Energy Sector Saw a Mixed Performance This Week

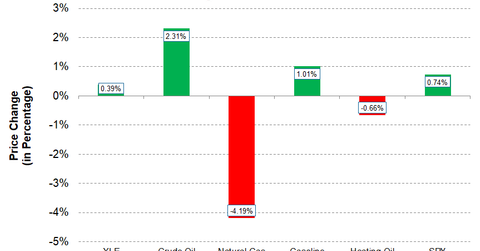

With the mixed performance from natural gas and crude oil, the energy sector is showing a modest increase this week.

Nov. 24 2017, Published 8:06 a.m. ET

Crude oil leading on the upside

In the week starting November 20, 2017, crude oil (USO) (USL) prices are leading the rise in energy commodities. Crude oil prices rose from last week’s close of $56.71 per barrel on November 17 to $58.02 per barrel on November 22, an increase of more than 2% so far this week. Crude oil traded in a narrow range on Monday and Tuesday but moved sharply on Wednesday by ~2%.

Natural gas leading on the downside

For the week starting November 20, 2017, natural gas (UNG) (BOIL) prices are leading on the downside. Natural gas prices fell from their last week’s close of $3.10 per MMBtu (million British thermal units) on November 17 to $2.97 per MMBtu on November 22, a decrease of more than 4% so far.

Unleaded gasoline and heating oil

Unleaded gasoline (UGA) prices are rising this week after last week’s decline. Unleaded gasoline prices rose from last week’s close of $1.74 per gallon on November 17 to $1.76 per gallon on November 22, an increase of 1.0%. Gasoline and heating oil prices impact refining companies (CRAK). Heating oil has fallen 0.66% so far this week. On November 22, 2017, heating oil closed at $1.94 per gallon.

Energy equities

With the mixed performance from natural gas and crude oil, the energy sector is showing a modest increase in the holiday-shortened week. As of November 22, the Energy Select Sector SPDR Fund (XLE), which represents an index of stocks across the energy sector, rose 0.39%.

Stocks that are leading the rise in XLE are Williams Companies (WMB), Helmerich and Payne (HP), TechnipFMC (FTI), Pioneer Natural Resources (PXD), and Newfield Exploration (NFX). These stocks are up 1.8%, 1.7%, 1.7%, 1.2%, and 1.2%, respectively, this week.

Falling stocks from XLE include Hess (HESS), Range Resources (RRC), Devon Energy (DVN), EQT (EQT), and Andeavor (ANDV). These stocks are down by 2.5%, 1.9%, 1.8%, 1.4%, and 1.3%, respectively, this week. In general, for the week starting November 20, XLE is underperforming the SPDR S&P 500 ETF (SPY). As of Wednesday, SPY rose 0.74% this week.

In this series

In this series, we’ll also look at the performance of energy subsectors. Specifically, we’ll look at the gainers and losers from the upstream and oilfield services. We’ll also analyze any news or developments behind the moves.

Let’s now start with upstream gainers from this week.