BTC iShares iBoxx USD High Yield Corporate Bond ETF

Latest BTC iShares iBoxx USD High Yield Corporate Bond ETF News and Updates

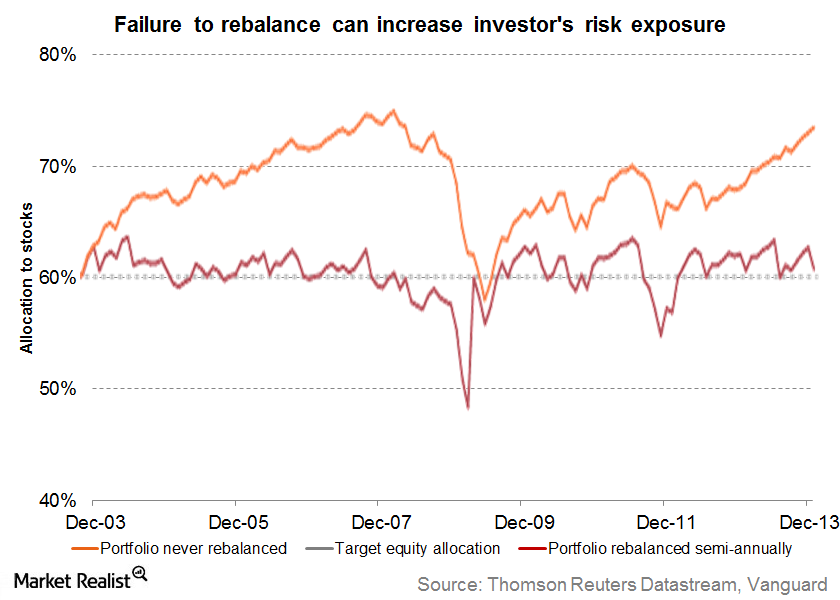

The Importance of Rebalancing Your Portfolio

Rebalancing your portfolio means bringing the portfolio back to the asset allocation levels specified in the financial plan. Not rebalancing can expose you to higher risk.Technology & Communications Exposure to junk bonds: How much should you hedge?

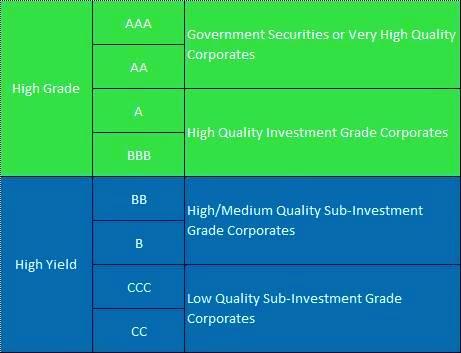

Junk bonds are high yield bonds issued by below–investment grade corporations. Due to the low ratings and high risk of default attached to these bonds, they’re popularly called “junk bonds.”

When The Net Asset Value Of A Bond ETF Differs From Market Price

The Intraday Indicative Value gives us a more real-time value than the bond ETF’s NAV. It’s considered an implied value of an ETF.

Why Does Fixed Income Look Promising?

Under the current uncertain economic circumstances, investors searching for higher yield might turn to fixed income.

Where Are Bond Markets Headed?

Rising US-China trade tensions have caused all assets, and especially bond markets, to move considerably over the last few sessions.

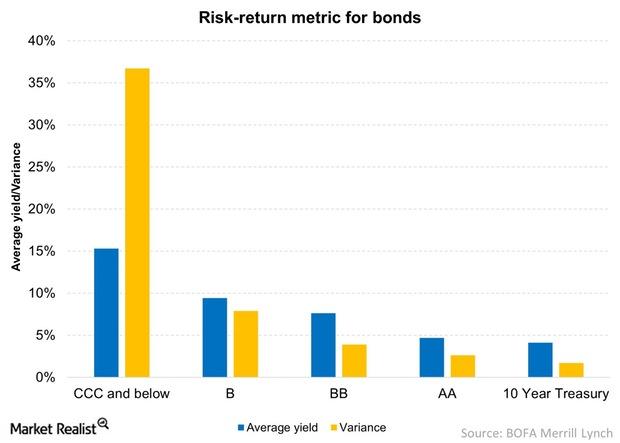

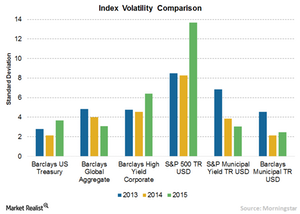

How Various Asset Classes Compare Using The Risk-Return Metric

The risk-return metric for ten-year Treasuries (IEF) are lowest, but also the safest, with a paltry 1.3% volatility and with an average yield of 4.1%.

Why Elliott Management Might Be in Trouble

Last week, Elliott Management filed its 13F for the first quarter of 2020. In the last quarter, the hedge fund’s AUM was worth around $73.15 billion.

The Difference between Corporate Bonds and Treasuries

Bond investors should understand the difference between Corporate Bonds and Treasuries. Below is a list of the key differences between the two.

