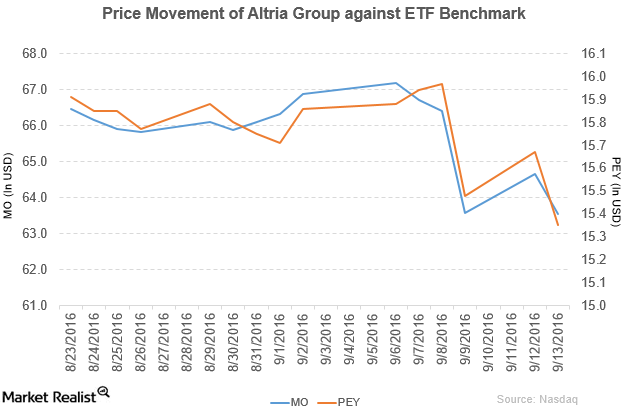

Citigroup Has Rated Altria Group a ‘Buy’

Altria Group (MO) has a market cap of $129.7 billion. It fell 1.7% to close at $63.55 per share on September 13, 2016.

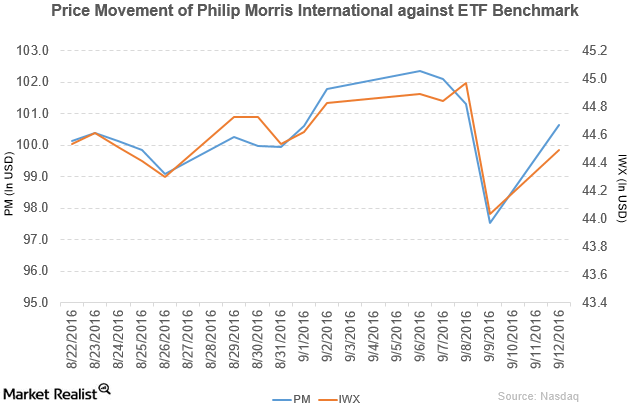

Goldman Sachs Upgrades Philip Morris International to ‘Conviction Buy’

Price movement Philip Morris International (PM) has a market cap of $162.2 billion. It rose 3.2% to close at $100.64 per share on September 12, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -1.1%, 1.8%, and 16.9%, respectively, on the same day. PM is trading 0.49% above its 20-day moving average, […]

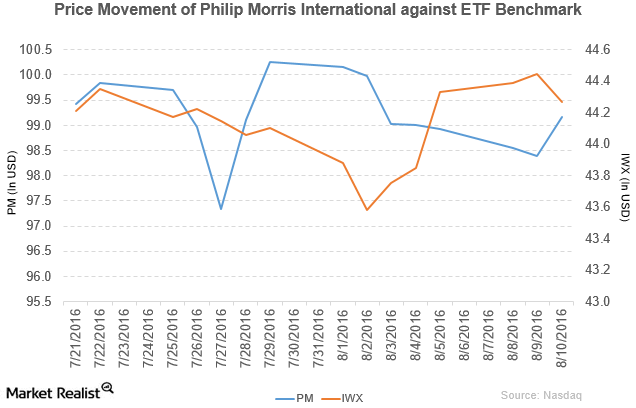

Moody’s Affirmed Philip Morris’s Ratings

Philip Morris International (PM) has a market cap of $155.4 billion. It rose by 0.78% to close at $99.17 per share on August 10, 2016.

Can ~6% Pricing Variance Help Philip Morris’s Margin Rise in 2Q16?

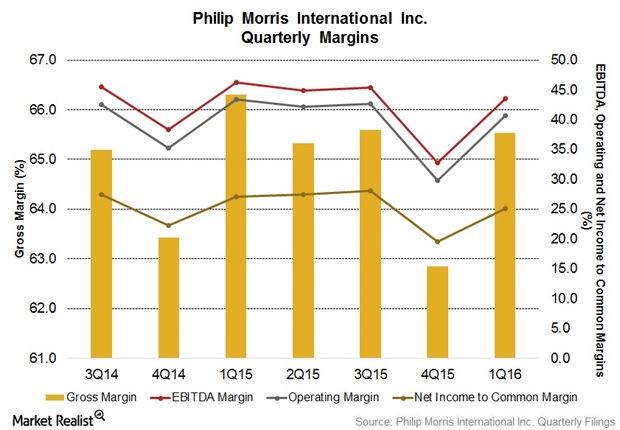

As a result of decreased operating income, Philip Morris’s (PM) operating margin fell by 2.8% to 41.9% in 1Q16.

Can Philip Morris Beat Its 2Q16 Earnings Expectations?

