US Natural Gas Futures Could Maintain Bearish Momentum

January US natural gas futures (GASL) contracts were below their 20-day, 50-day, and 100-day moving averages on December 7, 2017.

Dec. 8 2017, Published 10:08 a.m. ET

Hedge funds

On December 8, 2017, the CFTC will release its weekly “Commitment of Traders” report. In last week’s report, hedge funds’ net long bets in US natural gas futures (UNG) (FCG) and options contracts fell by 52,181 contracts or 72% to 20,668 on November 21–28, 2017. Positions also fell by 35,075 contracts or 63% from the same period in 2016. Net-long positions were near a one-month low. It suggests that hedge funds were bearish on NYMEX natural gas (BOIL) (UGAZ) prices.

Moving averages

January US natural gas futures (GASL) contracts were below their 20-day, 50-day, and 100-day moving averages on December 7, 2017. It indicates that prices could trade lower.

Lower gas (DGAZ) prices have a negative impact on energy producers’ (RYE) (VDE) earnings like Exco Resources (XCO), EQT (EQT), Range Resources (RRC), and Gulfport Energy (GPOR).

Natural gas futures contracts

The premium for January 2019 US natural gas futures over January 2018 US natural gas futures was at $0.34 per MMBtu (million British thermal units) on December 7, 2017. It was the highest level since July 2010. A higher premium suggests that prices could fall.

Natural gas price drivers

Any unexpected rise in US natural gas inventories compared to the historical and seasonal average could pressure natural gas prices next week. Mild weather forecasts could also pressure natural gas (UGAZ) prices. However, any fall in US natural gas production and a cold winter forecast could support gas prices.

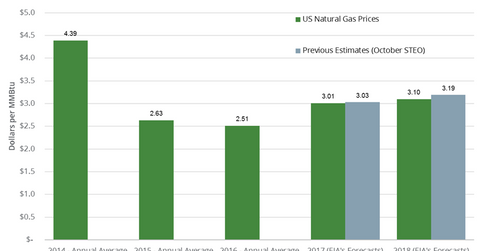

EIA’s forecast

US natural gas prices might not exceed $3.18 per MMBtu by the end of December 2017, according to Aegent Energy Advisors. The EIA and World Bank expect that US natural gas prices will average $3.1 per MMBtu in 2018.

Read Is It the Beginning of More Problems for Crude Oil Bulls? for the latest updates on crude oil.