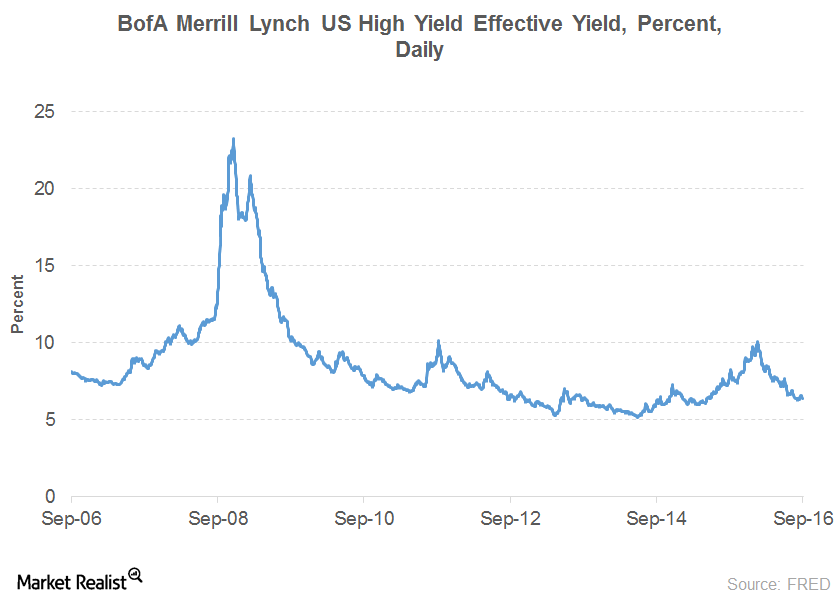

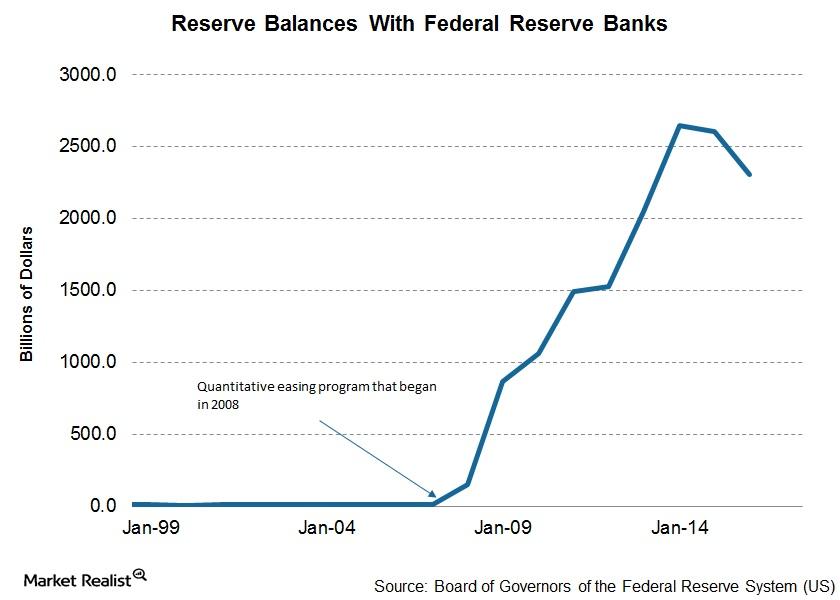

High-Yield Bonds Are Turning Out to Be the Real Winners

High-yield bonds gained popularity due to higher yields compared to Treasury bonds, whose yields were being pushed down by the Fed’s interest rate policy.

Connection Between Equities And High Yield Bonds

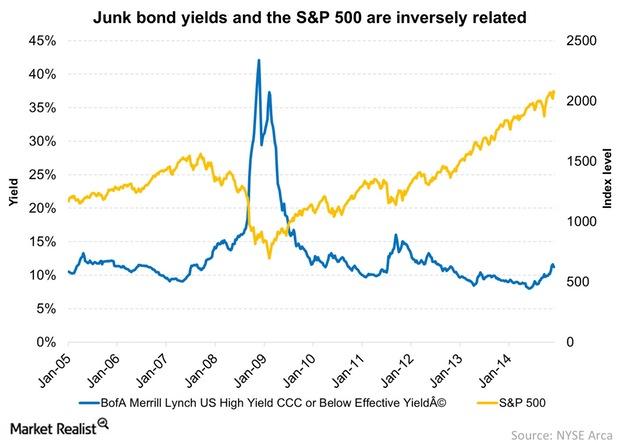

Equities and high yield bonds perform well when the economy is improving, and both underperform when the economy is slumping.Financials Hawks and doves: Why Fed-watching isn’t for the birds

The FOMC is made up of hawks and doves, and their balance could affect future policy. Investors who follow the Fed need be able to tell the differences.Financials How bond prices, interest rates, and credit spreads correlate

Bond prices and interest rates have an inverse relationship. If an interest rate increases, the price on a bond declines, and vice versa.Financials An investor’s guide to the US leveraged financial market

According to the Securities Industry and Financial Market Association, SIFMA, the total U.S. fixed income market size is about $38.6 trillion.

