Andeavor

Latest Andeavor News and Updates

These Midstream Players Have Created Maximum Wealth for Investors

In this series, we’ll look at the historical outliers in midstream energy, which have generated massive wealth amid turbulent times.

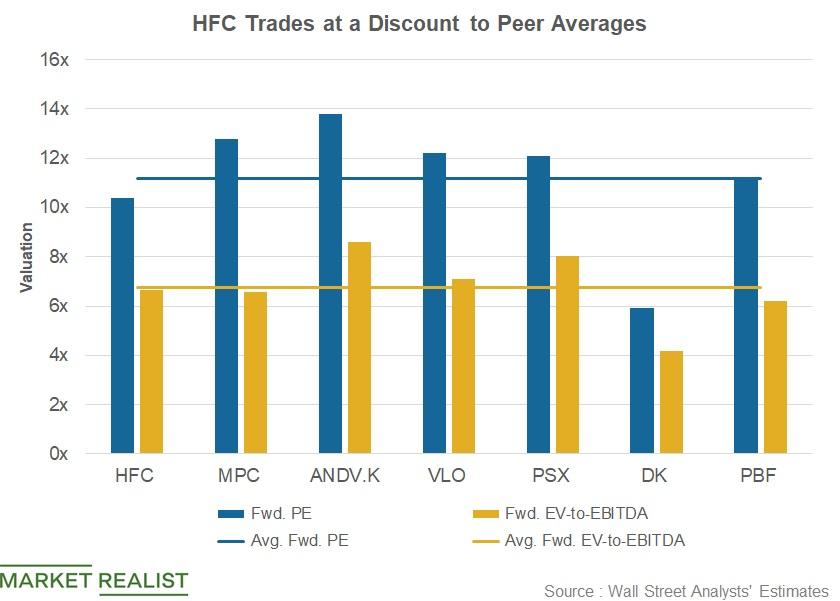

Comparing HollyFrontier’s Valuation with Peers’

HollyFrontier’s (HFC) forward PE ratio is 10.4x, below peers’ average of 11.2x. Marathon Petroleum’s (MPC), Andeavor’s (ANDV), and Phillips 66’s (PSX) forward PE ratios are higher than the average, at 12.8x, 13.8x, and 12.1x, respectively.

How Andeavor Stock Has Performed ahead of Q2 2018 Earnings

In the earlier two parts of this series, we looked at Andeavor’s (ANDV) earnings estimates and expected refining margin for Q2 2018.

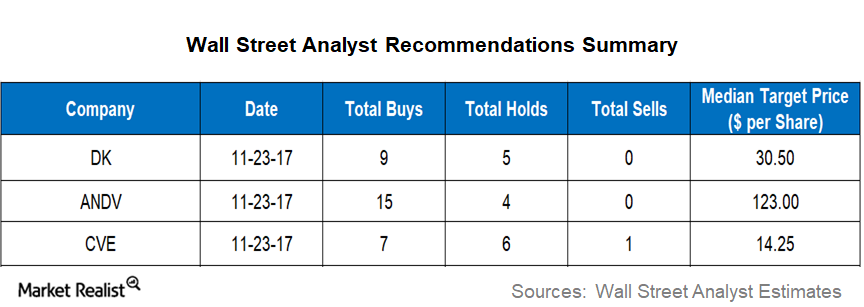

Analyzing Wall Street Targets for DK, ANDV, and CVE

As of November 23, 2017, four of the 14 analysts covering Delek US Holdings (DK) stock gave it a “strong buy” recommendation, and five gave it a “buy.”

