BTC iShares iBoxx USD High Yield Corporate Bond ETF

Latest BTC iShares iBoxx USD High Yield Corporate Bond ETF News and Updates

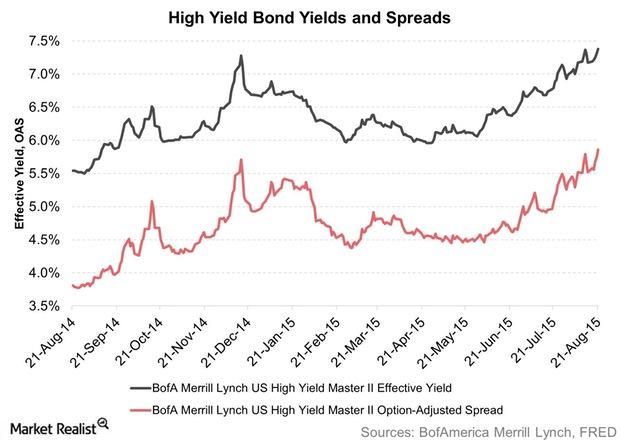

Widening High-Yield Bond Spreads: Opportunity or Threat?

Investors should note that high-yield bonds are risky securities to begin with. The add-on risk of widening spreads may not suit all types of investors.

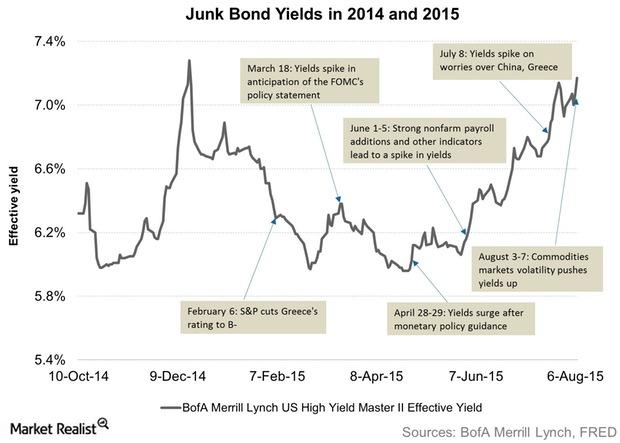

First Data was the Highest Junk Bond Issuer: Week to August 7

Junk bond issuance activity rose in the week ending August 7 after two weeks of subdued activity. The broad market conditions improved.

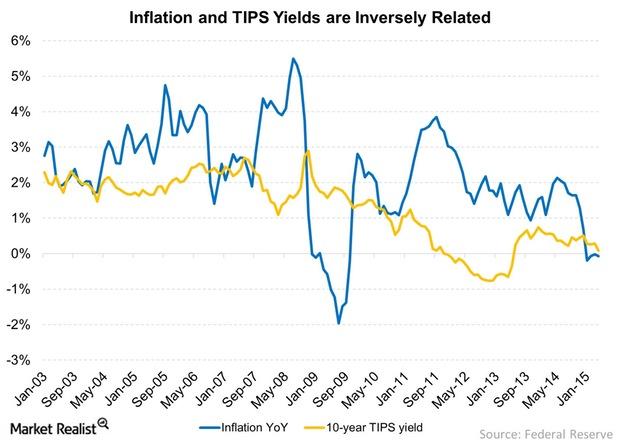

The Impact of Rising Interest Rates on TIPS

With interest rates likely to go up by the end of the year, TIPS with shorter maturities look more attractive.

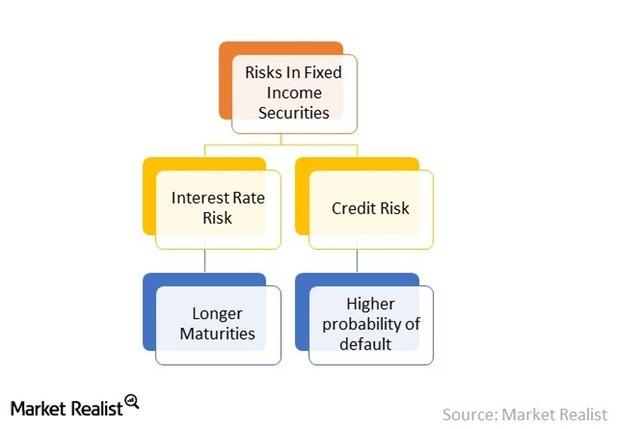

The Must-Know Risks of Fixed Income Investing

There are no free lunches. The risks involved in fixed income investing are two-fold.