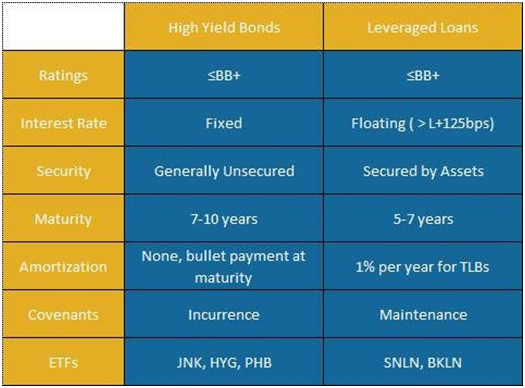

Comparing leveraged loans and high yield bonds: Credit rating

Credit rating measures the credit-worthiness of a debtor with respect to its financial and operational stability. Rating agencies such as Moody’s and Standard & Poor’s specialize in rating credit to government agencies and corporates.Financials Comparing leveraged loans and high yield bonds: Key distinctions

Leveraged loans (BKLN) are almost always secured or backed by a specific pledged asset or some form collateral. On the other hand, high yield bonds (JNK) may be secured or unsecured.Financials Comparing leveraged loans and high yield bonds: Debt terms

Another item that differentiates leveraged loans from high yield bonds is “covenants,” or the financial health metrics that issuers must adhere to.

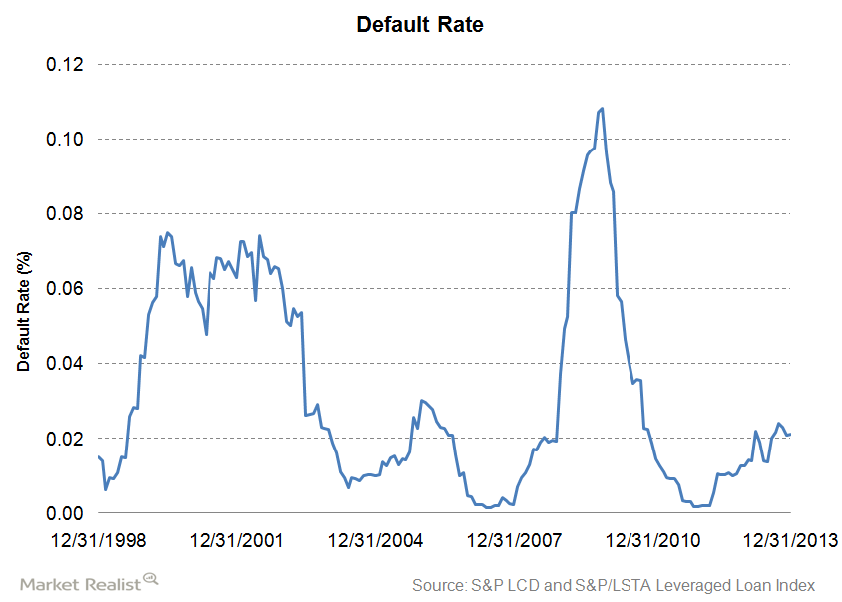

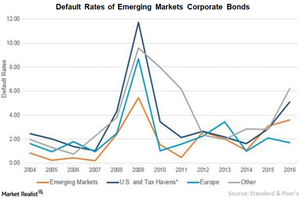

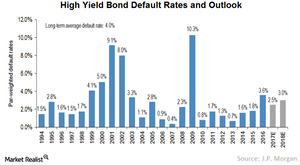

The default rate and its relation to bond and loan prices

Default rate is a key metric of credit risk and is defined as the risk that the counterparty will default on its financial obligations.

Must know: How credit rating affects default rate and bond price

A lower credit rating means higher risk, and therefore, higher yield as investors look for the premium to take the risk and vice versa.Financials Why credit upgrades and downgrades affect bond returns

A ratings upgrade or downgrade has a direct impact on fixed income yields, and therefore directly affects bond prices.Financials Why we need to relook at the consumer in this week’s releases

This week is full of indicators, with most of them being measures of national-level economic activity.

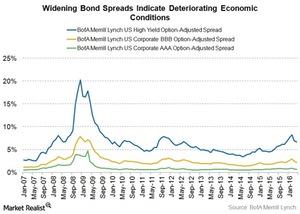

What Do Widening Bond Spreads Indicate?

Widening spreads indicate a slowing economy. Since companies are more likely to default in a slowing economy, credit risk related to their bonds rises.Financials Must-know: The difference between high-yield and leveraged loans

Historically, high-yield securities have outperformed investment grade securities in good times and vice versa in hard times.

