Daimler AG

Latest Daimler AG News and Updates

Mercedes-Benz Unveils Battery System for New Flagship Electric Sedan, the EQS

With Mercedes announcing their new electric car, the EQS, it is also expanding in innovative battery production. The German automaker says their battery outperforms Tesla's/

How Ferrari Got Its Start

Ferrari (RACE) is one of the most prestigious brands in the automobile industry. The Italian racing and sports car manufacturer entered the business in 1947.

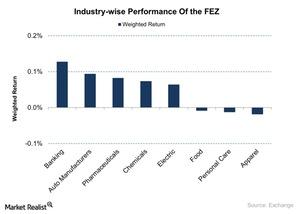

Positive Manufacturing Reports Drive the FEZ Up

The SPDR Euro Stoxx 50 ETF (FEZ) is a US exchange-traded ETF that tracks the performance of the 50 largest companies across the Eurozone.

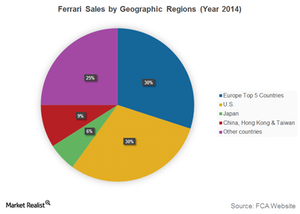

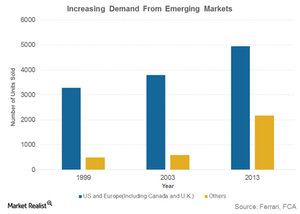

What Are Ferrari’s Key Geographical Markets?

Stable demand and strong brand image have kept Ferrari (RACE) moving forward, regardless of adverse global economic conditions.

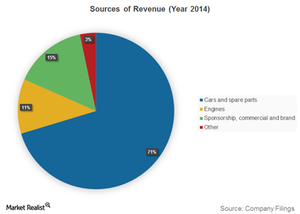

How Ferrari Manages to Remain Profitable

By focusing on extraordinary vehicle design and exclusivity, Ferrari is able to sell luxury cars with high-profit margins to end consumers.

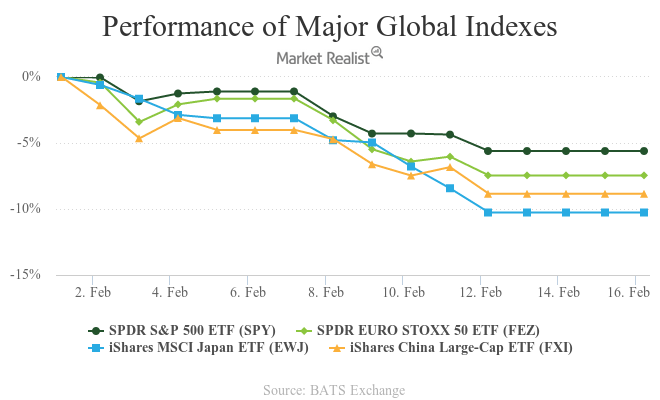

Can European Indexes Rally in the Current Global Turmoil?

In the current global scenario, the possibility of further devaluation of the Chinese yuan is a major concern for global equity markets. The Chinese PMI data released on January 31, 2016, indicated a slowdown in the Chinese economy.

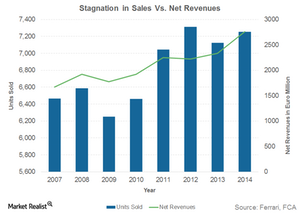

Ferrari Has Its Own Space in the Luxury Supercar Segment

Ferrari (RACE) is considered a symbol of power, speed, and passion by many motorsport enthusiasts. There are only a few key market players in the luxury supercar segment.Company & Industry Overviews Analyzing Ferrari’s Separation from Fiat Chrysler Automobiles

In October 2014, Fiat Chrysler Automobiles (FCAU) announced its intentions to spin off Ferrari (RACE) as an independent entity.Company & Industry Overviews Why Has CIGRX Delivered Below-Average Returns?

The Calamos International Growth Fund – Class A (CIGRX) seems to be cautious about its portfolio positioning for now.

Must-Knows about Tesla’s German Gigafactory 4

During the Golden Steering Wheel awards ceremony, Tesla’s (TSLA) CEO Elon Musk revealed that Berlin was selected for the company’s next Gigafactory.