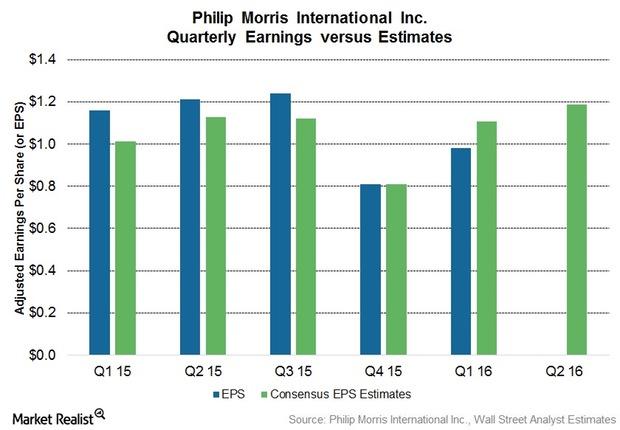

The Wall Street consensus analyst expectation for Philip Morris’s adjusted diluted EPS in 2Q16 is $1.19 per share.

ICSID Dismisses Philip Morris’s Lawsuit against Uruguay

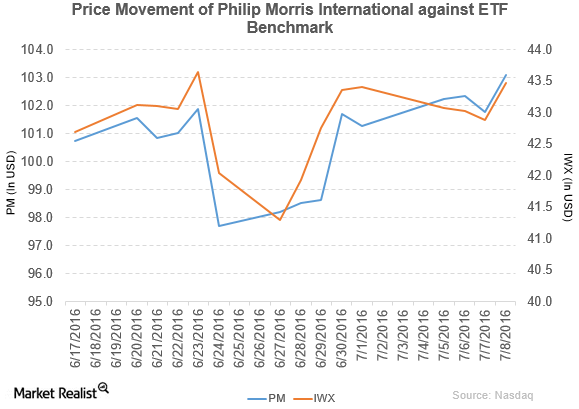

Philip Morris International (PM) has a market cap of $160.6 billion. Its stock rose by 1.3% to close at $103.09 per share on July 8, 2016.

Why Did Philip Morris Fall 4% on June 24?

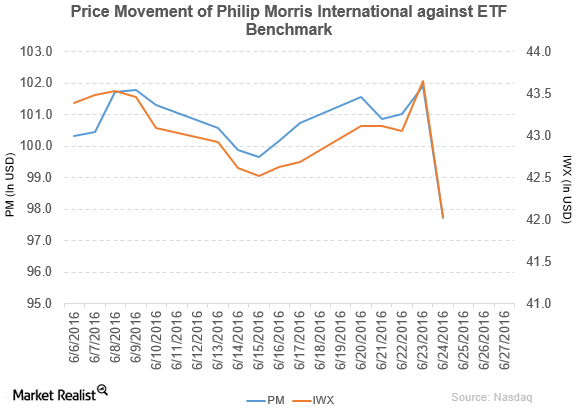

Philip Morris International (PM) has a market cap of $151.6 billion. It fell by 4.1% to close at $97.71 per share on June 24, 2016.

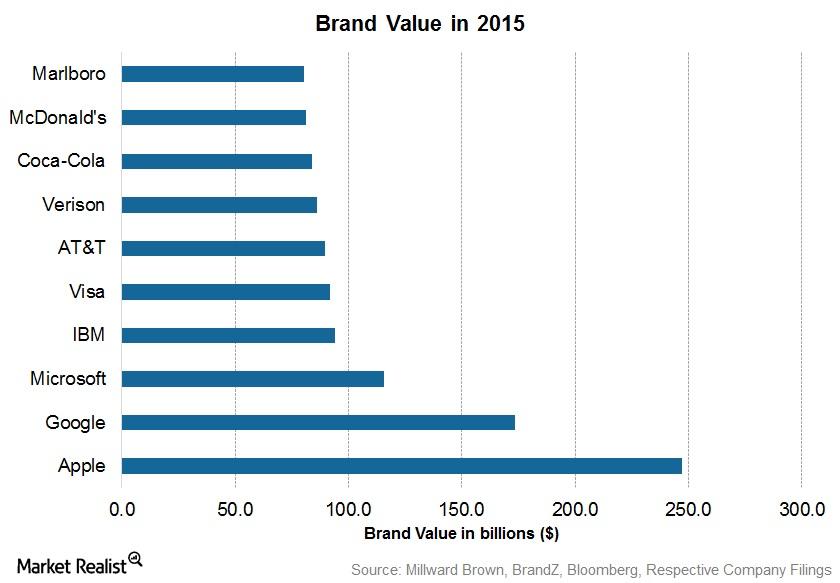

Weighing Altria Group’s Strengths and Opportunities

Altria’s major strength is its diversified portfolio, which includes wine and beer assets. Altria has the most diverse business model among US peers.