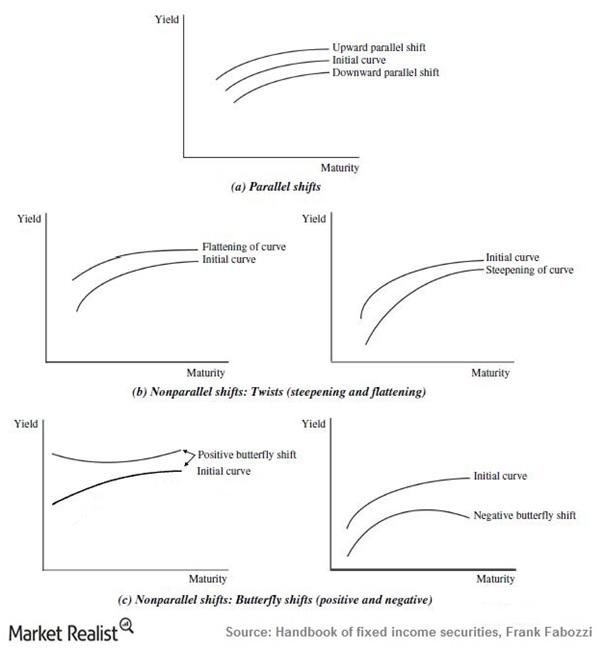

Why investors should follow shifts and twists in the yield curve

Yields on bonds don’t remain constant. When they change by the same magnitude across maturities, we call the change a “parallel shift.”Financials Key takeaways: Why is the yield curve normally upward-sloping?

In normal conditions, the yield curve is upward-sloping. As bonds pay only interest (the coupon) until maturity and pay face value at maturity, investors take longer to recover their principal.

How Are Citadel Advisors Hedging their Portfolio?

Kenneth Cordele Griffin is the CEO of investment management firm Citadel Advisors LLC. He is the hedge fund manager and he founded Citadel in 1990.Financials Investing in fixed income: What motivates bond investors?

We can understand the investment objectives of fixed income investors in terms of returns, risks, and constraints. There are two categories of investors.

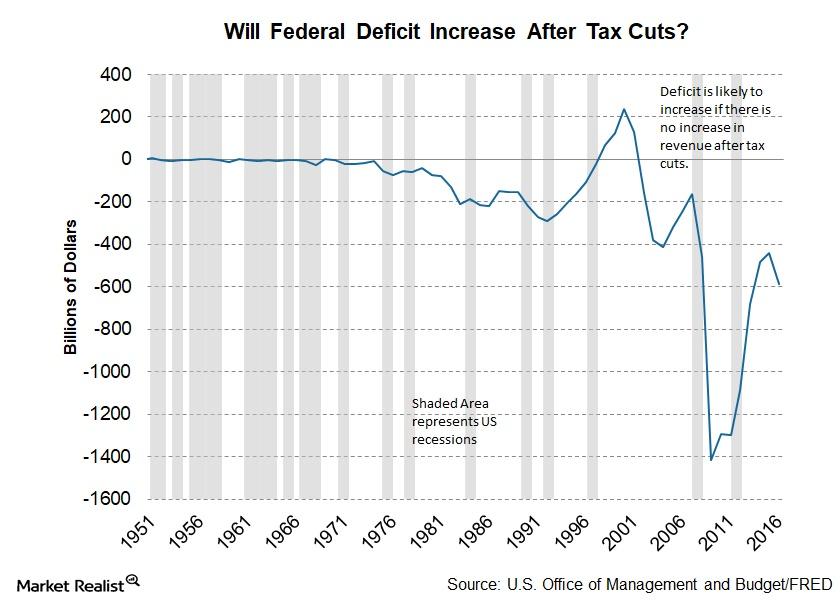

How Will Tax Cuts Impact the Federal Deficit?

The report from the Joint Committee on Taxation included an estimate of budgetary deficits for 2018–2027. Tax reforms could have a limited impact in 2018.