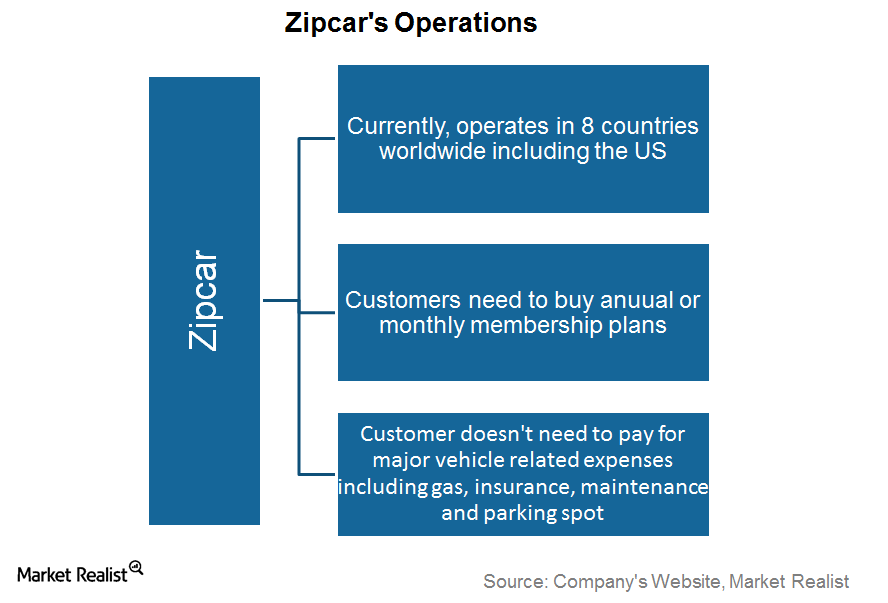

Understanding Zipcar’s Business Model

Founded in 2000, Zipcar was one of the car-sharing industry’s early entrants.

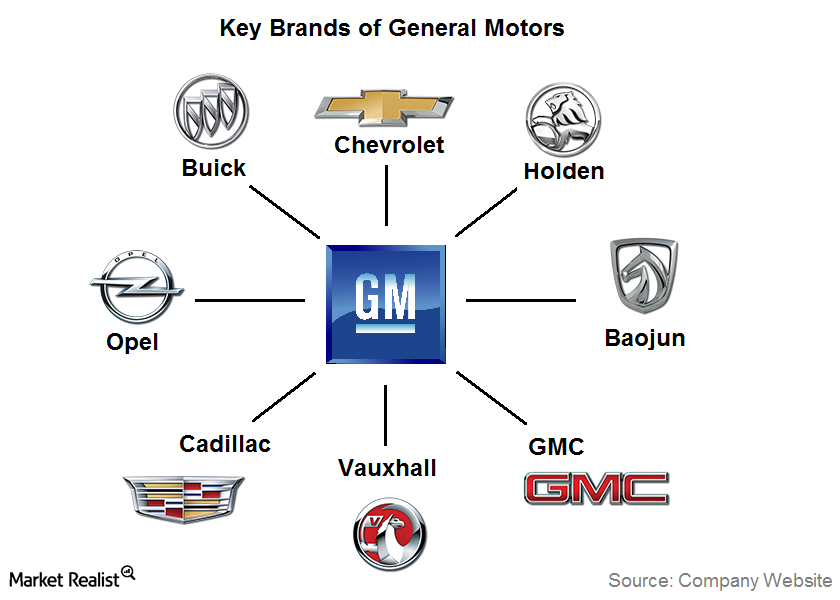

Key Brands Under General Motors’ Umbrella

Cadillac is the most popular luxury car brand in General Motors’ portfolio. It was established with the foundation of the Cadillac Automobile Company.

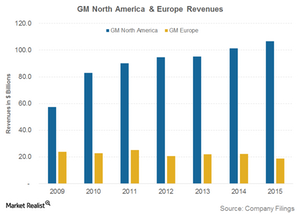

Key Geographical Markets for General Motors

Since General Motors’ beginning, North America has been its most important market. North America alone accounted for ~70% of GM’s total revenues in 2015.

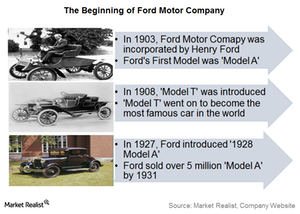

A Look at Ford Motor Company’s Humble Beginnings

Being born and raised in a farmer family, Henry Ford had the vision to produce a vehicle for the masses. This encouraged him to produce the Model T.

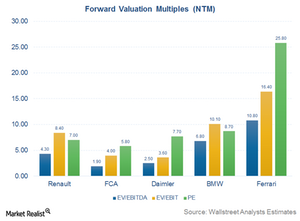

What Is Ferrari’s Current Valuation?

Ferrari is expected to witness high growth in earnings with relatively lower leverage than the industry average. This could be a reason why Ferrari has a high forward price-to-earnings multiple.

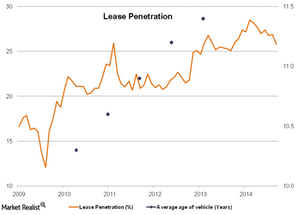

Vehicle leasing is driven by life cycles and innovation

There are higher maintenance and repair costs as a car gets older. This supports the option of leasing a vehicle.

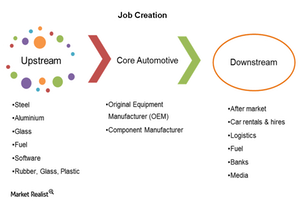

Why the automotive industry generates employment

The automotive sector plays a crucial role in job creation. Car manufacturing activity has an employment multiplier value of five.