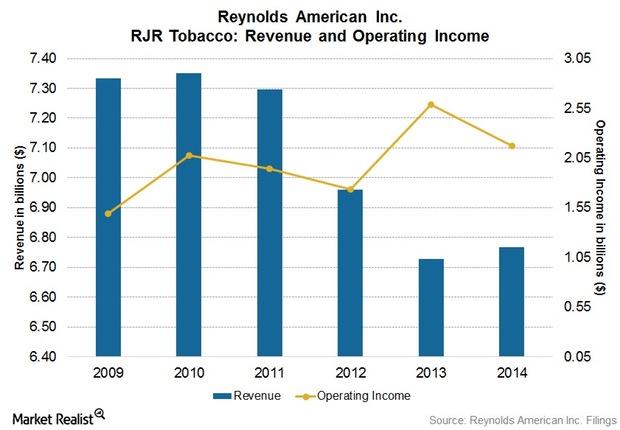

Reynolds American’s Largest Operating Segment: R. J. Reynolds Tobacco

R. J. Reynolds is Reynolds American’s largest operating segment. Its brands include the two best-selling cigarettes in the US, Camel and Pall Mall.

Obstacles to Altria Group’s Growth: Weaknesses and Threats

Altria’s business faces threats of high scrutiny, taxation, and regulation. Prohibitions on cigarette sales and smoking bans in public places affect sales.

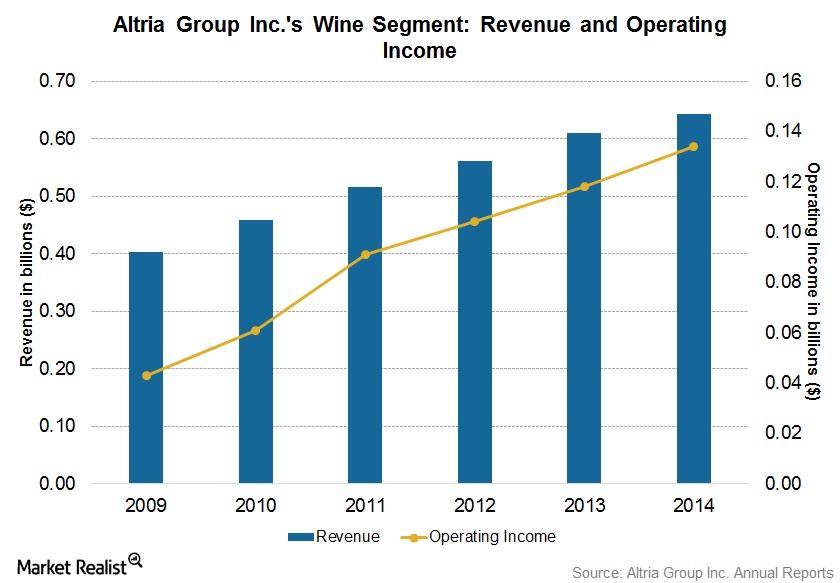

Understanding Altria’s Wine Business Segment

Altria’s subsidiary Ste. Michelle is a leading producer of Washington state wines. It owns wineries and distributes wines in several regions and countries.

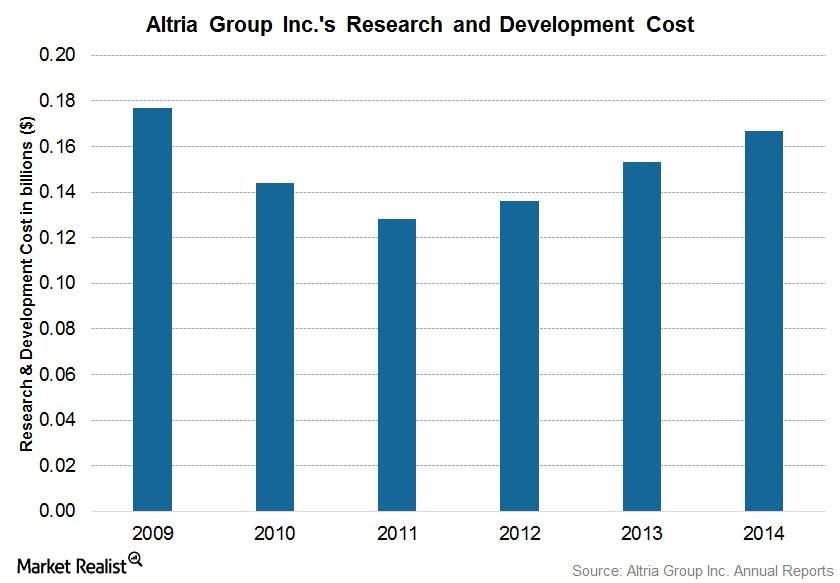

Altria’s Heritage of Innovation and Investments in R&D

Altria’s R&D expenses for fiscal 2014 were $0.2 billion, or 0.9% of net sales. Its R&D expenses upped by 9.2% in 2014, reflecting a trend toward innovation.