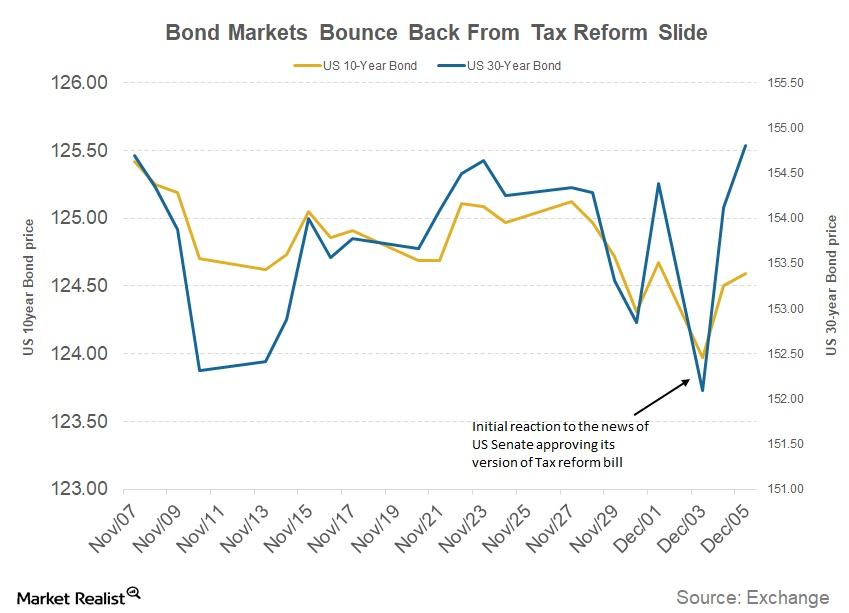

Tax Cuts and Rate Hikes Could Impact the Fed

The proposed tax cuts and the resulting increase in the federal deficit are expected to impact bond markets. It’s important to consider the Fed’s stance.

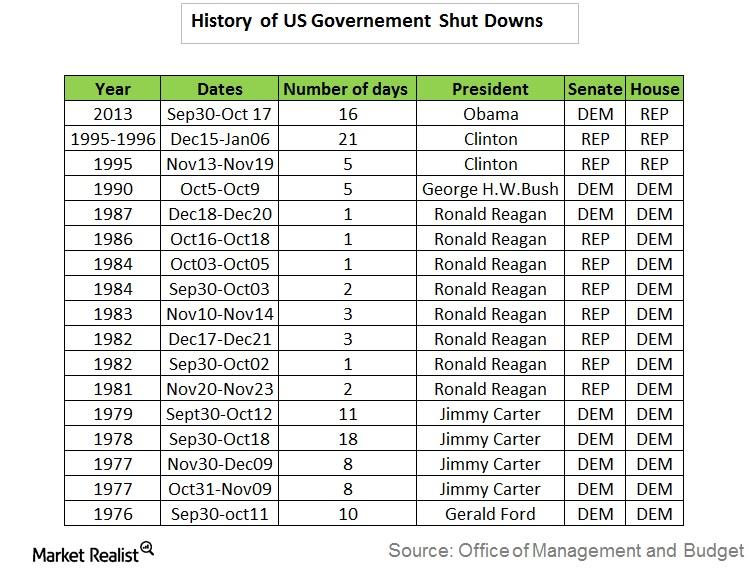

Why the US Government Has Been Shut Down Before

A failure to raise the debt ceiling will likely result in a US government shutdown and a default by the US, which would be catastrophic for the global economy and financial markets (VTI) (USMV).

EM Corporates Offer Huge Opportunities and Better Profile

VanEck A Diverse and Growing Category The emerging markets high yield bond market has grown tremendously over the past 10 years, from $56 billion at the end of 2007 to $440 billion as of June 30, 2017.[2. Source: BofA Merrill Lynch.] In addition to growing in size, diversity within the category has also increased. Investors currently […]

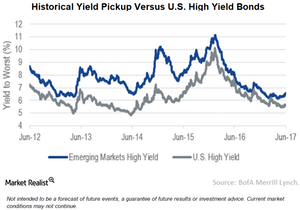

How to Benefit from Emerging Markets Corporate Debt

VanEck Higher Yield and Lower Duration Compared to U.S. high yield bonds, emerging markets high yield bonds offered a 90 bps yield pickup as of June 30, 2017.[1.U.S. high yield bonds and emerging markets high yield bonds are represented by BofA Merrill Lynch US High Yield Index and BofA Merrill Lynch Diversified HY US Emerging […]

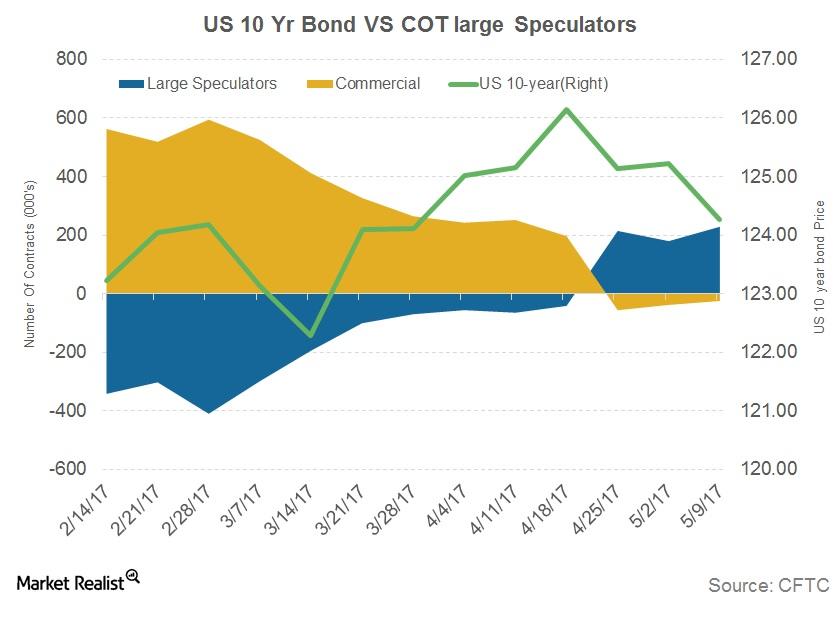

Why Are Bond Traders Increasing Their Net Positions?