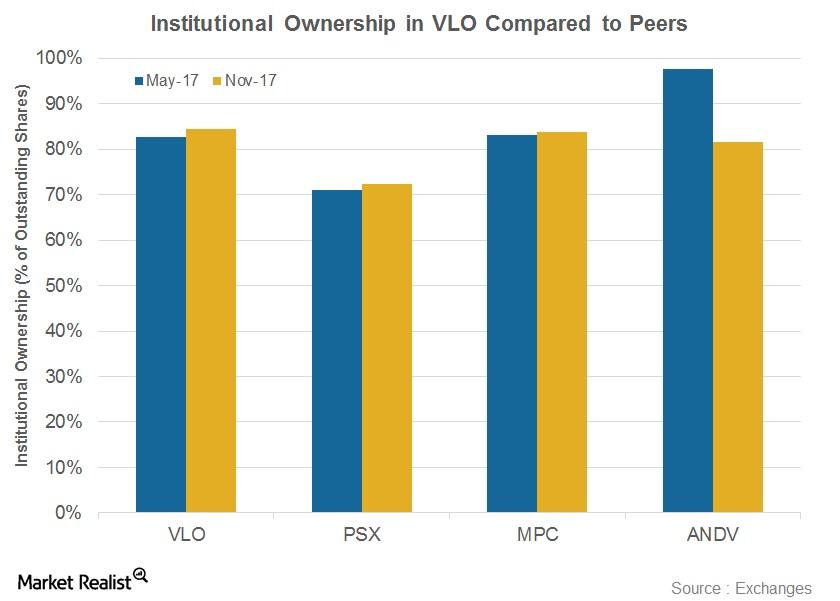

Valero’s Institutional Ownership Trends

What is institutional ownership? In this part, we’ll look at changes in institutional ownership in Valero Energy (VLO). Institutional ownership is a measure of how many shares of a company are owned by institutions such as banks and mutual funds. Institutional ownership suggests these institutions’ confidence level in a stock. Usually, everything else being equal, higher […]

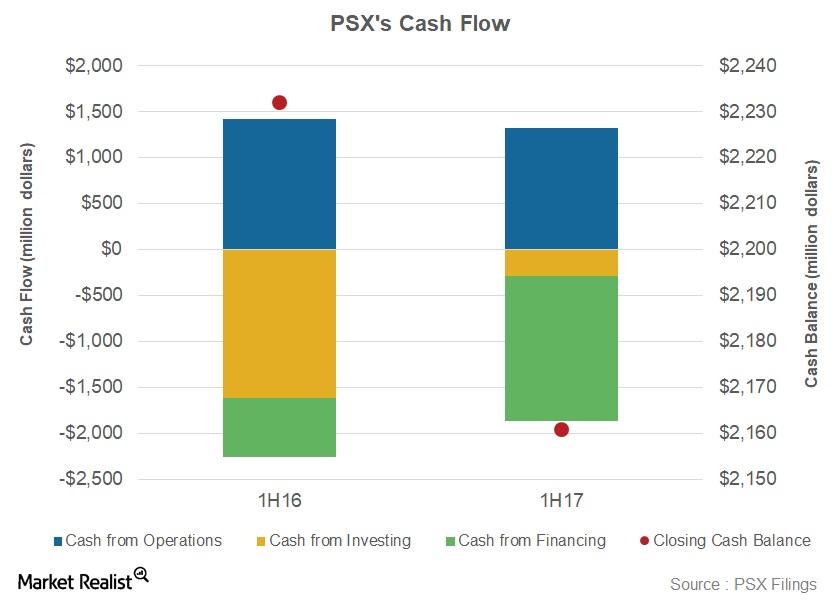

Understanding Phillips 66’s Cash Flow

In 1H17, Phillips 66 saw its cash from operations fall 7% YoY to ~$1.3 billion. This was due to negative cash flow in 1Q17, led by seasonal inventory build-up.

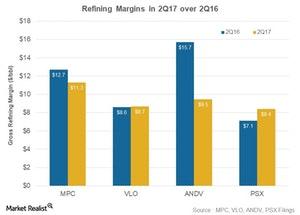

Refining Margins in 2Q17: A Comparison

Refining margins in 2Q17 In this part, we’ll compare leading US downstream companies’ GRMs (gross refining margins). Marathon Petroleum (MPC) had the widest GRM in 2Q17, followed by Andeavor (ANDV), Phillips 66 (PSX), and Valero Energy (VLO). The companies saw mixed GRM trends in 2Q17—let’s look at them more closely. Marathon Petroleum’s refining margin MPC’s gross […]