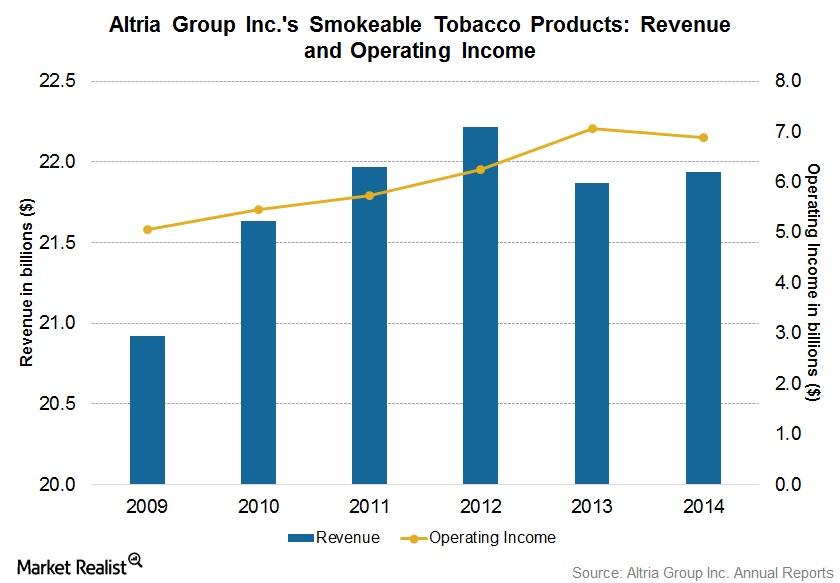

Altria Group’s Smokeable Tobacco Product Segment

MO’s tobacco business segment consists of smokeable and smokeless tobacco products. The company’s smokeable tobacco companies include PM USA and Middleton.

Philip Morris’s Growth Hurdles Ahead: Weaknesses and Threats

Philip Morris faces an exceptional level of scrutiny, taxation, and regulation. Global health consciousness and ongoing litigation also pose a threat.

Philip Morris’s Initiatives to Boost Distribution and Manufacturing Channels

Philip Morris oversees the distribution of tobacco products in more than 180 countries and territories and owns 50 manufacturing facilities across 23 markets.

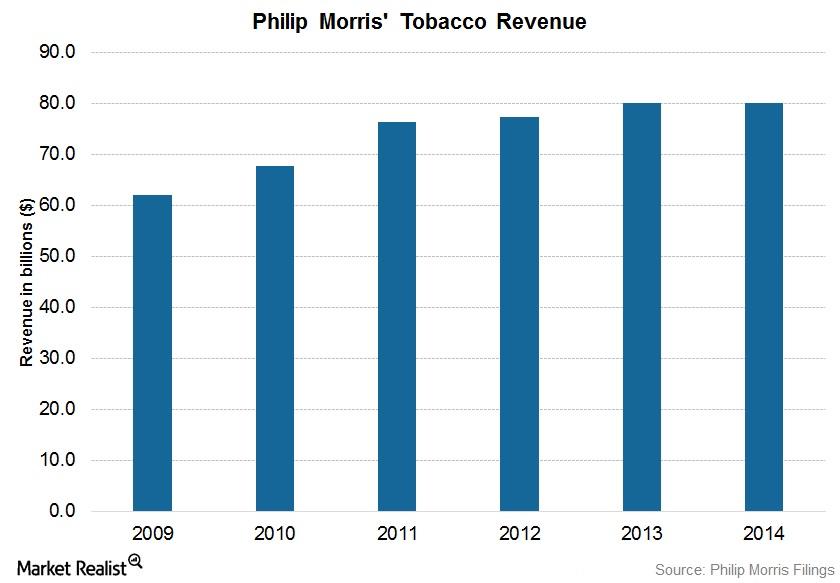

Introducing Philip Morris International

Incorporated in Virginia in 1987, Philip Morris is a leading tobacco company whose revenue in 2014 was ~$80 billion—$29.8 billion after excise taxes.