US bond markets are trading on the expectation of an interest rate hike by the US Federal Reserve in June 2017. Last week, bond yields extended their slides.

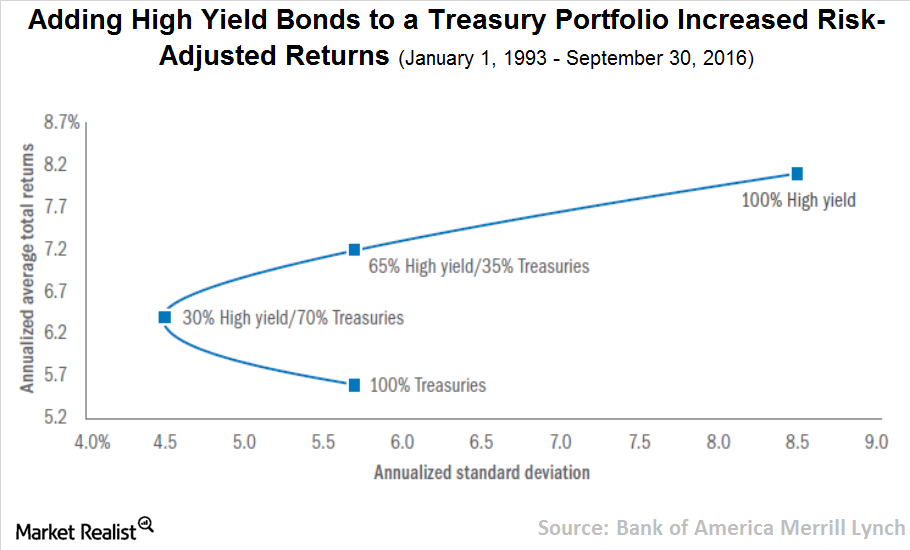

Why High-Yield Bonds Are Needed in a Portfolio

AB Summing It Up High-yield bonds present an alternative for investors at an uncertain crossroads. Equity valuations seem attractive based on some measures, but volatility has led many investors to search for ways to temper the risk in their portfolios. At the same time, bonds—a popular risk reducer—are less attractive than normal due to extremely […]

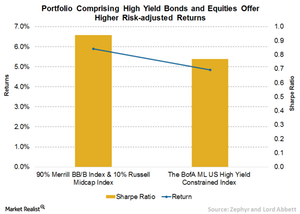

What Role Do High Yield Bonds Play in a Portfolio?

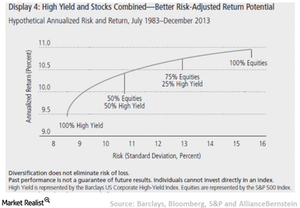

AB High Yield in the Portfolio Framework Given their higher risk levels, we’d expect that stocks would continue to outperform high yield over the long run. However, high-yield bonds have clearly demonstrated that they bring much to the table if they’re combined with stocks in a carefully designed and maintained portfolio. But not every investor […]

Your Update on the FOMC March Meeting Minutes

The minutes from the FOMC meeting on March 14 and 15 were reported on April 5 and revealed the tone of the conversation among members to be hawkish.

How Portfolio Rebalancing Boosts Overall Returns

AB Rebalancing in the Tails Because stocks have been so much more volatile than high yield, periodic portfolio rebalancing tends to occur during performance extremes—the “tails” in return distributions—when the gap between high-yield and equity returns is wide. This magnifies the “buy-low, sell-high” effect that rebalancing contributes to a portfolio’s performance. Of course, the gaps […]

How High-Yield Bonds Can Help Reduce Risk

AB A Place at the Asset-Allocation Table For investors seeking to control volatility in their equity portfolios while still maintaining return potential, high-yield bonds could represent an effective solution. A typical approach to moderating equity volatility is to reallocate assets to the greater stability of investment-grade bonds, or even cash. But this can exact a […]

Why High Yield Bonds Are an Effective Match with Equities

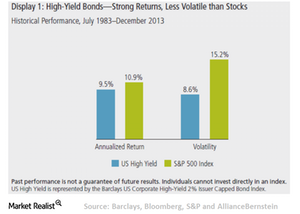

AB Keeping Pace with Equity Returns over Time In fact, when we widen the lens to take in the last three decades, high-yield bonds have nearly matched equity performance. And they’ve done it with much lower volatility. Since July 1983, stocks have produced an annualized return of 10.9% (Display 1). High-yield bonds have nearly equaled […]

