3M Co

Latest 3M Co News and Updates

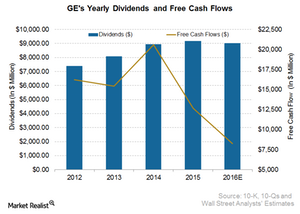

Are GE’s Free Cash Flows Sufficient for Dividend Growth?

General Electric’s 2016 free cash flows are expected to remain at $8.2 billion. This is mainly due to free cash flows of -$6.0 billion generated in 1H16.

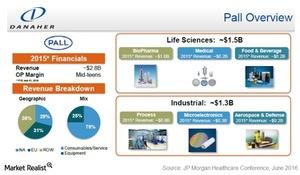

Pall Acquisition Gave Birth to Danaher’s Filtration Business

Danaher’s filtration business came into existence through the acquisition of Pall in 2015.

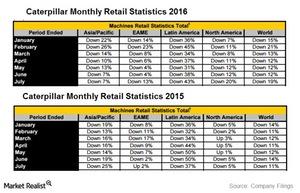

Investors Shouldn’t Expect Near-Term Optimism from Caterpillar

Caterpillar (CAT) released its retail statistics for July on a three-month rolling basis on August 18. However, Caterpillar’s retail sales fell in July.

Parker-Hannifin’s 2017 Guidance Suggests Slowdown in Industrials

Parker-Hannifin has guided its fiscal 2017 adjusted EPS at $6.40–$7.10. The midpoint of this range is roughly 4.5% higher than $6.46 in fiscal 2016.

How 3M Company’s Acquisition Strategy Has Changed

3M Company’s (MMM) acquisition strategy for the last ten years can be classified as “BI” (before Inge) and “AI” (after Inge).

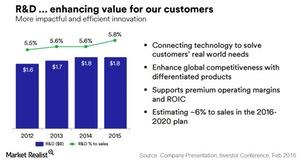

What Are the Financial Objectives of 3M Company’s 5-Year Plan?

In February 2016, 3M Company (MMM) set financial objectives for the five-year period from 2016 to 2020 that were slightly below its previous expectations.

What Strategy Is 3M Company Using to Increase Cost Savings?

Realizing that its capital structure was sub-optimal and was leading to a high cost of capital, 3M Company started adding leverage.

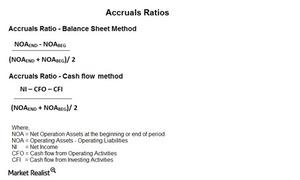

How Good Is the Quality of 3M Company’s Earnings?

3M Company’s (MMM) accruals ratios using the balance sheet and the cash flow methods rose considerably in 2015.

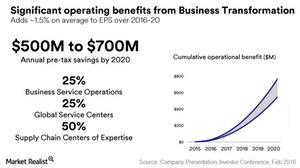

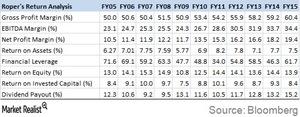

Understanding Roper Technologies’ Business Transformation

Roper Technologies’ Industrial Technology segment’s revenue stood at 21% of its sales in 2015. This segment’s revenue was 41% of its sales in 2014.

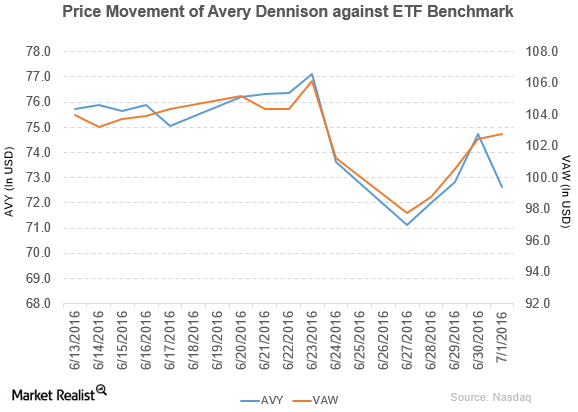

Bank of America Merrill Lynch Downgrades Avery Dennison

Avery Dennison (AVY) has a market capitalization of $6.5 billion. It fell by 2.9% to close at $72.62 per share on July 1, 2016.

3M Consumer Products: Your Everyday Kitchen and Office Companions

3M Company’s (MMM) Consumer Solutions segment is made up of four diverse businesses, which garnered a combined annual revenue of $4.4 billion in 2015.

What Strengths Differentiate 3M Company from the Competition?

3M Company is generating a massive 30%–32% of its annual revenue from products it’s introduced in the last five years.

How 3M Company Differs from Other Industrial Conglomerates

While 3M’s peer group includes industrial conglomerates such as Honeywell and General Electric, these companies hardly share any similarities with 3M.

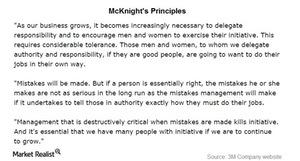

How the 15% Rule Became a Stepping Stone for 3M’s Innovation

3M company owes much of its innovative culture to William McKnight, who became the General Manager of the company in 1914.

Introducing 3M Company: A Jack of All Trades

Few companies have the kind of ubiquitous presence that 3M Company (MMM) likely does in your everyday life.

Essentials of the SaaS Business Model in Honeywell’s ACS Unit

Honeywell’s ACS unit uses the software-as-a-service (or SaaS) business model. In the SaaS model, software is licensed on a subscription basis to users.

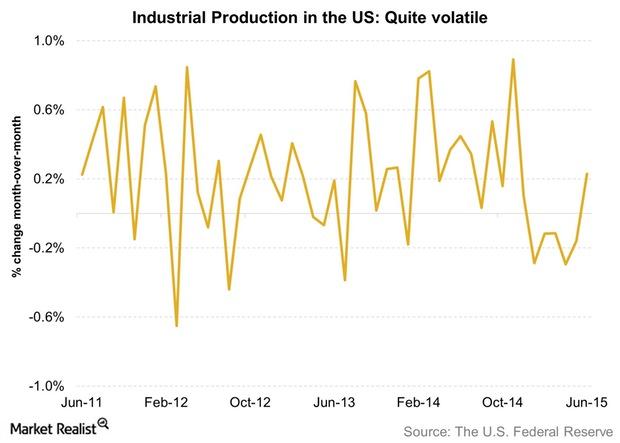

What Does Industrial Production Say about an Economy?

Industrial production—or in some cases, manufacturing production—provides important input about a nation’s economic output, irrespective of its business cycle.

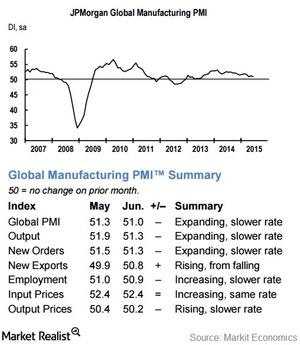

Markit Economics’ PMI Report: Global Manufacturing Slowed in June

The Markit PMI report serves as a business activity scorecard for the economy under survey. It provides insight into the private sector economy.

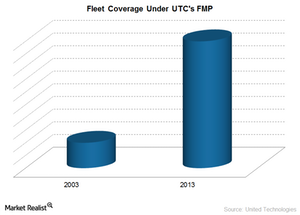

How Did UTC Improve Its Aftermarket Business?

Pratt & Whitney (UTX) originally focused only on selling airplane engines and spare parts. It covered only 10% of its engines under its aftermarket program.