How Did the Consumer Price Index Affect Crude Oil Prices?

The US (SPY) (VOO) CPI (consumer price index) rose 0.4% on a month-over-month basis in April, according to a US Department of Labor report on May 17, 2016.

May 23 2016, Updated 7:19 a.m. ET

US CPI numbers

The US (SPY) (VOO) CPI (consumer price index) rose 0.4% on a month-over-month basis in April, according to a US Department of Labor report on May 17, 2016. Analysts had forecast a ~0.3% rise. The rise in gasoline (UGA) prices and surging rents (VNQ)(REZ) were major contributors to the rise in inflation.

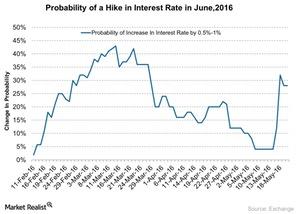

The inflation rate is one of the important economic data points that affect interest rate decisions. The Market’s expectation of a rate hike could strengthen the US Dollar Index (UUP) if the crude oil (USO) rally continues. Rising crude oil prices can also reflect improving consumer sentiment and expectations of economic growth. These factors can lead to higher interest rates. The probability of an interest rate hike increased significantly following the release of the US CPI inflation numbers. The graph above shows the rise in the probability of a rate hike in June 2016.

US Dollar Index and crude oil

The one-month correlation of crude oil prices with the US Dollar Index was -11.2% on May 20, 2016. The correlation is negative, indicating an impact of Market sentiment on crude oil prices. Apart from fundamental drivers, the US Dollar Index could be one of the dominating drivers of crude oil prices in the coming days.

The above analysis is important for crude oil–weighted stocks such as Abraxas Petroleum (AXAS), Triangle Petroleum (TPLM), and Denbury Resources (DNR). The Direxion Daily Energy Bear 3X Shares ETF (ERY), the First Trust Energy AlphaDEX Fund (FXN), the United States Brent Oil Fund (BNO), and the United States Oil Fund (USO) are also affected by the correlation of crude oil prices with the US Dollar Index.

In the next part of this series, we’ll look at the weather forecast and how it will impact natural gas prices.