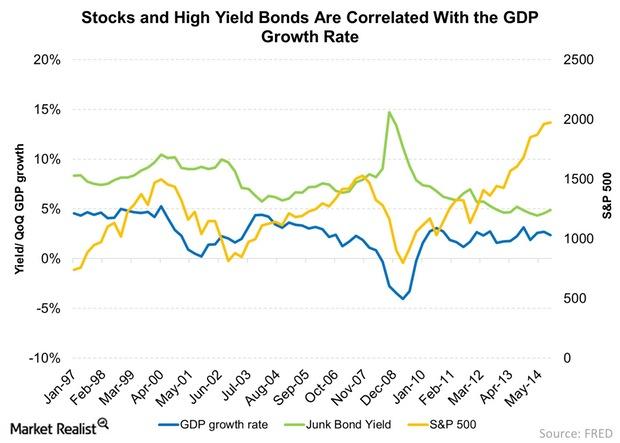

Why Corporate Bonds Correlate to Stocks

Corporate bonds, especially high yield corporate bonds, correlate to equities and hence, so they don’t provide great diversification benefits.

Where Are High Yield Bonds On The Risk Continuum?

High yield bonds (HYG), which are usually issued by mid- and small-cap companies, are considered riskier than investment grade corporate bonds.Healthcare Why-high-yield issuers coast on “drive-by” and “add-on” deals

DaVita HealthCare Partners (DVA) and Tenet Healthcare (THC) were among the more prominent HY debt issuers in the week ending June 13.Technology & Communications The latest word in telecom: Can SoftBank swing a T-Mobile deal?

Masayoshi Son, Chairman and CEO of SoftBank Corp. (SFTBF) and chairman of Sprint (S), has been pushing for more consolidation in the telecom sector in the U.S.

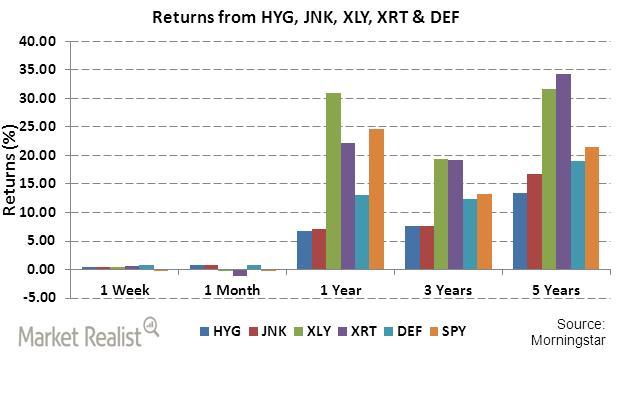

An investor’s guide to cyclical and counter-cyclical industries

XLY and XRT have performed better in terms of absolute returns over longer periods of three and five years

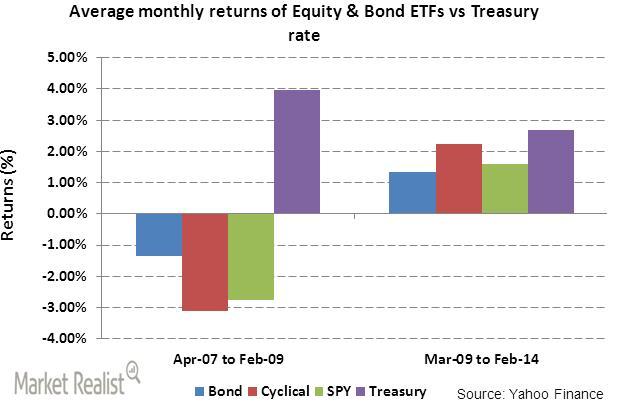

High yield bond ETFs’ performance compared to cyclical industry ETFs

During economic uncertainty, investors want steady, guaranteed returns from the Treasury instead of quick returns from price movements in equity ETFs.