How OPEC and Saudi Arabia Drive Crude Oil Prices

October WTI (West Texas Intermediate) crude oil (RYE)(VDE)(XLE) futures contracts rose 0.84% and were trading at $47.8 per barrel in electronic trading at 2:15 AM EST today.

Nov. 20 2020, Updated 11:38 a.m. ET

Crude oil futures

October WTI (West Texas Intermediate) crude oil (RYE)(VDE)(XLE) futures contracts rose 0.84% and were trading at $47.8 per barrel in electronic trading at 2:15 AM EST today. Prices rose due to an expectation for an extension of a production cut deal beyond March 2018.

Moves in crude oil prices impact oil and gas producers like Matador Resources (MTDR), SM Energy (SM), Sanchez Energy (SN), and Goodrich Petroleum (GDP).

Saudi’s Arabia plans for the extension of a production cut deal

On Sunday, September 10, Saudi Arabia’s energy minister discussed a possible extension of a production cut deal beyond March 2018 with Venezuela and Kazakhstan.

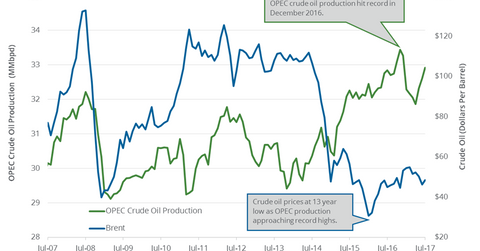

OPEC and non-OPEC producers agreed to cut crude oil production by 1.8 MM bpd from January 2017 to March 2018. The deal would reduce supplies and inventories and support oil prices. The production cut agreements took place at OPEC’s meetings on May 25, 2017, and November 30, 2016. The next OPEC meeting is on November 30, 2017.

OPEC’s crude oil production in August 2017

Reuters survey estimates that OPEC‘s (Organization of the Petroleum Exporting Countries) crude oil production fell by 170,000 bpd (barrels per day) to 32.8 MMbpd (million barrels per day) in August 2017 compared to the previous month. However, OPEC’s crude oil production hit a 2017 high in July 2017.

OPEC‘s crude oil production fell due to the supply outage in Libya. Libya’s crude oil production fell by 130,000 bpd to 900,000 in August 2017 compared to July 2017.

Impact

OPEC members’ compliance with the production cut deal rose to 89% in August 2017. It was 84% in July 2017. Higher compliance with the production cut deal and the possible extension of the production cut deal would support crude oil (SCO)(BNO) (XES) prices.

In the next part of this series, we’ll look at the relationship between crude oil and the US dollar.