US Crude Oil Production Hit a 5-Month Low

US crude oil production hit a five-month low due to slowing crude oil rigs and lower crude oil (XLE) (USO) (UCO) prices in the past few months.

Sept. 12 2017, Updated 11:36 a.m. ET

Crude oil prices

October West Texas Intermediate crude oil (UWT) (DWT) futures contracts fell 0.2% and were trading at $47.97 per barrel in electronic trade at 1:45 AM EST on September 12, 2017.

Volatility in crude oil (ERY) (ERX) prices impacts oil and gas producers like Comstock Resources (CRK), Chevron (CVX), Warren Resources (WRES), and QEP Resources (QEP).

Monthly US crude oil production

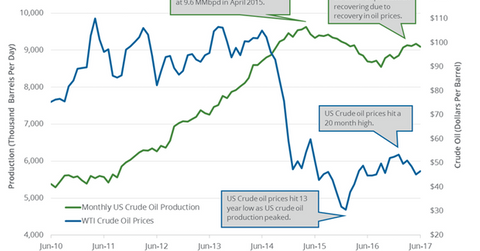

The EIA (U.S. Energy Information Administration) estimates that US crude oil production fell by 73,000 bpd (barrels per day) to 9.09 MMbpd (million barrels per day) in June 2017—compared to the previous month. Production fell by 0.8% month-over-month but rose by 399,000 bpd or 4.5% year-over-year.

US crude oil production hit a five-month low due to slowing crude oil rigs and lower crude oil (XLE) (USO) (UCO) prices in the past few months.

US crude oil (RYE) (VDE) prices have fallen ~15.85% year-to-date due to the rise in US crude oil production in 2017. US crude oil production has risen 6.4% since the lows in September 2016.

Weekly US crude oil production and Hurricane Harvey

The EIA estimates that US crude oil production fell 7.8% or by 749,000 bpd to 8.8 MMbpd on August 25–September 1, 2017. Production fell due to Hurricane Harvey.

US crude oil production estimates

The EIA estimates that US crude oil production could average 9.9 MMbpd in 2018—the highest level ever. The rise in US crude oil production could offset the production cut deal, which would pressure crude oil (SCO) (BNO) prices.

In the next part, we’ll look at how Libya’s crude oil production drives oil prices.