Natural Gas’s Surge in November 2017

Between October 30 and November 6, 2017, US crude oil futures rose 5.9%.

Dec. 4 2020, Updated 10:53 a.m. ET

Natural gas

On November 6, 2017, natural gas (UNG)(BOIL)(GASL) December futures rose 5.0% and closed at $3.13 per MMBtus (million British thermal units). Bullish weather forecast reports helped natural gas prices surpass the $3.00 mark again.

Between October 30 and November 6, 2017, US crude oil futures rose 5.9%. Over this period, the S&P 500 Index (SPY) and the Dow Jones Industrial Average Index (DIA) rose 0.7% and 0.9%, respectively.

Natural gas futures rose 5.7% over this period. However, natural gas’s impact could be limited over these equity indexes.

Natural gas–weighted stocks

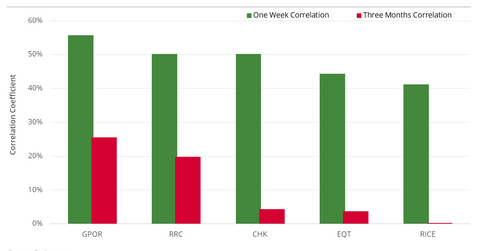

The list below highlights the natural gas–weighted stocks that had the highest correlations with natural gas active futures in the seven calendar days ended November 6, 2017:

- Gulfport Energy (GPOR): 55.7%

- Range Resources (RRC): 50.2%

- Chesapeake Energy (CHK): 50.2%

- EQT Corporation (EQT): 44.3%

- Rice Energy Inc. (RICE): 41.2%

The natural gas–weighted stocks that had the lowest correlations with natural gas futures in the last five trading sessions are:

We garnered our list of natural gas–weighted stocks from the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) but with at least 60% production mix in natural gas.