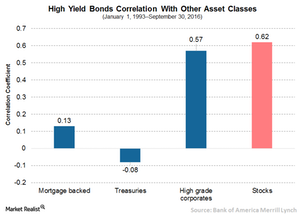

How High-Yield Bonds Are Connected to Other Asset Classes

AB Looks Are Deceiving But even though high-yield bonds look like other bonds, they don’t necessarily act like other bonds. This insight can have important implications for how investors consider them in an overall portfolio context. High-yield performance patterns, for example, don’t track those of other fixed-income sectors very closely over the long term. Looking […]

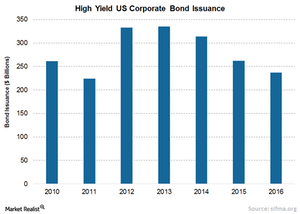

Why High Yield Bonds Are Attractive

In this series, we’ll discuss the many advantages of high yield bonds, their correlation with other asset classes, the rise of global high yield markets, and why high yield bonds should command a place in a portfolio.

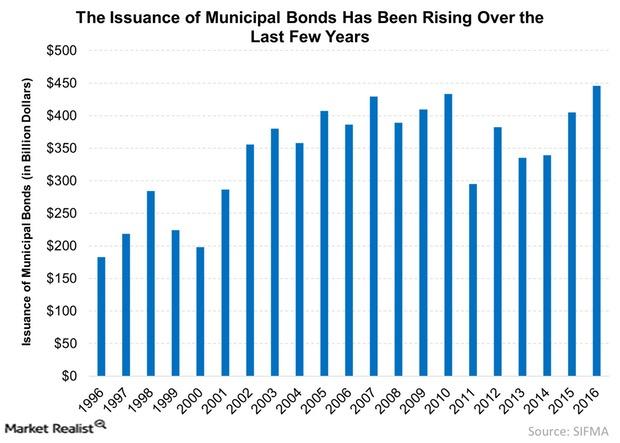

How Refundings Could Affect Municipal Bond Returns This Year

Municipal bond issuance has been rising over the last few years. More refundings would cause the supply to rise further.

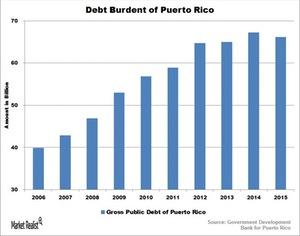

Looming Uncertainty of Puerto Rico’s Debt Crisis

Puerto Rico is currently in a meltdown mode. Over the past decade, it has accumulated $70.0 billion in public debt, which is close to 68.0% of its GDP.

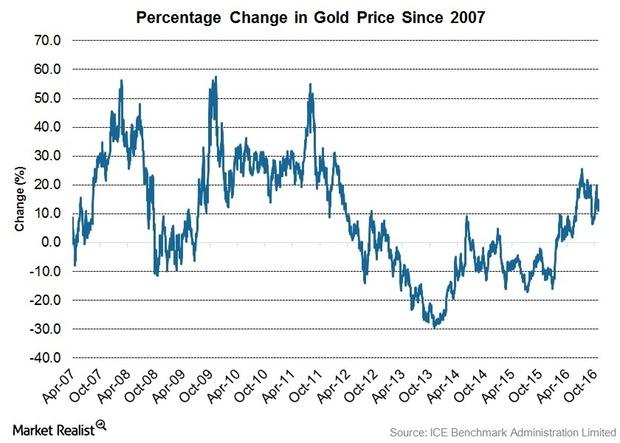

Bull Market: Expected for Gold, Not for Bonds

Long-Term Outlook Remains Positive for Gold Bull Market Our view on the long-term gold price is unchanged. We see the recent weakness as a consolidation phase within what we believe is the early stages of the next bull market for gold. We continue to believe dislocations created by the unconventional policies being implemented by central […]

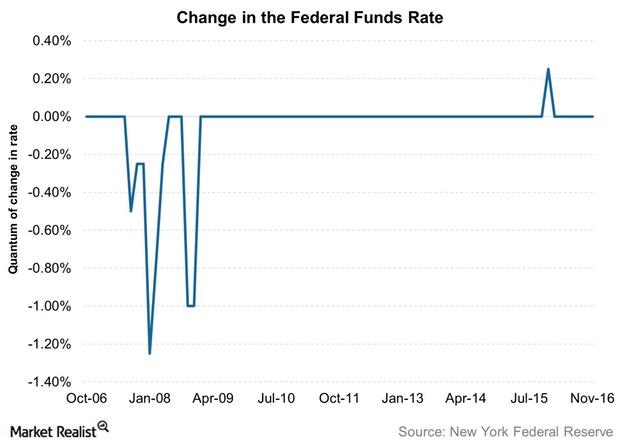

How the Next President Could Shape US Monetary Policy

The Federal Reserve’s second last meeting of 2016 is now over, leaving only one meeting left in which the central bank can enact a rate hike.

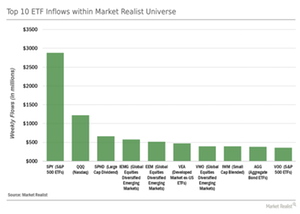

Category Flows: Looking for Yield? Be Picky!

The rise of the actively selective investor becomes more nuanced within the context of our entire ETF universe.

Why Municipal Bonds Are Immune to Market Volatility

Generally, municipal bonds (SUB) are immune to market volatility, thus providing considerable support to a portfolio.

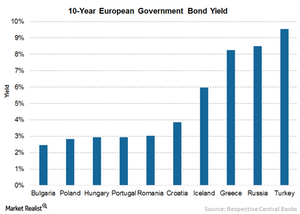

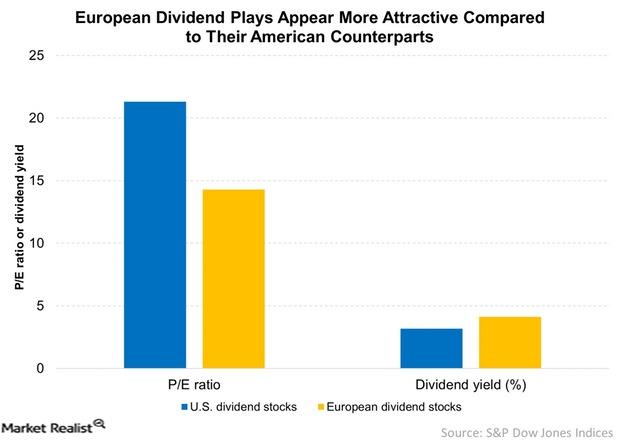

Yield for Yields! Where Can You Find Yields Today?

Not only are European stocks cheaper than American ones, they also offer more attractive dividend yields.

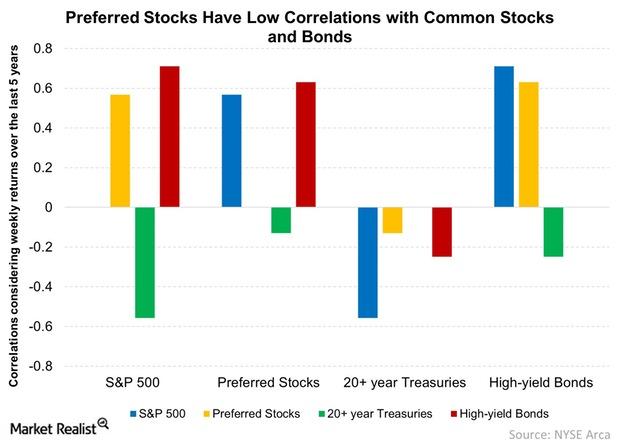

When Are Preferred Shares Appropriate for Your Portfolio?

Treasuries (TLO) add ballast to a stock-centric portfolio while providing low yields.

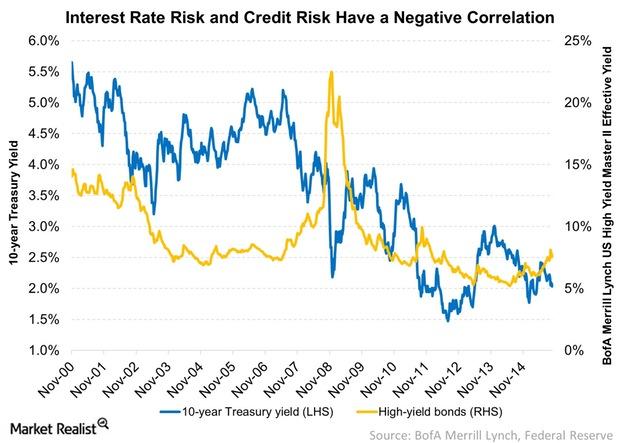

Credit Risk and Interest Rate Risk Have a Negative Correlation

Credit markets tend to improve when the economy is improving. The possibility of a default on corporate bonds (LQD) drops, thus causing their yields to fall.

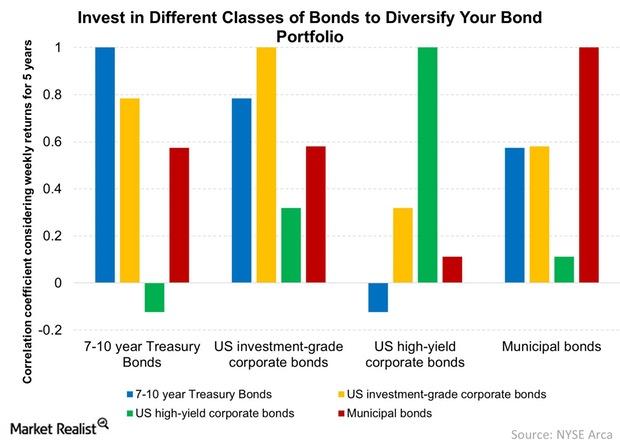

Own Bonds across Credit Quality to Diversify Your Portfolio

Adding bonds across credit classes helps diversify your bond portfolio. The weight of each category depends on your risk appetite and the business cycle.